Arthrex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arthrex Bundle

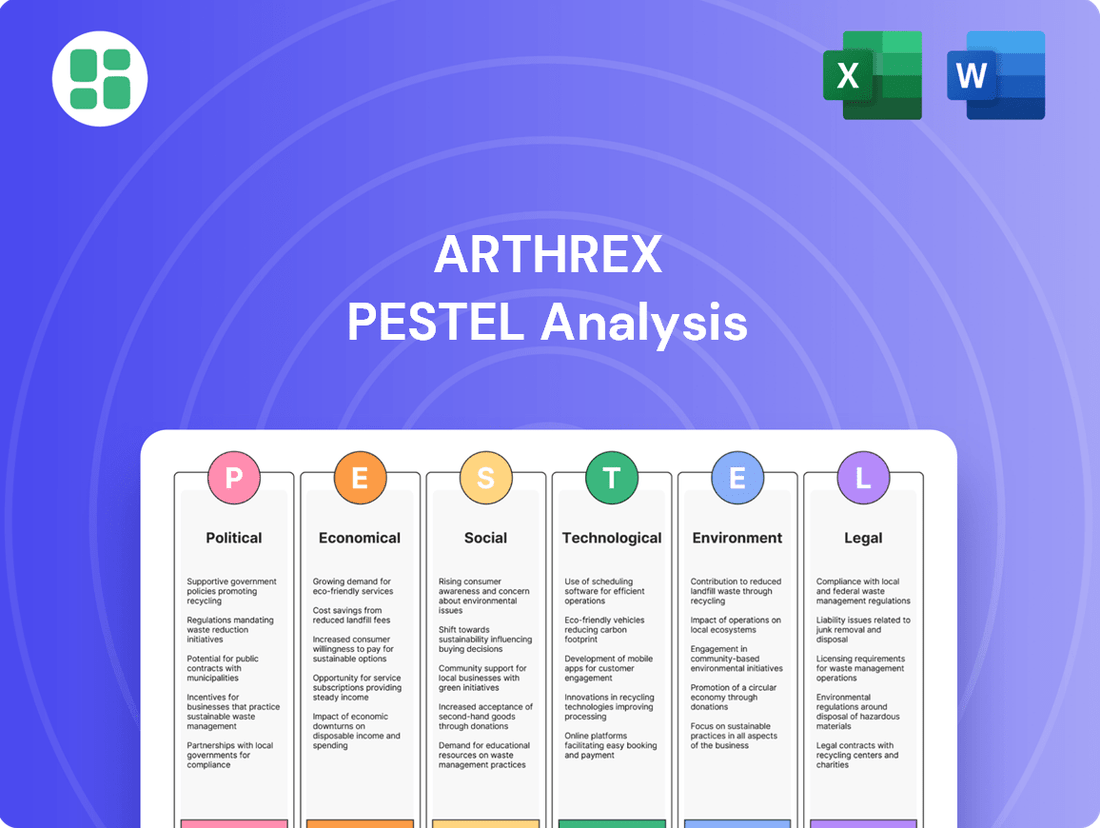

Uncover the critical external forces shaping Arthrex's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the opportunities and threats impacting this innovative medical device leader. Download the full report to gain actionable intelligence and refine your strategic planning.

Political factors

Government healthcare policies are a major driver for companies like Arthrex. Changes in how healthcare is funded and how providers are reimbursed directly affect the demand for orthopedic devices. For example, if governments push for more value-based care, where providers are paid based on patient outcomes rather than the number of procedures, it could lead to a greater focus on cost-effective solutions and potentially influence Arthrex's product development and pricing strategies.

In 2024, healthcare spending remains a critical area of government focus. For instance, the U.S. Medicare spending, a significant payer for medical procedures, was projected to reach over $1 trillion in 2024, highlighting the substantial financial impact of government programs on the medical device market. Policies that adjust reimbursement rates for orthopedic surgeries or encourage the use of specific types of implants could therefore significantly sway Arthrex's market position and revenue streams.

The regulatory environment, particularly concerning the FDA in the United States and the EU MDR/IVDR in Europe, is a significant political factor for Arthrex. These regulations dictate the approval pathways for medical devices, and any shifts towards stricter requirements or extended review periods can directly impact Arthrex's ability to bring new products to market. For instance, the transition to the EU Medical Device Regulation (MDR) has presented challenges for many companies, requiring extensive clinical data and rigorous conformity assessments, which can extend development timelines and increase costs. The FDA's evolving stance on digital health and AI-enabled medical devices also necessitates careful navigation to ensure compliance.

Global trade policies, including tariffs and trade agreements, significantly influence Arthrex's operations. For instance, the United States' imposition of tariffs on goods from China in recent years, and potential retaliatory measures from other nations, directly affect the cost of imported components and finished medical devices, impacting Arthrex's supply chain and ultimately its cost of goods sold.

Protectionist measures or shifts in import/export duties create uncertainty and can escalate operational expenses for a global entity like Arthrex. Changes in duties, like those seen in various trade disputes impacting medical device sectors, can necessitate adjustments to pricing strategies and potentially affect market competitiveness in different regions.

To counter these risks, Arthrex likely employs a strategy of maintaining a diversified supply chain, sourcing components and manufacturing from multiple countries to reduce reliance on any single trade bloc or policy. This approach helps to buffer against the financial impact of sudden tariff changes or trade disruptions, ensuring greater stability in its global operations.

Political Stability and Geopolitical Risks

Political stability in regions where Arthrex sources materials and operates is a critical factor. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in 2022 and continue to impact global trade routes and manufacturing, could indirectly affect Arthrex's supply chain resilience and operational costs.

Geopolitical risks, such as trade disputes or the imposition of tariffs, can significantly disrupt international business. As of early 2024, the global trade environment remains dynamic, with ongoing negotiations and potential policy shifts in major economies that could influence market access and pricing for medical devices.

- Monitoring Global Political Landscapes: Continuous assessment of political stability in key markets like the United States, Germany, and Japan is essential for Arthrex's strategic planning.

- Supply Chain Vulnerabilities: Geopolitical events, such as regional conflicts or sanctions, can create unforeseen disruptions, impacting the availability and cost of raw materials and finished goods.

- Market Access and Regulations: Political shifts can lead to changes in healthcare policies and regulatory frameworks, affecting Arthrex's ability to introduce new products and services in various countries.

- Economic Impact of Political Instability: Significant political instability in a major market could lead to reduced healthcare spending or investment, directly impacting demand for Arthrex's innovative surgical products.

Intellectual Property Protection

Government enforcement of intellectual property (IP) laws is a critical political factor for medical device innovators like Arthrex. Strong patent protection is essential, as companies invest substantial resources into research and development. For instance, the U.S. Patent and Trademark Office (USPTO) reported granting over 300,000 utility patents in 2023 alone, highlighting the volume of innovation seeking protection. This robust framework safeguards Arthrex's surgical solutions from infringement, thereby encouraging ongoing investment in cutting-edge technologies.

Changes in patent litigation outcomes or IP legislation can significantly impact Arthrex. For example, a shift towards more stringent patentability requirements or a reduction in the duration of patent protection could diminish the return on investment for R&D. Conversely, strengthened enforcement mechanisms could provide greater security for their innovations. The global landscape of IP enforcement also varies, with some regions offering stronger protections than others, influencing Arthrex's strategic market entry and partnership decisions.

- Patent Protection: Essential for safeguarding Arthrex's R&D investments in surgical solutions.

- Litigation Outcomes: Changes can affect the profitability and incentivization of future innovation.

- Legislative Changes: Modifications to IP laws directly influence the competitive landscape.

- Global Enforcement Variability: Differences in IP protection across countries impact market strategies.

Government healthcare policies, including reimbursement rates and funding models, directly influence demand for orthopedic devices. For instance, U.S. Medicare spending was projected to exceed $1 trillion in 2024, underscoring the financial impact of government programs on the medical device market.

Regulatory environments, such as the FDA in the U.S. and EU MDR in Europe, dictate product approval pathways. The EU MDR, for example, has increased compliance burdens and extended development timelines for many companies.

Global trade policies, including tariffs and trade agreements, affect supply chain costs and market access. The U.S. imposed tariffs on goods from China, impacting component costs for medical device manufacturers.

Political stability in operating regions is crucial; geopolitical events can disrupt supply chains and increase operational expenses.

| Political Factor | Impact on Arthrex | Example/Data (2024/2025) |

| Healthcare Policy & Reimbursement | Affects demand and pricing | U.S. Medicare spending projected over $1 trillion in 2024 |

| Regulatory Compliance | Impacts product launch timelines and costs | EU MDR implementation continues to pose challenges |

| Trade Policies & Tariffs | Influences supply chain costs and market access | Ongoing trade tensions can affect import/export duties |

| Geopolitical Stability | Affects supply chain resilience and operational costs | Global trade routes remain sensitive to regional conflicts |

What is included in the product

This Arthrex PESTLE analysis provides a comprehensive examination of how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact the company's strategic landscape.

The Arthrex PESTLE analysis provides a structured framework to identify and address external factors that could impact business, thereby alleviating the pain point of uncertainty and reactive decision-making.

Economic factors

Global healthcare spending is a significant economic driver for the medical device industry. Projections show this spending will continue to rise, fueled by an aging population and the growing incidence of chronic conditions. For instance, the World Health Organization estimated global health spending reached $9 trillion in 2021, and this upward trajectory is expected to persist through 2025 and beyond.

This sustained increase in healthcare expenditure directly translates into greater demand for orthopedic products, a key market for Arthrex. As more people require treatment for age-related ailments and chronic diseases, the need for advanced medical devices like those Arthrex produces will only grow. This creates a robust and favorable economic climate for the company's continued expansion and innovation.

Disposable income significantly impacts patient affordability for orthopedic procedures, especially elective ones. In 2024, global economic uncertainties and inflation may temper discretionary spending, potentially affecting patient choices for non-urgent treatments. For instance, a rise in the cost of living could lead individuals to postpone procedures not immediately critical to their health.

The willingness and ability of patients to pay out-of-pocket or opt for private care, even for medically necessary procedures, are directly linked to disposable income levels. Economic downturns can reduce this capacity. For example, if average disposable income in key markets like the US or Europe sees a decline in real terms due to inflation, patients might delay procedures or seek more cost-effective alternatives.

Inflationary pressures in 2024 and early 2025 are significantly impacting Arthrex by increasing the cost of essential raw materials, manufacturing processes, and global logistics. For example, the Producer Price Index (PPI) for manufactured goods saw a notable uptick in late 2024, directly affecting the cost of components used in Arthrex's medical devices.

Effectively managing these escalating supply chain costs and raw material procurement is paramount for Arthrex to safeguard its profit margins. This necessitates a proactive approach involving strategic sourcing initiatives and potentially adjusting pricing structures to reflect the higher operational expenses, which could influence Arthrex's competitive standing in the market.

Currency Exchange Rate Fluctuations

As a global entity, Arthrex's financial health is inherently tied to the ebb and flow of currency exchange rates. When a key market's currency strengthens against Arthrex's reporting currency, revenues earned in that market translate to a lower value back home. Conversely, a weaker foreign currency can boost reported earnings. This dynamic directly influences the price competitiveness of Arthrex's innovative orthopedic products in various international arenas.

For instance, in 2024, significant currency volatility was observed across major economies. The Euro experienced fluctuations against the US Dollar, impacting European sales figures. Similarly, the Japanese Yen's performance against the Dollar in 2024 presented challenges for pricing strategies in that market. Arthrex must therefore employ robust currency risk management strategies to mitigate these impacts.

- Impact on Revenue: A stronger US Dollar in 2024 meant that revenues from Arthrex's European subsidiaries were worth less when converted back to USD, potentially impacting reported growth.

- Product Competitiveness: If the Swiss Franc strengthens significantly, Arthrex's products manufactured or sold in Switzerland might become more expensive for international buyers compared to competitors in countries with weaker currencies.

- Cost of Goods Sold: Fluctuations can also affect the cost of imported raw materials or components, influencing Arthrex's overall cost structure and profit margins.

- Strategic Hedging: Arthrex likely utilizes financial instruments like forward contracts to lock in exchange rates for anticipated transactions, thereby reducing uncertainty in its financial planning for 2024-2025.

Ambulatory Surgery Center (ASC) Growth

The economic landscape is increasingly favoring ambulatory surgery centers (ASCs) for procedures, a trend that directly impacts medical device companies like Arthrex. ASCs provide a more cost-effective alternative to traditional hospitals, which in turn fuels demand for medical devices specifically designed for outpatient settings. This shift necessitates a focus on product innovation and sales strategies tailored to the unique needs and cost considerations of ASCs.

Data from 2023 indicated that ASCs performed over 2.5 million surgical procedures, a number projected to grow by an estimated 15-20% annually through 2025. This expansion highlights a significant market opportunity for Arthrex. The financial advantages of ASCs, often cited as 40-60% less expensive than hospital outpatient departments for comparable procedures, make them an attractive option for both patients and payers. This economic reality directly influences Arthrex's product development, pushing for solutions that are not only efficient but also competitively priced within the ASC environment.

- ASCs are becoming a preferred setting for many surgical procedures due to cost savings.

- The volume of surgeries performed in ASCs is projected for continued robust growth through 2025.

- This economic trend creates a demand for medical devices optimized for the ASC setting, influencing Arthrex's product design and sales strategies.

Global healthcare spending remains a robust economic engine for the medical device sector, with projections indicating continued growth through 2025, driven by an aging global population and increasing chronic disease prevalence. This sustained investment in health directly fuels demand for specialized orthopedic products like those offered by Arthrex.

Disposable income plays a crucial role in patient access to elective orthopedic procedures. Economic uncertainties and inflation in 2024 may lead some individuals to postpone non-urgent treatments, impacting demand for certain services.

Inflationary pressures in 2024 and early 2025 are increasing operational costs for Arthrex, affecting raw materials, manufacturing, and logistics. Managing these rising expenses is critical for maintaining profitability and competitive pricing.

Currency exchange rate fluctuations present ongoing challenges and opportunities for Arthrex's global operations, influencing reported revenues and product competitiveness across different markets.

| Economic Factor | 2024/2025 Trend/Impact | Arthrex Relevance |

|---|---|---|

| Global Healthcare Spending | Projected continued growth, exceeding $9 trillion in 2021. | Increased demand for orthopedic devices. |

| Disposable Income | Potential tempering of discretionary spending due to inflation. | May affect elective procedure uptake. |

| Inflation | Rising costs for raw materials, manufacturing, and logistics. | Impacts operational expenses and profit margins. |

| Currency Exchange Rates | Observed volatility in major economies (e.g., USD/EUR, USD/JPY). | Affects international revenue translation and pricing. |

Preview the Actual Deliverable

Arthrex PESTLE Analysis

The preview you see here is the exact Arthrex PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the external factors influencing Arthrex.

The content and structure shown in this preview is the same Arthrex PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

The world's population is getting older, and this is a major force shaping the orthopedic industry. As people age, they are more likely to experience issues like arthritis and bone fractures, which directly translates into a greater need for the kinds of products and services Arthrex offers, such as joint implants and surgical repair tools. For instance, by 2050, it's projected that 1 in 6 people globally will be over 65, up from 1 in 11 in 2015, highlighting a substantial and expanding market.

Societal shifts towards greater health consciousness and active living are profoundly impacting demand for orthopedic solutions. Across various demographics, there's a noticeable rise in participation in sports and recreational activities, which in turn, unfortunately, increases the likelihood of sports-related injuries. This trend directly translates into a growing need for advanced medical interventions aimed at restoring mobility and function.

Arthrex is well-positioned to capitalize on this societal trend. The company's focus on minimally invasive surgical techniques and specialized sports medicine products directly addresses the patient desire for quicker recovery times and a faster return to their active lifestyles. For instance, Arthrex's arthroscopic surgical systems allow for smaller incisions, leading to less trauma and often a shorter rehabilitation period compared to traditional open surgeries.

The market for sports medicine, a key area for Arthrex, continues to show robust growth. Global sports medicine market size was valued at approximately USD 14.5 billion in 2023 and is projected to reach over USD 23 billion by 2030, growing at a CAGR of around 7.0% during the forecast period. This expansion is driven by increasing sports participation, a growing aging population seeking to maintain active lifestyles, and advancements in orthopedic technologies, all of which align with Arthrex's core offerings.

Patients increasingly favor minimally invasive surgeries, seeking less pain, smaller scars, and faster recovery. This societal shift directly supports Arthrex's specialization in arthroscopic and minimally invasive techniques, making it a key driver for their market position.

In 2024, the global market for minimally invasive surgical devices was valued at approximately $35 billion, with a projected compound annual growth rate of over 10% through 2030. This robust growth underscores the strong patient demand that Arthrex is well-positioned to capitalize on.

Meeting these evolving patient expectations is not just about staying relevant; it's a critical differentiator. Arthrex's commitment to innovation in this space ensures they remain competitive and attractive to both patients and surgeons who prioritize these less invasive approaches.

Prevalence of Chronic Orthopedic Conditions

The increasing number of people experiencing chronic orthopedic issues, like arthritis and wear-and-tear on joints, is a significant sociological factor. This trend directly fuels a consistent need for both surgical interventions and less invasive treatments. For instance, the Centers for Disease Control and Prevention (CDC) reported in 2023 that an estimated 54.4 million U.S. adults (23.7%) reported having doctor-diagnosed arthritis. This large patient base means a sustained demand for Arthrex's innovative solutions.

Several lifestyle elements are contributing to this rise in orthopedic ailments. Growing rates of obesity, with the CDC noting that 42.4% of U.S. adults had obesity in 2021-2022, place additional stress on joints. Coupled with increasingly sedentary lifestyles, these factors expand the potential market for Arthrex's extensive product range, from implants to surgical instruments.

- Rising Chronic Conditions: An estimated 54.4 million U.S. adults reported doctor-diagnosed arthritis in 2023, indicating a substantial patient pool.

- Lifestyle Contributors: High obesity rates, affecting 42.4% of U.S. adults (2021-2022), directly correlate with increased orthopedic strain.

- Market Expansion: These trends create a growing and consistent demand for Arthrex's surgical and non-surgical orthopedic treatments.

Healthcare Workforce Shortages and Burnout

Healthcare workforce shortages, particularly in specialized fields like orthopedics, present a significant challenge. For instance, the Association of American Medical Colleges (AAMC) projected a potential shortage of between 37,800 and 124,000 physicians by 2034 in the US, a figure that includes various specialties. This scarcity directly impacts the number of orthopedic procedures that can be performed.

Clinician burnout exacerbates these shortages. The demanding nature of healthcare, amplified by events like the COVID-19 pandemic, has led to increased stress and turnover among medical professionals. A 2023 survey by the American Medical Association indicated that nearly half of physicians reported burnout symptoms. This strain on the existing workforce limits the capacity for patient care and innovation.

While advancements like robotic-assisted surgery can boost efficiency, a depleted or overworked workforce can become a bottleneck. This means that even with technological solutions, the sheer number of available surgeons and support staff dictates the overall volume of procedures. Consequently, limited patient access and reduced procedure volumes can directly affect the demand for orthopedic devices and related technologies.

- Physician Shortage Projections: AAMC forecasts a significant US physician shortage by 2034, impacting specialized fields.

- Burnout Rates: High burnout among physicians, reported by nearly 50% in AMA surveys, strains the healthcare system.

- Technology vs. Workforce: Robotic surgery efficiency is constrained by the availability of trained and available medical personnel.

- Impact on Device Demand: Workforce limitations can cap patient access and procedure volumes, directly influencing orthopedic device utilization.

The growing global population, particularly the aging demographic, is a significant driver for orthopedic solutions. By 2050, projections indicate that 1 in 6 people worldwide will be over 65, a substantial increase from 1 in 11 in 2015, creating a larger market for age-related orthopedic needs.

Societal trends embracing healthier and more active lifestyles contribute to increased sports participation, which in turn, elevates the incidence of sports-related injuries. This rise in injuries directly fuels the demand for advanced orthopedic interventions aimed at restoring mobility and function, aligning with Arthrex's specialized product lines.

The market for sports medicine, a key segment for Arthrex, demonstrated robust growth, valued at approximately USD 14.5 billion in 2023 and expected to exceed USD 23 billion by 2030, with a compound annual growth rate around 7.0%. This expansion is driven by increased participation in sports and the desire of an aging population to remain active.

Patient preference for minimally invasive surgeries is a strong sociological factor, as individuals seek less pain, smaller scars, and faster recovery times. In 2024, the global market for minimally invasive surgical devices was valued at around $35 billion, with a projected growth rate exceeding 10% annually through 2030, underscoring the alignment of Arthrex's offerings with patient desires.

| Sociological Factor | Impact on Arthrex | Relevant Data (2023-2025 Projections) |

| Aging Population | Increased demand for joint replacements, arthritis treatments, and mobility solutions. | 1 in 6 people globally projected to be over 65 by 2050. |

| Health & Active Lifestyles | Higher incidence of sports injuries, driving demand for sports medicine products and reconstructive surgery. | Global sports medicine market valued at USD 14.5 billion in 2023, projected to reach USD 23 billion by 2030 (7.0% CAGR). |

| Minimally Invasive Surgery Preference | Strong demand for Arthrex's arthroscopic and minimally invasive surgical systems and implants. | Global minimally invasive surgical device market valued at ~$35 billion in 2024, projected >10% CAGR through 2030. |

| Chronic Orthopedic Conditions | Sustained demand for treatments for arthritis, wear-and-tear, and other degenerative conditions. | 54.4 million U.S. adults reported doctor-diagnosed arthritis in 2023. |

Technological factors

Robotic-assisted surgery is transforming orthopedics, offering surgeons greater precision and enabling less invasive procedures. This trend is critical for Arthrex as it allows for reduced patient recovery times and improved surgical outcomes. The global robotic surgery market was valued at approximately $7.8 billion in 2023 and is projected to reach $22.1 billion by 2030, indicating strong growth.

Arthrex needs to actively develop and integrate its product portfolio with robotic platforms to remain competitive. This includes ensuring compatibility and potentially developing proprietary robotic solutions to meet the increasing demand from surgeons for advanced technological tools in orthopedic care.

Ongoing advancements in biomaterials are significantly enhancing the durability, biocompatibility, and overall functionality of medical implants. This technological evolution is crucial for companies like Arthrex, which heavily invest in developing next-generation orthopedic solutions.

Innovations such as 3D-printed custom implants, designed for precise patient anatomy, and drug-eluting polymers that combat post-operative infections are becoming increasingly prevalent. Furthermore, the development of bioresorbable materials promises to reduce the need for revision surgeries, improving patient outcomes and lowering healthcare costs.

Artificial intelligence (AI) and machine learning are revolutionizing orthopedics, impacting everything from diagnosis to patient recovery. For Arthrex, this means opportunities to integrate these advanced tools into their product development. For instance, AI algorithms can analyze medical images with remarkable speed and accuracy, potentially identifying subtle signs of disease that human eyes might miss. By 2024, AI in medical imaging was projected to reach a market value of over $2 billion globally, highlighting the significant investment and adoption of these technologies.

These advancements allow for more personalized surgical planning, where AI can predict the best implant size and placement based on a patient's unique anatomy. Furthermore, machine learning models are being developed to predict patient outcomes and identify those at higher risk of complications, enabling proactive interventions. Arthrex can leverage these capabilities to create smarter surgical systems and data-driven insights, ultimately leading to improved patient care and more efficient healthcare delivery.

Expansion of Minimally Invasive Techniques

The ongoing advancement of minimally invasive surgical approaches, such as arthroscopy and endoscopy, forms the bedrock of Arthrex's strategy. These methods translate to smaller surgical sites, reduced bleeding, and quicker patient recovery, which in turn fuels the demand for Arthrex's specialized instruments and implants.

The global market for minimally invasive surgical devices is projected for robust growth. For instance, the arthroscopy market alone was valued at approximately $3.5 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of over 7% through 2030. This expansion directly benefits Arthrex, a key player in this segment.

- Minimally Invasive Surgical Market Growth: The global market for minimally invasive surgical devices is experiencing significant expansion, driven by technological innovation and patient preference for less invasive procedures.

- Arthrex's Core Business: Arthrex is strategically positioned to capitalize on this trend, with a strong focus on developing and manufacturing instruments and implants for arthroscopic and endoscopic surgeries.

- Demand Drivers: Factors such as reduced patient trauma, shorter hospital stays, and faster return to normal activities are increasing the adoption of these techniques, bolstering demand for Arthrex's product portfolio.

- Market Projections: The arthroscopy market, a key area for Arthrex, is forecast to continue its upward trajectory, indicating sustained demand for the company's specialized offerings.

Digital Health and Remote Monitoring Solutions

The healthcare landscape is rapidly evolving with the widespread adoption of digital health tools, telemedicine, and remote patient monitoring. These technologies are fundamentally reshaping how post-operative care is delivered and how patients engage with their recovery journeys. For instance, the global digital health market was valued at over $200 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong trend towards virtual care solutions.

Arthrex can strategically leverage this trend by integrating its innovative medical devices with these burgeoning digital health platforms. This integration would allow for more comprehensive post-operative care, enabling continuous patient monitoring and fostering greater patient engagement throughout their recovery process. Such a move could provide valuable, real-time data on patient progress, ultimately leading to improved outcomes and potentially reducing readmission rates.

- Telemedicine growth: The use of telemedicine services saw a substantial surge, with some reports indicating a more than 300% increase in adoption during the early 2020s, a trend that continues to stabilize at elevated levels.

- Remote monitoring adoption: The remote patient monitoring market is expected to reach over $175 billion by 2027, driven by the increasing prevalence of chronic diseases and the demand for continuous patient oversight.

- Data-driven insights: Integrating digital health solutions with Arthrex devices can generate a wealth of patient data, enabling personalized treatment adjustments and predictive analytics for better patient management.

Technological advancements are central to Arthrex's operational success, particularly in areas like robotic-assisted surgery and minimally invasive techniques. The integration of AI and digital health tools is also creating new avenues for improved patient care and data utilization.

The global robotic surgery market is projected to reach $22.1 billion by 2030, underscoring the importance of Arthrex's investment in this sector. Similarly, the arthroscopy market, a core area for Arthrex, was valued at approximately $3.5 billion in 2023 and is expected to grow significantly.

Arthrex's commitment to innovation in biomaterials, including 3D-printed implants and bioresorbable materials, directly addresses the growing demand for personalized and effective orthopedic solutions.

The increasing adoption of digital health and telemedicine, with the global digital health market exceeding $200 billion in 2023, presents opportunities for Arthrex to enhance post-operative care and patient engagement through integrated device solutions.

Legal factors

Arthrex navigates a complex web of global medical device regulations, with the U.S. Food and Drug Administration's (FDA) Quality Management System Regulation (QMSR) and the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) being paramount. These frameworks dictate everything from product design and manufacturing to post-market surveillance, making strict adherence essential for continued market access and innovation.

In 2024, the MDR and IVDR continue to shape the European medical device landscape, demanding robust clinical evidence and rigorous conformity assessments. Companies like Arthrex must invest heavily in compliance infrastructure to meet these evolving standards, impacting product launch timelines and ongoing market presence.

Medical device companies like Arthrex face substantial product liability risks. Manufacturers are increasingly held responsible for defects, extending to software and AI components within their devices. This means rigorous safety testing and quality control are paramount.

Arthrex must maintain robust post-market surveillance to identify and address any potential issues promptly, thereby mitigating legal exposures. The U.S. Food and Drug Administration (FDA) has been actively strengthening its oversight of medical device cybersecurity, a key area of product liability in 2024 and beyond, with reported cybersecurity incidents in the healthcare sector rising.

Intellectual property laws, especially patents, are crucial for safeguarding Arthrex's groundbreaking medical device designs and technologies. The company's ability to innovate and maintain its market edge hinges on effectively protecting these assets.

Arthrex actively manages a portfolio of patents and must be prepared to defend against potential infringement claims, which can involve costly and time-consuming patent litigation to preserve its competitive standing.

Recent legal shifts, such as evolving interpretations of patent listing requirements and the scope of patentable subject matter, present ongoing challenges and opportunities for Arthrex's IP strategy, impacting how its innovations are protected and enforced.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity are critical for Arthrex, especially with the growing reliance on digital health and connected medical devices. Regulations like HIPAA in the United States and GDPR in Europe impose strict requirements for protecting sensitive patient information. For instance, the US Department of Health and Human Services reported over 130 million healthcare records breached in 2023 alone, highlighting the constant threat landscape.

Arthrex must maintain robust security measures to safeguard the patient data handled by its products and internal systems. Failure to comply can lead to significant financial penalties and reputational damage. The company's commitment to data privacy is not just a legal obligation but a fundamental aspect of building trust with patients and healthcare providers.

- HIPAA (Health Insurance Portability and Accountability Act): Mandates the protection of sensitive patient health information.

- GDPR (General Data Protection Regulation): Governs data privacy and security for individuals within the European Union.

- Cybersecurity Threats: The healthcare sector remains a prime target for cyberattacks, with ransomware incidents increasing year-over-year.

- Data Breach Costs: In 2024, the average cost of a data breach in the healthcare industry was estimated to be around $10.93 million.

Anti-Kickback and Sunshine Act Compliance

Regulations like the Anti-Kickback Statute and the Physician Payments Sunshine Act in the U.S. are crucial for medical device companies. These laws aim to prevent undue influence and promote transparency in relationships between manufacturers and healthcare providers. Arthrex must navigate these complex legal frameworks diligently to maintain ethical business operations and avoid significant penalties.

Non-compliance can result in severe consequences, including hefty fines, exclusion from federal healthcare programs, and substantial reputational damage. For instance, in 2024, several pharmaceutical and medical device companies faced significant settlements related to kickback allegations, underscoring the strict enforcement of these statutes. Arthrex's commitment to robust compliance programs is therefore paramount for its long-term sustainability and market trust.

- Anti-Kickback Statute: Prohibits offering, paying, soliciting, or receiving remuneration to induce or reward referrals for items or services covered by federal healthcare programs.

- Sunshine Act: Requires manufacturers of drugs, devices, biologics, and medical supplies to report payments and other transfers of value made to physicians and teaching hospitals.

- Enforcement Trends: Regulatory bodies continue to actively investigate and prosecute violations, with settlements often reaching millions of dollars.

- Arthrex's Responsibility: Maintaining comprehensive compliance training and auditing processes to ensure all interactions adhere to legal requirements.

Arthrex's legal landscape is dominated by stringent medical device regulations like the FDA's QMSR and the EU's MDR/IVDR, requiring substantial investment in compliance infrastructure. These evolving standards impact product development and market access, with significant penalties for non-adherence.

Product liability risks are a major concern, especially with the increasing integration of software and AI in medical devices, necessitating rigorous safety testing and robust cybersecurity measures. The U.S. healthcare sector saw over 130 million healthcare records breached in 2023, emphasizing the critical need for data privacy compliance under HIPAA and GDPR.

Intellectual property protection through patents is vital for Arthrex's innovation and competitive edge, requiring vigilance against infringement claims and adaptation to evolving patent law interpretations. Furthermore, adherence to U.S. laws like the Anti-Kickback Statute and Sunshine Act is crucial for ethical operations and avoiding substantial fines, as evidenced by significant settlements in 2024.

Environmental factors

Growing environmental awareness and stricter regulations are compelling medical device manufacturers like Arthrex to prioritize sustainability. This means actively seeking ways to reduce their environmental impact across manufacturing and the entire supply chain.

Arthrex's strategic focus should include minimizing its carbon footprint, optimizing energy consumption, and significantly cutting down waste generation throughout its operational lifecycle. For instance, the medical device industry's waste, including single-use plastics, presents a significant challenge, with estimates suggesting it contributes substantially to healthcare's overall environmental burden.

By embracing greener manufacturing techniques and fostering a more circular supply chain, Arthrex can not only meet regulatory demands but also enhance its brand reputation and potentially achieve cost savings through resource efficiency. For example, many companies are investing in renewable energy sources, with the global renewable energy capacity expected to reach over 7,300 GW by the end of 2025, a trend Arthrex can leverage.

The medical device sector, including companies like Arthrex, faces increasing scrutiny regarding waste generation. In 2023, the global medical waste market was valued at approximately $30 billion, with single-use products and extensive packaging contributing significantly. This trend is expected to continue growing, driven by advancements in disposable medical technologies.

Arthrex, like its peers, must proactively address its product lifecycle's environmental impact. Strategies such as implementing robust recycling programs for packaging materials and exploring the feasibility of reprocessing specific, non-critical components could significantly reduce waste. For instance, some companies in the industry are investing in biodegradable packaging solutions, aiming to cut plastic waste by up to 20% by 2026.

There's a growing push for medical devices to be designed with their environmental footprint in mind, covering everything from the materials used to how they're disposed of. Arthrex can stay ahead by choosing greener materials, making devices that last longer, and ensuring they can be recycled, all to meet stricter sustainability rules.

Climate Change Regulations and Reporting

Arthrex, like many global companies, is navigating an evolving landscape of climate change regulations. These new rules often mandate increased transparency regarding environmental impact and may require setting specific goals for reducing greenhouse gas emissions. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, requires extensive disclosure on environmental, social, and governance (ESG) matters, including climate-related risks and opportunities.

These regulatory shifts directly influence operational decisions and long-term corporate strategy. Companies are increasingly expected to integrate sustainability into their core business planning to meet compliance requirements and investor expectations. For example, the SEC's proposed climate disclosure rules in the US, though facing revisions, signal a trend towards more standardized reporting of climate-related financial impacts.

- Mandatory Disclosures: Companies may need to report on Scope 1, 2, and 3 emissions, aligning with frameworks like the Greenhouse Gas Protocol.

- Emission Reduction Targets: Regulations could push Arthrex to set science-based targets for emissions reduction, impacting supply chain management and manufacturing processes.

- Investor Pressure: A growing number of investors, particularly institutional ones, are demanding robust climate-related data, influencing capital allocation and corporate valuations. In 2024, ESG funds continued to see significant inflows, highlighting this trend.

- Supply Chain Scrutiny: Climate regulations often extend to supply chains, requiring companies to assess and manage the environmental performance of their suppliers.

Resource Scarcity and Water Usage

Growing concerns around resource scarcity, especially water, pose a significant challenge for manufacturing operations. Arthrex, like other medical device companies, must prioritize efficient water management within its production facilities to ensure continuity and minimize environmental impact. For instance, in 2023, global freshwater availability per capita continued its downward trend, highlighting the increasing pressure on this vital resource.

Mitigating risks associated with environmental limitations necessitates a proactive approach to sustainable material sourcing. This involves exploring alternative, more readily available, or recycled materials for product components and packaging. Such strategies not only address scarcity but can also lead to cost efficiencies and enhanced brand reputation.

- Water Stress Index: Many regions where manufacturing hubs are located face increasing water stress, impacting operational costs and regulatory compliance.

- Material Lifecycle Assessment: Companies are increasingly conducting lifecycle assessments to understand the environmental footprint of their materials, including water intensity.

- Sustainable Sourcing Initiatives: Industry-wide shifts towards recycled content and bio-based materials are gaining momentum, driven by both environmental and economic factors.

- Water Efficiency Technologies: Investments in water recycling and purification technologies within manufacturing plants are becoming standard practice to reduce reliance on external freshwater sources.

Arthrex must navigate increasing regulatory pressure concerning environmental impact and waste management. For example, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable to large companies from 2024, mandates detailed environmental disclosures, pushing for greater transparency in emissions and resource use.

The medical device industry, including Arthrex, faces scrutiny over waste, with the global medical waste market valued around $30 billion in 2023, largely due to single-use products and packaging. This necessitates strategies like enhanced recycling programs and exploring biodegradable packaging, with some industry players aiming for 20% plastic waste reduction by 2026.

Water scarcity is a growing concern, impacting manufacturing operations. Many regions with manufacturing hubs are experiencing increased water stress, affecting operational costs and compliance. Consequently, companies are investing in water efficiency technologies and sustainable sourcing initiatives, with global renewable energy capacity projected to exceed 7,300 GW by the end of 2025, offering opportunities for greener operations.

| Environmental Factor | Impact on Arthrex | Key Data Point (2023-2025) | Strategic Implication |

| Climate Change Regulations | Increased reporting requirements, emission reduction pressure | CSRD applicable from 2024; SEC climate disclosure proposals | Integrate sustainability into core planning; invest in emission reduction technologies. |

| Waste Management | Scrutiny on single-use products and packaging | Global medical waste market ~$30 billion (2023); industry goal of 20% plastic reduction by 2026 | Implement robust recycling; explore biodegradable packaging; focus on product lifecycle. |

| Resource Scarcity (Water) | Operational risk in water-stressed regions | Continued downward trend in global freshwater availability per capita (2023) | Prioritize water efficiency; invest in water recycling; explore sustainable material sourcing. |

| Renewable Energy Transition | Opportunity for cost savings and reduced footprint | Global renewable energy capacity projected >7,300 GW by end of 2025 | Leverage renewable energy sources for manufacturing facilities. |

PESTLE Analysis Data Sources

Our Arthrex PESTLE Analysis is built on a robust foundation of data from authoritative sources, including government regulatory bodies, leading economic think tanks, and reputable industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the medical device sector.