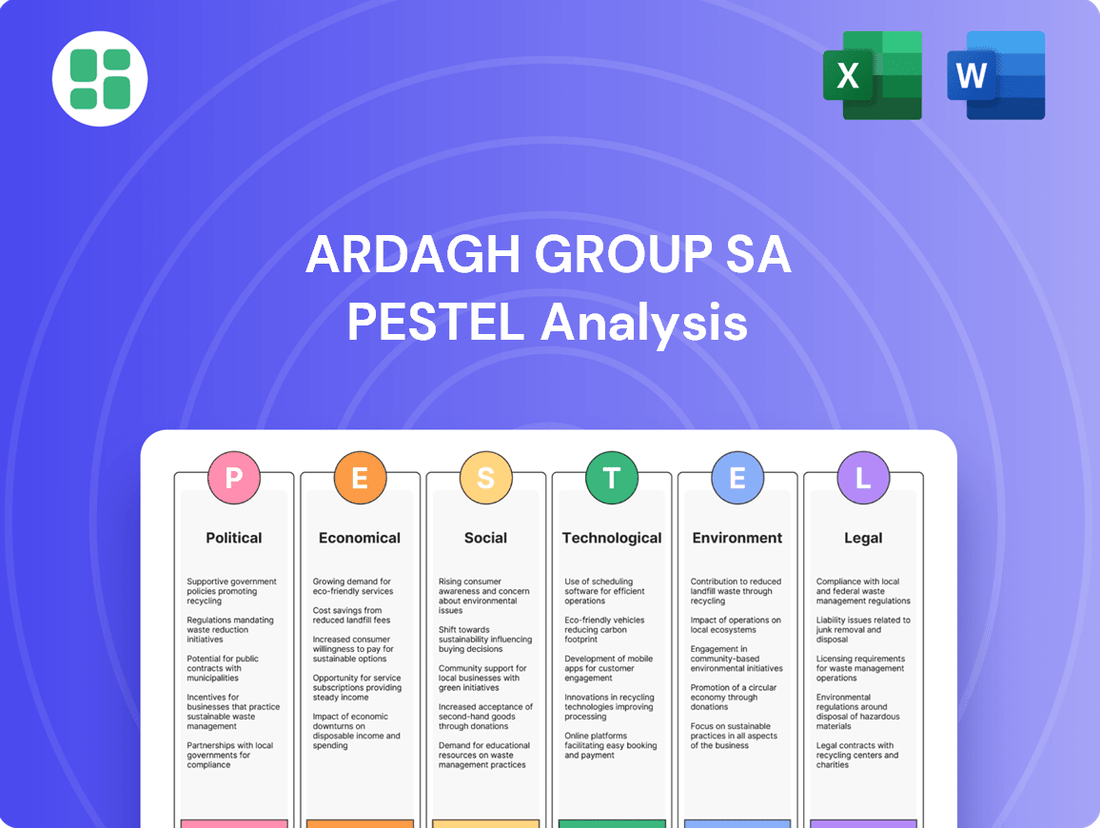

Ardagh Group SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardagh Group SA Bundle

Unlock the strategic advantages Ardagh Group SA holds by understanding the intricate web of political, economic, social, technological, legal, and environmental forces at play. Our PESTLE analysis dives deep into these external factors, revealing critical opportunities and potential threats that shape the company's trajectory. Don't be left behind; gain the foresight needed to navigate this dynamic landscape.

Ready to make informed decisions about Ardagh Group SA? Our comprehensive PESTLE analysis provides the expert insights you need, covering everything from evolving consumer behavior to shifting regulatory frameworks. Equip yourself with actionable intelligence to sharpen your strategy and secure your competitive edge. Download the full report now!

Political factors

Governments worldwide are intensifying their focus on packaging waste, with Europe leading the charge. The EU Packaging and Packaging Waste Regulation (PPWR), effective February 2025, is a prime example, pushing for increased recyclability and the adoption of reusable packaging solutions. This regulatory shift directly influences how companies like Ardagh Group design their products and manage their operations.

The PPWR sets ambitious goals, including making all packaging recyclable by 2030 and adhering to Design for Recyclability (DfR) standards. These mandates are designed to significantly curb the environmental footprint of packaging throughout its entire lifecycle, compelling manufacturers to innovate and adapt their material choices and production processes.

Extended Producer Responsibility (EPR) schemes are increasingly shaping the landscape for packaging manufacturers like Ardagh Group. These regulations are shifting the financial and logistical burden of managing packaging waste after consumers are done with it directly onto the producers themselves. This means companies like Ardagh are becoming more accountable for the entire lifecycle of their products.

The European Union, for example, is at the forefront of EPR evolution. Their legislation strongly encourages packaging designs that are lightweight, circular, and easily recyclable. This regulatory push directly influences Ardagh's strategic decisions, prompting significant investments in advanced recycling technologies and the development of more sustainable packaging materials. By proactively adapting, Ardagh aims to minimize its financial liabilities under these evolving EPR frameworks and stay ahead of global environmental compliance trends.

Changes in international trade policies, like the U.S. tariff on aluminum imports set at 25% from March 2025, directly affect Ardagh Group's operational costs. This tariff can increase the price of essential raw materials, potentially impacting supply chain stability and profitability.

While Ardagh's leadership anticipates a minimal effect on the final price of a beverage can, such trade measures necessitate strategic adjustments. Manufacturers are compelled to seek cost-optimization strategies and investigate alternative sourcing options to mitigate these financial pressures.

Political Stability in Operating Regions

Ardagh Group's extensive global presence, with 59-62 production facilities spanning 16 countries across Europe, North America, and South America, makes political stability in these operating regions paramount. Any instability can directly impact its ability to maintain consistent production and ensure reliable supply chains.

Geopolitical tensions or shifts in political landscapes can create significant operational hurdles. These can range from disruptions in manufacturing processes to challenges in logistics and a potential dampening of market demand, directly affecting Ardagh's profitability and the security of its worldwide operations.

- Ardagh's global footprint: 59-62 production facilities in 16 countries.

- Key operating regions: Europe, North America, and South America.

- Impact of instability: Disruptions to manufacturing, logistics, and market demand.

Government Support for Green Initiatives

Government incentives and support for green technologies present a significant opportunity for Ardagh Group. For instance, by 2025, the European Union aims for a 42.5% share of renewable energy in its gross final energy consumption, a target that encourages investments in energy-efficient processes and renewable energy sources for manufacturers like Ardagh. This support can accelerate the adoption of cleaner production methods, potentially lowering operational costs through reduced energy expenditure, and bolstering Ardagh's competitive edge in the growing sustainable packaging market.

These governmental pushes translate into tangible benefits:

- Incentives for Renewable Energy Adoption: Tax credits and grants for installing solar or wind power at manufacturing sites.

- Support for Circular Economy Models: Funding for research and development into advanced recycling technologies for glass and metal packaging.

- Regulatory Frameworks Favoring Sustainability: Policies that may mandate higher recycled content, directly benefiting Ardagh's core business.

- Potential for Lower Operational Costs: Reduced energy bills and waste disposal fees due to efficiency improvements and sustainable practices.

Governments globally are increasing scrutiny on packaging waste, with the EU's Packaging and Packaging Waste Regulation (PPWR), starting February 2025, mandating increased recyclability and reusable solutions. This directly impacts Ardagh's product design and operational strategies, pushing for all packaging to be recyclable by 2030.

Extended Producer Responsibility (EPR) schemes are making producers financially accountable for packaging waste management, influencing Ardagh to invest in advanced recycling technologies and sustainable materials to meet evolving global compliance trends and minimize liabilities.

Trade policies, such as the 25% U.S. tariff on aluminum imports from March 2025, increase raw material costs for Ardagh, necessitating cost-optimization and alternative sourcing strategies to maintain supply chain stability and profitability.

Political stability across Ardagh's 16 operating countries is crucial; geopolitical tensions can disrupt manufacturing, logistics, and market demand, directly affecting its global operations and profitability.

What is included in the product

This PESTLE analysis meticulously examines the Ardagh Group SA's operating environment, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and strategic advantages.

It provides actionable insights for stakeholders to navigate the complex external landscape and inform robust business strategies.

A concise PESTLE analysis of Ardagh Group SA that highlights key external factors impacting the packaging industry, simplifying strategic discussions and risk assessment.

Economic factors

Global economic growth is a key driver for Ardagh Group, as it directly impacts consumer spending on packaged goods. When economies are strong, people tend to spend more on items like beverages and food, which in turn increases demand for Ardagh's metal and glass packaging. This relationship is crucial for forecasting sales and production volumes.

Despite a generally challenging consumer spending environment, Ardagh Metal Packaging is projecting positive volume growth for 2025. This optimism is largely supported by resilient trends in beverage consumption, especially within non-alcoholic categories and energy drinks. These segments are particularly important for Ardagh, as they represent a significant portion of their business.

Ardagh Group's profitability is directly tied to the volatile costs of key inputs such as aluminum and energy. For instance, aluminum prices saw significant fluctuations in 2024, with the London Metal Exchange (LME) cash price averaging around $2,400 per tonne in the first half of the year, a notable increase from 2023 averages. Similarly, natural gas prices, a major energy component for glass production, remained a concern, although they stabilized somewhat in early 2025 compared to the spikes seen in 2022.

While Ardagh has a strong ability to pass on these increased raw material and energy costs to its customers through its pricing mechanisms, effectively managing these fluctuations is paramount. The company's focus on operational efficiencies, such as optimizing furnace performance and investing in renewable energy sources where feasible, is crucial for mitigating the impact on its profit margins. Strategic sourcing agreements also play a vital role in securing stable supply and predictable pricing for essential materials.

Inflationary pressures, particularly in Europe, present a significant challenge for Ardagh Group SA. Rising costs for raw materials, energy, and labor directly impact operating expenses. For instance, the Eurozone inflation rate averaged 5.3% in 2023, a figure that remained elevated in early 2024, impacting input costs for glass and metal packaging production.

Simultaneously, increasing interest rates, a global trend driven by central banks to curb inflation, raise Ardagh's debt servicing costs. As a capital-intensive business with substantial debt, higher borrowing costs can squeeze profit margins. The European Central Bank's policy rate, for example, moved from 0.5% in mid-2022 to 4.5% by late 2023, increasing the financial burden on the company.

Ardagh aims to mitigate these economic headwinds by focusing on operational improvements. The company's 2025 outlook highlights strategies such as increasing shipment volumes, optimizing capacity utilization across its facilities, and implementing further operational efficiencies to absorb rising costs and maintain profitability.

Currency Exchange Rate Fluctuations

Ardagh Group SA, as a global entity with operations spanning numerous continents, is inherently exposed to the volatility of currency exchange rates. These fluctuations directly influence how its revenues and adjusted EBITDA are reported. For instance, a strengthening of the US Dollar against the Euro could boost Ardagh's reported earnings when translated back into Euros, assuming a significant portion of its revenue is generated in dollars.

Conversely, unfavorable currency movements can present considerable headwinds. If the Euro weakens significantly against currencies where Ardagh has substantial costs or debt, its reported profitability could be negatively impacted. This dynamic is crucial for investors and analysts to monitor, as it can mask underlying operational performance.

For the first half of 2024, Ardagh reported a reported revenue of $5.1 billion, with reported Adjusted EBITDA at $1.0 billion. The company's financial statements often include disclosures on the impact of foreign currency translation, highlighting how currency shifts affect these key metrics. Understanding these impacts is vital for a true assessment of Ardagh's financial health and operational momentum.

- Revenue Translation: Favorable currency movements, such as a stronger USD against EUR for Ardagh, can inflate reported revenues when converted to the reporting currency.

- EBITDA Impact: Similarly, positive currency shifts can boost reported Adjusted EBITDA, making operational performance appear stronger than it might be on a constant currency basis.

- Cost of Goods Sold: Unfavorable currency shifts can increase the cost of imported raw materials or components, squeezing profit margins.

- Debt Servicing: If Ardagh holds debt denominated in a currency that strengthens against its operating currencies, the cost of servicing that debt increases.

Market Demand for Sustainable Packaging

The escalating global demand for sustainable packaging, especially glass and aluminum, represents a substantial economic advantage for Ardagh Group. Consumers are increasingly favoring eco-friendly materials, directly boosting the market for infinitely recyclable options.

The market for glass and aluminum containers is anticipated to experience strong growth between 2025 and 2034. This expansion is fueled by a combination of consumer preferences for environmentally sound choices and the implementation of more stringent environmental regulations worldwide.

- Market Growth Projection: The global glass and aluminum packaging market is expected to see significant expansion from 2025 through 2034.

- Key Drivers: Consumer preference for sustainable and recyclable materials is a primary economic driver.

- Regulatory Influence: Stricter environmental regulations are further incentivizing the adoption of eco-friendly packaging solutions.

- Ardagh's Position: These trends position Ardagh Group favorably to capitalize on the growing demand for its core products.

Ardagh Group's financial performance is significantly shaped by global economic conditions, particularly consumer spending and input costs. While the company anticipates positive volume growth in 2025, driven by resilient beverage consumption, it faces challenges from volatile aluminum and energy prices. For instance, aluminum prices averaged around $2,400 per tonne in early 2024.

Inflationary pressures and rising interest rates also impact Ardagh. Eurozone inflation remained elevated in early 2024, increasing operating expenses, while higher central bank rates, like the ECB's move to 4.5% by late 2023, increase debt servicing costs.

Currency exchange rate fluctuations are another key economic factor, affecting reported revenues and EBITDA. For the first half of 2024, Ardagh reported revenue of $5.1 billion and Adjusted EBITDA of $1.0 billion, with currency impacts needing careful monitoring.

The growing global demand for sustainable packaging, especially glass and aluminum, presents a significant economic opportunity for Ardagh, with the market projected for strong growth between 2025 and 2034, driven by consumer preference and environmental regulations.

Preview Before You Purchase

Ardagh Group SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ardagh Group SA delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of Ardagh Group SA's PESTLE landscape. This analysis is designed to provide actionable insights for stakeholders navigating the complexities of the global packaging industry.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion of global consumers willing to pay more for products with eco-friendly packaging. This trend is directly boosting demand for Ardagh Group's glass and metal packaging solutions, which are perceived as more environmentally responsible than many alternatives.

Data from 2024 indicates that over 60% of consumers globally consider sustainability when making purchasing decisions, with packaging being a key factor. Brands are responding by shifting towards infinitely recyclable materials like aluminum and glass to meet these evolving consumer expectations and improve their brand image.

Consumer lifestyles are shifting, with a notable increase in e-commerce adoption. This trend directly impacts Ardagh Group by necessitating packaging solutions that are not only robust for online shipping but also designed for ease of use and delivery. For instance, the convenience factor in packaging is paramount for busy consumers, pushing demand for ready-to-drink beverages and single-serve formats.

The growing preference for convenient and sustainable packaging, especially aluminum cans, is a significant driver. In 2024, the global aluminum can market is projected to reach over $60 billion, with millennials increasingly favoring these options for their portability and recyclability. This aligns with Ardagh's strategic focus on innovative metal packaging solutions.

Public scrutiny over product safety, particularly concerning materials like bisphenol A (BPA) in food can linings, is a significant driver for Ardagh Group. This pressure prompts continuous innovation in material science and manufacturing to meet evolving consumer expectations and regulatory demands. For instance, the ongoing shift away from BPA in many food contact applications reflects this trend.

Ardagh's strategic emphasis on infinitely recyclable materials, such as glass and metal, directly addresses many health and safety concerns often linked to alternative packaging solutions. Their commitment to sustainability in materials inherently mitigates risks associated with chemical leaching or degradation, aligning with public health priorities and contributing to a safer consumer environment.

Labor Force Trends and Skills Availability

Ardagh Group's operational efficiency and cost structure are significantly influenced by labor force trends and the availability of skilled workers across the 16 countries where it operates. As of 2024, the global manufacturing sector faces ongoing challenges in securing specialized talent, particularly in areas like advanced manufacturing and engineering, which are critical for Ardagh's production processes.

The company, which employs over 20,000 individuals worldwide, actively addresses these trends through strategic investments in its workforce and local communities. This includes a focus on STEM education initiatives designed to cultivate a pipeline of future talent, ensuring a competent and adaptable labor pool for its operations.

- Global Workforce: Ardagh Group employs more than 20,000 people globally, highlighting the scale of its human capital needs.

- Operational Reach: The company's presence in 16 countries means it must navigate diverse labor markets and regulations.

- Skills Gap: Persistent skills gaps in manufacturing and technical fields can affect production output and increase labor costs.

- Investment in Talent: Ardagh's commitment to STEM education aims to mitigate future labor shortages and enhance workforce competency.

Corporate Social Responsibility (CSR) Expectations

Societal demands for businesses to act responsibly and ethically are growing, impacting how Ardagh Group sources materials and interacts with communities. These expectations shape Ardagh's operational decisions, pushing for greater transparency and accountability across its value chain.

Ardagh's sustainability strategy is built on three key pillars: Emissions, Ecology, and Social. This framework guides their efforts to reduce environmental impact, cultivate a diverse workforce, and contribute positively to the communities where they operate. For instance, Ardagh reported a reduction in Scope 1 and 2 greenhouse gas emissions by 12.5% between 2022 and 2023, demonstrating progress towards their climate goals.

- Emissions Reduction: Ardagh aims to cut its carbon footprint, with a target of a 40% reduction in Scope 1 and 2 emissions by 2030 compared to a 2020 baseline.

- Ecology Focus: The company is committed to circular economy principles, increasing the use of recycled content in its packaging products. In 2023, their glass products contained an average of 78% recycled content.

- Social Impact: Ardagh emphasizes diversity and inclusion, with a goal to increase female representation in leadership roles to 30% by 2025. They also engage in community development programs, supporting local initiatives and environmental conservation projects.

Societal expectations for corporate responsibility are intensifying, influencing Ardagh Group's material sourcing and community engagement strategies. These evolving demands push for greater transparency and accountability throughout their operations.

Ardagh's sustainability framework, focusing on Emissions, Ecology, and Social impact, guides their commitment to reducing environmental footprints and fostering positive community relations. For example, Ardagh reported a 12.5% decrease in Scope 1 and 2 greenhouse gas emissions between 2022 and 2023.

The company's commitment to using recycled content is substantial, with glass products averaging 78% recycled material in 2023, underscoring a dedication to circular economy principles.

Ardagh is actively working towards increasing female representation in leadership to 30% by 2025, reflecting a focus on diversity and inclusion within its global workforce of over 20,000 employees.

Technological factors

Ardagh Group is heavily invested in R&D, pushing boundaries in packaging materials and design. Their focus on lightweighting and down-gauging metal and glass aims to cut down on material use and boost energy efficiency.

This commitment translates into tangible benefits, such as reducing the carbon footprint of packaging. For instance, in 2023, Ardagh reported significant progress in its sustainability initiatives, including a 3% reduction in CO2 emissions intensity compared to 2022, partly driven by these material innovations.

Beyond efficiency, Ardagh is exploring novel shapes and textures to offer brands enhanced aesthetic appeal and new product application possibilities, making packaging a more dynamic element for brand differentiation.

Ardagh Group's manufacturing operations are increasingly leveraging automation and Industry 4.0, a trend that significantly impacts efficiency and cost. For instance, advanced robotics and AI-driven process optimization are key to streamlining production lines. This technological shift is vital for maintaining a competitive edge in the global packaging market.

The integration of Industry 4.0 allows for real-time data analysis, enabling predictive maintenance and minimizing downtime across Ardagh's extensive network. This enhanced operational visibility is crucial for improving product quality and consistency. By 2024, the global manufacturing automation market was valued at over $60 billion, highlighting the widespread adoption of these technologies.

Ardagh Group's commitment to sustainability hinges on advancements in recycling. Innovations in sorting and processing technologies are crucial for maximizing the recovery of metal and glass, directly supporting the circular economy model for their packaging. This focus is essential for meeting their ambitious goals, such as achieving 100% aluminum can recycling in Europe by 2030.

The company's strategic investments in state-of-the-art recycling facilities are a testament to this. By enhancing infrastructure, Ardagh aims to significantly increase the efficiency and capacity of recycling operations, thereby bolstering the availability of recycled materials for their production processes and aligning with evolving environmental regulations.

Digitalization of Supply Chains and Operations

Ardagh Group is actively embracing digitalization to streamline its supply chain and operations. Initiatives like 'Smart Trucks' are being rolled out to enhance logistics, offering better tracking and real-time data for route optimization. This focus on digital transformation aims to improve efficiency and transparency across Ardagh's global manufacturing and distribution network.

The implementation of digital packaging management systems is another key technological factor. These systems allow for more precise inventory control and better visibility into the lifecycle of packaging materials. By leveraging these digital tools, Ardagh can achieve significant operational improvements, reducing waste and enhancing responsiveness to market demands.

- Smart Truck Deployment: Ardagh's investment in 'Smart Trucks' is designed to improve fleet management and delivery efficiency, contributing to lower operational costs and faster transit times.

- Digital Packaging Management: The adoption of digital systems for packaging offers enhanced tracking and reporting, providing valuable data for optimizing inventory and production schedules.

- Efficiency Gains: These digital advancements are projected to yield measurable improvements in Ardagh's overall supply chain performance, supporting its competitive positioning.

Energy Efficiency Technologies in Production

Ardagh Group SA is actively integrating energy efficiency technologies into its production processes. This strategic focus aims to lower its environmental impact and improve cost-effectiveness. For instance, the company is conducting trials with industrial fuel switching, utilizing lower-carbon biofuels to power its operations.

Further demonstrating its commitment, Ardagh is investing in on-site renewable energy generation. This includes the installation of solar-powered facilities at its production sites, directly contributing to a reduced reliance on traditional energy sources. These initiatives are crucial for meeting sustainability targets and managing energy expenditures in a volatile market.

In addition to on-site generation, Ardagh is securing renewable electricity through virtual Power Purchase Agreements (vPPAs). These agreements are vital for guaranteeing a consistent supply of clean energy for its global manufacturing facilities. By 2024, Ardagh aims to source a significant portion of its electricity from renewable sources, aligning with broader industry trends and regulatory pressures.

- Fuel Switching Trials: Ardagh is testing the use of biofuels to reduce carbon emissions in its industrial processes.

- On-site Solar Power: The company is installing solar facilities at its production plants to generate clean energy.

- Virtual Power Purchase Agreements (vPPAs): Ardagh is entering into vPPAs to secure renewable electricity for its operations.

- Renewable Electricity Targets: By 2024, Ardagh is working towards sourcing a substantial amount of its electricity from renewable sources.

Ardagh Group's technological advancements focus on material innovation and process efficiency. Their R&D efforts in lightweighting and down-gauging metal and glass packaging directly contribute to reduced material usage and enhanced energy efficiency, with a 3% CO2 emissions intensity reduction reported in 2023. The company is also embracing Industry 4.0, integrating automation and AI to optimize production lines, leading to improved operational visibility and reduced downtime.

Investments in recycling technologies are paramount for Ardagh's circular economy goals, aiming to maximize material recovery and ensure a steady supply of recycled content. Digitalization is key to streamlining operations, with initiatives like 'Smart Trucks' enhancing logistics and digital packaging management systems improving inventory control and lifecycle tracking. These technological integrations are vital for maintaining competitiveness and meeting sustainability targets.

Ardagh is also prioritizing energy efficiency and renewable energy adoption. Trials with industrial fuel switching to lower-carbon biofuels and investments in on-site solar power generation are underway. Furthermore, the company is utilizing virtual Power Purchase Agreements (vPPAs) to secure renewable electricity, with a target to source a significant portion of its electricity from renewables by 2024.

Legal factors

The new EU Packaging and Packaging Waste Regulation (PPWR), set to fully apply from August 2026, introduces significant changes for companies like Ardagh Group SA. This regulation mandates stricter rules for packaging design, recyclability, and reuse across all EU member states.

Ardagh must ensure its packaging meets specific minimum recycled content percentages for plastic elements. However, Ardagh's core materials, metal and glass, offer a distinct advantage as they are infinitely recyclable, aligning well with the PPWR's sustainability goals.

Extended Producer Responsibility (EPR) laws are increasingly shaping the landscape for packaging manufacturers like Ardagh Group SA. These regulations place the onus on producers for the entire lifecycle of their packaging, from collection and sorting to recycling. This means Ardagh must actively invest in and partner with recycling infrastructure to ensure compliance and manage the financial implications of waste management.

As of early 2024, many European countries have strengthened their EPR schemes, with some introducing higher recycling targets and fees. For instance, Germany's Green Dot system, a prominent EPR scheme, saw adjustments in licensing fees for packaging producers in 2024 based on recyclability. Ardagh's proactive engagement in these systems is crucial for cost optimization and maintaining a competitive edge in a market where sustainability is a growing consumer and regulatory demand.

Ardagh Group, as a major player in the global packaging industry, faces significant scrutiny under antitrust and competition laws across its operating regions. These regulations are designed to prevent anti-competitive practices and ensure a level playing field for all market participants. Failure to comply can lead to substantial fines and restrictions on business operations.

In 2024, regulatory bodies worldwide continue to focus on market concentration in key sectors, including packaging. For instance, mergers and acquisitions within the industry are closely examined to ensure they do not create dominant market positions that could stifle innovation or harm consumers. Ardagh's ongoing strategic initiatives, including potential acquisitions or divestitures, must therefore be carefully structured to satisfy these legal requirements.

Labor Laws and Employment Regulations

Ardagh Group, with its substantial workforce of over 19,000 employees spread across 16 countries, navigates a complex web of labor laws and employment regulations. These regulations cover critical areas such as minimum wage requirements, working hour limits, health and safety standards, and the rights of employees to unionize and engage in collective bargaining. Staying compliant is paramount for Ardagh to maintain smooth operations and avoid costly legal battles or disruptions stemming from labor disputes.

The company's global footprint means it must adapt its HR practices to comply with varying national and regional employment frameworks. For instance, in 2024, companies operating in the European Union face ongoing scrutiny regarding fair wages and working conditions under directives that aim to harmonize labor standards. Ardagh's proactive approach to managing these diverse legal obligations is crucial for its reputation and operational stability.

- Global Workforce Management: Ardagh employs approximately 19,000-20,000 individuals across 16 countries, necessitating adherence to a wide array of labor laws.

- Compliance Focus: Key areas of compliance include working conditions, wage regulations, and union relations, all vital for operational continuity.

- Risk Mitigation: Adherence to labor laws helps Ardagh avoid legal risks, fines, and potential operational disruptions caused by labor disputes.

- International Standards: The company must balance local labor laws with international best practices and evolving global employment standards.

Product Safety and Liability Laws

Ardagh Group operates under stringent product safety and liability laws, particularly crucial given its extensive involvement in packaging for food, beverage, and consumer care industries. These regulations mandate that all packaging materials must be safe, non-toxic, and consistently meet high-quality standards to prevent harm to consumers. For instance, in 2024, the European Food Safety Authority (EFSA) continued to emphasize the importance of migration testing for food contact materials, a key area for Ardagh.

To comply, Ardagh implements rigorous quality control measures throughout its manufacturing processes. Adherence to internationally recognized certifications, such as FSSC 22000 for food safety management systems, is essential. This certification, which Ardagh actively pursues across its facilities, demonstrates a commitment to producing safe packaging solutions that meet global benchmarks.

Failure to meet these legal requirements can result in significant penalties, including product recalls, fines, and damage to brand reputation. Ardagh's proactive approach to safety and quality, evidenced by its certifications and robust internal processes, is therefore a critical factor in mitigating these legal risks and maintaining customer trust in its packaging products.

The Ardagh Group navigates a complex legal environment, with evolving regulations like the EU Packaging and Packaging Waste Regulation (PPWR) impacting its operations. These laws, including Extended Producer Responsibility (EPR) schemes, require significant investment in recycling infrastructure and compliance with recycled content mandates, particularly for plastic elements, though Ardagh's metal and glass offerings are inherently recyclable.

Antitrust and competition laws are also critical, as regulatory bodies closely scrutinize market concentration and mergers. Ardagh must ensure its strategic initiatives, such as acquisitions, comply with these regulations to avoid penalties and maintain market access.

Furthermore, Ardagh's global workforce of approximately 19,000-20,000 employees necessitates strict adherence to diverse labor laws, covering everything from wages to working conditions, to prevent disputes and ensure operational stability.

Product safety and liability laws are paramount, especially for food and beverage packaging, requiring rigorous quality control and adherence to standards like FSSC 22000, as emphasized by bodies like the European Food Safety Authority (EFSA) in 2024.

Environmental factors

Ardagh Group is making significant strides in addressing climate change, aligning with global efforts to curb emissions. The company has committed to ambitious Science Based Targets initiative (SBTi) goals, aiming for a 42% reduction in absolute Scope 1 and 2 greenhouse gas (GHG) emissions by 2030. This commitment underscores their proactive approach to environmental stewardship and regulatory compliance.

To achieve these targets, Ardagh is channeling investments into key sustainability initiatives. These include expanding the use of renewable electricity sources across its operations, implementing comprehensive energy efficiency projects to minimize consumption, and actively exploring the adoption of lower-carbon biofuels. These strategic investments are crucial for navigating the increasingly stringent climate change regulations worldwide and demonstrating a tangible commitment to a greener future.

Ardagh Group is increasingly focused on resource scarcity, driving a commitment to sustainable sourcing for its raw materials. This includes maximizing the use of recycled content in its metal and glass packaging.

Metal and glass are infinitely recyclable, a key advantage for Ardagh in achieving resource efficiency and supporting circular economy principles. In 2023, Ardagh reported that its glass operations utilized an average of 60% recycled content globally, with some facilities exceeding 80%.

Ardagh Group is actively pursuing ambitious waste management goals, with a significant achievement of 75% of its facilities reaching zero waste to landfill (ZWTL) status in 2023. This commitment is further underscored by a target to extend this to 100% of Ardagh Metal Packaging facilities by 2025, demonstrating a clear drive towards operational sustainability.

The company's strategic approach heavily favors circular economy principles, focusing on boosting recycling rates across its operations. This is complemented by a strong emphasis on collaborative efforts throughout the entire value chain, aiming to create a more closed-loop system for its products.

Water Usage and Pollution Control

Ardagh Group recognizes water stewardship as a critical environmental focus. For Ardagh Glass Packaging, a significant target is to achieve a 26% reduction in water usage intensity by the year 2030. This commitment drives the implementation of various initiatives aimed at minimizing water consumption and effectively controlling pollution throughout its global manufacturing operations.

The company's approach involves:

- Water Conservation Technologies: Implementing advanced technologies to reduce water intake and reuse water within production processes.

- Wastewater Treatment: Employing robust wastewater treatment systems to ensure discharged water meets or exceeds regulatory standards, preventing pollution of local water bodies.

- Monitoring and Reporting: Continuously monitoring water usage and discharge quality to track progress against environmental targets and ensure compliance.

Biodiversity Protection and Land Use Impact

Ardagh Group, as a significant global manufacturer, must consider how its operations and supply chains affect local ecosystems. This includes evaluating the impact of its facilities on biodiversity and the land they occupy. Minimizing ecological disruption is a key aspect of responsible land use for such an enterprise.

While specific Ardagh Group initiatives aren't detailed here, companies of this scale often implement strategies to mitigate their environmental footprint. This can involve careful site selection to avoid sensitive habitats and adopting construction practices that reduce land disturbance. For instance, Ardagh's 2023 sustainability report highlighted efforts to reduce land use intensity in its glass manufacturing processes.

Furthermore, engaging in land restoration or conservation efforts in areas where Ardagh operates can be a crucial component of its environmental stewardship. This might involve supporting local biodiversity projects or rehabilitating land post-operation. The company's commitment to the UN Sustainable Development Goals, particularly SDG 15 (Life on Land), suggests an awareness of these responsibilities.

- Minimizing Habitat Disruption: Ardagh's operational planning likely includes assessments to avoid or reduce impacts on critical habitats and endangered species.

- Sustainable Sourcing: Ensuring raw materials are sourced from suppliers who also adhere to responsible land use and biodiversity protection practices is vital.

- Land Rehabilitation: Where feasible, Ardagh may engage in restoring land affected by its operations, aiming to improve ecological value.

- Regulatory Compliance: Adherence to local and international regulations regarding land use and biodiversity protection is a fundamental requirement for global operations.

Ardagh Group is actively pursuing ambitious climate goals, targeting a 42% reduction in Scope 1 and 2 GHG emissions by 2030 through increased renewable energy use and efficiency projects. The company emphasizes circular economy principles, with its glass operations utilizing an average of 60% recycled content globally in 2023, and 75% of its facilities achieving zero waste to landfill status that same year.

Water stewardship is a key focus, with a target of a 26% reduction in water usage intensity by 2030, supported by conservation technologies and robust wastewater treatment. Ardagh also considers its impact on local ecosystems, aiming to minimize habitat disruption and engage in sustainable land use practices, aligning with UN SDG 15.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ardagh Group SA is informed by a comprehensive review of official government publications, international financial institutions, and reputable industry-specific research. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the company.