Asbury Automotive Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asbury Automotive Group Bundle

Understand the critical political, economic, social, technological, legal, and environmental factors shaping Asbury Automotive Group's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Gain a competitive edge by leveraging these insights for strategic planning and risk mitigation.

Ready to make informed decisions about Asbury Automotive Group? Our expertly crafted PESTLE analysis offers a deep dive into the macro-environmental landscape, empowering you to identify opportunities and threats. Download the full version now for immediate access to data-driven strategic guidance.

Political factors

Government policies, including federal tax credits and state-level rebates, are pivotal in shaping consumer demand for electric vehicles (EVs), directly influencing Asbury Automotive Group's sales performance and inventory strategies. For instance, the federal EV tax credit, which in 2024 can offer up to $7,500 for qualifying new vehicles, plays a significant role in purchase decisions.

Changes to these incentives, such as the 2024 updates to the federal tax credit requiring North American battery component sourcing, can rapidly alter the market landscape and consumer preferences for specific EV models. This necessitates agile inventory management and strategic partnerships for dealerships like Asbury.

Furthermore, stringent regulations, such as California's Advanced Clean Cars II regulation mandating a growing percentage of zero-emission vehicle sales, compel manufacturers to ramp up EV production. This, in turn, pressures dealerships to expand their EV inventory and sales expertise to meet regulatory demands and consumer interest.

Changes in trade policies, particularly tariffs on imported vehicles and auto parts, directly impact the cost structure for dealerships like Asbury Automotive Group. For instance, a hypothetical 25% tariff on imported auto parts could significantly inflate the cost of vehicles that rely on these components, potentially forcing price increases for consumers.

These tariffs can also influence manufacturers' production decisions, potentially leading to shifts in supply chains and affecting the availability and pricing of specific vehicle models. The uncertainty surrounding future tariff implementations in 2024 and 2025 adds another layer of complexity, potentially encouraging more domestic production but also creating volatility in the market.

State franchise laws significantly shape the dynamics between auto manufacturers and dealerships like Asbury, safeguarding dealers from overly burdensome OEM demands. For instance, California's AB 473, enacted in 2023, directly addresses manufacturer competition with franchisees and mandates cost-sharing for EV charging, impacting Asbury's strategic investments.

Consumer Protection Regulations

Consumer protection regulations significantly shape Asbury Automotive Group's operations, particularly concerning vehicle sales, financing, and data privacy. Adhering to these laws is crucial for building and maintaining consumer trust, while also preventing costly legal repercussions. This necessitates a strong focus on transparent pricing, clear financing disclosures, and robust customer data handling practices, especially with the increasing adoption of digital sales channels.

In 2024, the automotive retail sector continued to see heightened scrutiny on consumer protection. For instance, the Federal Trade Commission (FTC) has been actively enforcing rules like the "Dealership Rule," aiming to enhance transparency in vehicle advertising and sales processes. Asbury Automotive Group, like its peers, must ensure its digital platforms and in-store practices align with these evolving standards. Failure to do so could result in fines and reputational damage, impacting customer acquisition and retention efforts.

- Vehicle Sales Transparency: Regulations mandate clear disclosure of vehicle pricing, fees, and financing terms, directly impacting Asbury's sales strategies and marketing materials.

- Financing Disclosures: Compliance with truth-in-lending laws ensures that customers fully understand loan terms, interest rates, and payment schedules, minimizing potential disputes.

- Data Privacy: As digital retailing grows, Asbury must safeguard customer personal and financial data, adhering to regulations like state-specific privacy laws which are becoming increasingly stringent.

- Compliance Costs: Investments in technology and training are necessary to ensure ongoing adherence to consumer protection mandates, representing a significant operational expenditure.

Labor Laws and Employment Policies

Government regulations significantly shape Asbury Automotive Group's operational landscape. For instance, minimum wage laws directly influence labor costs, a substantial component of the automotive retail sector. As of 2024, federal minimum wage remains at $7.25 per hour, but many states and cities have enacted higher rates, with California leading at $16.00 per hour in 2024, impacting Asbury's payroll expenses in those regions.

Workplace safety standards, mandated by bodies like OSHA, require continuous investment in training and equipment to ensure compliance and prevent accidents. Employment benefit mandates, such as those related to health insurance under the Affordable Care Act, also add to Asbury's overhead. These policies necessitate careful human resource management to balance compliance with cost-effectiveness.

The availability of a skilled workforce, particularly for servicing electric and hybrid vehicles, is a growing concern. Educational and vocational policies play a crucial role in developing the pipeline of qualified technicians. Asbury, like many in the industry, relies on these programs to source talent capable of handling evolving automotive technologies.

- Minimum Wage Impact: Higher state minimum wages, such as California's $16.00/hour in 2024, directly increase Asbury's labor costs in those operating areas.

- Workplace Safety Investment: Compliance with OSHA standards necessitates ongoing expenditure on safety training and equipment.

- Skilled Technician Shortage: The demand for technicians proficient in new vehicle technologies, like EVs, is influenced by the effectiveness of vocational training programs.

- Benefit Mandates: Regulations like the ACA's employer mandate contribute to the overall cost of employee benefits for Asbury.

Government policies, particularly those concerning environmental regulations and emissions standards, directly influence the automotive market and Asbury Automotive Group's product mix. For instance, the Inflation Reduction Act of 2022, which provides tax credits for electric vehicles, continues to drive consumer interest in EVs through 2024 and 2025, impacting demand for traditional internal combustion engine vehicles.

Trade policies and tariffs on imported vehicles and parts can significantly affect vehicle pricing and availability, a key consideration for Asbury's inventory management. Fluctuations in these policies create market uncertainty, potentially impacting sales volumes and profitability. For example, ongoing discussions around potential tariffs on vehicles manufactured in countries with which the U.S. has trade deficits remain a point of attention for the industry.

State franchise laws are crucial in defining the operational framework for dealerships like Asbury, protecting their business models from manufacturer overreach. Regulations enacted in 2023 and continuing into 2024, such as those related to direct-to-consumer sales by manufacturers or requirements for EV charging infrastructure investment by dealers, directly shape Asbury's strategic planning and capital allocation.

| Policy Area | Impact on Asbury | 2024/2025 Relevance |

|---|---|---|

| EV Tax Credits (e.g., IRA) | Boosts demand for EVs, influencing inventory mix and sales strategies. | Up to $7,500 federal credit available for qualifying new EVs in 2024, with evolving sourcing requirements. |

| Emissions Standards | Drives manufacturer focus on cleaner vehicles, impacting vehicle supply and technological advancements. | California's Advanced Clean Cars II regulation continues to influence national trends towards zero-emission vehicles. |

| Trade Tariffs | Affects vehicle import costs, potentially increasing prices and impacting supply chain stability. | Ongoing trade negotiations and potential tariff adjustments create market volatility. |

| Franchise Laws | Protects dealer autonomy and dictates manufacturer-dealer relationships. | State-level legislation continues to address issues like manufacturer competition and EV infrastructure mandates. |

What is included in the product

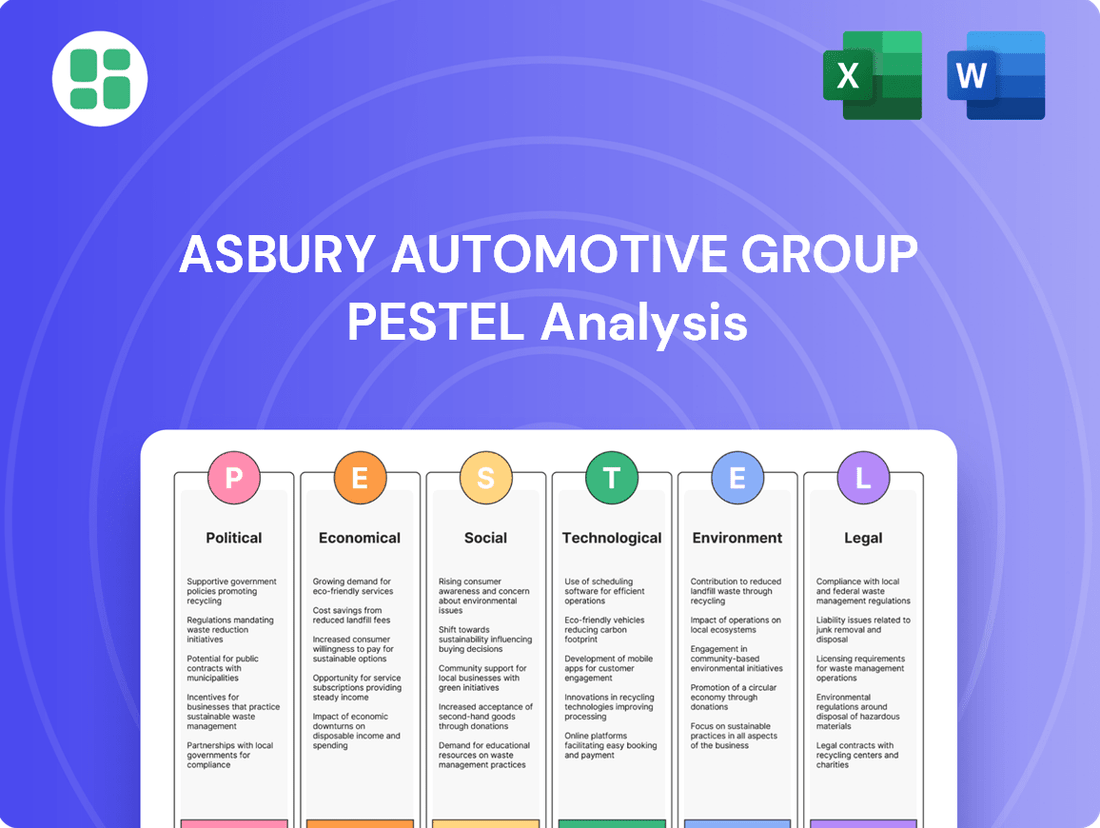

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing Asbury Automotive Group's operations and strategic decisions.

It provides a comprehensive overview of how these macro-environmental forces create both challenges and opportunities for the automotive retailer.

A PESTLE analysis for Asbury Automotive Group offers a clear, summarized version of external factors, simplifying strategic discussions and ensuring all stakeholders grasp key market influences.

Economic factors

Elevated interest rates for auto loans directly impact consumer affordability and demand for new and used vehicles. For instance, the Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through early 2024, a level not seen in over two decades, significantly increasing financing costs for car buyers. This can lead consumers to opt for older used cars, delay purchases, or pay cash, directly affecting Asbury's finance and insurance product sales and overall vehicle turnover.

Despite some relief in used car prices, high interest rates remain a persistent challenge for the auto industry throughout 2024 and into 2025. As of May 2024, the average interest rate for a 60-month new car loan hovered around 7.4%, a substantial increase from previous years, further squeezing consumer budgets and potentially dampening sales volumes for dealerships like Asbury.

Inflationary pressures directly impact Asbury Automotive Group by increasing operational expenses for vital inputs like parts, labor, and utilities. Simultaneously, this economic trend diminishes consumers' ability to spend, affecting their purchasing power.

Rising material costs are a significant driver behind higher vehicle prices, consequently making both new and used cars less accessible for the average buyer. For instance, the average price for a new vehicle in the US hovered around $47,000 in early 2024, a figure that can be prohibitive for many.

This challenging economic climate often encourages consumers to extend the lifespan of their current vehicles. This behavior can lead to a slowdown in new car sales and potentially reduce service revenue as fewer new vehicles are on the road requiring routine maintenance.

Ongoing supply chain issues, especially concerning semiconductor chips, continue to impact vehicle production and dealership inventories. While new vehicle inventory saw some improvement in 2024, these persistent disruptions can still cause production delays, increased costs, and extended customer wait times for specific models.

These factors directly affect Asbury's capacity to satisfy customer demand and maximize sales. For instance, the automotive industry experienced significant production slowdowns in 2023 due to these shortages, with some estimates suggesting millions of units were lost globally.

Used Vehicle Market Dynamics

The used vehicle market is a key economic driver, heavily influenced by the affordability of new cars and the availability of new vehicle inventory. When new cars are scarce or expensive, demand for used cars naturally rises, impacting pricing. For instance, in early 2024, while used car prices have softened from their pandemic highs, they remain elevated compared to pre-pandemic levels, with the Manheim Used Vehicle Value Index showing continued strength in certain segments.

Consumer preferences also play a crucial role. There's a persistent demand for more budget-friendly used vehicles, particularly older models, as economic pressures persist for some buyers. This trend requires companies like Asbury Automotive Group to strategically manage their used vehicle inventory, focusing on both volume and maintaining healthy profit margins amidst these shifting consumer needs.

- New Car Affordability Impact: Limited new car supply and higher MSRPs in 2023 and early 2024 have pushed more consumers towards the used market.

- Inventory Levels: While new vehicle inventory has improved, it hasn't fully saturated the market, maintaining underlying demand for pre-owned vehicles.

- Consumer Demand Shifts: A notable trend is the increased interest in older, more affordable used vehicles, reflecting cost-consciousness among buyers.

- Price Normalization: Used car prices have seen a gradual decline from their 2022 peaks, but remain higher than historical averages, indicating a dynamic pricing environment.

Overall Economic Growth and Consumer Confidence

The overall health of the U.S. economy is a significant driver for Asbury Automotive Group. Strong GDP growth and low unemployment rates, for instance, tend to boost consumer confidence, making individuals more inclined to purchase vehicles. For example, in Q1 2024, the U.S. GDP grew at an annualized rate of 1.3%, indicating a positive, albeit moderating, economic environment.

Higher consumer confidence directly correlates with increased vehicle sales. When consumers feel secure about their financial future and job prospects, they are more likely to make large discretionary purchases like new cars. The Conference Board Consumer Confidence Index stood at 102.0 in May 2024, reflecting a level of optimism that supports spending on big-ticket items.

- GDP Growth: A healthy economy with expanding GDP typically fuels demand for vehicles.

- Employment Rates: Low unemployment means more people have income to spend on cars.

- Consumer Confidence: High confidence levels encourage spending on non-essential purchases like automobiles.

- Disposable Income: Economic strength translates to more disposable income, directly impacting vehicle affordability.

Persistent high interest rates continue to challenge auto loan affordability throughout 2024 and into 2025, with average new car loan rates around 7.4% in May 2024. This economic factor directly impacts consumer purchasing power and Asbury's finance and insurance revenue streams. Inflation also squeezes operational costs and consumer budgets, while rising material costs keep new and used vehicle prices elevated, with average new car prices near $47,000 in early 2024.

| Economic Factor | Impact on Asbury Automotive Group | Relevant Data (2024/2025) |

|---|---|---|

| Interest Rates | Reduced affordability for vehicle financing, impacting sales volume and F&I product revenue. | Federal Reserve benchmark rate: 5.25%-5.50% (early 2024). Avg. 60-month new car loan rate: ~7.4% (May 2024). |

| Inflation | Increased operational costs (parts, labor, utilities) and decreased consumer disposable income. | General inflationary pressures affecting consumer spending power. |

| Vehicle Pricing | Higher new and used car prices due to material costs limit buyer accessibility. | Avg. new vehicle price: ~$47,000 (early 2024). Used car prices remain elevated compared to pre-pandemic levels. |

| Economic Growth & Confidence | Strong GDP growth and consumer confidence support vehicle demand. | U.S. GDP growth: 1.3% annualized (Q1 2024). Consumer Confidence Index: 102.0 (May 2024). |

Preview the Actual Deliverable

Asbury Automotive Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Asbury Automotive Group covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive retail industry. Understand the external forces shaping Asbury's strategic landscape.

Sociological factors

Consumers are increasingly comfortable handling major parts of the car buying journey online. This includes everything from initial research and virtual tours of vehicles to negotiating prices and even arranging home delivery.

This trend is a significant shift, with data from 2024 indicating that around 69% of car shoppers now prefer to complete more of the process from the comfort of their homes.

Consequently, Asbury Automotive Group must continue to invest in and refine its digital sales tools and ensure a smooth, integrated experience across all channels to satisfy these evolving customer demands.

Consumer environmental awareness is fueling a significant rise in demand for electric and hybrid vehicles. This shift is a crucial sociological factor influencing the automotive industry.

While the pace of electric vehicle (EV) adoption has seen fluctuations, the overarching trend clearly indicates a growing preference for sustainable transportation. For instance, in the first quarter of 2024, EV sales in the U.S. continued to show year-over-year growth, albeit at a moderated pace compared to previous periods, with market share hovering around 7-8% of total vehicle sales.

Asbury Automotive Group needs to proactively respond by expanding its investment in EV charging infrastructure across its dealerships and broadening its portfolio to include a wider selection of EV models. Furthermore, equipping sales and service staff with in-depth knowledge about EV technology and ownership is vital to effectively assist customers with their specific inquiries and concerns.

Younger demographics, especially Gen Z, are increasingly drawn to flexible mobility options over traditional vehicle ownership. This signals a move towards accessing transportation rather than possessing it outright.

Subscription services and leasing arrangements are gaining traction, reflecting a desire for adaptability. For instance, a 2024 report indicated that over 60% of Gen Z consumers are open to vehicle subscription models.

Asbury Automotive Group should consider incorporating these evolving ownership preferences into its business strategy. Adapting to these changing attitudes is crucial for remaining competitive in the automotive retail landscape.

Importance of Customer Experience and Online Reputation

Customer experience is now a top priority, with consumers heavily influenced by online reviews and social proof when making choices. In 2024, a significant majority of consumers reported that online reviews influence their purchasing decisions, with many trusting them as much as personal recommendations. Asbury Automotive Group needs to ensure a consistently positive customer journey, both digitally and in-person, to foster trust and long-term loyalty in this increasingly review-driven market.

A strong online reputation is no longer optional; it's essential for competitive advantage. Studies from late 2024 indicate that businesses with higher online ratings often see a substantial increase in customer acquisition compared to those with lower ratings. Asbury must therefore proactively manage its digital footprint and prioritize high levels of customer satisfaction across all touchpoints to maintain its market position.

- Customer Trust: 85% of consumers trust online reviews as much as personal recommendations (2024 data).

- Reputation Impact: Businesses with a 4.5-star average rating can attract up to 20% more customers.

- Digital Journey: A seamless online experience is critical, as 70% of consumers abandon a purchase if the online process is too complex.

- Brand Loyalty: Personalized customer experiences are linked to a 25% increase in customer retention rates.

Demographic Shifts and Lifestyle Changes

Demographic shifts are significantly reshaping the automotive market. For instance, the aging population in the US, projected to see individuals aged 65 and older increase by over 40% between 2020 and 2030, may influence demand for comfortable, accessible vehicles. Simultaneously, younger generations, like Gen Z, are entering the market with distinct preferences, often prioritizing technology, sustainability, and digital purchasing experiences. This contrast necessitates a nuanced approach from dealerships like Asbury Automotive Group.

Lifestyle changes, such as increased urbanization and the persistent trend of remote work, also play a crucial role. Urban dwellers might favor smaller, fuel-efficient vehicles or electric options for navigating city streets and dealing with parking constraints. Remote work, on the other hand, could alter commuting patterns, potentially decreasing the demand for daily drivers while increasing interest in vehicles suitable for leisure or occasional longer trips. Asbury Automotive Group must adapt its inventory and marketing to these evolving consumer needs.

- Aging Population Impact: Growing segment of older adults may seek vehicles with enhanced safety features and ease of access.

- Younger Buyer Preferences: Gen Z and Millennials often prioritize connectivity, sustainability, and online purchasing channels.

- Urbanization Trends: Demand for compact, electric, and shared mobility solutions is likely to rise in metropolitan areas.

- Remote Work Influence: Shifting commuting habits could lead to a decreased need for traditional daily drivers and an increased interest in versatile vehicles.

Shifting consumer preferences toward digital engagement are profoundly impacting automotive retail. By 2024, a significant majority of car shoppers, around 69%, preferred to handle more of their car buying journey online, from research to delivery. This necessitates Asbury Automotive Group's continued investment in seamless digital platforms and integrated omnichannel experiences to meet evolving customer expectations.

Growing environmental consciousness is a key sociological driver, fueling demand for electric and hybrid vehicles. Despite some moderation in adoption rates, EV sales in Q1 2024 continued their year-over-year growth, capturing approximately 7-8% of the U.S. market share. Asbury must expand its EV offerings and charging infrastructure, while also ensuring staff are well-versed in EV technology to cater to this trend.

Lifestyle changes, including urbanization and remote work, are reshaping vehicle needs. Urban dwellers may favor compact, electric vehicles, while remote work could decrease demand for daily commuters and increase interest in versatile vehicles for leisure. Asbury must adapt its inventory and marketing strategies to these demographic and lifestyle shifts.

| Sociological Factor | 2024/2025 Trend | Impact on Asbury Automotive Group |

|---|---|---|

| Digitalization of Car Buying | ~69% of shoppers prefer online processes. | Invest in digital tools, ensure omnichannel integration. |

| Environmental Awareness | Steady EV/Hybrid demand growth (7-8% market share in Q1 2024). | Expand EV inventory, charging infrastructure, and staff training. |

| Demographic Shifts & Lifestyles | Aging population seeks safety; Gen Z prefers flexibility/digital. Urbanization favors smaller EVs; remote work alters commuting needs. | Tailor inventory, marketing, and sales models to diverse preferences. |

Technological factors

The automotive retail sector is rapidly digitizing, with online sales and digital customer journeys becoming standard. Asbury Automotive Group must invest in virtual showrooms, e-commerce capabilities, and sophisticated digital marketing to support online transactions and customer interaction.

Asbury's collaboration with technology partners like Tekion, as seen in their pilot programs, underscores their proactive approach to integrating advanced digital solutions. This digital shift is crucial for maintaining competitiveness and meeting evolving consumer expectations for seamless online purchasing experiences.

Continuous advancements in battery technology, charging infrastructure, and electric vehicle (EV) range are significantly accelerating EV adoption. As of early 2024, battery costs have fallen by approximately 90% over the past decade, making EVs more accessible. This trend necessitates Asbury Automotive Group to remain current with the latest EV models and ensure their service centers are equipped for the specialized maintenance and repair of these sophisticated vehicles.

The increasing availability of more affordable EV options is a critical factor influencing market growth. For instance, several manufacturers introduced new EV models in the $30,000-$40,000 price range in 2023, broadening the consumer base. Asbury must strategically adapt its inventory and technician training to capitalize on this expanding segment of the automotive market.

The integration of artificial intelligence and data analytics is a significant technological factor for Asbury Automotive Group. By leveraging AI, dealerships can gain powerful data-driven insights to forecast market trends, refine pricing strategies, and enhance inventory management. For instance, Asbury's use of advanced analytics in 2024 allows for more precise demand forecasting, potentially reducing overstock situations and improving capital allocation.

Furthermore, AI and predictive analytics are instrumental in personalizing customer interactions. Asbury's investment in CRM systems, coupled with AI-driven insights, enables a more tailored and effective customer journey. This can translate into improved customer satisfaction and loyalty, as demonstrated by the increasing adoption of AI in customer service across the automotive sector, with many dealerships reporting a 10-15% uplift in engagement metrics through personalized outreach.

Evolution of Vehicle Connectivity and Autonomous Features

The automotive industry is rapidly advancing with connected vehicle technology, featuring sophisticated infotainment, over-the-air (OTA) software updates, and the gradual integration of autonomous driving features. For Asbury Automotive Group, this means dealerships need to be equipped to educate customers on these complex systems. By 2025, it's projected that over 90% of new vehicles sold globally will be connected, highlighting the critical need for sales and service staff to be proficient in explaining and troubleshooting these advancements.

These technological shifts also introduce new operational challenges. Cybersecurity for connected vehicles is paramount, requiring dealerships to implement robust security protocols. Furthermore, the complexity of these systems necessitates specialized diagnostic equipment and technicians trained in advanced automotive electronics and software, impacting service center capabilities and investment needs.

- Connected Vehicle Growth: Global connected car market expected to reach $250 billion by 2027, with a significant portion driven by advanced driver-assistance systems (ADAS) and infotainment.

- OTA Update Adoption: By late 2024, a majority of new vehicle models offer OTA update capabilities, streamlining software improvements and reducing the need for physical service visits for certain fixes.

- Autonomous Feature Demand: Consumer interest in semi-autonomous features like adaptive cruise control and lane-keeping assist continues to rise, influencing purchasing decisions and requiring dealership expertise.

- Service Complexity: The average repair cost for advanced electronic systems in vehicles can be 30-50% higher than for traditional mechanical repairs, demanding investment in specialized tools and training.

Cybersecurity in Vehicle Systems and Dealership Operations

The automotive industry is facing a significant technological shift with increasingly connected vehicles and digitized dealership operations, directly impacting cybersecurity. New mandatory regulations, effective from July 2024 for all newly manufactured vehicles, underscore the urgency of robust cybersecurity measures. Asbury Automotive Group must proactively address these evolving threats to safeguard its operations and customer data.

Compliance with stringent cybersecurity management systems (CSMS) and secure software update management systems (SUMS) is paramount. These frameworks are designed to protect against sophisticated cyber threats, ensuring the integrity of vehicle systems and dealership infrastructure. For instance, the increasing sophistication of ransomware attacks targeting automotive supply chains, with some incidents in late 2023 and early 2024 causing significant operational disruptions, highlights the need for Asbury to invest in advanced threat detection and response capabilities. Maintaining customer trust hinges on demonstrating a commitment to data privacy and vehicle security.

- Regulatory Compliance: Adherence to new mandatory cybersecurity regulations for vehicles from July 2024, including CSMS and SUMS, is critical for Asbury.

- Operational Security: Protecting dealership systems and customer data from escalating cyber threats, such as data breaches and ransomware, is essential.

- Vehicle Integrity: Ensuring the security of connected vehicle systems sold by Asbury is vital to prevent unauthorized access and protect driver safety.

- Customer Trust: Demonstrating strong cybersecurity practices is key to maintaining and enhancing customer confidence in Asbury's products and services.

Technological advancements are reshaping the automotive landscape, pushing Asbury Automotive Group towards digital integration and EV readiness. The increasing adoption of connected car technology, with over 90% of new vehicles projected to be connected by 2025, necessitates expertise in complex systems and cybersecurity. Asbury's strategic partnerships and investments in AI and data analytics are crucial for enhancing customer experiences and operational efficiency.

| Technology Trend | Impact on Asbury Automotive Group | 2024/2025 Data/Projections |

|---|---|---|

| Digital Sales & Customer Journeys | Need for virtual showrooms and e-commerce capabilities. | Online car sales are projected to grow significantly, with some analysts predicting over 20% of all car sales to be online by 2025. |

| Electric Vehicle (EV) Adoption | Requirement for EV-specific service and technician training. | EV battery costs have decreased by approximately 90% in the last decade, making EVs more accessible; new affordable EV models are entering the market. |

| Artificial Intelligence (AI) & Data Analytics | Enhancing market forecasting, pricing, and inventory management. | Asbury's use of advanced analytics in 2024 aids precise demand forecasting, potentially improving capital allocation. |

| Connected Vehicle Technology | Dealerships must educate customers on complex features and OTA updates. | By 2025, over 90% of new vehicles sold globally are expected to be connected; OTA update capabilities are becoming standard. |

| Cybersecurity | Implementing robust security for vehicle systems and customer data. | New mandatory cybersecurity regulations for vehicles are effective from July 2024, requiring CSMS and SUMS compliance. |

Legal factors

The U.S. Environmental Protection Agency (EPA) has finalized stricter greenhouse gas emission standards for light-duty and medium-duty vehicles, set to begin phasing in with the 2027 model year. These regulations are designed to push the automotive industry toward cleaner technologies, impacting Asbury Automotive Group's inventory strategy.

To comply, Asbury will need to increase its sales of vehicles with advanced powertrains, including hybrids, plug-in hybrids, and fully electric vehicles. This shift is crucial for meeting evolving regulatory targets and catering to a market increasingly focused on sustainability.

Asbury Automotive Group's reliance on digital channels for customer engagement means navigating a complex web of data privacy laws. States like California, with its Consumer Privacy Act (CCPA), and similar emerging legislation across the US, impose strict rules on how customer data can be collected, processed, and shared. Failure to comply can result in significant fines and damage to reputation.

State franchise laws are crucial for Asbury's dealerships, dictating how they interact with vehicle manufacturers and safeguarding against unfair practices like direct competition or excessive demands. These laws ensure a more balanced relationship, vital for dealership profitability and operational stability.

Recent legislative actions, such as California's AB 473, are reshaping these dynamics. This law, for instance, tackles key areas like the allocation of electric vehicle (EV) charging expenses, mandates greater transparency in how manufacturers distribute vehicles to dealerships, and clarifies reimbursement for digital services. These provisions directly influence Asbury's contractual obligations and operational strategies with automakers.

Consumer Financing and Lending Regulations

Regulations governing vehicle financing and lending directly shape Asbury Automotive Group's finance and insurance (F&I) operations. Adherence to laws like the Truth in Lending Act and fair credit reporting mandates is critical for compliant operations. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to scrutinize dealer participation in auto loan financing, impacting how dealerships earn revenue from these arrangements.

Shifts in consumer credit legislation can alter vehicle loan terms, influence the profitability of F&I products, and affect how easily customers can secure financing. These changes can necessitate adjustments in Asbury's product offerings and pricing strategies to maintain competitiveness and regulatory alignment.

- Truth in Lending Act (TILA) Compliance: Ensures transparent disclosure of credit terms to consumers.

- Fair Credit Reporting Act (FCRA): Governs the collection and use of consumer credit information.

- CFPB Scrutiny: Ongoing focus on dealer markups and potential discriminatory practices in auto lending.

- State-Specific Lending Laws: Varying regulations across states can impact financing structures and consumer protections.

Vehicle Recall and Safety Regulations

Vehicle recall and safety regulations are a critical legal factor for Asbury Automotive Group. The company must adhere to strict government mandates regarding vehicle safety standards and mandatory recall procedures for defects. Asbury, operating as both a retailer and a service provider, bears the responsibility of efficiently facilitating these recalls and ensuring all vehicles it sells and services consistently meet established safety requirements. For instance, in 2023, the National Highway Traffic Safety Administration (NHTSA) oversaw hundreds of recalls affecting millions of vehicles, underscoring the pervasive nature of these regulations.

Major recalls, often triggered by widespread manufacturing defects, can significantly erode consumer trust in specific vehicle brands and, by extension, in dealerships like Asbury. This can lead to a dip in sales and a surge in demand for recall-related services, placing a strain on service center capacity. Furthermore, failure to comply with recall notices or ensure the safety of vehicles can expose Asbury to substantial legal liabilities and financial penalties.

- Regulatory Compliance: Asbury must navigate and comply with evolving vehicle safety standards set by bodies like the NHTSA in the US and similar agencies globally.

- Recall Management: The group is responsible for managing the logistical and customer-facing aspects of vehicle recalls, ensuring timely notification and repair.

- Consumer Confidence: Proactive and transparent handling of recalls is essential for maintaining consumer confidence in Asbury's commitment to safety and vehicle integrity.

- Legal and Financial Risks: Non-compliance or mishandling of recalls can result in significant fines, lawsuits, and damage to brand reputation.

Asbury Automotive Group must navigate stringent federal and state regulations impacting vehicle sales and operations. The EPA's evolving emissions standards, pushing for cleaner vehicle technologies from 2027 onwards, directly influence inventory mix and sales strategies toward EVs and hybrids.

State franchise laws are critical, ensuring fair dealings with manufacturers and protecting dealerships from unfair practices, as exemplified by California's AB 473 which clarifies EV charging cost allocation and vehicle distribution transparency.

Compliance with consumer lending laws, such as the Truth in Lending Act, is paramount for Asbury's F&I operations, especially with the CFPB's continued scrutiny of auto loan financing practices in 2024.

Vehicle recall management and safety compliance, overseen by agencies like NHTSA, are essential for maintaining consumer trust and avoiding significant legal liabilities, as demonstrated by the millions of vehicles subject to recalls in 2023.

| Regulatory Area | Key Legislation/Agency | Impact on Asbury | 2024/2025 Relevance |

|---|---|---|---|

| Emissions Standards | EPA Greenhouse Gas Standards | Shift to EVs/Hybrids | Phasing in from 2027, impacting current inventory planning. |

| Dealership Operations | State Franchise Laws (e.g., CA AB 473) | Manufacturer Relations, EV Cost Allocation | Ongoing impact on dealership agreements and operational costs. |

| Financing & Lending | TILA, FCRA, CFPB | F&I Revenue, Compliance Scrutiny | CFPB focus on dealer participation in auto loans continues. |

| Vehicle Safety | NHTSA Recall Mandates | Recall Management, Consumer Trust | Constant need for efficient recall handling due to frequent recalls. |

Environmental factors

The automotive sector faces intensifying pressure to curb greenhouse gas emissions. Regulatory bodies, such as the U.S. Environmental Protection Agency (EPA), have introduced stringent standards for model years 2027 and beyond, targeting substantial reductions in CO2 emissions. This regulatory shift directly impacts manufacturers and, by extension, dealerships like Asbury Automotive Group, compelling them to adjust their product offerings.

As a result, Asbury Automotive Group must strategically adapt its inventory to meet evolving consumer preferences and regulatory demands for vehicles with lower or zero emissions. This includes a proactive approach to stocking and promoting electric vehicles (EVs) and hybrids, aligning with the broader industry trend towards electrification. For instance, the U.S. market saw a significant surge in EV sales, reaching over 1.2 million units in 2023, indicating a clear consumer shift.

The rapid surge in electric vehicle (EV) adoption, driven by environmental consciousness and supportive government policies, is a significant factor for automotive retailers like Asbury Automotive Group. By the end of 2024, projections indicate that EV sales in the U.S. could reach over 1.5 million units, a substantial increase from previous years. This trend necessitates investment in EV charging infrastructure across Asbury's dealership network to cater to sales, service, and customer needs.

Furthermore, dealerships must address the emerging challenge of managing battery waste and other specialized components associated with EVs, requiring new operational protocols and potentially new partnerships for responsible disposal and recycling. As of early 2025, the automotive industry is actively exploring solutions for battery lifecycle management, with significant R&D investment being channeled into this area.

Asbury Automotive Group, operating in vehicle maintenance and repair, faces stringent environmental regulations regarding the disposal and recycling of automotive waste like lubricants, tires, and hazardous materials. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize proper management of used oil, a common byproduct of vehicle servicing.

Implementing robust waste management and recycling programs is not only vital for regulatory compliance but also enhances Asbury's corporate social responsibility image. Many states, including California, have specific mandates for recycling a significant portion of vehicle tires, with programs aiming for over 80% diversion from landfills.

These sustainable practices can lead to cost savings through reduced disposal fees and potential revenue from recycled materials. The automotive aftermarket industry's focus on sustainability is growing, with many service providers actively seeking innovative solutions for waste reduction.

Energy Consumption and Carbon Footprint of Dealerships

Dealership operations, from brightly lit showrooms to busy service centers, are inherently energy-intensive. This high energy consumption directly contributes to a dealership's carbon footprint. Asbury Automotive Group, like many in the automotive retail sector, faces growing pressure from regulators and consumers to become more environmentally responsible.

The push for sustainability means businesses are increasingly expected to implement energy efficiency measures and explore renewable energy options. For Asbury, this could translate into necessary investments in upgrading facilities to be more energy-efficient and potentially incorporating renewable energy sources to meet evolving environmental goals and stakeholder expectations. For instance, in 2023, the automotive industry saw a continued focus on ESG (Environmental, Social, and Governance) reporting, with many companies detailing their energy reduction targets.

- Energy Use: Showrooms, service bays, and administrative offices are significant energy consumers.

- Carbon Footprint: Dealerships contribute to greenhouse gas emissions through their energy usage.

- Sustainability Pressure: Growing demand for energy efficiency and renewable energy adoption from consumers and regulators.

- Investment Needs: Potential need for Asbury to invest in greener technologies and operational practices.

Supply Chain Sustainability Pressures

Asbury Automotive Group faces indirect environmental pressures stemming from the sustainability demands placed upon the entire automotive supply chain. Manufacturers and their suppliers are under increasing scrutiny regarding their environmental footprint, encompassing everything from the extraction of raw materials to the energy used in production. For instance, by 2025, many automakers are targeting significant reductions in Scope 3 emissions, which include supply chain activities, impacting companies like Asbury through their sourcing practices.

These broader supply chain sustainability initiatives can directly affect Asbury's operations. For example, stricter regulations or voluntary commitments by manufacturers to use ethically sourced or recycled materials could alter the availability of certain vehicle components or even entire models. This shift might necessitate changes in inventory management and could potentially drive up the cost of vehicles and parts as suppliers invest in more sustainable processes.

The push for sustainability is not just about compliance; it's becoming a competitive differentiator. Companies that can demonstrate robust environmental stewardship throughout their value chain are increasingly favored by consumers and investors. Asbury's reliance on a global network of suppliers means it must be attuned to these evolving environmental standards to maintain operational efficiency and cost-effectiveness.

- Supply Chain Emissions Targets: Major automakers are setting ambitious Scope 3 emission reduction targets, with many aiming for 30-50% reductions by 2030, directly influencing supplier requirements.

- Sustainable Material Sourcing: Growing demand for recycled and bio-based materials in vehicle manufacturing could impact the availability and cost of traditional components.

- Regulatory Scrutiny: Environmental regulations are expanding to cover supply chain practices, potentially leading to increased compliance costs for manufacturers and their partners.

- Consumer Preference: Studies in 2024 indicate a rising consumer preference for vehicles from brands with transparent and sustainable supply chains.

Environmental factors significantly shape the automotive retail landscape for Asbury Automotive Group. The accelerating shift towards electric vehicles (EVs) is a primary driver, with U.S. EV sales projected to exceed 1.5 million units by the end of 2024. This necessitates substantial investment in dealership EV charging infrastructure and a strategic inventory adjustment to meet growing consumer demand for greener alternatives.

Furthermore, Asbury must navigate stringent regulations concerning automotive waste, including lubricants and hazardous materials, with ongoing EPA emphasis on proper disposal. The company also faces pressure to reduce its operational carbon footprint, driving the need for energy efficiency upgrades and potential adoption of renewable energy sources, as reflected in the growing focus on ESG reporting across the industry.

Supply chain sustainability is another critical environmental consideration. Automakers are increasingly targeting Scope 3 emission reductions, influencing Asbury through supplier practices and material sourcing. This trend, coupled with rising consumer preference for eco-conscious brands, underscores the importance of environmental stewardship throughout the value chain.

| Environmental Factor | Impact on Asbury Automotive Group | Supporting Data/Trend (2024-2025) |

| EV Adoption | Inventory management, service needs, infrastructure investment | U.S. EV sales projected over 1.5 million units by end of 2024. |

| Waste Management Regulations | Operational compliance, recycling programs, potential cost savings | Continued EPA focus on proper disposal of used oil and automotive waste. |

| Energy Consumption & Carbon Footprint | Facility upgrades, energy efficiency measures, renewable energy | Growing industry focus on ESG reporting and energy reduction targets. |

| Supply Chain Sustainability | Sourcing practices, material costs, brand reputation | Automakers targeting Scope 3 emission reductions; rising consumer preference for sustainable brands. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asbury Automotive Group is built on a comprehensive review of official government data, automotive industry reports, and reputable financial news outlets. This ensures that insights into political, economic, and market trends are grounded in current, verifiable information.