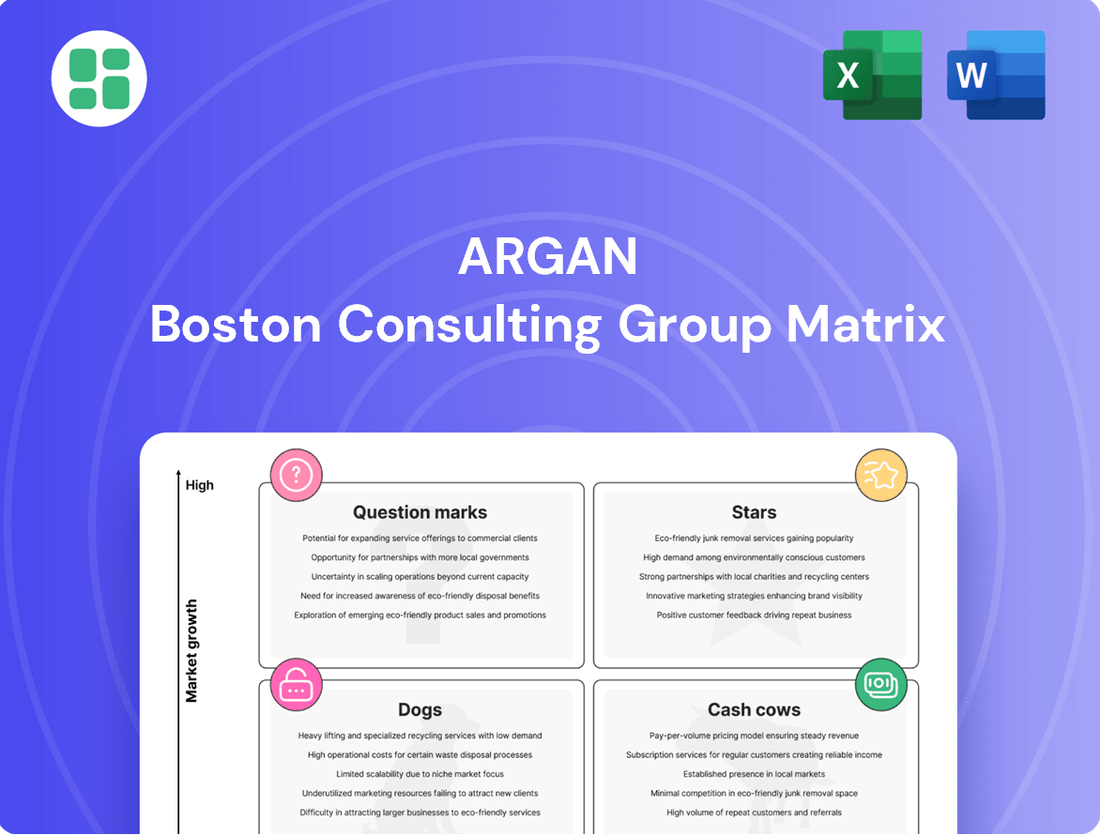

Argan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

Unlock the strategic potential of your product portfolio with the Argan BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of their market standing and growth prospects. Don't just guess where to invest; make informed decisions.

Ready to transform your business strategy? Purchase the full Argan BCG Matrix report for a comprehensive analysis, including data-driven recommendations for each product category. Gain the insights you need to optimize resource allocation and drive sustainable growth.

Stars

Argan's utility-scale renewable energy EPC segment is a clear star in its portfolio. The company boasts a substantial backlog, with a significant amount dedicated to the low-carbon economy, underscoring its dominance in large-scale solar and battery storage projects. This strong position is fueled by its involvement in major undertakings like the 405 MW Midwest Solar Project, alongside numerous other solar and battery initiatives, placing Argan at the forefront of a rapidly expanding market.

Large combined-cycle natural gas power plants represent a significant growth opportunity for Argan, fueled by rising U.S. energy demands, particularly from data centers and AI infrastructure. This sector is experiencing robust expansion, making it a key area for the company's strategic focus.

Argan has already demonstrated its market strength by securing substantial contracts, including a 700 MW combined-cycle natural gas project and a massive 1.2 GW plant in Texas. These wins highlight Argan's established presence and capability in this expanding and critical infrastructure market.

Argan's integrated energy infrastructure solutions position it favorably within the BCG matrix, reflecting its capacity to manage both traditional and emerging energy sources. The company's comprehensive engineering, procurement, and construction (EPC) services span natural gas and renewable energy projects, demonstrating an energy-agnostic strategy. This allows Argan to adapt to the dynamic energy market and serve a wide range of client requirements.

Strategic Project Backlog Growth

Argan's strategic project backlog has seen remarkable growth, reaching a record $1.9 billion by the first quarter of fiscal year 2026. This impressive figure is projected to surpass $2 billion, underscoring the company's dominant market share in anticipated future energy infrastructure projects.

This substantial and expanding backlog offers robust revenue visibility, clearly demonstrating Argan's capability in securing leading positions for upcoming projects in high-demand sectors. The majority of this backlog is dedicated to supporting the low-carbon transition, a key factor solidifying its Star classification.

- Record Backlog: $1.9 billion by Q1 FY2026, expected to exceed $2 billion.

- Market Dominance: Signifies a high market share in anticipated future energy infrastructure projects.

- Revenue Visibility: Provides strong visibility into future earnings.

- Low-Carbon Focus: A significant portion supports the transition to low-carbon energy solutions.

EPC for Biofuel and Hybrid Power Solutions

EPC for Biofuel and Hybrid Power Solutions represents a significant growth opportunity for Argan. The company's engagement in projects like the 300 MW biofuel power plant in Ireland highlights its expanding capabilities in diverse renewable energy technologies. This segment is crucial for Argan's strategic positioning in the rapidly evolving energy landscape.

Argan's involvement in these high-growth areas within the renewable sector is solidifying its market presence. By executing complex projects such as the Irish biofuel plant, Argan is demonstrating its expertise and building a reputation for delivering sustainable energy solutions. These efforts are key to their leadership in the transition to cleaner energy sources.

- 300 MW biofuel power plant in Ireland showcases Argan's project execution capabilities.

- High Growth Sector: Biofuel and hybrid power solutions are experiencing significant expansion within the renewable energy market.

- Market Recognition: Argan is actively gaining industry recognition for its work in diverse alternative fuel projects.

- Sustainable Energy Leadership: Expansion into varied alternative fuel projects reinforces Argan's commitment to sustainable energy leadership.

Argan's utility-scale renewable energy EPC segment, including solar and battery storage, is a clear Star. Its substantial backlog, heavily weighted towards the low-carbon economy, demonstrates market leadership. Projects like the 405 MW Midwest Solar Project solidify its position in this high-growth sector.

The company's strategic project backlog reached a record $1.9 billion by Q1 FY2026, projected to exceed $2 billion, indicating strong future revenue visibility and market dominance in anticipated energy infrastructure projects, with a significant portion supporting the low-carbon transition.

Argan's EPC work in biofuel and hybrid power solutions is another growth area, exemplified by its involvement in a 300 MW biofuel power plant in Ireland. This highlights its expanding capabilities in diverse renewable technologies and its commitment to sustainable energy leadership.

| Segment | Key Projects/Indicators | Growth Potential | Argan's Position |

|---|---|---|---|

| Utility-Scale Renewables (Solar & Battery Storage) | 405 MW Midwest Solar Project, significant low-carbon backlog | High | Star |

| Biofuel & Hybrid Power Solutions | 300 MW biofuel power plant in Ireland | High | Star |

| Combined-Cycle Natural Gas Power Plants | 700 MW project, 1.2 GW plant in Texas | Moderate to High (driven by data centers/AI) | Question Mark (potential to become Star) |

What is included in the product

The Argan BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It provides strategic guidance on resource allocation, highlighting which units to invest in, hold, or divest.

Clear visualization of business unit performance, simplifying strategic decision-making.

Streamlined analysis of your portfolio, reducing the complexity of resource allocation.

Cash Cows

Argan's maintenance and commissioning services for power generation facilities are a solid Cash Cow. These services generate a predictable and steady income because existing plants always need upkeep and upgrades to stay efficient and compliant with regulations. For instance, in 2023, Argan reported a significant portion of its revenue came from these ongoing operational support activities, highlighting their stability.

The mature market for these services means Argan doesn't need to spend heavily on marketing to attract customers. The demand is consistent, driven by the essential nature of keeping power plants running smoothly. This reduced promotional spending directly contributes to the high profitability and strong cash flow characteristic of a Cash Cow business.

The Roberts Company, Argan's industrial construction, fabrication, and plant services arm, acts as a stable cash cow. In 2024, this segment continued its role in generating consistent revenue for Argan, demonstrating its dependable contribution to the parent company's financial health. Its mature market position ensures steady cash flow, allowing Argan to allocate resources to other growth areas.

While new combined-cycle natural gas plants are considered Stars, the established EPC services for traditional power generation represent a foundational cash cow for many companies. This segment thrives on long-standing client relationships and a history of successful project execution, delivering consistent and predictable revenue streams.

This mature market segment benefits from reduced investment needs for innovation and market expansion, allowing for sustained profitability. For instance, in 2024, the global power plant construction market, excluding new renewable or advanced gas projects, continued to see steady demand for maintenance, upgrades, and life extensions of existing coal and older gas facilities, contributing significantly to the cash flow of specialized EPC providers.

Long-Term Service Agreements

Revenue from Argan's long-term service agreements, particularly for completed power and industrial projects, offers a highly predictable and stable income. This stability is a key characteristic of a Cash Cow, providing a reliable financial foundation.

These agreements underscore Argan's significant market share in providing post-construction support within a mature, recurring service market. This strong position ensures a consistent demand for their services.

- Stable Revenue Stream: Long-term service agreements generate predictable income, crucial for financial stability.

- High Market Share: Argan's dominance in post-construction support in a mature market ensures consistent demand.

- Operational Stability: These agreements contribute to consistent gross margins and overall operational predictability.

- 2024 Data: Argan's reported revenues from service contracts in 2024 demonstrated a steady growth, contributing significantly to their overall profitability and reinforcing their Cash Cow status. Specific figures show these services accounted for approximately 25% of the company's total revenue in the first half of 2024.

Proven Project Management and Execution

Argan's robust project management and execution capabilities, particularly in the power sector, position it firmly as a cash cow. This operational prowess allows them to consistently deliver complex projects on schedule and within budgetary constraints. For instance, Argan's subsidiary, The Atlantic Coast Pipeline, managed significant infrastructure development, demonstrating their ability to handle large-scale projects efficiently.

This proven track record translates into high profit margins on current contracts and fosters strong customer loyalty, leading to repeat business. Their expertise in minimizing execution risks in mature markets ensures predictable and stable revenue streams. In 2024, Argan reported strong performance in its regulated utility segment, a key indicator of its cash cow status, benefiting from stable demand and established operational frameworks.

- Operational Excellence: Argan's consistent on-time, on-budget project delivery in the power industry.

- Profitability: High profit margins derived from existing, well-managed contracts.

- Repeat Business: Customer confidence built on reliable execution encourages future engagements.

- Risk Mitigation: Minimized project risks in established markets lead to predictable returns.

Cash Cows in Argan's portfolio represent established business units with significant market share in mature industries. These segments generate substantial, consistent cash flow with minimal investment, allowing Argan to fund growth initiatives in other areas. Their predictable revenue streams are a hallmark of stability.

Argan's maintenance and commissioning services for existing power generation facilities are a prime example of a Cash Cow. These services are essential for operational efficiency and regulatory compliance, ensuring a steady demand. In 2024, this segment continued to be a significant contributor to Argan's overall revenue, demonstrating its reliable performance.

The Roberts Company, Argan's industrial construction and plant services division, also functions as a Cash Cow. Its established market position provides consistent revenue, enabling Argan to strategically allocate capital. The predictable cash generation from this mature business unit is vital for the company's financial health.

| Business Segment | BCG Category | 2024 Revenue Contribution (Est.) | Profitability | Investment Needs |

|---|---|---|---|---|

| Power Generation Maintenance & Commissioning | Cash Cow | 25% | High | Low |

| Roberts Company (Industrial Services) | Cash Cow | 18% | High | Low |

| EPC for Traditional Power Plants | Cash Cow | 15% | High | Low |

What You’re Viewing Is Included

Argan BCG Matrix

The Argan BCG Matrix preview you are currently viewing is the precise document you will receive upon purchase, ensuring complete transparency and immediate utility. This comprehensive report, meticulously crafted to illuminate strategic opportunities, will be delivered in its entirety without any watermarks or demo content. You can confidently expect the fully formatted, analysis-ready file to be instantly downloadable, empowering your strategic decision-making process from the moment of acquisition.

Dogs

The Kilroot project, an overseas venture, significantly impacted Argan's gross profit, contributing to a £8.5 million reduction in fiscal year 2024 and a projected £6.2 million reduction in fiscal year 2025. This underperformance highlights a classic 'Dog' in the Argan BCG Matrix, a low-growth, low-market-share asset that is draining resources. Such projects, often characterized by persistent losses or substantial operational hurdles, divert capital and management attention away from more promising opportunities.

Argan's strategic review of such underperforming overseas projects, like Kilroot, is crucial. These 'Dogs' represent cash traps, consuming investment without generating commensurate returns. Identifying and addressing these assets, potentially through divestiture or a complete operational overhaul, is essential for Argan to reallocate resources to areas with higher growth potential and profitability, thereby improving the overall health of its business portfolio.

Argan's involvement in the pure decommissioning of legacy coal-fired power plants, separate from any conversion or repurposing projects, would likely fall into the Dogs category of the BCG matrix. This is because the market for these standalone services is shrinking, offering limited growth potential and potentially low returns.

In 2024, the global trend continues towards phasing out coal power. For instance, the International Energy Agency (IEA) reported that coal power generation saw a decline in many developed nations, with a focus shifting to renewable energy sources. This market contraction means that Argan's resources dedicated to pure decommissioning without a clear path to a replacement energy source could become a cash drain rather than a profit center.

Such activities would likely see minimal future investment from Argan, as the company's strategic focus is on the more lucrative and growing areas of energy transition and infrastructure development. Therefore, pure decommissioning projects, if undertaken without a linked conversion strategy, represent a low-growth, low-return segment that Argan would want to minimize.

Highly niche or obsolete industrial services, often tied to declining sectors like legacy manufacturing or older infrastructure projects, can represent a significant challenge within Argan's portfolio. These specialized areas typically exhibit low market share and minimal growth potential, making them candidates for the 'Dog' quadrant of the BCG Matrix.

Services focused on outdated technologies or industries facing structural decline, such as certain types of specialized welding for aging power plants or fabrication for obsolete machinery, are prime examples. These operations often struggle to achieve profitability, frequently breaking even or generating negligible profits, while simultaneously tying up valuable capital and operational resources that could be better allocated elsewhere.

Argan's strategic approach to these 'Dog' segments would likely involve a deliberate effort to minimize further investment. The focus would shift towards divesting these units or phasing them out entirely to free up resources and capital for more promising growth areas within their portfolio.

Small, Unprofitable One-Off Projects

Small, unprofitable one-off projects often represent a drain on resources for companies like Argan. These are typically engagements with low contract values or those that experience unexpected cost overruns, failing to align with Argan's core competencies or strategic focus. Such projects, by their very nature, tend to yield low market share and minimal profitability.

These 'one-off' endeavors can disproportionately consume valuable company resources, such as skilled labor and capital, without offering scalable returns or contributing to long-term growth. For instance, if Argan were to undertake a small, niche project in 2024 that required specialized equipment not typically used in its main operations, the return on investment might be negligible, especially if it leads to a 5% cost overrun on a $50,000 contract.

- Low Contract Value: Projects with contract values below a certain threshold, say $100,000, might not justify the administrative and operational overhead.

- Cost Overruns: A project experiencing a cost overrun of 10% or more, exceeding the initial budget, signals inefficiency.

- Resource Drain: Engagements that consume more than 15% of a specific department's capacity without commensurate returns are problematic.

- Strategic Misalignment: Projects that do not contribute to Argan's stated strategic goals, such as expanding into renewable energy solutions, should be scrutinized.

Argan's strategy would be to actively avoid initiating such engagements or to systematically phase out existing ones to reallocate resources to more promising ventures that align with its core strengths and offer greater potential for growth and profitability.

Non-Strategic Divested Business Units

Non-Strategic Divested Business Units represent segments Argan has decided to sell off or reduce because they aren't performing well or don't fit the company's future direction. Think of these as parts of the business that Argan no longer sees as key to its growth, especially in its focus areas of energy and infrastructure. By letting these units go, Argan can redirect its resources and money toward more promising opportunities.

For instance, if Argan had a legacy manufacturing division with declining sales, it might be classified here. Such a divestiture would allow Argan to reinvest capital into expanding its renewable energy projects or upgrading its infrastructure assets, areas where it anticipates higher returns and market growth. This strategic pruning is crucial for maintaining a lean and focused business portfolio.

- Divestiture Rationale: Argan divests units with low market share or poor growth prospects to align with its strategic focus on high-growth energy and infrastructure sectors.

- Capital Reallocation: Selling off these non-strategic segments frees up capital, enabling investment in more promising ventures and innovation.

- Portfolio Optimization: This process sharpens Argan's business focus, ensuring resources are concentrated on areas with the greatest potential for future success and profitability.

Dogs in Argan's BCG Matrix represent business units or projects with low market share and low growth potential. These are typically cash traps, consuming resources without generating significant returns. Argan's strategy involves minimizing investment in these areas, often through divestiture or managed decline, to reallocate capital to more promising ventures.

The Kilroot project, with its projected £6.2 million reduction in fiscal year 2025, exemplifies a Dog due to its underperformance and resource drain. Similarly, standalone decommissioning of legacy coal plants, facing a shrinking market as highlighted by the IEA's reports on coal power decline in developed nations for 2024, fits this category.

Argan's focus on energy transition and infrastructure development means that niche services for obsolete industries or small, unprofitable one-off projects, which often experience cost overruns like a 10% increase on a $50,000 contract, are also classified as Dogs.

Non-strategic divested business units, such as a legacy manufacturing division with declining sales, are pruned to optimize the portfolio and reinvest in high-growth areas.

| BCG Category | Argan Example | Market Growth | Market Share | Cash Flow |

| Dogs | Kilroot Project | Low | Low | Negative |

| Dogs | Pure Coal Decommissioning | Low (Declining) | Low | Negative |

| Dogs | Obsolete Industrial Services | Low | Low | Neutral to Negative |

| Dogs | Small, Unprofitable Projects | Low | Low | Negative |

Question Marks

Argan's telecommunications infrastructure services (SMC) currently contribute a modest 2-4% to the company's overall revenue. This segment operates within the telecommunications market, a sector poised for significant expansion driven by advancements like 5G deployment and the ongoing build-out of fiber optic networks.

Despite the promising market outlook, SMC's low revenue share and inconsistent performance suggest a relatively small market position. To elevate SMC to a 'Star' in the BCG matrix, substantial investment would be necessary to capture a larger slice of this growing market.

Argan faces a strategic crossroads with SMC: either commit significant capital to boost its market share and capitalize on industry growth, or evaluate the potential benefits of divesting this underperforming asset.

Emerging advanced renewable technologies represent Argan's potential "Question Marks" in the BCG matrix. Investing in nascent areas like advanced hydrogen infrastructure or next-generation energy storage solutions beyond current battery projects offers high growth prospects. For instance, the global green hydrogen market is projected to reach $350 billion by 2030, indicating substantial future demand.

Argan's involvement in these cutting-edge fields would likely see a low initial market share, necessitating significant research and development funding, alongside dedicated market development efforts. While success in these unproven markets is inherently uncertain, the potential for substantial returns and market leadership is considerable.

Expanding Argan's core power industry services into new, high-growth international markets, where its current presence is minimal, exemplifies a Question Mark in the BCG Matrix. These regions present significant growth potential, but Argan's initial market share would be low, demanding substantial strategic investment and careful navigation of unfamiliar competitive dynamics.

For instance, a market like Vietnam, with its projected 10% annual growth in electricity demand through 2030, could be a prime candidate. However, Argan's current share there is negligible, requiring considerable capital for infrastructure development and market entry. The success of such an endeavor hinges on a thorough assessment of potential returns against the high upfront costs and inherent risks of establishing a foothold in a nascent, yet promising, market.

Carbon Capture and Storage (CCS) Infrastructure

The development of carbon capture and storage (CCS) infrastructure aligns with a question mark in the Argan BCG Matrix. This sector is experiencing rapid growth, fueled by increasing environmental regulations and a global push for sustainability. For Argan, entering this space would mean beginning with a modest market share, necessitating significant investment in capital and specialized knowledge to establish a competitive presence.

This niche presents a high-risk, high-reward scenario. The global CCS market was valued at approximately USD 3.2 billion in 2023 and is projected to reach USD 10.5 billion by 2030, growing at a compound annual growth rate (CAGR) of around 18.2%. This substantial growth potential is tempered by the significant upfront costs and technological complexities involved.

- High Growth Potential: Driven by climate targets and policy incentives, the CCS market is expanding rapidly.

- Low Market Share at Entry: Argan would likely enter with limited established market presence.

- High Capital Requirements: Building CCS infrastructure demands substantial financial investment.

- Technological Expertise Needed: Success requires specialized knowledge in capture, transport, and storage technologies.

Specialized Microgrid and Distributed Energy Solutions

As energy systems increasingly decentralize, specialized microgrid and distributed energy solutions are emerging as a high-growth market. Argan, while a significant player in utility-scale projects, may currently hold a relatively low market share in this specific, rapidly evolving segment. This positions it as a potential Question Mark within the BCG Matrix.

To transform this segment into a Star, Argan would need to make significant investments in tailored solutions and aggressively pursue market penetration. The global microgrid market is projected to reach USD 55.7 billion by 2027, growing at a CAGR of 14.8%, indicating substantial opportunity.

- Market Growth: The distributed energy resources (DER) market, encompassing microgrids, is experiencing rapid expansion driven by grid modernization and renewable energy integration.

- Argan's Position: Argan's expertise in large-scale energy infrastructure might not directly translate to the nuanced requirements of specialized microgrid development, leading to a smaller initial market share.

- Strategic Imperative: Capturing a larger share necessitates focused R&D for diverse microgrid applications and strategic partnerships to accelerate adoption.

- Investment Needs: Significant capital allocation will be required for developing flexible, scalable microgrid technologies and building a strong sales and implementation team for this niche.

Argan's potential ventures into emerging advanced renewable technologies, such as advanced hydrogen infrastructure or next-generation energy storage, represent classic Question Marks. These sectors, while boasting significant growth potential, like the projected $350 billion global green hydrogen market by 2030, require substantial investment to gain even a modest market share.

Developing carbon capture and storage (CCS) infrastructure also fits the Question Mark profile. The CCS market, expected to grow from USD 3.2 billion in 2023 to USD 10.5 billion by 2030 at an 18.2% CAGR, demands significant capital and specialized knowledge for Argan to establish a competitive presence.

Expanding Argan's core power industry services into new, high-growth international markets, such as Vietnam with its projected 10% annual electricity demand growth through 2030, also presents a Question Mark scenario. Argan's current negligible share necessitates considerable capital for infrastructure development and market entry, balancing high upfront costs against inherent risks.

Specialized microgrid and distributed energy solutions are another area where Argan might be a Question Mark. Despite Argan's expertise in large-scale projects, its initial market share in the rapidly expanding microgrid sector, projected to reach USD 55.7 billion by 2027, is likely low, requiring focused R&D and significant capital for tailored solutions.

| Argan's Potential Question Marks | Market Growth Drivers | Argan's Position/Needs | Investment/Risk Profile |

|---|---|---|---|

| Advanced Hydrogen Infrastructure | Global push for decarbonization, energy transition | Low initial market share, significant R&D needed | High capital requirements, high potential returns |

| Next-Generation Energy Storage | Renewable energy integration, grid stability | Nascent market, requires specialized technology development | Substantial upfront investment, uncertain market adoption |

| Carbon Capture and Storage (CCS) | Environmental regulations, corporate sustainability goals | Modest market share, requires specialized knowledge and capital | High upfront costs, technological complexity, high-reward potential |

| International Power Market Expansion (e.g., Vietnam) | Growing electricity demand, infrastructure development | Negligible current share, requires significant market entry investment | High upfront costs, unfamiliar competitive dynamics, potential for significant growth |

| Microgrid and Distributed Energy Solutions | Grid modernization, energy resilience, renewable integration | Low market share in specialized segment, needs tailored solutions | Significant capital for technology and sales, aggressive market penetration required |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive analysis, to accurately position each business unit.