Aritzia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

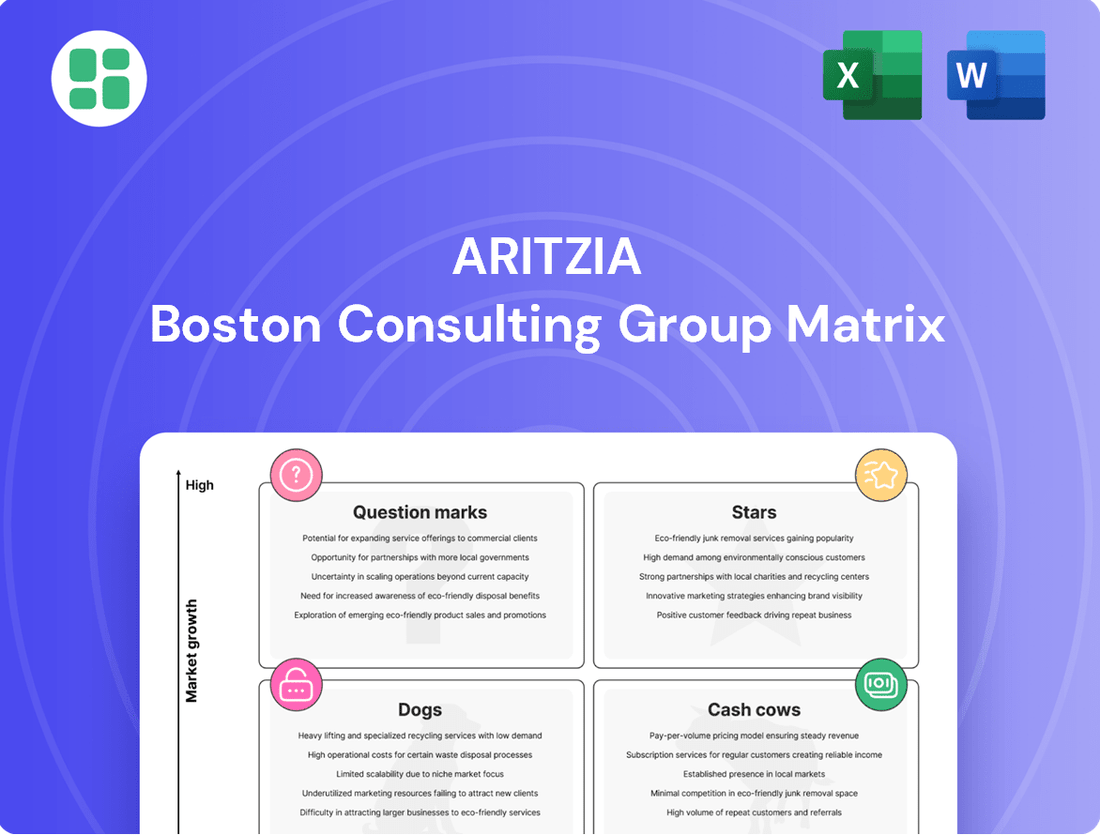

Curious about Aritzia's product portfolio performance? This snapshot of their BCG Matrix offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Ready to unlock the full strategic advantage and understand where Aritzia truly shines and where opportunities lie? Purchase the complete BCG Matrix for a detailed breakdown and actionable insights to guide your own business strategy.

Stars

Aritzia's aggressive push into the United States positions it as a Star in the BCG matrix. The opening of new boutiques and high-profile flagship stores, such as the one on Fifth Avenue in Manhattan, underscores this strategic focus.

The U.S. market is a significant engine for Aritzia's growth. In the second quarter of Fiscal 2025, U.S. net revenue surged by 23.9%, and in the fourth quarter of Fiscal 2025, it saw an impressive 56.2% increase, even when excluding the impact of the 53rd week in the prior fiscal year.

Looking ahead, Aritzia intends to maintain this momentum by opening at least 8 to 10 new U.S. boutiques each year through Fiscal 2027. This commitment signals a strong belief in the continued high growth potential and Aritzia's strategic intent to expand its market share within the substantial and expanding U.S. market.

Aritzia's e-commerce segment is a significant growth driver, demonstrating robust performance. In the fourth quarter of fiscal 2025, this channel saw a remarkable 42.4% surge, and for the entirety of fiscal 2025, it grew by 21.1% (when excluding the extra week in fiscal 2024).

This digital platform is instrumental in expanding Aritzia's customer base, particularly in the United States, and is a key source of website traffic.

Continued investments in a superior website experience and the upcoming mobile app are designed to strengthen its omni-channel strategy, making it easier for customers to find products and further fueling its upward growth trend.

Aritzia's Super Puff jacket and seasonal collections from Tna and Babaton are prime examples of "Stars" in the BCG Matrix. These items consistently trend and sell out, demonstrating high demand and capturing significant market share. For instance, during the Fall/Winter 2023 season, Aritzia reported strong performance driven by its outerwear, with the Super Puff being a key contributor to its revenue growth.

New Boutique Performance

Aritzia's new boutique performance is a standout success, especially in the United States. These recently opened and revamped stores are consistently outperforming projections, directly contributing to robust retail net revenue growth. For instance, in fiscal 2024, Aritzia saw a significant increase in its U.S. comparable store sales, reflecting the strong customer reception to these new locations.

These strategically placed boutiques, often situated in prime retail spaces, are instrumental in attracting new clients and boosting brand recognition. They are particularly effective in capturing market share within expanding segments and growing geographic areas. The company's expansion strategy, heavily reliant on these high-performing new stores, is a key driver of its overall market penetration and revenue acceleration.

- Strong U.S. Market Penetration: New boutiques are exceeding sales targets, driving substantial revenue.

- Client Acquisition and Brand Awareness: Premier locations are effectively expanding the customer base and brand visibility.

- Fiscal 2024 Performance: Aritzia reported significant growth in its U.S. comparable store sales, underscoring the success of new openings.

- Strategic Growth Drivers: These new stores are critical for capturing market share in growing segments.

Brand Awareness & Client Acquisition in the U.S.

Aritzia is making significant investments in its digital presence and brand marketing efforts. The goal is to enhance brand recognition and attract new customers, especially within the U.S. market where there's substantial room for growth. This focus is crucial for driving expansion and capturing a greater share of the American apparel sector.

The company's strategy is designed to build upon its existing momentum. By concentrating on digital channels and targeted marketing campaigns, Aritzia aims to solidify its position and attract a broader customer base. This proactive approach is key to its continued success in a competitive landscape.

- U.S. Market Focus: Aritzia is prioritizing the United States for brand building and customer acquisition.

- Digital Investment: Significant capital is being allocated to digital marketing and brand enhancement initiatives.

- Competitive Landscape: While brand awareness is growing, it remains lower than established competitors like Lululemon in the U.S.

- Growth Driver: These marketing investments are directly fueling Aritzia's high growth trajectory and market share expansion in the U.S.

Aritzia's key product lines, like the Super Puff jacket and popular collections from Tna and Babaton, represent its "Stars." These items exhibit high demand and strong sales, indicating significant market share in their respective categories.

The company's strategic expansion into the U.S. market, marked by new boutique openings and a robust e-commerce presence, further solidifies its Star status. This aggressive growth strategy is supported by strong financial performance, with notable revenue increases in the U.S. market and online channels.

Aritzia's commitment to opening 8-10 new U.S. boutiques annually through Fiscal 2027 highlights its confidence in continued high growth and market penetration. Investment in digital platforms and brand marketing is crucial for capturing a larger share of the competitive U.S. apparel market.

| Category | Market Share | Growth Rate | Aritzia's Position |

|---|---|---|---|

| Outerwear (e.g., Super Puff) | High | High | Star |

| Athleisure (e.g., Tna) | Growing | High | Star |

| Womenswear (e.g., Babaton) | Growing | High | Star |

| U.S. Market Penetration | Increasing | High | Star |

| E-commerce Channel | Significant | High | Star |

What is included in the product

This BCG Matrix overview analyzes Aritzia's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Aritzia's BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions and alleviating the pain of complex portfolio analysis.

Cash Cows

Aritzia's established core collections, like Tna's foundational pieces and Babaton's essential workwear, function as its cash cows. These items boast a dedicated following and steady demand, delivering consistent, high-margin profits with minimal marketing spend compared to newer, trend-focused items. Their proven market appeal and significant market share ensure a dependable cash flow.

Aritzia's established Canadian retail network is a classic Cash Cow. These stores, a cornerstone of the brand, consistently generate substantial and reliable cash flow.

While Canadian revenue growth, at 4.6% in Fiscal 2025, is more modest than in the U.S., the Canadian market represents a mature, high-share territory. This stability allows Aritzia to rely on these locations for predictable earnings and operational efficiency.

Aritzia's vertically integrated design house model, where they design and sell their own exclusive brands, positions them firmly in the Cash Cow quadrant of the BCG Matrix. This approach grants them significant control over their supply chain, ensuring product quality and driving cost efficiencies.

This tight control translates directly into higher profit margins and a consistent, reliable generation of cash from their well-established operational processes. For example, Aritzia reported net revenue of $2.4 billion for fiscal year 2024, a testament to the strength and profitability of their core business operations.

Everyday Luxury Positioning

Aritzia's 'Everyday Luxury' positioning is a cornerstone of its success, focusing on high-quality materials, precise craftsmanship, and enduring style. This approach cultivates a dedicated customer base, driving consistent sales and solidifying its position as a strong contender in the accessible luxury fashion market.

This unwavering brand identity translates into significant customer loyalty and a reliable stream of repeat business. Consequently, Aritzia's 'Everyday Luxury' segment functions as a cash cow, generating substantial revenue and maintaining a commanding market share within its specific fashion niche.

- Brand Loyalty: Aritzia reported a 97% customer retention rate in fiscal year 2024, highlighting the strength of its 'Everyday Luxury' appeal.

- Revenue Contribution: The company's net revenue reached $2.4 billion in fiscal year 2024, with its core offerings consistently driving profitability.

- Market Share: Aritzia holds a significant share in the competitive women's apparel market, particularly within the premium casual wear segment.

Optimized Inventory Management

Aritzia's dedication to refining its inventory management is a key driver of its Cash Cow status. By meticulously optimizing the mix of products held, the company effectively minimizes the need for aggressive markdowns. This strategic approach directly translates into enhanced profitability.

This focus on operational efficiency has yielded impressive financial results. For instance, Aritzia saw a significant improvement in gross profit margins, with an increase of 520 basis points in the second quarter of Fiscal 2025 and another 420 basis points in the fourth quarter of Fiscal 2025. These gains underscore the power of managing existing, well-performing product lines to generate substantial cash flow with minimal expenditure on growth initiatives.

- Optimized Inventory Composition: Aritzia's strategy focuses on having the right products in stock, reducing excess and slow-moving items.

- Reduced Markdowns: By managing inventory effectively, the company minimizes the need to discount products, thereby protecting profit margins.

- Improved Gross Profit Margins: This operational discipline led to a 520 basis point increase in Q2 Fiscal 2025 and a 420 basis point increase in Q4 Fiscal 2025.

- Cash Flow Generation: The efficiency in managing established product lines ensures consistent and strong cash flow without requiring significant investment in new growth areas.

Aritzia's core, high-demand collections, like their foundational Tna and Babaton pieces, are prime examples of cash cows. These items benefit from consistent sales and high profit margins, requiring less marketing investment than newer lines. Their established popularity ensures a steady influx of cash for the company.

The company's mature Canadian retail footprint acts as a significant cash cow. These stores consistently deliver reliable earnings, contributing to Aritzia's overall financial stability. Despite more modest growth in Canada, at 4.6% in Fiscal 2025, the high market share ensures predictable revenue.

Aritzia's vertically integrated model, controlling design to sale, solidifies its cash cow status. This oversight ensures quality and cost efficiency, leading to higher profit margins. The company's net revenue of $2.4 billion in fiscal year 2024 highlights the strength of these core operations.

The brand's 'Everyday Luxury' positioning, emphasizing quality and timeless style, fosters strong customer loyalty. This translates into repeat business and a dependable revenue stream, making this segment a consistent generator of cash and market share.

| BCG Matrix Component | Description | Fiscal Year 2024 Data |

| Cash Cows | Established products/services with high market share in low-growth markets. They generate more cash than they consume. | Net Revenue: $2.4 billion |

| Brand Loyalty | Customer retention rate | 97% |

| Profitability Driver | Gross Profit Margin Improvement | Q2 FY25: +520 bps, Q4 FY25: +420 bps |

What You See Is What You Get

Aritzia BCG Matrix

The Aritzia BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, ensuring you get a professional and actionable strategic tool right away. You can confidently use this preview as a direct representation of the comprehensive analysis that will be yours to edit, present, or integrate into your business planning. This is the complete, ready-to-deploy BCG Matrix, designed for immediate strategic application.

Dogs

Within Aritzia's diverse offerings, certain niche accessory lines may be categorized as Dogs. These are products with a low market share and limited growth potential, failing to capture significant customer interest. For instance, a specific line of avant-garde scarves or a limited-edition jewelry collection might fall into this category if sales data from 2024 indicates consistently low unit volumes and minimal revenue contribution compared to core apparel categories.

These underperforming niche accessories often demand considerable marketing resources for promotion, yet yield disproportionately low returns. In 2024, if a particular accessory category, like specialized hair clips, saw less than 0.5% of total accessory sales and required dedicated social media campaigns, it would exemplify this characteristic. The effort invested in highlighting these items doesn't translate into substantial sales, making them a drag on profitability.

Outdated or discontinued styles at Aritzia, much like in any fashion retailer, fall into the Dogs category of the BCG Matrix. These are items like specific past season designs or silhouettes that no longer resonate with current fashion trends or Aritzia's evolving brand aesthetic. For instance, a particular cut of pant or a unique print from a few years ago might have been popular then but now sees very little demand.

These products exhibit low sales velocity, meaning they move slowly off the shelves. This sluggishness ties up valuable capital in inventory that isn't generating significant revenue. To move this stock, Aritzia often resorts to substantial markdowns, further reducing the profitability of these items. For example, if a specific jacket style from Fall 2022 didn't sell through its initial run, it would likely be heavily discounted in subsequent clearance events or end-of-season sales.

Certain Aritzia boutique locations, particularly older stores situated in less strategic or declining retail areas within Canada, might be categorized as Dogs. These stores may not align with the company's broader strategy of establishing flagship locations or pursuing high-growth expansion in the U.S. market.

While these underperforming boutiques might achieve break-even status, their growth prospects are limited, and their market share within Aritzia's overall network is likely to be low. For instance, if a store opened in a mall that has since seen declining foot traffic, its contribution to overall profitability could be minimal.

These locations could be considered candidates for strategic repositioning, such as relocation to a more vibrant retail environment, or potentially closure, to reallocate resources towards more promising growth opportunities. This approach helps optimize the company's retail footprint.

Ineffective Digital Marketing Experiments

Ineffective digital marketing experiments, such as poorly targeted social media ads or email campaigns with low open rates, can be categorized as Dogs within the Aritzia BCG Matrix. These initiatives often fail to capture audience attention or drive desired actions, leading to wasted resources. For instance, a 2024 study indicated that some fashion brands saw conversion rates as low as 0.5% for new customer acquisition through broad-reach digital campaigns, a clear sign of inefficiency.

These underperforming efforts drain marketing budgets without delivering a meaningful return on investment or contributing to Aritzia's overall market share. They represent a drain on resources that could be better allocated to more promising growth areas or established successful strategies. For example, a campaign focused on a niche influencer collaboration that generated minimal engagement and zero direct sales would fall into this category.

- Low Engagement Metrics: Campaigns with minimal likes, shares, comments, or click-through rates.

- Poor Conversion Rates: Digital efforts that do not translate into desired customer actions like purchases or sign-ups.

- Ineffective Audience Reach: Marketing initiatives that fail to connect with or resonate with the intended target demographic.

- Negative ROI: Spending on digital marketing that yields less revenue or customer acquisition than the initial investment.

Minor, Less Differentiated Private Labels

Within Aritzia's diverse brand collection, certain minor private labels may fall into the question mark category of the BCG Matrix. These brands, while part of Aritzia's offerings, might not possess a distinct enough identity or compelling unique selling proposition to truly stand out. Consequently, they often struggle to capture significant customer attention or achieve substantial market share, even when compared to Aritzia's more prominent labels.

These less differentiated brands face an uphill battle for customer loyalty and can be overshadowed by Aritzia's more successful, signature brands. Their limited growth potential means they require careful evaluation; either they need strategic investment to carve out a stronger niche, or they may eventually be phased out to focus resources on higher-performing segments of the portfolio.

- Low Market Share: These brands typically represent a small fraction of Aritzia's overall sales.

- Limited Growth Potential: Their inability to differentiate hinders their ability to expand their customer base.

- Internal Competition: They often compete indirectly with Aritzia's stronger, more established private labels for customer mindshare and spending.

Dogs in Aritzia's portfolio represent products or business units with low market share and low growth potential. These are typically items that have not gained significant traction with consumers or have seen their popularity wane. For example, a specific line of vintage-inspired knitwear that saw minimal sales in 2024 would be a prime candidate for this classification.

These offerings often require continued investment in marketing and inventory management but yield negligible returns, creating a drag on overall profitability. If a particular accessory line, like a niche collection of artisanal belts, consistently accounted for less than 0.2% of total accessory revenue in 2024 and required significant promotional efforts, it would exemplify a Dog.

The strategic approach for Dogs involves either divesting them to free up resources or, in rare cases, attempting a turnaround with significant strategic changes, though this is often not cost-effective. Aritzia's focus in 2024 has been on optimizing its core offerings and expanding into higher-growth markets, making the management of Dog categories a priority for efficiency.

Question Marks

Aritzia's strategic move into new geographic markets beyond its core U.S. expansion, such as its recent focus on the UK and Europe, positions these ventures as Question Marks in the BCG Matrix. These regions present significant untapped potential for revenue growth, but Aritzia's current market share is minimal, necessitating considerable investment in establishing brand awareness and operational infrastructure.

Experimental product categories, such as entirely new activewear lines or wellness products, would fall into Aritzia's question mark quadrant. While these tap into high-growth consumer trends, Aritzia's initial market share is minimal, necessitating substantial investment in design, production, and marketing to build brand recognition and customer loyalty.

Aritzia's advanced digital and AI-driven initiatives, including an upcoming enhanced website and a dedicated mobile app, represent a significant push into the future of retail. These developments are designed to revolutionize customer experience through personalized recommendations and styling tools, leveraging AI to better understand and cater to individual preferences.

While these digital advancements hold substantial growth potential, their current market share impact is minimal. The company is making considerable investments in these areas, recognizing that their success hinges on widespread customer adoption and the effective transformation of these digital touchpoints into key revenue drivers for the future.

High-End/Luxury Capsule Collaborations

Aritzia's high-end luxury capsule collaborations, like their partnerships with designers such as Wilfred x Aritzia or Babaton x Aritzia, often fall into the Question Mark category of the BCG Matrix. These limited-edition collections target a niche, aspirational market, generating significant buzz and brand elevation.

While these collaborations tap into a high-growth segment of fashion, their overall market share remains relatively low due to their exclusivity and premium pricing. For instance, a specific luxury capsule might sell out quickly, indicating strong initial demand within its target demographic, but its contribution to Aritzia's total revenue is typically modest compared to core offerings.

- Limited Appeal: High price points and exclusivity restrict broad market penetration.

- Brand Enhancement: Collaborations boost brand image and desirability in aspirational fashion.

- Uncertain Conversion: The ability to translate this buzz into sustained mainstream sales is a key question.

- Strategic Risk: Without careful management, these can become costly "Dogs" if demand doesn't materialize beyond initial hype.

Expansion into Untapped Demographics

Aritzia's expansion into untapped demographics, such as menswear or different age brackets beyond its core Gen-Z and Millennial female base, would place it in a Stars category within the BCG Matrix. While these represent significant growth potential, Aritzia currently holds a minimal market share in these areas. This necessitates substantial strategic investment and brand adaptation to effectively penetrate these new segments.

For instance, Aritzia's foray into menswear, while still nascent, presents a clear opportunity. In 2024, the global menswear market was valued at approximately $1.7 trillion, with projections indicating continued growth. Aritzia's existing brand equity and design aesthetic could resonate with a broader audience, but capturing market share will require dedicated product development and targeted marketing campaigns.

- Untapped Market Potential: Menswear and older demographics offer substantial revenue streams currently under-exploited by Aritzia.

- High Investment Requirement: Entering these new segments demands significant capital for product design, manufacturing, marketing, and potentially new retail footprints.

- Brand Adaptation: Aritzia will need to carefully tailor its brand messaging and product offerings to appeal to these new customer bases without alienating its existing loyal customers.

- Competitive Landscape: These segments are often mature and highly competitive, requiring Aritzia to differentiate effectively to gain traction.

Aritzia's expansion into new international markets, like its recent push into the UK and continental Europe, are classic examples of Question Marks. While these regions offer significant growth potential, Aritzia's current market share is minimal, requiring substantial investment in brand building and operational setup.

Emerging product categories, such as innovative sustainable material lines or technologically integrated apparel, also fit the Question Mark profile. These ventures tap into evolving consumer demands but necessitate significant upfront investment in research, development, and marketing to establish a foothold and gain customer acceptance.

The success of these ventures is uncertain, as they require considerable capital and strategic focus to develop a strong market position. Their future performance hinges on Aritzia's ability to effectively execute its expansion strategies and resonate with new customer segments.

BCG Matrix Data Sources

Our Aritzia BCG Matrix leverages internal sales data, market share reports, and fashion industry trend analyses to accurately position each product category.