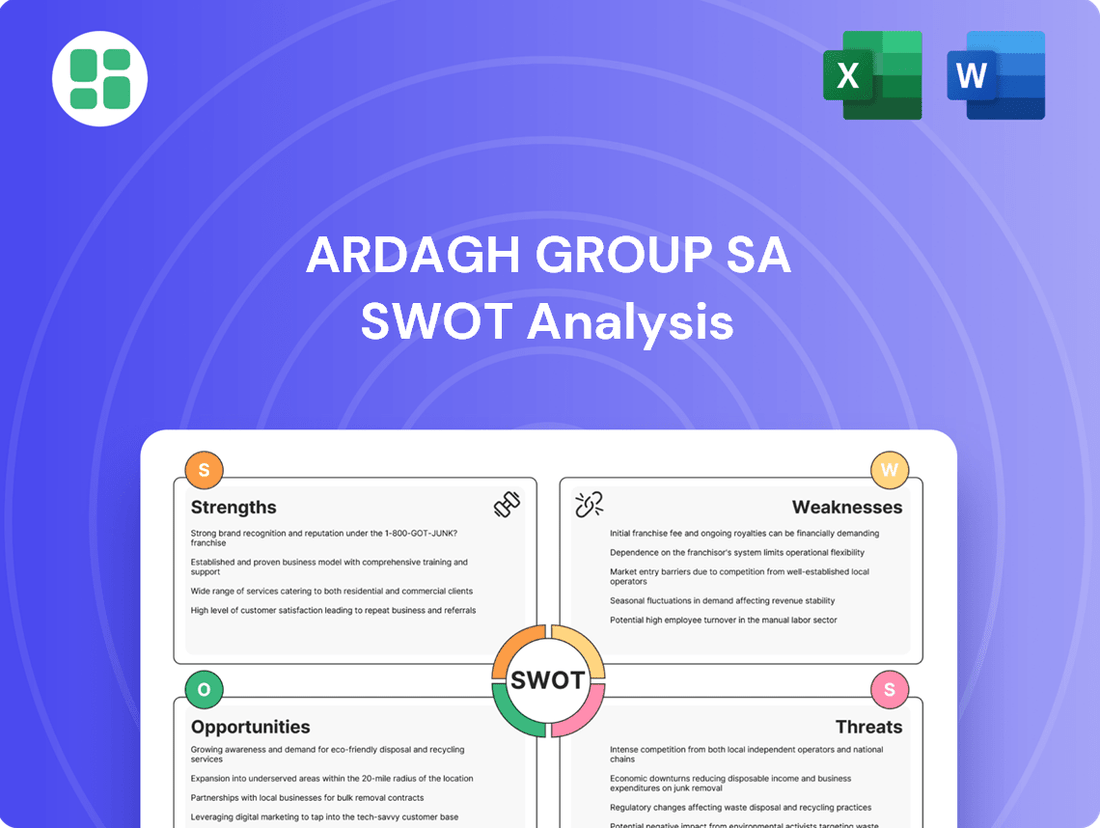

Ardagh Group SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardagh Group SA Bundle

Ardagh Group SA's robust market position is underpinned by significant strengths in its diverse packaging portfolio and global reach. However, understanding potential threats and weaknesses is crucial for navigating the competitive landscape.

Want the full story behind Ardagh Group SA's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ardagh Group SA stands as a global frontrunner in sustainable packaging, with a core focus on infinitely recyclable metal and glass. This leadership position is particularly advantageous as consumer demand and regulatory frameworks increasingly favor environmentally sound packaging solutions. By 2024, the global sustainable packaging market was projected to reach over $300 billion, a segment Ardagh is well-positioned to capture.

Ardagh Group SA's strength lies in its diverse market and customer base, serving key sectors like beverages, food, and consumer care. This broad reach significantly reduces its dependence on any single industry, offering a buffer against sector-specific downturns. In 2023, for instance, Ardagh reported that its packaging solutions were utilized by a substantial portion of the top global beverage and food brands, underscoring its embedded position in multiple supply chains.

Ardagh Group's core business is centered on metal and glass packaging, materials that are infinitely recyclable. This focus strongly aligns with the principles of a circular economy, a significant advantage in today's market.

This dedication to sustainability acts as a crucial differentiator for Ardagh, attracting both environmentally aware consumers and business clients. For instance, in 2023, Ardagh reported that 90% of its beverage can customers used recycled content, with many aiming for 100%.

Furthermore, Ardagh's commitment to recyclable materials positions the company favorably as environmental regulations become stricter and consumer demand for eco-friendly products continues to grow.

Innovation and Product Development

Ardagh Group SA's dedication to creating cutting-edge packaging solutions is a significant advantage, allowing them to adapt to changing consumer demands and maintain a competitive edge. Their focus on innovation in design, usability, and eco-friendly attributes opens doors to new markets and strengthens ties with clients.

This forward-thinking strategy keeps Ardagh at the forefront of packaging technology. For instance, in 2023, Ardagh invested heavily in R&D, with a reported €250 million allocated towards developing next-generation sustainable packaging materials and advanced manufacturing processes. This commitment is reflected in their product pipeline, which by early 2024 included several patented lightweight glass container designs and advanced barrier coatings for flexible packaging.

- Commitment to R&D: Significant investment in research and development, such as the €250 million in 2023, fuels continuous improvement.

- Product Pipeline: Development of patented lightweight glass and advanced barrier coatings demonstrates tangible innovation.

- Market Responsiveness: Innovation allows Ardagh to meet evolving customer needs for both functionality and sustainability.

- Technological Leadership: Proactive engagement with new technologies ensures Ardagh remains a leader in the packaging industry.

Extensive Operational Footprint

Ardagh Group SA boasts an impressive operational footprint, with facilities strategically located across Europe, North America, and South America. This extensive geographical presence is a significant strength, enabling efficient supply chain management and localized production to cater to diverse regional demands. As of early 2024, Ardagh operates over 100 manufacturing facilities globally, underscoring its vast reach.

This broad operational base provides Ardagh with enhanced resilience against localized economic fluctuations and offers a solid foundation for future growth and market penetration initiatives. The ability to serve multiple continents efficiently supports its position as a leading global supplier of sustainable packaging solutions.

- Global Reach: Operations in Europe, North America, and South America.

- Supply Chain Efficiency: Facilitates streamlined logistics and distribution.

- Market Responsiveness: Enables localized production and adaptation to regional needs.

- Economic Resilience: Mitigates risks associated with downturns in any single region.

Ardagh Group SA's leadership in sustainable packaging, particularly in infinitely recyclable metal and glass, is a major strength. This aligns perfectly with growing consumer and regulatory demand for eco-friendly options. By 2024, the global sustainable packaging market was projected to exceed $300 billion, a substantial opportunity Ardagh is positioned to capitalize on.

What is included in the product

Delivers a strategic overview of Ardagh Group SA’s internal and external business factors, identifying key strengths in its diversified product portfolio and market leadership, alongside weaknesses such as high debt levels and potential integration challenges.

Offers a clear, actionable framework for addressing Ardagh Group's competitive challenges and leveraging its market strengths.

Weaknesses

Ardagh Group's operations in metal and glass packaging demand substantial upfront investment in advanced manufacturing equipment and extensive production facilities. This capital intensity means significant ongoing outlays for machinery upkeep and technological upgrades, impacting financial agility. For instance, in 2023, Ardagh reported capital expenditures of €922 million, highlighting the scale of these requirements.

Ardagh Group's reliance on key inputs like sand, soda ash, aluminum, and steel makes it susceptible to price swings in these commodities. For instance, aluminum prices saw significant volatility in 2024, trading between $2,100 and $2,700 per metric ton, directly impacting Ardagh's metal packaging segment costs.

The energy-intensive nature of glass and metal production means that fluctuations in energy prices, such as natural gas which remained a volatile commodity throughout 2024, can significantly squeeze profit margins. This dependency on external energy markets exposes Ardagh to cost pressures that are largely outside its operational control.

Ardagh Group's extensive global operations, coupled with its history of significant acquisitions and continuous capital investment in its facilities, naturally lead to substantial debt accumulation. This financial leverage, while often enabling growth, presents a key weakness.

As of the end of 2023, Ardagh Group reported total debt of approximately $16.6 billion. This high debt load directly translates to increased financial risk, potentially limiting the company's ability to secure further financing for future strategic initiatives or acquisitions. Furthermore, a significant portion of Ardagh's operating cash flow is dedicated to servicing this debt, impacting its financial flexibility and potentially constraining its strategic agility in a dynamic market.

Intense Competition and Pricing Pressures

Ardagh Group operates in a packaging industry characterized by intense competition from both global giants and smaller regional players. This crowded market often translates into significant pricing pressures, making it difficult for Ardagh to maintain healthy profit margins. The need to constantly invest in operational efficiency and innovative packaging solutions becomes paramount just to hold onto existing market share.

For instance, the global rigid packaging market, a key segment for Ardagh, was projected to grow at a compound annual growth rate (CAGR) of around 4.5% between 2023 and 2028, according to Mordor Intelligence. However, this growth is accompanied by fierce competition, where price is often a deciding factor for customers. Ardagh must navigate this landscape by balancing cost-effectiveness with the development of advanced, sustainable packaging options.

- Price Sensitivity: Customers in the packaging sector are highly sensitive to price, forcing Ardagh to absorb cost increases rather than pass them on.

- Market Saturation: Many packaging segments are mature and saturated, limiting opportunities for organic growth without aggressive market share acquisition.

- Innovation Costs: Staying ahead requires continuous investment in R&D and new technologies, which can strain resources when margins are already thin.

Operational Complexity Across Geographies

Ardagh Group SA faces significant operational hurdles due to its widespread presence across Europe, North America, and South America. Managing diverse regulatory frameworks, differing labor laws, and distinct cultural nuances across these regions creates substantial complexity. These factors can directly impact efficiency and increase the costs associated with administrative oversight and supply chain management.

The intricate nature of these geographically dispersed operations presents a clear weakness for Ardagh Group. Navigating varied business practices and legal requirements in each market demands robust and adaptable management systems. For instance, harmonizing production standards and logistics across continents, while essential for scale, can be a source of inefficiency if not meticulously managed. This complexity can also hinder rapid decision-making and the implementation of standardized best practices, potentially impacting profitability.

- Geographic Dispersion: Operations span Europe, North America, and South America, increasing logistical and regulatory challenges.

- Regulatory Variety: Navigating differing legal and compliance standards across multiple countries adds layers of complexity and cost.

- Labor Law Differences: Managing varied employment regulations and labor relations in each region can create operational friction.

- Cultural Nuances: Adapting business practices and communication styles to diverse cultural environments is a constant challenge.

Ardagh's substantial debt load, reaching approximately $16.6 billion by the end of 2023, presents a significant financial weakness. This high leverage requires a considerable portion of operating cash flow to service debt obligations, thereby limiting financial flexibility and potentially hindering future strategic investments or acquisitions. The company's considerable capital expenditure, which was €922 million in 2023, further underscores the need for robust financial management to balance growth initiatives with debt reduction.

The company faces intense competition within the packaging industry, leading to significant pricing pressures. This market saturation, particularly in mature segments, necessitates continuous investment in operational efficiency and innovation to maintain market share, which can strain resources when profit margins are already under pressure. For instance, while the rigid packaging market is growing, fierce competition often dictates price over innovation.

Ardagh's geographically dispersed operations across Europe, North America, and South America introduce considerable complexity. Managing diverse regulatory frameworks, labor laws, and cultural nuances across these regions increases administrative oversight and supply chain management costs, potentially impacting efficiency and decision-making speed.

| Weakness | Description | Impact |

| High Debt Load | Total debt of approximately $16.6 billion at the end of 2023. | Limits financial flexibility, constrains strategic initiatives, and diverts cash flow to debt servicing. |

| Intense Competition & Price Sensitivity | Saturated markets and price-conscious customers. | Pressures profit margins, necessitates continuous investment in efficiency and innovation to retain market share. |

| Operational Complexity | Managing diverse regulations, labor laws, and cultural differences across multiple continents. | Increases administrative costs, can lead to inefficiencies, and may slow down decision-making. |

Same Document Delivered

Ardagh Group SA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Ardagh Group SA's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

Opportunities

The global move towards sustainability and circular economy principles is a major opportunity for Ardagh Group. Their core business in infinitely recyclable metal and glass packaging aligns perfectly with this trend.

As consumers and businesses increasingly favor environmentally conscious choices, the demand for Ardagh's products is poised for significant growth. This surge is fueled by growing environmental awareness and supportive regulatory frameworks worldwide.

For instance, the global sustainable packaging market was valued at approximately $271.7 billion in 2023 and is projected to reach $479.1 billion by 2030, growing at a compound annual growth rate of 8.4%. This expansion directly benefits Ardagh's offerings.

Ardagh Group SA can capitalize on its global presence by strategically expanding into emerging markets where demand for packaged goods is rapidly increasing due to economic development. For instance, while Ardagh has a strong presence in Europe and North America, regions like Southeast Asia and parts of Africa represent significant growth potential. The increasing disposable income in these areas directly correlates with a higher consumption of beverages and food, driving demand for Ardagh's glass and metal packaging solutions.

Ardagh can capitalize on ongoing packaging technology advancements like lightweighting and smart packaging. These innovations present a chance to boost product appeal and streamline operations. For instance, the push for sustainable packaging is driving demand for materials that reduce environmental impact, a trend Ardagh can leverage.

Investing in research and development for these cutting-edge technologies, such as advanced barrier coatings or interactive packaging features, could solidify Ardagh's market position. This strategic focus can unlock new revenue streams and differentiate its offerings in a competitive landscape.

Furthermore, technological progress in manufacturing processes, including automation and AI-driven quality control, offers significant opportunities for Ardagh to improve production efficiency. This can lead to cost savings and a reduction in material usage and energy consumption, aligning with sustainability goals and enhancing profitability.

Strategic Mergers and Acquisitions

The packaging industry, particularly in segments like glass and metal, remains somewhat fragmented, presenting Ardagh Group with significant opportunities for strategic mergers and acquisitions. By consolidating market share through carefully chosen deals, Ardagh can bolster its competitive standing and broaden its product offerings. For instance, in 2023, the global packaging market was valued at approximately $1 trillion, with continued growth projected, indicating a fertile ground for expansion.

These acquisitions can also provide access to cutting-edge technologies or entirely new geographic markets, accelerating growth and innovation. Ardagh’s ability to integrate acquired businesses effectively can unlock substantial economies of scale, leading to improved cost efficiencies and enhanced profitability.

- Consolidation: Acquire smaller, regional players to increase market share in key segments.

- Technology Access: Target companies with advanced manufacturing or sustainable packaging technologies.

- Market Expansion: Enter new geographic regions or product categories through strategic partnerships or takeovers.

- Synergies: Realize cost savings and revenue enhancements through operational integration and cross-selling opportunities.

Partnerships for Circular Economy Initiatives

Collaborating with governments, NGOs, and other industry players on circular economy initiatives offers Ardagh Group significant opportunities to boost its reputation and explore innovative business models. For instance, by 2024, the EU aims to increase recycling rates for packaging waste, creating a fertile ground for Ardagh to engage in such partnerships.

Participating in the development of recycling infrastructure or closed-loop systems can solidify Ardagh's market standing and secure a reliable supply of recycled materials. This is particularly relevant as the demand for sustainable packaging solutions continues to grow, with the global sustainable packaging market projected to reach over $400 billion by 2025.

- Enhanced Brand Reputation: Aligning with circular economy principles improves public perception and stakeholder trust.

- New Revenue Streams: Developing closed-loop systems can create new business models and revenue opportunities.

- Supply Chain Resilience: Investing in recycling infrastructure ensures a stable and cost-effective supply of raw materials.

- Policy Influence: Partnerships can provide a platform to influence environmental regulations and standards.

Ardagh Group's alignment with sustainability trends, particularly the circular economy, presents a significant opportunity. Their focus on infinitely recyclable glass and metal packaging directly addresses growing consumer and regulatory demand for eco-friendly solutions.

The global sustainable packaging market, valued at around $271.7 billion in 2023 and projected to hit $479.1 billion by 2030, demonstrates the substantial growth potential for Ardagh's core products.

Strategic expansion into emerging markets, driven by increasing disposable incomes and consumption of packaged goods, offers another avenue for growth. Furthermore, advancements in packaging technology, such as lightweighting and smart packaging, can enhance product appeal and operational efficiency, solidifying Ardagh's market position and opening new revenue streams.

The industry's fragmentation also creates opportunities for Ardagh to grow through mergers and acquisitions, consolidating market share and accessing new technologies or markets. Collaborations on circular economy initiatives can bolster Ardagh's reputation and create innovative business models, particularly as regions like the EU aim to increase recycling rates by 2024.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Sustainability & Circular Economy | Leveraging demand for infinitely recyclable packaging. | Global sustainable packaging market projected to reach $479.1B by 2030 (CAGR 8.4%). |

| Emerging Market Expansion | Capitalizing on growing packaged goods consumption in developing economies. | Increasing disposable incomes in regions like Southeast Asia and Africa. |

| Technological Advancements | Adopting lightweighting and smart packaging innovations. | Drive for reduced environmental impact and enhanced product features. |

| Mergers & Acquisitions | Consolidating market share in a fragmented industry. | Global packaging market valued at ~$1 trillion in 2023. |

| Partnerships & Collaborations | Engaging in circular economy initiatives and infrastructure development. | EU targets for increased packaging waste recycling rates by 2024. |

Threats

Consumer preferences are a dynamic force, and a significant threat to Ardagh Group arises from potential shifts towards alternative packaging materials. While glass and metal offer sustainability benefits, consumers might increasingly favor flexible plastics, paperboard, or even unpackaged options for certain product categories. This trend could divert demand away from Ardagh's core offerings.

For instance, the global flexible packaging market, which includes plastics, is projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) of over 4% through 2028. Similarly, innovations in paper-based packaging are making it a more viable alternative in sectors traditionally dominated by glass and metal. Ardagh must actively monitor these evolving consumer behaviors and material science advancements to mitigate this risk.

Increasingly strict environmental regulations globally, particularly concerning carbon emissions and waste management, present a significant challenge. For instance, the European Union's ambitious Green Deal aims for climate neutrality by 2050, which will likely translate into more stringent manufacturing standards for Ardagh Group's facilities across the continent.

These evolving standards, including waste reduction and enhanced recycling targets, could necessitate substantial capital expenditure for Ardagh Group to upgrade its production processes and implement advanced environmental control technologies. This is especially relevant as the company operates in sectors where material efficiency and circularity are paramount.

Failure to comply with these tightening regulations could expose Ardagh Group to considerable financial penalties and, equally important, damage its brand reputation among environmentally conscious consumers and investors. For example, in 2023, several industrial companies faced fines for exceeding emission limits.

Global economic downturns pose a significant threat to Ardagh Group. A slowdown in major economies, such as the United States or the Eurozone, directly correlates with decreased consumer spending on packaged goods, impacting Ardagh's core markets. For instance, if inflation remains elevated in 2024 and 2025, consumers might cut back on discretionary purchases, which can trickle down to reduced demand for beverages and food products packaged by Ardagh.

During economic contractions, Ardagh's clients, often beverage and food manufacturers, may face their own financial pressures. This can lead to reduced order volumes or a shift towards cheaper packaging materials, squeezing Ardagh's sales and profitability. The company's reliance on large-scale production means that even a moderate decrease in client orders can have a substantial impact on its top line and margins, a risk common across the packaging industry.

Supply Chain Disruptions and Geopolitical Instability

Global supply chains remain susceptible to disruptions stemming from geopolitical tensions, natural disasters, and trade policy shifts. For Ardagh Group, these events can directly affect the availability and cost of key inputs like aluminum, energy, and logistics services, potentially impacting production schedules and delivery timelines. For instance, in early 2024, ongoing conflicts in Eastern Europe continued to exert upward pressure on energy prices, a significant operating cost for glass and metal packaging manufacturers.

Ardagh's reliance on a global network of suppliers means that localized events can have ripple effects across its operations. The company's ability to source raw materials efficiently and transport finished goods is directly tied to the stability of international trade routes and the cost of shipping.

- Geopolitical Instability: Ongoing conflicts and trade disputes can lead to unpredictable price volatility for raw materials such as aluminum, impacting Ardagh's cost of goods sold.

- Supply Chain Vulnerabilities: Disruptions in shipping and logistics, exacerbated by events like port congestion or labor disputes, can delay deliveries and increase transportation expenses.

- Energy Price Fluctuations: As an energy-intensive industry, Ardagh is exposed to the risks associated with volatile energy markets, which can affect production costs significantly.

- Raw Material Availability: Dependence on specific raw materials means that supply chain disruptions can limit production capacity and potentially lead to higher input costs.

Intensifying Competition from New Entrants or Innovations

The packaging sector is increasingly vulnerable to disruption. Innovative startups are emerging with novel materials and technologies, potentially challenging Ardagh's established market share. For instance, the rise of biodegradable and compostable packaging solutions, driven by consumer demand and regulatory shifts, presents a significant competitive threat if Ardagh does not adapt its product portfolio swiftly.

Established players expanding into Ardagh's core markets, particularly in glass and metal packaging, also intensify competitive pressures. This could lead to price wars and reduced market penetration. For example, in 2024, several large European beverage companies began exploring in-house packaging production or forming strategic alliances with new suppliers, diverting business from traditional providers.

Technological advancements and evolving business models pose a threat to existing market positions. Companies leveraging advanced automation, AI-driven supply chain optimization, or direct-to-consumer packaging models could gain a significant competitive edge. Ardagh must remain vigilant and invest in R&D to counter these shifts.

The threat landscape necessitates continuous adaptation and strategic investment. Key areas to monitor include:

- Emergence of sustainable packaging alternatives, such as advanced bioplastics and paper-based solutions.

- Technological advancements in manufacturing processes, including 3D printing for specialized packaging.

- Shifts in consumer preferences towards more environmentally friendly and customizable packaging options.

- Potential consolidation or alliances among competitors to gain scale and market influence.

Ardagh Group faces a significant threat from evolving consumer preferences favoring alternative packaging materials, potentially impacting demand for its glass and metal products. For instance, the global flexible packaging market is expected to see robust growth, with projections indicating a CAGR exceeding 4% through 2028, highlighting a shift in material choice.

Stricter environmental regulations worldwide, particularly concerning carbon emissions and waste management, necessitate substantial capital investment for compliance and could lead to financial penalties or reputational damage if not met. The European Union's Green Deal, aiming for climate neutrality by 2050, exemplifies the increasing regulatory pressure on industrial operations.

Economic downturns directly impact Ardagh by reducing consumer spending on packaged goods, leading clients to decrease order volumes or opt for cheaper alternatives. Elevated inflation in 2024-2025 could further dampen demand, affecting Ardagh's sales and profitability.

Supply chain disruptions, driven by geopolitical instability and trade policy shifts, pose a risk to the availability and cost of key inputs like aluminum and energy. Ongoing conflicts in early 2024 continued to drive up energy prices, a critical cost factor for Ardagh's energy-intensive operations.

SWOT Analysis Data Sources

This Ardagh Group SA SWOT analysis is built upon comprehensive data from their official financial reports, in-depth market intelligence, and insights from industry experts and verified news sources, ensuring a robust and accurate strategic overview.