Ares Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

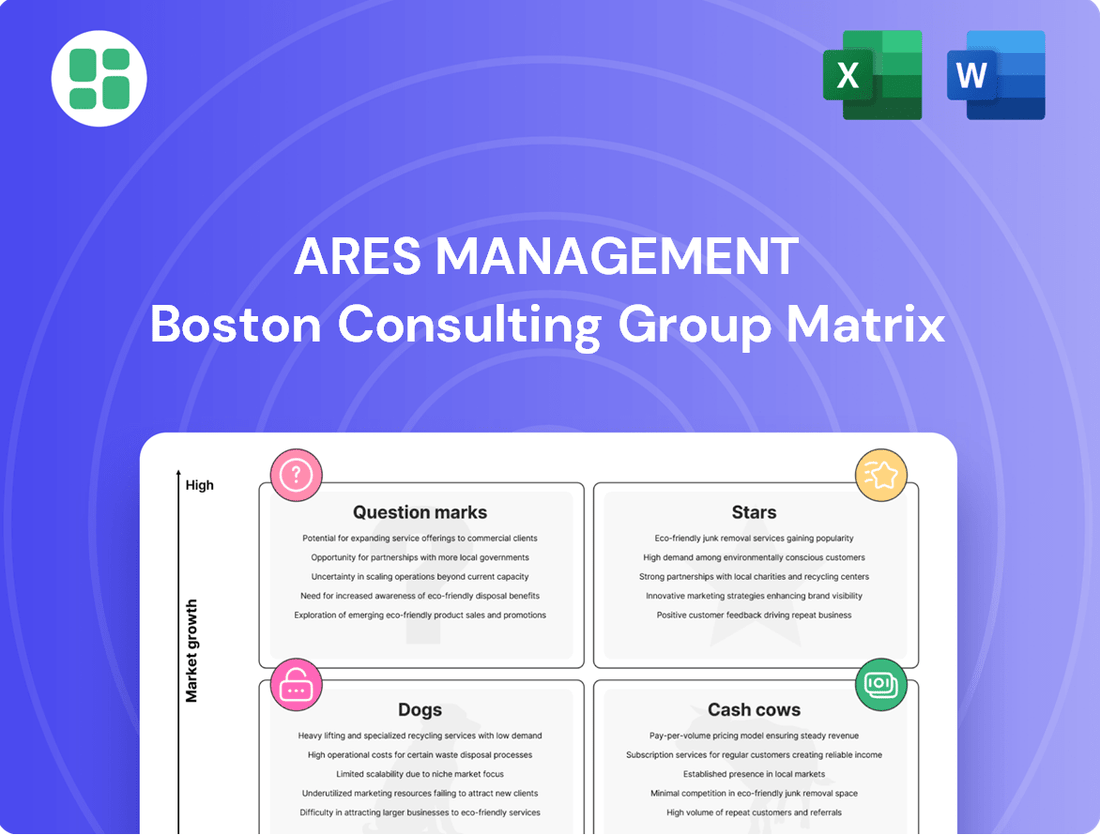

Curious about Ares Management's strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full picture and gain actionable insights into their market positioning and future growth opportunities.

Don't miss out on the complete Ares Management BCG Matrix report. It provides a comprehensive breakdown of each product's quadrant placement, along with strategic recommendations to optimize resource allocation and drive market leadership. Purchase now for a decisive advantage.

Stars

Ares Management's private credit strategies, especially its direct lending arm, are a clear star. This segment benefits from the booming private credit market, which is expected to hit $2.6 trillion by 2029. Ares is a major player, managing significant assets under management in direct lending, solidifying its star status.

Ares Management has strategically amplified its infrastructure segment, notably by acquiring GCP International in March 2025. This move injected over $45 billion into its Assets Under Management (AUM), significantly broadening its global reach, especially in key sectors like logistics real estate and data centers.

The global infrastructure investment landscape is experiencing a robust expansion, driven by a strong demand for renewable energy and digital infrastructure projects. Ares is well-positioned within this high-growth market, actively increasing its market share and influence through strategic initiatives and acquisitions.

The private secondary market is booming, with transaction volumes in 2024 projected to surpass $175 billion, a significant leap and a testament to its growing importance. This surge indicates a dynamic environment where investors are increasingly seeking liquidity for their private assets.

Ares Management's Secondaries Group is a key player in this expanding market, actively growing its capabilities across diverse asset classes. Their consistent performance highlights their strategic positioning to capitalize on the increasing demand for secondary transactions.

Growth Equity in Technology and Innovation

The technology sector, particularly in burgeoning fields like artificial intelligence (AI) and automation, continues to be a magnet for private equity investment. Projections for 2025 indicate sustained robust growth potential within these innovative spaces.

Ares Management's private equity strategies actively target these innovation-driven industries, seeking to support emerging technologies and high-growth startups. This strategic alignment places such investments within the 'Star' category of the BCG Matrix.

These 'Star' investments are characterized by their high market growth prospects and Ares's hands-on involvement in fostering their development. For instance, in 2024, private equity deal volume in the AI sector saw a notable increase, with valuations reflecting the significant growth anticipated.

Key areas attracting this capital include AI-powered software solutions, advanced robotics, and data analytics platforms. The ability of these companies to disrupt existing markets and create new ones fuels their 'Star' status.

- AI and Automation Growth: The AI market alone is projected to reach hundreds of billions of dollars by 2025, demonstrating substantial growth.

- Private Equity Interest: In 2024, private equity firms continued to deploy significant capital into technology, with a notable portion directed towards AI and software.

- Ares's Strategy: Ares's focus on backing disruptive technologies positions them to capitalize on these high-growth market opportunities.

- Valuation Metrics: Companies in these 'Star' segments often command premium valuations due to their rapid revenue expansion and market share gains.

Global Wealth Management Distribution

Ares Management is strategically broadening its reach in wealth management distribution, aiming to tap into the growing demand for alternative investments among individual investors. This expansion is crucial for their growth, as the firm seeks to capture a larger share of this evolving market.

The firm is actively diversifying its client base, focusing on institutional, wealth, and insurance sectors. A significant push is being made to bolster its global wealth operations, evidenced by substantial inflows, such as those recorded from Japan, highlighting the success of their international strategy in 2024.

- Global Wealth Expansion: Ares is prioritizing the growth of its global wealth management business, recognizing it as a key area for future inflows.

- Record Inflows: The company has experienced significant capital inflows, particularly from markets like Japan in 2024, demonstrating successful market penetration.

- Democratization of Alternatives: Ares is capitalizing on the trend of making alternative investments more accessible to a wider range of investors.

- Strategic Presence: The firm is building a robust and expanding presence in the wealth segment, positioning itself to benefit from increasing individual investor allocations to alternatives.

Ares Management's private credit strategies, particularly direct lending, are a clear star. This segment benefits from the booming private credit market, which is expected to reach $2.6 trillion by 2029, with Ares as a significant player managing substantial assets in this area.

The firm's infrastructure segment, bolstered by the March 2025 acquisition of GCP International, which added over $45 billion in AUM, is also a star. This strategic move enhances their global reach, especially in logistics real estate and data centers, tapping into a market driven by renewable energy and digital infrastructure demand.

Ares's private equity investments in high-growth technology sectors like AI and automation are also stars. With the AI market projected for substantial growth by 2025 and private equity deal volume in AI increasing in 2024, Ares's focus on disruptive technologies positions them for premium valuations and market share gains.

The firm's expansion in wealth management distribution, targeting individual investors and experiencing significant inflows, such as from Japan in 2024, solidifies its star status in this growing segment.

| Segment | Market Growth | Ares's Position | Key Drivers | 2024/2025 Data Point |

|---|---|---|---|---|

| Private Credit | High (est. $2.6T by 2029) | Major Player | Demand for alternative financing | Significant AUM in direct lending |

| Infrastructure | Robust Expansion | Increasing Market Share | Renewable energy, digital infrastructure | +$45B AUM from GCP acquisition (Mar 2025) |

| Private Equity (AI/Automation) | Very High (AI market $100B+ by 2025) | Strategic Investor | Disruptive technologies, AI adoption | Increased PE deal volume in AI (2024) |

| Wealth Management | Growing Demand | Expanding Global Presence | Democratization of alternatives | Significant inflows from Japan (2024) |

What is included in the product

Strategic assessment of Ares Management's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Identifies opportunities for investment, divestment, or harvesting based on market growth and relative market share.

The Ares Management BCG Matrix provides a clear, visual framework to identify underperforming assets, alleviating the pain of inefficient capital allocation.

Cash Cows

Ares Management's established direct lending and broader private credit funds are indeed significant cash cows. These strategies thrive in a mature market where Ares commands a leading position, consistently generating substantial management fees and fee-related earnings. This stability means less need for aggressive investment to attract new capital, allowing these funds to act as reliable income generators.

In 2023, Ares's Credit segment, which encompasses these strategies, reported Fee Related Earnings (FRE) of $1.1 billion, a testament to the recurring revenue from its established funds. This segment's strong performance, driven by consistent deployment and stable fee structures, provides the financial bedrock to support investments in Ares's other, more growth-oriented business areas.

Ares Management's mature, diversified private equity funds, especially those with a history of successful vintages, are prime examples of cash cows. These funds hold a significant share of the institutional investor market, consistently bringing in management fees and performance income as their underlying assets mature and are sold off. This steady income stream is a hallmark of a cash cow, indicating a stable market segment where Ares has a strong presence.

Within Ares Management's real assets group, their portfolio of core, income-generating real estate assets in stable, mature markets functions as a classic cash cow. These established properties consistently produce predictable rental income and stable cash flows, offering lower volatility compared to other market segments. This reliable income stream contributes significantly to Ares's overall earnings without requiring substantial new capital investment.

Management Fees from Long-Duration Funds

Ares Management's long-duration funds are a significant cash cow, generating substantial management fees. These fees come from a growing pool of assets across their Credit, Private Equity, Real Estate, and Infrastructure divisions. This provides a reliable and steady income source.

The predictable revenue from these management fees allows Ares to comfortably cover its operating expenses. It also frees up capital to invest in new strategic growth areas. This stability means the firm isn't overly dependent on performance fees or constantly needing to raise new capital for established funds.

- Fee-Paying AUM Growth: Ares reported total AUM of $427.5 billion as of March 31, 2024, with a significant portion attributable to its long-duration strategies.

- Stable Revenue Stream: Management fees provide a consistent revenue base, acting as the bedrock of Ares' financial stability.

- Operational Funding: These fees directly support ongoing operations and the pursuit of new investment opportunities.

- Reduced Reliance on Performance Fees: The strength of management fees lessens the firm's dependence on the more volatile performance-based income.

Developed Market Infrastructure Funds

Ares Management's investments in developed market infrastructure funds, focusing on stable assets like utilities and transportation networks, often function as cash cows within their portfolio. These mature assets are prized for their long-term, predictable cash flows, offering a reliable income stream with lower volatility compared to growth-oriented investments. For instance, as of early 2024, Ares's infrastructure funds have consistently demonstrated stable performance, with a significant portion of their capital allocated to these established, essential services.

Ares's substantial footprint in the global infrastructure sector, amplified by strategic acquisitions in recent years, enables them to effectively manage and extract consistent returns from these mature assets. This established market presence allows for operational efficiencies and economies of scale, further solidifying their cash cow status. The firm's commitment to this segment is underscored by their ongoing capital deployment, aiming to capitalize on the steady income generation these assets provide.

- Developed Market Infrastructure: Focuses on mature, stable assets like utilities and toll roads.

- Predictable Cash Flows: These assets generate consistent, long-term revenue streams.

- Low Volatility: Less susceptible to rapid market swings, providing stability.

- Ares's Strategy: Leverages established infrastructure for reliable returns, supported by recent acquisitions.

Ares Management's established direct lending and broader private credit funds are significant cash cows, consistently generating substantial management fees and fee-related earnings due to their leading market position. These mature strategies, which contributed to Ares's Credit segment reporting $1.1 billion in Fee Related Earnings (FRE) in 2023, provide a stable income base that supports investment in growth areas.

| Ares Management Segment | Cash Cow Characteristics | Key Financial Indicator (2023/Early 2024) |

|---|---|---|

| Direct Lending & Private Credit | Mature market, leading position, stable fee structures | $1.1 billion in Fee Related Earnings (Credit Segment) |

| Mature Private Equity Funds | History of successful vintages, strong institutional investor base | Consistent management fees and performance income |

| Core Real Estate Assets | Income-generating properties in stable markets, predictable rental income | Stable cash flows, lower volatility |

| Long-Duration Funds | Growing AUM across divisions, reliable management fees | Total AUM of $427.5 billion (as of March 31, 2024) |

| Developed Market Infrastructure | Stable assets (utilities, transportation), predictable long-term cash flows | Consistent performance, significant capital allocation to essential services |

Full Transparency, Always

Ares Management BCG Matrix

The Ares Management BCG Matrix preview you're currently viewing is the identical, fully unlocked document you'll receive immediately after purchase. This means you'll get the complete strategic analysis, free from any watermarks or demo limitations, ready for immediate application in your business planning. The comprehensive insights and professionally formatted layout you see here are exactly what you'll download, ensuring no surprises and immediate usability for your decision-making processes.

Dogs

Ares Commercial Real Estate (ACRE), a publicly traded entity overseen by Ares Management, experienced a net loss in the fourth quarter of 2024, falling short of earnings per share projections and consequently seeing its stock price dip. This performance highlights potential underperformance within specific niche real estate debt strategies that are particularly sensitive to prevailing market headwinds, such as elevated interest rates.

These underperforming niche debt strategies, despite being housed within Ares' broader, strong real estate operations, are facing difficulties in achieving positive returns or demonstrating growth. For instance, if a particular niche debt fund within ACRE focused on a segment like distressed retail properties experienced a significant increase in defaults due to economic slowdown in 2024, its performance would likely suffer, potentially showing negative net asset value growth for the year.

Legacy smaller funds with limited growth potential, often in niche or mature markets, can become a drag on resources. For instance, a specialized real estate fund launched in the early 2010s might have seen its initial growth stall as the market matured, with limited new development opportunities. Such funds, if they represent a small fraction of Ares Management's total Assets Under Management (AUM), which stood at $394 billion as of Q1 2024, may not justify the ongoing operational costs and strategic focus required to maintain them.

These funds, due to their size and market constraints, may not attract significant new capital. This lack of scale can hinder their ability to achieve economies of scale in management and operations. Ares Management, like other large asset managers, constantly evaluates its fund offerings to ensure they align with strategic growth objectives and deliver optimal returns for both investors and the firm.

Within Ares Management's diverse portfolio, areas with exposure to highly competitive or commoditized investment products, such as certain traditional fixed income strategies or broadly syndicated loans, could be considered question marks. These segments often face intense fee pressure and lower profit margins, demanding significant operational efficiency to remain competitive.

Illiquid or Non-Core Portfolio Assets

Illiquid or non-core legacy assets within broader portfolios, particularly those that are challenging to exit or demand significant operational management for meager returns, can be categorized as 'Dogs' within a framework like Ares Management's BCG Matrix. These assets, even within successful funds, might not fit current strategic objectives or prevailing market conditions, effectively immobilizing capital without yielding anticipated value.

For instance, a private equity fund might hold a minority stake in a mature, unlisted manufacturing company that requires constant attention from the management team due to its complex operational needs, yet it contributes less than 1% to the fund's overall internal rate of return. In 2024, the average holding period for private equity investments in mature companies has extended, with some illiquid assets remaining on balance sheets for over 10 years, highlighting the challenge of divesting such 'Dogs'.

- Low Growth Potential: These assets typically operate in stagnant or declining markets, offering limited prospects for capital appreciation.

- High Operational Burden: They often necessitate substantial management time and resources for maintenance rather than strategic growth initiatives.

- Difficulty in Divestment: Finding suitable buyers or achieving favorable exit valuations can be exceptionally difficult, leading to prolonged holding periods.

- Capital Tie-up: The capital invested in these assets could be deployed more effectively in higher-potential investments, hindering overall portfolio performance.

Strategies with Stagnant Investor Demand

Investment strategies experiencing stagnant investor demand, especially those not aligned with Ares's core growth objectives, would be classified as Dogs within the BCG Matrix. These strategies may struggle to attract new capital, potentially hindering Assets Under Management (AUM) growth and fee generation.

Maintaining underperforming strategies can drain resources without contributing significantly to overall profitability. For instance, if a particular fund strategy saw its AUM remain flat at $500 million in 2023 while operational costs were $10 million, its contribution to net revenue would be minimal, making it a prime candidate for re-evaluation.

- Stagnant Demand: Strategies that consistently fail to attract new capital commitments.

- Low Growth Potential: Little to no prospect of increasing AUM or generating substantial fee revenue.

- Resource Drain: Operational costs may outweigh the revenue generated by these strategies.

- Strategic Misalignment: May not fit Ares's long-term vision or competitive advantages.

Dogs within Ares Management's BCG Matrix represent investment strategies or assets with low market share and low growth potential. These are often legacy products or niche areas that have stalled, requiring significant resources but yielding minimal returns. For example, a real estate debt strategy focused on a declining sector might see its AUM stagnate, making it a drag on profitability.

These segments, characterized by limited scalability and difficulty in divestment, can tie up valuable capital. Ares Management, with its $394 billion AUM as of Q1 2024, must continually assess these 'Dogs' to reallocate resources to more promising ventures. The challenge lies in managing these assets efficiently while seeking strategic exits.

The operational burden of these underperforming areas can be substantial, potentially outweighing the revenue they generate. For instance, a niche fund with flat AUM and high operational costs would contribute negligibly to net revenue, prompting a strategic review.

These strategies are often characterized by stagnant investor demand and a lack of alignment with Ares's core growth objectives, making them prime candidates for re-evaluation and potential wind-down.

| Category | Characteristics | Example within Ares Management Context | 2024 Consideration |

| Dogs | Low Market Share, Low Growth | Stagnant niche real estate debt strategy, legacy private equity stake in a mature company | Requires resource reallocation, potential for divestment or restructuring |

| Market Growth | Low | Mature or declining sectors | Limited capital appreciation prospects |

| Operational Impact | High Burden, Low Return | Significant management time for minimal profit | Drains resources, impacts overall fund performance |

Question Marks

Ares Management's recent strategic acquisitions, like GCP International, have significantly broadened its geographic footprint, notably entering markets such as Japan, Brazil, and Vietnam. These emerging economies present substantial growth opportunities within the alternative investment landscape, aligning with Ares's expansion objectives.

While these new territories offer high growth potential, Ares's initial market share and brand recognition in Japan, Brazil, and Vietnam are likely still developing. This positions these ventures as potential 'question marks' within a BCG-like framework, demanding considerable investment to build a strong market presence and competitive advantage.

Ares Management is exploring the launch of new thematic or niche alternative funds, potentially focusing on areas like specialized climate technology, cutting-edge biotech, or property technology (proptech). These strategies also extend to highly specific asset-backed financing opportunities, reflecting a move into less crowded, high-potential markets.

While these nascent markets offer significant growth prospects, new funds typically begin with a smaller Assets Under Management (AUM) base. For instance, a new climate-tech fund might launch with $100 million in capital, compared to established funds in broader categories. These niche strategies necessitate considerable capital deployment and robust marketing to build scale and demonstrate long-term value, a common challenge for emerging alternative investment vehicles.

The push to democratize alternative investments, seen in new structures like European Long-Term Investment Funds (ELTIFs) and tokenized limited partnership shares, is a significant growth area. These products aim to bring previously inaccessible asset classes to individual investors.

Ares Management is actively building its private wealth business, a strategic move to tap into this burgeoning retail market for alternatives. However, their market share in these developing retail-focused products is still nascent.

Compared to Ares' established dominance in institutional alternatives, their position in retail-targeted products is likely in the Question Mark category of the BCG matrix. This implies a need for substantial investment in both product innovation and distribution channels to capture market share.

Venture Capital and Deep Tech Investments

While Ares Management is well-known for its private equity prowess, its venture capital and deep tech investments, especially in fields like quantum computing and advanced AI, represent significant growth potential coupled with substantial risk. These ventures demand long-term commitment and their outcomes are inherently uncertain, but a successful deep tech investment could evolve into a future market leader, a 'Star' within the firm's portfolio.

In 2024, the venture capital landscape continued to see substantial activity in deep tech sectors. For instance, investments in AI startups alone reached record highs, with funding rounds often exceeding hundreds of millions of dollars. Companies focused on generative AI, AI infrastructure, and specialized AI applications were particularly active. Quantum computing also attracted significant capital, though at earlier stages, with firms investing in foundational research and hardware development.

- Deep Tech Focus: Ares Management's venture arm actively seeks opportunities in nascent, technology-intensive sectors.

- High-Risk, High-Reward: Investments in areas like quantum computing and advanced AI carry inherent volatility but offer transformative potential.

- Patient Capital: These investments require a long-term investment horizon due to extended development cycles and market adoption timelines.

- Future Growth Drivers: Successful deep tech ventures are positioned to become significant contributors to Ares's future returns.

Hybrid or Cross-Asset Class Strategies

Ares Management's collaborative structure fosters the creation of hybrid strategies, merging credit, private equity, real estate, and infrastructure. These integrated approaches aim to capture untapped market growth. For instance, Ares' real estate credit strategies might combine direct lending with opportunistic equity investments, seeking alpha across the capital stack. This blending allows them to adapt to evolving market dynamics, offering diversified risk-return profiles.

The market adoption of these cross-asset class strategies is still evolving, placing them in a developmental phase within the BCG Matrix. While innovative, their long-term performance and scalability are under scrutiny. Ares' ability to successfully integrate diverse asset classes hinges on robust risk management and deep sector expertise. As of early 2024, the alternative investment landscape continues to see significant inflows into strategies that offer diversification and potentially higher yields, supporting the rationale for such hybrid approaches.

- Ares' collaborative investment groups develop hybrid strategies.

- These strategies blend credit, private equity, real estate, and infrastructure.

- Market adoption and ultimate success are still being determined, classifying them as 'question marks'.

- The goal is to tap into new market opportunities with high growth potential.

Ares Management's ventures into new geographic markets, such as Japan and Brazil, and its development of niche investment products like climate tech funds, represent classic 'question marks.' These initiatives require significant capital and strategic focus to build market share and establish a competitive edge.

The firm's push into democratizing alternative investments through structures like ELTIFs and tokenized shares also falls into this category. While promising for future growth, their current market penetration and AUM are still developing, demanding further investment to prove their long-term viability and attract broader investor adoption.

These 'question mark' areas, including nascent retail channels and emerging deep tech investments, are characterized by high potential but also considerable uncertainty, necessitating careful resource allocation and strategic patience.

The success of these question marks hinges on Ares's ability to effectively scale operations, build brand recognition, and navigate evolving regulatory landscapes in these new territories and product categories.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry growth forecasts, and competitor analysis to provide a clear strategic overview.