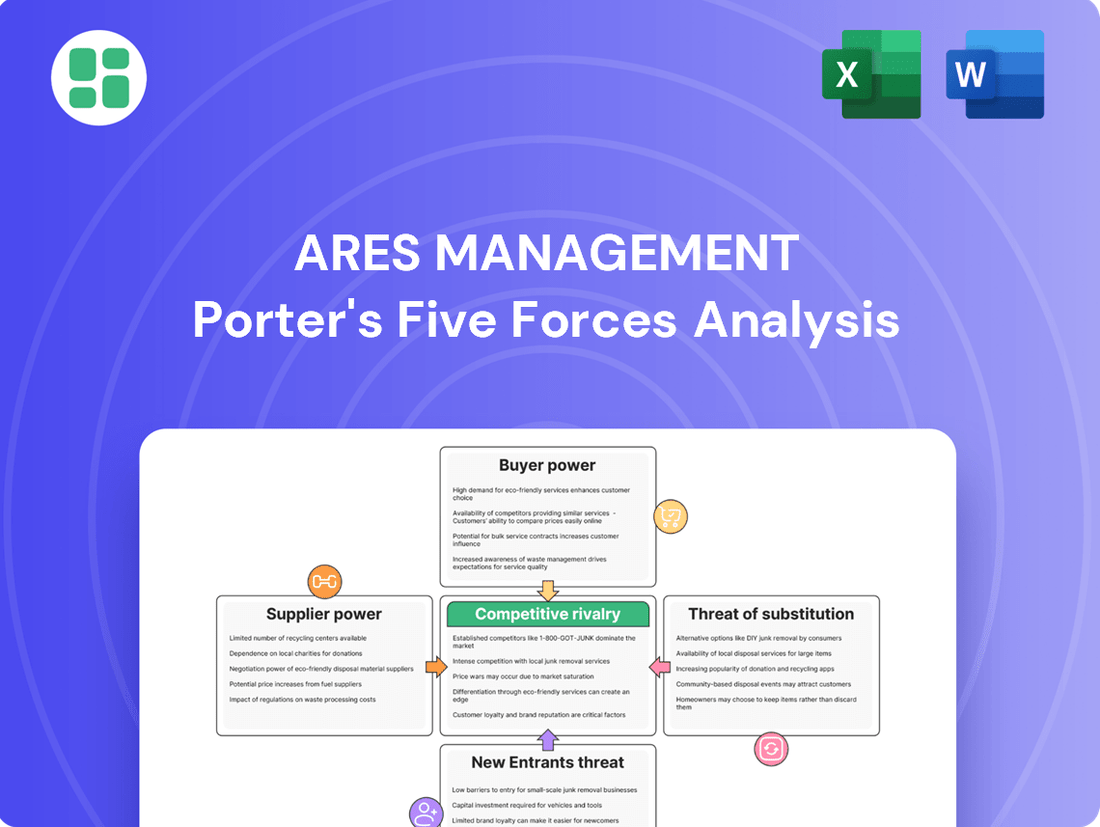

Ares Management Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Ares Management navigates a landscape influenced by the bargaining power of buyers and the intensity of rivalry within the alternative investment sector. Understanding these forces is crucial for any investor or strategist looking to grasp their competitive positioning.

The complete report reveals the real forces shaping Ares Management’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital providers, mainly limited partners (LPs), is growing in the alternative investment sector. LPs are being more discerning with their investments and are pushing for better fund conditions, such as reduced management fees and more appealing profit-sharing arrangements. This trend is evident as LPs increasingly scrutinize fund terms and seek greater transparency.

Despite this shift, elite managers like Ares Management continue to draw substantial capital, showcasing their robust fundraising abilities. In 2024, Ares successfully raised over $100 billion across its various strategies, a testament to its strong market position and investor confidence. This upward trajectory is expected to continue into 2025, indicating that while LPs exert more influence, established managers can still command favorable terms.

The market for experienced investment professionals is incredibly competitive, meaning talented individuals hold significant sway. This is a key factor in supplier power for firms like Ares Management.

Ares Management itself recognizes this, actively investing in bringing in new talent. In 2024 alone, they added over 100 investment professionals to bolster their deployment capabilities, underscoring the demand for skilled individuals.

Attracting, hiring, and keeping top-tier talent, especially those with niche skills, remains a persistent challenge for the industry. This competition naturally drives up compensation and intensifies recruitment efforts, directly impacting the cost of talent.

As alternative asset management firms like Ares Management increasingly depend on sophisticated technology and data analytics, the suppliers of these critical services are gaining significant leverage. The push towards AI and machine learning is revolutionizing operational efficiency and analytical capabilities, making specialized technology and data vendors indispensable allies.

This heightened reliance means that firms are compelled to invest heavily in technology to stay competitive. For instance, the global AI in finance market was valued at approximately $10.1 billion in 2023 and is projected to grow substantially, indicating the immense value placed on these solutions. This trend directly translates to increased bargaining power for the vendors providing these advanced tools and data sets.

Supplier Power: Legal and Advisory Services

Specialized legal, accounting, and consulting firms hold significant sway over alternative investment managers like Ares Management. These service providers are indispensable for navigating the labyrinthine regulatory landscape and the complex architecture of deals common in this sector. Their deep knowledge is crucial for ensuring compliance, effectively structuring investment funds, and successfully executing transactions.

The persistent high demand for these specialized advisory services bolsters their bargaining power. For instance, the global legal services market, which includes the specialized areas relevant to alternative investments, was valued at approximately $900 billion in 2023 and is projected to grow steadily. This sustained demand means these firms can often dictate terms, influencing fees and engagement conditions for managers.

- High Demand: The need for expert guidance in regulatory compliance, fund structuring, and transaction execution remains consistently strong in the alternative investment sector.

- Specialized Expertise: Firms offering niche legal, accounting, and consulting services possess unique knowledge that is difficult for investment managers to replicate internally.

- Regulatory Complexity: The ever-evolving and intricate regulatory environment necessitates reliance on external legal and compliance specialists, enhancing their leverage.

- Transaction Sophistication: Complex deal structures and cross-border transactions require specialized financial and legal advice, further concentrating power with a few key advisory firms.

Supplier Power: Underlying Asset Providers

While Ares Management doesn't deal with traditional suppliers, the entities providing underlying assets to its funds, like companies for private equity or properties for real estate, do wield influence. This power is particularly pronounced when market liquidity is low or competition for desirable assets is high.

Heading into 2025, a more robust economy with increased dealmaking could alleviate some of the valuation and liquidity challenges faced by buyers. However, the intense competition for prime investment opportunities is expected to persist, meaning that sellers of attractive assets will likely retain considerable negotiating leverage.

For fund managers actively deploying capital in 2024 and looking ahead, the current environment may offer an advantage. More favorable valuations and stronger negotiating positions can allow them to dictate terms, effectively becoming 'term-makers' in transactions.

- Asset Provider Influence: Sellers of companies and properties to Ares's funds possess bargaining power influenced by market liquidity and asset competition.

- 2025 Economic Outlook: Increased dealmaking in a more balanced 2025 economy could ease valuation and liquidity pressures, but competition for attractive assets will remain.

- Managerial Advantage: Fund managers deploying capital in 2024 may benefit from more attractive valuations and stronger negotiating power, enabling them to set terms.

The bargaining power of suppliers for Ares Management is multifaceted, encompassing capital providers, skilled professionals, technology vendors, and the providers of underlying assets. While limited partners (LPs) are increasingly discerning, demanding better terms, elite managers like Ares continue to attract significant capital, demonstrating resilience. In 2024, Ares successfully raised over $100 billion, highlighting its ability to command investor confidence despite evolving LP dynamics.

The competition for experienced investment professionals is fierce, driving up compensation and recruitment costs for firms like Ares, which hired over 100 investment professionals in 2024. Similarly, the growing reliance on advanced technology, particularly AI in finance—a market valued at approximately $10.1 billion in 2023—empowers specialized tech vendors. Furthermore, niche legal, accounting, and consulting firms, essential for navigating complex regulations and deal structures, hold considerable sway due to their specialized expertise and the sustained high demand for their services, with the global legal services market alone valued at around $900 billion in 2023.

| Supplier Type | Key Leverage Factors | Impact on Ares Management | 2024/2023 Data Point |

|---|---|---|---|

| Capital Providers (LPs) | Increased scrutiny on fees and terms | Push for more favorable fund conditions | Ares raised >$100bn in 2024 |

| Investment Professionals | High demand for specialized skills | Increased compensation and recruitment costs | Ares hired >100 investment professionals in 2024 |

| Technology Vendors | Reliance on AI and data analytics | Increased costs for essential tech solutions | AI in Finance market ~$10.1bn (2023) |

| Advisory Firms (Legal, Accounting) | Specialized expertise, regulatory complexity | Ability to dictate terms and fees | Global Legal Services market ~$900bn (2023) |

| Asset Providers (Companies, Properties) | Market liquidity, competition for assets | Negotiating leverage for sellers of attractive assets | Intense competition for prime opportunities expected to persist |

What is included in the product

This analysis dissects the competitive landscape for Ares Management, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the alternative investment sector.

Quickly identify and mitigate competitive threats with a comprehensive overview of industry rivalry, supplier power, buyer bargaining, new entrants, and substitute products.

Customers Bargaining Power

Institutional investors, like pension funds and sovereign wealth funds, are becoming more demanding clients for alternative asset managers. These sophisticated LPs are wielding more sway in negotiations regarding fund terms and are becoming pickier about where they place their capital, often favoring a smaller group of managers they trust deeply.

This trend is evident as LPs increasingly prioritize risk-adjusted returns and demand greater transparency from their investment partners. For instance, in 2024, many large pension plans reported scrutinizing manager fees and performance metrics more closely than ever before, leading to more concentrated allocations to top-tier managers.

The increasing accessibility of alternative investments to a broader retail and wealth management client base is a significant trend. This shift could diversify revenue for firms like Ares Management. However, these new clients often seek more standardized offerings, lower investment thresholds, and improved liquidity, which can heighten their sensitivity to pricing and contract terms.

Ares Management is actively developing its wealth and insurance channels, reporting substantial growth in fundraising within these segments. For instance, Ares's Alternative Investment Solutions (AIS) segment, which caters to wealth management clients, saw significant inflows in 2023. This strategic push aims to tap into this expanding customer pool.

Customers, particularly institutional investors, wield significant power due to their ability to allocate capital based on performance. Ares Management's success hinges on demonstrating consistent, attractive returns across various market conditions, as investors will readily shift their capital to managers who deliver superior value.

For instance, in 2023, Ares reported strong performance across its credit and alternative strategies, with several funds outperforming their benchmarks. This track record directly influences investor commitment, as a history of delivering alpha is the primary driver for retaining and attracting capital in the competitive asset management landscape.

Customer Power: Diversified Product Offerings

Customers seeking diversification across alternative asset classes may consolidate their investments with managers offering a broad suite of products. Ares Management's extensive offerings across Credit, Private Equity, Real Estate, and Infrastructure provide clients with comprehensive solutions. This breadth can reduce the incentive for clients to seek multiple managers, thereby somewhat limiting customer power.

Ares's ability to serve diverse investor needs through its multi-asset class platform is a key factor. For instance, by Q1 2024, Ares reported $422 billion in Assets Under Management (AUM), demonstrating significant scale and the capacity to cater to a wide range of investor mandates.

- Diversified Product Suite: Ares offers investment strategies across Credit, Private Equity, Real Estate, and Infrastructure.

- Consolidation Trend: Investors often prefer consolidating with managers who can meet multiple allocation needs.

- Reduced Client Switching: A broad product offering can decrease a client's motivation to switch to a different manager.

- AUM Growth: As of Q1 2024, Ares managed $422 billion in AUM, indicating its broad appeal and market penetration.

Customer Power: Liquidity Needs

The increasing demand for liquidity among Limited Partners (LPs) in private markets, driven by slower distribution cycles, is a notable factor influencing customer power. This has spurred LPs to explore avenues like the secondary market, which provides alternative exit strategies. For instance, the global private equity secondary market saw significant activity in 2023, with transaction volumes estimated to be in the tens of billions of dollars, reflecting this heightened need for liquidity.

This enhanced focus on liquidity, coupled with ongoing commitments to new funds, grants LPs greater flexibility and potentially increased leverage in their dealings with General Partners (GPs). As LPs navigate these evolving market dynamics, their ability to seek out alternative liquidity solutions directly impacts their bargaining position when negotiating terms with fund managers.

Ares Management's strategy of diversifying across various asset classes and investment strategies is designed to mitigate these liquidity pressures over the long term. By aiming for consistent returns across different market cycles, Ares seeks to provide LPs with more predictable capital flows, thereby addressing their underlying need for liquidity and potentially moderating their bargaining power.

- Increased LP focus on secondary markets: Driven by slower distributions, LPs are actively using secondary markets to access capital.

- Growing LP leverage: The combination of liquidity needs and new fund commitments strengthens LPs' negotiating position with GPs.

- Ares's diversification strategy: Ares aims to provide consistent returns to address LP liquidity concerns and maintain strong relationships.

Customers, especially large institutional investors, hold significant bargaining power because they can easily shift their capital to other asset managers if they are not satisfied with performance or terms. This means Ares Management must consistently deliver strong, risk-adjusted returns to retain and attract these crucial clients.

The trend of LPs consolidating their alternative investments with a few trusted managers further amplifies this power. For example, in 2024, many pension funds narrowed their manager lists, favoring those with proven track records and broad product offerings. This concentration means a single large client’s decision can have a substantial impact.

Ares's ability to offer a diversified suite of products across credit, private equity, and real estate helps mitigate this power by reducing the incentive for clients to seek out multiple managers. However, the increasing demand for liquidity from LPs, evidenced by robust activity in the secondary market throughout 2023, provides them with alternative exit strategies and thus greater leverage in negotiations.

| Customer Type | Bargaining Power Driver | Impact on Ares Management | 2023/2024 Data Point |

|---|---|---|---|

| Institutional Investors (e.g., Pension Funds) | Capital Allocation Decisions, Demand for Transparency & Performance | High; can shift significant capital, demanding better terms and fees. | Many LPs scrutinized fees and performance more closely in 2024, leading to concentrated allocations. |

| Retail & Wealth Management Clients | Sensitivity to Pricing & Standardization | Growing; as Ares expands into these channels, these clients may demand more accessible, lower-cost products. | Ares's Alternative Investment Solutions (AIS) segment saw significant inflows in 2023, indicating growth in this client base. |

| All Clients | Demand for Liquidity | Moderate to High; LPs seeking liquidity may use secondary markets, increasing their negotiating leverage. | Global private equity secondary market transaction volumes were in the tens of billions of dollars in 2023. |

Same Document Delivered

Ares Management Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Ares Management, detailing the competitive landscape and strategic positioning of the firm. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering no surprises or placeholders. This allows you to gain immediate insight into the industry's competitive intensity and Ares Management's strategic advantages.

Rivalry Among Competitors

The alternative investment sector is incredibly competitive, with a rising number of firms actively seeking capital and attractive investment prospects. This intense rivalry means that firms like Ares Management must constantly innovate and differentiate themselves to stand out.

Adding to this pressure, traditional asset managers are increasingly venturing into alternative strategies, like private equity and credit, which directly broadens the competitive set. For instance, in 2023, BlackRock, a traditional giant, reported significant inflows into its alternative asset classes, demonstrating this trend.

This heightened demand for yield across the market is driving more creative and flexible deal structures. Firms are compelled to offer more tailored solutions to attract investors and secure unique investment opportunities, making deal origination a critical differentiator.

Firms like Ares Management, boasting significant scale and diversified platforms across Credit, Private Equity, Real Estate, and Infrastructure, enjoy a distinct competitive edge. This breadth allows them to attract and manage substantial capital, deploy it across various investment strategies, and cater to a wide array of investor needs, thereby solidifying their market standing.

Ares Management’s robust performance in 2024, marked by record fundraising and Assets Under Management (AUM) growth, underscores this advantage. This expansion signifies their increasing capacity to compete effectively by offering a comprehensive suite of financial solutions and capitalizing on market opportunities across multiple sectors.

In the competitive landscape of alternative asset management, superior investment performance and a robust track record are paramount. Ares Management highlights its cycle-tested performance and disciplined investment philosophy as significant competitive advantages, crucial for attracting and retaining capital in an industry where consistent, strong risk-adjusted returns are the primary currency.

Ares Management's commitment to delivering strong performance is evident in its various strategies. For instance, as of March 31, 2024, their Credit segment, a significant contributor, has consistently aimed for robust returns, with specific fund vintages demonstrating outperformance relative to benchmarks, a testament to their disciplined approach.

Competitive Rivalry: Talent Acquisition and Retention

The competition for top-tier investment and operational talent is a defining characteristic of competitive rivalry within the alternative asset management industry. Firms like Ares Management must constantly vie for highly skilled professionals capable of sourcing promising deals, effectively managing complex portfolios, and innovating new investment strategies and products. This intense battle for human capital directly impacts a firm's ability to execute its business plan and generate superior returns.

The capacity to attract and retain these sought-after individuals is a significant strategic differentiator. In 2024, the demand for experienced private equity professionals, particularly those with expertise in credit, real estate, and infrastructure, remained exceptionally high. Compensation packages, including base salaries, bonuses, and carried interest, are critical levers, but career development opportunities and a strong firm culture are equally important for long-term retention.

- Talent Acquisition Costs: Firms are investing heavily in recruitment, with specialized headhunters and extensive interviewing processes contributing to significant upfront costs for acquiring new talent.

- Retention Challenges: High turnover rates can disrupt investment strategies and client relationships, making retention a key focus. For instance, the average tenure in some senior investment roles can be shorter than desired if compelling growth paths aren't provided.

- Compensation Benchmarks: In 2024, compensation for managing directors in private equity could range from $500,000 to over $1 million in base salary and bonus, excluding carried interest, reflecting the intense competition for senior talent.

- Impact on Performance: The quality of talent directly correlates with deal origination success and investment performance, underscoring the strategic importance of human capital management.

Competitive Rivalry: Innovation and Technology Adoption

Competitive rivalry within the asset management sector, including firms like Ares Management, is intensifying as companies increasingly differentiate themselves through innovation and technology adoption. The focus is on leveraging cutting-edge technologies such as artificial intelligence (AI) to enhance predictive analytics, automate processes, and boost operational efficiency. This technological edge is becoming a critical factor in gaining a competitive advantage.

Firms that effectively integrate AI into their operations can streamline workflows, improve the accuracy of their decision-making, and elevate the quality of client service. The industry is witnessing a significant trend towards AI-driven investment strategies, reflecting a broader shift in how investment management is approached. For example, by mid-2024, a significant portion of leading asset managers were actively investing in AI capabilities to refine their portfolio construction and risk management processes.

- AI Integration: Asset managers are increasingly adopting AI for tasks like market forecasting, sentiment analysis, and algorithmic trading.

- Operational Efficiency: Technology adoption, including AI, aims to reduce costs and improve turnaround times for investment processes.

- Client Service Enhancement: AI-powered tools are being used to personalize client interactions and provide more tailored investment advice.

- Competitive Differentiation: Early adopters of advanced technologies often gain an edge in attracting both capital and top talent.

The competitive rivalry in alternative asset management, including for Ares Management, is fierce due to the influx of both traditional and specialized firms vying for capital and talent. This dynamic forces companies to innovate and offer differentiated strategies to stand out in a crowded market.

Ares Management's scale and diversified platform across Credit, Private Equity, Real Estate, and Infrastructure provide a significant advantage, enabling them to attract and deploy substantial capital effectively. This broad reach allows them to cater to a wide investor base and capitalize on diverse market opportunities.

Superior investment performance and a strong track record are crucial differentiators, with Ares Management emphasizing its cycle-tested performance and disciplined approach. By mid-2024, the firm’s consistent ability to generate robust, risk-adjusted returns across various strategies solidified its competitive standing.

The intense competition for top-tier talent, particularly in private equity and credit, drives up acquisition costs and retention challenges. Firms like Ares must offer competitive compensation, career development, and a strong culture to attract and keep skilled professionals, as experienced talent is key to deal origination and overall performance.

| Metric | Ares Management (as of Q1 2024) | Industry Trend (2024) |

|---|---|---|

| Assets Under Management (AUM) | $424 billion | Continued growth across alternative asset classes |

| Fundraising Success | Record fundraising in 2024 | High demand for yield driving capital inflows |

| Talent Competition | High demand for experienced professionals | Increased compensation and focus on retention |

SSubstitutes Threaten

Public market investments like stocks and bonds are significant substitutes for alternative assets, offering greater liquidity and generally lower expense ratios. For instance, in early 2024, the S&P 500 saw substantial gains, making traditional equities an attractive option for many investors seeking accessible returns.

While alternative investments can offer diversification benefits and potentially higher returns, investor preferences can shift based on macroeconomic factors. As of mid-2024, rising interest rates have made fixed income more appealing, potentially drawing capital away from less liquid alternative strategies.

A more stable economic outlook projected for 2025 could encourage more deal activity in private markets, but lingering uncertainties might still push investors towards the perceived safety and predictability of public market assets.

Large institutional investors, such as sovereign wealth funds and major pension funds, are increasingly opting for direct investments or co-investments alongside asset managers. This approach offers them greater control and potentially reduced fees compared to traditional fund commitments, directly substituting the need for commingled funds. For instance, in 2023, co-investment deals in private equity saw significant growth, with limited partners (LPs) actively seeking these opportunities to boost returns and trim management expenses.

Some large institutional investors, like pension funds or sovereign wealth funds, possess the internal expertise and infrastructure to manage alternative assets themselves. This in-house capability acts as a direct substitute for external asset managers like Ares. For instance, a large pension fund might build out its own private equity or real estate team, bypassing the need to pay management fees to external firms.

While bringing asset management in-house can eliminate management fees and offer complete control, the significant upfront investment in talent and technology, coupled with the inherent complexity of many alternative strategies, often makes outsourcing more practical. The global alternative assets under management reached an estimated $13.2 trillion in 2023, highlighting the scale and specialized knowledge required, which can be a barrier for many institutions to replicate internally.

Threat of Substitutes: New Liquidity Solutions and Structures

The rise of secondary markets and novel fund structures like interval funds, Business Development Companies (BDCs), European Long-Term Investment Funds (ELTIFs), and tokenized limited partnership (LP) shares presents a significant threat of substitutes. These innovations offer investors alternative avenues to access private markets or manage their liquidity needs, potentially bypassing traditional fund commitments.

These evolving structures can diminish the perceived illiquidity of private market investments. For instance, BDCs, which are publicly traded investment companies, provided investors with a way to gain exposure to private debt and equity, with total assets under management in the sector reaching over $100 billion by early 2024. Similarly, the growth of ELTIFs, particularly in Europe, aims to channel retail and institutional capital into long-term illiquid assets, with regulatory frameworks evolving to support their expansion.

- Secondary Markets: Facilitate the trading of existing private fund interests, offering liquidity to LPs and creating new investment opportunities.

- Interval Funds: Provide periodic liquidity windows for investors in typically illiquid assets, broadening access.

- BDCs: Publicly traded vehicles offering exposure to private debt and equity, with significant market presence.

- ELTIFs: European regulated funds designed for long-term illiquid investments, fostering broader capital allocation.

- Tokenized LP Shares: Emerging digital representations of fund interests, promising enhanced transferability and fractionalization.

Threat of Substitutes: Macroeconomic Shifts and Investor Preferences

The allure of substitutes for Ares Management's services is significantly shaped by macroeconomic currents. For instance, rising inflation and interest rates, prevalent in early 2024 and projected to continue influencing economic policy through 2025, can drive investors away from traditional equity and fixed-income strategies towards inflation-hedging assets. This dynamic directly impacts the demand for Ares's alternative investment products.

Investor preferences are also in flux. As of mid-2024, there's a notable trend towards seeking stable income streams amidst market uncertainty. This could mean a greater allocation to real assets like infrastructure or real estate, areas where Ares has a strong presence, but also potentially to more traditional dividend-paying equities or bonds if they offer competitive yields. The evolving financial landscape in 2025 will likely see these preferences solidify, influencing the competitive pressures from substitute investment vehicles.

- Macroeconomic Sensitivity: Investor demand for Ares's offerings can shift dramatically based on inflation rates, interest rate policies, and overall market volatility.

- Inflation Hedges: In periods of rising inflation, investors may favor substitutes like commodities, precious metals, or real estate over traditional financial instruments.

- Income Generation: During economic uncertainty, the appeal of substitutes offering stable income, such as infrastructure or certain types of private debt, increases.

- 2025 Outlook: The continued influence of interest rate normalization and global economic stability will be key determinants in the attractiveness of substitutes versus Ares's core strategies.

The threat of substitutes for Ares Management's offerings is substantial, driven by the increasing accessibility and appeal of alternative investment vehicles and traditional markets. Publicly traded equities and fixed income remain strong substitutes, especially when offering attractive yields or growth prospects, as seen with the S&P 500's performance in early 2024. Furthermore, the evolution of secondary markets, interval funds, BDCs, ELTIFs, and tokenized LP shares provides investors with more liquid and potentially lower-cost avenues to access private markets, directly challenging traditional fund structures. The capacity of large institutions to internalize asset management also presents a direct substitute, bypassing external managers and their associated fees, a trend amplified by the $13.2 trillion in global alternative assets under management as of 2023.

| Substitute Category | Key Characteristics | Investor Appeal Factors | Example/Data Point (2023-2024) |

|---|---|---|---|

| Public Markets | High liquidity, transparency, lower fees | Market performance (e.g., S&P 500 gains early 2024), yield attractiveness | S&P 500 up 10% in Q1 2024 |

| Direct/Co-Investments | Control, reduced fees, direct access | Desire for greater control, fee optimization | Co-investment deal volume grew significantly in 2023 |

| In-House Management | Full control, no external fees | Internal expertise, cost savings | Barrier: High upfront investment in talent/tech |

| Novel Fund Structures | Periodic liquidity, broader access, fractionalization | Liquidity needs, diversification, lower entry points | BDC assets over $100 billion by early 2024 |

Entrants Threaten

The threat of new entrants in the alternative investment management space, particularly for a global firm like Ares Management, is significantly dampened by high capital requirements. Establishing and scaling operations, launching diverse funds, and engaging in substantial transactions demand immense financial resources, creating a formidable barrier for newcomers.

For instance, Ares Management's commitment to deploying vast amounts of capital, as evidenced by its significant fundraising and investment activities throughout 2024, further solidifies its market position and makes it exceedingly difficult for new players to compete effectively.

Ares Management's formidable brand reputation and a decade-long track record of strong investment performance, marked by its 10th IPO anniversary in 2024, present a significant barrier to new entrants. Institutional investors, who are crucial for capital deployment, prioritize established credibility and a history of consistent returns. This deep-seated trust, built over many years, makes it exceptionally challenging for emerging firms to attract the substantial capital needed to compete effectively.

The alternative asset management sector, where Ares Management operates, faces a significant threat from new entrants due to stringent regulatory requirements. Navigating these evolving frameworks, such as those from the SEC, demands substantial investment in compliance infrastructure and expertise, creating a high barrier to entry. For instance, the increasing scrutiny on private fund disclosures and investor protection measures, a trend likely to intensify by 2025, means new firms must allocate considerable resources just to meet basic operational standards.

Threat of New Entrants: Access to Deal Flow and Proprietary Networks

Established firms like Ares Management leverage extensive networks and deep relationships to secure proprietary deal flow, a critical advantage for generating superior investment returns. For instance, in 2024, Ares continued to expand its global private credit platform, demonstrating the value of its established relationships in sourcing attractive opportunities. New entrants face significant hurdles in replicating these long-standing connections and accessing high-quality investment prospects, which directly impacts their ability to compete effectively.

The difficulty for newcomers to build comparable proprietary networks and gain access to exclusive deals is a substantial barrier. This is particularly true in specialized sectors where Ares has a strong presence. For example, Ares’ success in opportunistic real estate in 2024 was partly driven by its ability to access off-market deals through its deep industry ties.

- Proprietary Deal Flow: Established firms possess an advantage in accessing exclusive investment opportunities not available on the open market.

- Network Effects: Long-standing relationships built by firms like Ares are difficult and time-consuming for new entrants to replicate.

- Competitive Disadvantage: New entrants struggle to gain access to the same quality and volume of deals, hindering their ability to generate competitive returns.

- Barriers to Entry: The reliance on deep networks and proven track records creates a significant barrier for new players entering the alternative asset management space.

Threat of New Entrants: Talent Scarcity and Retention

The scarcity of experienced investment professionals, particularly those with deep expertise in specialized alternative asset classes like private credit or infrastructure, presents a substantial barrier for new entrants. This talent gap means that firms looking to break into these markets must invest heavily in attracting and retaining skilled individuals.

New firms face intense competition from established players like Ares Management for this limited pool of talent. In 2024, the demand for seasoned professionals in alternative investments remained exceptionally high, driving up compensation packages and the need for robust retention strategies, including significant equity participation and performance-based bonuses.

- Talent Acquisition Costs: New entrants must offer premium compensation and benefits to attract experienced professionals, potentially increasing operational costs by 20-30% compared to established firms.

- Retention Challenges: High turnover among junior staff is common, requiring continuous investment in training and development, while retaining senior talent demands competitive long-term incentives.

- Specialized Skill Demand: The need for professionals skilled in areas like ESG integration within private equity or complex derivative structuring in hedge funds further exacerbates talent scarcity.

The threat of new entrants for Ares Management is considerably low due to the immense capital requirements and regulatory hurdles inherent in alternative asset management. For instance, Ares' substantial fundraising in 2024, deploying billions across various strategies, underscores the financial muscle needed to even begin competing.

Furthermore, the established reputation and deep client relationships cultivated by Ares over decades, highlighted by its 2024 IPO anniversary, create a significant barrier. Attracting institutional investors requires a proven track record and trust, which new firms struggle to build quickly.

The intense competition for scarce, specialized talent further limits new entrants. In 2024, demand for experienced alternative investment professionals remained robust, driving up compensation and making it difficult for newcomers to assemble competitive teams.

| Barrier Type | Description | Impact on New Entrants | Ares Management Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for fund launch and operations. | Extremely high; limits the number of potential entrants. | Vast capital base and proven fundraising ability. |

| Regulatory Compliance | Complex and evolving rules from bodies like the SEC. | Significant cost and expertise needed to navigate. | Established compliance infrastructure and legal teams. |

| Brand Reputation & Track Record | Investor trust built on years of performance. | Difficult to gain credibility and attract initial capital. | Long history of strong, consistent investment returns. |

| Proprietary Networks & Deal Flow | Access to exclusive, off-market investment opportunities. | Struggles to secure high-quality deal flow. | Extensive global relationships for sourcing unique investments. |

| Talent Acquisition | Competition for experienced investment professionals. | High costs and difficulty in attracting and retaining key personnel. | Strong employer brand and competitive compensation packages. |

Porter's Five Forces Analysis Data Sources

Our Ares Management Porter's Five Forces analysis leverages a comprehensive suite of data sources, including SEC filings, investor presentations, and industry-specific market research reports. This ensures a robust understanding of competitive dynamics.