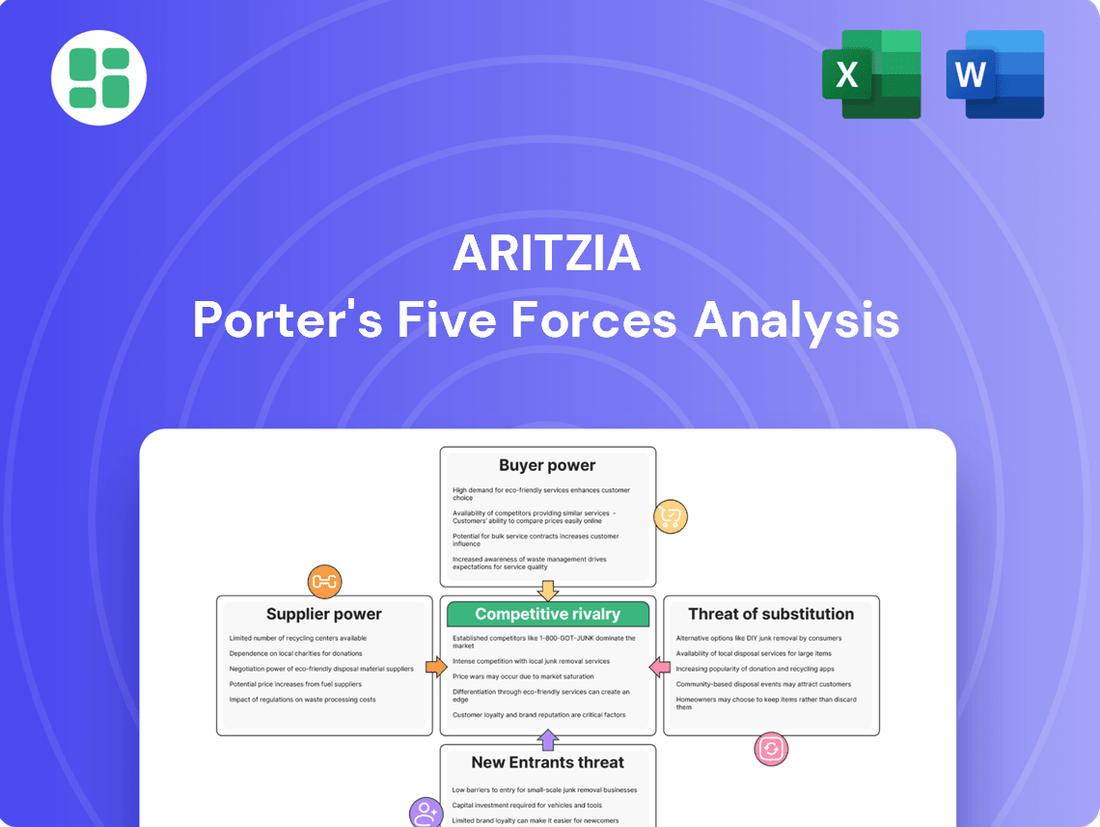

Aritzia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

Aritzia navigates a competitive retail landscape where buyer power and the threat of substitutes significantly shape its strategy. Understanding these forces is crucial for grasping Aritzia's market position and resilience.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aritzia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aritzia's bargaining power with suppliers is influenced by the concentration of its key suppliers for fabrics, trims, and manufacturing. If Aritzia relies on a limited number of large suppliers, those suppliers gain significant leverage, potentially dictating terms and prices. Conversely, a broad and diverse supplier base dilutes individual supplier power.

Aritzia's vertical integration strategy, which includes in-house design and some manufacturing capabilities, likely reduces its reliance on external suppliers for critical components and processes. This internal control strengthens Aritzia's position by giving it more options and reducing vulnerability to supplier price increases or disruptions. For instance, as of early 2024, Aritzia's commitment to its own design and product development centers allows for greater control over material sourcing and quality, thereby mitigating supplier concentration risks.

Switching suppliers for Aritzia could involve significant costs. These might include the expense of retooling manufacturing equipment to accommodate different material specifications or production processes. Aritzia would also need to invest in new quality control measures and potentially conduct extensive testing to ensure new suppliers meet their brand standards.

Building relationships with new suppliers also represents a substantial, albeit less tangible, cost. This involves time spent on negotiation, establishing trust, and ensuring smooth communication channels. Any disruption or delay in production during this transition period would directly impact Aritzia's ability to meet customer demand, thereby strengthening the bargaining power of their current suppliers.

Aritzia's suppliers' bargaining power is influenced by the uniqueness of their inputs. If suppliers provide proprietary fabrics, exclusive designs, or specialized manufacturing techniques that are difficult for Aritzia to replicate or source elsewhere, their leverage increases.

For example, if a supplier holds patents on innovative, sustainable textiles or possesses advanced, proprietary garment manufacturing technology, Aritzia would face higher costs or production delays if that supplier were to demand better terms. This exclusivity significantly strengthens the supplier's position.

Threat of Forward Integration by Suppliers

The threat of forward integration by Aritzia's suppliers poses a significant challenge. If suppliers, particularly those involved in manufacturing or fabric sourcing, possess the capabilities and see a strategic advantage, they could move into direct-to-consumer sales or even develop their own competing brands. This would directly undermine Aritzia's market position and customer relationships.

Consider the potential for a large textile manufacturer or a specialized apparel producer to leverage their existing infrastructure and expertise to bypass Aritzia and sell directly to end consumers. Such a move would not only capture Aritzia's retail margins but also potentially offer a more competitive product, thereby increasing supplier bargaining power.

For instance, in 2024, the global apparel manufacturing industry continued to see consolidation and the rise of vertically integrated players. Companies with strong design capabilities and established supply chains are increasingly exploring direct-to-consumer models. This trend suggests that Aritzia needs to carefully manage its supplier relationships to mitigate the risk of these partners becoming direct competitors.

- Potential for Vertical Integration: Suppliers in the fashion industry, especially those with design and manufacturing capabilities, could integrate forward into retail.

- Impact on Aritzia: This would create new competitors, potentially eroding Aritzia's market share and profitability.

- Supplier Motivation: Suppliers might be motivated by capturing higher retail margins and gaining direct customer insights.

- Industry Trend: The fashion sector has seen a rise in vertically integrated brands, increasing the likelihood of this threat materializing.

Importance of Aritzia to Suppliers

Aritzia's significance to its suppliers plays a crucial role in determining their bargaining power. If Aritzia constitutes a substantial portion of a supplier's annual revenue, that supplier's leverage over Aritzia is naturally reduced. This is because the supplier is more dependent on Aritzia's continued business and is less likely to risk disrupting that relationship with unfavorable terms.

Conversely, if Aritzia represents only a small fraction of a supplier's overall sales, the supplier holds a stronger bargaining position. In such scenarios, the supplier can afford to be more assertive regarding pricing, delivery schedules, or quality standards, as losing Aritzia's business would have a minimal impact on their financial performance. For instance, in 2023, Aritzia reported total revenue of CAD $2.4 billion, indicating a significant volume of purchasing power that can influence smaller, more specialized suppliers.

- Supplier Dependence: Aritzia's substantial revenue contribution to many of its suppliers diminishes those suppliers' bargaining power.

- Revenue Concentration: If Aritzia makes up a large percentage of a supplier's income, the supplier is less likely to demand unfavorable terms.

- Market Position: Aritzia's strong market presence and consistent demand for its apparel mean it can often secure favorable terms from suppliers who rely on its volume.

- Supplier Diversification: Aritzia's ability to source from multiple suppliers also limits the power of any single supplier.

Aritzia's bargaining power with suppliers is influenced by several factors, including supplier concentration and Aritzia's vertical integration. A diverse supplier base and in-house capabilities, like design and some manufacturing, reduce reliance on any single supplier, thereby strengthening Aritzia's negotiating position.

Switching costs, such as retooling and quality control, can be substantial for Aritzia, giving current suppliers leverage. The uniqueness of inputs, like proprietary fabrics, also empowers suppliers. For example, in 2024, the fashion industry saw continued consolidation, highlighting the importance of managing supplier relationships to avoid direct competition from partners exploring direct-to-consumer models.

Aritzia's significant revenue contribution to many of its suppliers limits their bargaining power. Conversely, if Aritzia represents a small portion of a supplier's sales, that supplier gains more leverage. In 2023, Aritzia's CAD $2.4 billion in revenue indicates considerable purchasing power with smaller, specialized suppliers.

| Factor | Aritzia's Position | Supplier's Position |

| Supplier Concentration | Lower power if many suppliers | Higher power if few suppliers |

| Vertical Integration | Strengthens Aritzia's position | Reduces supplier leverage |

| Switching Costs | High costs for Aritzia | Suppliers benefit from Aritzia's dependence |

| Uniqueness of Inputs | Supplier leverage if inputs are unique | Aritzia's dependence increases |

| Supplier Dependence on Aritzia | Suppliers have less power if Aritzia is a large client | Suppliers have more power if Aritzia is a small client |

What is included in the product

Analyzes Aritzia's competitive environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the fashion retail industry.

Aritzia's Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, perfect for quick strategic decision-making.

Customers Bargaining Power

Aritzia's 'Everyday Luxury' positioning suggests a segment of its customer base is less price-sensitive, valuing the brand's perceived quality and style. However, the fashion industry, especially in the contemporary segment, can still see customers swayed by competitor promotions. For instance, in 2023, the apparel retail sector experienced a notable increase in promotional activity as companies sought to manage inventory and attract shoppers.

Aritzia's customers have significant bargaining power due to the wide availability of substitute products in the apparel market. Consumers can easily find similar styles and quality from numerous competitors, ranging from fast fashion retailers to other premium brands and even the growing second-hand market.

The sheer volume of fashion brands means Aritzia must continually innovate and maintain its brand appeal to retain customers. For instance, the global apparel market is projected to reach over $1.7 trillion by 2027, indicating a highly competitive landscape where alternatives are abundant.

Customers today have unprecedented access to information regarding product pricing, quality, and competitor offerings. The digital landscape, with its price comparison websites and extensive review platforms, significantly amplifies this buyer information availability.

For instance, in 2024, a significant majority of online shoppers utilize search engines and review sites before making a purchase, directly impacting their ability to negotiate or seek better deals. This readily available data empowers consumers, generally increasing their bargaining power against retailers like Aritzia.

Customer Loyalty and Brand Differentiation

Aritzia cultivates significant customer loyalty through its carefully curated selection of exclusive, in-house fashion brands. This differentiation means customers seeking Aritzia's specific aesthetic and quality are less inclined to switch to competitors, even if prices are slightly higher. For instance, Aritzia reported a 45% increase in revenue for fiscal 2024, reaching $2.4 billion, demonstrating strong customer engagement and a willingness to pay for their unique offerings.

The strength of Aritzia's brand loyalty directly impacts the bargaining power of its customers. When a brand offers unique products and a strong emotional connection, customers have fewer viable alternatives. This reduces their ability to demand lower prices or higher quality, as they are invested in the specific value proposition Aritzia provides.

- Brand Exclusivity: Aritzia's strategy of developing and exclusively selling its own brands (e.g., Wilfred, Super World, Babaton) limits direct product comparisons and reduces customer options.

- Customer Engagement: High customer retention rates, evidenced by repeat purchases and strong sales growth, indicate that customers value Aritzia's offerings beyond just price.

- Reduced Price Sensitivity: The unique fashion appeal and perceived quality of Aritzia's brands make customers less sensitive to minor price fluctuations, thereby lowering their bargaining power.

Customers' Propensity to Backward Integrate

Customers' propensity to backward integrate, while less common in the fashion industry, represents a potential avenue for exerting pressure on retailers like Aritzia. This involves customers either producing their own apparel or forming collective buying groups to gain leverage. For instance, a large group of Aritzia loyalists could theoretically pool resources to contract directly with manufacturers, bypassing Aritzia's retail markup.

While a full-scale backward integration by individual customers is unlikely, the concept of collective action, such as forming buying cooperatives or demanding greater transparency and customization, could emerge. This would be driven by a desire for lower prices or more personalized products, directly challenging Aritzia's existing business model. For example, if Aritzia's net profit margin in the fiscal year 2023 was 13.5%, customers might seek to capture some of that margin through direct sourcing if it became feasible.

- Customer Backward Integration Likelihood: Generally low for individual fashion consumers, but potential for organized groups.

- Impact on Aritzia: Could lead to price pressure or demands for greater customization.

- Example Scenario: Formation of buying groups to contract directly with manufacturers.

- Financial Context: Aritzia's fiscal 2023 net profit margin of 13.5% indicates potential leverage for customers if collective action is organized.

Aritzia's customers possess moderate bargaining power, primarily due to the vast array of apparel alternatives available. However, Aritzia mitigates this by cultivating strong brand loyalty through exclusive, in-house brands, which reduces price sensitivity. For instance, Aritzia's revenue grew 45% to $2.4 billion in fiscal 2024, showcasing customer commitment.

| Factor | Aritzia's Position | Customer Bargaining Power |

| Availability of Substitutes | High | Moderate to High |

| Brand Loyalty & Differentiation | Strong (Exclusive Brands) | Low to Moderate |

| Customer Information Access | High (Digital Landscape) | Moderate to High |

| Likelihood of Backward Integration | Very Low (Individual) | Low |

Same Document Delivered

Aritzia Porter's Five Forces Analysis

This preview showcases the comprehensive Aritzia Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the fashion retail industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring complete transparency and immediate usability. You're looking at the actual document, providing a clear understanding of the strategic insights into Aritzia's market position and competitive pressures.

Rivalry Among Competitors

Aritzia operates in a highly competitive landscape within the women's apparel market. Its direct competitors include other contemporary fashion retailers like Zara, H&M, and Everlane, which offer similar styles and price points. Indirect competitors, such as online-only brands and department stores, also vie for consumer attention and spending.

The sheer number of players, ranging from fast-fashion giants to niche boutiques, intensifies rivalry. Zara and H&M, for instance, boast extensive global store networks and rapid inventory turnover, creating significant pressure. Aritzia's focus on a curated, elevated aesthetic differentiates it, but the overall market saturation means constant innovation and strong brand loyalty are crucial for maintaining market share.

The fashion retail industry, while dynamic, has experienced varying growth rates. In recent years, particularly leading up to and including 2024, the sector has navigated a landscape of moderate growth, influenced by economic conditions and evolving consumer spending habits. For instance, global apparel market revenue was projected to reach over $1.7 trillion by 2024, indicating continued expansion, albeit with regional and segment-specific fluctuations.

When the fashion retail industry experiences slower growth, or even a decline in certain segments, the intensity of competition typically escalates. Companies are compelled to fight more aggressively for existing market share, often leading to price wars, increased promotional activities, and a greater emphasis on customer retention. This environment can put pressure on profit margins for all players involved.

Aritzia's extensive portfolio of exclusive, in-house brands, such as Wilfred, Babaton, and Tna, significantly differentiates it from competitors. This curated approach fosters a unique brand identity and appeals to a specific customer base, reducing the likelihood of direct price comparisons with mass-market retailers. In 2023, Aritzia reported a 34% increase in net revenue to $2.4 billion, underscoring the success of its differentiation strategy in a competitive apparel market.

Exit Barriers for Competitors

Aritzia faces moderate exit barriers, meaning it's not excessively difficult for competitors to leave the market. However, factors like significant investments in physical retail locations and substantial inventory levels do present some hurdles for those looking to exit. These ongoing commitments can tie up capital, making a swift departure challenging.

The fashion retail industry, while dynamic, does involve certain sunk costs that can influence a competitor's decision to exit. These include investments in brand building, established supply chains, and potentially long-term leases for retail space. For instance, maintaining a national presence with numerous brick-and-mortar stores requires considerable ongoing expenditure.

While not as extreme as some capital-intensive industries, the need to liquidate large amounts of inventory at potentially discounted prices can also act as a deterrent to a quick exit. Competitors might prefer to weather market fluctuations rather than incur significant losses on unsold goods. This can prolong competitive intensity as businesses strive to recover their investments.

- High Fixed Costs: Significant capital tied up in prime retail real estate and extensive inventory management systems.

- Specialized Assets: Investments in unique store designs and brand-specific operational infrastructure.

- Brand Reputation: The effort and cost involved in building a recognized brand can make exiting a market with an established brand difficult.

Fixed Costs and Capacity

The fashion retail industry, including companies like Aritzia, generally involves significant fixed costs related to store leases, inventory management, and marketing. These substantial overheads can pressure retailers to maintain high sales volumes to achieve profitability.

When fixed costs are high, companies are incentivized to operate at or near full capacity. This often leads to more aggressive pricing strategies, such as frequent sales and promotions, to drive customer traffic and cover ongoing expenses, intensifying competitive rivalry.

- High Fixed Costs: Aritzia's retail model, with its network of physical stores, necessitates considerable investment in real estate, store design, and staffing, contributing to high fixed operating expenses.

- Capacity Utilization Pressure: To offset these fixed costs, Aritzia and its competitors must aim for high sales volumes per store and across their online platforms.

- Aggressive Pricing Tendencies: The need to cover overheads can result in a competitive environment where price reductions and promotional activities become common tools to attract and retain customers, impacting profit margins across the sector.

Competitive rivalry within the women's apparel market is intense, driven by numerous players offering similar styles and price points. Aritzia differentiates itself through exclusive, in-house brands, a strategy that contributed to a 34% increase in net revenue to $2.4 billion in 2023. The overall apparel market, projected to exceed $1.7 trillion in revenue by 2024, sees companies like Zara and H&M leveraging vast store networks and rapid inventory turnover, intensifying the pressure on market share.

High fixed costs associated with prime retail real estate and inventory management create a constant pressure for Aritzia and its competitors to maintain high sales volumes. This often translates into aggressive pricing and promotional activities to cover overheads and attract customers, impacting sector-wide profit margins.

| Competitor Type | Key Characteristics | Impact on Rivalry |

| Direct Competitors (e.g., Zara, H&M) | Extensive global store networks, rapid inventory turnover, similar styles and price points | High pressure due to scale and speed |

| Online-only Brands | Lower overheads, direct-to-consumer model | Increased price competition and customer acquisition challenges |

| Department Stores | Broad product assortment, established customer base | Indirect competition for wallet share, can offer competing brands |

SSubstitutes Threaten

The threat of substitutes for Aritzia's fashion-forward apparel is significant, primarily due to the price-performance trade-off. Customers seeking stylish, on-trend clothing can often find comparable looks at lower price points from fast-fashion retailers like Zara or H&M, or even through the growing second-hand market on platforms like Depop or Poshmark.

While Aritzia emphasizes quality and a curated brand experience, these substitutes can mimic the aesthetic appeal, albeit with potentially lower material quality or less ethical production practices. For instance, a $50 top from Shein might offer a similar silhouette to an Aritzia piece priced at $150, presenting a compelling value proposition for budget-conscious consumers.

Furthermore, clothing rental services, though less direct, also represent a substitute by offering access to fashionable items for specific occasions without the commitment of purchase, further challenging Aritzia's market share, especially among younger demographics who prioritize variety and affordability.

Aritzia's customers face relatively low switching costs when considering substitutes. Monetary costs are minimal, primarily involving the potential need to purchase new items from a different brand. Non-monetary costs, such as learning a new brand's sizing or style preferences, are also not substantial, especially given the accessibility of online reviews and in-store try-ons. This ease of transition means customers can readily explore alternatives without significant financial or time investment.

Aritzia's customers have a wide array of readily available substitute options for their apparel needs. Brands like Zara, H&M, and Everlane offer similar styles and price points, making it easy for consumers to switch. The widespread accessibility of these competitors through both online platforms and physical stores amplifies the threat.

Changes in Consumer Preferences

Changes in consumer preferences represent a significant threat of substitutes for Aritzia. As consumers increasingly prioritize sustainability, they may gravitate towards the growing resale market for fashion, seeking pre-owned items from various brands, including those similar to Aritzia's aesthetic. This trend is bolstered by platforms that facilitate the buying and selling of used clothing, offering a more budget-conscious and environmentally friendly alternative. For example, the global secondhand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $350 billion by 2027, indicating a substantial shift in consumer behavior.

Furthermore, a heightened focus on budget-consciousness can drive consumers towards more affordable fast-fashion brands or private-label offerings from large retailers. These substitutes can replicate current trends at lower price points, directly competing with Aritzia's mid-to-high-end positioning. The increasing accessibility and rapid trend cycles of these competitors mean consumers have more options that may satisfy their desire for new styles without the associated cost of Aritzia's products.

The rise of rental services for clothing also presents a viable substitute, particularly for occasion wear or trend-driven pieces. Consumers might opt to rent an outfit for a specific event rather than purchase it, reducing the need for ownership and opening the door to a wider variety of styles from different brands. This model appeals to those who value variety and sustainability, directly impacting the demand for Aritzia's core offerings.

Key shifts influencing these preferences include:

- Growing demand for sustainable fashion: Consumers are increasingly seeking eco-friendly options, which can lead them to second-hand markets or brands with transparent ethical practices.

- Increased price sensitivity: Economic factors can push consumers towards more affordable alternatives, making fast fashion and private labels attractive substitutes.

- Popularity of rental and resale platforms: Services like Rent the Runway and The RealReal offer access to a wide array of styles without the commitment of ownership, directly challenging traditional retail models.

- Influence of social media: The constant exposure to diverse styles and brands online can encourage exploration of a broader range of fashion sources beyond a single retailer.

Innovation in Substitute Industries

The threat of substitutes for Aritzia's offerings is amplified by rapid innovation in adjacent industries. For instance, the burgeoning clothing rental market, exemplified by platforms like Rent the Runway, provides consumers with access to high-fashion items at a fraction of the purchase price, directly competing with Aritzia's premium apparel. By mid-2024, the global online clothing rental market was projected to reach over $2 billion, indicating significant consumer adoption of these alternatives.

Furthermore, the increasing consumer demand for sustainable and ethically sourced fashion presents another avenue for substitution. Brands focusing on eco-friendly materials or circular economy models can attract environmentally conscious shoppers who might otherwise patronize Aritzia. This trend is supported by reports indicating that over 60% of consumers consider sustainability when making purchasing decisions in the fashion sector.

The emergence of virtual fashion and digital clothing for online avatars and gaming environments also represents a nascent but growing substitute. While still a niche market, the potential for digital garments to fulfill certain fashion desires, particularly among younger demographics, could gradually erode the demand for physical apparel in the long term.

These evolving substitute industries, driven by technological advancements and shifting consumer preferences, pose a dynamic threat to Aritzia's market position, requiring continuous adaptation and innovation in their own product and service offerings.

The threat of substitutes for Aritzia is substantial, driven by the availability of similar fashion aesthetics at lower price points. Fast-fashion retailers like Zara and H&M, along with the burgeoning resale market on platforms such as Depop, offer compelling alternatives. These substitutes often mimic Aritzia's on-trend styles, making them attractive to budget-conscious consumers.

The ease with which consumers can switch to substitutes is notable, with minimal switching costs involved. Monetary costs are low, and non-monetary costs, like adapting to new brand sizing, are also not significant barriers. This accessibility means customers can readily explore alternatives, especially as platforms like Shein offer trendy items for as little as $50 compared to Aritzia's $150 price point for similar styles.

Shifting consumer preferences further bolster the threat of substitutes. A growing emphasis on sustainability drives consumers towards the secondhand market, where pre-owned items offer a more eco-friendly and affordable option. The global secondhand apparel market was valued at approximately $177 billion in 2023 and is projected to grow significantly, highlighting a major shift in consumer behavior that directly impacts traditional fashion retailers.

Additionally, clothing rental services present a growing substitute, particularly for occasion wear. These services allow consumers to access a variety of fashionable items without the commitment of purchase, appealing to those who prioritize variety and affordability. The online clothing rental market is projected to exceed $2 billion by mid-2024, underscoring the increasing adoption of rental models.

| Substitute Category | Key Players | Price Comparison Example (Approximate) | Consumer Driver |

|---|---|---|---|

| Fast Fashion | Zara, H&M, Shein | $50 for a trendy top vs. $150 at Aritzia | Affordability, trend-following |

| Resale Market | Depop, Poshmark, The RealReal | Variable, often significantly lower than original retail | Sustainability, affordability, unique finds |

| Clothing Rental | Rent the Runway | Rental fee for an outfit vs. purchase price | Occasion wear, variety, sustainability |

Entrants Threaten

Entering the vertically integrated fashion industry at a scale comparable to Aritzia demands substantial capital. Costs for design, sourcing, manufacturing, and maintaining a robust inventory can easily run into tens of millions of dollars. For instance, establishing a global supply chain and quality control processes requires significant upfront investment.

Beyond production, the capital outlay for physical retail presence is considerable. Aritzia operates numerous boutiques in prime locations, each requiring extensive build-out, leasehold improvements, and initial inventory stocking. In 2024, retail store build-out costs can range from $500,000 to over $2 million per location, depending on size and location, presenting a major barrier to entry.

Furthermore, a sophisticated e-commerce platform, digital marketing, and brand building are essential. Developing and maintaining a seamless online shopping experience, coupled with effective digital advertising campaigns to reach a broad customer base, adds another layer of significant financial commitment. This integrated approach to retail and digital presence necessitates a deep pool of capital, effectively limiting the threat of new entrants.

Aritzia's strong brand loyalty, built on exclusive designs and a curated customer experience, creates a significant hurdle for new competitors. It's tough for newcomers to replicate the emotional connection and perceived value Aritzia offers its clientele, which is crucial in the fashion industry. For instance, in fiscal year 2024, Aritzia reported a revenue increase of 17.5% to $2.4 billion, demonstrating continued customer engagement and demand.

New entrants face significant hurdles in replicating Aritzia's established omnichannel distribution network. Building a comparable footprint of desirable physical boutiques requires substantial capital investment and prime retail real estate, which is often scarce and costly. For instance, securing prime locations in major urban centers, a key component of Aritzia's strategy, involves intense competition and high leasehold improvements.

Developing a sophisticated and user-friendly e-commerce platform, coupled with efficient logistics and supply chain management, also demands considerable financial resources and technical expertise. Aritzia's robust online presence, which accounted for a significant portion of its revenue growth in recent years, is a testament to years of investment and refinement, making it difficult for newcomers to match its reach and customer experience.

Economies of Scale

Aritzia benefits significantly from economies of scale across its operations. Its substantial size in design, sourcing, and distribution allows for lower per-unit costs compared to smaller, emerging competitors. This cost advantage makes it difficult for new entrants to compete on price from the outset.

For instance, Aritzia's ability to negotiate bulk discounts with manufacturers and suppliers is a direct result of its high sales volume. New businesses entering the fashion retail space would likely incur considerably higher production and inventory management costs until they reach a comparable scale of operations.

This scale also translates into more efficient marketing and advertising spend. Aritzia can spread its marketing budget over a larger customer base, reducing the cost per customer acquisition. New entrants would need to invest heavily to build brand awareness and attract customers, facing a steeper uphill battle.

- Design & Sourcing: Bulk purchasing of fabrics and materials leads to lower input costs.

- Manufacturing: Higher production runs with contract manufacturers reduce per-unit manufacturing expenses.

- Distribution: Centralized warehousing and logistics networks optimize shipping costs.

- Marketing: Larger brand visibility allows for more efficient customer acquisition.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in the fashion retail sector. For instance, in 2024, ongoing discussions around potential tariffs on imported textiles could increase costs for new businesses relying on overseas manufacturing, thereby raising the barrier to entry. Similarly, evolving environmental regulations, such as those mandating sustainable sourcing or waste reduction, require substantial upfront investment from newcomers to ensure compliance.

Business licensing and zoning laws also play a role. While generally straightforward, navigating these requirements can be more burdensome for smaller, less capitalized entrants compared to established players. For example, obtaining the necessary permits for physical retail locations in prime urban areas can be a complex and time-consuming process, potentially deterring new fashion brands from establishing a physical presence.

The regulatory landscape can also create opportunities. Government initiatives aimed at supporting small businesses or promoting domestic manufacturing might offer incentives that reduce the cost of entry for certain types of fashion retailers. However, the overall impact in 2024 leans towards creating a more complex environment for new entrants due to increasing compliance demands.

- Trade Policies: Potential tariffs on imported materials can increase operational costs for new fashion retailers.

- Environmental Regulations: Stricter rules on sustainability and waste management necessitate upfront investment in compliant practices.

- Business Licensing: Navigating permits and zoning can be a hurdle, particularly for new businesses seeking prime retail locations.

- Support Initiatives: Government programs aimed at small businesses or domestic production could offer some mitigation for entry barriers.

The threat of new entrants into Aritzia's market segment is considerably low due to the immense capital required for establishing a comparable brand presence and operational scale. Significant upfront investment is needed for design, sourcing, manufacturing, and building a robust inventory, easily reaching tens of millions of dollars. For instance, developing a global supply chain and ensuring quality control demands substantial initial outlays.

The cost of physical retail presence is another major deterrent. Aritzia's strategy of operating boutiques in prime locations involves extensive build-out and initial inventory. In 2024, the cost to build out a single retail store can range from $500,000 to over $2 million, depending on its size and location, creating a substantial financial barrier for newcomers.

Furthermore, a sophisticated e-commerce platform and effective digital marketing are crucial. Building and maintaining a seamless online experience, alongside impactful digital advertising campaigns, requires significant capital. Aritzia's integrated retail and digital approach necessitates deep financial resources, effectively limiting the threat from new competitors.

Aritzia's strong brand loyalty, cultivated through exclusive designs and a curated customer experience, presents a significant challenge for new entrants. Replicating the emotional connection and perceived value Aritzia offers its clientele is difficult. In fiscal year 2024, Aritzia reported a revenue increase of 17.5% to $2.4 billion, underscoring its sustained customer engagement and demand.

New entrants face considerable obstacles in replicating Aritzia's established omnichannel distribution network. Building a comparable footprint of desirable physical boutiques requires substantial capital and access to prime retail real estate, which is often scarce and costly. Securing prime urban locations, a cornerstone of Aritzia's strategy, involves intense competition and high leasehold improvement costs.

Developing a sophisticated e-commerce platform and efficient logistics also demands considerable financial resources and technical expertise. Aritzia's robust online presence, a key driver of its recent revenue growth, is the result of years of investment and refinement, making it difficult for newcomers to match its reach and customer experience.

Aritzia benefits from significant economies of scale across its operations, leading to lower per-unit costs in design, sourcing, and distribution compared to smaller competitors. This cost advantage makes it difficult for new entrants to compete on price. For example, Aritzia's ability to negotiate bulk discounts with manufacturers stems directly from its high sales volume. New fashion retailers would likely face considerably higher production and inventory management costs until they achieve similar operational scale.

This scale also enhances marketing efficiency. Aritzia spreads its marketing budget across a larger customer base, reducing the cost per customer acquisition. New entrants would need substantial investment to build brand awareness and attract customers, facing a steeper challenge.

| Barrier to Entry | Estimated Cost/Impact for New Entrants (2024) | Aritzia's Advantage |

|---|---|---|

| Capital Investment (Operations) | Tens of millions of dollars (design, sourcing, manufacturing, inventory) | Established scale and infrastructure reduce per-unit costs. |

| Physical Retail Presence | $500,000 - $2 million+ per store (build-out, prime locations) | Extensive network of high-traffic boutiques. |

| E-commerce & Digital Marketing | Significant investment in platform development, user experience, and advertising. | Sophisticated, integrated online presence driving substantial revenue. |

| Brand Loyalty & Customer Experience | Difficult to replicate emotional connection and perceived value. | Strong brand equity and loyal customer base, evidenced by 17.5% revenue growth in FY24. |

| Economies of Scale | Higher per-unit costs for design, sourcing, manufacturing, and marketing. | Lower input costs through bulk purchasing and efficient operations. |

Porter's Five Forces Analysis Data Sources

Our Aritzia Porter's Five Forces analysis leverages data from Aritzia's investor relations website, annual reports, and SEC filings to understand its competitive landscape. We also incorporate industry research from firms like IBISWorld and market share data from sources such as Statista to assess competitive rivalry and buyer power.