Asbury Automotive Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asbury Automotive Group Bundle

Unlock the strategic blueprint of Asbury Automotive Group with our comprehensive Business Model Canvas. Discover how they connect with key customer segments, deliver unique value propositions, and leverage crucial partnerships to drive revenue. This detailed analysis is your key to understanding their success.

Ready to gain a competitive edge? Our full Business Model Canvas for Asbury Automotive Group breaks down their core activities, revenue streams, and cost structure. Download it now to benchmark your own strategy or inspire your next business venture.

Partnerships

Asbury Automotive Group maintains vital partnerships with Original Equipment Manufacturers (OEMs), both domestic and international. These relationships are the bedrock for securing a consistent supply of new vehicle inventory and are essential for obtaining franchise agreements that allow them to sell specific brands. For instance, in 2024, Asbury continued to leverage these OEM connections to offer a wide array of vehicles, from popular sedans to advanced SUVs, directly to consumers.

These OEM collaborations are not just about inventory; they provide Asbury with access to the latest technological advancements and crucial manufacturer support. This includes warranty services, co-op advertising funds, and specialized training for their service technicians, all of which enhance the customer experience and operational efficiency. The ability to offer manufacturer-backed warranties is a significant draw for buyers, reinforcing Asbury's value proposition.

Asbury Automotive Group's partnerships with financial institutions are crucial for its finance and insurance (F&I) operations. These relationships with third-party banks and lending institutions allow Asbury to provide a wide array of financing and insurance options to its customers, including vehicle loans, leases, and aftermarket products.

These collaborations are vital for offering products like extended service contracts and guaranteed asset protection (GAP) insurance. In 2023, Asbury reported significant revenue from its F&I segment, highlighting the importance of these financial partnerships to its profitability.

Asbury Automotive Group's strategic alliances with technology and software providers are fundamental to its operational backbone. Collaborations with companies like Tekion, a cloud-native automotive retail platform, and AI-driven solutions such as Salty and Insignia, are crucial for elevating both efficiency and the customer journey.

These partnerships are instrumental in powering Asbury's digital retailing initiative, Clicklane, and optimizing dealership management systems. By integrating real-time services, including instant insurance quoting, Asbury enhances dealership productivity and provides a more seamless experience for its customers.

Aftermarket Product Providers

Asbury Automotive Group collaborates with aftermarket product providers, a strategy that enhances its revenue and customer loyalty. This includes leveraging its subsidiary, Total Care Auto, Powered by Landcar, to offer a suite of vehicle protection products like extended service contracts. These offerings are crucial for their parts and service revenue, demonstrating a clear value proposition for vehicle owners.

These strategic alliances are vital for Asbury's business model, directly contributing to its financial performance. In 2024, the aftermarket and service segment continued to be a robust revenue driver, reflecting the success of these partnerships in providing comprehensive vehicle ownership solutions. This focus on aftermarket products not only generates immediate income but also fosters enduring relationships with customers by addressing their ongoing vehicle needs.

- Aftermarket Product Integration Asbury partners with external providers and utilizes its own Total Care Auto subsidiary to offer extended service contracts and vehicle protection plans.

- Revenue Generation These partnerships are a significant contributor to Asbury's parts and service revenue stream, bolstering overall financial performance.

- Customer Relationship Building By offering comprehensive vehicle ownership solutions, Asbury strengthens long-term customer relationships and enhances brand loyalty.

Acquisition Targets and Sellers

Asbury Automotive Group strategically partners with acquisition targets and their sellers to fuel its expansion. These relationships are the bedrock of its merger and acquisition (M&A) strategy, enabling the company to broaden its dealership network, diversify its brand offerings, and penetrate new geographic markets. This approach directly contributes to increased market share and revenue growth.

A prime example of this partnership in action is the acquisition of The Herb Chambers Automotive Group. This significant deal, completed in 2023, added substantial revenue and a strong presence in the Northeast. For the fiscal year 2023, Asbury reported total revenue of $10.5 billion, a testament to the impact of such strategic acquisitions.

- Strategic M&A Partnerships: Asbury cultivates relationships with dealership owners and their representatives to identify and execute acquisitions.

- Footprint Expansion: These partnerships directly enable Asbury to acquire dealerships, thereby expanding its physical presence and market reach.

- Revenue and Market Share Growth: The successful integration of acquired dealerships, like The Herb Chambers Automotive Group, significantly boosts Asbury's overall revenue and competitive standing. In 2023, Asbury’s total revenue reached $10.5 billion.

Asbury Automotive Group's key partnerships are primarily with Original Equipment Manufacturers (OEMs), financial institutions, technology providers, and aftermarket product companies. These alliances are critical for inventory sourcing, financing options, operational efficiency, and revenue diversification. Strategic acquisitions also form a vital partnership category, driving geographic expansion and market share growth.

| Partnership Type | Key Function | Impact/Example |

|---|---|---|

| OEMs | New vehicle inventory, franchise agreements | Access to diverse vehicle brands and models; essential for sales. |

| Financial Institutions | Financing and insurance (F&I) products | Enables offering loans, leases, and protection plans; significant revenue driver. Asbury's F&I segment contributed substantially in 2023. |

| Technology Providers | Digital retailing, dealership management systems | Powers Clicklane, enhances customer experience and operational efficiency. |

| Aftermarket Providers | Vehicle protection products (e.g., extended service contracts) | Boosts parts and service revenue; fosters customer loyalty. This segment was a robust driver in 2024. |

| Acquisition Targets | Dealership network expansion | Facilitates market penetration and revenue growth. Acquisition of The Herb Chambers Automotive Group in 2023 exemplifies this strategy. |

What is included in the product

Asbury Automotive Group's business model focuses on delivering a comprehensive automotive retail experience through a network of dealerships, emphasizing customer relationships and efficient operations.

This model details their customer segments, value propositions, and channels, reflecting real-world operations and plans for growth.

Asbury Automotive Group's Business Model Canvas offers a clear, structured approach to understanding how they solve customer pain points in the automotive industry, from the frustration of car buying to the complexity of maintenance.

This visual tool distills Asbury's strategy, highlighting how their customer relationships and value propositions alleviate common automotive-related stresses for consumers.

Activities

Asbury Automotive Group's core activity is the retail sale of new and used vehicles. They operate franchised dealerships offering a wide range of domestic and foreign brands. This involves managing inventory, setting prices, and handling sales through both physical locations and their online presence.

New vehicle sales are a substantial driver of revenue for Asbury. In 2024, the automotive industry saw continued demand for new vehicles, with Asbury capitalizing on this trend. Their strategic focus on optimizing the sales process, both online and in-person, ensures they meet customer needs effectively.

Used vehicle sales are equally crucial, contributing significantly to overall volume and profitability. Asbury leverages its extensive service and parts operations to acquire and recondition used vehicles, presenting them to customers as a valuable alternative. This segment often provides higher margins and helps move a greater quantity of vehicles.

Asbury Automotive Group offers comprehensive vehicle maintenance and repair services, encompassing everything from routine oil changes and tire rotations to intricate engine diagnostics and complex mechanical repairs. This broad service offering ensures they can cater to a wide array of customer needs, fostering loyalty and repeat business.

This segment is a significant profit driver for Asbury, characterized by its high-margin nature. In 2024, Asbury's service and parts revenue continued to be a cornerstone of its financial performance, demonstrating a stable and recurring income stream that significantly contributes to the company's overall profitability and customer retention strategies.

Beyond general repairs, Asbury strategically operates dedicated collision repair centers. These specialized facilities handle accident-related damage, offering a full spectrum of bodywork, painting, and structural repairs, further solidifying Asbury's position as a one-stop shop for automotive care and enhancing its revenue diversification.

A crucial activity for Asbury Automotive Group is the sale of finance and insurance (F&I) products. This includes facilitating vehicle financing with external lenders and offering valuable add-ons like extended service contracts and guaranteed asset protection (GAP) plans.

These F&I products are a significant driver of profitability, contributing substantially to the gross profit generated from each vehicle sold. In 2024, Asbury reported that its F&I segment continued to be a strong performer, bolstering the profitability of its core vehicle sales operations.

Acquisition and Integration of Dealerships

Asbury Automotive Group's strategy heavily relies on acquiring and integrating new dealerships. This key activity involves a continuous search for suitable acquisition targets, followed by the complex process of merging them into Asbury's operational framework. The goal is to not only grow the company's footprint but also to enhance its overall financial performance through these strategic additions.

In 2023, Asbury completed 18 acquisitions, adding 25 dealerships to its portfolio. This aggressive acquisition pace demonstrates a commitment to expanding market share and diversifying its brand offerings. For instance, the acquisition of David Wilson Automotive Group in Southern California, a deal valued at approximately $1.3 billion, significantly bolstered Asbury's presence in a key automotive market.

- Acquisitive Growth Strategy: Asbury actively seeks and integrates new dealerships and groups to expand its market reach and brand diversity.

- Synergy Realization: The integration process aims to unlock operational efficiencies and revenue growth opportunities from acquired entities.

- 2023 Acquisition Performance: The company acquired 25 dealerships across 18 transactions in 2023, underscoring its aggressive expansion strategy.

- Major Acquisitions: Significant deals, like the $1.3 billion acquisition of David Wilson Automotive Group, highlight Asbury's commitment to strategic market penetration.

Digital Retail Platform Management (Clicklane)

Asbury Automotive Group's key activity revolves around the operation and continuous improvement of its digital retail platform, Clicklane. This involves meticulously managing the entire online sales process, from initial customer engagement to the final transaction, ensuring a smooth and intuitive experience for buyers.

The platform's enhancement includes integrating cutting-edge technologies to offer a truly seamless omnichannel journey, bridging the gap between online browsing and in-person vehicle acquisition. This focus on guest experience and operational fluidity is central to Asbury's strategy.

Clicklane is instrumental in Asbury's commitment to a guest-centric approach, allowing for greater accessibility and convenience in vehicle purchasing. This digital backbone also bolsters the company's operational resilience.

In 2024, Asbury continued to invest in Clicklane's capabilities, aiming to further streamline the digital car buying process. While specific 2024 platform performance metrics are proprietary, the company's overall digital retail strategy has been a significant driver of its growth. For instance, Asbury reported a substantial increase in its digital channel contribution to total revenue in prior years, underscoring the platform's importance.

- Platform Operation: Managing the day-to-day functionality and user experience of Clicklane.

- Digital Sales Funnel Management: Optimizing the customer journey from online discovery to purchase completion.

- Technology Integration: Incorporating new tools and features to enhance the digital retail experience.

- Omnichannel Experience Development: Ensuring a consistent and convenient customer interaction across online and physical touchpoints.

Asbury's key activities center on selling new and used cars, offering comprehensive service and repair, and providing finance and insurance products.

They also focus on acquiring and integrating new dealerships and continuously improving their digital retail platform, Clicklane.

These activities collectively drive revenue, profitability, and market expansion.

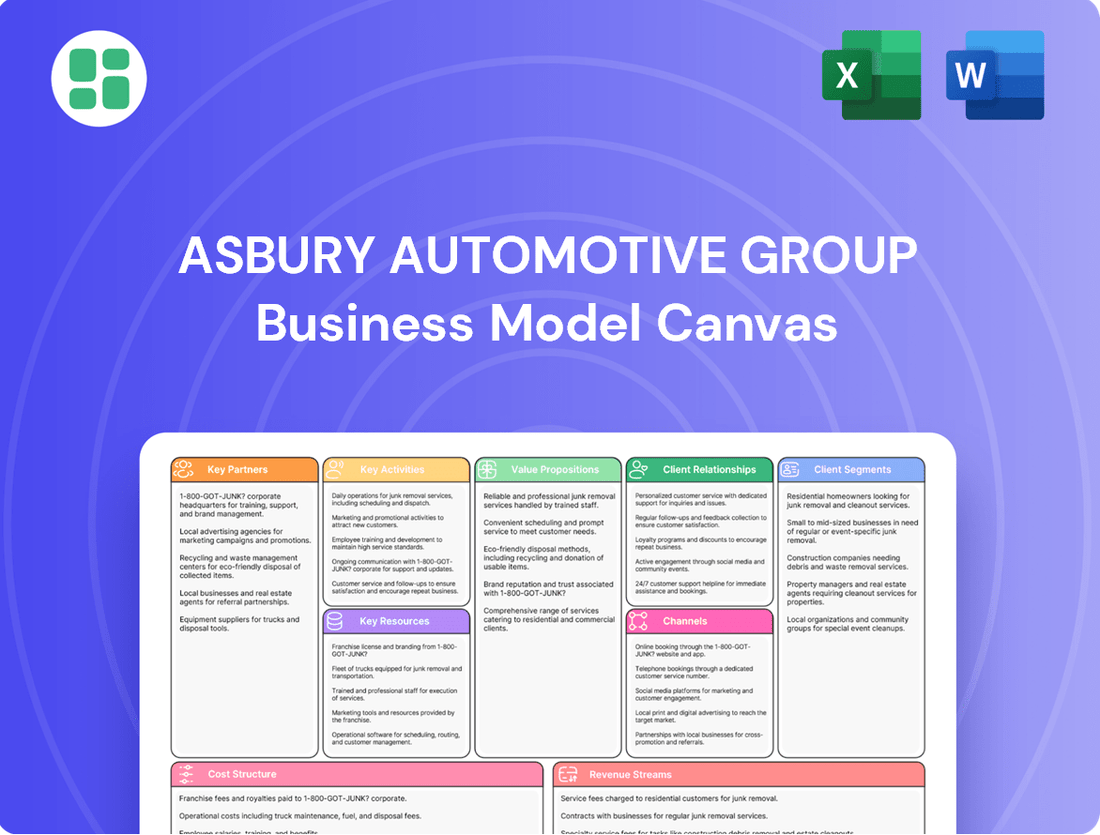

Preview Before You Purchase

Business Model Canvas

The Asbury Automotive Group Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means you're getting a direct, unedited look at the comprehensive strategy document, ensuring no surprises and full transparency in your acquisition. Once your order is complete, you'll have full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your own strategic planning.

Resources

Asbury Automotive Group's extensive network of physical dealerships and facilities forms a cornerstone of its operations. As of August 2025, the company boasts 177 new vehicle dealerships and 40 collision centers, representing substantial tangible assets. These locations are crucial for facilitating vehicle sales, providing essential service operations, and fostering direct customer engagement.

Asbury Automotive Group's vehicle inventory, encompassing both new and used cars, is a cornerstone resource. This vast selection, featuring numerous brands, directly drives their revenue generation through sales.

Managing this inventory requires substantial capital. For instance, in 2024, Asbury reported significant investments in their vehicle stock, a critical factor in meeting diverse customer preferences and capitalizing on market shifts.

Asbury Automotive Group's skilled workforce is a cornerstone of its success. This includes highly experienced sales professionals who understand customer needs, certified service technicians ensuring vehicle reliability, and finance and insurance specialists adept at navigating complex transactions. Their collective expertise is critical to delivering a superior guest experience.

The strength of Asbury's management team is equally vital. This leadership group possesses deep knowledge of the automotive retail landscape, focusing on operational efficiency and fostering a guest-centric philosophy across all dealerships. Their strategic direction directly impacts the company's performance and its ability to adapt to market changes.

In 2023, Asbury Automotive Group reported total revenue of $10.7 billion, a testament to the effective execution driven by its human capital and management. The company's ongoing commitment to training and development, particularly for its service technicians, ensures it stays at the forefront of automotive technology and customer service standards.

Proprietary Technology Platforms (Clicklane, Tekion)

Asbury Automotive Group leverages proprietary technology platforms like Clicklane and Tekion as critical resources. Clicklane facilitates a streamlined online car buying experience, while Tekion's integrated system enhances dealership operations. These digital investments are central to their strategy for efficient customer engagement and operational excellence.

In 2024, Asbury continued to emphasize digital transformation. Their investment in platforms like Clicklane directly supports their goal of increasing digital retail penetration. This focus aims to capture a larger share of the market by offering a superior, convenient customer journey compared to traditional methods.

The utilization of Tekion's dealership management system is another cornerstone of Asbury's technological advantage. This platform provides real-time data and analytics, enabling better inventory management, service scheduling, and overall business performance tracking. This data-driven approach is vital for maintaining a competitive edge.

- Clicklane: Enhances online sales and customer convenience, driving digital retail growth.

- Tekion: Optimizes dealership operations through an integrated, cloud-based management system.

- Competitive Edge: These platforms provide a significant advantage in the rapidly digitizing automotive retail sector.

- Efficiency and Experience: They are key to improving operational efficiency and delivering a superior customer experience.

Brand Franchises and Manufacturer Relationships

Asbury Automotive Group's extensive portfolio, featuring new vehicle franchises for over 31 domestic and foreign brands, is a foundational intangible asset. These franchise agreements are not merely licenses to sell; they represent deep-seated relationships with manufacturers, providing Asbury with vital support and the exclusive right to market specific automotive lines.

These established manufacturer relationships are critical for Asbury's operational success. They ensure a consistent supply of vehicles and access to manufacturer-backed incentives and training programs. For example, in 2024, Asbury continued to leverage these partnerships to drive sales and maintain brand representation across a wide spectrum of the automotive market.

- Brand Diversity: Over 31 domestic and foreign new vehicle franchises.

- Manufacturer Support: Access to incentives, training, and product information.

- Strategic Value: Underpins the ability to sell and service a broad range of vehicles.

Asbury Automotive Group's key resources are its physical dealership network, extensive vehicle inventory, skilled workforce, proprietary technology platforms, and strong manufacturer relationships. The 177 new vehicle dealerships and 40 collision centers, coupled with a diverse inventory, form the tangible backbone of its sales and service operations. Its human capital, from sales professionals to technicians, and the strategic guidance of its management team are crucial for customer experience and operational efficiency, as evidenced by its $10.7 billion revenue in 2023. Digital assets like Clicklane and Tekion streamline operations and enhance customer engagement, while franchise agreements with over 31 brands ensure a consistent supply and market access.

| Resource Category | Specific Resources | Impact/Function |

|---|---|---|

| Physical Assets | 177 New Vehicle Dealerships, 40 Collision Centers | Facilitate sales, service, and direct customer engagement. |

| Inventory | New and Used Vehicle Stock | Drives revenue generation through sales; requires significant capital investment. |

| Human Capital | Sales Professionals, Service Technicians, Finance Specialists, Management Team | Ensures superior guest experience, operational efficiency, and strategic direction. |

| Technology | Clicklane, Tekion | Streamlines online car buying, enhances dealership operations, provides data analytics. |

| Intangible Assets | Franchise Agreements (31+ Brands), Manufacturer Relationships | Provides exclusive marketing rights, vehicle supply, incentives, and training. |

Value Propositions

Asbury Automotive Group boasts an extensive selection of new and used vehicles, catering to a wide array of customer needs and preferences. This vast inventory, spanning numerous brands, ensures buyers can find the perfect fit for their budget and lifestyle.

With a robust network of dealerships, Asbury maintains high vehicle availability, making the car-buying process convenient and accessible. For instance, in 2024, Asbury reported a significant increase in its total vehicle inventory, reflecting its commitment to offering a broad choice to consumers.

Asbury Automotive Group provides comprehensive after-sales service through its extensive network of full-service vehicle maintenance, repair, and collision centers. This commitment ensures customers receive reliable and convenient support throughout their vehicle ownership journey.

These services are crucial for maintaining vehicle longevity and offering customers peace of mind. For instance, in 2023, Asbury's service and parts revenue reached $2.8 billion, demonstrating the significant contribution of these offerings to customer satisfaction and the company's financial performance.

Asbury Automotive Group offers a truly integrated shopping journey, blending their physical dealerships with their powerful online tool, Clicklane. This allows customers to explore, secure financing, and finalize vehicle purchases from the comfort of their homes, or to easily move between digital and in-person experiences.

This flexibility is crucial in today's market. In 2024, a significant portion of car buyers, estimated to be around 70%, conducted extensive online research before visiting a dealership, highlighting the demand for a robust digital presence and seamless omnichannel capabilities.

Trusted Finance and Insurance Solutions

Customers gain access to a broad spectrum of finance and insurance offerings, encompassing competitive financing and diverse vehicle protection plans. These are frequently facilitated through partnerships with external providers, granting customers significant financial flexibility and robust coverage to augment their vehicle acquisition.

In 2024, Asbury Automotive Group reported that finance and insurance (F&I) revenue per vehicle retailed reached $2,468, a notable increase reflecting the value customers place on these integrated solutions. This segment provides essential financial tools and peace of mind.

- Competitive Financing Options: Access to a variety of loan and lease programs designed to fit different customer needs and credit profiles.

- Vehicle Protection Plans: Extended warranties, GAP insurance, and other coverage options to safeguard against unexpected repair costs and depreciation.

- Insurance Products: Opportunities to secure auto insurance, often bundled or offered alongside vehicle purchases for convenience.

- Third-Party Partnerships: Collaboration with leading finance and insurance companies to broaden the range of available products and competitive rates.

Guest-Centric Approach and Customer Service

Asbury Automotive Group’s business model places a strong emphasis on a guest-centric approach, striving to cultivate enduring customer relationships. This philosophy underpins their commitment to delivering transparent, fair, and superior service across the entire vehicle ownership journey, from initial purchase to ongoing maintenance.

This dedication to exceptional customer service acts as a significant competitive advantage, fostering loyalty and aiming to create what they refer to as Customers for Life. For instance, Asbury reported that in 2023, over 50% of their service revenue came from repeat customers, highlighting the success of their relationship-building efforts.

- Guest-Centric Philosophy: Prioritizing the customer experience at every touchpoint.

- Customer Service Excellence: Offering transparent and fair dealings throughout the vehicle lifecycle.

- Long-Term Relationships: Aiming to build loyalty and create 'Customers for Life.'

- Repeat Business: Demonstrating success through significant repeat customer engagement in service departments.

Asbury Automotive Group offers a vast selection of new and used vehicles, ensuring customers can find the perfect fit. Their extensive dealership network and commitment to high inventory availability, as seen with significant inventory increases in 2024, make car buying convenient. Furthermore, their integrated online and in-person shopping experience via Clicklane caters to modern consumer preferences, with an estimated 70% of car buyers researching online before visiting a dealership in 2024.

The company provides comprehensive after-sales support through a wide network of service, repair, and collision centers, crucial for vehicle longevity. This is supported by substantial revenue from service and parts, which reached $2.8 billion in 2023, underscoring customer reliance on these offerings. Asbury also excels in finance and insurance (F&I) products, with F&I revenue per vehicle retailed reaching $2,468 in 2024, demonstrating the value customers place on these integrated financial solutions.

A core value proposition is their guest-centric approach, focused on building lasting customer relationships and fostering loyalty to create 'Customers for Life.' This is evidenced by over 50% of their service revenue in 2023 stemming from repeat customers, highlighting the effectiveness of their service excellence and relationship-building strategies.

| Value Proposition | Key Features | Supporting Data (2023-2024) |

|---|---|---|

| Extensive Vehicle Selection & Availability | Wide range of new and used vehicles across numerous brands. Robust dealership network. | Significant inventory increases in 2024. |

| Integrated Digital & Physical Shopping Experience | Clicklane platform for online purchasing. Seamless transition between online and in-person. | ~70% of car buyers research online before dealership visit (2024 estimate). |

| Comprehensive After-Sales Services | Full-service maintenance, repair, and collision centers. | Service and parts revenue: $2.8 billion (2023). |

| Value-Added Finance & Insurance (F&I) | Competitive financing, vehicle protection plans, insurance products. | F&I revenue per vehicle retailed: $2,468 (2024). |

| Guest-Centric Approach & Customer Loyalty | Focus on transparent, fair, and superior service. Building long-term relationships. | Over 50% of service revenue from repeat customers (2023). |

Customer Relationships

Asbury Automotive Group prioritizes a personalized dealership experience, fostering direct customer interaction through its physical locations. Sales associates and service staff build relationships by offering tailored recommendations and guiding customers through their automotive journey, ensuring a human touch to address needs and concerns.

Asbury Automotive Group cultivates enduring customer connections by offering dedicated after-sales service and proactive follow-up. This commitment extends beyond the initial sale, encompassing scheduled maintenance reminders, prompt responses to post-purchase inquiries, and ensuring overall satisfaction with vehicle performance and service quality.

In 2024, Asbury's focus on these relationships is evident. For instance, their service departments aim to retain a significant portion of their customer base for ongoing maintenance, a critical factor in their revenue stream. A high customer retention rate in service, often exceeding 70% for routine maintenance at well-managed dealerships, directly contributes to the profitability and stability of the business model.

Asbury Automotive Group leverages its Clicklane online platform and other digital tools for continuous customer engagement. These digital touchpoints, including online chat, virtual consultations, and self-service options, offer unparalleled convenience and accessibility. In 2023, Asbury reported that over 50% of its vehicle sales originated from digital channels, highlighting the significant role of these platforms in customer interaction and support.

Finance and Insurance Product Support

Asbury Automotive Group deepens customer relationships by providing robust support for finance and insurance products. This includes guiding customers through financing options and assisting with the claims process for extended warranties, ensuring a smooth post-purchase experience.

- Financing Guidance: Helping customers understand loan terms and rates, a critical step in vehicle acquisition.

- Warranty Claims Assistance: Streamlining the process for customers to utilize their extended warranty coverage.

- Product Renewals and Upgrades: Proactively offering renewals for existing protection plans or introducing new coverage options to maintain customer loyalty and provide ongoing value.

- 2024 Data Point: In 2024, Asbury Automotive Group reported that its finance and insurance (F&I) segment contributed significantly to overall profitability, with F&I revenue per vehicle retailed showing a consistent upward trend, reflecting successful customer engagement with these products.

Loyalty Programs and Repeat Business Initiatives

Asbury Automotive Group focuses on building lasting relationships through initiatives designed to foster loyalty and drive repeat business. Their strategy centers on creating 'Customers for Life' by offering exclusive benefits to returning patrons and consistently delivering exceptional service.

These efforts are crucial for sustained growth, as evidenced by the automotive industry's emphasis on customer retention. For instance, a study in 2024 indicated that acquiring a new customer can cost five times more than retaining an existing one, highlighting the financial sense behind Asbury's approach.

- Loyalty Programs: Asbury implements loyalty programs that reward customers for their continued patronage, offering discounts or exclusive access to services.

- Special Offers: Targeted promotions and special offers are extended to existing customers, incentivizing them to return for future purchases and maintenance.

- High Service Standards: Maintaining a high standard of customer service across all touchpoints is paramount to encouraging long-term engagement and positive word-of-mouth referrals.

Asbury Automotive Group cultivates strong customer relationships through a blend of personalized in-person interactions at its dealerships and robust digital engagement via platforms like Clicklane. Their strategy emphasizes creating loyal customers for life by offering exceptional service, financial guidance, and proactive after-sales support. This focus on retention, crucial in an industry where acquiring new customers is significantly more expensive, underpins their long-term success.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Dealership Experience | Direct interaction with sales and service staff, tailored recommendations. | High customer retention in service departments, often exceeding 70% for routine maintenance, directly boosting profitability. |

| Digital Engagement | Clicklane platform, online chat, virtual consultations, self-service options. | Over 50% of vehicle sales originated from digital channels in 2023, demonstrating significant customer reliance on these tools. |

| After-Sales Support & Loyalty | Maintenance reminders, warranty claims assistance, loyalty programs, special offers. | F&I segment contributed significantly to profitability, with F&I revenue per vehicle retailed showing a consistent upward trend in 2024. |

Channels

Asbury Automotive Group's core channel is its vast physical dealership network, comprising 177 new vehicle dealerships and 40 collision centers. This extensive footprint spans 15 states, providing direct customer touchpoints for sales, financing, and essential vehicle maintenance.

These brick-and-mortar locations are crucial for the customer journey, acting as showrooms where potential buyers can experience vehicles firsthand and service bays for ongoing care. In 2023, Asbury reported total revenue of $10.4 billion, with a significant portion directly attributable to the sales and services conducted through this physical network.

Clicklane is a key digital sales channel for Asbury Automotive Group, enabling customers to handle the entire car buying process online, from browsing to financing and purchase. This platform significantly extends Asbury's market reach, tapping into the increasing consumer preference for digital transactions in the automotive sector.

In 2023, Asbury reported that its digital retail channel, including Clicklane, contributed to a substantial portion of its overall sales, demonstrating the growing importance of online platforms. This digital expansion allows Asbury to serve a wider customer base, overcoming geographical limitations of its physical dealerships.

Asbury Automotive Group leverages its corporate website, asburyauto.com, and numerous individual dealership websites as primary hubs for information dissemination and customer engagement. These digital storefronts are crucial for showcasing inventory, providing service information, and facilitating customer inquiries, acting as a vital first point of contact for many potential buyers.

The company's digital marketing strategy is robust, employing search engine optimization (SEO) to ensure high visibility in online searches for vehicles and services. This is complemented by targeted social media campaigns and online advertising, which effectively drive both online engagement and foot traffic to their physical dealerships, converting digital interest into tangible sales leads.

In 2023, Asbury reported significant growth in its digital channels, with online lead volume increasing by 15% year-over-year, directly contributing to a substantial portion of their overall sales. This highlights the critical role of their digital presence in the automotive sales funnel, demonstrating a successful integration of online marketing with offline retail operations.

Call Centers and Customer Support Lines

Asbury Automotive Group leverages dedicated call centers as a critical component of its customer relationship management. These centers act as a primary conduit for customer engagement, handling everything from initial sales inquiries and appointment scheduling to post-sale support and general assistance. This direct line of communication ensures customers receive prompt, personalized attention, fostering loyalty and addressing concerns efficiently.

In 2024, Asbury's commitment to customer service through these channels is underscored by significant investments in staffing and technology. For instance, many leading automotive retailers aim to answer over 90% of inbound calls within 30 seconds, a benchmark Asbury likely strives to meet or exceed. This focus on accessibility and responsiveness is vital for maintaining a competitive edge in the automotive retail sector.

- Direct Customer Engagement: Facilitates sales, service scheduling, and general inquiries.

- Problem Resolution: Provides a channel for addressing customer concerns and issues.

- Efficiency Gains: Streamlines communication, improving operational flow.

- Customer Satisfaction: Enhances the overall customer experience through accessible support.

Third-Party Online Marketplaces and Portals

Third-party online marketplaces like AutoTrader and CarGurus act as crucial, albeit indirect, channels for automotive retailers such as Asbury Automotive Group. These platforms significantly expand a dealership's reach, connecting them with a vast pool of potential buyers actively searching for vehicles. In 2024, the automotive retail sector continued to rely heavily on these digital avenues to drive showroom traffic and online leads.

These marketplaces offer a broad audience that might not otherwise discover Asbury's inventory. By listing vehicles on these widely recognized portals, Asbury can generate interest and direct consumers to its own digital properties or physical locations for further engagement. This strategy is vital for maximizing visibility in a competitive market.

- Increased Lead Generation: Third-party sites are a primary source for inbound leads for many dealerships.

- Brand Exposure: Listing on popular portals enhances brand recognition beyond Asbury's direct online presence.

- Market Insights: Data from these platforms can offer valuable insights into pricing and consumer demand.

- Competitive Advantage: Maintaining a strong presence on these sites helps Asbury compete effectively with other automotive retailers.

Asbury Automotive Group utilizes a multi-channel strategy, blending its extensive physical dealership network with robust digital platforms and third-party marketplaces. This integrated approach aims to capture customers at various stages of their car-buying journey, from initial online research to in-person vehicle evaluation and purchase.

The company's digital channels, including its corporate website and the Clicklane platform, are critical for extending market reach and accommodating the growing consumer preference for online transactions. In 2023, Asbury's digital retail channels contributed significantly to overall sales, demonstrating their increasing importance.

Furthermore, dedicated call centers provide essential customer support and streamline communication, while third-party online marketplaces like AutoTrader and CarGurus enhance brand visibility and lead generation by connecting Asbury with a wider audience of active car shoppers.

| Channel Type | Key Characteristics | Customer Interaction | 2023/2024 Relevance |

|---|---|---|---|

| Physical Dealerships | 177 new vehicle dealerships, 40 collision centers across 15 states | Direct sales, financing, service, test drives | Significant revenue driver; 2023 revenue $10.4 billion |

| Digital Sales Platform (Clicklane) | End-to-end online car buying experience | Online browsing, financing, purchase, delivery | Extended market reach, caters to digital preferences |

| Corporate & Dealership Websites | Online inventory, service information, lead capture | Information hub, initial customer contact, online inquiries | Drives online engagement; 15% YoY online lead volume growth in 2023 |

| Call Centers | Customer support, sales inquiries, appointment scheduling | Personalized assistance, problem resolution, efficiency | Focus on customer service; aiming for high call answer rates |

| Third-Party Marketplaces | AutoTrader, CarGurus, etc. | Broad audience reach, lead generation, market insights | Crucial for visibility and attracting active buyers in a competitive market |

Customer Segments

New vehicle buyers represent a core customer segment for Asbury Automotive Group, encompassing individuals and families actively looking for the latest models. These buyers are often drawn to specific luxury, import, or domestic brands that Asbury dealerships carry, prioritizing features, manufacturer warranties, and the appeal of a brand-new car. In 2024, the new vehicle market saw continued demand, with total new vehicle sales in the U.S. projected to reach approximately 15.5 million units, reflecting a steady recovery and consumer interest in updated automotive technology and design.

Used vehicle buyers represent a significant portion of Asbury Automotive Group's customer base. This segment includes individuals seeking pre-owned cars, trucks, and SUVs, often prioritizing affordability and value over new vehicle features. They might be first-time car buyers, those looking for a second vehicle, or individuals seeking specific older models no longer in production.

Within this segment, certified pre-owned (CPO) vehicles hold particular appeal. These vehicles typically undergo rigorous inspections and come with extended warranties, offering buyers a greater sense of security and reliability. In 2023, the used vehicle market saw continued strong demand, with average used car prices fluctuating but generally remaining elevated compared to pre-pandemic levels, indicating a persistent need for budget-friendly transportation solutions.

This segment encompasses a wide range of vehicle owners who need routine maintenance, unexpected repairs, or genuine replacement parts for their vehicles. It includes both customers who initially bought their cars from Asbury and those who own vehicles of the brands Asbury is authorized to service. This is a vital segment for generating consistent, recurring revenue and fostering long-term customer loyalty.

In 2024, the automotive aftermarket service industry continued to be a significant revenue driver. For instance, the U.S. automotive repair and maintenance market was projected to reach over $300 billion, highlighting the substantial demand from vehicle owners. Asbury Automotive Group, with its extensive network of dealerships and service centers, is well-positioned to capture a considerable portion of this market by offering convenient and reliable service options.

Customers Seeking Finance and Insurance Products

This segment comprises individuals who need financial assistance to purchase vehicles or opt for supplementary protection products. These can include extended warranties, Guaranteed Asset Protection (GAP) insurance, or prepaid maintenance packages, all designed to enhance the ownership experience and mitigate unforeseen costs. They value integrated solutions that simplify the car buying process.

Asbury Automotive Group, a major automotive retailer, reported significant finance and insurance (F&I) revenue. In the first quarter of 2024, Asbury’s F&I revenue per vehicle retailed reached $2,511, showcasing the strong demand for these products. This indicates a substantial portion of their customer base actively seeks these value-added services.

- Vehicle Financing: Customers require loans or leases to acquire new and used vehicles, often seeking competitive rates and flexible terms.

- Aftermarket Products: Demand exists for extended service contracts, GAP insurance, tire and wheel protection, and prepaid maintenance plans to cover potential repair costs and enhance vehicle longevity.

- Convenience: This segment prioritizes one-stop shopping, preferring to arrange financing and purchase protection products at the dealership rather than through separate third-party providers.

- Risk Mitigation: Customers are motivated by the desire to protect their investment against unexpected mechanical failures or accidents, thereby reducing out-of-pocket expenses.

Fleet and Commercial Buyers

Asbury Automotive Group serves fleet and commercial buyers, which are businesses and organizations needing to acquire multiple vehicles for their operations. This segment often requires specific vehicle models, customization options, and ongoing fleet management support. Asbury's extensive inventory and dealership network are well-positioned to meet these larger volume demands.

In 2024, the commercial vehicle market continued to see robust demand, driven by sectors like logistics, construction, and delivery services. For instance, the U.S. commercial truck market saw significant activity, with sales figures indicating sustained interest from businesses looking to expand or update their fleets. Asbury's ability to provide a diverse range of vehicles, from light-duty vans to heavy-duty trucks, directly addresses the varied needs of these commercial clients.

- Fleet Sales Growth: Asbury's 2024 performance included a notable contribution from fleet and commercial sales, reflecting successful engagement with business clients.

- Customization and Support: The company offers tailored solutions, including vehicle upfitting and specialized financing, to meet the unique operational requirements of commercial buyers.

- Inventory Advantage: With a wide selection of makes and models across its dealerships, Asbury provides a centralized resource for businesses seeking to acquire multiple vehicles efficiently.

- Fleet Management Services: Beyond the initial sale, Asbury aims to support these clients with ongoing maintenance and management services, fostering long-term relationships.

Asbury Automotive Group's customer base is diverse, ranging from individuals seeking new or used vehicles to businesses requiring fleet solutions. They also cater to existing vehicle owners needing service and parts, as well as customers looking for financing and aftermarket products. This broad approach allows Asbury to capture revenue across different stages of the automotive lifecycle.

The company's ability to serve both retail and commercial clients, coupled with its focus on after-sales services like maintenance and parts, highlights a comprehensive business model. In 2024, Asbury's performance in finance and insurance per vehicle retailed, reaching $2,511 in Q1, underscores the importance of this segment. Furthermore, the projected over $300 billion U.S. automotive repair and maintenance market indicates the significant recurring revenue potential from service customers.

| Customer Segment | Key Characteristics | 2024/Recent Data Insight |

|---|---|---|

| New Vehicle Buyers | Seeking latest models, prioritizing features, warranties, and brand appeal. | U.S. new vehicle sales projected around 15.5 million units in 2024. |

| Used Vehicle Buyers | Prioritizing affordability and value; includes CPO buyers seeking security. | Used car prices remained elevated in 2023, showing sustained demand. |

| Service and Parts Customers | Vehicle owners needing maintenance, repairs, or replacement parts. | U.S. aftermarket service market projected over $300 billion. |

| Finance & Insurance (F&I) Customers | Seeking vehicle financing, extended warranties, GAP insurance, etc. | Asbury's F&I revenue per vehicle retailed was $2,511 in Q1 2024. |

| Fleet and Commercial Buyers | Businesses needing multiple vehicles, customization, and fleet management. | Robust demand in commercial vehicle market driven by logistics and delivery. |

Cost Structure

The most significant element in Asbury Automotive Group's cost structure is the expense of purchasing new and used vehicles. This cost is directly tied to the number of cars they sell and is influenced by prevailing market prices and how smoothly the supply chain operates.

For the fiscal year 2023, Asbury Automotive Group reported a Cost of Goods Sold (COGS) of $8.9 billion, representing the bulk of their operational expenses. This figure underscores the substantial investment required to maintain their vehicle inventory, a critical factor in their retail operations.

Asbury Automotive Group's cost structure is heavily influenced by personnel and compensation expenses, reflecting its substantial workforce. This category encompasses salaries, wages, and crucial commissions for its sales teams, a significant driver of revenue. For instance, in 2023, Asbury's selling, general and administrative expenses, which include compensation, totaled $2.9 billion.

Beyond sales, compensation extends to a broad array of service technicians, administrative staff, and management across its numerous dealerships and corporate operations. Employee benefits and ongoing training programs are also integral components, ensuring a skilled and motivated team to support customer service and operational efficiency.

Asbury Automotive Group's Selling, General, and Administrative (SG&A) expenses encompass a broad spectrum of operational costs vital for maintaining its extensive dealership network. These include significant outlays for advertising and marketing campaigns to drive customer traffic, as well as the ongoing costs of rent, utilities, and property taxes for its numerous facilities. In 2024, Asbury reported SG&A expenses of $2.3 billion, reflecting the substantial investment required to operate and promote its diverse automotive brands across the country.

Floorplan Interest and Financing Costs

Asbury Automotive Group's cost structure is significantly impacted by floorplan interest and financing costs. These expenses are directly tied to the capital required to purchase new vehicle inventory from manufacturers, a critical component of their operations.

In 2024, Asbury Automotive Group reported substantial interest expenses related to their floorplan financing. For instance, in the first quarter of 2024, Asbury's interest expense on floorplan financing alone was $59.8 million, a notable increase from the previous year, reflecting higher interest rates and inventory levels.

- Floorplan Interest: This represents the cost of borrowing money to finance new vehicle inventory held on dealership lots.

- Debt Financing Costs: Includes interest on other forms of debt used for general corporate purposes, capital expenditures, and acquisitions.

- Impact on Profitability: Higher interest rates and increased borrowing directly reduce net income and can affect the company's ability to invest in growth.

- Liquidity Considerations: Managing these financing costs is crucial for maintaining healthy cash flow and operational flexibility.

Capital Expenditures and Acquisition Costs

Asbury Automotive Group's cost structure heavily features capital expenditures and acquisition costs. This includes significant investments in upgrading and expanding their dealership facilities, as well as crucial technology enhancements to improve customer experience and operational efficiency. For example, in 2023, Asbury's capital expenditures totaled $276.4 million, reflecting ongoing investments in their physical and digital infrastructure.

Furthermore, the company incurs substantial costs when acquiring new dealerships or entire dealership groups. These acquisition expenses often include the purchase price of the business, along with the valuation of intangible assets like goodwill and the underlying real estate. These strategic acquisitions are key to Asbury's growth, though they represent a major component of their capital outlay.

- Facility Investments: Ongoing spending on new and existing dealership locations.

- Technology Upgrades: Costs associated with implementing new systems and digital tools.

- Acquisition Expenses: Significant outlay for purchasing new dealerships, including goodwill and real estate.

- 2023 Capital Expenditures: Asbury reported $276.4 million in capital expenditures for the year 2023.

The primary cost driver for Asbury Automotive Group remains the acquisition of new and used vehicles, a direct reflection of sales volume and market pricing. This is closely followed by significant personnel expenses, encompassing salaries, commissions, and benefits for a large workforce, which totaled $2.9 billion in selling, general, and administrative (SG&A) expenses in 2023. Furthermore, financing costs, particularly floorplan interest on new vehicle inventory, represent a substantial outlay, with Q1 2024 interest expenses on floorplan financing alone reaching $59.8 million, indicating the impact of interest rate fluctuations.

| Cost Component | 2023 (Millions) | Q1 2024 (Millions) | Notes |

|---|---|---|---|

| Cost of Goods Sold (Vehicles) | $8,900 | N/A | Represents the bulk of operational expenses. |

| Selling, General & Administrative (SG&A) | $2,900 | $2,300 (for 2024) | Includes personnel, marketing, and facility costs. |

| Floorplan Interest Expense | N/A | $59.8 | Cost of financing new vehicle inventory. |

| Capital Expenditures | $276.4 | N/A | Investments in facilities and technology. |

Revenue Streams

New vehicle sales represent Asbury Automotive Group's most significant revenue generator, stemming from the sale of cars, trucks, and SUVs across numerous franchised brands. This core business segment, while substantial in overall revenue contribution, generally operates with tighter gross profit margins compared to other areas of the automotive retail business.

For the first quarter of 2024, Asbury reported total revenue of $3.9 billion, with new vehicle sales forming the largest component of this figure. Despite lower individual profit margins on each sale, the sheer volume of new vehicles sold drives this segment's overall financial impact.

Revenue generated from the retail and wholesale of used vehicles is a cornerstone for Asbury Automotive Group. This segment often provides more attractive gross profit margins per unit when compared to new vehicle sales, directly bolstering the company's overall profitability.

In 2024, Asbury Automotive Group reported that its used vehicle sales accounted for a substantial portion of its total revenue, demonstrating the critical role this segment plays in their business model. For instance, in the first quarter of 2024, the company saw significant growth in used vehicle revenue, highlighting its importance to their financial performance.

Parts and Service revenue is a cornerstone for Asbury Automotive Group, providing a highly profitable and stable income. This segment encompasses vehicle maintenance, repair services, and the sale of replacement parts, serving both retail and wholesale customers.

This revenue stream is diversified, including customer-pay services, warranty work performed for manufacturers, and collision repair services. In 2023, Asbury reported that its Aftermarket Services segment, which includes parts and service, generated approximately $2.3 billion in revenue, highlighting its significant contribution to the company's overall financial performance.

The stability of parts and service revenue makes it a crucial anchor for Asbury, especially during periods of market volatility. This consistent demand for vehicle upkeep and repair ensures a reliable revenue base, supporting the company's operations and profitability throughout the year.

Finance and Insurance (F&I) Revenue

Asbury Automotive Group generates significant revenue from its Finance and Insurance (F&I) operations. This segment encompasses income derived from facilitating vehicle financing with external lenders, thereby earning commissions. It also includes the sale of various aftermarket products designed to enhance customer ownership experience and provide financial protection.

Key F&I revenue drivers for Asbury Automotive Group include:

- Vehicle Financing: Commissions earned from arranging loans and leases for customers through third-party financial institutions.

- Extended Service Contracts: Revenue from selling service agreements that cover vehicle repairs beyond the manufacturer's warranty.

- GAP Insurance: Income generated from offering Guaranteed Asset Protection insurance, which covers the difference between a vehicle's actual cash value and the amount owed on a loan or lease in case of total loss.

- Aftermarket Products: Sales of various add-on products such as paint protection, fabric protection, and anti-theft devices.

The F&I segment is characterized by its high-margin nature, contributing substantially to the profitability per vehicle retailed. For instance, in the first quarter of 2024, Asbury reported that its F&I revenue per vehicle retailed was $2,414, a slight increase from $2,396 in the same period of 2023, underscoring its consistent profitability.

Collision Repair Services Revenue

Asbury Automotive Group generates revenue through its standalone collision repair centers, offering specialized services for vehicle body repairs after accidents. This segment acts as a significant ancillary income stream, directly tied to vehicle ownership and the need for maintenance beyond routine servicing.

In 2024, Asbury’s collision repair segment demonstrated robust performance, contributing meaningfully to the company's overall financial health. The demand for these services remains consistently strong, driven by the ongoing need for vehicle upkeep and accident recovery.

- Revenue Source: Vehicle body repairs and associated services at dedicated collision centers.

- Market Position: Complements dealership maintenance and sales, offering a comprehensive vehicle ownership solution.

- 2024 Performance Highlight: Collision repair revenue saw a notable increase year-over-year, reflecting strong customer demand and operational efficiency.

- Strategic Importance: Enhances customer loyalty and provides a recurring revenue stream independent of new vehicle sales cycles.

Asbury Automotive Group diversifies its income through several key revenue streams beyond new vehicle sales. These include the profitable sales of used vehicles, which often carry higher margins, and the essential parts and service segment, providing consistent income from maintenance and repairs.

The Finance and Insurance (F&I) division is a high-margin contributor, generating income from vehicle financing commissions and aftermarket product sales, while dedicated collision repair centers offer specialized services, further broadening the company's revenue base.

| Revenue Stream | Description | 2024 Q1 Impact |

| New Vehicle Sales | Primary revenue from selling new cars, trucks, and SUVs. | Largest component of $3.9B total Q1 revenue. |

| Used Vehicle Sales | Retail and wholesale of pre-owned vehicles. | Significant revenue contributor with attractive gross profit margins. |

| Parts and Service | Vehicle maintenance, repair, and parts sales. | Generated ~$2.3B in 2023 (Aftermarket Services segment). |

| Finance & Insurance (F&I) | Commissions from financing, extended warranties, GAP insurance, and add-ons. | F&I revenue per vehicle retailed was $2,414 in Q1 2024. |

| Collision Repair | Specialized vehicle body repairs at dedicated centers. | Notable year-over-year increase in revenue in 2024. |

Business Model Canvas Data Sources

The Asbury Automotive Group Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research on automotive retail trends, and strategic insights derived from competitor analysis. These data sources ensure each component of the canvas accurately reflects the company's operational realities and market positioning.