Ardagh Group SA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardagh Group SA Bundle

Unlock the strategic potential of Ardagh Group SA with our comprehensive BCG Matrix analysis. Understand which of their diverse product lines are market leaders (Stars), which reliably generate cash (Cash Cows), which are underperforming (Dogs), and which hold future promise but require investment (Question Marks).

This preview offers a glimpse into Ardagh Group SA's strategic positioning, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to make informed decisions about resource allocation and future growth.

Don't miss out on the complete picture. Purchase the full BCG Matrix for Ardagh Group SA and gain a clear roadmap to optimizing your investment strategy and product portfolio for sustained success in the competitive packaging industry.

Stars

Ardagh Metal Packaging's European beverage can operations are a clear Star in the BCG Matrix. In 2024, this segment saw robust performance, fueled by industry volume increases and a rebound from earlier customer inventory adjustments. The market leadership here is undeniable, as beverage cans are increasingly favored by European customers for their packaging needs.

This segment's strength is further evidenced by Ardagh's ongoing capacity expansions, a direct response to sustained high demand. This strategic move reinforces their dominant market position within a growing European beverage can market.

North American non-alcoholic beverage cans represent a strong Star for Ardagh Group. This segment benefits from Ardagh Metal Packaging's focus on high-growth areas like sparkling water and soft drinks, which make up a substantial part of their offerings.

Despite economic headwinds, this sector is projected to see low single-digit shipment growth through 2025, demonstrating its resilience. For instance, the U.S. sparkling water market alone was valued at over $10 billion in 2023 and continues to expand.

Ardagh Group's dedication to sustainable, infinitely recyclable metal packaging is a significant advantage. The global metal cans market is expected to expand from $50.42 billion in 2024 to $70.72 billion by 2029, highlighting strong market demand for these eco-friendly solutions. This aligns perfectly with Ardagh's established market leadership in metal packaging, positioning its sustainable products as a Star in the BCG matrix – a high-growth, high-market-share category.

Overall Ardagh Metal Packaging (AMP) Performance

Ardagh Metal Packaging (AMP) demonstrated impressive financial results, achieving double-digit Adjusted EBITDA growth in 2024. This was driven by a solid 3% increase in global volumes. The positive trajectory continued into the first quarter of 2025, with shipments growing by over 6% and Adjusted EBITDA surging by 16%.

The company's strong performance has led to an upward revision of its full-year 2025 Adjusted EBITDA guidance and shipment growth forecasts. This reflects AMP's leading position in a growing market and its ability to capitalize on favorable industry trends.

- 2024 Performance: Double-digit Adjusted EBITDA growth and 3% global volume increase.

- Q1 2025 Acceleration: Over 6% global shipments growth and 16% Adjusted EBITDA increase.

- Revised Outlook: Raised full-year 2025 Adjusted EBITDA guidance and shipment growth forecasts.

- Market Position: Solidifies its Star position due to robust momentum and industry leadership.

Innovation-driven Product Development in Metal Packaging

Ardagh Metal Packaging (AMP) actively pursues innovation in metal packaging, exemplified by its collaboration with Britvic Soft Drinks. This partnership has led to sophisticated designs, such as the distinctive Tango Mango cans, which elevate the consumer experience and boost brand recognition.

This dedication to advancing product development and design is a key strategy for AMP to secure greater market share. It particularly targets expanding beverage segments, including the burgeoning markets for alcoholic beverages, ready-to-drink cocktails, and energy drinks.

- Innovation Focus: AMP's continuous investment in new designs and functionalities for metal packaging.

- Market Capture: Strategy to gain market share in high-growth beverage categories.

- Consumer Engagement: Enhancing product appeal through premium design, like the Tango Mango cans.

- Category Growth: Targeting expansion in alcohol innovation, cocktails, and energy drinks.

Ardagh Metal Packaging's European beverage can operations are a clear Star, showing robust performance in 2024 with industry volume increases. Their North American non-alcoholic beverage can segment also shines as a Star, benefiting from Ardagh's focus on high-growth areas like sparkling water, which saw its U.S. market valued over $10 billion in 2023.

AMP's overall performance in 2024 was strong, with double-digit Adjusted EBITDA growth and a 3% increase in global volumes. This momentum continued into Q1 2025, with shipments up over 6% and Adjusted EBITDA surging 16%, leading to upward revisions of 2025 guidance.

| Segment | 2024 Performance Indicators | Growth Drivers | Market Position |

|---|---|---|---|

| European Beverage Cans | Robust volume increases | Increased customer preference, capacity expansions | Market leadership in a growing segment |

| North American Non-Alcoholic Beverage Cans | Resilient low single-digit shipment growth projected through 2025 | Focus on sparkling water, soft drinks | Strong presence in expanding categories |

What is included in the product

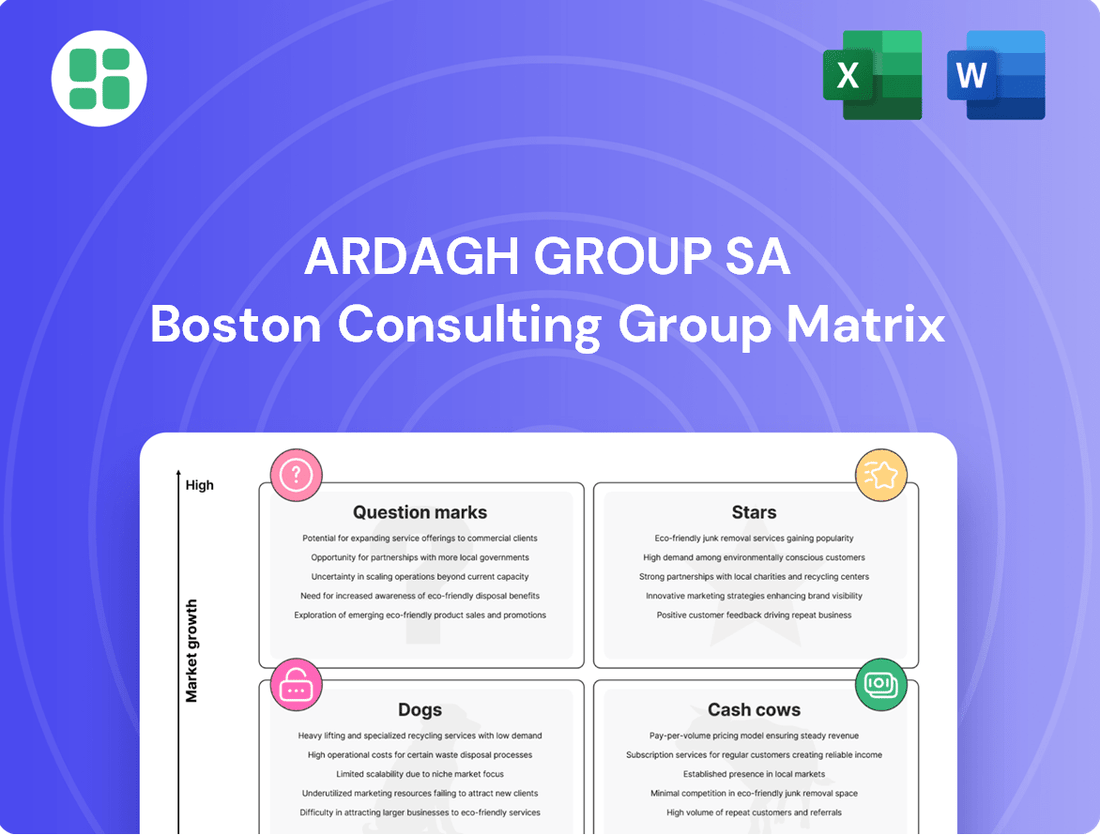

The Ardagh Group SA BCG Matrix provides a visual representation of its business units, categorizing them by market share and growth rate to guide strategic decisions.

A clear BCG Matrix visualizes Ardagh Group's portfolio, easing strategic decision-making and resource allocation.

Cash Cows

Ardagh Glass Packaging-Europe, a significant contributor to Ardagh Group SA, is classified as a Cash Cow. Despite facing some production adjustments in 2023 due to market headwinds, this segment demonstrated resilience. In 2024, its revenue saw a healthy increase of 6%, underscoring its established position and consistent performance.

This business operates within a mature and stable European market for glass packaging. While growth may be moderate, its substantial market share ensures a reliable and significant generation of cash flow for the Group, a hallmark of a Cash Cow.

Ardagh Group's core North American glass packaging for food and beverage is a strong Cash Cow. Despite some demand softness, this segment benefits from a mature market expected to grow to $19.657 billion by 2029.

As a dominant force in glass manufacturing, this division consistently generates substantial, dependable cash flow. Its robust infrastructure and deep ties with major food and beverage companies solidify its position.

Ardagh Group's involvement in traditional metal food and specialty packaging, notably through its significant stake in Trivium Packaging, positions this segment as a Cash Cow within its portfolio. This market, while mature, demonstrates remarkable stability, fueled by consistent consumer demand for essential food products and an increasing preference for sustainable packaging solutions.

In 2024, the global metal packaging market, encompassing food and beverage cans, continued its steady trajectory. For instance, the rigid metal packaging sector, a core area for Ardagh and Trivium, was projected to see continued demand, driven by factors like recyclability and durability. This stability translates into predictable and robust cash flow generation for Ardagh, despite lower growth potential compared to other market segments.

High-Volume, Standardized Packaging Production

Ardagh Group's high-volume, standardized packaging production, particularly for beverage cans and glass bottles, firmly places it in the Cash Cows quadrant of the BCG Matrix. This segment benefits from established, efficient production lines and significant economies of scale. In 2023, Ardagh operated 59-60 production facilities across 16 countries, a testament to its vast operational footprint.

The sheer volume of over 35 billion packaging units produced annually underscores the maturity and market dominance of these standardized offerings. These products, like common beverage containers, represent a high market share in a stable, albeit slow-growing, industry. This maturity translates into consistent revenue streams and strong profitability, making them reliable cash generators for the broader Ardagh Group.

- Operational Scale: 59-60 production facilities across 16 countries in 2023.

- Annual Output: Over 35 billion packaging units produced annually.

- Product Maturity: High market share in established, standardized packaging segments.

- Financial Contribution: Serves as a dependable cash generator due to efficient operations and consistent demand.

Global Beer and Carbonated Soft Drink (CSD) Packaging

Ardagh Group's global beer and carbonated soft drink (CSD) packaging operations function as a classic Cash Cow. Supplying industry titans like Coca-Cola and Anheuser-Busch InBev, Ardagh commands a significant share in these well-established, predictable markets.

The consistent, high-volume demand from these major clients translates into robust and reliable cash flow for Ardagh. While the overall market growth for packaging in these mature sectors may be modest, the sheer scale of operations and long-term contracts ensure substantial earnings. For instance, in 2024, the beverage packaging sector continued to see steady demand, driven by global consumption patterns.

- High Market Share: Ardagh holds a substantial position in the global beer and CSD packaging market.

- Stable Demand: Consistent orders from major beverage companies like Coca-Cola and AB InBev provide predictable revenue streams.

- Mature Market: While growth is moderate, the stability of the beer and CSD markets underpins strong cash generation.

- Predictable Cash Flow: The segment reliably generates significant cash, supporting other Ardagh business units.

Ardagh Group's North American beverage can operations represent a prime example of a Cash Cow. This segment benefits from a mature market with consistent demand, allowing Ardagh to leverage its extensive production capacity and established customer relationships.

The sheer volume of beverage cans produced annually, coupled with Ardagh's significant market share, ensures a steady and substantial generation of cash flow. In 2024, Ardagh's beverage packaging segment continued to be a bedrock of financial stability for the group.

This business unit operates with high efficiency due to its scale and focus on standardized products, contributing reliably to Ardagh's overall profitability. The predictable nature of beverage consumption supports the consistent performance of this segment.

| Segment | BCG Classification | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| North American Beverage Cans | Cash Cow | Mature market, high volume, established customers | Consistent, strong cash flow generation |

| European Glass Packaging | Cash Cow | Stable market, significant market share | 6% revenue increase in 2024 |

| Metal Food & Specialty Packaging (Trivium) | Cash Cow | Stable demand, growing sustainability focus | Continued steady demand in rigid metal packaging |

What You See Is What You Get

Ardagh Group SA BCG Matrix

The Ardagh Group SA BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no unexpected alterations – just the comprehensive strategic analysis ready for your immediate use. You can confidently download this report knowing it’s the complete, professionally designed tool you need for evaluating Ardagh Group's business units and making informed strategic decisions.

Dogs

Certain regional glass facilities within Ardagh Group SA have experienced production curtailments in 2023. This downturn is attributed to difficult market conditions and reduced demand, signaling potential underperformance. These specific assets may be consuming resources without yielding substantial returns.

Facilities operating with low capacity utilization and persistent weak demand contribute minimally to overall profitability. For instance, if a facility operates at only 50% capacity, its contribution to profits is significantly hampered, making it a drain on the group's resources.

Ardagh Group's legacy glass packaging products, particularly those serving declining beverage categories like certain traditional beer segments, likely fall into the 'Dog' quadrant of the BCG Matrix. These product lines, while perhaps historically significant, now face both low market share and low market growth due to shifting consumer preferences and increased competition from alternative packaging materials.

For instance, while the overall glass beverage market shows resilience, specific segments within traditional beer packaging may be experiencing sustained declines. Ardagh's focus on these niche areas, where demand is contracting, positions them as candidates for divestiture or a strategic decision to minimize further investment, thereby freeing up resources for more promising ventures.

Ardagh Group's older production lines, particularly those that haven't seen recent upgrades for efficiency or decarbonization, are likely to be classified as Dogs in the BCG matrix. These facilities often carry higher operating expenses and struggle with profitability compared to their more modern counterparts. For instance, if a plant relies on older machinery, its energy consumption per unit produced could be significantly higher than newer, more energy-efficient models.

These less competitive assets, especially when situated in markets with limited growth prospects, would naturally fall into the low market share and low growth quadrant. Ardagh Group, as a major player in the packaging industry, continually evaluates its asset base. In 2024, the company’s focus on sustainability and operational excellence means that facilities lagging in these areas represent a strategic challenge. For example, if a particular glass manufacturing plant in a mature European market is operating with outdated technology, it would likely exhibit lower output per hour and higher waste percentages.

Non-Strategic or Divested Business Units

Ardagh Group SA, like many diversified companies, may identify certain business units that no longer align with its core strategic objectives. These non-strategic or divested units, if they possess low market share and limited growth potential, would typically be categorized as Dogs within the BCG Matrix. Such units often require significant investment to maintain their position or are simply not generating sufficient returns to justify continued ownership.

Ardagh Group's ongoing capital structure discussions, which have included the possibility of divesting certain interests, underscore the potential for such units to be considered for disposal. For instance, if a specific packaging segment or regional operation within Ardagh demonstrates stagnant sales and a declining competitive position, it could be a prime candidate for divestment. In 2023, the global packaging market saw varied performance, with some segments experiencing slower growth, which could impact units with less robust market positions.

- Low Market Share: Units with a small percentage of their respective market.

- Minimal Growth Prospects: Segments unlikely to expand significantly in the near future.

- Strategic Review Candidates: Businesses considered for divestment due to lack of alignment with core strategy.

- Potential Divestment: Units that may be sold off to focus resources on more promising areas.

Low-Margin Glass Packaging for Commodity Products

Within Ardagh Group SA's portfolio, the low-margin glass packaging for commodity products likely falls into the Dogs category of the BCG matrix. These segments operate in markets characterized by intense price competition and limited product differentiation, leading to thin profit margins and sluggish growth prospects.

Ardagh's involvement in packaging for highly commoditized goods, such as basic food jars or beverage bottles where brand loyalty is minimal and cost is the primary driver, exemplifies this. In 2024, the global glass packaging market, while growing, saw significant pressure on margins for these types of products due to raw material cost fluctuations and competition from alternative packaging materials.

- Low Profitability: Segments focused on commodity glass packaging often struggle with profitability due to price sensitivity and high production costs.

- Limited Growth: These markets typically experience slow or stagnant growth, offering little opportunity for significant expansion.

- Intense Competition: The commoditized nature of these products leads to fierce competition, further eroding margins.

- Market Position: Ardagh's market share in these specific niche areas might not be dominant, contributing to their classification as Dogs.

Ardagh Group SA's "Dogs" likely represent legacy glass facilities and packaging for commoditized products with low market share and minimal growth. These segments, such as packaging for certain traditional beverage categories or basic food jars, face intense price competition and shifting consumer preferences. For example, in 2024, the global glass packaging market saw continued pressure on margins for these less differentiated products.

These underperforming assets may have low capacity utilization and higher operating expenses due to outdated technology, making them less competitive. Ardagh's strategic reviews and potential divestments of non-core interests further highlight these units as candidates for disposal to reallocate resources. The company’s focus on efficiency and sustainability in 2023 and 2024 means that older, less efficient plants are increasingly viewed as liabilities.

| Category | Characteristics | Ardagh Example |

|---|---|---|

| Low Market Share | Small percentage of market | Niche glass packaging for declining beverage segments |

| Low Market Growth | Limited expansion prospects | Packaging for highly commoditized food items |

| Low Profitability | Thin margins, high costs | Older glass production lines with higher energy consumption |

| Strategic Concern | Candidates for divestment | Facilities with outdated technology and low capacity utilization |

Question Marks

Ardagh Glass Packaging-Europe's NextGen Furnace is a prime example of a Star in the BCG matrix, showcasing significant innovation and high growth potential, particularly with its successful production of the world's first emerald green glass using this advanced technology. This pioneering effort positions Ardagh at the forefront of sustainable glass manufacturing, a rapidly expanding sector driven by increasing environmental consciousness and regulatory pressure. The technology promises substantial improvements in energy efficiency and reduced carbon emissions, key differentiators in today's market.

However, the NextGen Furnace is still in its early adoption and trial phases, meaning its current market share is nascent. Significant capital investment is required to scale this technology across more production lines, a common characteristic of Stars that need further investment to maintain their growth trajectory and eventually become Cash Cows. The long-term success hinges on overcoming these scaling challenges and proving the economic viability at a larger industrial scale.

Ardagh Group's successful industrial fuel switching trials using lower-carbon biofuel in glass packaging by May 2025 highlight their commitment to sustainable innovation. This segment represents a high-growth opportunity, driven by tightening environmental regulations and a growing consumer preference for eco-friendly products.

Despite its potential, this area currently holds a low market share. The adoption of these advanced technologies requires significant capital investment, which is a barrier to widespread implementation, positioning it as a nascent but promising venture within Ardagh's portfolio.

Ardagh Glass Packaging-Europe's introduction of 300g lightweight glass wine bottles showcases their commitment to innovation and sustainability. This move positions them to capture a growing segment of the beverage market focused on reduced environmental impact and improved logistics.

These ultra-lightweight bottles represent a Stars category in Ardagh's BCG Matrix. While the lightweighting trend is strong, the market penetration and widespread adoption of these specific new products are still in their early stages. This signifies high growth potential with a currently modest market share.

Advanced Recycling and Circular Economy Initiatives (beyond core)

Ardagh Group's commitment to advanced recycling and circular economy initiatives, such as aiming for zero waste to landfill by 2025 and investing in technologies like the partnership with CAP Glass, positions them in a rapidly expanding environmental market. These efforts, while forward-thinking, represent significant capital investments and are often in the nascent stages of commercial viability or broad market adoption.

These ventures, though crucial for long-term sustainability, currently demand substantial cash outflows without immediate, guaranteed high returns or established market leadership. This cash consumption, typical of early-stage, capital-intensive projects in emerging sectors, places them in a category requiring careful management within the BCG matrix.

- High Growth Potential: Ardagh's investments in advanced recycling align with the growing global demand for sustainable packaging solutions and the push towards a circular economy, a market projected to see significant expansion.

- Capital Intensity: Developing and implementing advanced recycling technologies requires substantial upfront investment, impacting Ardagh's cash flow in the short to medium term.

- Early Commercialization: Many of these technologies are still maturing, meaning their full commercial impact and profitability are yet to be realized, characteristic of 'question mark' or early-stage 'star' assets.

- Zero Waste to Landfill Goal: The 2025 target for zero waste to landfill underscores the strategic importance Ardagh places on these initiatives, driving innovation and resource efficiency.

Emerging Niche Beverage Can Markets (e.g., Craft Beverages, New Categories)

Ardagh Group's strength in traditional beverage cans is undeniable, but exploring niche markets like craft beverages presents a significant opportunity. These segments, though fragmented, are experiencing rapid growth. For instance, the U.S. craft beer market alone generated over $26 billion in sales in 2023, showcasing substantial demand.

Expanding into these evolving categories, such as hard seltzers or functional beverages, requires strategic investment. While Ardagh has a strong foundation, capturing significant share in these dynamic spaces means competing with nimble, specialized players. This could position these niche markets as potential question marks within Ardagh's BCG matrix, demanding careful evaluation of investment versus potential return.

- High Growth Potential: Niche beverage markets, like the expanding functional drink sector, are showing robust year-over-year growth, exceeding 15% in some segments.

- Fragmentation Challenges: The craft beverage landscape is highly fragmented, with thousands of small producers, making market penetration and share acquisition a complex endeavor.

- Investment Requirements: Building capacity and tailored solutions for diverse niche products could necessitate targeted capital expenditure, impacting Ardagh's financial allocation.

- Competitive Landscape: Agile, smaller competitors often have established relationships and greater flexibility in these emerging markets, posing a competitive hurdle for larger entities.

Ardagh's investments in advanced recycling and circular economy initiatives, while crucial for long-term sustainability and aiming for zero waste to landfill by 2025, represent significant capital outlays in nascent technologies. These ventures require substantial cash without immediate, guaranteed high returns or established market leadership, characteristic of question marks needing careful strategic evaluation.

Exploring niche beverage markets, such as the rapidly growing craft beverage sector where the U.S. market generated over $26 billion in sales in 2023, also presents question marks. While these segments offer high growth potential, their fragmented nature and the need for tailored investments to compete with agile players require a cautious approach to market share acquisition.

The development of new, specialized packaging solutions for these emerging beverage categories demands targeted capital expenditure. Ardagh must carefully assess the investment required against the potential return in these dynamic, competitive landscapes to effectively capture market share.

BCG Matrix Data Sources

Our BCG Matrix leverages Ardagh Group's financial disclosures, industry growth forecasts, and market share data to accurately position each business unit.