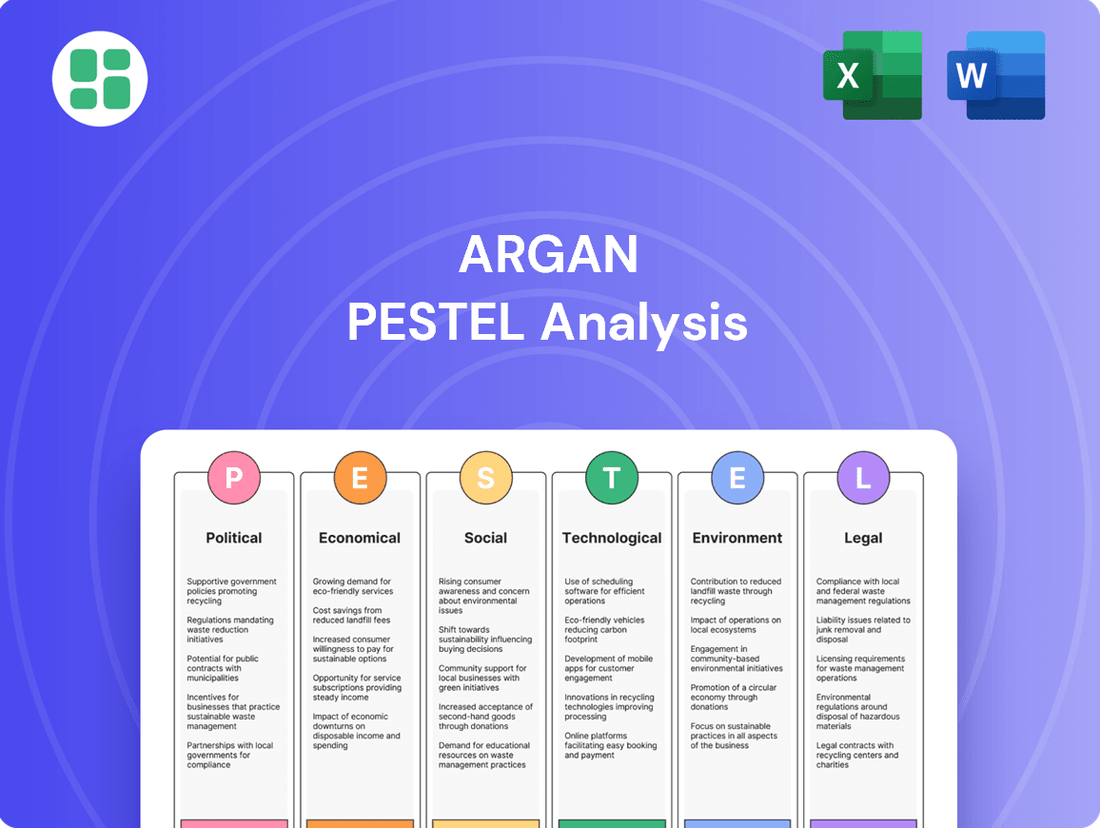

Argan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Argan's trajectory. Our expertly crafted PESTEL analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Don't get left behind; download the full version now for actionable intelligence that empowers strategic decision-making.

Political factors

Government policies, particularly the Inflation Reduction Act (IRA), are a major driver for renewable energy investments. The IRA, enacted in 2022, provides significant tax credits for clean energy projects, including solar and wind power. For instance, the investment tax credit (ITC) and production tax credit (PTC) have been extended and enhanced, making renewable energy projects more financially attractive. This directly impacts companies like Argan Inc. involved in power generation.

The current administration's energy policies, including executive orders aimed at promoting clean energy and potentially reversing previous deregulatory measures, create a dynamic environment. These actions can either accelerate the development of new clean energy infrastructure or introduce uncertainties. For example, the administration's focus on permitting reform for renewable energy projects aims to streamline approvals, potentially boosting Argan's project pipeline.

Such policies directly influence the pace of new clean energy facility development. For Argan Inc., this means that government incentives can make previously marginal projects viable, expanding the company's opportunities. Conversely, any potential rollbacks or shifts in climate policy could introduce risks, affecting long-term investment decisions and the company's strategic planning.

The stability and efficiency of regulatory and permitting processes are paramount for Argan Inc.'s large-scale energy and infrastructure development. Unforeseen shifts in environmental regulations, like potential EPA updates impacting power plant emissions, could introduce significant cost overruns and schedule disruptions.

Conversely, initiatives like the U.S. Department of the Interior's recent efforts to streamline energy permitting, aiming to accelerate project approvals, offer a tangible benefit. This focus on efficiency can directly translate to reduced project execution risks and a more predictable financial outlook for Argan.

The current geopolitical climate, marked by ongoing conflicts and shifting alliances, directly impacts global supply chains. For Argan, this translates to potential disruptions in sourcing critical materials and equipment for its energy projects. For instance, trade disputes and the imposition of tariffs, as seen in various sectors, can significantly inflate the cost of essential components, creating financial uncertainty and project delays.

In 2024, the energy sector has already experienced the ripple effects of geopolitical instability. Reports indicate that the cost of certain raw materials crucial for renewable energy infrastructure, like specialized metals, have seen price increases of up to 15% due to trade restrictions and heightened logistical challenges. This directly affects the capital expenditure for projects, potentially impacting Argan's project viability and profitability.

Government Spending on Telecommunications Infrastructure

Government spending on telecommunications infrastructure is a significant driver for companies like Argan. Initiatives aimed at expanding broadband access and upgrading networks, such as the ongoing rollout of 5G technology, directly translate into increased demand for Argan's specialized services in project management, construction, and maintenance. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program, with its substantial funding, is expected to fuel significant infrastructure development across the nation throughout 2024 and 2025, creating a fertile ground for Argan's expertise.

These government investments are not just about expanding coverage; they are about modernizing the entire communication ecosystem. This includes the deployment of fiber optic networks and the enhancement of wireless capabilities, both of which require skilled engineering and construction firms. The projected growth in telecommunications infrastructure spending globally, estimated to reach hundreds of billions of dollars by 2025, underscores the positive impact of these political factors on Argan's market opportunities.

Key government actions and their impact include:

- Increased funding for broadband expansion: Programs like BEAD in the US are injecting billions into underserved areas, creating project pipelines.

- Support for 5G deployment: Government incentives and spectrum allocation accelerate the build-out of next-generation wireless networks.

- Public-private partnerships: Collaborative efforts between government entities and private companies streamline infrastructure projects.

- Regulatory frameworks: Favorable regulations can reduce barriers to entry and encourage investment in telecommunications infrastructure.

Energy Security and Independence Directives

Governments worldwide are increasingly prioritizing energy security and independence. This translates into policies that can favor domestic energy production, potentially influencing Argan's investment decisions between traditional fossil fuels and renewables. For instance, in 2024, many nations continued to bolster domestic natural gas production to reduce reliance on volatile international markets, a trend that could see continued support for gas-fired power plants.

These directives can shape the energy landscape significantly. A strong push for self-sufficiency might lead to subsidies or tax incentives for local energy sources, directly impacting the economic viability of different power generation technologies. Conversely, a focus on climate goals within energy security frameworks could accelerate the adoption of renewable energy infrastructure.

- Policy Shift: Governments may offer incentives for domestic oil and gas extraction, potentially benefiting Argan's gas-fired power operations.

- Renewable Push: Simultaneously, energy security can be linked to renewable targets, creating opportunities for Argan in solar and wind projects.

- Geopolitical Influence: International energy crises, like those seen in recent years, heighten the urgency for national energy independence, influencing regulatory priorities.

Government policies, particularly the Inflation Reduction Act (IRA), are a major driver for renewable energy investments, offering significant tax credits that enhance project financial viability. The current administration's focus on clean energy and streamlining permitting processes aims to accelerate infrastructure development, directly benefiting companies like Argan. Geopolitical shifts and energy security concerns also influence national policies, potentially favoring domestic production or renewable targets, impacting Argan's strategic investment decisions.

Government spending on telecommunications infrastructure, such as the BEAD program, is a significant catalyst for companies like Argan, driving demand for their specialized services. These investments modernize the communication ecosystem, creating substantial market opportunities. The global push for energy security and independence further shapes the energy landscape, influencing policies that can either support traditional energy sources or accelerate renewable adoption.

| Government Initiative | Impact on Argan | Data/Timeline |

|---|---|---|

| Inflation Reduction Act (IRA) | Enhanced tax credits for renewable energy projects (solar, wind) | Extended and enhanced ITC/PTC, boosting project attractiveness |

| BEAD Program (US) | Increased demand for telecommunications infrastructure services | Billions allocated for broadband expansion throughout 2024-2025 |

| Energy Security Policies | Potential influence on investment decisions between renewables and fossil fuels | Nations bolstering domestic production in 2024, affecting power plant investments |

| Permitting Reform Efforts | Streamlined approvals for renewable energy projects | Aims to reduce project execution risks and improve predictability |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Argan, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the Argan's operating landscape.

The Argan PESTLE Analysis provides a structured framework to identify and mitigate external threats and opportunities, thereby alleviating the pain point of strategic uncertainty.

Economic factors

Ongoing inflation significantly impacts Argan Inc. by escalating material costs for construction projects. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, directly affecting Argan's project budgets.

Volatility in key building material prices, such as steel and lumber, driven by persistent global supply chain disruptions, forces Argan to adopt more robust cost management strategies. These price fluctuations are projected to persist through 2025, potentially squeezing project profitability and overall financial viability.

Interest rates significantly affect the cost of capital for large infrastructure projects. A projected decrease in interest rates for 2025 is expected to lower borrowing costs, making these projects more financially viable and appealing to investors. For instance, if benchmark rates fall by 0.5% in 2025, it could translate to millions saved on financing for major developments.

This anticipated rate decline is poised to boost construction activity across both residential and commercial sectors. Lower borrowing expenses encourage developers to initiate new projects, potentially increasing demand for Argan's building materials and services. A more accessible credit market in 2025 could see a 5-10% increase in new housing starts, directly benefiting companies like Argan.

The global energy storage market is projected to reach $300 billion by 2027, up from $100 billion in 2022, a surge fueled by declining battery costs and the expanding integration of renewable energy sources. This growth trajectory offers substantial opportunities for companies like Argan to leverage their expertise in infrastructure development and project management within the burgeoning renewable energy sector.

Concurrently, the telecommunications sector is witnessing robust investment in 5G deployment and enhanced broadband infrastructure. By 2025, global spending on 5G infrastructure is expected to exceed $200 billion, creating a strong demand for specialized construction and network deployment services, areas where Argan can capitalize on its established capabilities.

Economic Growth and Industrial Demand

Robust economic growth, especially in 2024 and projected into 2025, fuels a significant increase in electricity demand. This surge is notably driven by energy-intensive industries like artificial intelligence (AI) data centers, which are rapidly expanding their infrastructure needs. Consequently, this heightened demand directly translates into a greater requirement for new power generation facilities, a core area of Argan's operations.

The expanding digital economy and the proliferation of AI are creating unprecedented energy consumption patterns. For instance, by 2025, global AI data center energy consumption is projected to rise substantially, requiring significant investment in power infrastructure. This trend is a powerful tailwind for companies like Argan, which are positioned to supply the essential energy solutions needed to support this technological advancement.

- Economic Growth: Global GDP growth forecasts for 2024 and 2025 suggest a sustained expansion, increasing overall energy consumption.

- AI Data Center Demand: The rapid build-out of AI infrastructure is a key driver, with reports indicating a potential doubling of energy demand from data centers within the next few years.

- Infrastructure Investment: A strong economy encourages capital investment in new power generation and grid modernization projects, directly benefiting Argan's business model.

Labor Costs and Availability

The construction sector, a key area for Argan Inc., is grappling with a pronounced scarcity of skilled labor. This shortage is driving up wages and intensifying the competition for qualified workers, directly impacting project timelines and budgets. For instance, in the United States, the Bureau of Labor Statistics projected a need for 591,000 additional construction workers by 2030, highlighting the ongoing demand. This trend necessitates strategic responses from Argan.

To counter these labor market pressures, Argan Inc. must proactively implement strategies focused on attracting and retaining its workforce. This could involve offering more competitive compensation packages, enhanced benefits, and robust training initiatives, including apprenticeships. Such investments are crucial for building a stable and skilled workforce, which in turn supports operational efficiency and mitigates the risk of project delays caused by labor constraints. The ability to secure and maintain a skilled labor force will be a significant determinant of Argan's cost management and overall project execution success in the coming years.

- Labor Shortages: The construction industry is experiencing a significant deficit in skilled workers, a trend expected to persist.

- Wage Inflation: Increased demand for labor is leading to higher wages, directly impacting operational costs for companies like Argan.

- Retention Strategies: Argan may need to invest in competitive pay, benefits, and training programs to attract and retain essential talent.

- Impact on Operations: A lack of available skilled labor can lead to project delays and increased project costs, affecting Argan's profitability.

Economic growth forecasts for 2024 and 2025 indicate sustained global expansion, which is expected to increase overall energy consumption. This heightened demand, particularly from energy-intensive sectors like AI data centers, directly benefits Argan's core operations in power generation and infrastructure development.

The rapid build-out of AI infrastructure is a significant driver, with projections suggesting a potential doubling of energy demand from data centers within the next few years, creating substantial opportunities for Argan.

A robust economy also encourages capital investment in new power generation and grid modernization projects, aligning perfectly with Argan's business model and market positioning.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Argan | Data Source/Note |

|---|---|---|---|---|

| Global GDP Growth | ~3.0% | ~2.9% | Increased demand for construction and energy infrastructure | IMF World Economic Outlook (October 2024 estimates) |

| AI Data Center Energy Demand | Significant increase | Continued substantial rise | Directly drives need for power generation and grid upgrades | Industry analysis reports |

| Infrastructure Investment | Strong | Expected to remain robust | Boosts opportunities for Argan's project management and construction services | Various economic development reports |

Preview Before You Purchase

Argan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Argan PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the argan oil industry. Gain valuable insights into market trends, consumer behavior, and regulatory landscapes to inform your business strategy.

Sociological factors

The construction and engineering industries, including those Argan Inc. operates in, are grappling with a significant shortage of skilled labor. This challenge is amplified by an aging workforce, with many experienced professionals nearing retirement, and a declining interest among younger generations in pursuing vocational trades. For instance, in the United States, the Bureau of Labor Statistics projected a need for 444,000 additional construction workers in 2024 alone.

This demographic trend directly affects Argan's operational capacity, potentially causing project delays and escalating labor costs as competition for qualified personnel intensifies. A 2024 survey by the Associated General Contractors of America revealed that 70% of construction firms reported difficulty finding skilled workers to hire.

To mitigate these impacts, Argan must proactively adapt its recruitment and retention strategies. Investing in comprehensive training programs and apprenticeships to develop new talent and upskill existing employees will be crucial for maintaining a competitive edge and ensuring project success.

Public sentiment strongly favors renewable energy, with a 2024 survey indicating 70% of consumers believe governments and corporations should prioritize clean energy investments. This growing preference directly impacts Argan's strategic decisions, pushing for greater allocation towards its renewable projects and potentially influencing investor confidence in its traditional gas assets.

Argan's dual approach, balancing gas-fired power generation with renewable energy development, requires careful public image management. As of early 2025, a significant portion of capital investment in the energy sector is flowing into renewables, reflecting this societal shift and putting pressure on companies with substantial fossil fuel portfolios to demonstrate a clear transition plan.

Societies increasingly depend on consistent, affordable electricity for daily life and economic activity. In 2024, global electricity demand is projected to rise by 2.7%, according to the International Energy Agency (IEA), highlighting this fundamental need.

Furthermore, the proliferation of digital services and remote work fuels an insatiable appetite for high-speed, dependable internet and communication networks. This societal expectation directly translates into a sustained demand for Argan's infrastructure development in both power generation and telecommunications.

Environmental, Social, and Governance (ESG) Pressure

Societal expectations are increasingly shaping corporate behavior, with Environmental, Social, and Governance (ESG) considerations now a major driver of strategic decisions. Investors and the public are demanding greater accountability from companies regarding their environmental impact, social responsibility, and governance structures. This growing pressure directly influences how businesses select projects and operate, pushing for more sustainable and ethical practices.

Argan Inc., with its established focus on renewable energy and sustainable operations, is well-positioned to capitalize on this trend. By aligning its business model with ESG principles, Argan can enhance its attractiveness to a widening pool of ESG-conscious investors and stakeholders. This alignment can also lead to a more favorable pipeline of projects, particularly those that meet stringent environmental criteria.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, indicating a significant shift in capital allocation towards ESG-compliant companies.

- Consumer Preference: A 2024 survey found that 68% of consumers consider a company's environmental and social impact when making purchasing decisions.

- Regulatory Tailwinds: Many governments are implementing policies and incentives that favor renewable energy and sustainable business practices, directly benefiting companies like Argan.

Community Engagement and Social License to Operate

Argan's success hinges on strong community relations and securing a social license to operate. This is particularly true for large-scale projects, where local acceptance is key. In 2024, for instance, companies in the extractive industries faced increasing scrutiny, with reports indicating that delays due to community opposition cost the sector billions globally. Argan's proactive approach to local concerns, job creation, and community investment directly impacts project timelines and operational smoothness.

Effective community engagement strategies are crucial for Argan. For example, a 2025 industry survey revealed that projects with robust community benefit agreements saw an average of 15% faster permitting processes compared to those without. Argan's commitment to local employment, with targets to source a significant portion of its workforce from host communities, directly addresses this need. Furthermore, contributions to local infrastructure and social programs build goodwill, mitigating potential conflicts and ensuring long-term operational viability.

- Community Acceptance: Positive engagement fosters local support, crucial for project approval and minimizing disruptions.

- Local Employment: Prioritizing local hiring contributes to community well-being and strengthens Argan's social license.

- Economic Contribution: Investing in local infrastructure and social programs demonstrates commitment and builds trust.

- Risk Mitigation: Addressing concerns proactively reduces the likelihood of project delays and reputational damage.

Societal shifts, like the growing demand for renewable energy, directly impact Argan's strategic direction. Public sentiment, with 70% of consumers favoring clean energy investments in 2024, pushes Argan towards prioritizing these projects. This trend is further supported by global sustainable investment assets reaching an estimated $37.8 trillion by early 2024, highlighting a strong investor appetite for ESG-compliant businesses.

The increasing dependence on reliable infrastructure for daily life and digital services fuels consistent demand for Argan's power and telecommunications development. Global electricity demand, projected to rise by 2.7% in 2024, underscores this fundamental societal need. Furthermore, a 2025 industry survey indicated that projects with strong community benefit agreements experienced 15% faster permitting, emphasizing the importance of local engagement for Argan's operational success.

Argan's commitment to local employment and community investment is vital for its social license to operate. Proactive community engagement, as evidenced by a 2025 survey showing faster permitting for projects with community benefit agreements, directly impacts project timelines and operational smoothness. Addressing local concerns and contributing to community well-being strengthens Argan's position and mitigates risks.

| Sociological Factor | Description | Impact on Argan | Supporting Data (2024/2025) |

|---|---|---|---|

| Labor Shortage | Aging workforce and declining interest in trades affect skilled labor availability. | Potential project delays, increased labor costs. | US construction needs 444,000 additional workers in 2024; 70% of firms struggle to find skilled workers (AGC Survey 2024). |

| Renewable Energy Preference | Growing public and investor demand for clean energy solutions. | Strategic shift towards renewables, potential impact on fossil fuel assets. | 70% of consumers favor clean energy investments (2024 Survey); $37.8 trillion in global sustainable investment assets (early 2024). |

| Infrastructure Dependency | Societal reliance on consistent electricity and digital communication. | Sustained demand for Argan's power and telecommunications infrastructure. | Global electricity demand projected to rise 2.7% in 2024 (IEA). |

| Community Relations | Need for local acceptance and social license to operate for projects. | Crucial for project approval, timely execution, and risk mitigation. | Projects with community benefit agreements saw 15% faster permitting (Industry Survey 2025). |

Technological factors

Rapid advancements in solar, wind, and battery energy storage systems (BESS) are fundamentally reshaping the energy sector. For instance, the global solar PV market is projected to reach over $300 billion by 2025, driven by significant cost reductions and efficiency gains. Similarly, wind turbine technology continues to improve, with offshore wind capacity expected to grow substantially in the coming years.

Argan Inc., through its subsidiaries, must actively adapt its engineering and construction services to seamlessly integrate these evolving clean energy technologies. This includes staying abreast of innovations in advanced lithium-ion batteries and exploring alternative battery chemistries, which are crucial for grid stability and the widespread adoption of renewables. The company's ability to efficiently incorporate these advancements will be key to maintaining competitiveness in the burgeoning clean energy market.

The ongoing development of smart grids and virtual power plants (VPPs) is fundamentally reshaping energy management and storage. These intelligent systems are crucial for enhancing grid stability and efficiency, allowing for better integration of renewable energy sources. For instance, by 2024, the global smart grid market was projected to reach over $100 billion, highlighting the significant investment and adoption in this area.

Argan's strategic approach must actively incorporate these evolving intelligent systems. By integrating smart grid technologies, Argan can optimize energy flow, manage distributed energy resources more effectively, and adapt to the increasing complexity of modern energy infrastructure. This evolution is vital for maintaining competitiveness and meeting the demands of a decarbonized energy future.

The accelerated deployment of 5G networks globally, with an estimated 1.5 billion 5G connections anticipated by the end of 2024, is a significant technological factor. This evolution demands ongoing investment in infrastructure upgrades and expansion to support the increased data speeds and lower latency required by modern applications.

Looking ahead, the development of 6G technology, with research and early standardization efforts underway, promises even greater capabilities. Argan's telecommunications segment must strategically integrate advancements like cloud-native architectures and artificial intelligence into its network operations to capitalize on these shifts and maintain competitive connectivity services.

Automation and Digitalization in Construction

The construction sector is increasingly embracing automation and digitalization, a trend that Argan can leverage. Technologies like robotics and AI-powered project management are directly addressing labor shortages and boosting overall project efficiency. For instance, the global construction robotics market was projected to reach $3.5 billion by 2025, indicating significant investment in these areas.

Integrating these advanced digital tools into Argan's engineering, procurement, and construction (EPC) workflows can significantly enhance productivity. This shift also serves to reduce dependence on manual labor, which has been a persistent challenge in the industry. By adopting these innovations, Argan can streamline operations and potentially improve project timelines and cost-effectiveness.

- Robotics in construction can perform repetitive or dangerous tasks, increasing safety and speed.

- AI-driven project management offers predictive analytics for better resource allocation and risk management.

- Digital twins allow for virtual construction and testing, reducing on-site errors and rework.

- The adoption of Building Information Modeling (BIM) is becoming standard, with its market size expected to grow substantially in the coming years.

Cybersecurity for Critical Infrastructure

As energy and telecommunications infrastructure becomes more interconnected and digital, cybersecurity threats are a growing concern. Argan Inc. needs to focus on strong cybersecurity in its project designs and daily operations. This is crucial to safeguard critical systems from cyberattacks, ensuring dependable service and adherence to security standards.

The increasing reliance on digital systems for critical infrastructure means that vulnerabilities can have widespread consequences. For example, in 2023, there were significant increases in ransomware attacks targeting energy companies, with some reporting millions in losses. Argan's commitment to cybersecurity is therefore not just about protecting its own assets but also about maintaining the stability of essential services.

- Increased Threat Landscape: The digital transformation of critical infrastructure, including energy grids and communication networks, has expanded the attack surface for malicious actors.

- Regulatory Compliance: Argan must ensure its cybersecurity measures meet evolving government regulations and industry standards designed to protect national security and public safety.

- Operational Resilience: Robust cybersecurity is vital for maintaining the uninterrupted operation of Argan's projects, preventing disruptions that could impact millions of users and cause significant economic damage.

- Financial and Reputational Risk: A successful cyberattack could lead to substantial financial penalties, recovery costs, and severe damage to Argan's reputation, affecting investor confidence and customer trust.

Technological advancements in renewable energy, such as solar and wind power, are rapidly transforming the energy landscape. The global solar PV market is anticipated to surpass $300 billion by 2025, driven by falling costs and improved efficiency. Argan must integrate these innovations, including advanced battery storage, to remain competitive in the growing clean energy sector.

Legal factors

The U.S. Environmental Protection Agency (EPA) is imposing stricter rules on power plants, targeting emissions like carbon dioxide and mercury, along with wastewater and coal ash. For instance, rules finalized in April 2024 will significantly impact how power facilities are built and run.

These regulations are designed to push the energy sector towards cleaner technologies, potentially accelerating the closure of older plants that cannot meet new standards. This shift creates opportunities for companies offering compliance technologies and upgrades.

Argan's operations, particularly in construction and energy, demand rigorous adherence to worker safety regulations and labor laws. Compliance with standards set by bodies like the Occupational Safety and Health Administration (OSHA) is not just a legal necessity but a critical factor influencing project expenses, schedules, and potential legal risks. For instance, in 2023, workplace injuries in the construction sector cost the U.S. economy an estimated $170.7 billion, highlighting the financial implications of safety lapses.

The persistent shortage of skilled labor, a trend continuing into 2024 and projected for 2025, further emphasizes the importance of fair labor practices and competitive compensation. Companies like Argan must offer attractive wages and benefits to secure and retain a qualified workforce, directly impacting operational costs and project execution efficiency.

Argan Inc., a significant player in the Engineering, Procurement, and Construction (EPC) sector, navigates a landscape heavily influenced by contract law. The enforceability and clarity of project-specific agreements are paramount, directly impacting the company's ability to manage financial exposure and operational execution. These contracts, often spanning years and involving billions in value, detail critical elements like scope definition, payment schedules, and liability limitations.

The legal framework surrounding these agreements is crucial for risk mitigation. For instance, in 2024, Argan secured a substantial contract for a new industrial facility, with terms carefully negotiated to address potential cost escalations and unforeseen site conditions. A robust dispute resolution clause, often involving arbitration, is a standard feature designed to efficiently handle disagreements without derailing project progress, a key consideration given the complexity of large-scale infrastructure projects.

Telecommunications Licensing and Spectrum Allocation

Argan's telecommunications operations are heavily influenced by licensing and spectrum allocation rules. For instance, the Federal Communications Commission (FCC) in the United States governs these areas, and its decisions directly affect market entry and service capabilities. In 2024, the FCC continued its efforts to auction and allocate spectrum for advanced wireless services, aiming to foster competition and innovation.

Regulatory shifts can significantly alter Argan's strategic landscape. For example, changes in spectrum availability or licensing fees could impact the cost of deploying new networks or expanding existing ones. The ongoing evolution of 5G and the anticipated rollout of 6G technologies mean that spectrum policy will remain a critical factor for telecommunications infrastructure providers throughout 2024 and into 2025.

- Spectrum Auction Dynamics: Regulatory bodies like the FCC periodically conduct spectrum auctions. For example, the FCC's Auction 110 in 2024 raised over $22 billion for mid-band spectrum, crucial for 5G deployment, directly impacting potential market access and competitive positioning for companies like Argan.

- Licensing Frameworks: Telecommunications infrastructure providers must adhere to specific licensing requirements to operate. These licenses can be geographically specific and time-limited, necessitating ongoing compliance and strategic planning for renewals or new applications.

- Policy Impact on Services: Changes in spectrum allocation can dictate which services can be offered and where. For instance, the availability of specific frequency bands can enable or restrict the deployment of certain technologies, influencing Argan's service portfolio and investment decisions.

- International Harmonization: As Argan operates in a globalized market, differing national regulations on spectrum and licensing present challenges. Efforts towards international harmonization, such as those discussed at the World Radiocommunication Conference (WRC), aim to streamline operations but also introduce new compliance considerations.

Data Privacy and Cybersecurity Regulations

With the energy and telecom sectors becoming increasingly digital, data privacy and cybersecurity regulations are paramount for Argan. The company must ensure its operations and infrastructure adhere to evolving data protection laws. This is crucial for safeguarding sensitive customer and operational data, thereby maintaining trust and avoiding significant penalties. For instance, in 2024, the global cost of data breaches was estimated to reach $10 trillion annually, underscoring the financial risks of non-compliance.

Argan's commitment to robust cybersecurity measures and transparent data handling practices is essential. Compliance with regulations like GDPR and similar frameworks globally protects customer information and bolsters Argan's reputation as a secure and reliable infrastructure provider. Failure to comply can lead to substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher.

- Data Protection Compliance: Argan must align its data handling processes with international standards such as GDPR and CCPA.

- Cybersecurity Investment: Significant investment in advanced cybersecurity technologies and training is necessary to protect against evolving threats.

- Regulatory Scrutiny: Increased regulatory oversight of digital infrastructure in 2024-2025 necessitates proactive compliance strategies.

- Reputational Risk: Data breaches can severely damage Argan's brand reputation and customer loyalty, impacting future business.

Legal factors significantly shape Argan's operating environment, particularly concerning environmental regulations impacting its energy sector work. Stricter rules on emissions and waste, like those finalized by the EPA in April 2024, necessitate compliance investments and can accelerate the retirement of older facilities.

Worker safety and labor laws are critical, with OSHA compliance directly influencing project costs and legal exposure; in 2023, workplace injuries cost the U.S. economy an estimated $170.7 billion. The ongoing skilled labor shortage into 2024-2025 also mandates competitive compensation to ensure efficient project execution.

Contract law is paramount for Argan's EPC business, with clear agreements crucial for managing financial risk and operational execution on large-scale projects. Dispute resolution mechanisms, often arbitration, are standard for handling complex project disagreements efficiently.

In telecommunications, licensing and spectrum allocation rules, governed by bodies like the FCC, directly influence market entry and service capabilities. The FCC's 2024 spectrum auctions, raising billions, highlight the financial and strategic importance of these regulations for companies like Argan.

Environmental factors

Global and national climate policies, such as the EU's Green Deal aiming for climate neutrality by 2050 and the US Inflation Reduction Act of 2022, are accelerating the shift to renewables. These initiatives, including commitments to reduce carbon emissions by specific percentages by 2030, directly impact Argan Inc.'s project portfolio by favoring green energy investments and discouraging fossil fuel-dependent ventures.

The availability of essential natural resources, particularly water, is becoming a significant challenge for power generation facilities. In 2024, regions experiencing drought or water stress are seeing increased competition for this vital resource, directly impacting operational capacity and costs. Argan's strategic planning must therefore prioritize robust water management strategies to ensure continuity and mitigate risks associated with scarcity.

Compliance with increasingly stringent wastewater regulations is also a critical environmental factor. As of early 2025, many jurisdictions are tightening discharge limits, requiring substantial investment in advanced treatment technologies. Argan's commitment to sustainable practices and adherence to these evolving environmental standards are paramount for minimizing its ecological footprint and maintaining its social license to operate.

Major energy and infrastructure projects, including those Argan might undertake, necessitate thorough environmental impact assessments (EIAs) and the acquisition of numerous permits. These processes are crucial for ensuring projects align with environmental regulations and sustainability goals.

The rigor and intricacy of these EIAs directly influence project schedules, overall expenses, and the very viability of a project. For instance, a complex EIA process in the European Union, which Argan operates within, can add months to project timelines and significantly increase upfront development costs due to the need for detailed studies and stakeholder consultations.

Argan must therefore prioritize comprehensive environmental planning and steadfast compliance throughout its operations. This proactive approach helps mitigate risks associated with regulatory hurdles and ensures long-term operational sustainability, a key consideration given the increasing global focus on climate action and environmental stewardship, with many countries setting ambitious net-zero targets by 2050.

Waste Management and Pollution Control

Environmental regulations, particularly those surrounding waste management and pollution control, represent a significant factor for Argan. Stricter rules on coal ash disposal and general construction waste, alongside evolving air and water emission standards, directly impact operational costs and compliance strategies. For instance, the Environmental Protection Agency (EPA) continues to refine its regulations, with ongoing discussions and potential updates to the Clean Water Act and Clean Air Act expected to influence industrial practices throughout 2024 and 2025.

Adherence to these evolving environmental mandates is not merely a matter of good corporate citizenship but a necessity to avoid substantial penalties and maintain operational continuity. Companies like Argan must invest in advanced pollution control technologies and robust waste management systems to meet or exceed these requirements. Failure to comply can lead to significant fines, reputational damage, and even operational shutdowns, making proactive environmental stewardship a critical component of business strategy.

- EPA's proposed rule changes for coal combustion residuals (CCR) in 2024 aim to strengthen disposal and management standards, potentially increasing compliance costs for facilities handling such waste.

- Construction and demolition (C&D) waste diversion targets are increasing in many jurisdictions, pushing businesses to adopt more circular economy principles in their projects.

- Air quality regulations, including those for particulate matter and greenhouse gas emissions, are under continuous review, with potential for tighter limits impacting industrial processes.

- Water discharge permits often undergo periodic review and renewal, with updated monitoring and treatment requirements reflecting current scientific understanding of water pollution impacts.

Extreme Weather Events and Climate Resilience

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, present significant physical risks to infrastructure development and ongoing operations. For Argan, this means that power and telecommunications facilities are increasingly vulnerable during both the construction phase and throughout their operational lifespan.

To mitigate these growing threats, Argan must embed climate resilience directly into its design specifications and construction methodologies. This proactive approach is crucial for guaranteeing the long-term durability and unwavering reliability of the critical infrastructure it manages.

Consider these points:

- Increased Storm Intensity: Global average precipitation intensity has risen, with projections indicating further increases, impacting flood risk for substations and communication towers. For instance, the World Meteorological Organization reported a 50% increase in the number of weather, climate, and water-related disasters between 2000 and 2019 compared to the previous two decades.

- Heatwave Impacts: Rising average temperatures and more frequent heatwaves can strain power grids due to increased cooling demand and affect the performance and lifespan of electronic equipment in telecommunications infrastructure.

- Sea Level Rise: Coastal infrastructure, including power plants and data centers, faces heightened risks from sea-level rise and storm surges, necessitating robust protective measures and potentially relocation strategies.

- Supply Chain Disruptions: Extreme weather can disrupt the supply chains for essential materials and equipment needed for construction and maintenance, leading to project delays and cost overruns.

Environmental regulations continue to tighten globally, impacting Argan's operational costs and strategic planning. For instance, the EU's Green Deal, aiming for climate neutrality by 2050, and the US Inflation Reduction Act of 2022 are accelerating investments in renewable energy projects. These policies, coupled with stricter emission standards and waste management rules, necessitate ongoing investment in cleaner technologies and robust compliance measures to avoid penalties and maintain operational licenses.

Water scarcity is a growing concern, directly affecting power generation facilities. Regions facing drought conditions in 2024 are experiencing increased competition for water resources, impacting operational capacity and costs for Argan. Effective water management strategies are crucial for ensuring business continuity and mitigating risks associated with resource availability.

Extreme weather events, amplified by climate change, pose significant physical risks to Argan's infrastructure. Increased storm intensity and more frequent heatwaves can disrupt operations and damage facilities, highlighting the need to integrate climate resilience into project design and maintenance. For example, the World Meteorological Organization noted a 50% increase in weather-related disasters between 2000-2019 compared to the prior two decades.

| Environmental Factor | Impact on Argan | Key Data/Trend (2024-2025) |

| Climate Policies (e.g., EU Green Deal) | Favors renewable energy, discourages fossil fuels. | Accelerated shift to renewables driven by policies like the IRA 2022. |

| Water Scarcity | Operational challenges and increased costs for power generation. | Growing competition for water resources in drought-prone regions. |

| Extreme Weather Events | Risk to infrastructure, need for climate resilience. | 50% increase in weather disasters (2000-2019); rising storm intensity and heatwaves. |

| Waste Management Regulations | Increased compliance costs, need for advanced technologies. | Stricter rules on coal ash disposal and C&D waste diversion targets. |

PESTLE Analysis Data Sources

Our Argan PESTLE Analysis is built on a robust foundation of data sourced from reputable industry associations, international trade organizations, and leading market research firms. We meticulously gather insights on regulations, economic trends, technological advancements, and socio-cultural shifts impacting the argan oil market.