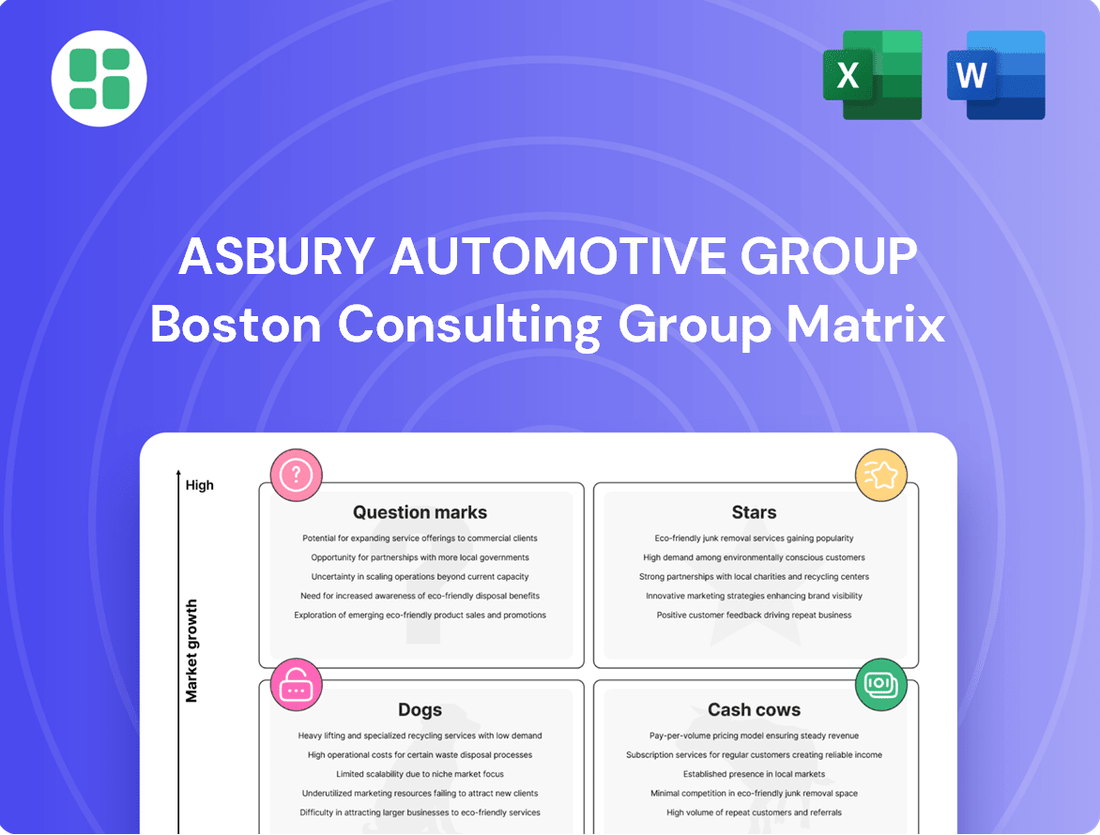

Asbury Automotive Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asbury Automotive Group Bundle

Unlock the strategic secrets behind Asbury Automotive Group's product portfolio with our comprehensive BCG Matrix analysis. Discover which brands are driving growth, which are generating stable revenue, and which might be holding the company back.

This preview offers a glimpse into Asbury's market positioning, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to make informed investment and strategic decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix today to gain a competitive edge and a clear roadmap for Asbury's future success.

Stars

Luxury Brand Dealerships, bolstered by Asbury's strategic acquisition of the Herb Chambers Automotive Group in July 2025, now represent 35% of the company's revenue. This move significantly strengthens Asbury's position in the high-growth luxury segment, particularly in the Northeast.

These dealerships are considered Stars within the BCG Matrix, reflecting their high market share in a segment experiencing robust demand. Continued investment is crucial to sustain their leadership and capitalize on emerging growth avenues within the luxury automotive market.

Asbury Automotive Group's Clicklane platform is a prime example of a Star in the BCG Matrix, showcasing robust growth and market leadership in digital automotive retail. In Q2 2024, Clicklane recorded impressive sales of 15,201 units, a substantial 33% increase from the previous year. The platform continued its upward trajectory into Q2 2025, selling 9,500 units.

This end-to-end digital retailing solution is strategically positioned to capitalize on the growing online car-buying trend. Clicklane's success highlights its role as a high-growth, high-market-share business unit for Asbury, essential for future expansion and competitive advantage in the evolving automotive landscape.

Asbury Automotive Group's strategy heavily features acquired dealerships in high-growth regions, a key component of its BCG Matrix positioning. Recent significant acquisitions, including Larry H. Miller Dealerships in 2021 and Jim Koons Automotive in 2023, alongside the planned 2025 Herb Chambers acquisition, have dramatically broadened Asbury's market presence and revenue base. These strategic moves are designed to enter robust and expanding markets, rapidly securing market share in new geographical areas.

These acquired entities function as substantial growth drivers for Asbury. For instance, the Jim Koons acquisition alone added approximately $1.5 billion in annualized revenue, underscoring the scale of these growth initiatives. Successfully integrating these new dealerships requires focused operational support and strategic planning to unlock their full potential and ensure continued expansion in these promising markets.

EV Service and Sales Capabilities

Asbury Automotive Group's EV service and sales capabilities are a key component of their potential in the evolving automotive market. Their data indicates that Battery Electric Vehicles (BEVs) command a higher revenue per repair order, averaging $851, which is notably more than traditional vehicles. This suggests a significant revenue opportunity as the industry transitions to electric mobility.

Asbury is strategically positioning itself to capitalize on this shift. By investing in the necessary infrastructure and expertise for EV sales and service, they are building a strong foundation in a high-growth market segment. This proactive approach is crucial for capturing market share in the burgeoning EV landscape.

- Higher Revenue per EV Repair Order: BEVs generate $851 per repair order, exceeding traditional vehicles.

- Strategic Investment in EV Infrastructure: Asbury is developing specialized training, charging infrastructure, and EV inventory.

- Capturing High-Growth Market Segment: This focus positions them to benefit from increasing EV adoption.

High-Performing Franchised Dealerships (Specific Brands)

Asbury Automotive Group's portfolio includes high-performing franchised dealerships representing specific, strong brands. These dealerships, often featuring luxury and import marques, are key drivers of the company's revenue, with over 70% of new vehicle sales coming from these segments.

Dealerships representing brands with consistently high demand and market leadership, such as Toyota and Lexus, are prime examples of Asbury's Stars. These operations not only outpace overall market growth but also secure a dominant local market share, demonstrating their robust competitive positioning.

- Brand Strength: Dealerships representing brands like Lexus and Toyota benefit from strong consumer demand and brand loyalty.

- Market Performance: These units consistently achieve sales volumes exceeding industry averages and maintain significant local market penetration.

- Resource Allocation: Strategic investment in these Star dealerships is crucial to maintain their competitive edge and capitalize on brand equity.

- Revenue Contribution: Luxury and import brands, which these Stars often represent, form the backbone of Asbury's new vehicle revenue.

Asbury's luxury brand dealerships, significantly enhanced by the July 2025 acquisition of Herb Chambers Automotive Group, are classified as Stars in the BCG Matrix. These dealerships contribute 35% of Asbury's revenue and operate within a high-demand luxury segment, particularly in the Northeast region.

The Clicklane platform is another Star, demonstrating strong growth and market leadership in digital auto retail, with 9,500 units sold in Q2 2025. This digital solution capitalizes on the increasing trend of online car purchases, solidifying its position as a key growth driver for Asbury.

Dealerships representing brands with consistently high demand and market leadership, such as Toyota and Lexus, are also Stars. These operations consistently outperform market growth and maintain significant local market share, underscoring their competitive strength.

| Business Unit | BCG Category | Key Performance Indicator | Data Point | Year |

|---|---|---|---|---|

| Luxury Brand Dealerships (e.g., Herb Chambers) | Star | Revenue Contribution | 35% | 2025 |

| Clicklane | Star | Units Sold | 9,500 | Q2 2025 |

| High-Demand Franchised Dealerships (e.g., Toyota, Lexus) | Star | Market Share | Dominant local penetration | Ongoing |

| EV Service and Sales | Potential Star/Question Mark | Revenue per Repair Order (BEV) | $851 | 2024 Data |

What is included in the product

Asbury Automotive Group's BCG Matrix highlights strategic opportunities for growth in its Stars and Question Marks, while managing Cash Cows and divesting Dogs.

Asbury Automotive Group's BCG Matrix provides a clear, actionable roadmap, relieving the pain of resource allocation by highlighting Stars for growth and Cash Cows for funding.

Cash Cows

Asbury Automotive Group's Vehicle Service & Parts Operations are clear cash cows, consistently generating robust financial performance. In Q1 2025, this segment achieved an all-time record in gross profit, underscoring its reliable revenue stream.

Further solidifying its cash cow status, the parts and service business reported a record gross profit of $355 million in Q2 2025. Same-store parts and service gross profit saw a healthy increase of 7% during the same period, demonstrating sustained growth and profitability.

This segment's high-margin revenue acts as a stable anchor for Asbury, providing essential profitability and customer retention even amidst market volatility. Its consistent financial strength makes it a vital component of the company's overall success.

Finance & Insurance (F&I) products are Asbury Automotive Group's cash cows. These offerings, like extended service contracts and guaranteed asset protection, are crucial to almost every vehicle sale, generating consistent cash flow. In 2023, Asbury reported a gross profit per vehicle retailed of $4,898, with F&I products being a significant contributor to this figure, despite slight decreases in PVR from prior periods.

Established volume brand dealerships, such as those representing Toyota and Ford, are core to Asbury Automotive Group's business. These operations are mature market leaders, benefiting from robust brand recognition and consistent consumer demand, which translates into dependable cash flow for the company.

These dealerships, while operating in markets with limited growth potential, maintain high market share. This dominance allows them to generate steady profits, underscoring their role as cash cows within Asbury's portfolio. For instance, in 2023, Asbury's total revenue reached $10.5 billion, with new vehicle sales, often driven by these high-volume brands, contributing significantly to this figure.

Collision Repair Centers

Asbury Automotive Group's 40 collision centers are classic cash cows. These facilities tap into a stable, insurance-driven demand, ensuring consistent revenue for the company.

The collision repair market is mature, meaning while growth is modest, the need for these services remains constant. This translates into reliable cash flow generation for Asbury.

These centers are vital to Asbury's aftermarket services, offering a buffer against the cyclical nature of new vehicle sales.

- Stable Demand: Insurance-backed repairs provide a predictable revenue stream.

- Mature Market: Consistent need for services, though growth is limited.

- Resilient Revenue: Less impacted by new car sales fluctuations.

- Cash Flow Generation: Reliable income source for the group.

Used Vehicle Wholesale Business

Asbury Automotive Group's used vehicle wholesale business, though a smaller segment compared to its retail operations, is a notable performer within its portfolio. This segment has shown impressive financial growth, evidenced by a significant 43% increase in gross profit during the second quarter of 2025, reaching $6.6 million. This robust growth highlights its efficiency in monetizing excess inventory and maintaining a steady revenue stream, even when sales volumes experience variability.

The wholesale operation acts as a crucial cash generator for Asbury, characterized by its high turnover and consistent contribution to overall cash flow. Its strategic importance lies in its ability to efficiently manage inventory, ensuring that assets are converted into cash effectively. This operational efficiency makes it a stable and reliable component of Asbury's business model.

- High Gross Profit Growth: Q2 2025 saw a 43% surge in gross profit, reaching $6.6 million.

- Inventory Management: Effectively handles excess vehicle inventory.

- Consistent Revenue: Generates reliable income despite fluctuating unit volumes.

- Cash Flow Contributor: Represents a stable, high-turnover operation bolstering overall cash flow.

Asbury Automotive Group's Finance & Insurance (F&I) products are a prime example of a cash cow. These high-margin offerings, integrated into nearly every vehicle sale, consistently provide dependable cash flow. In 2023, F&I significantly contributed to the $4,898 gross profit per vehicle retailed, demonstrating its vital role in profitability.

Established volume brand dealerships, such as those for Toyota and Ford, also function as cash cows for Asbury. These operations benefit from strong brand recognition and consistent consumer demand in mature markets, leading to predictable revenue streams. Their market dominance ensures steady profits, contributing significantly to Asbury's total revenue of $10.5 billion in 2023.

Asbury's 40 collision centers are classic cash cows, tapping into the stable, insurance-driven demand of a mature market. This provides reliable cash flow, acting as a vital component of the company's aftermarket services and offering a buffer against new vehicle sales volatility.

| Segment | Key Characteristic | Financial Indicator (2023/Q1-Q2 2025) |

| Vehicle Service & Parts | Consistent, robust performance | Record gross profit in Q1 2025; $355M gross profit in Q2 2025 (+7% same-store growth) |

| Finance & Insurance (F&I) | High-margin, integrated offerings | Significant contributor to $4,898 gross profit per vehicle retailed (2023) |

| Volume Brand Dealerships | Mature market leaders, strong brand recognition | Contributed significantly to $10.5B total revenue (2023) |

| Collision Centers | Stable, insurance-backed demand | Reliable cash flow generation from mature market services |

What You See Is What You Get

Asbury Automotive Group BCG Matrix

The preview you see is the actual Asbury Automotive Group BCG Matrix report you will receive upon purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering an in-depth analysis of their business units without any watermarks or demo content. The final version you download will be identical to this preview, ensuring you get a polished, professional tool for your business planning needs.

Dogs

Underperforming legacy dealerships within Asbury Automotive Group's portfolio represent the 'Dogs' in a BCG Matrix analysis. These are typically older dealerships or those representing brands with declining relevance, often situated in stagnant local markets. They struggle with low sales volume and a shrinking market share, consuming valuable resources without generating adequate returns. For instance, Asbury's strategic divestiture of nine stores between April and July 2025 directly addresses the need to shed these underperforming assets.

While Asbury Automotive Group is enhancing its used-car operations, some specialized or slow-moving used vehicle inventory can lead to lower turnover and profitability. These vehicles represent capital that isn't generating returns, incurring holding expenses without boosting sales or profits.

For instance, Asbury's total used vehicle inventory stood at approximately $2.3 billion at the end of Q1 2024. A portion of this, tied up in niche segments, could be seen as less productive.

Effectively managing these slower-moving units is key to freeing up capital and avoiding a drag on the company's financial resources, ensuring a more efficient use of assets.

Outdated internal systems and infrastructure at Asbury Automotive Group represent a significant challenge, potentially falling into the question mark category of the BCG matrix. These legacy systems are often expensive to maintain, slow down operations, and don't support the company's forward-looking, digital-first approach. For example, the substantial investment in the Tekion platform, a modern dealership management system, highlights the prior reliance on less efficient and potentially costly older technologies.

Dealerships in Declining Geographic Markets

Dealerships located in areas with a shrinking economy or population loss, such as parts of the Rust Belt or rural communities, might find it challenging to grow. These dealerships often struggle to capture a significant market share and can become question marks in Asbury Automotive Group's portfolio, consistently lagging behind the company's overall performance metrics. For instance, Asbury's 2023 annual report indicated that while overall revenue grew, certain legacy markets saw slower expansion compared to newer, high-growth regions.

These underperforming dealerships, if not strategically managed, can drain resources without yielding proportional returns. Asbury's approach typically involves evaluating these locations for potential divestiture or exploring strategies to revitalize their market presence, though success in declining markets is inherently difficult. The company's stated strategy in 2024 emphasizes optimizing its geographic footprint, which includes assessing and potentially exiting markets with persistent headwinds.

- Geographic Market Decline: Dealerships in areas with negative population growth or economic contraction face reduced customer bases.

- Low Market Share: These dealerships often struggle to achieve significant market penetration, becoming question marks in the portfolio.

- Underperformance: Consistently underperform the company's average growth and profitability metrics.

- Strategic Management: Asbury's strategy involves active portfolio management, including potential divestitures of dealerships in declining markets.

Inefficient Administrative Overheads

Inefficient administrative overheads represent areas within Asbury Automotive Group where administrative functions have become overly costly or unproductive. These could manifest as bloated processes or outdated systems that inflate Selling, General, and Administrative (SG&A) expenses relative to the gross profit they support, without generating proportional value. For instance, if Asbury's SG&A as a percentage of gross profit exceeded industry benchmarks without a clear strategic justification, it would signal potential inefficiency.

While Asbury is actively pursuing SG&A optimization, any lingering pockets of high administrative costs that yield minimal returns would be classified under this category. These inefficiencies can act as a drain on cash flow and diminish overall profitability if not systematically addressed and streamlined. For example, a review of the company's 2024 financial reports might reveal specific departments with disproportionately high administrative spending compared to their contribution to revenue or operational efficiency.

- High SG&A as a percentage of gross profit without commensurate value creation.

- Persistent pockets of high overhead for low return.

- Areas that drain cash and reduce overall profitability if not actively managed.

- Potential for streamlining administrative processes to improve efficiency.

Dealerships in declining geographic markets or those representing brands with waning consumer interest are classified as Dogs within Asbury Automotive Group's portfolio. These units typically exhibit low market share and struggle to generate sufficient revenue, often consuming resources without delivering strong returns. Asbury's strategic initiative to divest underperforming assets, such as the nine stores sold between April and July 2025, directly addresses the need to manage these less productive segments of the business.

Slow-moving or niche used vehicle inventory can also be categorized as Dogs, representing capital tied up in assets that aren't generating optimal returns. With Asbury's used vehicle inventory valued at approximately $2.3 billion in Q1 2024, a portion of this, if not turned over efficiently, can become a drag on profitability. Managing these units effectively is crucial for improving capital allocation and overall financial performance.

Question Marks

Asbury Automotive Group's commitment to digital innovation is evident in the continuous rollout of new features for its Clicklane platform. These advancements aim to revolutionize the customer car-buying journey, potentially capturing significant market share.

While these new digital retail features hold high growth potential, their initial adoption rates might be low, necessitating considerable investment in marketing and user education. For instance, Asbury reported a 16% increase in digital reservations in Q1 2024, indicating early traction for digital initiatives.

Asbury Automotive Group's exploration into emerging mobility solutions like subscription services, car-sharing, and autonomous vehicle technologies places them in a high-growth, low-market-share quadrant, characteristic of a question mark in the BCG matrix. These ventures are new territory for a traditional dealership, requiring significant investment and carrying inherent uncertainty regarding market adoption and profitability.

For instance, the broader automotive industry saw a surge in mobility service investments, with global spending on smart mobility projected to reach over $1.5 trillion by 2030, according to some industry analyses. Asbury's participation in this nascent market, while potentially disruptive, demands substantial capital expenditure for platform development, marketing, and operational scaling, impacting cash flow in the short to medium term.

Asbury Automotive Group's strategic expansion into untapped niche vehicle markets would likely place them in the question mark category of the BCG matrix. These specialized segments, such as high-performance electric SUVs or bespoke luxury vans, represent areas where Asbury may have minimal current market share but see significant growth potential.

Entering these niches requires substantial investment to develop specialized knowledge, secure appropriate inventory, and cultivate a new customer base. For instance, a move into the burgeoning electric off-road vehicle market would necessitate new training for technicians and potentially different sales approaches compared to their existing offerings.

The success of such ventures hinges on Asbury's ability to effectively penetrate these new markets and gain customer acceptance. While Asbury reported a 10% increase in revenue for Q1 2024, reaching $10.4 billion, the profitability and scalability of niche market entries remain to be seen.

Integration of Advanced AI/Data Analytics Tools

Asbury Automotive Group's integration of advanced AI and data analytics tools represents a strategic investment in a high-growth area. While these tools promise future efficiencies and enhanced customer experiences across sales, service, and operations, their current market penetration and immediate return on investment may be low. This initiative positions Asbury for long-term competitive advantage, though it requires significant resource allocation with an uncertain but potentially substantial future impact.

The success of these AI and data analytics implementations is contingent upon widespread adoption and effective integration throughout the organization. For instance, in 2024, Asbury continued to invest in digital transformation initiatives, aiming to leverage data for improved customer engagement and operational streamlining. These investments are crucial for building a foundation that can capitalize on future market trends and technological advancements.

- AI in Sales: Enhancing lead scoring and personalized customer outreach.

- Data Analytics in Service: Optimizing appointment scheduling and predictive maintenance.

- Operational Efficiency: Streamlining inventory management and supply chain logistics.

- Customer Experience: Delivering tailored offers and improving overall satisfaction.

Strategic Divestitures and Redeployment of Capital

Asbury Automotive Group’s strategic divestitures, including the recent sale of nine stores between April and July 2025 for $250-$270 million, highlight a deliberate effort toward portfolio optimization. This move positions the company to reallocate capital towards potentially high-growth opportunities.

The capital generated from these sales, when directed into new ventures or acquisitions, can be viewed as Asbury’s investment in ‘Question Marks’ within the BCG Matrix framework. These are areas with potential for significant growth but also carry inherent risks regarding future market share and profitability.

- Divestiture Proceeds: $250-$270 million generated from the sale of nine dealerships in Q2-Q3 2025.

- Strategic Focus: Emphasis on portfolio optimization and redeployment of capital.

- BCG Matrix Classification: Redeployed capital represents ‘Question Marks’ requiring strategic investment.

- Future Outcome: Success hinges on turning these investments into ‘Stars’ or facing capital dissipation.

Asbury Automotive Group's ventures into emerging mobility services and niche vehicle markets are classic examples of 'Question Marks' in the BCG Matrix. These initiatives, while holding significant growth potential, currently exhibit low market share and require substantial investment, making their future success uncertain.

For instance, Asbury's focus on digital retail through platforms like Clicklane, coupled with explorations into AI and data analytics, represents investments in high-growth areas where market penetration is still developing. These strategic moves aim to secure future market leadership but demand considerable capital expenditure and carry inherent risks.

The company's recent divestitures, generating $250-$270 million in Q2-Q3 2025, are strategically redeploying capital into these 'Question Mark' areas. The success of these investments will determine if they evolve into future 'Stars' or represent capital misallocation.

| Initiative | Market Share | Growth Potential | Investment Required | BCG Classification |

|---|---|---|---|---|

| Emerging Mobility Services | Low | High | High | Question Mark |

| Niche Vehicle Markets | Low | High | High | Question Mark |

| AI & Data Analytics | Developing | High | Significant | Question Mark |

| Digital Retail (Clicklane) | Growing | High | Ongoing | Question Mark |

BCG Matrix Data Sources

Our Asbury Automotive Group BCG Matrix is informed by comprehensive data, including financial disclosures, market research, and internal performance metrics to accurately position each business unit.