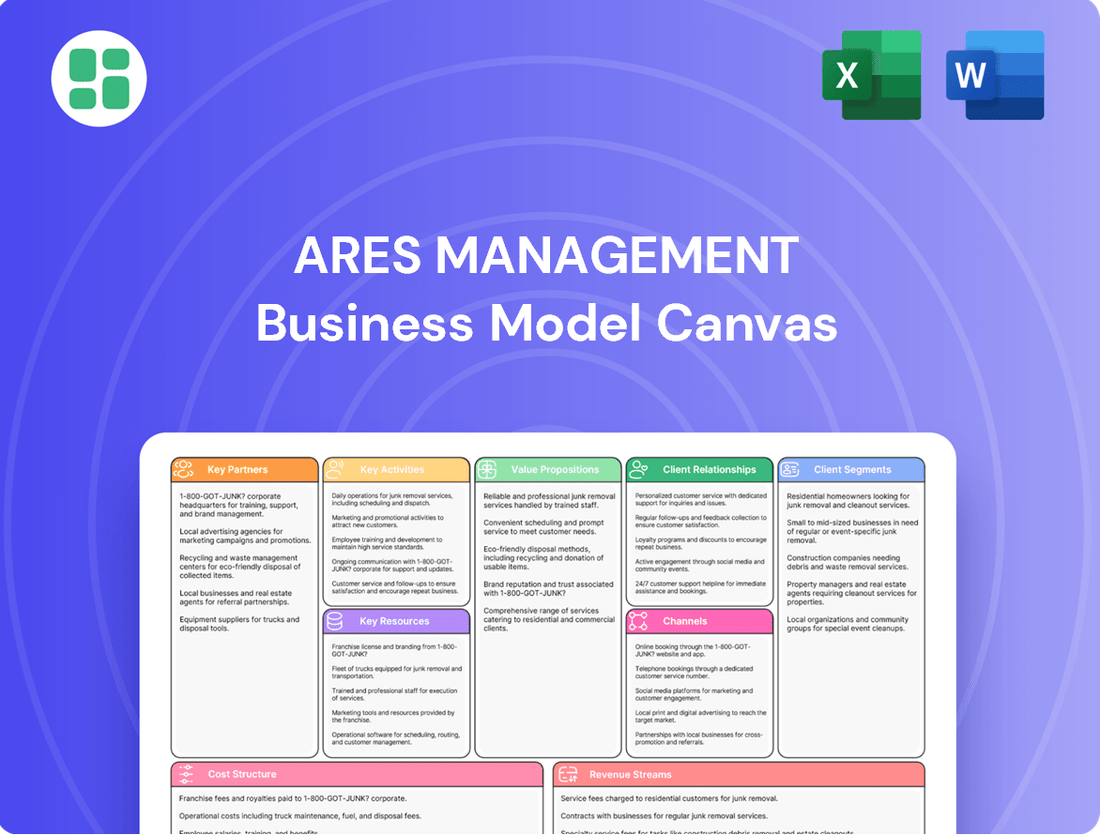

Ares Management Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Unlock the full strategic blueprint behind Ares Management's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ares Management actively collaborates with co-investors, including major pension funds and sovereign wealth funds, to execute significant transactions across its diverse business segments. These strategic alliances are crucial for Ares to participate in larger, more complex deals, effectively spreading risk and accessing substantial capital pools. For instance, in 2023, Ares raised over $10 billion for its Infrastructure and Real Estate strategies, much of which was deployed alongside these institutional partners.

Joint ventures represent another cornerstone of Ares' partnership strategy, enabling the firm to enter new markets and develop specialized assets. A prime example is its collaboration with Savion, a leading solar energy developer, to expand renewable energy projects in the United States. This type of partnership allows Ares to leverage specialized operational expertise while providing the necessary financial backing for growth.

Ares Management actively cultivates relationships with a diverse array of origination partners. These include major financial institutions like banks, specialized brokers, and strategic consultants. This network is vital for identifying and accessing a steady stream of promising investment prospects, especially within the direct lending and private credit sectors.

These collaborations are fundamental to Ares' ability to discover attractive financing needs for businesses and to efficiently syndicate larger, more complex credit facilities. For instance, in the second quarter of 2025, Ares' Credit Group successfully closed around $8.8 billion in U.S. direct lending commitments, spread across 70 distinct transactions. In many of these deals, Ares played a key role, acting as the administrative agent, lead arranger, or bookrunner, underscoring the strength of its partnership ecosystem.

Ares Management relies on a robust network of external service providers to maintain its global operations and investment activities. These include top-tier legal counsel, reputable accounting firms, specialized tax advisors, and meticulous due diligence specialists. For instance, in 2024, Ares continued to leverage established relationships with major global law firms to navigate complex cross-border regulations and ensure deal integrity across its diverse asset classes.

These partnerships are critical for ensuring Ares' compliance with stringent regulatory frameworks across various jurisdictions and for conducting in-depth analysis essential for informed decision-making. The firm’s ability to execute intricate transactions and manage its vast portfolio of alternative investments worldwide hinges on the expertise these providers bring, particularly in areas like financial reporting and tax structuring.

Placement Agents and Distribution Partners

Ares Management strategically leverages placement agents and distribution partners to significantly broaden its investor reach and secure capital for its expanding fund offerings. These crucial alliances enable Ares to tap into a wider array of client segments, including high-net-worth individuals and financial advisors, thereby moving beyond its established base of institutional investors.

In 2024, Ares continued its robust efforts to diversify its distribution channels. This strategic push aims to capture capital from institutional, wealth management, and insurance sectors, reflecting a proactive approach to market penetration. For example, Ares's Global Private Debt strategy, a key area for capital raising, benefits from these partnerships by accessing a more varied investor pool.

- Broadened Investor Access: Placement agents and distribution partners are instrumental in connecting Ares with a diverse client base, extending beyond traditional institutional investors to include high-net-worth individuals and financial advisors.

- Capital Raising Efficiency: These partnerships enhance Ares's ability to raise capital efficiently for new funds by utilizing established networks and distribution capabilities.

- Strategic Diversification: Ares actively diversifies its distribution channels across institutional, wealth, and insurance clients, a trend that was prominent in its 2024 capital-raising initiatives to capture a wider market share.

Technology and Data Solution Providers

Ares Management, as a forward-thinking investment firm, actively collaborates with technology and data solution providers. These partnerships are crucial for refining their investment strategies, bolstering risk oversight, and streamlining overall operations. For instance, in 2024, Ares continued to invest in sophisticated platforms designed for real-time portfolio tracking and in-depth market intelligence gathering.

These collaborations often involve integrating cutting-edge analytics and potentially artificial intelligence to foster innovation and boost efficiency across their diverse business units. Such alliances allow Ares to leverage external expertise and advanced tools that might be cost-prohibitive to develop in-house, thereby maintaining a competitive edge in the rapidly evolving financial landscape.

- Data Analytics Platforms: Partnering with firms that offer advanced data aggregation and analysis tools to identify investment opportunities and manage risk.

- Cloud Infrastructure Providers: Collaborating with leading cloud service providers to ensure secure, scalable, and efficient data storage and processing capabilities.

- AI and Machine Learning Specialists: Engaging with experts in artificial intelligence and machine learning to explore predictive modeling and enhance investment decision-making processes.

- Cybersecurity Firms: Working with specialized cybersecurity companies to safeguard sensitive client and proprietary data against evolving threats.

Ares Management cultivates strategic alliances with a broad spectrum of origination partners, including banks, brokers, and consultants, to source promising investment opportunities, particularly in direct lending and private credit.

These collaborations are vital for identifying businesses with financing needs and efficiently syndicating large credit facilities, as demonstrated by Ares's $8.8 billion in U.S. direct lending commitments in Q2 2025, often acting as lead arranger.

Furthermore, Ares leverages placement agents and distribution partners to expand its investor base beyond institutions to high-net-worth individuals and financial advisors, a strategy actively pursued in 2024 to diversify capital sources.

| Partner Type | Role/Benefit | Example/Data Point |

| Co-investors (Pension Funds, Sovereign Wealth Funds) | Enable participation in larger, complex deals, spread risk, access capital pools. | Raised over $10 billion for Infrastructure and Real Estate strategies in 2023 with partners. |

| Origination Partners (Banks, Brokers, Consultants) | Source investment prospects, especially in direct lending and private credit. | Facilitated $8.8 billion in U.S. direct lending commitments in Q2 2025 across 70 transactions. |

| Placement Agents & Distribution Partners | Broaden investor reach (HNWIs, advisors), enhance capital raising efficiency. | Actively diversified distribution channels in 2024 across institutional, wealth, and insurance sectors. |

What is included in the product

Ares Management's business model focuses on providing alternative investment solutions across credit, private equity, and real estate to institutional and retail clients, leveraging a global platform and deep sector expertise.

Ares Management's Business Model Canvas offers a clear, structured approach to identifying and addressing operational inefficiencies, acting as a pain point reliever by simplifying complex strategies for actionable insights.

Activities

Ares Management's key activities center on sourcing and meticulously evaluating investment opportunities across its diverse strategies: Credit, Private Equity, Real Estate, and Infrastructure. This involves deep dives into market trends, thorough financial modeling, and comprehensive due diligence to pinpoint potential risks and lucrative returns.

In 2024, Ares continued to actively deploy capital, demonstrating its commitment to opportunistic investing. For instance, the firm's credit funds, which represent a significant portion of its assets under management, actively sought out performing and opportunistic credit investments, leveraging their expertise to navigate complex market conditions and identify attractive risk-reward profiles.

Ares Management's core activity involves continuously raising capital for its various funds from a broad spectrum of investors. This includes cultivating and maintaining relationships with major players like pension funds, sovereign wealth funds, and other institutional and high-net-worth individuals.

Maintaining strong investor relations is crucial. Ares actively communicates fund performance, investment strategies, and market outlooks to its diverse client base, ensuring transparency and trust. In 2024 alone, Ares successfully raised an impressive $93 billion in new funds, demonstrating its robust fundraising capabilities.

The momentum continues into 2025, with Ares securing $20.2 billion in new capital commitments during the first quarter. This consistent influx of capital underscores their ability to attract and retain investor capital across different market cycles.

Following an investment, Ares Management actively engages in the hands-on management of its portfolio companies and assets. This proactive approach is designed to enhance their underlying value through strategic guidance, operational enhancements, and targeted financial restructuring. The aim is to foster sustainable growth and optimize overall performance.

Ares' strategy centers on generating consistent and attractive investment returns, irrespective of prevailing market conditions. This commitment to performance is evident in their track record, where they have consistently delivered for investors by identifying opportunities and executing value-creation plans across various economic cycles.

Risk Management and Compliance

Ares Management's key activities include implementing robust risk management frameworks and ensuring strict adherence to regulatory requirements. This involves continuous monitoring of market, credit, and operational risks.

Navigating complex legal and compliance landscapes across multiple jurisdictions is paramount. Ares emphasizes its ability to perform well through market cycles due to its resilient business model.

- Risk Monitoring: Ongoing assessment of market volatility, credit defaults, and operational disruptions.

- Regulatory Adherence: Strict compliance with financial regulations in all operating regions.

- Resilient Model: Demonstrating consistent performance across varying economic conditions.

- Compliance Investment: As of Q1 2024, Ares reported significant investments in its compliance infrastructure to manage evolving regulatory demands.

Asset Divestment and Exit Strategies

Ares Management's key activity of asset divestment and exit strategies is fundamental to generating realized returns for its investors. This involves proactively identifying and executing optimal exit opportunities, such as sales to strategic buyers, secondary buyouts, or initial public offerings (IPOs) for its portfolio companies.

Ares' success in this area is directly reflected in its financial performance. For instance, in the first quarter of 2024, Ares reported significant realized gains from its investment portfolio, demonstrating its proficiency in monetizing assets and returning capital to its Limited Partners. The firm actively manages its portfolio to ensure timely and profitable exits, a critical component of its value creation model.

- Realized Gains: Ares Management consistently aims to maximize capital appreciation through strategic divestments, contributing substantially to its fee-related earnings and carried interest.

- Liquidity Events: The firm actively pursues and executes various liquidity events, including M&A transactions and IPOs, to provide investors with timely access to their capital.

- Portfolio Optimization: A core function involves identifying underperforming assets or mature investments ripe for divestment to reallocate capital towards new, higher-growth opportunities.

- Investor Returns: Ultimately, the effectiveness of Ares' divestment strategies directly impacts the realized returns delivered to its Limited Partners, reinforcing investor confidence and capital commitments.

Ares Management's key activities encompass sourcing and rigorously evaluating investment opportunities across its Credit, Private Equity, Real Estate, and Infrastructure segments. This involves meticulous market analysis, financial modeling, and due diligence to identify promising ventures and mitigate risks. The firm actively deploys capital, as seen in its credit funds' focus on opportunistic investments throughout 2024, navigating market complexities for attractive risk-reward profiles.

A core function is continuous capital raising from a diverse investor base, including pension funds and sovereign wealth funds, alongside cultivating strong investor relations through transparent communication. In 2024, Ares successfully raised $93 billion in new funds, and this momentum continued into Q1 2025 with $20.2 billion in new commitments, highlighting their consistent ability to attract and retain capital.

Post-investment, Ares actively manages its portfolio companies and assets through strategic guidance and operational enhancements to drive value creation and optimize performance. Their strategy prioritizes consistent, attractive returns across market cycles, a commitment reflected in their historical performance. Furthermore, robust risk management and regulatory adherence are paramount, with significant compliance infrastructure investments made as of Q1 2024.

Finally, Ares excels in asset divestment and exit strategies, proactively seeking optimal opportunities like sales to strategic buyers or IPOs to generate realized returns for investors. This proficiency is evident in the significant realized gains reported in Q1 2024, underscoring their skill in monetizing assets and returning capital.

| Key Activity | Description | 2024/2025 Data Point |

| Investment Sourcing & Evaluation | Identifying and analyzing potential investments across strategies. | Active deployment in credit funds throughout 2024. |

| Capital Raising & Investor Relations | Securing funds from institutional investors and maintaining relationships. | $93 billion raised in 2024; $20.2 billion in Q1 2025. |

| Portfolio Management & Value Creation | Active hands-on management of portfolio assets to enhance value. | Focus on strategic guidance and operational enhancements. |

| Risk Management & Compliance | Implementing robust frameworks and adhering to regulations. | Significant compliance infrastructure investments in Q1 2024. |

| Asset Divestment & Exit Strategies | Executing optimal exit opportunities to realize investor returns. | Reported significant realized gains in Q1 2024. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive Ares Management business model, ready for your immediate use. You'll gain full access to this complete, professionally structured analysis, ensuring no surprises and immediate utility for your strategic planning.

Resources

Ares Management's most critical resource is the vast financial capital it oversees, quantified by its Assets Under Management (AUM). This AUM is the engine driving its investment activities and client service capabilities.

As of the second quarter of 2025, Ares reported approximately $572 billion in AUM. This substantial figure underscores the firm's considerable scale and its ability to deploy significant capital across diverse investment strategies.

Ares Management's human capital is its bedrock, featuring highly skilled investment professionals, seasoned management teams, and dedicated support staff. Their collective deep industry knowledge, sharp investment acumen, and extensive relationship networks are absolutely critical for identifying promising deals, effectively managing diverse portfolios, and ultimately driving strong returns for clients.

In 2024, Ares continued to prioritize significant investment in its talent pool, recognizing that expertise directly translates to performance. This focus includes expanding its global client solutions team, ensuring clients receive top-tier service and strategic guidance, a key differentiator in the competitive alternative asset management landscape.

Ares Management's proprietary investment strategies and analytical models are a cornerstone of their business. These sophisticated tools, honed over decades in the alternative investment space, allow them to pinpoint distinctive opportunities and navigate intricate deals across various asset classes. For instance, their credit strategies, a significant part of their business, have consistently delivered strong performance, with their credit segment generating $1.3 billion in fee-related earnings in 2023.

Global Network and Relationships

Ares Management leverages its vast global network, connecting with businesses, financial institutions, and industry specialists across key regions. This expansive web of relationships is crucial for identifying promising investment opportunities and gaining critical market insights.

The firm's established connections are instrumental in sourcing deal flow and fostering co-investment partnerships. By the end of 2023, Ares had a significant presence and deep relationships across North America, South America, Europe, Asia Pacific, and the Middle East, facilitating diverse investment strategies.

- Global Reach: Ares actively cultivates relationships across North America, South America, Europe, Asia Pacific, and the Middle East, enabling broad market access.

- Deal Flow Generation: These relationships are a primary driver for identifying and originating new investment opportunities.

- Market Intelligence: The network provides valuable real-time insights into market trends and sector developments.

- Co-Investment Opportunities: Ares frequently partners with its network for co-investment, sharing risk and leveraging expertise.

Technology and Data Platforms

Ares Management leverages advanced technology infrastructure and sophisticated data analytics platforms as crucial resources. These digital tools are fundamental to managing its global operations efficiently, conducting in-depth risk analysis across diverse asset classes, and providing transparent, enhanced reporting to its investors. The firm is actively investigating the application of artificial intelligence to further streamline its business processes and drive operational efficiencies.

The firm's commitment to technology is evident in its ongoing investments. For instance, in 2023, Ares continued to enhance its proprietary data management systems, which are essential for processing the vast amounts of information generated by its alternative investment strategies. This focus on data underpins their ability to identify opportunities and manage risk effectively in dynamic markets.

- Advanced Technology Infrastructure: Supports global operations and diverse investment strategies.

- Data Analytics Platforms: Enable sophisticated risk analysis and enhanced investor reporting.

- Digital Tools: Drive operational efficiencies and facilitate data-driven decision-making.

- AI Exploration: Ares is actively exploring AI to improve business processes.

Ares Management's key resources include its substantial Assets Under Management (AUM), which reached approximately $572 billion by Q2 2025, demonstrating its significant scale and capital deployment capacity. The firm's human capital, comprising skilled investment professionals and management, is paramount for deal identification and portfolio management, with a continued focus in 2024 on expanding its global client solutions team.

Value Propositions

Ares Management offers investors a gateway to a wide array of alternative asset classes, including credit, private equity, real estate, and infrastructure. These opportunities are often out of reach for investors solely focused on public markets, providing a crucial avenue for diversification.

By tapping into these less conventional investments, clients can build more robust portfolios designed to meet their long-term financial goals. For instance, Ares's credit strategies have shown resilience, with their Direct Lending funds consistently delivering attractive risk-adjusted returns, as evidenced by strong performance metrics reported throughout 2024.

Ares Management provides highly adaptable capital solutions, meticulously crafted to align with the unique requirements of businesses seeking funding and investors desiring bespoke strategies. This flexibility enables Ares to strategically deploy capital across diverse market environments and throughout a company's entire lifecycle.

For instance, in 2024, Ares' credit segment managed over $247 billion in assets, a testament to its capacity to structure and execute a wide array of financing arrangements, from traditional debt to more specialized structures tailored for specific industry needs or growth phases.

Ares Management is committed to delivering robust risk-adjusted returns, a cornerstone of their value proposition. They emphasize a disciplined investment philosophy designed to perform consistently across different economic landscapes.

The firm's track record showcases its ability to achieve strong performance throughout various market cycles, a testament to their expertise. For instance, Ares's credit strategies have consistently delivered attractive returns, with their Alternative Credit strategy, as of the first quarter of 2024, showing a net IRR of over 15% since inception.

Expertise in Specialized Markets

Ares Management's deep expertise in specialized markets is a cornerstone of its value proposition. By organizing dedicated investment groups for each asset class, such as credit, private equity, real estate, and infrastructure, Ares cultivates profound knowledge and a nuanced understanding of complex, often less-efficient private markets. This focused approach enables them to identify unique opportunities and implement tailored strategies for value creation.

This specialization translates into a differentiated investment approach. For instance, in 2024, Ares' credit strategies, known for their deep sector specialization, continued to demonstrate resilience and alpha generation, even amidst evolving macroeconomic conditions. Their ability to navigate the intricacies of diverse private credit markets, from direct lending to distressed debt, underscores their commitment to specialized knowledge.

- Deep Sector Knowledge: Dedicated teams possess granular insights into specific industries and market niches, facilitating superior deal sourcing and due diligence.

- Differentiated Investment Strategies: Specialization allows for unique approaches to value creation, often unearthing opportunities missed by more generalized investors.

- Navigating Complexity: Expertise in less-efficient markets, such as complex credit structures or niche real estate segments, provides a competitive advantage.

- Value Creation Focus: Beyond capital deployment, Ares leverages its specialized knowledge to actively improve portfolio companies and assets.

Global Reach and Local Presence

Ares Management leverages its extensive global network, complemented by a deep understanding of local market dynamics, to source and execute investment opportunities across diverse geographies. This dual approach allows them to capitalize on worldwide trends while remaining attuned to specific regional nuances and regulatory landscapes.

Their strategic acquisitions, such as the significant deal involving GCP International in 2021, have been instrumental in bolstering this global reach. This expansion not only broadens their geographical footprint but also enhances their ability to deploy capital effectively across different regions, providing a distinct competitive edge in the alternative investment sector.

- Global Network: Ares operates across North America, Europe, and Asia, with offices in major financial hubs.

- Local Expertise: Dedicated teams in each region provide on-the-ground insights and relationship management.

- Strategic Acquisitions: Past integrations, like the GCP International transaction, have demonstrably expanded their global operational capacity.

- Opportunity Identification: The combined global and local perspective facilitates the identification of unique investment prospects worldwide.

Ares Management provides access to a diverse range of alternative asset classes, offering clients diversification beyond traditional public markets. Their strategies aim to build resilient portfolios for long-term financial objectives.

The firm crafts flexible capital solutions tailored to specific business needs and investor preferences, enabling strategic capital deployment across various market conditions and company lifecycles. This adaptability is a key differentiator.

Ares is committed to delivering strong risk-adjusted returns through a disciplined investment philosophy that performs consistently across economic cycles. Their expertise in specialized markets further enhances this value.

Their deep sector knowledge, cultivated through dedicated investment groups, allows for the identification of unique opportunities and the implementation of tailored value creation strategies in complex private markets.

Customer Relationships

Ares Management prioritizes client relationships through dedicated relationship management teams. These teams offer personalized service to institutional and high-net-worth clients, fostering long-term, trusted partnerships by deeply understanding individual needs.

The firm's commitment is evident in its substantial investments in global client solutions and investor relations functions. This strategic focus ensures clients receive tailored support and timely information, reinforcing Ares' dedication to client satisfaction and partnership building.

Ares Management prioritizes transparency through detailed, regular performance reporting. This includes clear communication on fund performance, investment activities, and financial results, fostering investor trust. For example, Ares consistently reports its quarterly and annual financial results, providing stakeholders with timely updates on the firm's financial health and investment outcomes.

Ares Management actively cultivates its investor relationships through dedicated investor conferences and ongoing educational initiatives. These events serve as crucial touchpoints for keeping clients informed about prevailing market dynamics, the firm's nuanced investment strategies, and its forward-looking perspectives. For instance, Ares hosted a significant Investor Day in May 2024, offering a platform for in-depth discussions.

These carefully curated events are designed to foster robust engagement, providing clients with invaluable opportunities for direct interaction with Ares' senior leadership and its specialized investment teams. This direct line of communication enhances transparency and builds trust, reinforcing the firm's commitment to its stakeholders.

Customized Investment Solutions

Ares Management excels in crafting bespoke investment solutions, meticulously aligning with each client's unique risk-return appetite and long-term financial goals. This dedication to personalization is a cornerstone of their strategy, reflecting a deep understanding of their sophisticated investor base.

The firm's focus on tailored mandates ensures that investment strategies are not one-size-fits-all but are precisely engineered to meet specific client objectives. This client-centric approach fosters strong, enduring relationships built on trust and demonstrable performance.

- Customized Mandates: Ares designs investment strategies that directly address individual client objectives, from capital preservation to aggressive growth.

- Risk-Return Alignment: Solutions are calibrated to match the client's specific tolerance for risk and desired return, ensuring a comfortable and effective investment journey.

- Sophisticated Investor Focus: The firm's expertise caters to a discerning clientele, including institutional investors, pension funds, and high-net-worth individuals.

Trust and Long-Term Partnership Building

Ares Management places significant emphasis on building and maintaining trust, which is the bedrock of its customer relationships and the foundation for long-term partnerships. This commitment is demonstrated through a consistent track record of performance and transparent operational practices. Ares prioritizes client service, viewing it as a critical element for fostering enduring relationships that drive future growth.

- Consistent Performance: Ares's ability to deliver strong results across its diverse strategies, such as its credit and alternative asset platforms, reinforces client confidence.

- Transparency: The firm maintains open communication regarding investment strategies, performance reporting, and fee structures, ensuring clients are well-informed.

- Client-Centric Approach: Ares focuses on understanding and meeting the unique needs of its clients, from institutional investors to high-net-worth individuals, cultivating loyalty.

- Long-Term Vision: By aligning its interests with those of its clients and demonstrating a commitment to sustained value creation, Ares solidifies its reputation as a trusted partner.

Ares Management cultivates deep client loyalty through highly personalized service, exemplified by dedicated relationship managers who understand individual client needs. This approach is reinforced by substantial investments in global client solutions and investor relations, ensuring tailored support and transparent communication, such as detailed quarterly performance reports.

The firm actively engages clients via investor conferences and educational events, like the May 2024 Investor Day, fostering direct interaction with senior leadership. This commitment to transparency and engagement builds trust, underpinning Ares' client-centric strategy focused on bespoke investment solutions aligned with unique risk-return profiles.

Ares Management's client relationships are built on a foundation of trust, consistently demonstrated through strong performance and transparent practices. By offering customized mandates and aligning with client objectives, Ares solidifies its position as a trusted partner for sophisticated investors, including institutional and high-net-worth clients.

| Key Aspect | Description | Example/Data Point |

| Dedicated Relationship Management | Personalized service for institutional and high-net-worth clients | Dedicated teams understand unique client needs to foster long-term partnerships. |

| Transparency & Reporting | Clear communication on fund performance and financial results | Regular, detailed performance reporting; Ares consistently reports quarterly and annual financial results. |

| Client Engagement | Investor conferences and educational initiatives | May 2024 Investor Day provided direct client interaction with senior leadership. |

| Bespoke Solutions | Tailored investment strategies to meet specific client objectives | Crafting mandates aligned with individual risk-return appetites and financial goals. |

Channels

Ares Management relies heavily on its dedicated direct sales and investor relations teams to cultivate relationships with major institutional investors like pension funds, sovereign wealth funds, and university endowments. These internal teams are the primary conduit for client acquisition and capital raising, ensuring a personalized approach to managing these significant relationships.

The firm's commitment to direct client engagement is underscored by its substantial expansion of the global client solutions team. This strategic growth reflects Ares' focus on providing robust support and communication to its diverse investor base, a key component of its fundraising success.

Ares Management actively cultivates relationships with investment consultants and financial advisors. These professionals act as crucial conduits, recommending Ares' alternative investment strategies to their extensive client networks, which often include significant institutional investors. This channel is vital for expanding the firm's reach and securing new investment mandates.

The influence of these advisors is substantial; many institutional clients are guided by their recommendations to increase their allocations to alternative investments. For instance, in 2023, a significant portion of institutional capital flowed into alternative asset classes, underscoring the importance of advisor endorsements in driving AUM growth for firms like Ares.

Ares Management leverages secure digital platforms and investor portals, offering clients seamless access to crucial fund information, performance metrics, and detailed reporting documents. This commitment to digital infrastructure significantly boosts efficiency and accessibility for its diverse global investor base.

The firm's investor login feature on its website serves as a central hub, streamlining client interactions and providing a dedicated channel for accessing personalized account information and updates. This digital approach is vital for managing relationships with a growing international clientele.

Strategic Partnerships and Joint Ventures

Ares Management actively forms strategic partnerships and joint ventures to broaden its client base, particularly targeting retail and high-net-worth individuals through collaborations with wealth management platforms and other financial institutions. These alliances are crucial for extending the firm's distribution capabilities for its alternative investment products.

By leveraging these partnerships, Ares can access new distribution channels and client segments more efficiently than through organic growth alone. For instance, in 2024, Ares continued to explore and solidify relationships that enhance its ability to bring its diverse alternative investment strategies to a wider audience.

- Expanded Reach: Partnerships with wealth management platforms allow Ares to tap into segments previously harder to access.

- Streamlined Distribution: Collaborations simplify the process of offering alternative investments to a broader investor base.

- Access to New Clients: Joint ventures can provide entry into markets or client types where Ares may not have a direct presence.

Industry Conferences and Events

Ares Management actively participates in key industry conferences and forums. This participation is a crucial channel for building their brand, fostering networking opportunities, and attracting potential investors. These events allow Ares to demonstrate their expertise and strategic approach to a wide audience.

By engaging in these thought leadership platforms, Ares gains significant visibility. For instance, in 2024, Ares executives frequently spoke at prominent alternative investment conferences, sharing insights on credit markets and private equity trends. This presence helps solidify their reputation as industry leaders.

- Brand Building: Conferences provide a platform to showcase Ares' capabilities and market position.

- Networking: Direct interaction with potential investors, partners, and industry peers is facilitated.

- Investor Attraction: Thought leadership and visibility at events can directly lead to new capital inflows.

- Expertise Showcase: Presenting research and strategies highlights Ares' deep understanding of various asset classes.

Ares Management's channels are a multi-faceted approach to reaching and servicing its diverse investor base. Direct engagement through dedicated sales and investor relations teams is paramount for cultivating relationships with large institutional clients. Strategic partnerships with wealth managers and financial advisors extend their reach into broader investor segments, while digital platforms ensure efficient client communication and access to information. Participation in industry conferences further bolsters brand visibility and thought leadership.

| Channel Type | Key Activities | Target Audience | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales & Investor Relations | Cultivating relationships, capital raising | Institutional Investors (pensions, endowments) | Continued expansion of global client solutions team |

| Investment Consultants & Advisors | Recommendations, client network access | Institutional Investors | Crucial for driving AUM growth in alternatives |

| Digital Platforms & Investor Portals | Information access, reporting, client interaction | All Clients | Enhancing user experience for seamless access |

| Strategic Partnerships & Joint Ventures | Broadening client base, new distribution | Retail, High-Net-Worth Individuals | Exploring alliances to enhance distribution capabilities |

| Industry Conferences & Forums | Brand building, networking, thought leadership | Potential Investors, Industry Peers | Executives speaking at key alternative investment events |

Customer Segments

Pension funds, both public and corporate, are a cornerstone client segment for Ares Management. These institutions are primarily driven by the need for long-term, stable investment returns to meet their future obligations to retirees. In 2024, pension and profit-sharing plans continued to represent a significant portion of Ares' substantial Assets Under Management, underscoring their reliance on Ares for diversification and consistent growth.

Sovereign Wealth Funds (SWFs) represent a significant client segment for Ares Management, drawn to the firm's expertise in alternative assets. These entities, managing trillions in assets globally, leverage Ares' platforms for diversified exposure to private equity, credit, and real estate. For instance, the Norway Government Pension Fund Global, one of the world's largest SWFs, reported assets under management exceeding $1.3 trillion as of early 2024, showcasing the scale of capital available for such partnerships.

Ares caters to the long-term investment objectives and substantial capital allocations of SWFs. These funds typically seek to deploy significant capital across various strategies, including infrastructure and private debt, aiming for stable, risk-adjusted returns. The demand for private market investments among SWFs remained robust in 2024, with many actively increasing allocations to strategies that Ares specializes in, driven by a search for yield and diversification beyond traditional public markets.

Institutional investors like university endowments, charitable foundations, and insurance companies represent a crucial customer segment for Ares Management. These entities are actively seeking to boost their investment returns and diversify their holdings, often turning to alternative asset classes. In 2023, Ares reported significant inflows from these types of clients, underscoring their growing reliance on alternative investment managers.

Family Offices

Family offices represent a crucial and growing customer segment for Ares Management. These entities, managing substantial wealth for affluent families, are actively seeking tailored investment strategies and exclusive access to private markets. Ares has strategically enhanced its wealth platform to cater directly to these high-net-worth individuals and their family offices.

The firm's commitment to this segment is evident in its dedicated wealth solutions, which aim to provide sophisticated and personalized investment management. In 2024, Ares continued to build out its capabilities to serve this discerning clientele, recognizing the increasing demand for alternative investments and bespoke portfolio construction. This focus allows Ares to capture a significant share of the burgeoning family office market.

- Targeted Bespoke Solutions: Family offices require customized investment approaches that align with their unique risk appetites and long-term financial objectives.

- Access to Private Markets: A key draw for family offices is Ares's ability to provide differentiated access to private equity, credit, and real estate opportunities.

- Wealth Platform Expansion: Ares's investment in its wealth platform underscores its dedication to serving wealthy families directly, offering a more integrated client experience.

- Growing Market Importance: The increasing concentration of wealth in family offices makes them a vital component of Ares's overall client strategy, driving significant AUM growth.

High-Net-Worth Individuals and Retail Clients

Ares Management actively engages high-net-worth individuals and retail clients by offering them pathways into alternative investments, traditionally the domain of large institutions. This segment is crucial for Ares's diversified revenue streams.

Through strategic alliances and tailored investment products, Ares democratizes access to asset classes like private equity and credit. For instance, Ares's focus on wealth management solutions and non-listed vehicles directly addresses the needs of individual investors seeking alternative asset exposure.

- Access to Alternatives: Ares provides individual investors with opportunities in private equity, credit, and real estate, historically limited to institutional players.

- Wealth Management Solutions: The firm offers bespoke wealth management services, integrating alternative investments into broader financial planning for affluent clients.

- Non-Listed Vehicles: Ares develops and manages non-listed investment funds, catering to the long-term investment horizons and specific liquidity needs of retail and high-net-worth clients.

- Growth in Retail AUM: Ares has seen significant growth in assets under management from individual investors, reflecting the increasing demand for alternative strategies beyond traditional public markets.

Ares Management serves a broad spectrum of clients, from massive pension funds and sovereign wealth funds seeking stable, long-term growth to family offices and high-net-worth individuals desiring bespoke investment strategies. The firm's ability to provide access to alternative asset classes like private equity, credit, and real estate is a key differentiator across these diverse segments.

Institutional investors, including endowments and foundations, rely on Ares for diversification and enhanced returns, often allocating substantial capital to alternative strategies. This demand remained strong through 2024, with many institutions increasing their exposure to private markets. The firm’s wealth platform expansion further solidifies its commitment to serving the growing needs of family offices and individual investors.

| Client Segment | Key Drivers | 2024 Relevance |

|---|---|---|

| Pension Funds | Long-term stability, meeting obligations | Continued significant AUM, reliance on Ares for growth |

| Sovereign Wealth Funds | Diversified exposure, risk-adjusted returns | Robust demand for private markets, increased allocations |

| Endowments & Foundations | Return enhancement, diversification | Significant inflows into alternative assets |

| Family Offices | Tailored strategies, private market access | Strategic platform expansion, growing AUM |

| High-Net-Worth Individuals | Access to alternatives, wealth management | Growing demand for non-listed vehicles |

Cost Structure

Personnel compensation and benefits represent the most significant cost for Ares Management, a key factor in its human capital-driven business model. This includes salaries, bonuses, and the critical carried interest component for its investment professionals.

In the second quarter of 2025, Ares Management reported that higher compensation and benefits expenses directly affected its net income. This underscores the direct correlation between talent acquisition and retention costs and the firm's profitability in the competitive alternative asset management landscape.

Ares Management's operating and administrative expenses encompass essential costs like office rent across its global locations, utilities, and the significant investment in technology infrastructure required for its sophisticated investment platform. These overheads are meticulously managed to ensure profitability.

In 2024, Ares Management continued to invest in its global operational footprint, with administrative and other operating expenses totaling approximately $2.4 billion. This figure reflects ongoing investments in personnel, technology, and facilities necessary to support its diverse investment strategies and client base.

Ares Management incurs significant expenses for third-party fund administration, which is critical for managing the intricacies of its diverse investment vehicles. These costs cover accounting, investor reporting, and NAV calculations, ensuring operational efficiency and accuracy.

Legal and compliance fees represent another substantial component of Ares' cost structure. This includes engaging legal counsel for fund formation, transaction structuring, and ongoing regulatory adherence across multiple global jurisdictions, a necessity for a firm operating in complex financial markets.

In 2024, the alternative asset management industry, where Ares operates, saw continued pressure on operating expenses due to increasing regulatory scrutiny and the need for sophisticated compliance infrastructure. While specific figures for Ares are proprietary, industry benchmarks suggest that these administrative and legal costs can range from 0.5% to 2% of assets under management annually, depending on fund complexity and geographic reach.

Marketing and Investor Relations Expenses

Ares Management dedicates significant resources to marketing and investor relations, recognizing these as crucial drivers for fundraising and client acquisition. These expenses encompass a range of activities aimed at building and maintaining strong relationships with both existing and potential investors. In 2024, Ares continued to invest heavily in its distribution capabilities to fuel business expansion.

The company's cost structure includes expenditures on marketing campaigns designed to raise awareness of its diverse investment strategies and funds. Furthermore, substantial costs are incurred for hosting investor events, such as annual meetings and roadshows, which are vital for direct engagement and transparency. Client service activities, including dedicated relationship management, also contribute to these expenses, ensuring high levels of client satisfaction and retention.

- Fundraising Costs: Expenses related to marketing Ares's various funds to institutional investors and high-net-worth individuals.

- Client Acquisition: Investment in sales teams and marketing efforts to attract new clients to Ares's alternative asset management platforms.

- Investor Relations: Costs associated with maintaining ongoing communication and providing regular updates to the investor base.

- Distribution Investment: Funds allocated to enhance Ares's global distribution network to support ongoing business growth and new product launches.

Due Diligence and Transaction Costs

Ares Management incurs significant expenses in evaluating and executing new investment opportunities. These costs are crucial for ensuring the quality and viability of potential deals.

These expenses include fees paid to external experts for financial, legal, and operational due diligence. Transaction advisory services also contribute to this cost category, assisting in the negotiation and structuring of deals.

- Due Diligence Expenses: Fees for auditors, legal counsel, and operational consultants to scrutinize potential investments.

- Transaction Advisory Fees: Costs associated with investment bankers and other advisors who facilitate deal execution.

- Integration Costs: Expenses related to onboarding and integrating acquired businesses into existing portfolios.

- Market Data and Research: Investment in data platforms and research to identify and analyze market trends and opportunities.

Personnel compensation, including salaries, bonuses, and carried interest, forms the largest portion of Ares Management's cost structure, directly impacting its profitability. The firm's 2024 operating expenses, totaling approximately $2.4 billion, reflect significant investments in global operations, technology, and personnel to support its diverse strategies.

Key cost drivers also include substantial spending on third-party fund administration, legal, compliance, marketing, and investor relations to ensure operational integrity and client engagement. These expenses are essential for navigating complex financial markets and attracting capital.

| Cost Category | 2024 Estimate (USD Billion) | Significance |

|---|---|---|

| Personnel Compensation & Benefits | N/A (Largest Component) | Human capital-driven model, includes carried interest. |

| Operating & Administrative Expenses | ~$2.4 | Global footprint, technology, facilities, personnel support. |

| Fund Administration | N/A (Significant) | Operational efficiency for diverse investment vehicles. |

| Legal & Compliance | N/A (Substantial) | Regulatory adherence, transaction structuring, global operations. |

| Marketing & Investor Relations | N/A (Heavy Investment) | Fundraising, client acquisition, distribution network enhancement. |

| Investment Execution & Due Diligence | N/A (Crucial) | Deal evaluation, external expert fees, market research. |

Revenue Streams

Ares Management's core revenue comes from management fees, a consistent income stream derived from a percentage of their total Assets Under Management (AUM). This predictable revenue model is a cornerstone of their financial stability. In the second quarter of 2025, these fees saw a significant increase, growing by 24% year-over-year to reach $900.3 million.

Performance fees, often called carried interest, are a crucial revenue source for Ares Management. These fees are earned when their investment funds perform well, exceeding a predetermined hurdle rate and generating profits for their investors. This means the more successful their investments, the higher the revenue from this stream.

This revenue is inherently variable, directly tied to the ups and downs of market performance. For instance, Ares Management reported a substantial increase in their carried interest allocation in the second quarter of 2025, highlighting its sensitivity to investment success.

Ares Management generates significant revenue through transaction and advisory fees. These fees stem from their expertise in advising on, structuring, and executing deals for their portfolio companies and external clients. For instance, in the first quarter of 2024, Ares reported approximately $160 million in transaction and advisory fees, showcasing a key component of their income beyond management fees.

Interest and Dividend Income

Ares Management's Credit Group, its largest segment, is a primary engine for generating revenue through interest income derived from its extensive debt investments. This income stream is crucial, particularly for vehicles within this segment that focus on lending and debt financing.

For certain investment vehicles, especially within the Credit group, Ares can earn dividend income from its equity holdings. These dividends contribute to the overall financial performance of these specific investment strategies.

- Interest Income: Ares' Credit segment, its largest, significantly contributes to revenue through interest earned on a substantial portfolio of debt investments.

- Dividend Income: Specific investment vehicles within Ares may also generate revenue via dividend payouts from equity positions held.

- 2024 Performance Snapshot: While specific quarterly breakdowns for 2024 are still unfolding, Ares reported strong performance in its Credit segment throughout 2023, indicating continued potential for robust interest and dividend income generation in 2024.

Other Fees and Income

Other Fees and Income represent a diverse collection of revenue streams beyond core management and performance fees. This includes administrative charges, facility fees, and other miscellaneous income generated from Ares Management's extensive operations and investment activities.

For instance, in the second quarter of 2025, these other fees saw a significant increase, reaching $76.1 million. This surge highlights the growing contribution of these ancillary revenue sources to the firm's overall financial performance.

- Administrative Fees: Charges levied for the day-to-day management and administration of funds and investment vehicles.

- Facility Fees: Income generated from providing operational or administrative support services to portfolio companies or funds.

- Miscellaneous Income: This encompasses a broad range of other income, potentially including interest income on cash balances, gains from the sale of minor assets, or other operational revenues not classified elsewhere.

- Q2 2025 Performance: Other Fees and Income amounted to $76.1 million in the second quarter of 2025, indicating a substantial increase in these revenue streams.

Ares Management's revenue streams are multifaceted, primarily driven by management fees charged on its substantial Assets Under Management (AUM). These fees provide a stable foundation for the company's earnings. Performance fees, or carried interest, are also a significant contributor, earned when investment funds exceed specific return targets, directly linking revenue to investment success.

Transaction and advisory fees are generated from the firm's expertise in deal structuring and execution, adding another layer to their income. Furthermore, the Credit segment, Ares' largest, generates substantial revenue through interest income on its extensive debt investments, while specific vehicles also earn dividend income from equity holdings.

| Revenue Stream | Description | Q2 2025 (Millions USD) | Q1 2024 (Millions USD) |

|---|---|---|---|

| Management Fees | Percentage of AUM | 900.3 | N/A |

| Performance Fees | Carried Interest on successful funds | Significant increase reported | N/A |

| Transaction & Advisory Fees | Fees for deal structuring and advice | N/A | 160 |

| Interest Income | From Credit segment debt investments | Primary driver for Credit | N/A |

| Dividend Income | From equity holdings in specific vehicles | Contributes to specific strategies | N/A |

| Other Fees and Income | Admin, facility, and miscellaneous charges | 76.1 | N/A |

Business Model Canvas Data Sources

The Ares Management Business Model Canvas is built upon a foundation of extensive market research, proprietary financial data, and detailed operational analysis. These sources ensure that every component of the canvas, from value propositions to cost structures, is informed by accurate and actionable insights.