Arthrex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arthrex Bundle

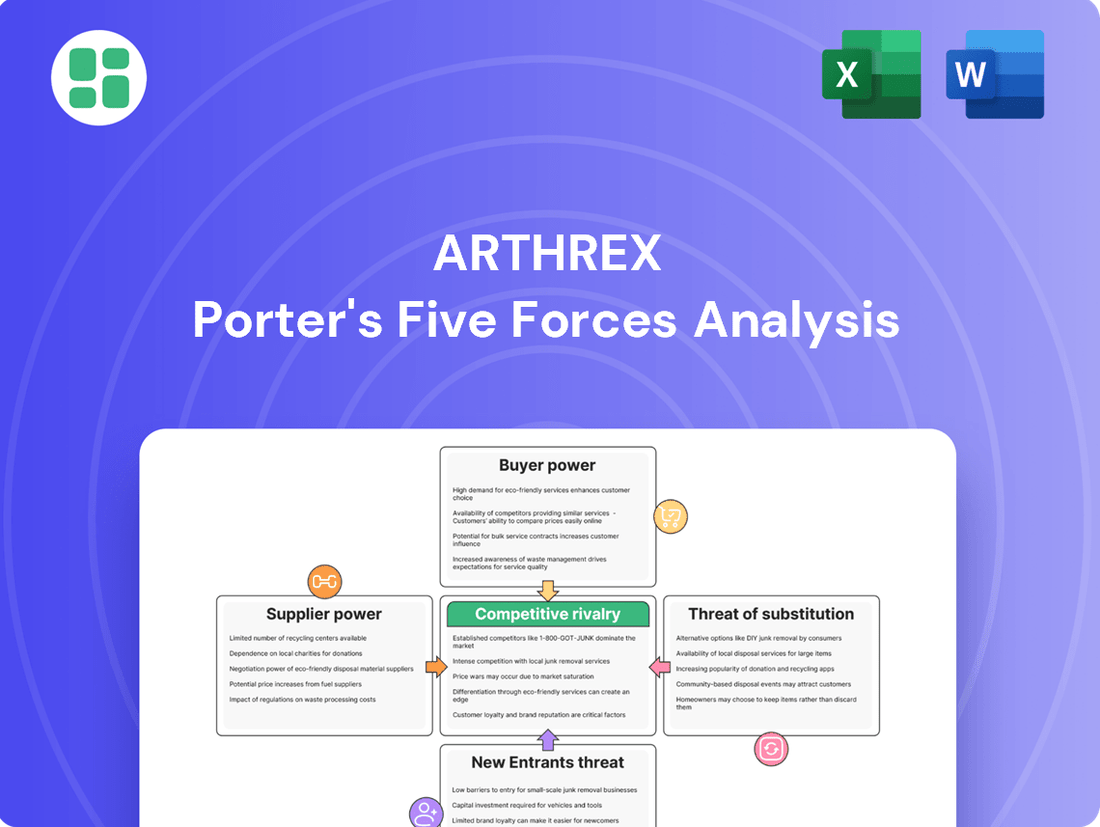

Arthrex operates in a dynamic medical device market, facing intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Arthrex’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized medical-grade raw materials, such as specific titanium alloys or biocompatible polymers, and unique electronic components for Arthrex's advanced surgical devices wield considerable bargaining power. The limited pool of suppliers capable of meeting Arthrex's stringent quality and performance standards, coupled with the extensive validation processes required by regulatory bodies like the FDA, makes switching suppliers a costly and time-consuming endeavor. This reliance on a select few can translate into higher material costs for Arthrex, impacting its overall profitability.

Arthrex's reliance on suppliers with proprietary technologies or unique intellectual property significantly bolsters their bargaining power. For instance, if a key component for Arthrex's advanced surgical instruments relies on a patented material science innovation held by a single supplier, Arthrex faces a challenging situation. This dependency limits Arthrex's ability to negotiate pricing or explore alternative sourcing without considerable investment in R&D or costly licensing agreements, potentially impacting product margins.

Arthrex's reliance on specialized suppliers for human and animal tissues for its biologics portfolio significantly influences supplier bargaining power. The highly regulated nature of sourcing these biological materials, coupled with potential supply fluctuations and ethical considerations, can create a situation where suppliers hold considerable sway over terms and pricing. This is particularly true for in-demand or rare biological components, directly impacting Arthrex's cost of goods sold and product availability.

Concentration of Key Suppliers

Arthrex's reliance on a concentrated group of suppliers for specialized components, particularly those with unique technological specifications or limited alternative manufacturers, significantly amplifies supplier bargaining power. For instance, if a critical component for Arthrex's arthroscopic surgical systems is sourced from only two or three highly specialized firms, these suppliers gain considerable leverage. This situation can lead to price increases or supply disruptions that directly affect Arthrex's cost of goods sold and production schedules. In 2024, the medical device industry continued to see consolidation among component manufacturers, exacerbating this risk for companies like Arthrex.

The implications of supplier concentration are substantial. A single supplier failure, whether due to quality issues, labor disputes, or financial instability, can halt Arthrex's manufacturing lines. This dependency means Arthrex might face higher input costs if suppliers can dictate terms, impacting profit margins. For example, a 10% increase in the cost of a key raw material from a dominant supplier could directly reduce Arthrex's operating income by a measurable percentage, especially if those costs cannot be easily passed on to customers.

- Supplier Concentration: Arthrex faces increased supplier bargaining power when dependent on a few key providers for specialized medical-grade materials or components.

- Risk of Disruption: A limited supplier base increases vulnerability to production stoppages and price hikes if a single supplier experiences issues.

- Cost Impact: Higher input costs from concentrated suppliers can squeeze Arthrex's profit margins if price increases are not feasible in the competitive market.

- Strategic Sourcing Challenge: Diversifying the supplier network in the highly regulated medical device sector is often a lengthy and costly endeavor.

High Switching Costs for Arthrex

Switching suppliers in the medical device sector, like for Arthrex, is a complex undertaking. It's not simply about finding a new vendor; it involves rigorous qualification processes, obtaining necessary regulatory re-approvals, and potentially re-designing existing products to accommodate new components. This intricate process, driven by the paramount need to ensure quality, safety, and compliance with stringent healthcare regulations, significantly increases the cost and time associated with changing suppliers.

These substantial switching costs directly impact Arthrex's negotiating leverage. When it becomes prohibitively expensive or time-consuming to switch, suppliers gain considerable power. This strengthens their position, making it challenging for Arthrex to aggressively negotiate for lower prices or more favorable terms. For instance, a supplier of specialized surgical instruments might leverage the extensive validation required for their components to maintain pricing power.

The medical device industry, in general, sees high switching costs. A 2024 report highlighted that for many medical technology firms, the average cost to switch a critical component supplier can range from tens of thousands to hundreds of thousands of dollars, depending on the complexity and regulatory oversight involved. This reality means Arthrex, like its peers, must carefully weigh the benefits of seeking new suppliers against the significant investment in time and resources required for a transition.

- High Qualification Costs: Medical device components require extensive testing and validation to meet FDA and other regulatory standards.

- Regulatory Hurdles: Any change in a component supplier necessitates re-submission and approval from regulatory bodies, a process that can take months.

- Product Re-design Impact: If a new supplier's component differs even slightly, it could require costly re-engineering and re-testing of the final medical device.

- Supply Chain Disruption Risk: A supplier change introduces the risk of production delays and potential shortages, impacting market availability.

Suppliers of highly specialized medical-grade raw materials, such as specific titanium alloys or biocompatible polymers, and unique electronic components for Arthrex's advanced surgical devices wield considerable bargaining power. The limited pool of suppliers capable of meeting Arthrex's stringent quality and performance standards, coupled with the extensive validation processes required by regulatory bodies like the FDA, makes switching suppliers a costly and time-consuming endeavor. This reliance on a select few can translate into higher material costs for Arthrex, impacting its overall profitability.

Arthrex's reliance on suppliers with proprietary technologies or unique intellectual property significantly bolsters their bargaining power. For instance, if a key component for Arthrex's advanced surgical instruments relies on a patented material science innovation held by a single supplier, Arthrex faces a challenging situation. This dependency limits Arthrex's ability to negotiate pricing or explore alternative sourcing without considerable investment in R&D or costly licensing agreements, potentially impacting product margins.

Arthrex's reliance on specialized suppliers for human and animal tissues for its biologics portfolio significantly influences supplier bargaining power. The highly regulated nature of sourcing these biological materials, coupled with potential supply fluctuations and ethical considerations, can create a situation where suppliers hold considerable sway over terms and pricing. This is particularly true for in-demand or rare biological components, directly impacting Arthrex's cost of goods sold and product availability.

Arthrex's reliance on a concentrated group of suppliers for specialized components, particularly those with unique technological specifications or limited alternative manufacturers, significantly amplifies supplier bargaining power. For instance, if a critical component for Arthrex's arthroscopic surgical systems is sourced from only two or three highly specialized firms, these suppliers gain considerable leverage. This situation can lead to price increases or supply disruptions that directly affect Arthrex's cost of goods sold and production schedules. In 2024, the medical device industry continued to see consolidation among component manufacturers, exacerbating this risk for companies like Arthrex.

| Factor | Impact on Arthrex | Example Data (2024) |

| Supplier Concentration | Increased leverage for few suppliers | Consolidation in specialized component manufacturing |

| Switching Costs | High barriers to changing suppliers | Tens to hundreds of thousands of dollars for critical component changes |

| Proprietary Technology | Dependency on unique supplier innovations | Patented materials limit alternative sourcing options |

| Regulatory Hurdles | Extended validation and re-approval times | Months-long processes for component supplier changes |

What is included in the product

Analyzes the competitive intensity within the orthopedic device market, focusing on Arthrex's strategic positioning against rivals, buyer and supplier power, and the threat of new entrants and substitutes.

Instantly identify and address competitive threats with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Consolidated healthcare systems and Group Purchasing Organizations (GPOs) significantly amplify the bargaining power of customers for medical device manufacturers like Arthrex. These entities pool the purchasing volume of many individual hospitals and clinics, allowing them to demand substantial discounts. For instance, in 2024, major GPOs often negotiate price reductions of 10-15% or more on medical supplies and devices compared to what individual facilities could achieve.

This concentrated buying power means that Arthrex faces a smaller number of highly influential customers who can dictate terms. The ability of these large systems to switch suppliers if pricing or contract terms are not met creates considerable pressure on Arthrex's profit margins. In 2023, the average hospital operating margin was around 2.5%, making cost-effectiveness a paramount concern for these purchasing groups.

Healthcare's increasing focus on cost containment, fueled by new reimbursement structures and the move to value-based care, significantly heightens customer price sensitivity. Hospitals and surgeons are now meticulously evaluating the cost-effectiveness of medical devices, seeking products that clearly prove clinical and economic advantages. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize bundled payments for various surgical procedures, directly linking device costs to overall patient outcomes.

Arthrex, therefore, needs to strongly support its pricing by presenting robust data on improved patient results and demonstrable cost reductions. This means moving beyond simply highlighting product features to quantifying the economic benefits, such as reduced hospital stays or fewer revision surgeries, which directly appeal to budget-conscious healthcare providers.

The orthopedic market is intensely competitive, with numerous established companies providing comparable products and surgical techniques. Customers, including hospitals and surgeons, have a broad selection of alternatives to Arthrex from major competitors like Stryker, Zimmer Biomet, and Smith & Nephew. This abundance of choices significantly enhances customer bargaining power, as they can readily switch suppliers if they find more favorable pricing, superior service, or more advanced product features.

Influence of Surgeons and Clinical Evidence

Orthopedic surgeons wield considerable influence over Arthrex's product selection, as their hands-on expertise and preference for specific surgical tools and implants often dictate purchasing decisions within hospitals. This surgeon preference is a key factor in driving demand for Arthrex's innovative offerings.

However, the growing emphasis on standardization and cost containment within healthcare systems is beginning to shift the balance. Larger hospital networks and integrated delivery systems can leverage their collective bargaining power, especially when presented with clinically comparable alternatives at a lower price point. For instance, in 2024, many hospital systems reported increased scrutiny on capital equipment purchases, with a preference for vendors offering bundled pricing or demonstrating clear cost-effectiveness over a period of use.

- Surgeons' preference for specific Arthrex implants and instruments directly impacts product adoption.

- Hospital systems' focus on cost-efficiency can lead to a preference for standardized, lower-cost alternatives.

- Clinical evidence supporting Arthrex's product efficacy is crucial in counteracting price-based purchasing decisions.

- Negotiations often involve balancing surgeon satisfaction with institutional financial goals.

Demand for Integrated Solutions and Training

Customers, particularly in the medical device sector, are increasingly demanding more than just products. They seek integrated solutions encompassing devices, comprehensive training programs, ongoing technical support, and seamless data integration into their existing workflows. Arthrex's investment in surgeon education and its ability to provide these all-encompassing packages directly influence customer loyalty and can mitigate the bargaining power of buyers.

For instance, Arthrex's commitment to education is evident in its extensive training centers and programs, which are crucial for surgeons adopting new technologies. In 2024, the demand for such integrated services continues to rise, as healthcare providers aim for greater efficiency and improved patient outcomes through technology adoption. If competitors can offer more robust training or a more compelling end-to-end solution, customers may find themselves with greater leverage, potentially driving down prices or demanding more favorable terms.

- Demand for Integrated Solutions: Customers increasingly expect bundled offerings of devices, training, and support.

- Arthrex's Competitive Edge: Superior training and holistic solutions can foster customer loyalty.

- Customer Leverage: Competitors offering better integrated solutions can shift customer preference and increase their bargaining power.

The bargaining power of Arthrex's customers is substantial, driven by consolidated healthcare systems and Group Purchasing Organizations (GPOs) that leverage collective buying power for discounts, often in the range of 10-15% in 2024. This concentration of purchasing power allows fewer, more influential customers to dictate terms, pressuring Arthrex's margins, especially given that average hospital operating margins hovered around 2.5% in 2023. Furthermore, the increasing focus on cost containment and value-based care, exemplified by CMS's continued emphasis on bundled payments in 2024, makes customers highly price-sensitive and keen on demonstrable economic advantages from medical devices.

The highly competitive orthopedic market offers customers numerous alternatives from major players like Stryker and Zimmer Biomet, enhancing their ability to switch suppliers for better pricing or features. Orthopedic surgeons also wield significant influence through their product preferences, though hospital systems are increasingly prioritizing standardization and cost-efficiency, scrutinizing capital equipment purchases more closely in 2024. Customers are also demanding integrated solutions beyond just devices, including robust training and support, where Arthrex's investment in education offers a competitive advantage, but superior offerings from rivals can increase customer leverage.

| Customer Influence Factor | Impact on Arthrex | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Consolidated Buying Power (GPOs/Health Systems) | Increased price pressure, reduced margins | GPOs negotiate 10-15%+ discounts; Hospital operating margins ~2.5% (2023) |

| Cost Containment & Value-Based Care | Heightened price sensitivity, demand for cost-effectiveness | CMS bundled payments emphasis; increased scrutiny on device ROI |

| Market Competition & Alternatives | Enhanced customer ability to switch suppliers | Multiple major competitors offer comparable products |

| Surgeon Preference vs. System Cost-Efficiency | Balancing act between clinical needs and institutional budgets | Hospital systems prioritize standardization and cost-effectiveness in capital purchases (2024) |

| Demand for Integrated Solutions (Training, Support) | Opportunity for differentiation, but also leverage for competitors | Growing demand for holistic offerings; Arthrex's training centers are key |

Full Version Awaits

Arthrex Porter's Five Forces Analysis

This preview showcases the complete Arthrex Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the orthopedic industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can trust that this professionally crafted analysis, covering buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, is ready for your immediate use.

Rivalry Among Competitors

The orthopedic medical device market is a battleground for major global players, with Arthrex facing off against giants like DePuy Synthes (a Johnson & Johnson company), Stryker, Zimmer Biomet, and Smith & Nephew. This intense competition means these well-funded companies are always pushing the envelope with new products, making smart acquisitions, and investing heavily in marketing to capture market share. For instance, Stryker reported net sales of $21.8 billion in 2023, highlighting the scale of investment in this sector.

The medical device industry, particularly in orthopedics, is characterized by intense competitive rivalry, largely driven by significant investments in research and development. Companies are in a constant race to innovate, developing next-generation implants, advanced surgical instruments, and novel procedural techniques. This relentless pursuit of technological advancement is crucial for capturing surgeon loyalty and market share.

Arthrex exemplifies this trend, consistently launching a substantial number of new products each year. For instance, in 2023, the company introduced over 100 new products, underscoring its commitment to rapid innovation. This high volume of new product introductions is a direct result of substantial R&D spending, which is essential for maintaining a competitive edge and influencing surgeon adoption in a dynamic market.

Rivals actively differentiate their surgical products by focusing on unique features and proven clinical effectiveness, especially within arthroscopic and minimally invasive procedures. This intense competition means Arthrex must consistently highlight its superior performance and distinct value.

The market sees companies competing on advanced materials, intelligent implants, and the integration of robotic systems. For instance, as of early 2024, the global orthopedic robotics market was projected to reach over $5 billion, underscoring the significant investment in these specialized areas.

Aggressive Marketing and Distribution Networks

Competitors in the orthopedic market heavily invest in expansive sales forces and comprehensive medical education programs. These efforts are strategically designed to reach and influence orthopedic surgeons and healthcare facilities on a global scale. For instance, in 2024, major competitors continued to expand their field sales teams, with some reporting double-digit percentage increases in headcount dedicated to direct customer engagement and product training.

The effectiveness of these aggressive marketing and distribution strategies directly correlates with market penetration and the cultivation of brand loyalty. Arthrex must therefore maintain a robust and highly responsive commercial presence to counter these efforts. Global distribution networks are critical, as evidenced by the increasing reliance on localized warehousing and logistics by competitors to ensure timely product delivery and support in key international markets throughout 2024.

- Aggressive Sales Force Expansion: Competitors are increasing the size of their direct sales teams globally.

- Medical Education Investment: Significant resources are allocated to surgeon training and educational events.

- Global Distribution Reach: Establishing and maintaining extensive networks to serve diverse markets is paramount.

- Brand Loyalty through Engagement: Marketing and distribution effectiveness directly impacts customer retention.

Pricing Pressures and Value-Based Competition

The medical device industry, including Arthrex's market, is characterized by intense rivalry. Healthcare cost-containment measures and the growing influence of consolidated purchasing groups exert considerable downward pressure on prices. This environment forces companies like Arthrex to carefully calibrate their pricing, balancing the premium associated with innovative, high-quality products against the imperative to remain cost-competitive, particularly within the evolving value-based care models prevalent in 2024.

Companies frequently employ competitive pricing tactics or offer comprehensive product bundles to gain market share. For Arthrex, this translates into a strategic challenge: how to maintain its position with advanced solutions while ensuring affordability and demonstrating clear value to healthcare providers who are increasingly scrutinized for their spending. For instance, in 2023, the average price increase for medical devices in the US was approximately 4.5%, a figure that is expected to moderate in 2024 due to these pressures.

- Intense Rivalry: The medical device sector is highly competitive, with numerous players vying for market dominance.

- Pricing Pressures: Healthcare cost-containment initiatives and consolidated purchasing power significantly drive down prices.

- Value-Based Competition: Arthrex must align its premium product pricing with the cost-effectiveness demanded by value-based care.

- Strategic Pricing: Balancing innovation-driven premium pricing with competitive cost strategies is crucial for market success.

Competitive rivalry in the orthopedic device market is fierce, with established players like Stryker and Zimmer Biomet constantly innovating and expanding their reach. These companies invest heavily in R&D, as seen by Stryker's 2023 net sales of $21.8 billion, and focus on differentiated products and surgeon education. Arthrex's strategy of launching over 100 new products in 2023 reflects this intense competition, where staying ahead technologically and commercially is paramount to capturing market share.

The market also sees significant competition in advanced areas like orthopedic robotics, projected to exceed $5 billion globally by early 2024. This technological race, coupled with aggressive sales force expansion and extensive medical education programs by competitors, necessitates Arthrex's continuous investment in its commercial presence and product development to maintain its competitive edge.

Healthcare cost-containment measures and consolidated purchasing groups are also intensifying pricing pressures. While Arthrex offers premium, innovative products, it must balance this with cost-competitiveness, especially as value-based care models gain traction in 2024. For context, average medical device price increases in the US were around 4.5% in 2023, a trend likely to moderate due to these market forces.

SSubstitutes Threaten

The threat of substitutes is significant for Arthrex, particularly from non-surgical and conservative treatments. These alternatives, including physical therapy, pain management techniques, and injections like corticosteroids or hyaluronic acid, offer less invasive and often more cost-effective solutions for musculoskeletal conditions. For instance, the global pain management market was valued at approximately USD 85 billion in 2023 and is projected to grow, indicating a strong demand for non-surgical relief.

As patients and healthcare providers increasingly prioritize less invasive options, these conservative approaches directly compete with surgical interventions that rely on Arthrex's specialized implants and instruments. This trend can potentially reduce the overall demand for surgical procedures, thereby impacting Arthrex's market share and revenue streams.

Emerging regenerative medicine therapies represent a significant threat to traditional orthopedic implant providers like Arthrex. Advances in areas such as stem cell treatments and platelet-rich plasma (PRP) injections are offering less invasive alternatives for tissue repair and regeneration. For instance, the global regenerative medicine market was valued at approximately $13.5 billion in 2023 and is projected to grow substantially, indicating increasing patient and physician adoption of these non-implant solutions.

The threat of substitutes for Arthrex's product portfolio is significant, stemming from alternative surgical techniques. These can include advancements in minimally invasive procedures that may bypass the need for Arthrex's specialized instruments or implants. For example, the increasing adoption of endoscopic techniques in orthopedic surgery, which often utilize different toolsets, presents a direct substitute.

Furthermore, the burgeoning field of robotic-assisted surgery, even from competing manufacturers, offers an alternative approach. If these robotic systems become more accessible and demonstrate superior patient outcomes or cost-effectiveness, they could draw demand away from Arthrex's traditional offerings. In 2023, the global robotic surgery market was valued at approximately $7.5 billion, with projections indicating continued robust growth, highlighting the competitive landscape.

Beyond technological advancements, evolving surgical philosophies themselves can act as substitutes. A shift towards non-operative treatments for certain conditions, or the development of entirely new therapeutic modalities, could reduce the overall demand for surgical interventions that rely on Arthrex's products. This underscores the need for Arthrex to continually innovate and adapt to changing clinical paradigms.

Preventative Healthcare and Lifestyle Changes

The growing emphasis on preventative healthcare and lifestyle changes presents a significant threat of substitutes for Arthrex. As individuals adopt healthier habits like improved nutrition and regular exercise, the incidence and severity of musculoskeletal issues requiring surgical intervention may decrease. For instance, a 2024 report indicated a 15% year-over-year increase in participation in wellness programs focused on physical activity and nutrition among adults aged 30-55, a key demographic for orthopedic procedures.

This long-term trend towards proactive health management can lead to a gradual reduction in the demand for certain orthopedic surgical products. Early diagnosis and non-surgical management of conditions, bolstered by advancements in diagnostics and physical therapy, offer alternatives to traditional surgical solutions. In 2023, the global market for physical therapy services saw a 7% growth, signaling a shift towards conservative treatment options.

The availability and increasing effectiveness of these non-surgical interventions act as substitutes, potentially eroding Arthrex's market share if the company does not adapt. Consider these points:

- Reduced Demand: A healthier populace means fewer patients needing orthopedic surgeries, impacting sales volumes.

- Shift in Treatment: Increased adoption of physical therapy and wellness programs offers alternatives to surgical products.

- Early Diagnosis Impact: Better diagnostic tools allow for earlier intervention, potentially avoiding the need for more complex surgeries later.

- Consumer Empowerment: Individuals are increasingly empowered to manage their health proactively, seeking non-invasive solutions first.

Pharmaceutical Interventions and Pain Management

The development of highly effective new pharmaceutical drugs presents a significant threat to surgical interventions in pain management. For instance, advancements in medications targeting obesity, like GLP-1 agonists, could indirectly reduce the need for orthopedic procedures by mitigating joint issues associated with excess weight. In 2024, the global obesity drug market, including GLP-1s, was projected to exceed $30 billion, demonstrating substantial investment and rapid innovation in this area.

If these pharmaceuticals can substantially alleviate pain or modify disease progression, they may decrease the volume of orthopedic surgeries. This substitution effect could impact Arthrex's revenue streams if patients opt for less invasive, drug-based treatments. For example, studies in 2023 indicated that certain pain management medications achieved comparable patient satisfaction scores to minimally invasive procedures for specific conditions.

- Pharmaceutical Innovation: The pipeline for novel pain relief and disease-modifying drugs is robust, with significant R&D spending by major pharmaceutical companies.

- GLP-1 Drug Impact: The success of GLP-1 agonists in weight management could significantly reduce obesity-related orthopedic conditions, a key market for surgical solutions.

- Comparative Efficacy: As drug therapies become more potent, their ability to substitute for surgical interventions in managing pain and disease progression increases.

- Market Shift: A substantial shift towards pharmaceutical solutions could lead to a contraction in the demand for certain surgical procedures offered by companies like Arthrex.

The threat of substitutes for Arthrex is substantial, encompassing both non-surgical treatments and alternative surgical techniques. Conservative options like physical therapy and injections, along with emerging regenerative medicine, offer less invasive and potentially cost-effective alternatives to surgical implants. For instance, the global pain management market reached approximately $85 billion in 2023, highlighting demand for non-surgical relief.

Advancements in minimally invasive procedures and robotic-assisted surgery also pose a threat, potentially bypassing the need for Arthrex's specialized instruments. The robotic surgery market, valued at $7.5 billion in 2023, is experiencing robust growth, indicating a competitive shift.

Furthermore, a broader societal trend towards preventative healthcare and lifestyle changes can reduce the overall demand for orthopedic surgeries. Increased participation in wellness programs and a focus on early diagnosis through better diagnostics and physical therapy, which saw a 7% market growth in 2023, further underscore this substitution threat.

The rise of advanced pharmaceuticals, particularly in weight management like GLP-1 agonists, could also indirectly reduce orthopedic procedure demand. The obesity drug market, projected to exceed $30 billion in 2024, signifies significant innovation that may offer alternatives to surgical interventions for conditions linked to excess weight.

| Threat Category | Examples | Market Context (2023/2024 Data) | Implication for Arthrex |

| Non-Surgical Treatments | Physical Therapy, Injections (corticosteroids, hyaluronic acid), Regenerative Medicine (stem cells, PRP) | Pain Management Market: ~$85 billion (2023); Regenerative Medicine Market: ~$13.5 billion (2023) | Reduced demand for surgical implants and procedures. |

| Alternative Surgical Techniques | Minimally Invasive Procedures, Robotic-Assisted Surgery | Robotic Surgery Market: ~$7.5 billion (2023) | Potential bypass of Arthrex's specialized instruments and implants. |

| Preventative Healthcare & Lifestyle | Improved Nutrition, Regular Exercise, Wellness Programs | Physical Therapy Market Growth: 7% (2023); Wellness Program Participation: +15% YoY (2024, ages 30-55) | Long-term reduction in the incidence of conditions requiring surgery. |

| Pharmaceutical Advancements | Obesity Drugs (GLP-1 agonists), Advanced Pain Management Medications | Obesity Drug Market: >$30 billion projected (2024) | Indirect reduction in orthopedic procedures due to improved health outcomes. |

Entrants Threaten

Entering the orthopedic medical device market, where companies like Arthrex operate, requires immense upfront capital. This isn't just about a small office; it involves massive investments in research and development to create innovative surgical tools and implants. For instance, developing a new arthroscopic system can cost tens of millions of dollars before it even reaches the market.

Beyond R&D, establishing cutting-edge manufacturing facilities is crucial. These facilities must adhere to strict regulatory standards, such as FDA approvals, which are costly to obtain and maintain. Building a global distribution network to reach surgeons and hospitals worldwide adds another layer of significant financial commitment, often running into hundreds of millions of dollars for established players.

These prohibitively high initial costs act as a formidable barrier to entry. Potential new competitors find it incredibly difficult to amass the necessary capital to compete effectively with established companies that have already made these investments. This financial hurdle significantly limits the number of new players that can realistically challenge market leaders like Arthrex.

Stringent regulatory approval processes act as a significant deterrent for new entrants in the medical device sector. Globally, bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate lengthy clinical trials and rigorous testing. For instance, obtaining FDA clearance for a new medical device can take years and cost millions, a substantial hurdle for startups.

Arthrex benefits from an established brand reputation and deep surgeon loyalty, built over decades. This makes it incredibly difficult for new entrants to gain traction.

New companies must overcome the significant hurdle of building trust and credibility with orthopedic surgeons, who often have long-standing relationships with established players like Arthrex.

Gaining surgeon adoption and displacing these entrenched loyalties requires substantial investment in marketing, extensive clinical validation, and a considerable amount of time, presenting a high barrier for potential new competitors.

Intellectual Property and Patent Protection

The orthopedic market is heavily defended by a dense web of intellectual property and patents safeguarding existing innovations. This intricate landscape poses a significant barrier for new companies looking to enter the space.

New entrants face the daunting task of either creating entirely new technologies that do not infringe on existing patents, a process that is both expensive and lengthy, or securing licenses for current technologies. Both paths present substantial challenges, limiting their capacity to compete on a level playing field. For instance, in 2023, the global orthopedic devices market was valued at approximately $55 billion, with a significant portion of this driven by patented technologies.

- High R&D Investment: Developing novel, non-infringing orthopedic technologies requires substantial investment in research and development, often running into tens or hundreds of millions of dollars.

- Licensing Costs: Acquiring licenses for patented technologies can be prohibitively expensive, impacting the profitability of new entrants.

- Patent Litigation Risk: Even with careful planning, new entrants face the risk of costly patent infringement lawsuits from established players.

- Market Entry Hurdles: The combination of R&D costs, licensing fees, and litigation risks significantly raises the barrier to entry in the orthopedic market.

Complex Sales, Distribution, and Service Infrastructure

The significant investment and expertise required to build a robust sales force, manage complex supply chains for specialized medical devices, and deliver comprehensive post-sale service and training present a formidable barrier for potential new entrants. For instance, establishing a global distribution network for medical technology, as Arthrex has, involves substantial capital outlay and logistical expertise.

Newcomers face immense difficulty in matching the scale, efficiency, and deeply entrenched infrastructure that established players like Arthrex have cultivated over years of operation. This operational and logistical hurdle makes it challenging to compete effectively from the outset.

- Sales Force Development: Building a specialized sales team with deep product knowledge and established relationships in the medical field is a lengthy and costly process.

- Supply Chain Complexity: The intricate nature of medical device supply chains, requiring adherence to strict regulations and just-in-time delivery for sensitive products, is a significant barrier.

- Post-Sale Support: Providing extensive training, technical support, and maintenance for sophisticated medical equipment demands a substantial and ongoing investment in personnel and resources.

The threat of new entrants into the orthopedic device market, where Arthrex operates, is significantly low due to several formidable barriers. These include the extremely high capital requirements for research and development, manufacturing, and establishing a global distribution network. For example, developing a single new arthroscopic system can cost tens of millions of dollars, and building a comprehensive global presence requires hundreds of millions.

Stringent regulatory hurdles, such as lengthy FDA approval processes that can take years and cost millions, further deter new players. Coupled with the need to overcome established brand loyalty and surgeon relationships, which demands substantial marketing and clinical validation, the barriers are substantial.

The dense patent landscape protecting existing innovations necessitates either costly licensing or extensive, expensive efforts to develop non-infringing technologies. Furthermore, building the necessary sales force, managing complex supply chains, and providing post-sale support require significant expertise and investment, making it very difficult for newcomers to compete with established entities like Arthrex.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | R&D for new devices, advanced manufacturing, global distribution | Tens to hundreds of millions of dollars |

| Regulatory Approvals | FDA, EMA clearance processes | Years and millions of dollars per device |

| Brand Loyalty & Surgeon Relationships | Overcoming established trust and adoption | Significant marketing, clinical validation, and time investment |

| Intellectual Property | Navigating patents, licensing, or developing novel tech | High licensing fees or extensive R&D costs |

| Operational & Logistical | Building sales force, complex supply chains, post-sale support | Substantial ongoing investment in personnel and infrastructure |

Porter's Five Forces Analysis Data Sources

Our Arthrex Porter's Five Forces analysis leverages a comprehensive suite of data, including company annual reports, industry-specific market research from firms like IBISWorld, and regulatory filings from bodies such as the FDA. This ensures a robust understanding of the competitive landscape.