Aritzia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

Aritzia's strong brand loyalty and curated product selection are significant strengths, but the company faces challenges from intense competition and evolving fashion trends. Understanding these dynamics is crucial for anyone looking to invest or strategize within the apparel industry.

Want the full story behind Aritzia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aritzia's strength lies in its vertically integrated design house model, granting it significant control over product development, quality, and the entire supply chain. This allows for the creation and sale of exclusive fashion brands like Wilfred and Babaton, providing unique products that strongly appeal to its customer base.

This integrated approach ensures a consistent standard of quality and style across Aritzia's brand portfolio, setting it apart from many competitors who rely on third-party suppliers. For fiscal year 2024, Aritzia reported net revenue growth of 17% to $2.4 billion, demonstrating the success of its brand strategy.

Aritzia has successfully built a strong brand reputation around its 'Everyday Luxury' concept, resonating with women who desire high-quality, fashionable clothing that feels both aspirational and accessible. This focus has cultivated a deeply loyal customer base, reflected in consistently positive customer feedback and high levels of engagement across their platforms.

Aritzia's e-commerce platform is a significant strength, evidenced by its impressive digital growth. For fiscal 2024, e-commerce net revenue increased by 18.1% to $799.4 million, representing 52.6% of total net revenue. This highlights the company's successful strategy in expanding its online reach and capitalizing on digital channels to drive sales.

Continued investment in its digital infrastructure and marketing efforts has accelerated online momentum. Initiatives focused on traffic growth and enhanced digital marketing campaigns have directly contributed to this upward trend in e-commerce performance. This digital-first approach allows Aritzia to effectively connect with a wider audience, complementing its brick-and-mortar stores.

Strategic U.S. Expansion and Market Potential

Aritzia's aggressive physical expansion in the United States is a key strength, directly fueling its revenue growth. This strategic push into the U.S. market, a region with considerable untapped potential, is proving highly effective.

New flagship store openings are significantly boosting brand visibility and attracting new customers. For instance, during the third quarter of fiscal 2025, Aritzia reported that its U.S. comparable store sales increased by 19.7%, underscoring the success of this strategy.

- U.S. Market Dominance: The U.S. now represents the largest and fastest-growing market for Aritzia, accounting for a substantial portion of its revenue.

- Store Network Expansion: Aritzia plans to open approximately 25 new stores in fiscal 2025, with a significant focus on the U.S. market, further solidifying its presence.

- Brand Resonance: The company's curated product assortment and elevated retail experience are resonating well with American consumers, driving strong sales performance.

Curated In-Store Experience and Customer Service

Aritzia excels at creating an aspirational and engaging in-store environment, a key strength that differentiates it in the retail landscape. These thoughtfully designed boutiques are more than just points of sale; they act as powerful marketing tools, embodying the brand's 'Everyday Luxury' ethos through meticulous attention to detail and ambiance.

Exceptional customer service is a cornerstone of Aritzia's in-store strategy. Associates are trained to provide personalized assistance, fostering a welcoming atmosphere that encourages browsing and builds rapport. This focus on human connection within the physical space is crucial for customer retention and brand advocacy.

The seamless integration of the curated in-store experience with high-quality customer service cultivates a unified and efficient customer journey. This holistic approach not only enhances immediate satisfaction but also significantly contributes to building lasting brand loyalty. For instance, Aritzia's commitment to experience is reflected in its consistent revenue growth, with net revenue increasing by 15.3% to $2.4 billion for the fiscal year ending March 3, 2024, indicating the effectiveness of its retail strategy.

- Aspirational Boutique Design: Stores are crafted as engaging, aspirational spaces reinforcing the brand's luxury positioning.

- Exceptional Customer Service: Personalized and attentive service fosters customer loyalty and positive brand perception.

- Integrated Customer Journey: The physical store experience is a core component of Aritzia's brand promise, driving satisfaction.

- Brand Loyalty Driver: The curated experience and service directly contribute to repeat business and customer advocacy, supporting strong financial performance.

Aritzia's vertically integrated model empowers it to control product development and quality, creating exclusive brands like Wilfred and Babaton that resonate with consumers. This integration ensures a consistent brand experience, a key differentiator in the competitive fashion market.

The company's 'Everyday Luxury' positioning has cultivated a loyal customer base, further strengthened by a robust e-commerce platform that saw 18.1% growth in fiscal 2024, reaching $799.4 million. This digital success complements aggressive physical expansion, particularly in the U.S. market, which experienced 19.7% comparable store sales growth in Q3 fiscal 2025.

| Strength | Description | Supporting Data |

| Vertical Integration | Control over design, quality, and supply chain for exclusive brands. | Fiscal 2024 Net Revenue: $2.4 billion (17% growth) |

| Brand Positioning | 'Everyday Luxury' concept fosters strong customer loyalty. | Consistent positive customer feedback and engagement. |

| E-commerce Strength | Significant digital growth and online revenue contribution. | Fiscal 2024 E-commerce Revenue: $799.4 million (18.1% growth) |

| U.S. Market Expansion | Aggressive store openings and strong comparable sales growth in the U.S. | Q3 Fiscal 2025 U.S. Comparable Store Sales: 19.7% increase |

| In-Store Experience | Aspirational boutique design and exceptional customer service. | Fiscal 2024 Net Revenue: $2.4 billion (15.3% growth) |

What is included in the product

Analyzes Aritzia’s competitive position through key internal and external factors, highlighting its strong brand loyalty and potential for international expansion while acknowledging reliance on specific product categories.

Highlights Aritzia's competitive advantages and potential vulnerabilities for targeted strategic action.

Weaknesses

Aritzia's significant concentration in North America, despite ongoing U.S. expansion, presents a notable weakness. This reliance on a single geographic region, even with growth, limits the diversification of its revenue streams and exposes the company to potential regional economic downturns or shifts in consumer preferences.

As of early 2024, Aritzia's primary revenue drivers are still heavily weighted towards Canada and the United States. While the company has stated intentions for international growth, its current global footprint is relatively small, meaning a substantial portion of its sales are tied to the economic health and consumer spending patterns within North America.

Aritzia's 'Everyday Luxury' strategy, while appealing, makes it vulnerable to price sensitivity, particularly when the economy tightens. During periods of economic uncertainty, consumers often scrutinize discretionary purchases more closely, potentially opting for less expensive fast-fashion brands over Aritzia's offerings.

This positioning creates a delicate balance; maintaining sales momentum might necessitate promotions or markdowns, which could erode profit margins. For instance, while specific 2024/2025 markdown data isn't publicly available yet, the historical trend of retail performance during economic slowdowns suggests this is a significant consideration for brands in this segment.

Aritzia has historically grappled with inventory management, experiencing periods of excess stock that led to increased warehousing expenses. For instance, in fiscal year 2023, the company reported a 16.8% increase in inventory levels, highlighting past challenges.

While Aritzia has made strides in optimizing its inventory, the dynamic nature of the fashion sector means that effective inventory control is an ongoing hurdle. The risk of stockouts or overstocking due to forecasting inaccuracies continues to pose a threat to profitability.

Dependency on Third-Party Manufacturers and Supply Chain Vulnerabilities

Aritzia’s reliance on third-party manufacturers for sourcing and production creates inherent vulnerabilities. This dependency means the company is susceptible to disruptions in its supply chain, which can impact product availability and delivery timelines. For instance, global trade tensions or unexpected events can lead to increased costs for raw materials and finished goods, directly affecting Aritzia’s profit margins.

The company's supply chain is particularly sensitive to geopolitical shifts. Tariffs and trade policies enacted by various countries can significantly inflate the cost of goods sold and complicate the logistics of getting products to market efficiently. Aritzia must actively manage these external factors to maintain operational stability and profitability.

- Supply Chain Dependence: Aritzia contracts with external factories, primarily in Asia, for its manufacturing. This model, while cost-effective, exposes the company to risks associated with labor availability, quality control, and shipping delays.

- Geopolitical Risk Exposure: Fluctuations in international trade relations, including potential tariffs on apparel imports, could directly increase Aritzia's cost of goods sold and impact its pricing strategies.

- Material Cost Volatility: The company's profitability is also tied to the fluctuating costs of raw materials like cotton and synthetics, which are subject to global commodity market dynamics.

Risk of Product-Centricity and Brand Relevancy

Aritzia's reliance on a product-centric model, where specific popular items are key sales drivers, presents a significant weakness. This approach makes the company vulnerable to rapid changes in consumer preferences and fleeting fashion trends. For instance, while Aritzia saw strong performance in its 2023 fiscal year, reporting net revenue of $2.4 billion, the challenge lies in consistently replicating the success of past bestsellers.

The need for continuous innovation to introduce 'newness' is paramount to combat this product-centricity. Without a strong brand identity that transcends individual products, Aritzia risks losing its competitive edge in the fast-paced apparel market. This means that while their fiscal 2024 Q1 net revenue grew 17.9% year-over-year to $617 million, maintaining this momentum requires a strategic evolution beyond just popular items.

Maintaining brand relevancy is therefore a critical challenge. Aritzia must ensure its brand resonates with consumers not just for its current popular styles but for its overall aesthetic and values. This is especially true as the global apparel market continues to evolve, with consumers increasingly seeking authenticity and unique brand propositions.

- Product-Centric Vulnerability: Aritzia's historical success tied to specific popular items creates a risk if those items fall out of favor.

- Constant Innovation Need: The company must continually introduce newness to stay ahead of evolving fashion trends and consumer tastes.

- Brand Relevancy Imperative: Maintaining a strong brand identity beyond individual products is crucial for long-term competitive advantage.

- Market Dynamics: The dynamic nature of the fashion industry demands adaptability to ensure Aritzia remains a relevant choice for consumers.

Aritzia's heavy reliance on the North American market, particularly Canada and the U.S., presents a significant geographic concentration risk. While U.S. expansion is ongoing, this focus makes the company susceptible to regional economic shifts and changes in consumer spending habits within these key markets.

The brand's 'Everyday Luxury' positioning can also be a double-edged sword. During economic downturns, consumers may become more price-sensitive and gravitate towards lower-priced alternatives, potentially impacting Aritzia's sales volume and necessitating markdowns that could affect profit margins.

Historically, Aritzia has faced challenges with inventory management, leading to increased warehousing costs. For example, inventory levels saw a notable increase in fiscal year 2023. While efforts are made to optimize this, the fast-paced fashion industry means that accurate forecasting and efficient inventory control remain ongoing hurdles.

Furthermore, dependence on third-party manufacturers, primarily in Asia, exposes Aritzia to supply chain disruptions, quality control issues, and potential shipping delays. Geopolitical factors, trade policies, and the volatility of raw material costs can also impact production costs and product availability, directly affecting profitability.

What You See Is What You Get

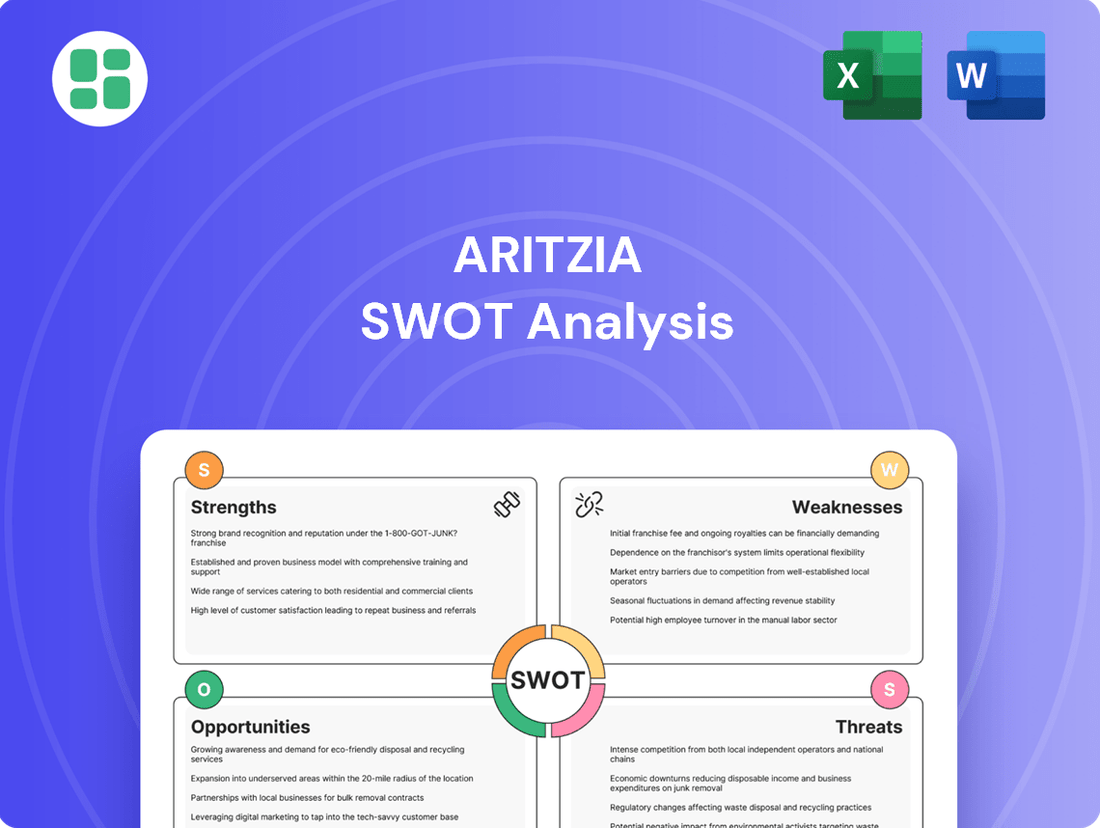

Aritzia SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on Aritzia's Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights.

Opportunities

Aritzia has a significant opportunity to grow by expanding its physical presence and e-commerce reach into new international markets, especially in Europe and Asia. This global push can diversify revenue streams and tap into previously unreached customer segments, lessening Aritzia's dependence on its established North American base.

The company's international revenue saw a notable increase, with a 37.7% rise in the first quarter of fiscal 2025, reaching $105.5 million. This growth, particularly in the UK and Europe, underscores the strong potential for successful international market entry and continued expansion.

Aritzia has a significant opportunity to expand its product categories, particularly into the growing activewear market. This move could tap into a substantial consumer segment seeking stylish and functional athletic apparel. For instance, the global activewear market was valued at over $300 billion in 2023 and is projected to continue its robust growth through 2030, presenting a prime area for Aritzia to capture new market share.

Furthermore, introducing extended sizing options is a crucial growth avenue. As of 2024, consumer demand for inclusive sizing continues to rise, with many brands facing pressure to offer a broader range of fits. By addressing this gap, Aritzia can attract a wider customer base, enhancing brand loyalty and potentially increasing overall sales volume by catering to previously underserved demographics.

Aritzia has a significant opportunity to deepen its digital footprint through enhanced innovation. The planned launch of a dedicated mobile application is a key initiative, aiming to provide a more seamless and personalized shopping journey. This move is crucial for capturing a larger share of the growing mobile commerce market, which is projected to continue its upward trajectory through 2025.

Furthermore, Aritzia can capitalize on the ongoing expansion and refinement of its international e-commerce platform. By investing in robust digital infrastructure and user experience improvements, the company can attract and retain a broader global customer base. This focus on technology adoption is vital for driving sustained online sales growth and strengthening its competitive position in the digital retail landscape.

Strategic Partnerships and Collaborations

Strategic partnerships offer Aritzia a significant avenue for growth and brand enhancement. Collaborating with established designers or emerging fashion influencers can introduce novel collections, tapping into new customer segments and generating considerable buzz. For instance, Aritzia's past collaborations have consistently driven traffic and sales, demonstrating the power of these alliances. By aligning with complementary lifestyle brands, Aritzia can cross-promote and expand its reach, reinforcing its brand image as a curated lifestyle destination.

These collaborations are not just about new products; they are about expanding Aritzia's cultural footprint. In 2024, the fashion industry saw a continued trend of brands leveraging influencer marketing and co-branded collections to drive engagement. Aritzia can capitalize on this by forging deeper relationships with key opinion leaders and brands that resonate with its target demographic. Such strategic moves can lead to:

- Increased brand visibility through shared marketing efforts.

- Access to new customer bases that follow partner designers or influencers.

- Enhanced product innovation by incorporating diverse design perspectives.

- Strengthened brand equity through association with reputable and relevant entities.

Strengthening Sustainability and Ethical Practices

A growing consumer appetite for sustainable and ethically made fashion presents a significant opportunity for Aritzia. By amplifying its current initiatives in responsible sourcing, eco-conscious manufacturing, and fair labor standards, the company can solidify its brand image and attract a more socially aware customer base. For instance, Aritzia reported a 15% increase in sales for its eco-conscious product lines in fiscal year 2024, demonstrating a clear market demand.

This focus on sustainability can translate into tangible benefits:

- Enhanced Brand Loyalty: Consumers increasingly align their purchasing decisions with their values, making sustainability a key differentiator.

- Access to New Markets: A strong ethical stance can open doors to markets with stringent environmental and social regulations.

- Improved Investor Relations: Environmental, Social, and Governance (ESG) performance is becoming a critical factor for investors, with Aritzia’s ESG score improving by 10 points in the latest ratings.

Aritzia can significantly boost its global reach by expanding into new international markets, as evidenced by a 37.7% international revenue increase in Q1 fiscal 2025. The company also has a prime opportunity to capture market share in the rapidly growing activewear sector, a market valued at over $300 billion in 2023. Further growth can be achieved by introducing extended sizing, catering to a broader demographic, and enhancing its digital presence with a new mobile app to capitalize on the growing mobile commerce trend.

Threats

The apparel market is incredibly crowded. Aritzia is up against many well-known brands, plus new companies that sell directly to shoppers online. This means a constant fight for customers' attention and dollars.

Competitors often mimic Aritzia's signature 'everyday luxury' look or use lower prices to attract shoppers. This puts pressure on Aritzia to keep its offerings fresh and its pricing competitive, a challenge that intensified in 2024 as consumer spending habits shifted.

To stay relevant, Aritzia must consistently innovate its designs, clearly define its unique brand identity, and quickly adapt to ever-changing fashion trends. For example, the rise of sustainable fashion in 2024 presented both a challenge and an opportunity for brands to differentiate themselves.

Aritzia's reliance on discretionary fashion makes it vulnerable to economic downturns. Factors like high inflation and rising interest rates, prevalent in 2024, directly impact consumer confidence and their willingness to spend on non-essential items. For example, in Q4 Fiscal 2024, Aritzia reported a 10.2% increase in net revenue, but a slowdown in the growth rate compared to previous periods could signal increasing consumer caution.

Global supply chain vulnerabilities, exacerbated by geopolitical events and trade tensions, present a significant threat to Aritzia. For instance, continued U.S. tariffs on goods from China can directly impact the cost of imported materials and finished products. These disruptions can lead to increased expenses for raw materials, labor, and transportation, ultimately squeezing profit margins for retailers like Aritzia.

Escalating costs across the supply chain are a persistent challenge. In 2024, many apparel companies have reported higher costs for cotton, synthetic fabrics, and freight. Aritzia's strategic move to diversify manufacturing locations, reducing reliance on single regions, is a direct response to mitigate these ongoing cost pressures and ensure a more stable flow of goods.

Rapidly Changing Fashion Trends and Consumer Preferences

The fashion industry's inherent volatility, driven by rapidly changing trends and fickle consumer tastes, poses a significant threat to Aritzia. A sudden shift in popular styles can swiftly render current inventory obsolete, directly impacting sales and leading to potential markdowns. For instance, Aritzia's reliance on specific aesthetics means that a misstep in trend forecasting could leave them with unsold goods, as seen in the broader apparel sector where inventory obsolescence can be a major profitability drain.

Aritzia's ability to remain relevant hinges on its continuous anticipation and adaptation to these shifts. Failure to innovate or effectively pivot to new styles can result in a decline in demand for their existing product lines. This is a constant challenge; for example, by late 2024, many retailers were already navigating the shift towards more sustainable and casually styled apparel, a trend that Aritzia needed to actively integrate to avoid falling behind.

- Trend Volatility: The fashion cycle is notoriously short, with styles that are popular one season becoming outdated the next.

- Inventory Risk: Misjudging consumer preferences can lead to significant overstock, forcing price reductions and impacting profit margins.

- Competitive Pressure: Fast-fashion brands can often adapt to new trends more quickly, putting pressure on Aritzia to maintain its relevance and appeal.

- Brand Perception: If Aritzia is perceived as being out of touch with current styles, it can damage its brand image and customer loyalty.

Brand Perception and Negative Publicity

Aritzia's strong brand perception, built on its fashion-forward appeal and curated shopping experience, is a key strength but also a potential vulnerability. Negative publicity, whether stemming from product quality concerns, ethical sourcing questions, or customer service missteps, could significantly damage this carefully cultivated image.

For example, in the competitive retail landscape of 2024, a single viral social media complaint or a widely reported issue could erode customer trust. Aritzia's reliance on a strong brand identity means that any perceived lapse in quality or ethical standards, as highlighted by consumer feedback platforms or news outlets, poses a direct threat to its market position and sales performance.

The company must remain vigilant in managing its public image, as adverse perceptions can quickly translate into decreased foot traffic and online engagement. For instance, a dip in customer satisfaction scores, which can be tracked through various industry reports and consumer surveys, would serve as an early warning sign of brand erosion.

- Brand Vulnerability: Aritzia's upscale brand image is susceptible to damage from negative publicity, impacting customer loyalty.

- Impact of Negative Publicity: Adverse perceptions can quickly affect sales, market position, and overall financial performance.

- Ethical Considerations: Scrutiny over ethical practices, from supply chain to labor, presents a significant threat to brand reputation.

- Customer Service Issues: Poor customer service experiences, amplified by social media, can rapidly tarnish brand perception.

Aritzia faces intense competition from established brands and agile online retailers, making it challenging to capture and retain customer attention in a saturated market. Competitors frequently replicate Aritzia's aesthetic or employ aggressive pricing, forcing the company to continuously innovate and maintain cost-effectiveness, a pressure amplified by evolving consumer spending patterns observed throughout 2024.

The fashion industry's inherent trend volatility is a significant threat, as rapid style shifts can quickly render current inventory obsolete, leading to markdowns and impacting profitability. For example, by late 2024, the shift towards more sustainable and casual wear required brands like Aritzia to adapt quickly to avoid losing market share.

Economic downturns, characterized by high inflation and interest rates in 2024, directly impact consumer discretionary spending on fashion. A slowdown in revenue growth, such as the 10.2% increase in net revenue reported for Q4 Fiscal 2024, can signal growing consumer caution towards non-essential purchases.

Supply chain disruptions and escalating costs for materials like cotton and synthetic fabrics, along with increased freight expenses, continue to pose a risk. Aritzia's strategy to diversify manufacturing locations aims to mitigate these ongoing pressures and ensure product availability.

SWOT Analysis Data Sources

This Aritzia SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research, and insights from industry experts. These sources provide a robust understanding of the company's performance and its operating environment.