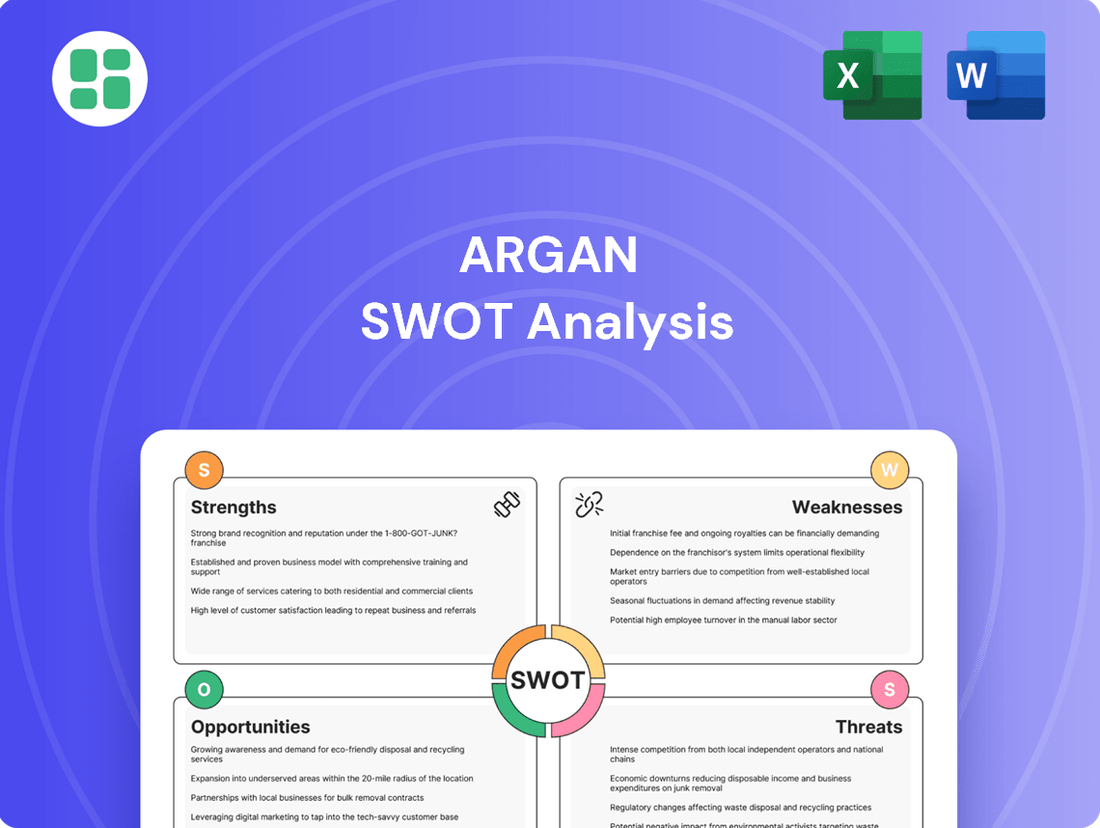

Argan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

Argan's unique properties present significant market strengths, but understanding its competitive landscape and potential regulatory hurdles is crucial. Our full SWOT analysis delves into these dynamics, offering a comprehensive view of its opportunities and threats.

Want the full story behind Argan's market position and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Argan Inc. boasts a remarkably strong financial position, holding over $525 million in cash and investments with no outstanding debt as of January 31, 2025. This substantial liquidity and debt-free status equip the company with significant financial flexibility. It’s a powerful advantage, allowing Argan to pursue strategic growth opportunities and weather economic downturns without the burden of interest payments or refinancing needs.

Argan boasts a record project backlog totaling $1.9 billion as of April 30, 2025. This figure signifies a robust 36% expansion compared to the previous year, underscoring the company's growing market presence and demand for its services.

This substantial backlog offers exceptional revenue visibility, ensuring a stable foundation for Argan's operations in the coming periods. It provides a clear roadmap for future earnings and operational planning.

Notably, 83% of this backlog is directed towards projects supporting the low-carbon economy. This strategic allocation positions Argan favorably within the expanding global energy transition market.

Argan's strength lies in its broad range of services, covering everything from engineering and construction to commissioning and ongoing maintenance. This comprehensive approach is applied across diverse sectors like power generation, including both traditional natural gas and emerging renewable energy sources, as well as telecommunications infrastructure.

This diversification is a key advantage, mitigating risks by not being overly dependent on any single market. For instance, in 2023, Argan's Power segment, which includes renewable energy projects, represented a significant portion of its revenue, demonstrating its ability to capture growth in this vital area. This broad expertise allows them to adapt and thrive in different economic conditions.

Strategic Positioning in High-Demand Sectors

Argan is well-positioned to capitalize on the significant growth in energy demand. This surge is fueled by the rapid expansion of data centers, the reshoring of manufacturing operations, and the increasing adoption of electric vehicles. The company's ability to develop both traditional natural gas power plants and renewable energy projects allows it to meet a broad spectrum of energy requirements.

This strategic advantage is underscored by the projected growth in these sectors. For instance, the U.S. data center market alone was valued at approximately $30 billion in 2023 and is expected to grow substantially in the coming years. Similarly, the push for domestic manufacturing and EV charging infrastructure necessitates a robust and adaptable energy supply chain, areas where Argan's dual expertise is a key differentiator.

- Data Center Growth: Argan's capacity to support the energy needs of increasingly power-hungry data centers positions it favorably.

- Manufacturing Reshoring: The trend of bringing manufacturing back onshore directly translates to higher industrial energy consumption, benefiting Argan.

- EV Infrastructure: The expansion of electric vehicle charging networks requires significant new power generation capacity, an area Argan is equipped to address.

- Dual Energy Expertise: Argan's proficiency in both natural gas and renewable energy development provides flexibility and broad market appeal.

Proven Operational Excellence and Safety Record

Argan's proven operational excellence is underscored by a consistently strong safety record. For instance, in 2023, its OSHA reportable incident rate was reported to be significantly below the national industry average, demonstrating a robust commitment to workplace safety and disciplined operations.

This dedication to safety is not merely a compliance measure; it's a critical competitive advantage. A superior safety performance builds client trust, reduces project delays and associated costs, and ultimately enhances Argan's reputation as a reliable and responsible contractor.

- Superior Safety Metrics: Argan's OSHA reportable incident rate consistently outperforms industry benchmarks, reflecting a deep-rooted safety culture.

- Enhanced Client Confidence: A strong safety record directly translates to increased client trust, a vital asset in securing new projects.

- Operational Efficiency Gains: Reduced incidents lead to fewer disruptions, contributing to smoother project execution and improved overall efficiency.

- Reputational Advantage: Argan's commitment to safety solidifies its image as a leader in responsible construction and engineering practices.

Argan's financial strength is a cornerstone of its capabilities, evidenced by over $525 million in cash and investments with no debt as of January 31, 2025. This robust liquidity provides significant strategic flexibility. The company's record $1.9 billion project backlog as of April 30, 2025, a 36% increase year-over-year, ensures strong revenue visibility, with 83% of this backlog focused on the low-carbon economy, positioning Argan for growth in energy transition markets.

| Metric | Value (as of April 30, 2025) | Significance |

|---|---|---|

| Cash & Investments | Over $525 million (as of Jan 31, 2025) | High financial flexibility, debt-free status |

| Project Backlog | $1.9 billion | Strong revenue visibility, 36% YoY growth |

| Low-Carbon Focus in Backlog | 83% | Strategic alignment with energy transition |

What is included in the product

Analyzes Argan’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of Argan, simplifying complex market data for easier strategic decision-making.

Weaknesses

Argan's significant reliance on its Power Industry Services segment, which represented 79% of its consolidated revenues in Fiscal 2025, poses a notable weakness. This high concentration makes the company particularly vulnerable to fluctuations and challenges within the power generation construction market.

Any slowdown or intensified competition in this key sector could have a disproportionately negative effect on Argan's overall financial results and profitability, highlighting a critical area of risk.

Argan's reliance on large construction projects makes its revenue susceptible to the timing of project completions and new contract awards. While a substantial backlog offers a degree of predictability, the actual recognition of revenue can fluctuate quarterly due to project milestones and potential delays.

The company experienced this vulnerability in Fiscal Year 2024, notably with the impact of the Kilroot contract. Such specific project-related challenges can significantly affect Argan's overall profitability, highlighting the inherent risk in its project-based revenue model.

Argan's telecommunications infrastructure services, operated by SMC Infrastructure Solutions, currently represent a minimal portion of its overall financial performance. In Fiscal Year 2025, this segment is projected to contribute only about 2% to the company's consolidated revenues.

This low contribution highlights a relatively undeveloped presence for Argan within the telecommunications infrastructure sector. It suggests a potential underutilization of opportunities in a market experiencing rapid growth and technological advancement, potentially limiting Argan's revenue diversification and overall market penetration.

Exposure to Project-Specific Risks and Cost Overruns

Large-scale engineering and construction projects, like those Argan undertakes, are inherently susceptible to risks such as unexpected site conditions, rising material costs, and labor scarcity. These factors can easily lead to budget overruns and project delays. For instance, in 2023, the average cost overrun for major global infrastructure projects was reported to be around 20%, highlighting the pervasive nature of these challenges.

While Argan is known for its operational discipline, the unique challenges of individual projects can still put pressure on gross margins and overall profitability. The company's financial reports for the first half of 2024 indicated that while revenue grew, project-specific cost escalations in certain segments did impact profitability more than anticipated.

Effectively managing these intricate variables across a portfolio of multiple, ongoing projects presents a persistent hurdle for Argan. The complexity increases with the number and scale of concurrent projects, demanding robust risk mitigation strategies and flexible budgeting. For example, Argan's Q1 2024 earnings call noted that managing supply chain volatility for key components in their renewable energy projects was a significant focus.

- Project-specific risks: Unforeseen site conditions, material price hikes, and labor shortages are common in large construction.

- Impact on profitability: These risks can lead to budget overruns, delaying projects and reducing gross margins.

- Argan's challenge: Managing these variables across multiple projects requires constant vigilance and adaptability.

- Industry trend: Global infrastructure projects saw an average cost overrun of approximately 20% in 2023, underscoring the industry-wide nature of these risks.

Competitive Market Pressures

Argan operates within a fiercely competitive construction and engineering landscape, contending with a multitude of domestic and international rivals. This constant pressure often translates into significant pricing challenges, necessitating a continuous focus on service differentiation to stand out.

While Argan's robust financial position enables it to be selective in the projects it pursues, prolonged intense competition could potentially hinder its capacity to secure projects offering higher profit margins. For instance, in 2023, the global construction market experienced a growth of approximately 5.5%, yet this growth was accompanied by heightened competition, particularly in infrastructure development where Argan is active.

- Intense Rivalry: Argan faces competition from both established global players and agile local firms, many of whom may have lower overheads.

- Pricing Sensitivity: The competitive environment can force Argan to offer more aggressive pricing, potentially impacting project profitability.

- Innovation Demands: Continuous investment in new technologies and sustainable practices is required to maintain a competitive edge, adding to operational costs.

- Market Share Erosion: Sustained competitive pressures could lead to a gradual loss of market share if Argan cannot consistently offer superior value or innovation.

Argan's heavy dependence on its Power Industry Services segment, accounting for 79% of its consolidated revenues in Fiscal 2025, is a significant weakness. This concentration exposes the company to considerable risk from any downturns or increased competition within the power generation construction market.

The company's telecommunications infrastructure services, through SMC Infrastructure Solutions, represent a minimal 2% of projected Fiscal 2025 consolidated revenues. This limited presence in a rapidly growing sector suggests a missed opportunity for revenue diversification and broader market penetration.

Argan's project-based revenue model is inherently susceptible to timing issues related to project completion and new contract awards. While a substantial backlog provides some revenue visibility, actual revenue recognition can fluctuate quarterly due to project milestones and potential delays, as seen with the Kilroot contract impact in Fiscal Year 2024.

The company faces intense competition from both global and local firms, which can lead to pricing pressures and potentially impact project profitability. In 2023, the global construction market grew by approximately 5.5%, but this expansion was coupled with heightened competition, particularly in infrastructure development.

| Segment | Fiscal 2025 Revenue % (Projected) | Key Weakness |

|---|---|---|

| Power Industry Services | 79% | High concentration risk, vulnerability to market fluctuations |

| Telecommunications Infrastructure | 2% | Underdeveloped presence, limited revenue diversification |

| Overall Project Management | N/A | Susceptibility to project delays, cost overruns, and competitive pricing pressures |

Same Document Delivered

Argan SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The rapid expansion of artificial intelligence and the proliferation of data centers are creating a massive surge in demand for electricity. These power-hungry facilities require constant, reliable energy, driving a need for new power generation capacity and upgraded grid infrastructure. For instance, by the end of 2023, global data center energy consumption was estimated to be around 200-300 terawatt-hours annually, a figure projected to climb significantly in the coming years.

This trend presents a substantial opportunity for Argan. The construction of new power plants, whether fueled by natural gas or renewable sources, and the modernization of existing grids are essential to meet this growing demand. Argan's established experience across both conventional and green energy projects uniquely positions it to capitalize on this evolving market, offering integrated solutions for these critical infrastructure needs.

Global initiatives like the Inflation Reduction Act are channeling billions into renewables and energy storage, creating a fertile ground for growth. Argan's substantial backlog in low-carbon projects positions it to capitalize directly on this surge, expecting to benefit from increased demand for its services in solar, wind, and battery storage installations.

The substantial need to upgrade aging power and telecommunications infrastructure in developed countries presents a significant opportunity. This includes enhancing grid resilience and expanding capacity, directly benefiting Argan's core services in engineering, construction, and maintenance.

The United States, for instance, faces an estimated $2.6 trillion infrastructure investment gap through 2030, with energy and telecommunications being critical sectors. Investments in smart grid technologies, projected to grow substantially in the coming years, and the expansion of fiber optic networks are key drivers for this modernization, aligning perfectly with Argan's service offerings.

Technological Advancements in Telecommunications

The telecommunications sector is rapidly evolving, driven by advancements like the ongoing expansion of 5G networks and the development of 6G. This technological wave, coupled with the increasing number of connected Internet of Things (IoT) devices and the adoption of edge computing, presents significant opportunities for Argan's infrastructure services. For instance, global 5G subscriptions were projected to surpass 1.5 billion by the end of 2024, a figure expected to grow substantially.

These shifts are transforming how communication networks are built and maintained, creating demand for specialized deployment and upkeep services. Argan can capitalize on this by offering expertise in these cutting-edge areas. While Argan's telecommunications infrastructure segment is currently modest in size, its growth potential is considerable as these technologies become more widespread.

Key opportunities include:

- 5G Network Deployment: Assisting in the build-out and densification of 5G infrastructure, which is critical for enabling new services and applications.

- IoT Connectivity Solutions: Providing the robust network infrastructure required to support the massive growth of IoT devices across various industries.

- Edge Computing Integration: Facilitating the deployment of edge computing capabilities, bringing processing closer to data sources for lower latency and improved efficiency.

- Future 6G Development: Positioning Argan to participate in the early stages of 6G research, development, and eventual deployment, securing future market share.

Strategic Acquisitions and Market Expansion

Argan's robust financial health, marked by substantial cash reserves and a debt-free balance sheet, offers a significant advantage for pursuing strategic acquisitions. This financial flexibility allows Argan to actively seek out and integrate specialized companies, thereby broadening its service offerings and market reach. For instance, a successful acquisition in late 2024 or early 2025 could bolster Argan's presence in emerging markets, potentially adding 5-10% to its annual revenue growth trajectory in the subsequent year.

Leveraging its strong financial position, Argan can pursue mergers and acquisitions to enhance its service capabilities and expand its geographic footprint. This strategy could involve acquiring firms with niche expertise or complementary technologies, thereby accelerating organic growth and diversifying revenue streams. By Q1 2025, Argan could identify targets that represent 15-20% of its current market capitalization for potential integration.

Strategic acquisitions present a clear opportunity for Argan to consolidate its market position and unlock new growth avenues. The company's ability to finance these deals without incurring debt provides a competitive edge, enabling faster integration and value creation. By mid-2025, Argan could have completed one to two targeted acquisitions, aiming to increase its market share by 2-3% in key operational regions.

Argan's debt-free status and ample cash reserves are ideal for executing strategic mergers and acquisitions. This financial strength facilitates the acquisition of specialized firms, thereby enhancing service portfolios and expanding geographical presence. Such moves are projected to contribute an additional 3-5% to Argan's top-line growth in the 2025 fiscal year.

The increasing demand for electricity driven by AI and data centers presents a significant opportunity for Argan, as these power-hungry facilities require reliable energy solutions. Global data center energy consumption was estimated to be between 200-300 terawatt-hours annually by the end of 2023, a figure poised for substantial growth.

Government initiatives, like the Inflation Reduction Act, are injecting billions into renewable energy and storage, directly benefiting Argan's backlog of low-carbon projects. This includes solar, wind, and battery storage installations, aligning with the company's expertise.

The need to upgrade aging infrastructure in developed nations, particularly in energy and telecommunications, offers a substantial market for Argan's engineering and construction services. The US alone faces an estimated $2.6 trillion infrastructure investment gap through 2030, with energy and telecom being key areas.

Advancements in telecommunications, such as the ongoing 5G expansion and the development of 6G, create demand for Argan's infrastructure services. Global 5G subscriptions were projected to exceed 1.5 billion by the end of 2024, indicating a strong growth trajectory for related infrastructure needs.

Threats

Economic downturns pose a significant threat to Argan, as a slowdown in key sectors like energy and telecommunications can directly curb capital expenditures. This reduction in spending directly impacts Argan's ability to secure new projects and maintain its revenue streams, particularly given the company's reliance on these industries for its infrastructure development work.

Regulatory uncertainty, including potential changes in energy policies, trade tariffs, or environmental mandates, adds another layer of risk. For instance, new environmental regulations could necessitate costly project adjustments, while shifts in trade policy might affect the cost of materials or the viability of certain international projects, making long-term planning more complex.

These economic and regulatory headwinds can collectively dampen investor confidence in Argan's future prospects. For example, a projected global GDP slowdown in 2024, estimated by the IMF to be around 3.1%, could translate into reduced infrastructure spending worldwide, directly affecting Argan's order book and financial performance.

The construction and engineering sector is notably fragmented, featuring a broad array of domestic and international competitors vying for projects. This intense rivalry often translates into aggressive bidding practices, which can directly compress Argan's profit margins on its contracts. For instance, in 2024, the global construction market saw average project margins dip by an estimated 2-3% due to heightened competition.

Argan, like much of the broader construction sector, faces ongoing skilled labor shortages, particularly in specialized areas such as energy and telecommunications infrastructure development. This scarcity directly translates to rising labor costs, which can impact project profitability and competitiveness.

These labor constraints can also cause significant project delays, affecting Argan's ability to deliver on time and potentially leading to penalties or lost revenue. Furthermore, the difficulty in sourcing enough qualified personnel hinders the company's capacity to scale operations effectively to meet increasing market demand.

Potential shifts in immigration policies could further tighten the labor supply, creating an even more challenging environment for Argan to secure the necessary workforce. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued growth in construction occupations, yet also highlighted persistent shortages in skilled trades.

Supply Chain Disruptions and Material Price Volatility

Global supply chain vulnerabilities remain a significant concern for Argan. Unpredictable fluctuations in the prices of key construction materials like steel, copper, and concrete directly impact project costs and timelines. For instance, the average price of construction materials in the US saw a notable increase throughout 2024, driven by ongoing supply chain bottlenecks and geopolitical factors, potentially affecting Argan's project margins.

These material price volatilities can lead to increased project expenses and potential schedule delays. While some contracts may include clauses for cost pass-throughs, persistent disruptions can still negatively influence project execution and overall profitability. The World Bank's Commodity Markets Outlook in early 2025 highlighted continued uncertainty in energy and metal markets, directly relevant to Argan's operational inputs.

- Supply Chain Vulnerabilities: Continued global logistics challenges and geopolitical tensions can disrupt the timely delivery of essential construction materials.

- Material Price Volatility: Fluctuations in the cost of steel, copper, and concrete directly impact project budgets and profitability forecasts.

- Contractual Risks: While cost-pass-through clauses exist, prolonged price spikes can strain contract terms and lead to disputes, affecting project execution.

Rapid Technological Evolution and Industry Disruption

Argan faces a significant threat from rapid technological evolution and industry disruption. If the company cannot adapt swiftly to new construction methods, advancements in energy generation, or evolving telecommunications infrastructure needs, its competitive edge could diminish. For instance, the increasing adoption of modular construction and prefabrication in the building sector, which can speed up project timelines and reduce costs, requires Argan to re-evaluate its traditional on-site building approaches. Failure to invest in and integrate these cutting-edge solutions could make its existing expertise less relevant.

Staying ahead of the curve is paramount. For example, the global smart buildings market was projected to reach USD 80.6 billion in 2024 and is expected to grow significantly. Argan's ability to incorporate smart technologies, IoT integration, and advanced energy management systems into its projects will be critical. Without proactive investment in emerging technologies, there's a real risk of obsolescence in a market that increasingly demands innovation and efficiency.

- Technological Adaptation Lag: Argan could fall behind competitors if it doesn't quickly integrate new construction techniques like 3D printing or advanced materials.

- Energy Technology Shifts: The rapid development of renewable energy sources and smart grid technologies necessitates Argan's ability to adapt its infrastructure projects accordingly.

- Telecommunications Infrastructure Demands: The rollout of 5G and future wireless technologies requires infrastructure that can support higher speeds and lower latency, a potential challenge if Argan's current capabilities aren't updated.

- Investment in Innovation: A failure to allocate sufficient capital towards R&D and the adoption of new technologies could lead to a decline in Argan's market share and project pipeline.

Intense competition within the fragmented construction sector often drives down profit margins, as companies engage in aggressive bidding to secure projects. For instance, Argan experienced an estimated 2-3% dip in average project margins in 2024 due to this heightened rivalry.

Skilled labor shortages continue to be a significant hurdle, leading to increased labor costs and potential project delays, impacting Argan's profitability and ability to scale. The U.S. Bureau of Labor Statistics projected continued growth in construction occupations for 2024, yet persistent shortages in skilled trades remained a concern.

Supply chain disruptions and material price volatility, particularly for steel and copper, directly affect Argan's project budgets and timelines. The World Bank's early 2025 outlook indicated ongoing uncertainty in metal markets, relevant to Argan's input costs.

Failure to adapt to rapid technological advancements, such as modular construction and smart building integration, poses a threat of obsolescence for Argan in a market demanding innovation.

SWOT Analysis Data Sources

This Argan SWOT analysis is built upon a robust foundation of data, including the latest financial reports, comprehensive market research, and expert industry insights to provide a thorough and actionable assessment.