Arthrex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arthrex Bundle

Arthrex's innovative product pipeline and strong brand reputation are significant strengths, but the competitive landscape and regulatory hurdles present considerable challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within the orthopedic sector.

Want the full story behind Arthrex's market position, potential growth drivers, and the strategic implications of its internal capabilities and external threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your critical business decisions.

Strengths

Arthrex is a powerhouse in innovation, consistently leading the charge in surgical solutions. Their dedication to cutting-edge technology is evident in their impressive track record of new product and procedure development, averaging over 1,000 annually.

This commitment to innovation was further solidified in 2025 when Arthrex earned both Gold and Bronze Edison Awards. The Gold award recognized their TightRope® SB implant, a significant advancement in surgical stabilization, while the NanoScopic™ Release system secured the Bronze award, showcasing their pioneering work in minimally invasive techniques.

Arthrex boasts a remarkably comprehensive product portfolio, encompassing a vast array of implants, instruments, and biologics specifically designed for arthroscopic and minimally invasive orthopedic procedures. This extensive offering allows surgeons to address a wide spectrum of orthopedic conditions with precision and efficacy.

The company's strategic expansion into new medical specialties, such as trauma, endoscopy, spine, and cardiothoracic surgery, further broadens its market penetration and diversifies its revenue streams. This commitment to innovation and market reach underpins Arthrex's strong competitive position.

Arthrex boasts a robust global market presence, distributing its innovative orthopedic products and solutions to surgeons across the world, solidifying its reputation as a reliable international partner.

The company's commitment to quality and supply chain resilience is underscored by its significant manufacturing operations within the United States, where it assembles over 87% of its product portfolio. These operations are strategically located across facilities in Florida, South Carolina, and California, ensuring stringent quality control and efficient distribution.

Focus on Minimally Invasive Surgery (MIS)

Arthrex's strategic focus on minimally invasive surgery (MIS) is a significant strength, tapping into a rapidly expanding market. This specialization aligns perfectly with growing patient demand for procedures that offer quicker recovery, less discomfort, and shorter hospital stays. For instance, the global MIS market was valued at approximately $30 billion in 2023 and is projected to grow substantially in the coming years, with Arthrex well-positioned to benefit.

This deep expertise in MIS technology allows Arthrex to develop innovative solutions that meet the evolving needs of surgeons and patients alike.

- Market Leadership: Arthrex is a recognized leader in MIS orthopedic technologies.

- Patient Preference: Growing patient demand for less invasive procedures fuels market growth.

- Technological Innovation: The company's specialization drives continuous development of advanced MIS tools.

Strong Medical Education and Surgeon Relationships

Arthrex's commitment to medical education is a significant strength, evident in its extensive global training programs. These initiatives equip surgeons with the skills needed to effectively utilize Arthrex's innovative orthopedic solutions. For instance, in 2023, Arthrex conducted over 1,500 educational events, training more than 100,000 healthcare professionals worldwide.

This deep engagement cultivates strong, lasting relationships with surgeons. By fostering trust and ensuring proficiency, Arthrex becomes a preferred partner for surgical innovation. This focus on surgeon education directly translates into increased product adoption and reinforces brand loyalty within the medical community.

- Global Reach: Over 100,000 healthcare professionals trained in 2023.

- Product Adoption: Education drives surgeon comfort and use of Arthrex technologies.

- Brand Loyalty: Strong surgeon relationships foster repeat business and advocacy.

Arthrex's strength lies in its unparalleled innovation, consistently introducing groundbreaking surgical solutions. Their commitment to advancing minimally invasive surgery (MIS) is a key differentiator, aligning with a growing global demand for less invasive procedures. This focus has led to significant market leadership, with the company recognized for its continuous development of advanced MIS tools.

What is included in the product

This SWOT analysis provides a comprehensive look at Arthrex's internal strengths and weaknesses, alongside external opportunities and threats, to understand its strategic positioning and future growth potential.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

The orthopedic device market is a battlefield, dominated by giants like Stryker, Zimmer Biomet, and Medtronic. This intense concentration means Arthrex faces constant pressure on pricing and a struggle to hold onto its market share. For instance, the global orthopedic devices market was valued at approximately $54.1 billion in 2023 and is projected to reach $77.1 billion by 2028, indicating substantial growth but also fierce competition for a slice of that pie.

Arthrex's commitment to innovation, with over 1,000 new products and procedures developed annually, requires significant and ongoing investment in research and development. This aggressive R&D strategy, while a key strength, places a considerable financial burden on the company, potentially impacting its profit margins. Maintaining this pace of innovation is essential for market leadership but comes at a substantial cost.

Arthrex's deep specialization in orthopedics, while a strength, also presents a weakness. This singular focus means the company is heavily reliant on the health and growth of this specific medical sector. If the orthopedic market were to face significant headwinds, such as a major economic downturn impacting elective procedures or a disruptive shift towards non-surgical treatments, Arthrex could be disproportionately affected.

The company's limited diversification beyond orthopedics amplifies this vulnerability. While its comprehensive offerings within the orthopedic niche are impressive, a lack of significant presence in other medical device or healthcare segments leaves Arthrex exposed. For instance, if new technologies emerge that bypass traditional orthopedic interventions, Arthrex's market share could erode without a diversified revenue stream to cushion the impact.

Complex and Evolving Regulatory Environment

Arthrex, like many in the medical device sector, faces a complex and constantly changing regulatory environment. Anticipated shifts in 2025, such as the ongoing implementation of EU MDR and IVDR, alongside emerging regulations for AI and cybersecurity in healthcare, create significant compliance challenges. Successfully navigating these evolving requirements necessitates substantial investment in resources and specialized expertise.

This continuous compliance burden can act as a weakness by potentially hindering market access and increasing operational costs. For instance, the EU MDR, which fully came into effect in May 2021, has already demonstrated its rigor, with many companies still working to ensure full compliance, a process that often takes years and significant financial outlay. The upcoming AI and cybersecurity regulations will add further layers of complexity and cost for device manufacturers to manage.

- Increased Compliance Costs: Adapting to new regulations like EU MDR and IVDR requires significant investment in documentation, testing, and quality management systems.

- Potential Market Access Delays: Failure to meet evolving regulatory standards can lead to delays in product approvals and market entry, impacting revenue streams.

- Resource Strain: Managing the intricate web of global medical device regulations demands specialized personnel and robust internal processes, stretching company resources.

Vulnerability to Economic Downturns

Economic uncertainties, such as potential recessions or prolonged periods of high inflation, can significantly impact Arthrex. Rising operational costs, including raw materials and labor, directly affect the healthcare sector. This financial pressure on hospitals and healthcare systems might lead to delayed capital equipment purchases and a heightened focus on the cost-effectiveness of medical devices, potentially impacting Arthrex's sales and revenue growth.

For instance, persistent inflation in 2024 and into 2025 could exacerbate these pressures. If healthcare providers face tighter budgets due to economic headwinds, their willingness to invest in new surgical technologies or equipment may decrease. This could translate into slower adoption rates for Arthrex's innovative product lines, thereby affecting its market penetration and overall financial performance.

- Economic Downturns: A contraction in the broader economy can reduce healthcare spending.

- Inflationary Pressures: Increased costs for materials and operations can squeeze profit margins.

- Capital Expenditure Delays: Hospitals may postpone large purchases of medical devices during uncertain economic times.

- Cost Scrutiny: Healthcare providers are likely to scrutinize the pricing and value proposition of medical devices more closely.

Arthrex's heavy reliance on the orthopedic market makes it susceptible to sector-specific downturns or disruptive technological shifts. This lack of diversification means that any significant negative event within orthopedics could disproportionately impact Arthrex's overall financial health, unlike more diversified medical device companies.

Preview the Actual Deliverable

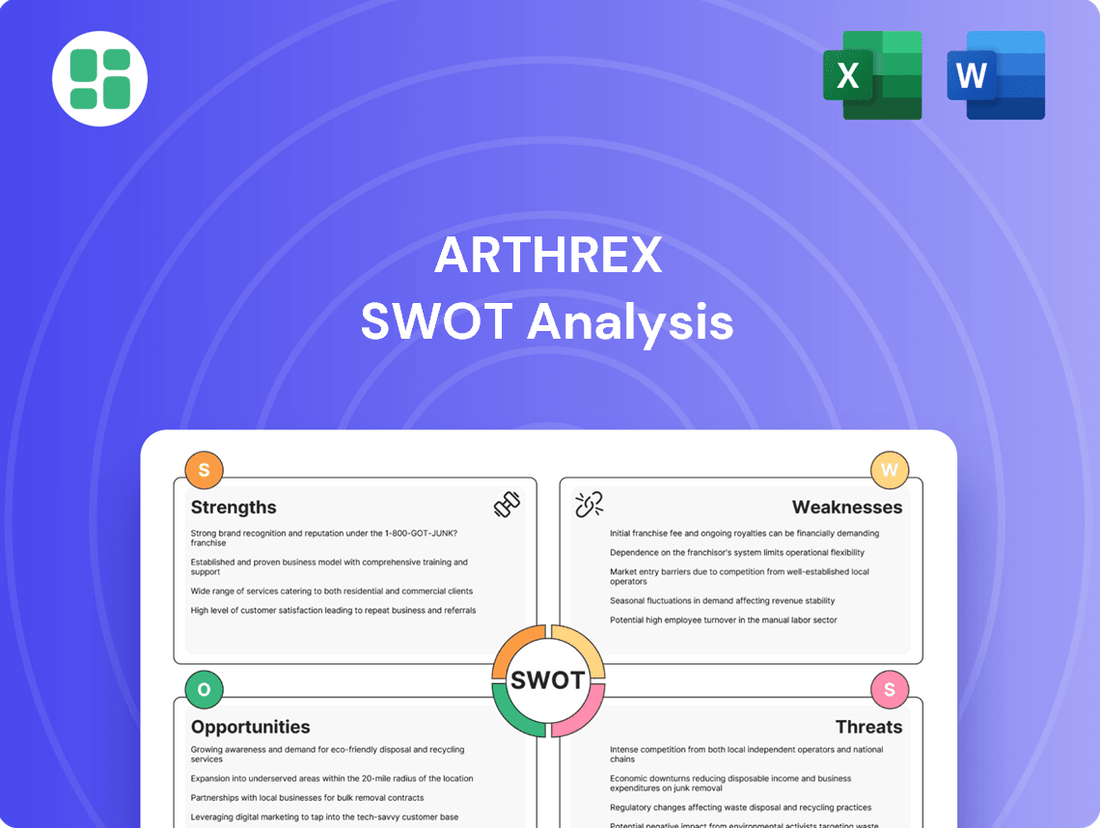

Arthrex SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and confidence in the quality of our Arthrex SWOT analysis. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

The world's population is getting older, and with that comes a rise in bone and joint issues like arthritis and broken bones. This trend is a big deal for companies making orthopedic devices because it means more people will need surgeries and implants. In 2024, the global orthopedic devices market was valued at over $60 billion, and it's expected to keep growing steadily due to this demographic shift.

Arthrex is in a great spot to benefit from this. As more people require joint replacements, trauma care, and other orthopedic solutions, the demand for Arthrex's innovative products and surgical techniques will naturally increase. The company's focus on minimally invasive procedures and advanced implants directly addresses the needs of an aging population seeking better recovery and mobility.

Arthrex can capitalize on the burgeoning integration of advanced technologies in orthopedics. The market for surgical robotics, for instance, is projected to reach $11.5 billion by 2028, growing at a CAGR of 17.6% from 2023, according to some market analyses. This presents a significant opportunity for Arthrex to further embed AI-driven surgical planning tools and robotic-assisted systems into its offerings, enhancing precision and patient-specific solutions.

The company can also leverage 3D printing for the creation of custom implants and surgical guides, a segment that saw substantial growth in 2024. By expanding its portfolio with AI-powered diagnostic tools that can predict surgical risks or optimize implant selection, Arthrex can solidify its position as an innovator, driving improved patient outcomes and capturing market share in this technologically advancing sector.

Emerging markets, especially in Asia-Pacific and Latin America, are seeing robust growth in healthcare spending and a greater acceptance of sophisticated medical technologies. This trend is fueled by expanding middle classes and improved healthcare access.

Arthrex can capitalize on this by broadening its presence in these regions, which are projected to contribute significantly to global medical device market growth. For instance, the Asia-Pacific medical device market alone was valued at over $150 billion in 2023 and is expected to grow at a compound annual growth rate of around 7-8% through 2028, offering substantial sales potential.

Establishing new distribution channels and tailoring product offerings to local needs will be key to unlocking this potential. This expansion will not only boost Arthrex's revenue streams but also solidify its position as a global leader in orthopedics.

Shift Towards Outpatient and Ambulatory Surgery Centers (ASCs)

The healthcare industry is increasingly favoring outpatient and ambulatory surgery center (ASC) settings for orthopedic procedures. This shift is largely due to the cost savings and enhanced patient convenience offered by these facilities compared to traditional hospitals. In 2023, the ASC market for orthopedic procedures was valued at approximately $30 billion globally and is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 7-8% through 2030.

Arthrex is well-positioned to capitalize on this trend. Its strong portfolio of minimally invasive surgical (MIS) technologies and instruments directly supports the efficient and effective execution of procedures in ASCs. This alignment allows Arthrex to capture a greater market share as more orthopedic surgeries transition from inpatient hospital settings to these outpatient environments.

Key opportunities stemming from this shift include:

- Expansion of ASC product offerings: Developing and marketing specialized kits and implants tailored for ASC workflows and patient demographics.

- Partnerships with ASCs: Collaborating with ASC management groups and surgeons to integrate Arthrex's solutions and training programs.

- Market share growth: Gaining a larger share of the orthopedic surgery market as procedures migrate to more cost-effective outpatient settings.

- Innovation in MIS: Continuing to lead in the development of next-generation MIS technologies that further enhance ASC efficiency and patient outcomes.

Strategic Partnerships and Acquisitions for Diversification

Arthrex can significantly broaden its market reach and reduce reliance on its core orthopedic offerings by forming strategic partnerships or acquiring companies in adjacent surgical fields. This approach allows for the swift integration of new technologies and the expansion into untapped markets.

For instance, by acquiring a company specializing in minimally invasive cardiovascular devices, Arthrex could leverage its established distribution channels to quickly gain traction in that sector. This diversification strategy is crucial for long-term growth and resilience.

- Market Expansion: Entering new surgical specialties like neurosurgery or ophthalmology through acquisitions could unlock substantial revenue streams, complementing its existing orthopedic business.

- Technology Integration: Partnerships can bring in innovative technologies, such as advanced AI-powered diagnostic tools or robotic surgical platforms, enhancing Arthrex’s product ecosystem.

- Portfolio Enhancement: Acquisitions can fill gaps in Arthrex's current portfolio, offering a more comprehensive suite of solutions to healthcare providers and improving competitive positioning.

Arthrex is poised to benefit from the global aging population, a trend driving increased demand for orthopedic solutions. The company can also capitalize on the growing integration of advanced technologies like robotics and AI in surgery, with the surgical robotics market alone projected to reach $11.5 billion by 2028. Furthermore, expanding into emerging markets, particularly in Asia-Pacific, presents significant growth potential, as this region's medical device market was valued at over $150 billion in 2023.

The shift towards outpatient and ambulatory surgery centers (ASCs) for orthopedic procedures offers a substantial opportunity, as this market was valued at approximately $30 billion globally in 2023. Arthrex's minimally invasive surgical technologies align perfectly with the efficiency and cost-effectiveness of ASCs. Strategic partnerships and acquisitions in adjacent surgical fields can also broaden Arthrex's market reach and diversify its revenue streams beyond orthopedics.

| Opportunity Area | Key Drivers | Market Data/Projections |

|---|---|---|

| Aging Population & Orthopedic Demand | Increased incidence of bone and joint issues | Global orthopedic devices market > $60 billion (2024) |

| Technological Integration | Advancements in robotics, AI, and 3D printing | Surgical robotics market to reach $11.5 billion by 2028 |

| Emerging Markets | Growing healthcare spending and technology adoption | Asia-Pacific medical device market > $150 billion (2023) |

| Ambulatory Surgery Centers (ASCs) | Cost savings and patient convenience | ASC orthopedic procedures market ~$30 billion (2023) |

| Diversification via Partnerships/Acquisitions | Access to new technologies and markets | Potential to enter neurosurgery, ophthalmology, etc. |

Threats

The orthopedic device market is fiercely competitive, with established giants and nimble startups constantly vying for market share. This intense rivalry, particularly evident in 2024 and projected into 2025, translates into significant pricing pressures. Companies like Arthrex must navigate this landscape by focusing on innovation and efficiency to maintain profitability amidst these demands.

Arthrex faces a significant threat from increasingly complex and stringent global regulatory compliance. This is especially true for medical devices incorporating new technologies like AI. For instance, the US FDA's evolving framework for AI/ML-based medical devices, with new guidance released in early 2024, demands rigorous validation and continuous monitoring, adding layers of complexity and potential delays to product launches.

Failure to keep pace with these evolving regulations, covering areas from product approvals to robust cybersecurity measures, can lead to substantial financial penalties and restricted market access. The cost of maintaining compliance is substantial, with companies needing significant ongoing investment in dedicated regulatory affairs teams and sophisticated compliance systems to navigate these challenges effectively.

Global economic instability, including potential recessions and persistent inflationary pressures, poses a significant threat to Arthrex. These factors can lead to reduced healthcare spending by hospitals and patients, particularly impacting elective procedures and capital equipment purchases. For instance, a projected global GDP growth slowdown in 2024-2025 could directly curb demand for specialized medical devices.

Disruptive Technologies and Alternative Therapies

The advancement of non-surgical treatments presents a significant challenge to Arthrex's established product lines. For instance, the growing efficacy of regenerative medicine and new pharmaceutical options, like GLP-1 agonists for obesity-related conditions, could diminish the reliance on traditional orthopedic surgeries. This trend, gaining momentum through 2024 and projected to continue into 2025, directly impacts the long-term demand for Arthrex's surgical implants and instruments.

The market for regenerative medicine, projected to reach over $1.5 billion by 2025 according to some industry analyses, highlights the potential shift away from surgical interventions. Furthermore, the increasing adoption of minimally invasive techniques, while often utilizing Arthrex products, also signals a broader move towards less invasive patient care pathways. This evolving landscape necessitates continuous innovation from Arthrex to adapt to these changing therapeutic modalities.

- Emerging Non-Surgical Therapies: Growing adoption of regenerative medicine and advanced pharmaceuticals could reduce demand for orthopedic surgeries.

- Market Shift: The regenerative medicine market is expected to see substantial growth, potentially diverting patients from surgical procedures.

- Competitive Pressure: Competitors focusing on non-invasive solutions may capture market share, impacting Arthrex's traditional revenue streams.

Supply Chain Vulnerabilities and Geopolitical Risks

Arthrex, like many global medical device manufacturers, faces significant threats from supply chain vulnerabilities. The reliance on international sourcing for raw materials and components means that disruptions, whether from natural disasters, trade disputes, or political instability, can directly impact production. For instance, the semiconductor shortages experienced globally in 2021-2022, which affected numerous industries including medical technology, highlighted the fragility of extended supply chains.

Geopolitical risks further exacerbate these vulnerabilities. Tensions between major global powers can lead to trade restrictions, tariffs, and increased shipping costs, all of which can drive up Arthrex's cost of goods sold. A report from the U.S. Chamber of Commerce in late 2023 indicated that geopolitical instability was a top concern for businesses, directly impacting their ability to forecast and manage operational costs.

These combined threats can translate into tangible business challenges for Arthrex:

- Increased Production Costs: Shortages of key materials or components can lead to price hikes from suppliers, directly impacting Arthrex's margins.

- Manufacturing Delays: Disruptions in logistics or component availability can halt or slow down production lines, leading to backorders and missed sales opportunities.

- Inability to Meet Demand: Extended supply chain issues can make it difficult for Arthrex to scale production to meet growing market demand for its innovative orthopedic solutions, potentially ceding market share to competitors.

The orthopedic device market is intensely competitive, with pricing pressures intensifying due to established players and emerging startups, a trend that continued strongly through 2024 and is expected in 2025.

Arthrex must also contend with evolving global regulatory landscapes, particularly for devices incorporating new technologies like AI, demanding rigorous validation and potentially delaying product launches.

Economic instability, including inflation and potential recessions, threatens to reduce healthcare spending, impacting demand for elective procedures and capital equipment purchases, with global GDP growth projections for 2024-2025 indicating a potential slowdown.

The rise of non-surgical treatments and regenerative medicine, a market projected to exceed $1.5 billion by 2025, poses a significant challenge to Arthrex's traditional surgical implant business.

| Threat Category | Specific Threat | Impact on Arthrex | 2024/2025 Data/Projection |

| Competition | Intense Market Rivalry | Pricing pressures, reduced market share | Continued high competition, focus on innovation |

| Regulatory | Complex Global Compliance | Product launch delays, increased R&D costs | Evolving AI/ML medical device guidance (e.g., FDA early 2024) |

| Economic | Global Economic Instability | Reduced healthcare spending, lower demand | Projected global GDP growth slowdown (2024-2025) |

| Therapeutic Trends | Non-Surgical Treatment Advancement | Decreased demand for surgical products | Regenerative medicine market projected >$1.5B by 2025 |

SWOT Analysis Data Sources

This Arthrex SWOT analysis is built upon a foundation of credible data, including Arthrex's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a robust understanding of the company's performance, competitive landscape, and future opportunities.