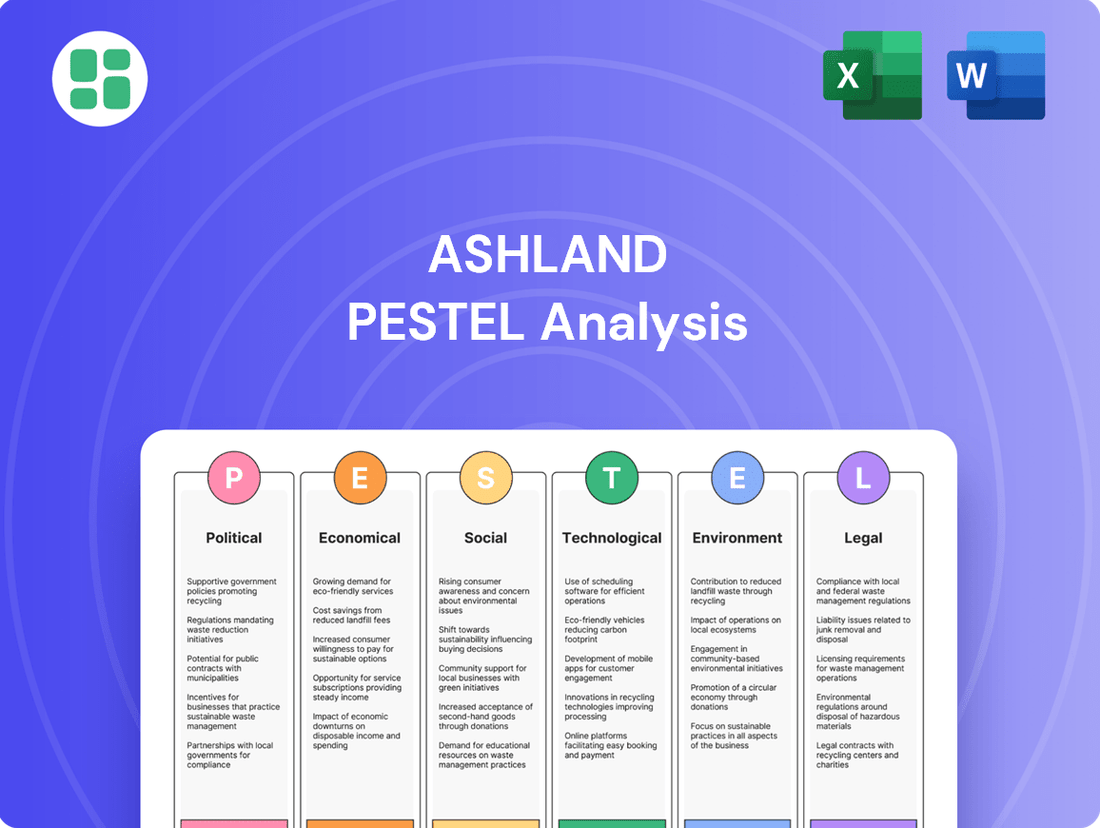

Ashland PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashland Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Ashland's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making in today's dynamic market. Gain a competitive edge by understanding these external influences—download the full report now for actionable intelligence.

Political factors

Ashland, operating as a global specialty materials company, faces significant headwinds from ongoing geopolitical tensions, most notably the trade disputes between the United States and China. These trade conflicts directly translate into increased tariffs and trade barriers, which can escalate the cost of essential raw materials and diminish the competitive edge of Ashland's diverse product portfolio in crucial global markets.

The company's forward-looking statements, particularly its fiscal year 2025 outlook, explicitly recognize the persistent nature of geopolitical and economic uncertainty. This outlook highlights particularly challenging market conditions anticipated in China, underscoring the direct impact of these global political dynamics on Ashland's operational strategy and financial performance.

Ashland operates within a highly regulated global chemical industry, with agencies like the U.S. Environmental Protection Agency (EPA) and the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) setting strict standards. For instance, the U.S. enacted TSCA reform, impacting how chemicals are assessed and managed, directly affecting Ashland's product development and manufacturing practices.

Compliance with these evolving regulations requires significant ongoing investment. In 2024, chemical companies globally are projected to spend billions on environmental compliance and product safety initiatives, a cost Ashland must absorb to maintain market access and operational integrity.

Governments globally are actively championing sustainable manufacturing and green chemistry, implementing policies and offering incentives. This trend is particularly evident in regions where Ashland operates, with many nations setting ambitious net-zero targets for 2050. For instance, the European Union's Green Deal aims to make the bloc climate-neutral by this date, encouraging significant investment in eco-friendly technologies and processes.

Ashland's dedication to the Paris Climate Accord and the UN Global Compact directly mirrors these governmental priorities. This alignment positions the company favorably for potential collaborations with governments on projects related to sustainable product development, possibly leading to access to subsidies or grants. Such support can be crucial for R&D in areas like biodegradable materials or energy-efficient production methods.

By proactively embracing sustainability, Ashland gains a distinct competitive edge. Meeting and exceeding evolving regulatory requirements, such as those anticipated under the Biden administration's renewed focus on climate action in the US, ensures compliance and builds trust. Furthermore, this commitment resonates with a growing consumer base that increasingly favors environmentally responsible brands, driving demand for Ashland's green solutions.

Political Stability in Key Operating Regions

Political stability in Ashland's key operating regions directly impacts its supply chain, production, and market access. For instance, geopolitical tensions in Eastern Europe, a region with significant industrial activity, could disrupt raw material sourcing and logistics for Ashland's specialty chemicals. Ashland's presence in over 100 countries necessitates constant vigilance regarding diverse political landscapes and potential changes in governmental policies that could affect business operations.

Instability can manifest as supply chain disruptions, leading to increased operational costs and difficulties in enforcing contractual agreements. In 2024, the World Bank's Ease of Doing Business report, while not directly measuring political stability, highlights that countries with more stable political environments generally rank higher in ease of doing business, suggesting a correlation with operational efficiency for companies like Ashland.

- Supply Chain Vulnerability: Political unrest in regions like the Middle East, a key supplier of petrochemical feedstocks, could significantly impact Ashland's raw material availability and pricing.

- Market Access Challenges: Trade policy shifts or sanctions imposed due to political instability in a major market could restrict Ashland's ability to sell its products, affecting revenue streams.

- Operational Risk: Increased security costs and potential damage to facilities due to civil unrest or conflict in operating countries are direct consequences of political instability.

Intellectual Property Protection Policies

Ashland's ability to protect its innovations is directly tied to the strength of intellectual property (IP) laws globally. Robust IP protection encourages Ashland's significant investments in research and development, which are crucial for maintaining its competitive advantage in the specialty materials sector. For instance, in 2023, Ashland reported R&D expenses of $298 million, underscoring the importance of safeguarding these investments.

Weak enforcement of IP rights in certain markets poses a significant risk, potentially leading to the counterfeiting of Ashland's proprietary formulations and technologies. This can erode market share and profitability. For example, reports from the European Union Intellectual Property Office (EUIPO) indicate that counterfeit goods cost businesses billions annually, a threat Ashland actively mitigates through legal and operational strategies.

- Global IP Landscape: Ashland operates in over 100 countries, each with varying levels of IP enforcement.

- R&D Investment Protection: Protecting patents and trade secrets is vital for recouping the $298 million invested in R&D in 2023.

- Counterfeiting Risks: Weak IP enforcement in emerging markets can lead to unauthorized replication of Ashland's advanced chemical formulations.

- Competitive Advantage: Strong IP protection allows Ashland to maintain its edge in specialized markets like adhesives and personal care ingredients.

Geopolitical tensions and trade disputes, particularly between the US and China, directly impact Ashland by increasing tariffs and potentially raising raw material costs. The company's 2025 outlook acknowledges ongoing global economic uncertainty, with specific challenges anticipated in the Chinese market due to these political dynamics.

Governmental focus on sustainability and green chemistry, exemplified by the EU's Green Deal aiming for climate neutrality by 2050, presents both opportunities and compliance demands for Ashland. Political stability is crucial for Ashland's global operations, affecting supply chains and market access across its presence in over 100 countries.

The strength of intellectual property laws globally is critical for Ashland, which invested $298 million in R&D in 2023. Weak IP enforcement in some markets risks counterfeiting of its proprietary chemical formulations, a challenge that costs businesses billions annually.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ashland, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Ashland's financial performance is closely tied to the global economic climate, with projections for fiscal year 2025 pointing to slower growth in many areas and tougher market conditions, particularly in China. This subdued economic backdrop can dampen demand for Ashland's diverse product portfolio, impacting sectors such as architectural coatings and construction.

The company's Q3 fiscal 2025 performance highlighted this mixed demand environment, prompting Ashland to adjust its full-year outlook downwards. For instance, the company reported a net sales decrease of 5% year-over-year to $510 million in Q3 FY25, reflecting these broader economic headwinds.

Raw material costs represent a substantial operational outlay for Ashland, with prices susceptible to significant swings driven by global supply and demand, geopolitical tensions, and energy price fluctuations. Ashland's Q4 fiscal 2024 performance suggested a relatively stable raw material landscape, yet the company consistently navigates the complexities of cost management to preserve profitability. This volatility directly affects gross margins and segment profitability, a challenge particularly evident in its Asia/Pacific operations.

Currency exchange rate fluctuations significantly impact Ashland, a global enterprise with operations in over 100 countries. For instance, in the first quarter of 2024, the company noted that favorable currency movements contributed positively to its reported results, boosting both sales and Adjusted EBITDA. Conversely, unfavorable shifts can diminish reported revenues and profitability, making currency risk management a constant element of Ashland's financial planning.

Interest Rates and Access to Capital

Changes in interest rates directly impact Ashland's cost of capital. For instance, if the Federal Reserve raises its benchmark rate, Ashland's future borrowing for expansion or R&D will likely become more expensive. This can influence decisions on capital allocation for new projects.

Ashland's financial structure offers some insulation in the near term. With no floating rate debt and no long-term debt maturing within the next two years, the company is protected from immediate interest rate hikes impacting its existing debt obligations. This provides a degree of financial stability.

However, the broader economic environment shaped by interest rates is a significant indirect factor. Higher rates often lead to reduced consumer spending and slower industrial activity, which can dampen demand for Ashland's specialty chemicals and materials. For example, a slowdown in construction, often sensitive to mortgage rates, could impact demand for certain Ashland products.

- Interest Rate Impact: Higher interest rates increase borrowing costs for future investments.

- Ashland's Debt Structure: No floating rate debt and no maturities in the next two years provide short-term stability.

- Indirect Demand Effects: Broader economic slowdowns due to higher rates can reduce demand for Ashland's products.

- Federal Reserve Policy: Actions by the Fed in 2024 and 2025 will be crucial in shaping the interest rate environment.

Supply Chain Disruptions and Logistics Costs

Global supply chain resilience is a significant concern for Ashland, as disruptions directly affect the availability and cost of both raw materials and finished products. Issues such as ongoing port congestion and labor shortages, exacerbated by geopolitical tensions, have led to a notable increase in logistics expenses and delivery timelines throughout 2024 and into early 2025. For example, the average cost to ship a 40-foot container from Asia to the US West Coast, which was around $1,500 in early 2020, surged to over $10,000 during peak disruptions and remained significantly elevated, averaging around $3,000-$4,000 in late 2024, impacting global freight costs. Ashland's capacity to effectively manage these ongoing supply chain challenges is therefore paramount to ensuring a steady and reliable supply of its specialty chemicals and materials to its broad customer base across various industries.

Ashland's operational efficiency hinges on its ability to mitigate the impact of these logistical hurdles. The company's strategic focus on diversifying its supplier base and optimizing transportation routes aims to counter the volatility in shipping rates and transit times.

- Increased Freight Costs: Global shipping costs saw a significant spike in 2024, with the Drewry World Container Index showing an average increase of 15% year-over-year for major trade routes by Q3 2024.

- Extended Lead Times: The average lead time for key chemical precursors for Ashland, sourced internationally, extended by an average of 10-15 days in 2024 compared to pre-pandemic levels.

- Geopolitical Impact: Conflicts in Eastern Europe and the Middle East continued to disrupt key shipping lanes, forcing rerouting and contributing to higher fuel surcharges, impacting Ashland's landed costs.

Slowing global economic growth, particularly in China, is a key factor affecting Ashland's performance in 2025. This trend, coupled with persistent inflation and higher interest rates, is expected to create a more challenging market environment for the company's specialty chemicals and materials. For instance, Ashland's Q3 FY25 net sales declined 5% year-over-year, reflecting these headwinds.

Raw material cost volatility remains a significant concern for Ashland, driven by global supply and demand dynamics and geopolitical events. While Q4 FY24 showed some stability, the company must continue managing these costs to protect its margins. The Asia/Pacific region, in particular, experienced pricing pressures impacting profitability.

Currency fluctuations present both opportunities and risks for Ashland's global operations. Favorable movements boosted results in Q1 2024, but unfavorable shifts can negatively impact reported revenues and profitability, underscoring the need for robust currency risk management strategies.

Higher interest rates increase Ashland's cost of capital for future investments, though the company's current debt structure offers short-term stability with no floating rate debt and no maturities in the next two years. However, reduced consumer and industrial spending due to higher rates can indirectly dampen demand for Ashland's products, especially in interest-sensitive sectors like construction.

Supply chain disruptions, including port congestion and elevated freight costs, continue to impact Ashland. For example, average container shipping costs from Asia to the US West Coast remained around $3,000-$4,000 in late 2024, significantly higher than pre-pandemic levels. Extended lead times for key chemical precursors, averaging 10-15 days longer in 2024, further complicate operations.

| Economic Factor | Impact on Ashland | Data Point/Example (2024-2025) |

|---|---|---|

| Global GDP Growth | Slower growth dampens demand for specialty chemicals. | China's economic slowdown impacting demand; Ashland's Q3 FY25 net sales down 5% YoY. |

| Inflation & Interest Rates | Increases borrowing costs; can reduce consumer/industrial spending. | Federal Reserve rate hikes increase cost of capital; construction sector slowdown impacts demand. |

| Raw Material Costs | Volatility impacts gross margins and profitability. | Geopolitical tensions and energy prices affect input costs; Asia/Pacific operations faced pricing pressures. |

| Currency Exchange Rates | Fluctuations affect reported revenues and profitability. | Favorable currency movements boosted results in Q1 2024; unfavorable shifts can diminish profitability. |

| Supply Chain Disruptions | Increases logistics expenses and delivery times. | Average container shipping costs $3,000-$4,000 (late 2024); lead times for precursors extended by 10-15 days. |

Same Document Delivered

Ashland PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ashland PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview to inform your strategic decisions.

Sociological factors

Consumers worldwide are increasingly prioritizing products that are good for the planet, natural, and sourced responsibly. This trend is significantly impacting sectors like personal care, food and beverage, and even architectural coatings, as people seek out more ethical options.

Ashland has actively addressed this shift by focusing on innovation in areas like bio-based ingredients and clean beauty. This strategic alignment ensures their product offerings resonate with these growing consumer preferences for sustainability.

Data from 2024 indicates a strong market signal: over 68% of consumers actively prefer environmentally responsible chemical products. This preference directly fuels Ashland's revenue growth in sustainable product lines, demonstrating a clear market advantage.

Growing consumer attention to health and wellness is significantly boosting demand for specialized ingredients across pharmaceuticals, nutraceuticals, and personal care sectors. This trend is a key driver for companies like Ashland, which strategically positions itself within these life sciences markets.

Ashland's commitment to life sciences, particularly its pharmaceutical excipients and premium personal care ingredients, directly addresses this burgeoning consumer demand. For example, in 2024, the global nutraceuticals market was valued at approximately $617 billion and is projected to grow substantially, highlighting the immense opportunity.

The company's strategic portfolio adjustments, including the divestment of less profitable nutrition products, underscore its dedication to concentrating on these high-value, health-focused segments. This focus allows Ashland to better capitalize on the increasing consumer preference for products that support well-being.

Global demographic shifts, including an aging population and a significant increase in urbanization, are reshaping consumer needs. By 2050, it's projected that 68% of the world's population will live in urban areas, a substantial rise from 57% in 2021. This trend directly fuels demand for construction materials and coatings, areas where Ashland's specialty additives play a crucial role.

Ashland's portfolio is well-aligned with the infrastructure development and renovation efforts accompanying urbanization. The company's additives for architectural coatings and construction materials support the creation of energy-efficient buildings and the modernization of urban infrastructure, key priorities in rapidly growing cities worldwide.

Social Responsibility and Ethical Sourcing

Consumers and investors are increasingly demanding that companies act responsibly, focusing on ethical labor and clear supply chains. Ashland actively incorporates environmental, social, and governance (ESG) principles into its core business strategy, aligning with global standards such as the UN Global Compact and improving its ESG reporting transparency. This focus is crucial for attracting socially aware investors and solidifying customer trust.

Ashland's commitment to social responsibility is demonstrated through concrete actions and reporting. For instance, in their 2023 ESG report, they highlighted progress in areas such as reducing greenhouse gas emissions by 20% compared to a 2019 baseline and achieving a 10% increase in renewable energy usage across their operations. These metrics underscore a tangible effort to meet stakeholder expectations for ethical business conduct.

- Ethical Labor Practices: Ashland is committed to fair labor standards throughout its global operations and supply chain, aiming to ensure safe working conditions and fair wages.

- Transparent Supply Chains: The company is working to enhance visibility within its supply chains, providing greater clarity on the origin and ethical treatment of materials used in its products.

- ESG Integration: Ashland's strategy actively integrates ESG factors, with specific goals set for environmental impact reduction and social progress, as detailed in their annual sustainability reports.

- Socially Conscious Investment: By adhering to strong ESG principles, Ashland aims to attract and retain investors who prioritize sustainable and ethical business practices, a trend that has seen significant growth in the 2024-2025 investment landscape.

Talent Attraction and Retention in Specialized Fields

The availability of highly skilled labor, especially scientists, research chemists, and engineers, is absolutely critical for Ashland's continued innovation and smooth operations. In 2024, the demand for these specialized roles remains exceptionally high, with reports indicating a persistent shortage in key scientific disciplines.

Ashland's dedication to fostering an inclusive and diverse workplace, coupled with its emphasis on creating a collaborative atmosphere, plays a significant role in attracting and keeping the best talent in today's competitive landscape. Companies that prioritize these aspects often see higher employee engagement and lower turnover rates.

Furthermore, initiatives aimed at engaging youth in STEM fields are crucial for building a robust talent pipeline for the future. For instance, programs that encourage early exposure to science and technology can directly influence the pool of qualified candidates available in the coming years.

- Skilled Labor Demand: Continued high demand for scientists, chemists, and engineers in 2024.

- Diversity & Inclusion Impact: Key factors for attracting and retaining top talent in specialized fields.

- STEM Engagement: Crucial for developing future talent pipelines.

Societal values are increasingly emphasizing sustainability and ethical consumption, driving demand for Ashland's bio-based and responsibly sourced ingredients. This aligns with the 2024 trend where over 68% of consumers prefer eco-friendly chemical products, directly benefiting Ashland's green product lines.

The growing focus on health and wellness is fueling demand for Ashland's specialized ingredients in pharmaceuticals and personal care, as evidenced by the 2024 global nutraceuticals market valuation of approximately $617 billion.

Demographic shifts, including urbanization, are increasing demand for construction materials and coatings, where Ashland's additives are essential. By 2050, 68% of the global population is expected to live in urban areas, a significant increase from 57% in 2021.

Ashland's commitment to ESG principles, including a 20% reduction in greenhouse gas emissions by 2023 from a 2019 baseline, resonates with investors and consumers prioritizing ethical business practices.

Technological factors

Ashland's commitment to research and development is a cornerstone of its strategy, driving the creation of innovative solutions that boost customer product performance. The company highlighted its advanced technological capabilities and broader uses for its scalable platforms at its Innovation Day 2025, specifically targeting global megatrends.

Significant investment continues to flow into new technology platforms that directly support Ashland's key markets, including pharmaceuticals, personal care, and specialty additives, ensuring future growth and market relevance.

Ashland is capitalizing on material science and biotechnology breakthroughs to create new ingredients. For instance, their expansion into bioresorbable polymers for medical devices and aesthetic treatments highlights their commitment to advanced material technologies. This focus is crucial as the specialty chemicals sector thrives on innovation in resin formulations for superior performance.

Ashland's manufacturing operations are increasingly benefiting from digitalization and automation. These advancements are crucial for boosting efficiency, cutting operational expenses, and elevating the quality of their diverse product portfolio.

A key element of Ashland's strategy involves substantial investments in productivity enhancements. For instance, the commissioning of new equipment within their Specialty Additives segment directly supports this objective, aiming to streamline production and improve output.

By optimizing its manufacturing network through these technological integrations, Ashland is better positioned to navigate the challenges posed by fluctuating raw material prices and volatile manufacturing costs, thereby strengthening its financial resilience.

Intellectual Property Landscape and Protection

Ashland's competitive edge hinges on safeguarding its intellectual property, particularly its innovative, proprietary chemical formulations. The company's market leadership is directly tied to its strong patent portfolio and the diligent protection of its trade secrets. For instance, Ashland's significant investment in R&D, which reached $297 million in fiscal year 2023, underscores the importance of these protected innovations.

The strength and breadth of Ashland's intellectual property directly impact its strategic decisions regarding partnerships and collaborations. A robust IP position allows Ashland to enter into more favorable agreements, ensuring that its unique technologies are leveraged effectively while maintaining control. This is crucial as the company explores new markets and applications for its specialty ingredients.

Key aspects of Ashland's intellectual property strategy include:

- Patent Portfolio Strength: Maintaining a comprehensive and active patent portfolio across its key product lines, particularly in areas like pharmaceutical excipients and personal care ingredients.

- Trade Secret Management: Implementing rigorous internal controls to protect proprietary manufacturing processes and customer-specific formulations that are not patented.

- Licensing and IP Agreements: Strategically engaging in licensing agreements that allow for the expansion of its technology while generating revenue and maintaining competitive barriers.

- Enforcement and Defense: Actively monitoring the market for potential infringements and vigorously defending its intellectual property rights to preserve its market exclusivity.

Circular Economy and Sustainable Technology

Technological advancements are pivotal in driving the chemical industry towards a circular economy, with a growing emphasis on recyclability and biodegradability. Ashland is actively embedding Environmental, Social, and Governance (ESG) principles into its innovation pipeline, prioritizing solutions that minimize carbon emissions and foster circularity.

This strategic focus translates into the development of products that are natural, nature-derived, and biodegradable, particularly for the personal care sector. For instance, Ashland's commitment to sustainability is reflected in its portfolio of bio-based ingredients, which aim to reduce reliance on petrochemicals. In 2024, the company continued to invest in research and development for these sustainable alternatives, aiming to increase the percentage of its revenue derived from environmentally advantaged products.

- Circular Economy Technologies: Development of advanced recycling processes and biodegradable material science.

- ESG Integration: Ashland's innovation agenda prioritizes solutions that reduce carbon footprints and promote circularity.

- Product Focus: Emphasis on natural, nature-derived, and biodegradable ingredients, especially in personal care applications.

- Market Trend: Growing consumer and regulatory demand for sustainable chemical solutions is a key driver.

Ashland's technological strategy is deeply intertwined with innovation in material science and biotechnology, leading to new ingredients like bioresorbable polymers for medical applications. The company's significant R&D investment, totaling $297 million in fiscal year 2023, fuels advancements in areas such as pharmaceutical excipients and personal care ingredients. Digitalization and automation are also key, enhancing manufacturing efficiency and product quality across its diverse portfolio.

Ashland is actively developing circular economy technologies and prioritizing biodegradable solutions, aligning with growing market demand for sustainable chemical alternatives. This focus is evident in their expansion of bio-based ingredients, aiming to reduce petrochemical reliance and increase revenue from environmentally advantaged products in 2024.

The company's commitment to R&D is further demonstrated by its focus on scalable platforms targeting global megatrends, as highlighted at its Innovation Day 2025. These investments ensure Ashland remains at the forefront of creating high-performance specialty chemicals.

Legal factors

Ashland navigates a complex global regulatory landscape, adhering to stringent environmental and product safety mandates from bodies such as the EPA, FDA, and EU REACH. Failure to comply can lead to substantial financial penalties, operational limitations, and significant damage to its public image.

The company's 2024 10-K filing explicitly acknowledges the legal and political risks associated with its international operations, including those stemming from evolving trade policies and regulations impacting the chemical sector.

Product liability and safety laws are critical for Ashland, given its role in supplying additives and ingredients to sensitive sectors like pharmaceuticals and personal care. Failure to meet these rigorous standards can lead to significant legal repercussions and damage brand integrity. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize strict adherence to Current Good Manufacturing Practices (cGMP) for all ingredients used in regulated products, a framework Ashland actively implements across its personal care and life sciences operations to mitigate quality-related risks.

International trade laws and tariffs are critical for Ashland, directly affecting its global supply chain and how easily it can access markets worldwide. Changes in these policies, like the ongoing US-China trade disputes, can significantly raise the costs of importing raw materials or exporting finished goods, thereby altering the competitive landscape in various regions.

Ashland's financial projections for fiscal year 2025 explicitly account for the tangible financial consequences stemming from these evolving global trade policies. For instance, increased tariffs can directly impact the cost of goods sold and ultimately influence the company's profitability and pricing strategies in affected markets.

Labor and Employment Laws

Ashland must navigate a complex web of labor and employment laws in over 100 countries. This involves ensuring compliance with varying regulations on minimum wage, working hours, health and safety standards, and employee benefits, which differ significantly by jurisdiction. For instance, in 2024, the International Labour Organization (ILO) reported that over 50 countries had updated their national labor laws, impacting areas like remote work policies and gig economy worker protections.

Maintaining a consistent approach to non-discrimination and equal opportunity is paramount. Ashland's commitment to diversity and inclusion must be reflected in its adherence to these laws globally. Failure to comply can lead to substantial fines and reputational damage, impacting employee morale and recruitment efforts. For example, in 2023, the European Union saw a 15% increase in reported cases of workplace discrimination, highlighting the ongoing challenges companies face.

- Global Compliance: Adherence to diverse labor laws across 100+ operating countries is critical.

- Key Regulatory Areas: Focus on wages, working conditions, employee benefits, and non-discrimination policies.

- Risk Mitigation: Strict compliance prevents legal disputes, fines, and protects the company's reputation.

- Evolving Landscape: Staying updated on changes, such as those related to remote work and gig economy, is essential.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are paramount for Ashland, especially with the growing reliance on digital platforms. Laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impact how Ashland manages customer and proprietary business information. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Ashland must implement stringent cybersecurity measures to safeguard against evolving threats. This includes not only technological defenses but also comprehensive employee training to foster a culture of security awareness. In 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial imperative for robust protection.

- GDPR and CCPA compliance is essential for handling customer data.

- Cybersecurity investments are critical to mitigate data breach risks.

- Employee training is vital for maintaining data protection standards.

- Non-compliance can lead to significant financial penalties.

Ashland's legal framework is significantly shaped by global product safety and environmental regulations, such as EPA and EU REACH standards, with non-compliance risking substantial fines and operational disruptions. The company's 2024 filings highlight the legal risks tied to international trade policies impacting the chemical sector, and adherence to FDA's cGMP standards remains crucial for its personal care and life sciences ingredients.

The company must also manage varying labor laws across its global operations, focusing on fair wages, safe working conditions, and non-discrimination, as highlighted by the ILO's 2024 updates on labor laws. Furthermore, data privacy laws like GDPR and CCPA necessitate robust cybersecurity measures, with the global average cost of a data breach in 2024 reaching $4.45 million, underscoring the financial imperative for compliance.

Environmental factors

Ashland is deeply committed to mitigating climate change, aligning its strategy with the Paris Agreement's goal of keeping global temperature increases below 1.5°C. This commitment is demonstrated through the establishment of science-based emissions reduction targets across all operational scopes, validated by the Science Based Targets initiative (SBTi).

These ambitious targets are driving significant investments in decarbonization technologies and the enhancement of sustainable operational practices throughout the company. For example, Ashland aims for a 40% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, compared to a 2019 baseline.

The drive for sustainably sourced raw materials and efficient resource management is a significant environmental factor influencing companies like Ashland. This includes a growing consumer and regulatory push for materials that are produced with minimal environmental impact.

Ashland demonstrates this commitment by adhering to certification standards such as the Forest Stewardship Council (FSC) and the Program for the Endorsement of Forest Certification (PEFC) for its responsibly managed sources. These certifications ensure that forest products come from forests that are managed to meet the social, economic, and environmental needs of present and future generations.

Furthermore, Ashland is focused on wise water usage, particularly in areas susceptible to the impacts of climate change. For instance, in 2023, Ashland reported a 5% reduction in water intensity across its global operations compared to its 2019 baseline, highlighting its proactive approach to water stewardship.

Stricter environmental regulations, like those from the EPA's Clean Air Act and RCRA, demand substantial capital for sustainable manufacturing. Ashland actively invests in minimizing its environmental footprint by enhancing waste management and reducing hazardous chemical usage. For instance, in 2023, the company reported a 5% reduction in hazardous waste generation compared to 2022, reflecting ongoing efforts in process optimization.

Biodiversity and Ecosystem Protection

Ashland acknowledges the critical role of biodiversity and ecosystem health, embedding these considerations into its overarching sustainability strategy. This commitment extends beyond carbon reduction, focusing on broader ecological restoration and conservation efforts.

The company's support for initiatives such as The Nature Conservancy's Plant a Billion Trees project exemplifies this dedication. By participating in such programs, Ashland aims to contribute to reforestation and actively pursue a 'nature-positive' operational model.

- Biodiversity Integration: Ashland's sustainability framework explicitly includes biodiversity and ecosystem protection as core components.

- Reforestation Support: The company actively backs reforestation efforts, notably through its partnership with The Nature Conservancy's Plant a Billion Trees initiative.

- Nature-Positive Ambition: Ashland is working towards becoming a 'nature-positive' company, signifying a commitment to environmental enhancement beyond neutrality.

- Broader Environmental Goals: These actions underscore a commitment to environmental stewardship that encompasses ecological well-being, not solely focusing on emissions reduction.

Product Lifecycle Environmental Impact

The environmental footprint of products, from sourcing raw materials to their eventual disposal, is increasingly scrutinized. Ashland is actively addressing this by prioritizing the development of natural, nature-derived, and biodegradable products that support a circular economy. This strategic focus aims to minimize environmental impact through innovation.

Ashland’s commitment to sustainability is evident in its product development pipeline. For instance, the company is advancing water-based solutions for the coatings industry, which significantly reduce volatile organic compound (VOC) emissions compared to solvent-based alternatives. In 2023, the global market for waterborne coatings was valued at approximately $85 billion, highlighting the demand for such environmentally friendlier options.

Furthermore, Ashland is investing in eco-friendly packaging solutions and exploring biodegradable materials. These efforts align with broader market trends; by 2025, the global biodegradable packaging market is projected to reach over $50 billion, indicating a strong consumer and regulatory push towards sustainable packaging practices.

- Focus on Biodegradability: Ashland is developing products designed to break down naturally, reducing landfill waste.

- Water-Based Innovations: The company is a leader in water-based solutions for paints and coatings, lowering VOC emissions.

- Circular Economy Contributions: Ashland's strategy includes creating products that fit into a circular economy model, emphasizing reuse and recycling.

- Eco-Friendly Packaging: Development of sustainable packaging materials is a key area of investment for the company.

Environmental factors significantly shape Ashland's operations, pushing for reduced emissions and sustainable sourcing. The company's commitment to science-based targets, aiming for a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, underscores this focus. This includes responsible forest product sourcing, evidenced by FSC and PEFC certifications, and a 5% reduction in water intensity globally by 2023.

Stricter regulations, such as those from the EPA, necessitate investments in sustainable manufacturing, leading Ashland to reduce hazardous waste generation by 5% in 2023 compared to the prior year. Furthermore, Ashland is actively developing natural, nature-derived, and biodegradable products, aligning with the growing market for sustainable solutions, with the biodegradable packaging market projected to exceed $50 billion by 2025.

Ashland’s dedication to biodiversity is demonstrated through support for initiatives like The Nature Conservancy's Plant a Billion Trees project, aiming for a 'nature-positive' operational model. The company's innovation in water-based coatings, a market valued at approximately $85 billion in 2023, also reflects its strategy to minimize environmental impact and meet evolving consumer demands for eco-friendly alternatives.

| Environmental Focus | Target/Metric | Baseline Year | Progress/Status |

| Scope 1 & 2 GHG Emissions Reduction | 40% reduction | 2019 | On track for 2030 |

| Water Intensity Reduction | 5% reduction | 2019 | Achieved by 2023 |

| Hazardous Waste Generation Reduction | 5% reduction | 2022 | Achieved in 2023 |

| Biodegradable Packaging Market Growth | Projected >$50 billion | 2025 | Indicative market trend |

| Waterborne Coatings Market Value | ~$85 billion | 2023 | Current market size |

PESTLE Analysis Data Sources

This PESTLE analysis for Ashland is built on a foundation of comprehensive data from reputable sources including government publications, international economic organizations, and leading industry research firms. We ensure each factor is supported by current, verifiable information.