Arthrex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arthrex Bundle

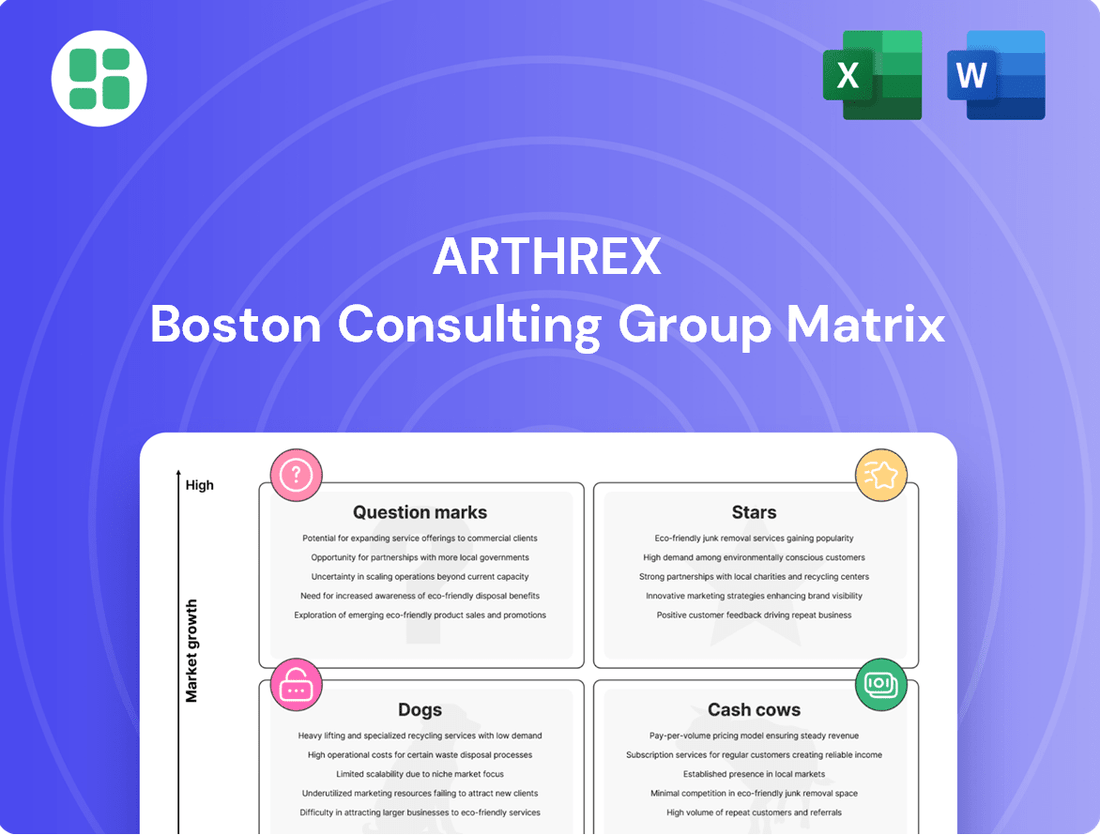

Understanding Arthrex's product portfolio is crucial for strategic growth. Our BCG Matrix analysis categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear picture of market performance and potential.

Dive deeper into Arthrex's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Sports medicine implants, such as Arthrex's FiberWire and TightRope systems, represent a strong category within the company's portfolio. Arthrex commanded an estimated 33% of the sports medicine market share in 2024, a segment expected to expand at a mid-single-digit annual pace.

These innovative products, including the recently introduced all-suture TightRope SB, are critical to Arthrex's leadership in procedures like ACL reconstruction. The continued high demand and technological evolution in these reconstructive surgeries underscore the robust performance of these implant offerings.

The NanoScope system, a standout in Arthrex's portfolio, is positioned as a strong Star in the BCG matrix. Its FDA clearance for numerous procedures, including pediatric orthopedics and laparoscopy, underscores its market penetration and potential. This technology is a prime example of Arthrex's commitment to advancing minimally invasive surgical techniques, a trend that continues to gain significant traction in healthcare.

The market's embrace of less invasive surgical options directly benefits the NanoScope. Patients and surgeons alike are seeking procedures that offer quicker recovery and better outcomes, and this system delivers on those fronts. Arthrex's strategic marketing, including platforms like TheNanoExperience.com, further solidifies its position by educating and engaging the medical community.

The Synergy Power™ System, launched in June 2025, represents Arthrex's strategic push into the high-growth market for advanced surgical instrumentation. This innovative powered system is engineered for precision across a wide range of orthopedic specialties, including sports medicine, arthroplasty, trauma, and distal extremities.

Its broad applicability and recent introduction are key factors in its anticipated rapid market adoption. The global orthopedic surgical instruments market was valued at approximately $25 billion in 2024 and is projected to grow significantly, driven by an aging population and increasing demand for minimally invasive procedures. Synergy Power™ is well-positioned to capture a substantial share of this expanding market.

Orthobiologics for Tissue Regeneration

Arthrex's investment in orthobiologics positions it strongly within the regenerative medicine market, which is projected to exceed $1 billion in the coming years. This segment focuses on harnessing the body's inherent healing capabilities to address orthopedic issues, tapping into a significant growth opportunity.

The company's dedication to developing and refining these regenerative products aligns with the increasing demand for less invasive and more natural treatment methods for joint preservation and repair. This strategic focus on innovation in orthobiologics is a key driver for Arthrex's future growth.

- Market Growth: The global orthobiologics market is experiencing robust expansion, with projections indicating it will surpass $1 billion in the near future, driven by advancements in regenerative medicine.

- Product Focus: Arthrex is concentrating on products that utilize biological agents to stimulate and accelerate the body's natural healing processes for orthopedic conditions.

- Strategic Alignment: This focus aligns with the broader healthcare trend towards regenerative approaches, emphasizing joint preservation and non-surgical interventions.

- Investment Driver: Continued investment and innovation in orthobiologics are expected to fuel Arthrex's high growth prospects in this expanding market.

Advanced Surgical Visualization & OR Integration

Arthrex's Advanced Surgical Visualization & OR Integration solutions are central to its portfolio, offering high-definition 4K imaging and seamless integration for diverse surgical specialties. These technologies directly contribute to improved surgical accuracy and patient results, making them indispensable in contemporary surgical settings.

The global arthroscopic surgery market, a key segment for these visualization systems, demonstrated significant expansion. For instance, the market was valued at approximately $6.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.5% through 2030, reaching an estimated $11.3 billion. This growth is fueled by increasing adoption of minimally invasive techniques and ongoing technological innovation in imaging and OR integration.

- Market Growth: The arthroscopic surgery equipment market, including visualization systems, is experiencing robust expansion.

- Technological Advancement: Innovations in 4K imaging and OR integration are driving demand for these advanced solutions.

- Surgical Precision: Arthrex's offerings enhance surgical accuracy and improve patient outcomes.

- High-Value Segment: These integrated systems are considered a high-growth, high-value component of modern operating rooms.

Arthrex's sports medicine implants, like FiberWire and TightRope, are key Stars. The company held about 33% of the sports medicine market in 2024, a segment growing at a mid-single-digit rate annually. These products are vital for procedures like ACL reconstruction, showing strong performance due to continued demand and innovation.

The NanoScope system is another Star, cleared by the FDA for many procedures. Its role in advancing minimally invasive surgery, a growing healthcare trend, positions it for significant market penetration. The system's ability to facilitate quicker recovery and better outcomes appeals to both patients and surgeons.

The Synergy Power™ System, launched in June 2025, targets the high-growth orthopedic surgical instruments market, valued at around $25 billion in 2024. Its precision across various orthopedic specialties and broad applicability make it a strong contender for rapid market adoption.

Arthrex's orthobiologics segment is also a Star, tapping into the regenerative medicine market projected to exceed $1 billion. This focus on the body's natural healing capabilities aligns with the demand for less invasive treatments and joint preservation.

Advanced Surgical Visualization & OR Integration solutions are Stars, crucial for modern surgery. The arthroscopic surgery market, where these systems are vital, was valued at approximately $6.8 billion in 2023 and is expected to reach $11.3 billion by 2030, growing at a 7.5% CAGR.

| Product Category | Market Share (2024 Est.) | Market Growth Rate | Key Features | BCG Status |

|---|---|---|---|---|

| Sports Medicine Implants | ~33% | Mid-single-digit annually | FiberWire, TightRope systems; ACL reconstruction | Star |

| NanoScope System | N/A (New Technology) | High (Minimally Invasive Surgery Trend) | FDA cleared for multiple procedures, less invasive | Star |

| Synergy Power™ System | N/A (Launched June 2025) | High (Orthopedic Instruments Market) | Precision, broad orthopedic applications | Star |

| Orthobiologics | N/A (Emerging Segment) | High (Projected >$1 Billion) | Regenerative medicine, natural healing | Star |

| Surgical Visualization & OR Integration | N/A (Part of Arthroscopic Market) | ~7.5% CAGR (Arthroscopic Market) | 4K imaging, OR integration, improved accuracy | Star |

What is included in the product

The Arthrex BCG Matrix analyzes its product portfolio by market share and growth rate, guiding investment decisions.

Arthrex BCG Matrix offers a clear, one-page overview of each business unit's strategic position.

This optimized layout simplifies complex data, making it a pain point reliever for strategic planning.

Cash Cows

Arthrex's traditional arthroscopic instruments are firmly positioned as Cash Cows. Having pioneered the field, Arthrex commands a significant market share in this mature but essential segment of minimally invasive orthopedic surgery. These instruments are the bedrock of countless procedures, ensuring consistent demand and generating substantial, reliable cash flow for the company.

Arthrex's shoulder and knee arthroscopy products are prime examples of Cash Cows within the BCG Matrix. These markets are mature, meaning they have stable, predictable demand and are characterized by high procedure volumes, contributing significantly to Arthrex's revenue. For instance, the global arthroscopy market was valued at approximately USD 4.5 billion in 2023 and is projected to grow at a CAGR of around 5.5% through 2030, indicating a robust and consistent demand for these established product lines.

The strength of these offerings, which include a wide array of implants and fixation devices, stems from their integration into well-established surgical techniques. Surgeons are highly familiar with these products, leading to widespread adoption and repeat business. This familiarity reduces the need for extensive new product education and marketing, allowing Arthrex to maintain high profit margins and generate substantial, consistent cash flow from these core business segments.

Arthrex's suture management devices, including suture anchors and repair systems, are foundational to arthroscopic surgery, reflecting a strong market position. These products are critical for procedures like rotator cuff repairs and ACL reconstructions, demonstrating their widespread adoption and necessity.

This segment acts as a cash cow for Arthrex, generating consistent revenue due to the high demand and established market share in orthopedic sports medicine. The reliability and efficacy of these devices ensure their continued use across a broad spectrum of surgical interventions, solidifying their role as a stable income generator.

For instance, the global orthopedic soft tissue repair market, which heavily features suture management products, was valued at approximately $6.5 billion in 2023 and is projected to grow steadily. This growth underscores the persistent demand for Arthrex's cash cow offerings.

Orthopedic Capital Equipment (e.g., Imaging Systems)

Arthrex's orthopedic capital equipment, particularly its advanced imaging and resection systems, represents a significant Cash Cow within its product portfolio. These high-ticket items are essential for modern surgical practices, providing the foundational technology that surgeons rely on daily. The initial investment in these systems often leads to long-term customer loyalty and a predictable revenue stream.

The long lifecycle of capital equipment, coupled with ongoing service contracts and the sale of complementary disposable instruments, solidifies its Cash Cow status. For instance, Arthrex's imaging solutions, like the Synergy platform, are integrated into operating rooms globally, generating consistent revenue through maintenance agreements and the purchase of associated surgical supplies. This recurring revenue model is characteristic of a mature, high-performing product line.

- High Initial Investment: Orthopedic capital equipment requires substantial upfront costs for healthcare facilities, creating a barrier to entry for competitors and locking in customers.

- Long Product Lifecycles: These systems are designed for durability and longevity, meaning customers continue to rely on them for many years.

- Recurring Revenue Streams: Beyond the initial sale, Arthrex benefits from ongoing revenue through maintenance contracts, software updates, and the sale of disposable instruments used with the capital equipment.

- Established Market Presence: Arthrex's imaging and resection systems are widely adopted in surgical centers and hospitals worldwide, ensuring a stable and predictable demand.

Medical Education and Training Programs

Arthrex's dedication to medical education and training, encompassing workshops, hands-on sessions, and digital learning, solidifies its market presence. This commitment, though a service, fosters deep customer loyalty and encourages ongoing product utilization, thereby generating consistent and substantial revenue streams.

This robust educational infrastructure acts as a significant competitive advantage, reinforcing Arthrex's established leadership. For instance, in 2024, Arthrex reported a 7% increase in participation across its global training programs, directly correlating with higher adoption rates for its innovative surgical technologies.

- Brand Loyalty: Educational programs build strong relationships with healthcare professionals.

- Product Adoption: Training ensures clinicians are proficient with Arthrex devices.

- Stable Revenue: Consistent demand for training services contributes to predictable income.

- Competitive Moat: Extensive training infrastructure is difficult for competitors to replicate.

Arthrex's traditional arthroscopic instruments and their shoulder and knee arthroscopy products are firmly established as Cash Cows. These mature markets, characterized by high procedure volumes and stable demand, contribute significantly to Arthrex's revenue. For example, the global arthroscopy market was valued at approximately USD 4.5 billion in 2023, with projections indicating continued steady growth.

The suture management devices, including anchors and repair systems, also operate as cash cows, generating consistent revenue due to their critical role in common orthopedic procedures like rotator cuff repairs. The global orthopedic soft tissue repair market, a key segment for these products, was valued at around $6.5 billion in 2023, demonstrating the persistent demand for these reliable offerings.

Arthrex's orthopedic capital equipment, such as advanced imaging and resection systems, represents another significant Cash Cow. The long lifecycles of these high-ticket items, coupled with recurring revenue from maintenance contracts and disposable instruments, solidify their status. The Synergy platform, for instance, is integrated globally, ensuring consistent income through service agreements and associated surgical supply purchases.

Furthermore, Arthrex's extensive medical education and training programs, which saw a 7% increase in global participation in 2024, act as a powerful driver for its cash cow products. This commitment fosters deep customer loyalty and ensures high product utilization, translating into substantial and predictable revenue streams.

What You See Is What You Get

Arthrex BCG Matrix

The Arthrex BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase. This ensures you know precisely what you are acquiring—a complete, analysis-ready strategic tool without any hidden alterations or limitations. You'll gain immediate access to this professionally designed report, ready for immediate integration into your business planning and decision-making processes.

Dogs

Older generation open surgery instruments, while still functional, likely reside in the Dogs category of the Arthrex BCG Matrix. These products are characterized by low market growth as surgical practices increasingly favor minimally invasive techniques. For instance, while Arthrex heavily promotes its arthroscopic and endoscopic systems, legacy open surgical tools may see their market share erode.

The demand for these older instruments is declining, facing stiff competition from more affordable, generic alternatives. Arthrex's strategic focus on innovation in minimally invasive surgery means these older product lines offer limited growth potential and may even drain resources. Consideration for divestiture or discontinuation is a logical step to reallocate capital towards more promising, high-growth areas within Arthrex's portfolio.

Within Arthrex's trauma fixation portfolio, certain niche or less utilized products, such as specialized external fixators or specific types of bone plates for rare fracture patterns, might fall into the 'Dogs' category of the BCG Matrix. These items often possess low market share and experience limited growth, reflecting a highly competitive and fragmented trauma market where established giants hold sway in key sub-segments.

For instance, while Arthrex is a leader in sports medicine, its presence in certain specialized trauma areas might be smaller. The trauma market, unlike some of Arthrex's core strengths, can be characterized by a wide array of competitors, including large, diversified medical device companies with extensive trauma divisions. This competitive landscape means that even well-designed niche products can struggle to gain significant traction, especially if they don't offer a distinct technological advantage or cater to a substantial patient volume.

Investing further in these niche trauma fixation products could yield minimal returns due to the inherent challenges in market penetration and the potential need for substantial marketing investment or product redesign. Companies often find that resources are better allocated to product lines with higher growth potential and clearer market leadership, making these 'Dogs' less attractive candidates for significant capital deployment.

Certain legacy biocompatible materials, while still serving their purpose in some Arthrex implants, are likely positioned as Dogs in the BCG Matrix. Their market growth is slowing as newer, more advanced biomaterials emerge, offering enhanced performance and patient outcomes. For instance, while traditional titanium alloys remain a staple, the market for advanced coatings and bioresorbable polymers is experiencing a CAGR of over 7% in orthopedic applications, according to 2024 market reports.

Discontinued or Obsolete Surgical Accessories

Discontinued or obsolete surgical accessories within Arthrex's portfolio would likely be categorized as Dogs in the BCG Matrix. These items, due to technological shifts or evolving surgical practices over Arthrex's more than 40 years, have minimal market share and no growth potential. They are no longer actively marketed or incorporated into current surgical procedures.

These products represent aging inventory that Arthrex may need to divest or write off, as they generate little to no revenue. For instance, older generations of arthroscopic instruments or specific implant components that have been superseded by more advanced designs would fall into this category. The focus here is on managing and phasing out these low-performing assets.

- Low Market Share: These products have a negligible presence in the current surgical accessory market.

- No Market Growth: Demand for obsolete items does not increase; in fact, it typically declines.

- Minimal Cash Flow Generation: Sales are infrequent and unlikely to contribute significantly to revenue.

- Inventory Management Challenge: They represent a drain on resources if not properly managed and phased out.

Products with High Competition in Commoditized Segments

In highly commoditized segments of the orthopedic device market, Arthrex may face intense price competition for products with low differentiation, such as basic screws or plates. These items, even within a growing market, could represent products with a limited market share and low profit margins.

Maintaining a presence in these areas demands considerable effort for minimal returns, positioning them as potential 'Dogs' within Arthrex's product portfolio. For instance, in 2024, the global orthopedic implants market, while robust, sees significant pressure on pricing for standard hardware. Companies often struggle to achieve substantial market share in these segments without a unique technological advantage.

- Low Market Share: Products in commoditized segments often struggle to capture significant market share due to intense competition.

- Low Profit Margins: Price-based competition in these areas leads to reduced profitability for each unit sold.

- High Effort, Low Return: Significant resources may be needed to maintain even a small market presence, yielding minimal returns.

- Potential 'Dogs': Such products, characterized by low growth and low market share, fit the 'Dog' quadrant of the BCG matrix.

Products in the Dogs category for Arthrex are those with low market share and low growth prospects. These often include older, less innovative instruments or components that have been superseded by newer technologies. For example, legacy open surgery instruments, while still functional, likely fall into this quadrant due to the shift towards minimally invasive procedures.

These product lines may not generate significant revenue and could even be a drain on resources if continued investment is made. Arthrex's strategic focus on innovation in areas like arthroscopy means these older products have limited potential for expansion. Their continued presence might be more about managing existing inventory rather than driving future growth.

The market for these products is often stagnant or declining, with little opportunity for differentiation or price increases. In 2024, the trend towards advanced surgical techniques continues to marginalize older, less efficient methods and the instruments associated with them.

Examples of potential Dogs include discontinued surgical accessories, basic orthopedic hardware in highly commoditized markets, or niche trauma fixation devices with minimal adoption. These items typically have low sales volumes and minimal strategic importance to Arthrex's overall portfolio.

Question Marks

Arthrex's recent launch of its endoscopic spine portfolio positions it as a new entrant in a dynamic and expanding orthopedic surgery market. While the overall spine market is substantial, Arthrex's share in this nascent endoscopic segment is likely modest against established competitors.

This product line exhibits significant growth prospects, contingent on increased market acceptance. However, it demands considerable investment in research and development, along with efforts to gain market traction, typical of a ‘question mark’ in the BCG matrix.

Arthrex is actively investing in AI and machine learning for surgical tools, exemplified by their VIP targeting system for shoulder arthroplasty. This area shows immense growth potential, but current market penetration for these advanced AI-integrated tools is likely modest as adoption is still in its early stages.

The development and successful commercialization of these sophisticated AI-driven surgical systems demand substantial capital investment. Arthrex's strategic focus here aims to capture a significant future market share in this high-growth, albeit nascent, technological segment.

While competitors like Stryker and Zimmer Biomet secured FDA approvals for shoulder reconstruction in 2024, Arthrex's position in this specific robotic application might be emerging. The broader robotic surgery market is experiencing significant growth, with projections indicating a CAGR of over 15% through 2030, reaching billions in value. This competitive landscape suggests Arthrex's initial market share in robotic shoulder reconstruction could be modest.

To elevate its robotic shoulder reconstruction offerings from a potential 'Question Mark' to a 'Star', Arthrex would need substantial investment in research and development, alongside aggressive strategies for clinical validation and surgeon adoption. This focus is crucial given the increasing demand for minimally invasive procedures and the technological advancements driving the orthopedic robotics sector.

New Arthroplasty Innovations Beyond Core Arthroscopy

Arthrex is actively pursuing innovations in arthroplasty, showcasing new knee repair and reconstruction products at events like the AAOS 2025 Annual Meeting. This strategic push aims to capture growth in segments adjacent to their core arthroscopic offerings.

While the broader orthopedic implant market is projected to reach approximately $80 billion by 2027, Arthrex's penetration in the highly competitive total joint replacement market, especially for novel arthroplasty solutions, may currently be limited. This presents a significant opportunity for high-growth if they can effectively differentiate their offerings.

- Expanding Knee Arthroplasty: Arthrex's focus on new knee products for repair and reconstruction indicates a strategy to leverage their existing strengths in orthopedic surgery.

- Market Share Dynamics: The dominance of larger players in the full joint replacement segment means Arthrex faces established competition, but also opportunities in niche or emerging arthroplasty areas.

- Growth Potential: Successfully differentiating new arthroplasty solutions could unlock substantial growth, capitalizing on the overall expansion of the orthopedic implant market.

- Innovation Focus: Beyond core arthroscopy, Arthrex's investment in arthroplasty signifies a commitment to broadening their implant portfolio and addressing a wider range of patient needs.

Direct-to-Patient Digital Health Solutions (e.g., OrthoPedia Patient)

Arthrex's direct-to-patient digital health solutions, such as OrthoPedia Patient and TheNanoExperience.com, are designed to educate and engage consumers directly. While these platforms are vital for patient outreach in the expanding digital health sector, their immediate revenue generation or market share as standalone products is likely minimal.

These initiatives represent strategic investments focused on building brand awareness and stimulating demand for Arthrex's surgical offerings, with the potential to evolve into integrated service models. For instance, by providing accessible information on procedures and recovery, Arthrex aims to empower patients and build trust early in their healthcare journey.

- Patient Education Platforms: OrthoPedia Patient and TheNanoExperience.com offer resources directly to consumers.

- Low Direct Revenue: These platforms are not primarily revenue-generating products in themselves.

- Strategic Investment: Their value lies in driving awareness and demand for core surgical products.

- Future Potential: They may evolve into integrated service offerings within Arthrex's broader digital health strategy.

Arthrex's new endoscopic spine portfolio and AI-driven surgical tools are prime examples of 'Question Marks.' These ventures require substantial investment to gain market share in rapidly growing but still developing segments.

The company's push into robotic shoulder reconstruction also fits this category, facing strong competition from established players, necessitating significant R&D and market adoption efforts.

Similarly, Arthrex's expansion into arthroplasty, particularly knee repair, represents a strategic move into a large market where their current penetration might be modest, offering high growth potential if differentiation is achieved.

Their direct-to-patient digital health platforms, while crucial for engagement, are also 'Question Marks' due to their current limited direct revenue generation and focus on building future demand.

| Arthrex 'Question Mark' Areas | Market Segment | Estimated Market Growth (CAGR) | Arthrex's Current Position | Strategic Focus |

|---|---|---|---|---|

| Endoscopic Spine Portfolio | Orthopedic Spine Surgery | High (Specific segment growth varies) | Emerging / Modest Market Share | Market Penetration & Adoption |

| AI-Driven Surgical Tools | Robotics & AI in Surgery | >15% (Broader Robotic Surgery Market) | Nascent / Early Adoption | R&D Investment & Commercialization |

| Robotic Shoulder Reconstruction | Orthopedic Robotics | High (Broader Robotic Surgery Market) | Emerging / Modest Market Share | Clinical Validation & Surgeon Adoption |

| Arthroplasty (Knee) | Orthopedic Implants | Projected ~$80 Billion by 2027 (Overall Market) | Limited in Full Joint Replacement | Differentiation & Market Capture |

| Digital Health Platforms | Digital Health / Patient Engagement | Significant Growth (Digital Health Sector) | Low Direct Revenue / Brand Building | Demand Stimulation & Service Integration |

BCG Matrix Data Sources

Our Arthrex BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official product performance reports to ensure reliable, high-impact insights.