Asbury Automotive Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asbury Automotive Group Bundle

Asbury Automotive Group navigates a competitive landscape shaped by moderate buyer power and significant rivalry among existing dealerships. The threat of new entrants is somewhat mitigated by high capital requirements, while the bargaining power of suppliers, particularly for new vehicles, presents a notable challenge. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Asbury Automotive Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Asbury Automotive Group's dependence on a select group of major car makers grants these manufacturers substantial leverage. This is evident as manufacturers control vehicle supply, set pricing structures, and enforce dealership operational standards through binding franchise agreements.

The persistent global supply chain issues, particularly the shortage of semiconductor chips and essential auto parts, have amplified manufacturers' bargaining power. For instance, in 2023, the automotive industry continued to grapple with these shortages, impacting production volumes and, consequently, the availability of new vehicles for dealerships like Asbury.

Asbury Automotive Group relies on a vast network of parts and component suppliers for its service, maintenance, and collision repair businesses. While the sheer number of suppliers might suggest low bargaining power, the availability and cost of specialized or Original Equipment Manufacturer (OEM) parts can shift leverage towards certain suppliers.

The automotive parts market in 2025 is experiencing ongoing supply chain challenges, including rising raw material costs and logistics disruptions. These factors are likely to increase the bargaining power of suppliers, potentially impacting Asbury's procurement costs and inventory management.

Asbury Automotive Group relies on third-party providers for various finance and insurance (F&I) products like extended service contracts and guaranteed asset protection. The influence these F&I providers wield over Asbury is tied to how much Asbury's customers want these products, the F&I provider's reputation, and the sheer volume of business Asbury funnels their way.

In 2023, Asbury reported that its F&I segment contributed significantly to its overall profitability, highlighting the importance of these partnerships. However, Asbury's strategic move to develop its own F&I offerings through its Total Care Auto subsidiary is designed to lessen its dependence on external suppliers, thereby reducing their bargaining power.

Leverage of Technology and Software Vendors

The increasing digitization of automotive retail places Asbury Automotive Group in a position of dependence on technology and software vendors. These partners are crucial for essential operations, including dealership management systems, online sales platforms like Clicklane, and customer relationship management (CRM) tools. Vendors offering cutting-edge, integrated solutions, such as Tekion, can wield considerable leverage.

This leverage stems from several factors. Firstly, the high switching costs associated with changing critical software systems mean Asbury faces significant disruption and expense if they decide to move away from a current provider. Secondly, the technology provided by these vendors plays a vital role in Asbury's day-to-day operational efficiency and directly impacts the customer experience. For instance, in 2024, the automotive retail sector continued to see significant investment in digital transformation, with companies like Asbury prioritizing seamless online-to-offline customer journeys. The reliability and functionality of these underlying software platforms are therefore paramount, giving successful vendors substantial bargaining power.

- High Switching Costs: Implementing new dealership management or CRM software can take months and involve substantial data migration and employee retraining, making a change costly and disruptive.

- Critical Operational Dependence: Asbury's ability to manage inventory, process sales, and engage customers relies heavily on the functionality and integration of its technology stack.

- Vendor Innovation: Leading technology providers continually update their platforms, offering advanced features that enhance efficiency and customer satisfaction, which can be difficult for competitors to match quickly.

- Market Consolidation: In some areas of automotive software, there may be a limited number of dominant players, further concentrating bargaining power with those key vendors.

Bargaining Power of Skilled Labor

The availability of skilled automotive technicians and specialized labor is a significant factor for Asbury Automotive Group. A persistent shortage of qualified technicians, particularly for complex maintenance, repair, and collision work, can drive up labor costs. This directly impacts Asbury's service department profitability, as higher wages are needed to attract and retain this essential talent.

The demand for fixed operations, which heavily relies on skilled labor, remains robust. Consumers are increasingly holding onto their vehicles for longer periods, necessitating more frequent and specialized maintenance and repairs. This sustained demand further amplifies the bargaining power of skilled technicians, making their expertise even more valuable to dealership groups like Asbury.

- Technician Shortage Impact: Reports from industry associations like the Auto Care Association have highlighted ongoing shortages, with estimates suggesting a deficit of over 100,000 technicians in the U.S. by 2026.

- Wage Pressures: As a result of this scarcity, average technician wages have seen consistent increases, with some specialized roles commanding significantly higher compensation packages.

- Service Revenue Dependence: Asbury's 2023 annual report indicated that their Parts and Service revenue segment contributed approximately 30% of their total revenue, underscoring the financial importance of efficient and well-staffed service centers.

Asbury Automotive Group faces considerable bargaining power from its primary vehicle manufacturers due to franchise agreements and supply chain constraints. This leverage is amplified by ongoing parts shortages, impacting production and availability, as seen throughout 2023 and continuing into 2024.

The company's reliance on specialized or OEM parts for its service operations also shifts power to certain suppliers, particularly with rising raw material costs and logistics challenges projected for 2025. Furthermore, dependence on technology vendors for critical systems like dealership management and online platforms gives these providers significant leverage due to high switching costs and operational criticality.

The bargaining power of skilled labor, especially automotive technicians, is substantial due to persistent shortages. This drives up labor costs, impacting Asbury's service department profitability, as the demand for maintenance and repairs remains strong, with technicians being essential for a significant portion of Asbury's revenue.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Asbury Automotive Group |

| Vehicle Manufacturers | Franchise agreements, supply chain control, pricing structures | Limited vehicle inventory, pricing dictates, operational standards |

| Parts Suppliers (Specialized/OEM) | Availability of critical components, raw material costs | Increased procurement costs, inventory management challenges |

| F&I Product Providers | Customer demand for products, provider reputation | Profitability of F&I segment, potential for reduced reliance |

| Technology/Software Vendors | Switching costs, operational dependence, innovation | High costs for system changes, reliance on vendor functionality |

| Skilled Labor (Technicians) | Technician shortages, demand for services | Increased labor costs, impact on service department profitability |

What is included in the product

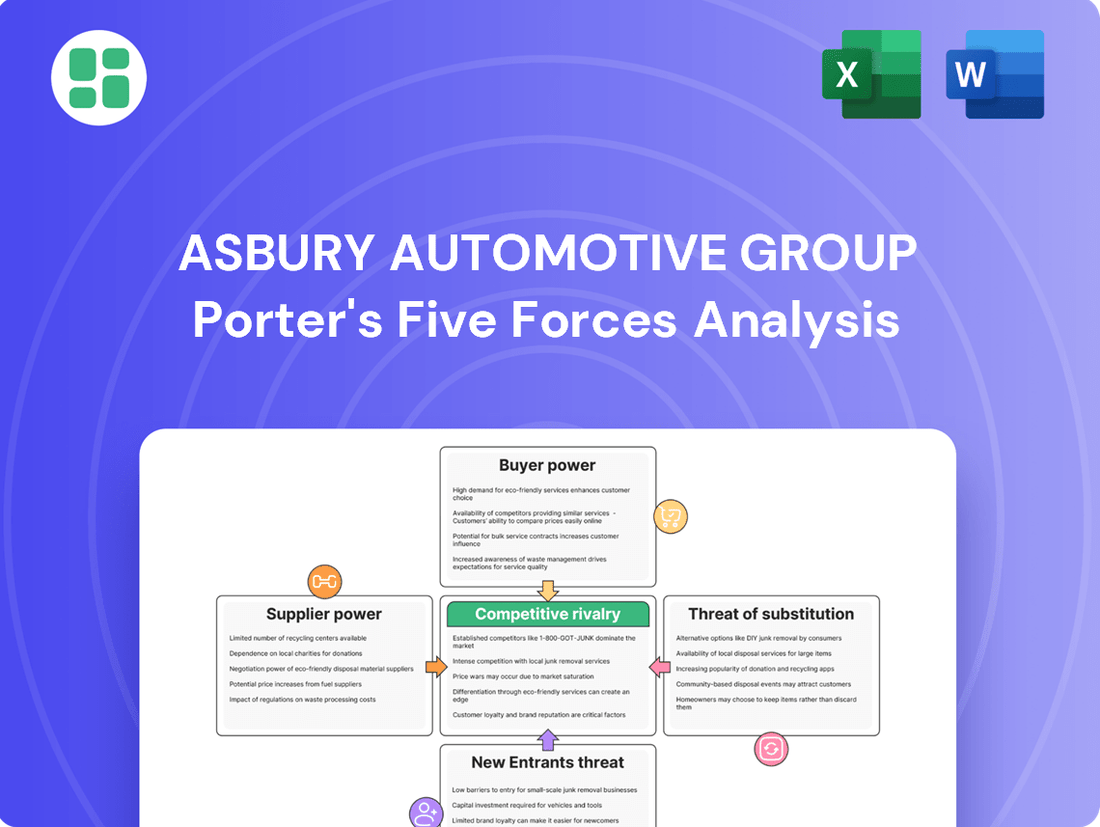

Asbury Automotive Group's Porter's Five Forces analysis reveals the intense competition, significant buyer power, and moderate threat of new entrants within the automotive retail sector.

Understand the competitive landscape by visualizing Asbury Automotive Group's Porter's Five Forces, providing clarity on industry pressures.

Customers Bargaining Power

Customers buying cars, new or used, are very focused on price. This is because they can easily find out about pricing, car features, and what competitors are offering thanks to the internet. In 2023, the average transaction price for a new vehicle in the US hovered around $48,000, a figure that makes any price difference significant for buyers.

Online tools and websites allow shoppers to compare different dealerships and their prices quickly, giving them the upper hand. This easy access to information means buyers can negotiate harder or simply go elsewhere if they don't get a good deal, directly impacting Asbury Automotive Group's pricing power and potentially squeezing profit margins.

The proliferation of online vehicle retailing platforms significantly amplifies customer bargaining power. Asbury's own Clicklane, alongside competitors, offers consumers more convenient and transparent purchasing avenues, diminishing their dependence on traditional dealerships.

Customers can effortlessly compare inventory across numerous sources, including other franchised dealers, independent lots, and even direct-to-consumer manufacturers. This accessibility allows them to identify the best pricing and terms, thereby strengthening their negotiating position.

In 2024, the digital retail of vehicles continued its upward trajectory. Reports indicated that a substantial percentage of car buyers conducted their research online, and a growing number completed a significant portion of their purchase process digitally, underscoring the impact of these diverse channels on customer leverage.

Customers often face minimal costs when switching vehicle brands or service providers. This ease of transition means buyers can readily compare prices and offerings across different dealerships and independent repair shops, significantly enhancing their leverage.

For instance, in 2024, the average customer satisfaction score for independent repair shops often rivals or exceeds that of dealerships, encouraging a wider range of choices. This dynamic forces dealerships like those under Asbury Automotive Group to differentiate through competitive pricing, superior service, and a compelling customer experience to foster loyalty.

Impact of Economic Conditions on Affordability

Economic conditions directly impact how much customers can afford to spend on vehicles, which in turn affects Asbury Automotive Group. For instance, in 2024, persistent high interest rates make car loans more expensive, reducing overall affordability. Coupled with rising new vehicle prices, this economic pressure amplifies the bargaining power of customers.

When affordability becomes a major concern, customers gain more leverage. They might postpone their purchase, look for less expensive models or brands, or shift their focus to the used car market. This behavior forces dealerships like Asbury to be more accommodating in negotiations to secure sales.

- Rising Interest Rates: Federal Reserve rate hikes in 2023 and continued economic uncertainty in early 2024 have made auto loans pricier, impacting buyer budgets.

- Vehicle Cost Inflation: Despite some stabilization, average new vehicle prices remained elevated in 2024, continuing a trend that began during supply chain disruptions.

- Consumer Sentiment: Economic headwinds can dampen consumer confidence, leading to more cautious spending and a greater willingness to negotiate prices.

- Used Vehicle Market Dynamics: A strong used car market can offer customers viable alternatives, increasing their ability to walk away from new car deals if terms aren't favorable.

Shifting Preferences Towards Online Experience

The bargaining power of customers is influenced by their evolving preferences for car buying. While traditional dealership visits remain important, a significant segment, especially younger buyers, now favors digital or hybrid purchasing journeys. This shift means customers expect a smooth integration between online research and in-person interactions.

Asbury Automotive Group's commitment to digital platforms like Clicklane directly addresses this trend. However, this also elevates customer expectations for convenience and efficiency throughout the entire buying process. For instance, in 2024, online car shopping continues to gain traction, with a notable percentage of consumers indicating a preference for digital tools to research and even complete parts of their vehicle purchase.

- Growing digital adoption: By 2024, a substantial portion of car buyers utilize online platforms for research and price comparisons.

- Demand for seamless experience: Customers expect a fluid transition between online browsing and dealership engagement.

- Influence of younger demographics: Millennials and Gen Z are key drivers of the digital and hybrid car-buying trend.

- Increased customer leverage: Enhanced digital options empower customers with more information and choice, potentially increasing their bargaining power.

Customers wield significant bargaining power in the automotive sector due to readily available price comparisons and the ease of switching between providers. In 2024, the continued rise of online retail platforms and digital research tools empowers buyers with extensive information, allowing them to negotiate more effectively or opt for competitors. This heightened leverage puts pressure on dealerships like Asbury Automotive Group to offer competitive pricing and superior customer experiences to retain business.

The economic climate further amplifies customer influence. In 2024, elevated interest rates and sustained vehicle cost inflation made purchasing a car less affordable for many. This financial pressure encourages buyers to seek better deals, postpone purchases, or explore alternative options like the used car market, thereby strengthening their negotiating position against dealerships.

| Factor | 2023 Data | 2024 Trend/Data |

|---|---|---|

| Average New Vehicle Transaction Price (US) | ~$48,000 | Remained elevated, though some stabilization noted |

| Online Car Shopping Preference | Significant portion of buyers | Continued upward trajectory, increasing digital completion of purchase steps |

| Interest Rate Impact on Auto Loans | Increasingly higher | Continued to make auto loans pricier, impacting affordability |

Preview the Actual Deliverable

Asbury Automotive Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Asbury Automotive Group Porter's Five Forces Analysis details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive retail sector.

Rivalry Among Competitors

Asbury Automotive Group faces fierce competition from other major automotive retail groups such as AutoNation, Penske Automotive Group, and Lithia Motors. These large, well-funded competitors are actively pursuing market share through strategic acquisitions and expanding their digital offerings.

This intense rivalry means Asbury must constantly innovate and adapt to stay ahead. For instance, in 2023, AutoNation reported total revenue of $22.1 billion, highlighting the scale of resources available to key competitors.

The U.S. automotive retail landscape, while featuring prominent players like Asbury Automotive Group, remains quite fragmented. Thousands of independent dealerships operate across the nation, contributing to a highly dispersed market structure.

This fragmentation, however, is undergoing a significant shift. A notable trend of consolidation is evident, with larger automotive groups actively acquiring smaller, often family-owned, dealerships. This strategic move intensifies competition, particularly for desirable franchise agreements and prime market locations.

For instance, in 2023, Asbury Automotive Group itself completed several acquisitions, adding to its growing footprint and demonstrating the ongoing industry consolidation. This pattern suggests that while many smaller entities exist, the competitive environment is increasingly shaped by the strategic expansion of larger entities.

The automotive retail sector, including companies like Asbury Automotive Group, faces intense price competition, especially in the pre-owned vehicle segment and for highly sought-after new car models. This pressure often forces dealerships to offer substantial incentives and discounts, directly impacting their profit margins. For instance, in 2024, the average gross profit per vehicle retailed across the industry saw fluctuations, with increased incentives on new vehicles contributing to tighter margins for many dealerships.

Competition from Online Retailers and Direct-to-Consumer Models

The rise of online-only car retailers and manufacturers selling directly to consumers, like Carvana and Tesla, intensifies competition for traditional dealerships. These digital-first approaches streamline the buying process, appealing to a growing consumer base seeking convenience and transparency, thereby challenging Asbury Automotive Group's established dealership network.

For instance, Carvana reported a significant increase in vehicle sales, reaching approximately 435,000 vehicles in 2023, highlighting the growing consumer adoption of online car purchasing. This direct-to-consumer (DTC) model often allows for competitive pricing and a more personalized customer journey, forcing established players to adapt their strategies.

- Online Retailers' Market Share Growth: Online used car sales are projected to capture an increasing share of the total used car market, with some estimates suggesting it could reach over 20% by 2025.

- Direct-to-Consumer Sales Impact: Manufacturers like Tesla have demonstrated the viability of DTC models, bypassing traditional franchise dealerships and setting new customer expectation benchmarks.

- Consumer Preference Shifts: Surveys indicate a growing preference among consumers, particularly younger demographics, for online research and purchasing options for vehicles, driven by convenience and perceived value.

- Asbury's Digital Investment: In response, Asbury Automotive Group has been investing in its digital capabilities and omni-channel sales strategies to better compete with these evolving market dynamics.

Differentiation Through Service, Technology, and Customer Experience

Competitive rivalry within the automotive retail sector, including for Asbury Automotive Group, is intense and extends well beyond the initial vehicle sale. Profitability is significantly driven by service, parts, and finance and insurance (F&I) products, making these areas critical battlegrounds for dealerships.

Dealerships are actively differentiating themselves by focusing on superior customer experiences. This includes investing in technologies like artificial intelligence for personalized interactions and digital sales solutions to streamline the purchasing process. Asbury, for instance, has been noted for its digital initiatives aimed at enhancing customer engagement throughout the ownership lifecycle.

- Service & Parts Revenue: In 2023, Asbury Automotive Group reported significant revenue from its Aftermarket divisions, which includes service and parts, underscoring their importance in the competitive landscape.

- Customer Loyalty: By offering comprehensive after-sales services and a seamless digital experience, dealerships aim to build lasting customer loyalty, reducing the likelihood of customers seeking service or future purchases elsewhere.

- Technological Adoption: The adoption of advanced technologies, such as AI-powered customer relationship management tools and virtual showrooms, is becoming a key differentiator for dealerships seeking to attract and retain customers in a competitive market.

The competitive rivalry for Asbury Automotive Group is characterized by the presence of large, well-capitalized competitors like AutoNation and Lithia Motors, who are actively expanding through acquisitions and digital investments. This intense competition forces Asbury to innovate, as evidenced by the industry-wide pressure on profit margins due to increased incentives on new vehicles in 2024.

The market is also shaped by online-only retailers such as Carvana, which saw approximately 435,000 vehicle sales in 2023, and direct-to-consumer manufacturers like Tesla, setting new customer expectations for convenience and transparency. Asbury's response includes significant investment in its digital capabilities and omni-channel strategies to counter these evolving market dynamics.

Beyond vehicle sales, competition extends fiercely into service, parts, and finance and insurance (F&I) products, which are crucial for profitability. Asbury's own aftermarket divisions contributed significantly to its revenue in 2023, highlighting the importance of these post-sale services in retaining customers and differentiating from rivals through superior customer experiences and technological adoption.

SSubstitutes Threaten

For many urban consumers, the availability of public transportation and ride-sharing services presents a significant substitute for owning a personal vehicle. In 2024, cities continue to invest in expanding their transit infrastructure, making it a more viable option for daily commutes. For instance, many metropolitan areas reported increased ridership on public transit in the past year, directly impacting the need for new car purchases.

The convenience and cost-effectiveness of services like Uber and Lyft further erode the necessity of private car ownership, particularly in densely populated areas. This trend directly affects Asbury Automotive Group by potentially reducing the overall demand for both new and used vehicles sold through their dealerships, impacting sales volumes and market share.

Car-sharing services like Zipcar and emerging vehicle subscription models present a growing threat to traditional car ownership, and by extension, to dealerships like Asbury Automotive Group. These alternatives offer consumers flexible access to transportation without the long-term financial commitment and responsibilities of owning a vehicle. For instance, in 2024, the global car-sharing market continued its expansion, with reports indicating a steady increase in user adoption, particularly in urban centers where convenience and cost-effectiveness are paramount.

Micro-mobility solutions, such as e-bikes and scooters, present a growing threat to traditional automotive sales, particularly for shorter urban and suburban trips. These alternatives can decrease the perceived need for a second or even third family car, impacting demand for entry-level or smaller vehicle segments. In 2024, the global micro-mobility market was valued at over $100 billion, indicating a significant and expanding alternative for personal transportation.

Direct-to-Consumer Sales by Manufacturers

Manufacturers increasingly embracing direct-to-consumer (DTC) sales, exemplified by Tesla's model, present a significant substitute threat to traditional franchised dealerships like those operated by Asbury Automotive Group. Consumers can bypass multi-brand retailers by purchasing vehicles directly from manufacturers online or at brand-owned showrooms, fundamentally altering the sales channel. This shift allows manufacturers to control the customer experience and pricing more directly.

For instance, Tesla's DTC approach has proven highly effective, with the company reporting a significant portion of its vehicle sales occurring through its online platform and company-owned stores. In 2023, Tesla's global deliveries reached approximately 1.81 million vehicles, a substantial volume that bypasses traditional dealership networks. This trend suggests a growing consumer comfort with purchasing vehicles without the traditional dealership intermediary.

- Direct Sales Impact: Manufacturers selling directly to consumers offer an alternative to the franchised dealership model.

- Consumer Preference Shift: The rise of online purchasing and brand-owned stores provides consumers with a new, often more streamlined, buying experience.

- Market Disruption: Companies like Tesla have demonstrated the viability and consumer acceptance of DTC auto sales, challenging established dealership structures.

- Competitive Pressure: This DTC model creates competitive pressure on traditional retailers by offering an alternative pathway for vehicle acquisition.

Longer Vehicle Lifespans and Increased Maintenance

Consumers are holding onto their vehicles for significantly longer periods. The average age of passenger vehicles in operation in the U.S. reached a record 12.5 years in 2023, according to S&P Global Mobility. This extended ownership cycle can act as a substitute for new vehicle purchases, as owners opt for repairs and maintenance rather than upgrading.

While longer vehicle lifespans increase demand for after-sales services, they directly challenge the volume of new and used car sales. This trend means that Asbury Automotive Group, like other automotive retailers, faces a market where the replacement cycle for new vehicles is lengthening, potentially impacting overall sales volume.

- Average Vehicle Age: 12.5 years (as of 2023 in the U.S.)

- Impact on Sales: Extended ownership can substitute new vehicle purchases.

- Service Demand: Increased maintenance and repair needs for older vehicles.

The threat of substitutes for Asbury Automotive Group is substantial, encompassing public transit, ride-sharing, car-sharing, micro-mobility, and direct-to-consumer sales models. These alternatives offer consumers flexible and often more cost-effective transportation solutions, reducing the inherent need for traditional vehicle ownership and, consequently, new vehicle purchases from dealerships. The increasing average age of vehicles also contributes to this, as consumers opt for maintenance over replacement.

| Substitute Category | Examples | 2023/2024 Trend/Data Point |

|---|---|---|

| Public Transportation & Ride-Sharing | Buses, trains, Uber, Lyft | Increased urban transit investment and ridership in 2024; continued growth in ride-sharing usage. |

| Car-Sharing & Subscription | Zipcar, vehicle subscription services | Global car-sharing market expansion in 2024 with steady user adoption in urban areas. |

| Micro-Mobility | E-bikes, scooters | Global micro-mobility market valued over $100 billion in 2024; impacting demand for smaller vehicles. |

| Direct-to-Consumer (DTC) Sales | Tesla's model | Tesla's 2023 global deliveries ~1.81 million vehicles, bypassing traditional dealerships. |

| Extended Vehicle Ownership | Repairing older vehicles | Average age of U.S. passenger vehicles reached 12.5 years in 2023, substituting new purchases. |

Entrants Threaten

The automotive retail sector, especially for franchised dealerships like those operated by Asbury Automotive Group, presents formidable barriers to entry due to immense capital requirements. Establishing a new dealership necessitates significant investments in prime real estate, state-of-the-art facilities, a diverse inventory of vehicles, and robust operational infrastructure. These substantial upfront costs act as a powerful deterrent for potential new players looking to enter the market.

Restrictive franchise laws and manufacturer agreements significantly deter new entrants in the automotive retail sector. These regulations, often state-specific, mandate that new dealerships must secure franchise agreements directly from established automotive manufacturers. For instance, in 2024, the automotive industry continued to see manufacturers carefully manage their dealer networks, making it challenging for independent businesses to gain access to popular brands and establish a foothold.

Established brand recognition and customer loyalty present a significant barrier to new entrants in the automotive retail sector. Major players like Asbury Automotive Group have cultivated strong reputations and loyal customer bases over many years, making it difficult for newcomers to gain traction. For instance, Asbury's 2023 revenue reached $9.2 billion, reflecting the scale and customer trust they command.

Economies of Scale and Experience Curve Advantages

The threat of new entrants for Asbury Automotive Group is significantly mitigated by the substantial economies of scale and experience curve advantages enjoyed by established players. Large, existing retailers like Asbury can leverage their purchasing power to secure better terms from manufacturers and suppliers. For instance, in 2024, major automotive groups often negotiate volume discounts that smaller, new dealerships simply cannot access, directly impacting their cost of goods sold and ability to compete on price.

Furthermore, these established companies have honed their operational efficiencies and marketing strategies over years, building brand recognition and customer loyalty. A new entrant would face immense difficulty in replicating this without considerable upfront investment and time to build a comparable track record and customer base. This deep-seated experience curve allows them to manage overheads more effectively and absorb fluctuations in the market, presenting a formidable barrier.

- Economies of Scale: Large dealership groups benefit from bulk purchasing of vehicles and parts, leading to lower per-unit costs.

- Marketing Efficiency: Established brands can spread marketing expenses across a larger sales volume, making their advertising more cost-effective per customer acquired.

- Operational Expertise: Years of experience translate into optimized service departments, inventory management, and administrative processes, reducing operational costs.

- Capital Requirements: The significant capital needed to establish a new dealership, acquire inventory, and build brand awareness acts as a substantial barrier to entry.

Complex Regulatory Environment and Compliance Costs

The automotive retail sector faces a formidable barrier to entry due to its intricate regulatory landscape. Federal and state laws govern everything from sales practices and financing to consumer protection and environmental compliance, creating significant hurdles for newcomers. For instance, in 2024, many states continued to update their dealership licensing and operational requirements, adding layers of complexity.

The cost and time investment required to understand and adhere to these diverse regulations are substantial. New entrants must dedicate considerable resources to legal counsel, compliance officers, and training programs to ensure they meet all obligations. This ongoing compliance burden can be a significant deterrent, especially when compared to less regulated industries.

- Regulatory Complexity: Federal and state laws impact sales, financing, consumer protection, and environmental standards.

- Compliance Costs: Navigating and adhering to these regulations requires significant financial investment and dedicated personnel.

- Time Investment: Understanding and implementing compliance measures is a time-consuming process for new businesses.

- Deterrent to Entry: The combined effect of complexity and cost makes the automotive retail sector less attractive for potential new competitors.

The threat of new entrants for Asbury Automotive Group is low, largely due to the substantial capital required to establish a franchised dealership. Beyond real estate and facilities, significant investment is needed for vehicle inventory and operational setup, making it difficult for newcomers to compete. For example, the average cost to open a new car dealership can range from $1 million to over $10 million, depending on brand and location.

Furthermore, manufacturers meticulously control their dealer networks, often requiring specific franchise agreements that are hard for independent businesses to secure. This exclusivity, coupled with established brand loyalty and the operational efficiencies gained from economies of scale, creates a robust defense against new competitors entering the automotive retail market.

| Barrier to Entry | Impact on New Entrants | Asbury's Advantage |

|---|---|---|

| Capital Requirements | High (millions of dollars for real estate, inventory, facilities) | Established financial strength and access to capital markets |

| Franchise Agreements & Manufacturer Control | Difficult to obtain brand representation | Existing strong relationships and volume purchasing power with manufacturers |

| Brand Recognition & Customer Loyalty | Challenging to build trust and repeat business | Decades of operation and proven customer service, evidenced by $9.2 billion in 2023 revenue |

| Economies of Scale & Operational Expertise | Higher per-unit costs, less efficient operations | Lower cost of goods sold through bulk purchasing and optimized processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asbury Automotive Group utilizes data from annual reports, SEC filings, industry trade publications, and market research reports to provide a comprehensive view of the automotive retail landscape.