Aritzia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

Unlock the secrets to Aritzia's success with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and evolving social trends are shaping its future. Gain a competitive edge by understanding these external forces. Download the full PESTLE analysis now for actionable insights.

Political factors

Aritzia's global operations are highly sensitive to trade policies and tariffs, especially the ongoing trade dynamics between the U.S. and China. The company has made a strategic move to lessen its dependence on China, a significant manufacturing hub for many apparel brands.

To counter the impact of tariffs, Aritzia is actively diversifying its supply chain. They plan to reduce their production in China from 25% to a mid-single-digit percentage by spring 2025. This shift is a direct response to the economic pressures created by tariffs, which can significantly increase the cost of goods sold.

The company is expanding its manufacturing footprint into countries like Vietnam and Cambodia, alongside exploring new supplier relationships. This strategy aims to build a more resilient supply chain, mitigating the financial risks associated with tariffs and potential disruptions in any single sourcing region.

Governments in Aritzia's core markets, including Canada and the United States, are stepping up with new laws focused on labor standards and supply chain openness. For instance, Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act and California's Transparency in Supply Chains Act are pushing companies to be more accountable.

Aritzia's fiscal 2025 report details its proactive steps to tackle modern slavery risks, such as forced and child labor, within its supply network. This demonstrates a commitment to compliance with these evolving regulatory landscapes.

These governmental mandates require Aritzia to invest in thorough due diligence and ethical sourcing strategies. Such efforts can impact operational expenses but are crucial for maintaining brand integrity and consumer trust in an increasingly conscientious market.

New sustainability regulations, particularly in the EU and select US states, are increasingly shaping the fashion industry, demanding greater environmental accountability. For instance, the EU's Ecodesign for Sustainable Products Regulation, with its full implementation expected by 2025, and state-level bans on substances like PFAS, alongside textile Extended Producer Responsibility (EPR) programs, directly influence how companies operate.

Aritzia must proactively adapt its product design, material sourcing strategies, and waste management practices to align with these evolving legal frameworks. These regulations are designed to foster eco-friendly practices and significantly reduce the environmental footprint of fashion production, requiring substantial adjustments to ensure compliance and maintain market access.

Political Stability in Sourcing Countries

The political stability of countries where Aritzia sources materials and manufactures goods is crucial for its supply chain. Geopolitical tensions and changing international relationships can cause production delays, higher expenses, and ethical dilemmas. For instance, disruptions in key manufacturing hubs due to political instability can directly impact inventory levels and delivery times, as seen with past global supply chain challenges exacerbated by regional conflicts.

Aritzia's strategy to diversify production beyond China, exploring new sourcing countries, is a direct response to mitigate risks tied to the political climate of any single region. This diversification aims to build a more resilient supply chain, less susceptible to localized political shocks. For example, reports from late 2024 and early 2025 indicate increased scrutiny and potential trade policy shifts impacting Asian manufacturing, reinforcing the need for such diversification strategies.

- Supply Chain Vulnerability: Political instability in sourcing countries can lead to unpredictable disruptions, affecting Aritzia's ability to meet demand.

- Cost Implications: Geopolitical tensions can result in increased tariffs, shipping costs, and currency fluctuations, impacting Aritzia's profit margins.

- Ethical Sourcing Risks: Unstable political environments may present challenges in ensuring fair labor practices and ethical sourcing throughout the supply chain.

- Diversification Strategy: Aritzia's proactive approach to exploring new manufacturing locations aims to reduce reliance on any single country's political stability.

Consumer Protection and Data Privacy Laws

Aritzia, as a significant player in e-commerce and retail, must navigate a complex web of consumer protection and data privacy laws across its operating regions, primarily North America. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), significantly impact how Aritzia handles customer data. These laws grant consumers more control over their personal information, requiring robust consent mechanisms and clear data usage policies.

Compliance with these evolving regulations necessitates substantial investment in cybersecurity infrastructure and sophisticated data management systems. For instance, the CCPA, effective since 2020, has set a precedent for other US states, with several enacting similar legislation. This focus on data privacy directly influences Aritzia's digital marketing strategies and customer relationship management, demanding transparency and secure data handling practices to maintain consumer trust and avoid potential penalties.

- CCPA/CPRA Compliance: Aritzia must ensure its data collection, storage, and usage practices align with California's stringent privacy laws, impacting targeted advertising and personalization efforts.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, highlighting the financial imperative for Aritzia to invest in robust data security.

- Evolving Regulatory Landscape: With over a dozen US states enacting comprehensive data privacy laws by mid-2024, Aritzia faces a fragmented regulatory environment requiring continuous adaptation.

Aritzia's global sourcing strategy is heavily influenced by political factors, particularly trade policies and tariffs impacting its reliance on China. The company is actively diversifying its supply chain, aiming to reduce production in China from 25% to a mid-single-digit percentage by spring 2025, shifting manufacturing to countries like Vietnam and Cambodia to mitigate risks associated with trade tensions and potential disruptions.

Governments in key markets like Canada and the US are implementing stricter labor and supply chain transparency laws, such as Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act. Aritzia's fiscal 2025 report highlights its proactive measures to address modern slavery risks, demonstrating a commitment to compliance with these evolving regulations, which necessitate investments in due diligence and ethical sourcing.

New sustainability regulations, including the EU's Ecodesign for Sustainable Products Regulation and state-level bans on certain substances, are reshaping the fashion industry. Aritzia must adapt its product design, material sourcing, and waste management to comply with these mandates, which aim to reduce the environmental footprint of fashion production and ensure market access.

Political stability in sourcing regions is critical; geopolitical tensions can lead to production delays and increased costs. Aritzia's diversification strategy directly addresses these risks, aiming to create a more resilient supply chain less vulnerable to localized political instability, especially given increased scrutiny on Asian manufacturing reported in late 2024 and early 2025.

What is included in the product

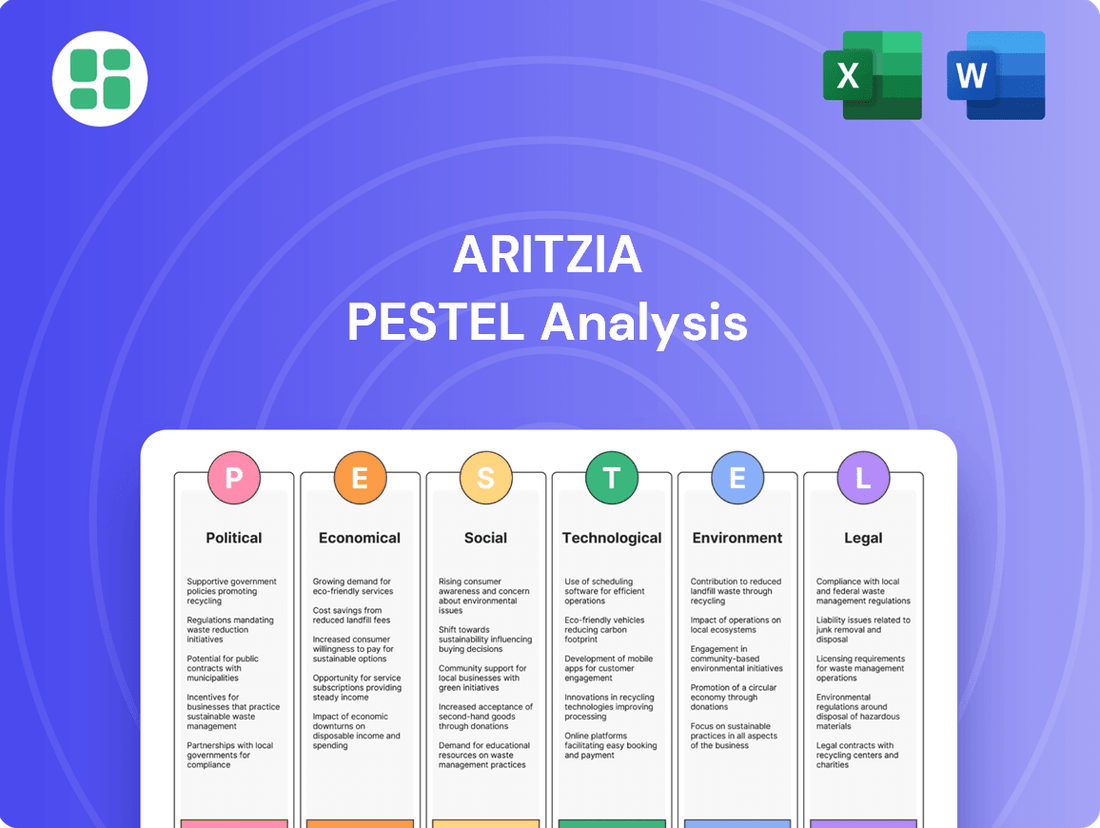

This Aritzia PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external forces shaping Aritzia's market landscape, identifying potential challenges and avenues for growth.

This Aritzia PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings and strategic planning.

By visually segmenting the analysis by PESTEL categories, it allows for quick interpretation at a glance, relieving the pain of sifting through complex data for key insights.

Economic factors

High inflation in early 2025 is directly impacting consumer spending power. As the cost of essentials like groceries and energy rises, discretionary income for items like fashion shrinks. This economic reality means consumers are becoming more cautious with their purchases.

This heightened price sensitivity is a major concern for premium retailers. Aritzia, known for its stylish apparel, faces a challenge as consumers increasingly prioritize needs over wants. Reports from early 2025 indicate a noticeable slowdown in apparel and luxury goods sales, with a shift towards spending on experiences like travel and essential goods.

The trend towards value consciousness is further amplified by the growing popularity of second-hand markets. Consumers are actively seeking discounts and exploring pre-owned options to stretch their budgets further. This behavior directly affects retailers that rely on full-price sales for a significant portion of their revenue.

Aritzia, being a Canadian company with substantial growth in the United States, closely monitors the exchange rate between the Canadian dollar (CAD) and the US dollar (USD). A stronger US dollar relative to the CAD can significantly enhance Aritzia's reported earnings when US sales are converted back to Canadian dollars.

For instance, in the fiscal year 2024, Aritzia reported that approximately 50% of its net revenue was generated in the United States. This geographical revenue split means that even small movements in the USD/CAD exchange rate can have a material impact on the company's consolidated financial results.

Conversely, a weakening US dollar against the Canadian dollar would reduce the value of those US-generated revenues when reported in CAD, potentially impacting profitability. Managing this currency exposure through hedging strategies is therefore a key element of Aritzia's financial risk management.

The general economic growth forecast and the possibility of recessionary pressures significantly impact how well the retail sector performs. The fashion industry, in particular, is seeing a slowdown, with revenue growth settling into the low single digits, which presents a challenging backdrop.

Aritzia demonstrated robust performance in Fiscal 2025, achieving growth in net revenue and comparable sales, highlighting its ability to withstand economic headwinds. However, the company itself points to a dynamic consumer environment and ongoing macro uncertainty, suggesting that future performance could be influenced by these broader economic trends.

Interest Rates and Access to Capital

Changes in interest rates directly affect Aritzia's borrowing costs for growth. For instance, if benchmark rates, like the Bank of Canada's overnight rate, which stood at 5.00% as of early 2024, were to increase, Aritzia's expenses for financing new stores or upgrading facilities would rise, potentially impacting profitability.

While Aritzia maintained a strong financial position with a healthy balance sheet reported in its fiscal year 2023 results, a sustained period of higher interest rates could make future capital expenditures, such as its aggressive expansion into the U.S. market, more costly. This is crucial given that access to capital is fundamental to executing its real estate development plans.

- Interest Rate Impact: Higher interest rates can increase the cost of debt financing for Aritzia's expansion projects.

- Capital Access for Growth: Aritzia's ambitious U.S. real estate expansion strategy relies heavily on consistent and affordable access to capital.

- Fiscal Year 2023 Financials: Aritzia reported robust financials, but future borrowing costs are sensitive to prevailing interest rate environments.

Supply Chain Costs and Logistics

Aritzia, like many apparel retailers, faces significant pressure from rising supply chain costs. Increases in raw material prices, manufacturing expenses, and global freight rates directly impact the company's gross profit margins. For instance, the cost of cotton, a key material, saw significant volatility in 2024, with some reports indicating price increases of over 20% year-over-year for certain grades.

To counter these pressures, Aritzia has been actively optimizing its inventory management and implementing 'smart spending initiatives'. These strategies aim to mitigate the impact of escalating costs on product pricing and overall profitability. However, persistent global shipping disruptions and rising labor costs in key manufacturing regions continue to present ongoing challenges.

The impact of these supply chain dynamics is substantial. For example, a 5% increase in freight costs could translate to a noticeable reduction in gross margin for a company like Aritzia, depending on its ability to pass these costs onto consumers. The company's ability to navigate these complexities will be crucial for maintaining its competitive edge and financial performance through 2025.

- Global freight rates experienced a surge in late 2023 and early 2024, with some maritime routes seeing cost increases exceeding 50% compared to pre-pandemic levels due to geopolitical tensions and capacity constraints.

- Manufacturing expenses, particularly in Southeast Asia, have been affected by rising minimum wage laws and increased energy costs, adding to the overall cost of goods sold.

- Aritzia's focus on inventory optimization aims to reduce carrying costs and minimize markdowns, indirectly buffering the impact of higher inbound logistics expenses.

Persistent inflation in early 2025 is eroding consumer purchasing power, forcing a shift from discretionary fashion spending towards essential goods and experiences. This economic climate directly challenges premium retailers like Aritzia, as consumers become more price-sensitive and explore value-oriented options such as the growing second-hand market.

The exchange rate between the Canadian dollar (CAD) and the US dollar (USD) significantly impacts Aritzia's reported earnings, given that approximately 50% of its revenue originated from the U.S. in fiscal year 2024. A stronger USD enhances reported CAD earnings, while a weaker USD reduces them, necessitating careful currency risk management.

Rising interest rates, exemplified by the Bank of Canada's 5.00% overnight rate in early 2024, increase Aritzia's borrowing costs for expansion, potentially impacting profitability and the execution of its U.S. real estate development plans despite a strong fiscal year 2023 balance sheet.

Supply chain cost pressures, including a potential 20% year-over-year increase in cotton prices in 2024 and surging freight rates, directly affect Aritzia's gross profit margins. The company's inventory optimization and 'smart spending initiatives' aim to mitigate these impacts amidst ongoing global shipping disruptions and rising manufacturing labor costs.

| Economic Factor | Impact on Aritzia | Data Point/Example |

| Inflation | Reduced consumer discretionary spending | Shift towards essentials and experiences |

| Exchange Rate (USD/CAD) | Affects reported earnings from U.S. sales | ~50% of FY2024 revenue from U.S. |

| Interest Rates | Increased cost of capital for expansion | Bank of Canada overnight rate at 5.00% (early 2024) |

| Supply Chain Costs | Pressure on gross profit margins | Cotton price increases >20% (2024); Freight rates up >50% (late 2023/early 2024) |

Preview Before You Purchase

Aritzia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Aritzia provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into Aritzia's market position and future outlook by examining these crucial external influences.

Sociological factors

Consumers are increasingly vocal about their desire for transparency and ethical production. A 2024 report indicated that over 60% of Gen Z and Millennial shoppers consider a brand's sustainability practices when making purchasing decisions. This means Aritzia needs to actively showcase its commitment to fair labor and responsible sourcing to resonate with this growing demographic.

The fashion industry is seeing a significant shift with the rise of gender-fluid and inclusive styles. This reflects a broader societal move towards embracing diverse identities and self-expression. For instance, a 2024 report indicated that 45% of Gen Z consumers actively seek out brands that champion inclusivity, a key demographic for fashion retailers.

Aritzia can leverage this by expanding its offerings to include more versatile, unisex pieces. This strategy not only caters to a growing demand but also aligns with evolving consumer values, potentially attracting a wider and more loyal customer base. Brands that demonstrate a genuine commitment to inclusivity often see enhanced brand perception and customer engagement.

Social media platforms are powerful drivers of fashion trends and consumer choices. Aritzia effectively uses digital marketing, with Instagram and TikTok being key channels for engaging customers and boosting sales. For instance, in the first quarter of fiscal 2025, Aritzia reported a 17% increase in net revenue, partly fueled by its strong digital engagement strategies.

Aging Population and 'Silver Generation' Spending

The demographic shift towards an aging population, often referred to as the 'Silver Generation' (consumers over 50), presents a significant, yet often overlooked, opportunity for the fashion industry. This group controls a substantial portion of global wealth and is a key driver of spending growth. For instance, in 2024, it's projected that individuals aged 50 and over will account for a significant percentage of discretionary spending globally, a trend expected to continue through 2025.

Aritzia, with its current strong appeal to younger demographics, could strategically expand its market by tailoring offerings to this financially resilient and fashion-conscious segment. The 'Silver Generation' often exhibits higher per capita fashion spending compared to younger cohorts, demonstrating a willingness to invest in quality and style. Data from late 2023 and early 2024 indicates that this age group is increasingly seeking sophisticated, comfortable, and versatile clothing options.

- Growing Wealth: Consumers aged 50+ are projected to control an increasing share of global wealth, estimated to reach trillions of dollars by 2025.

- Higher Spending Power: This demographic often has more disposable income and less debt than younger consumers, enabling higher fashion expenditure.

- Demand for Quality: The Silver Generation tends to prioritize quality, fit, and timeless style over fast-fashion trends, presenting an opportunity for Aritzia's premium positioning.

- Market Potential: By 2025, the spending power of consumers over 50 is expected to represent a substantial percentage of the total retail market, offering significant growth potential.

Demand for 'Everyday Luxury' and Quality

Aritzia's core strategy revolves around 'Everyday Luxury,' a concept resonating with a growing consumer preference for enduring quality and value. This trend sees shoppers increasingly prioritizing well-made, lasting garments over fleeting fashion trends, particularly when seeking demonstrable value for their money. In 2024, with ongoing economic considerations, consumers are more likely to invest in pieces that offer longevity and a premium feel.

The company's commitment to premium fabrics and detailed craftsmanship directly addresses this demand. This focus on durability and sophisticated design appeals to a segment of the market willing to pay more for items that stand the test of time, even during periods of economic fluctuation. For instance, Aritzia reported a significant increase in comparable store sales in its fiscal year 2024, indicating strong consumer response to its quality-focused offerings.

- Consumer Shift: Growing demand for durable, high-quality apparel over fast fashion.

- Value Perception: Shoppers increasingly evaluate perceived value for money in clothing purchases.

- Aritzia's Strategy: Focus on premium materials and construction aligns with this trend.

- Market Resilience: 'Everyday Luxury' appeals to consumers seeking long-term value, even in uncertain economic climates.

Societal values are increasingly emphasizing sustainability and ethical practices, with a 2024 survey showing over 60% of Gen Z and Millennials consider a brand's environmental impact when buying. This necessitates Aritzia to highlight its commitment to responsible sourcing and fair labor to connect with these key consumer groups.

The fashion landscape is evolving with a strong push towards gender-fluid and inclusive styles, reflecting a broader societal acceptance of diverse identities. Reports from 2024 indicate that approximately 45% of Gen Z consumers actively seek brands that champion inclusivity, making this a crucial demographic for fashion retailers.

Aritzia can capitalize on this trend by expanding its product lines to include more versatile, unisex apparel. This approach not only meets growing consumer demand but also aligns with shifting values, potentially fostering a larger and more dedicated customer base.

Social media plays a pivotal role in shaping fashion trends and consumer decisions, with Aritzia effectively utilizing platforms like Instagram and TikTok for customer engagement and sales growth. Aritzia's net revenue saw a 17% increase in Q1 fiscal 2025, partly attributed to its robust digital marketing efforts.

The growing demographic of consumers over 50, often termed the 'Silver Generation,' represents a significant, yet often underutilized, market opportunity in fashion. This segment commands substantial global wealth and is a major driver of consumer spending. Projections for 2024 indicate that individuals aged 50 and above will contribute a considerable portion of global discretionary spending, a trend anticipated to persist into 2025.

Aritzia, known for its appeal to younger demographics, could strategically broaden its market reach by developing offerings tailored to this financially stable and style-conscious age group. The 'Silver Generation' typically spends more per capita on fashion than younger consumers, demonstrating a readiness to invest in quality and enduring style. Data from late 2023 and early 2024 suggests this demographic is increasingly looking for sophisticated, comfortable, and adaptable clothing options.

| Sociological Factor | Description | Aritzia's Relevance/Action | Supporting Data (2024/2025) |

|---|---|---|---|

| Ethical Consumerism | Demand for transparency, sustainability, and fair labor practices. | Highlighting ethical sourcing and production to appeal to conscious consumers. | 60%+ of Gen Z/Millennials consider sustainability in purchasing (2024). |

| Inclusivity & Diversity | Shift towards gender-fluid and diverse style representation. | Expanding offerings to include unisex and inclusive designs. | 45% of Gen Z seek inclusive brands (2024). |

| Demographic Shifts | Growth of the 'Silver Generation' (50+) with significant spending power. | Developing targeted collections for the mature, affluent market. | Silver Generation's spending power projected to increase significantly by 2025. |

| Value-Based Consumption | Preference for 'Everyday Luxury,' quality, and longevity over fast fashion. | Emphasizing premium materials and timeless design in Aritzia's collections. | Strong comparable store sales growth in FY2024 indicates positive consumer response to quality. |

Technological factors

The ongoing surge in e-commerce, coupled with the demand for seamless omnichannel experiences, represents a significant technological driver. Aritzia is actively bolstering its e-commerce capabilities and digital strategies to fuel continued online growth.

By merging its physical stores with online channels, Aritzia crafts a cohesive shopping journey, boosting customer ease and fostering stronger brand allegiance. This integration is key to meeting evolving consumer expectations in the digital age.

AI and machine learning are revolutionizing retail through hyper-personalization. This means everything from spot-on product suggestions to virtual fitting rooms and smarter stock management. For Aritzia, using AI to understand customer data and anticipate their tastes can lead to much more engaging shopping journeys, boosting satisfaction and sales.

Aritzia leverages advanced data analytics to deeply understand its customers and the market. For instance, by analyzing sales data and online engagement, the company can identify emerging fashion trends and predict demand for specific styles, allowing for more targeted inventory management. This data-driven approach helps refine product assortments, ensuring they resonate with the target demographic.

The company's business intelligence capabilities are crucial for optimizing marketing spend and improving operational efficiency. By tracking campaign performance and customer acquisition costs, Aritzia can allocate resources more effectively, maximizing return on investment. In 2023, Aritzia reported a 36% increase in net revenue, partly attributed to its enhanced ability to connect with customers through personalized marketing efforts informed by data.

Supply Chain Technology and Automation

Technological advancements are revolutionizing supply chain management. Automation in distribution centers, for instance, is significantly boosting efficiency. In 2023, companies adopting advanced robotics saw an average reduction in order processing times by up to 30%, directly translating to lower operational costs.

Aritzia leverages these technologies to optimize its global supply chain. Improved tracking systems provide real-time visibility, enabling faster fulfillment and a more agile response to changing consumer demand. This technological integration is crucial for managing a complex, international network and ensuring inventory accuracy.

Key technological benefits for Aritzia's supply chain include:

- Enhanced Efficiency: Automation in warehouses and distribution centers streamlines operations, reducing labor costs and speeding up order processing.

- Improved Inventory Management: Advanced tracking and data analytics allow for more precise inventory control, minimizing stockouts and overstock situations.

- Greater Responsiveness: Real-time data and predictive analytics enable Aritzia to adapt quickly to demand shifts, ensuring products are available when and where customers want them.

- Cost Reduction: By optimizing logistics and reducing manual processes, technology contributes to a more cost-effective supply chain.

Digital Marketing and Social Commerce Tools

The continuous evolution of digital marketing and social commerce platforms offers Aritzia significant new pathways for engaging customers and driving sales. By investing in digital marketing, Aritzia aims to both safeguard and advance its brand presence in a competitive landscape.

The growing prevalence of interactive features such as shoppable posts, direct product links within videos, and strategic influencer partnerships on platforms like Instagram and TikTok are crucial for Aritzia to connect with and convert today's digitally-savvy consumers. For instance, Aritzia's Q3 2024 earnings report highlighted a continued focus on leveraging these digital channels to enhance customer reach and conversion rates, reflecting the increasing importance of social commerce in their overall strategy.

- Digital Marketing Investment: Aritzia strategically invests in digital marketing to reinforce brand identity and expand market reach.

- Social Commerce Growth: The rise of shoppable posts and in-video links on platforms like Instagram and TikTok directly impacts Aritzia's sales funnel.

- Influencer Collaborations: Partnerships with influencers are vital for Aritzia to tap into new demographics and build authentic brand connections.

- Consumer Engagement: These digital tools are essential for Aritzia to interact with and understand modern consumer behavior, driving loyalty and sales.

Aritzia's commitment to enhancing its e-commerce platform and integrating it with physical stores is a key technological focus, aiming to provide a seamless omnichannel experience. The company's strategic use of AI and machine learning for hyper-personalization, from product recommendations to virtual try-ons, aims to deepen customer engagement and boost sales. Furthermore, Aritzia's investment in advanced data analytics allows for keen insights into customer behavior and market trends, informing product assortment and marketing strategies. For example, in fiscal 2024, Aritzia reported that its digital channels continued to be a significant growth driver, with online net revenue increasing by 35% year-over-year.

| Metric | Value | Year |

| Online Net Revenue Growth | 35% | Fiscal 2024 |

| Digital Channels Contribution | Significant Growth Driver | Fiscal 2024 |

Legal factors

Aritzia's operations across North America necessitate strict adherence to a patchwork of labor laws. These range from minimum wage requirements, which saw various increases across Canadian provinces and US states in 2024, to detailed regulations on working conditions and employment standards. For instance, in 2024, several Canadian provinces raised their minimum wage rates, directly impacting Aritzia's retail staff costs.

As Aritzia continues its expansion, particularly with new store openings planned for 2025, managing compliance with these evolving labor regulations becomes increasingly complex. Ensuring fair labor practices and maintaining a safe working environment are paramount to avoiding legal penalties and reputational damage.

The company's commitment extends to its global supply chain, where it actively works to mitigate risks associated with forced and child labor. Through robust due diligence and monitoring programs, Aritzia aims to uphold ethical sourcing standards, a critical factor given increasing consumer and regulatory scrutiny on supply chain transparency in 2024 and beyond.

Consumer protection laws are crucial for ensuring Aritzia operates with integrity, mandating fair dealings, product safety, and truthful advertising. This means Aritzia's marketing campaigns must strictly adhere to regulations preventing deceptive practices, particularly concerning sustainability claims, to avoid accusations of greenwashing.

The Digital Markets, Competition and Consumers Act 2024 in the UK exemplifies the increasing regulatory scrutiny, empowering authorities to impose significant fines for breaches of consumer law. For example, the Competition and Markets Authority (CMA) has actively pursued businesses for misleading environmental claims, underscoring the financial and reputational risks of non-compliance for companies like Aritzia.

Aritzia's legal strategy heavily relies on safeguarding its exclusive fashion brands and designs from counterfeiting and unauthorized replication. This is paramount for maintaining brand integrity and its competitive edge in the fast-paced fashion industry. The company actively utilizes trademarks, copyrights, and design patents to protect its unique aesthetic and product offerings.

International Trade Laws and Customs Regulations

Aritzia's global supply chain is subject to a complex web of international trade laws and customs regulations. These rules govern how goods move across borders, including tariffs, quotas, and documentation requirements. For instance, changes in trade policies, such as those affecting apparel imports from countries like China or Vietnam, can significantly impact Aritzia's cost of goods sold and lead times. In 2024, the ongoing evolution of trade relationships means Aritzia must remain agile in adapting its sourcing and logistics to mitigate potential disruptions and ensure compliance.

Navigating these regulations is crucial for maintaining smooth operations and avoiding costly penalties. For example, in 2023, the US Customs and Border Protection continued to enforce regulations related to forced labor, which can lead to detentions and seizures of goods, underscoring the importance of supply chain transparency. Aritzia's commitment to compliance directly supports its ability to deliver products efficiently to its global customer base.

- Tariff Volatility: Fluctuations in import duties, particularly on textiles and apparel, can impact Aritzia's profitability. For example, a 7.5% tariff on certain goods from China, which was a point of discussion in 2023-2024, directly affects the landed cost of inventory.

- Trade Agreement Impact: Changes or renewals of trade agreements, like the USMCA, can create opportunities or challenges for sourcing and market access. Staying informed about these shifts is vital for strategic planning.

- Customs Compliance: Adherence to customs procedures, including accurate product classification and valuation, is essential to prevent delays and fines. In 2024, increased scrutiny on e-commerce shipments means robust compliance systems are paramount.

Sustainability and Environmental Compliance Legislation

Aritzia must navigate a landscape of increasing environmental regulations impacting the fashion sector. Legislation targeting harmful chemicals, such as per- and polyfluoroalkyl substances (PFAS), and the implementation of Extended Producer Responsibility (EPR) schemes for textile waste are becoming more prevalent. For instance, by 2023, several US states, including California and New York, have advanced or enacted EPR legislation for textiles, requiring brands to manage the end-of-life of their products.

Adapting to these evolving legal requirements means Aritzia needs to scrutinize its material sourcing and develop robust strategies for managing textile waste. This includes ensuring compliance with both federal and state-level environmental mandates in its primary operating regions.

- PFAS Bans: Regulations prohibiting the use of PFAS in apparel are gaining traction, impacting water-repellent finishes and other functional treatments.

- EPR Programs: Extended Producer Responsibility laws are emerging, placing the onus on brands to finance and manage the collection and recycling of post-consumer textiles.

- Chemical Restrictions: Beyond PFAS, other chemical restrictions related to dyes and finishing agents are being introduced, requiring careful supply chain oversight.

- Reporting Requirements: Increased transparency demands may lead to new reporting obligations concerning environmental impact and material composition.

Aritzia's commitment to ethical sourcing means navigating international labor laws and regulations designed to prevent forced and child labor. In 2024, increased global focus on supply chain transparency, exemplified by ongoing enforcement actions by bodies like US Customs and Border Protection, necessitates rigorous due diligence. Failure to comply can result in significant financial penalties and reputational damage, impacting Aritzia's ability to import goods and maintain consumer trust.

Environmental factors

Consumer demand for eco-conscious fashion is a significant environmental factor. Aritzia is responding by prioritizing sustainably sourced cotton, aiming to reduce its environmental footprint. This commitment extends to rigorous supplier assessments and the adoption of lower-impact materials, reflecting a broader industry trend toward greener production methods.

The fashion industry is actively embracing waste reduction and circular economy principles, with a growing emphasis on reuse, repair, and recycling. This shift is crucial as the Ellen MacArthur Foundation reported that textile waste generation globally is projected to increase by 50% by 2030 if current trends continue.

Aritzia is actively engaged in these efforts, committed to its Zero Waste Philosophy Program and aiming for its expansion. This aligns with broader industry trends where brands are increasingly incorporating sustainability into their core operations.

The surge in popularity of second-hand and thrift shopping, fueled by heightened environmental consciousness, offers significant opportunities for brands like Aritzia to participate in the circular fashion movement. For instance, the resale market for clothing is expected to double in value between 2022 and 2027, reaching an estimated $350 billion globally.

Aritzia actively addresses carbon emissions and climate change, a critical environmental factor for businesses. The company tracks its Scope 1, 2, and 3 greenhouse gas emissions, demonstrating a commitment to understanding its environmental footprint.

Maintaining carbon neutrality since 2010, Aritzia utilizes renewable energy credits and carbon offset projects to achieve this status. This long-standing commitment underscores their dedication to environmental responsibility, with a focus on reducing energy consumption across all operational areas.

Water Usage in the Supply Chain

Water scarcity and pollution represent significant environmental challenges, especially within the textile industry where water-intensive processes are common. Aritzia actively tracks its water consumption across its supply chain, demonstrating a commitment to reducing its environmental footprint.

The company's focus on improving water efficiency and mitigating pollution throughout its manufacturing processes is a key aspect of its sustainability strategy. For example, in 2023, the apparel industry globally consumed an estimated 79 billion cubic meters of water, highlighting the scale of the issue.

- Water Scarcity: Textile dyeing and finishing alone can account for a substantial portion of a garment's water footprint.

- Pollution Concerns: Wastewater from factories can contain dyes, chemicals, and microfibers, impacting local water sources.

- Aritzia's Approach: The company is investing in technologies and partnerships to promote water conservation and cleaner production methods.

- Industry Benchmarks: By 2025, the global textile market is projected to see increased regulatory scrutiny on water usage and discharge quality.

Chemical Management and Hazardous Substances

Regulations like the proposed PFAS ban in textiles, expected to impact many apparel brands by 2025, underscore the critical need for robust chemical management. Aritzia must proactively ensure its supply chain adheres to these evolving restrictions to safeguard consumer health and environmental integrity.

This necessitates rigorous monitoring of all material inputs and manufacturing processes to guarantee compliance with global hazardous substance regulations. For instance, the EU's REACH regulation continues to evolve, requiring ongoing assessment of chemical safety in imported goods.

- PFAS Bans: Anticipated 2025 regulations on per- and polyfluoroalkyl substances in textiles demand Aritzia's attention to material sourcing.

- REACH Compliance: Ongoing adherence to the EU's Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) is vital for market access.

- Supply Chain Transparency: Aritzia's commitment to responsible chemical management requires deep visibility into its manufacturing partners' practices.

- Consumer Safety: Ensuring products are free from harmful substances directly impacts brand reputation and consumer trust.

Aritzia's environmental strategy is deeply intertwined with consumer expectations for sustainability. The company's focus on sourcing eco-friendly materials and its Zero Waste Philosophy Program reflect a commitment to reducing its ecological impact. This proactive approach is crucial as the fashion industry faces increasing pressure to adopt circular economy principles, with textile waste projected to grow significantly by 2030.

The company's dedication to carbon neutrality since 2010, supported by renewable energy credits and offsets, highlights its long-term environmental stewardship. Furthermore, Aritzia's efforts to manage water consumption and pollution in its supply chain are vital, given the industry's substantial water footprint. By 2025, the global textile market anticipates heightened regulatory oversight on water usage, making Aritzia's current practices particularly relevant.

| Environmental Factor | Aritzia's Response/Data | Industry Trend/Data |

|---|---|---|

| Sustainable Sourcing | Prioritizing sustainably sourced cotton. | Growing demand for eco-conscious fashion. |

| Waste Reduction | Zero Waste Philosophy Program. | Textile waste projected to increase 50% by 2030. |

| Carbon Neutrality | Carbon neutral since 2010. | Increasing focus on Scope 1, 2, and 3 emissions. |

| Water Management | Tracking water consumption; improving efficiency. | Apparel industry consumed ~79 billion cubic meters of water in 2023. |

| Chemical Management | Ensuring compliance with evolving regulations (e.g., PFAS, REACH). | PFAS ban in textiles expected by 2025. |

PESTLE Analysis Data Sources

Our Aritzia PESTLE Analysis is built on a comprehensive review of data from reputable industry publications, financial reports, and government statistics. We incorporate insights from market research firms, economic forecasts, and fashion industry trend reports to ensure a well-rounded perspective.