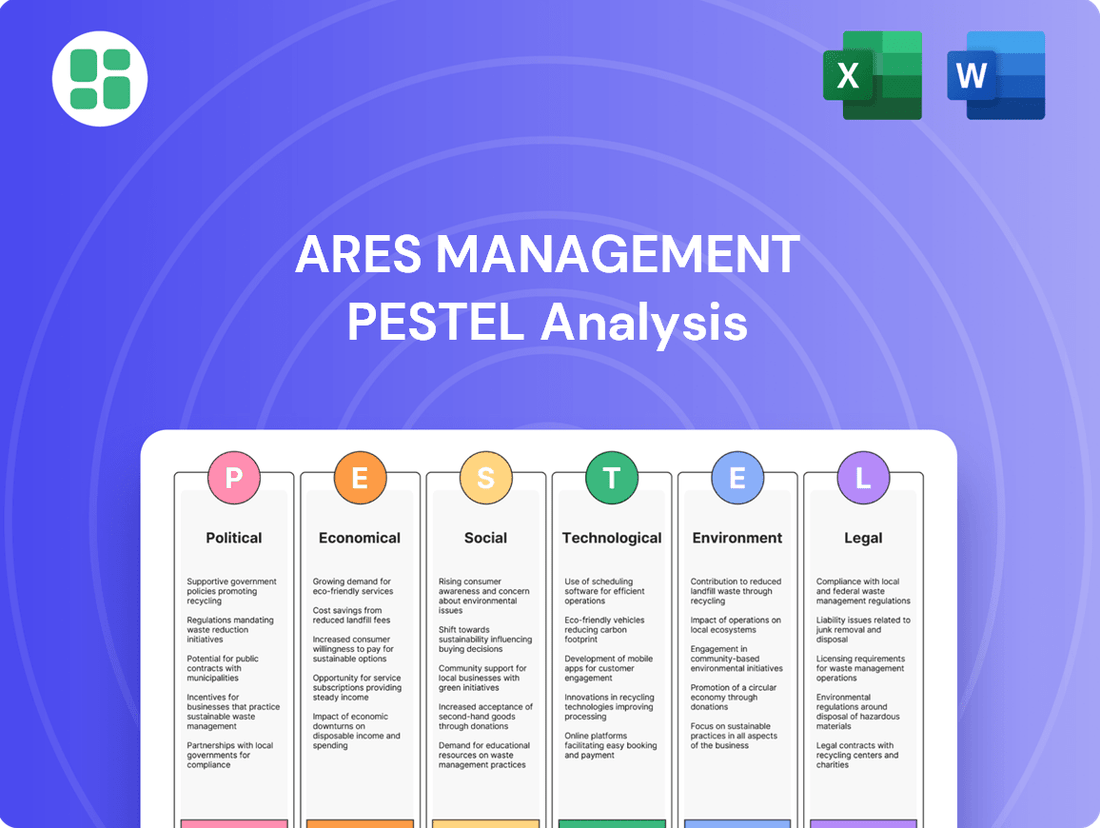

Ares Management PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Ares Management's strategic landscape. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Equip yourself with actionable intelligence for smarter decision-making. Download the full version now and gain a decisive competitive advantage.

Political factors

Government bodies are intensifying their watch on alternative investment firms, including Ares Management. This heightened scrutiny, particularly evident in late 2024 and projected into 2025, can lead to stricter reporting mandates and capital requirements. For instance, the Securities and Exchange Commission (SEC) has been actively proposing new rules concerning private fund disclosures and liquidity management.

Global political instability, such as ongoing conflicts or regional tensions, can significantly impact cross-border investments and market access for a firm like Ares Management. For instance, the persistent geopolitical risks in Eastern Europe and the Middle East in 2024 continue to create volatility, influencing investment decisions in affected regions and potentially rerouting capital flows.

Trade wars or significant shifts in international relations also pose challenges. The imposition of tariffs or the renegotiation of trade agreements can disrupt supply chains and alter the profitability of companies within Ares Management's diverse portfolio, necessitating careful risk assessment and strategic adjustments to maintain market access and competitive advantage.

As a global firm with investments spanning various continents and sectors, Ares Management must closely monitor these geopolitical dynamics. For example, the ongoing trade disputes between major economic blocs in 2024 introduce uncertainty, directly affecting the valuation of assets and the potential returns on new investments, underscoring the need for proactive risk management.

Changes in government fiscal spending and central bank monetary policies significantly shape capital markets and asset class appeal. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023, aiming to curb inflation, directly impacted borrowing costs and valuations across various sectors. This environment, often described as 'higher for longer,' has a pronounced effect on Ares Management's Credit and Real Estate divisions, influencing deal flow and the attractiveness of fixed-income and property investments.

Political Support for Infrastructure and Renewable Energy

Government initiatives and subsidies are actively fostering infrastructure and renewable energy development, presenting substantial investment prospects for Ares Management. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides over $370 billion in clean energy tax credits and incentives, directly benefiting projects Ares might invest in. This political support can significantly de-risk investments in sectors like solar power generation, where Ares has established joint ventures, thereby potentially enhancing returns.

Ares' strategic alignment with political agendas focused on sustainable development and energy security is evident. Many governments globally are prioritizing energy transition to meet climate goals and bolster energy independence. This creates a favorable environment for Ares' expertise in infrastructure and energy investments. For example, the European Union's REPowerEU plan aims to accelerate the green transition, earmarking substantial funds for renewable energy deployment, which aligns with Ares' investment thesis.

- Government Incentives: Programs like the U.S. Inflation Reduction Act offer significant tax credits for renewable energy projects, making them more attractive for investment.

- Energy Security Focus: Political emphasis on energy independence encourages investment in domestic renewable resources, a sector Ares actively participates in.

- Sustainable Development Agendas: Global and national commitments to sustainability, such as the EU's REPowerEU plan, create a supportive policy backdrop for Ares' infrastructure and energy transition strategies.

- De-risking Investments: Political backing and favorable regulatory frameworks can lower the risk profile of infrastructure and renewable energy projects, improving their financial viability.

Tax Policy Changes

Changes in corporate tax rates, capital gains taxes, and specific investment-related tax incentives can significantly affect Ares Management's profitability and the net returns for its investors. For instance, a reduction in the US corporate tax rate from 21% to 15% could boost after-tax earnings for Ares' portfolio companies. Similarly, shifts in capital gains tax policies in key markets like the United States or Europe directly influence the attractiveness of investment exits for both the firm and its clients.

Ares Management, with its global reach and diverse investor base including pension funds and sovereign wealth funds, must navigate a complex web of international tax regulations. For example, evolving tax treaties and differing approaches to taxing carried interest across jurisdictions require continuous strategic adaptation. The firm's ability to manage these tax implications effectively is crucial for maintaining its competitive edge and delivering consistent value.

- US Corporate Tax Rate: Remains at 21% as of mid-2024, impacting the profitability of US-domiciled portfolio companies.

- Capital Gains Tax: The US federal long-term capital gains tax rate can range from 0% to 20%, depending on income levels, affecting investor returns upon asset sales.

- International Tax Scrutiny: Increased focus on tax avoidance strategies by multinational corporations and investment funds by organizations like the OECD.

Government regulations on alternative asset managers are tightening, with increased oversight on private funds and liquidity management, as seen in SEC proposals throughout 2024. Geopolitical instability, such as ongoing conflicts in Eastern Europe and the Middle East in 2024, continues to create market volatility and affect cross-border investment strategies. Shifts in global trade policies and international relations, including trade disputes between major economic blocs, introduce uncertainty impacting asset valuations and necessitate proactive risk management for Ares Management.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Ares Management across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic planning.

A concise PESTLE analysis for Ares Management simplifies complex external factors, providing clear insights that can be readily integrated into strategic planning discussions and decision-making processes.

Economic factors

The current interest rate environment, with projections indicating rates may remain elevated for an extended period, directly impacts Ares Management's performance. For instance, the Federal Reserve kept its benchmark interest rate steady in the 5.25%-5.50% range through early 2024, a move that influences borrowing costs across all sectors.

Inflationary pressures also play a crucial role. While inflation showed signs of moderating in late 2023 and early 2024, persistently high inflation can erode the real returns on fixed-income investments within Ares' credit portfolios. This necessitates careful management to preserve capital and generate alpha.

A 'higher for longer' rate scenario can be a double-edged sword for Ares. It may bolster returns in their private credit strategies due to higher yields on new loans. However, it can simultaneously depress valuations in real estate and private equity, potentially slowing deal-making and impacting exit opportunities.

Global economic growth is projected to moderate in 2024 and 2025, with the IMF forecasting 3.2% GDP growth for 2024, a slight uptick from 2023's 3.0%. However, recession risks remain elevated in certain regions due to persistent inflation and tighter monetary policies. These conditions directly impact Ares Management by influencing corporate earnings, the creditworthiness of borrowers, and demand for real estate assets, all critical components of their investment strategies.

Ares Management's success hinges on its adaptability across economic cycles. The firm's diversified strategies, spanning credit, private equity, and real estate, allow it to deploy capital effectively whether the economy is expanding or contracting. For instance, in a downturn, their credit strategies might focus on distressed debt, while in an upswing, they might pursue growth equity opportunities.

Ares Management's growth hinges on consistent capital availability from both institutional and retail clients, alongside its ability to navigate a competitive fundraising environment. The firm has demonstrated significant prowess in this area, notably achieving record fundraising figures in recent periods. This success is partly due to a strategic diversification of capital sources, actively tapping into wealth and retail channels beyond traditional institutional investors.

Market liquidity and overall investor sentiment are crucial economic factors that directly influence Ares' fundraising capacity. For instance, as of the first quarter of 2024, Ares reported approximately $424 billion in assets under management, reflecting substantial capital inflows. The firm's ability to attract and retain capital is a testament to its strategic positioning and market appeal, even amidst fluctuating economic conditions.

Asset Valuations and Investment Opportunities

Market valuations across credit, private equity, real estate, and infrastructure significantly influence Ares Management's ability to identify and pursue new investment opportunities. When valuations are high, the firm's disciplined strategy emphasizes deploying capital only when suitable opportunities arise at attractive prices, even in competitive environments.

Ares Management's substantial 'dry powder,' totaling $121 billion as of the first quarter of 2024, positions it to capitalize on potential market dislocations and acquire assets at favorable valuations.

- Dry Powder: Ares Management reported $121 billion in total distributable and undeployed capital as of Q1 2024, providing significant capacity for new investments.

- Valuation Sensitivity: The firm's investment strategy is contingent on identifying opportunities at attractive entry points, particularly in sectors like private equity and real estate where valuations can fluctuate.

- Market Dislocation Opportunities: Ares is poised to leverage its capital base to invest during periods of market stress or increased volatility, potentially acquiring assets at discounted prices.

Real Estate Market Dynamics

Real estate market dynamics significantly influence Ares Management's investment strategies. Factors like supply-demand imbalances, rental growth, and fluctuating property values are critical considerations for the firm's portfolio. For instance, the U.S. industrial sector, a key focus for Ares, saw average asking rents increase by approximately 10% year-over-year in Q1 2024, demonstrating robust demand.

Ares is strategically positioning itself within 'New Economy' real estate sectors, such as logistics and data centers. These segments are often more resilient to traditional real estate downturns and are propelled by enduring trends like e-commerce growth and the accelerating pace of digitization. The demand for industrial and logistics space in the U.S. remained strong through early 2024, with net absorption exceeding new supply in many key markets.

- Logistics Sector Growth: Continued expansion of e-commerce fuels demand for modern logistics facilities.

- Data Center Expansion: Increasing reliance on cloud computing and AI drives significant investment in data center infrastructure.

- Resilience to Cycles: 'New Economy' assets often exhibit lower correlation to broader economic real estate cycles.

- Rental Growth Potential: Favorable supply-demand dynamics in targeted sectors support sustained rental income growth.

The economic landscape in 2024 and early 2025 presents a complex environment for Ares Management, characterized by elevated interest rates and moderating global growth. While higher rates can boost yields in credit strategies, they also pose risks to valuations in sectors like real estate and private equity, impacting deal flow and exit opportunities.

Ares' substantial dry powder, totaling $121 billion as of Q1 2024, positions it to capitalize on market dislocations. The firm's diversified strategies across credit, private equity, and real estate enable it to navigate various economic cycles, seeking attractive entry points even amidst competition.

| Economic Factor | Data Point (as of Q1 2024/Early 2024) | Impact on Ares Management |

|---|---|---|

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (steady) | Potentially higher yields on new credit investments, but pressure on asset valuations. |

| Global GDP Growth Forecast | IMF: 3.2% for 2024 | Moderating growth impacts corporate earnings and creditworthiness of borrowers. |

| Assets Under Management (AUM) | ~$424 billion | Reflects strong capital inflows and investor confidence, supporting fundraising. |

| Dry Powder | $121 billion | Provides significant capacity to invest in opportunities, especially during market stress. |

| U.S. Industrial Rents | ~10% year-over-year increase (Q1 2024) | Indicates strong demand in key real estate sectors like logistics, benefiting Ares' portfolio. |

Preview the Actual Deliverable

Ares Management PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ares Management delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm. Gain actionable insights into the strategic landscape for Ares Management.

Sociological factors

Societal pressure and growing investor demand for Environmental, Social, and Governance (ESG) factors are significantly reshaping how investment decisions are made. Ares Management acknowledges this shift, integrating ESG into its sustainability and responsible investment initiatives to align with market expectations and enhance long-term value. This focus is crucial as global ESG assets are projected to exceed $50 trillion by 2025, underscoring its growing influence.

Global demographics are shifting, with an aging population in developed nations and a growing middle class in emerging markets. This creates a demand for specialized wealth management services and investment products that cater to different life stages and risk appetites. For instance, the global population aged 65 and over is projected to reach 1.6 billion by 2050, according to the United Nations, highlighting a significant segment seeking retirement income and capital preservation solutions.

The rise of new wealth segments, including millennials and Generation Z, who often prioritize ESG (Environmental, Social, and Governance) factors and digital engagement, is also reshaping the financial landscape. Ares Management is actively adapting by expanding its distribution channels to reach wealth and retail clients, offering tailored solutions that resonate with these evolving investor preferences. This strategic move aims to capture a broader market share by providing accessible and relevant investment opportunities, including alternative assets which are increasingly sought after by both institutional and individual investors.

Societal pressure for Diversity, Equity, and Inclusion (DEI) is significantly influencing corporate behavior and investment strategies. Firms are increasingly recognizing that a diverse workforce and inclusive culture are not just ethical imperatives but also drivers of innovation and financial performance.

Ares Management demonstrates a commitment to DEI, aiming to leverage diverse perspectives to enhance its operations and investment decision-making. This commitment is reflected in their efforts to build an inclusive environment that benefits both the firm and its stakeholders, integrating DEI principles into their core business practices.

For instance, as of early 2024, many leading investment firms, including those in Ares's peer group, report increased focus on DEI metrics in their talent acquisition and retention strategies. Ares Management’s own reporting in their 2023 ESG update highlighted initiatives to expand diverse representation across various levels of the organization, aiming to mirror the diversity of the markets they serve.

Societal Expectations for Corporate Responsibility

Societal expectations for corporate responsibility are increasingly shaping how investment firms like Ares Management operate. Beyond delivering financial returns, there's a pronounced demand for demonstrable positive social impact. This includes active engagement in philanthropic endeavors and a conscious effort to align business practices with evolving societal values, creating value not just for shareholders but for the wider community.

Ares Management actively pursues this by fostering strategic philanthropic partnerships and integrating social considerations into its investment strategies. For instance, in 2023, Ares committed to significant contributions to various charitable causes, reflecting a growing trend among financial institutions to leverage their resources for social good. This focus on stakeholder capitalism and community betterment is becoming a critical component of corporate reputation and long-term sustainability.

- Growing Stakeholder Demand: Investors and the public alike are scrutinizing corporate social responsibility (CSR) initiatives more closely than ever before.

- Impact Investing Growth: The global impact investing market, which seeks both financial return and measurable social or environmental impact, was estimated to be over $1 trillion in 2024, indicating a strong market appetite for socially responsible investments.

- Reputational Risk and Reward: Companies demonstrating strong CSR practices often experience enhanced brand reputation and customer loyalty, while those lagging face reputational damage.

- ESG Integration: Environmental, Social, and Governance (ESG) factors are increasingly integrated into investment decision-making processes by major asset managers, including Ares, to meet client demands and manage long-term risks.

Talent Attraction and Retention in Finance

Societal expectations regarding work-life balance and the overall employee experience significantly impact talent acquisition in the highly competitive alternative investment sector. Firms that champion flexible work arrangements and a supportive corporate environment are better positioned to attract skilled professionals. Ares Management actively cultivates a culture emphasizing collaboration and professional growth, aiming to retain its workforce by providing robust development programs and fostering a strong sense of community.

The financial industry's ability to attract and keep its best people is paramount, especially in specialized fields like alternative investments. In 2023, the financial services sector saw an average employee tenure of around 4.5 years, highlighting the challenge of retention. Ares Management's strategy includes offering comprehensive training and mentorship, which is vital for keeping employees engaged and developing their careers within the firm.

Key factors influencing talent attraction and retention in finance include:

- Societal emphasis on work-life integration: Employees increasingly seek roles that offer flexibility and respect personal time.

- Corporate culture and values: A positive and inclusive workplace environment is a major draw for top talent.

- Career development and advancement: Opportunities for learning new skills and progressing within the organization are critical for retention.

- Compensation and benefits: While important, these are often weighed against the other cultural and developmental aspects of a role.

The increasing demand for socially responsible investments, often driven by younger generations, is a significant sociological factor influencing Ares Management. This trend is supported by data showing that ESG-focused funds saw substantial inflows in 2023, with many investors prioritizing companies demonstrating strong social impact and ethical governance. Ares's adaptation involves offering more ESG-integrated products and transparently reporting on their social initiatives to meet this evolving investor sentiment.

Technological factors

Ares Management is increasingly integrating advanced data analytics and digital platforms into its investment processes. This technological shift is crucial for enhancing decision-making accuracy, refining risk management strategies, and boosting overall operational efficiency across their diverse portfolio.

The firm actively uses technology to gain better visibility into portfolio emissions, a key aspect of environmental, social, and governance (ESG) considerations. By prioritizing data quality, Ares aims to improve the reliability of its insights, leading to more informed strategic choices and robust reporting for stakeholders.

As Ares Management's operations increasingly rely on digital platforms, the risk of cyberattacks and data breaches is a significant technological concern. Protecting sensitive client and investment data is crucial for maintaining trust and operational stability in the financial industry.

Ares Management must prioritize continuous investment in advanced cybersecurity measures to fortify its digital infrastructure against evolving threats. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the substantial financial implications of inadequate protection.

Fintech innovation is reshaping investment management, presenting both challenges and opportunities for firms like Ares Management. The rise of digital platforms and AI-driven tools can streamline everything from client onboarding to portfolio analysis, potentially lowering costs and increasing efficiency. For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, underscoring the scale of this transformation.

Ares Management's strategic engagement with fintech, including exploring partnerships for alternative investment distribution, highlights a proactive approach to this disruption. This suggests a focus on leveraging technology to improve client access to their diverse investment strategies and to enhance the operational backbone of their business. Such moves are crucial for maintaining a competitive edge in an increasingly digitized financial landscape.

Adoption of AI and Machine Learning in Financial Analysis

Artificial intelligence and machine learning are becoming essential tools in financial analysis, powering everything from market trend prediction to the discovery of new investment avenues. Ares Management can leverage these technologies to refine its quantitative research, leading to more robust investment strategies and sharper decision-making.

The integration of AI and ML allows for the processing of vast datasets at speeds previously unimaginable, uncovering patterns and correlations that human analysts might miss. This can directly translate into improved alpha generation and risk management for Ares.

- AI in Financial Services: Global spending on AI in financial services is projected to reach $25.6 billion by 2026, up from $11.1 billion in 2022, indicating significant industry adoption.

- Predictive Analytics Growth: The market for predictive analytics in finance is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2027.

- Ares' Quantitative Focus: Ares Management's existing strength in quantitative strategies positions it well to capitalize on AI/ML advancements for enhanced portfolio construction and alpha capture.

Digital Infrastructure Investments (Data Centers)

The relentless expansion of data centers, fueled by the surge in cloud computing, artificial intelligence, and the Internet of Things, creates a compelling investment landscape. Global spending on data center infrastructure was projected to exceed $300 billion in 2024, with a significant portion dedicated to new builds and upgrades.

Ares Management has proactively fortified its real estate and infrastructure divisions to capitalize on this trend. Their strategic focus on digital infrastructure acknowledges the escalating need for robust power solutions and purpose-built facilities to support the ever-growing digital economy.

- Data Center Market Growth: The global data center market is expected to reach over $1 trillion by 2030, demonstrating sustained high growth.

- AI's Impact: AI workloads are driving demand for high-density power and advanced cooling systems within data centers.

- Ares' Strategy: Ares' investment in digital infrastructure aligns with the increasing demand for specialized real estate assets.

Technological advancements are fundamentally reshaping how Ares Management operates, from enhancing investment analysis with AI and machine learning to managing the risks associated with an increasingly digital footprint. The firm's proactive integration of these tools is key to maintaining its competitive edge.

The exponential growth in data and the demand for sophisticated analytics, particularly driven by AI, presents significant opportunities for investment. For instance, the global AI market is projected to reach $1.8 trillion by 2030, highlighting substantial growth potential for firms that can effectively leverage these technologies.

Ares Management's strategic investments in digital infrastructure, like data centers, directly capitalize on the escalating demand for computing power and connectivity. This sector is booming, with the global data center market expected to surpass $1 trillion by 2030, driven by AI and cloud computing needs.

However, the reliance on digital platforms also elevates cybersecurity risks. The projected annual cost of cybercrime globally reaching $10.5 trillion by 2025 underscores the critical need for robust security measures to protect sensitive data and ensure operational continuity.

| Technology Area | 2024/2025 Projection/Stat | Impact on Ares Management |

|---|---|---|

| AI & Machine Learning | Global AI market to reach $1.8T by 2030; AI in financial services spending to hit $25.6B by 2026. | Enhanced investment analysis, predictive modeling, and operational efficiency. |

| Cybersecurity | Global cybercrime cost to reach $10.5T annually by 2025. | Increased focus on data protection, risk mitigation, and maintaining client trust. |

| Digital Infrastructure (Data Centers) | Data center market to exceed $1T by 2030; Global data center infrastructure spending > $300B in 2024. | Investment opportunities in real estate and infrastructure supporting digital growth. |

Legal factors

Ares Management navigates a dense global web of financial regulations, including oversight from the U.S. Securities and Exchange Commission (SEC) and various international financial authorities. These rules, which are constantly being updated, can significantly impact operational strategies and require substantial investment in compliance infrastructure.

The financial services industry, particularly alternative asset managers like Ares, faces increasing scrutiny. For instance, the SEC's proposed rule changes in 2023 aimed at enhancing private fund adviser regulation could introduce new disclosure obligations and operational complexities, directly affecting compliance costs and administrative burdens for firms managing trillions in assets.

Changes in tax laws, such as potential adjustments to corporate tax rates or carried interest regulations, significantly influence Ares Management's bottom line and investor returns. For instance, the U.S. corporate tax rate, currently at 21%, remains a key factor in the firm's profitability. Navigating these evolving legal landscapes, including international tax treaties, is crucial for optimizing fund structures and maintaining tax efficiency across Ares' global footprint.

Ares Management, like all financial institutions, must navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate thorough due diligence during client onboarding and continuous monitoring to thwart illicit financial activities. For instance, in 2024, global AML spending was projected to reach over $10 billion, highlighting the significant investment required for compliance.

Adherence to these legal frameworks is paramount for Ares to retain its operating licenses and safeguard its reputation, introducing considerable legal and operational complexity. Failure to comply can result in substantial fines; in 2023, the Financial Crimes Enforcement Network (FinCEN) reported over $2.7 billion in penalties for AML violations in the US alone.

Data Privacy and Protection Laws (e.g., GDPR, CCPA)

Global data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) in the US, are increasingly shaping how companies manage personal information. For Ares Management, a firm that handles substantial client and employee data, adherence to these laws is critical. Non-compliance can lead to significant financial penalties and damage to its reputation. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. CCPA violations can result in penalties of $2,500 per unintentional violation and $7,500 per intentional violation.

Ares Management's commitment to data privacy is not just a legal obligation but also a strategic imperative. Robust data protection measures build trust with clients and stakeholders, which is paramount in the financial services industry. Ensuring compliance involves meticulous data mapping, clear consent mechanisms, and secure data storage protocols. The firm must continuously adapt its practices to evolving privacy landscapes, which include ongoing updates and interpretations of existing laws and the potential introduction of new regulations globally.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Fines: $2,500 per unintentional violation, $7,500 per intentional violation.

- Client Trust: Data privacy is a key factor in maintaining client confidence.

- Regulatory Evolution: Continuous adaptation to new and updated privacy laws is necessary.

Contract Law and Investment Agreements

Contract law is the bedrock of Ares Management's operations, ensuring the enforceability of its diverse investment agreements. This legal framework underpins everything from intricate debt covenants to complex acquisition terms across its credit, private equity, real estate, and infrastructure portfolios. Without these robust legal protections, the integrity of Ares' contractual obligations, especially in high-stakes cross-border deals, would be compromised.

The enforceability of these contracts is critical for managing risk and ensuring predictable returns. For instance, in 2024, Ares continued to navigate a global landscape where varying interpretations of contract law can impact the execution and profitability of its investments. The ability to rely on clear, legally binding agreements is therefore paramount.

- Enforceability of Investment Agreements: Ares relies on strong contract law to ensure its investment agreements, including those for private equity buyouts and real estate development, are legally binding and can be enforced in courts.

- Debt Covenants: The precise wording and legal enforceability of debt covenants within its credit segment are vital for managing borrower compliance and protecting Ares' capital.

- Cross-Border Transactions: Ares' significant international presence means it must contend with diverse legal systems, making the clarity and enforceability of contracts across jurisdictions a key operational consideration.

- Acquisition Agreements: The success of Ares' acquisition strategies hinges on the legal soundness of its purchase agreements, ensuring smooth transitions and the fulfillment of all contractual terms.

Ares Management operates within a highly regulated financial sector, necessitating strict adherence to evolving legal frameworks. The firm's global operations mean it must navigate a complex patchwork of international and domestic laws, impacting everything from fund structuring to client interactions.

The firm's compliance efforts are substantial, driven by regulations like those overseen by the SEC and global AML/KYC mandates. For instance, the projected over $10 billion in global AML spending for 2024 underscores the significant investment required to meet these obligations, with US AML penalties alone exceeding $2.7 billion in 2023.

Key legal considerations include data privacy laws such as GDPR and CCPA, with potential fines reaching up to 4% of global annual turnover for GDPR violations. Contract law is also fundamental, ensuring the enforceability of Ares' diverse investment agreements across its global portfolio.

Environmental factors

Growing global awareness of climate change is significantly reshaping investment landscapes, pushing demand for sustainable options and compelling companies like Ares Management to actively reduce their environmental impact. This shift is not just about corporate responsibility; it's a market imperative.

Ares Management is actively addressing these concerns through its Ares Climate Transition (ACT) Program. This initiative focuses on measuring and reducing greenhouse gas emissions across the firm's diverse investment portfolio. The program underscores a commitment to transparency and employing data to guide tangible climate action, aligning with investor expectations for ESG performance.

By mid-2024, the alternative investment sector, including firms like Ares, saw continued growth in sustainable assets. For instance, global sustainable investment assets reached an estimated $37.5 trillion by the end of 2023, a figure expected to climb as regulatory pressures and investor demand intensify through 2025. Ares' ACT program positions them to capitalize on this trend.

Environmental factors, especially climate-related risks and opportunities, are now central to how investment decisions are made. Ares Management recognizes that focusing on environmental, social, and governance (ESG) factors isn't just about compliance; it's about finding better returns. They actively incorporate material environmental issues into how they evaluate and manage their investments, reflecting a growing industry trend.

Governments worldwide are intensifying their focus on sustainability, leading to a surge in regulatory pressure for comprehensive environmental, social, and governance (ESG) reporting. For instance, the European Union's upcoming European Sustainability Reporting Standards (ESRS) will significantly broaden the scope and detail required from companies operating within its jurisdiction, impacting entities like Ares Management. This regulatory shift underscores a global trend towards greater corporate accountability regarding environmental impact.

Ares Management is actively responding to these evolving disclosure mandates by enhancing its sustainability reporting frameworks. The firm recognizes that transparent reporting on environmental performance, including metrics on carbon emissions and resource management, is becoming crucial for investor confidence and compliance. This proactive approach ensures alignment with the increasing demand for data-driven ESG insights from stakeholders.

Resource Scarcity and Supply Chain Resilience

Environmental concerns such as resource scarcity and climate-related disruptions pose significant risks to the operational resilience and profitability of Ares Management's portfolio companies. These factors directly influence asset values and future cash flows, particularly for sectors like real estate and infrastructure. Ares integrates these environmental considerations into its due diligence processes to safeguard long-term value creation.

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, create tangible threats to physical assets. For instance, the global cost of natural disasters reached an estimated $280 billion in 2023, according to Swiss Re, highlighting the potential for significant asset impairment. Ares's focus on supply chain resilience also extends to ensuring portfolio companies can navigate potential disruptions caused by resource shortages or logistical breakdowns, which are often exacerbated by environmental instability.

- Climate Change Impact: Rising global temperatures and increased weather volatility threaten physical assets in real estate and infrastructure portfolios.

- Resource Availability: Scarcity of key resources like water and critical minerals can impact operational costs and feasibility for certain portfolio companies.

- Supply Chain Vulnerabilities: Geopolitical events and climate-driven disruptions can create significant bottlenecks in global supply chains, affecting project timelines and costs.

- Due Diligence Focus: Ares Management actively assesses environmental risks, including resource scarcity and climate resilience, during the acquisition and ongoing management of its investments.

Investment in Renewable Energy and Green Infrastructure

The global push towards a low-carbon economy is a major driver for investment in renewable energy and green infrastructure. Ares Management is strategically positioning itself to benefit from this trend, evidenced by its substantial investments in U.S. solar power generation projects.

Ares is also broadening its infrastructure debt platform to support the increasing demand for sustainable energy solutions. This expansion allows them to finance a wider range of green projects, aligning with worldwide decarbonization goals and creating new avenues for growth.

- Ares Management's commitment to renewable energy is underscored by its significant capital allocation to U.S. solar power projects.

- The firm's infrastructure debt platform is expanding to meet the growing financing needs of the green energy sector.

- This strategic focus aligns with the global imperative to transition to a low-carbon economy, creating substantial investment opportunities.

Environmental factors are increasingly shaping investment strategies, with climate change and sustainability at the forefront. Ares Management's proactive approach, including its Climate Transition (ACT) Program, demonstrates a commitment to addressing these shifts. The firm recognizes that integrating environmental considerations into its investment processes is not just about risk mitigation but also about capitalizing on emerging opportunities within the growing sustainable investment market.

| Environmental Factor | Impact on Ares Management | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Physical asset risk, operational disruptions, insurance costs | Global natural disaster costs reached $280 billion in 2023. Increased frequency of extreme weather events. |

| Resource Scarcity | Increased operational costs, supply chain vulnerabilities | Growing concerns over water and critical mineral availability impacting various industries. |

| Regulatory Landscape (ESG Reporting) | Compliance burden, enhanced transparency requirements | EU's ESRS expanding reporting scope; global trend towards stricter ESG disclosure mandates. |

| Low-Carbon Transition | Investment opportunities in renewables, green infrastructure | Global sustainable investment assets estimated at $37.5 trillion by end of 2023, with continued growth projected. Ares investing significantly in U.S. solar projects. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ares Management is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside reports from reputable market research firms and government regulatory bodies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the alternative investment management sector.