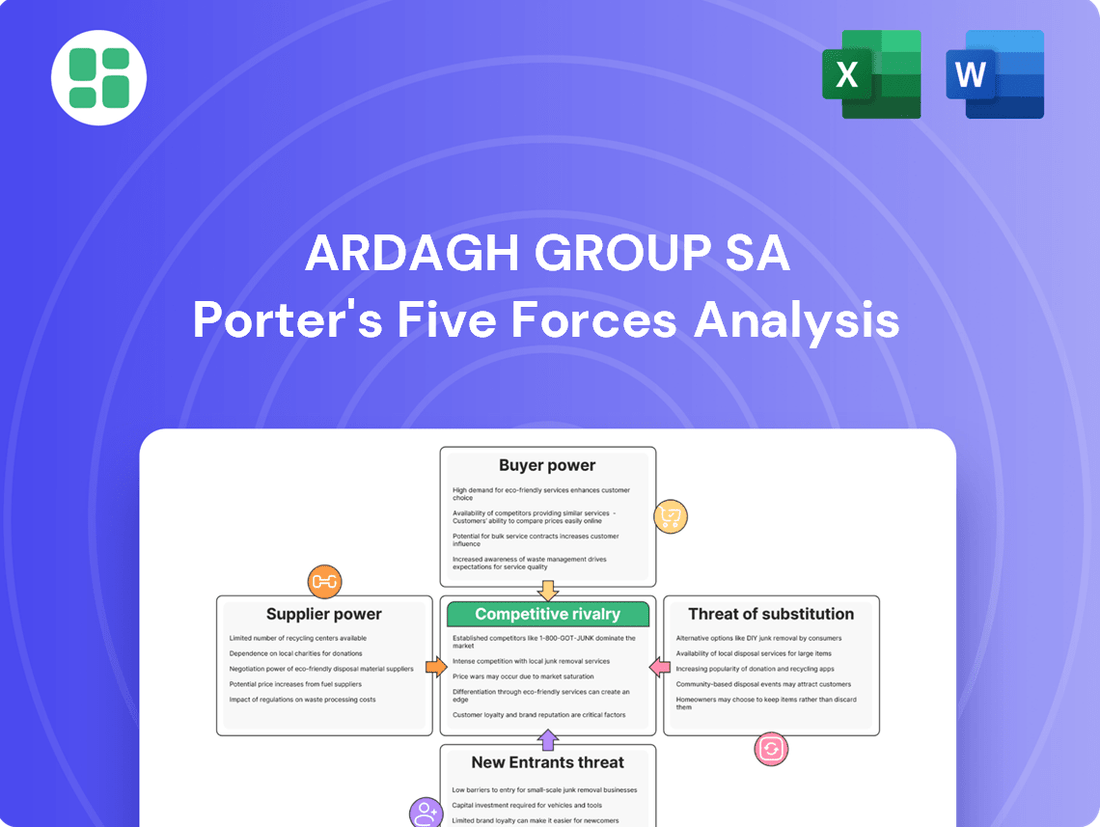

Ardagh Group SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardagh Group SA Bundle

Ardagh Group SA operates in a dynamic packaging industry shaped by moderate buyer power and significant capital requirements for new entrants. Understanding the intensity of rivalry and the availability of substitutes is crucial for strategic planning.

The complete report reveals the real forces shaping Ardagh Group SA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ardagh Group SA's reliance on essential raw materials such as aluminum, steel, and glass cullet, alongside substantial energy requirements, positions it to face significant supplier bargaining power. When suppliers of these critical inputs are few in number or provide highly specialized components, their ability to dictate terms and prices escalates, directly impacting Ardagh's operational costs.

The metal packaging sector, a core area for Ardagh, highlights the strategic importance of materials like aluminum. In 2025, aluminum held a commanding 42.7% market share within this segment, underscoring its prevalence and the potential leverage held by its suppliers.

The cost and complexity for Ardagh Group SA to switch suppliers for its primary inputs, such as metal sheets for cans or glass batch materials, can be quite significant. These substantial switching costs, which can encompass re-tooling manufacturing equipment, obtaining new supplier certifications, and re-aligning intricate supply chains, empower existing suppliers. This leverage allows them to negotiate more favorable pricing and contract terms, a reality amplified by the highly capital-intensive nature of Ardagh's packaging manufacturing operations.

The threat of suppliers integrating forward into packaging manufacturing, thereby becoming direct competitors to Ardagh Group, is generally considered low. This is primarily due to the high capital investment and specialized expertise required to operate in the metal and glass packaging sectors. For instance, establishing a new glass packaging facility can cost hundreds of millions of dollars, creating a significant barrier.

However, this threat isn't entirely absent. Certain suppliers of specialized components or even raw material producers might find it feasible to enter packaging production if the barriers to entry diminish. For example, if a new, more efficient production technology emerges that lowers the initial capital outlay for packaging manufacturing, it could empower some raw material suppliers to consider forward integration.

Impact of Raw Material Price Volatility

Fluctuations in the prices of key raw materials like aluminum, steel, and glass directly affect Ardagh Group SA's cost of goods sold. These costs are a significant factor in their profitability.

In 2024, Ardagh likely experienced continued upward pressure on raw material expenses. This was driven by persistent inflation, ongoing supply chain challenges, and a growing demand for materials used in more sustainable packaging solutions.

The situation was further complicated by trade policies. For instance, the U.S. reinstated a 25% tariff on aluminum imports in March 2025, which would inevitably increase production costs for Ardagh's metal packaging segment.

- Raw Material Cost Impact: Rising aluminum, steel, and glass prices directly increase Ardagh's production expenses.

- 2024 Trends: Inflation, supply chain issues, and demand for sustainable materials were expected to keep raw material costs elevated.

- Trade Policy Effect: The March 2025 U.S. tariff on aluminum imports adds a significant cost burden to metal packaging production.

Availability of Alternative Inputs

The availability of alternative inputs significantly shapes supplier power for Ardagh Group. While Ardagh relies heavily on primary materials like metal and glass, the landscape of sourcing is evolving. Innovations in sustainable steel production are emerging, offering potential shifts in raw material reliance.

The energy intensity of Ardagh's glass manufacturing is a critical factor. Without widespread adoption of renewable energy sources, the dependence on traditional energy suppliers remains high, potentially increasing their leverage.

- Material Innovation: Research into lighter weight and eco-friendly coatings for metal packaging is ongoing, potentially diversifying material needs.

- Energy Dependence: The high energy consumption in glass production means Ardagh's reliance on energy suppliers is a key consideration.

- Sustainability Drive: As sustainability becomes paramount, the development of alternative, greener production methods could alter input availability and supplier dynamics.

Ardagh Group SA faces considerable bargaining power from its suppliers due to its reliance on key raw materials like aluminum, steel, and glass cullet, alongside significant energy needs. The limited number of specialized suppliers for these critical inputs allows them to influence pricing and contract terms, directly impacting Ardagh's operational costs. In 2024, Ardagh likely saw continued raw material cost increases driven by inflation and supply chain issues, exacerbated by trade policies such as the U.S. aluminum tariff reinstated in March 2025.

| Input Material | 2024 Cost Trend | Supplier Leverage Factor | Impact on Ardagh |

|---|---|---|---|

| Aluminum | Upward pressure due to inflation and tariffs | High (concentrated suppliers, high switching costs) | Increased production costs for metal packaging |

| Steel | Upward pressure due to inflation and supply chain issues | Moderate to High (depending on specialty steel needs) | Increased production costs for metal packaging |

| Glass Cullet | Stable to Moderate increase | Moderate (availability can fluctuate) | Impacts glass production costs |

| Energy | Volatile, generally upward trend | High (reliance on traditional sources) | Significant cost factor for glass manufacturing |

What is included in the product

This analysis unpacks the competitive forces impacting Ardagh Group SA, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its global packaging operations.

Quickly assess Ardagh Group's competitive landscape with a visual breakdown of each force, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

Ardagh Group's customer base includes many top global brands in beverages, food, and personal care. This concentration of major clients means these customers hold significant sway. Their substantial purchasing volumes allow them to negotiate for better prices and terms, directly impacting Ardagh's profitability.

For instance, a large beverage company buying millions of containers annually can leverage its volume to demand customized packaging solutions and preferential pricing. Ardagh's strategy of building direct sales relationships and long-term contracts with these key accounts is a direct response to this customer power, aiming to secure stable demand and mitigate price pressures.

Customer switching costs play a significant role in Ardagh Group's bargaining power. While Ardagh strives to be the preferred packaging partner, clients face expenses if they decide to change suppliers. These costs can include redesigning packaging, the complex process of re-qualifying new suppliers, and potential disruptions to their logistics and supply chains.

These switching costs act as a barrier, effectively reducing the bargaining power of Ardagh's customers. For instance, a beverage company that has invested heavily in custom-molded bottles from Ardagh would incur substantial costs to switch to a different manufacturer, including new tooling and extensive product testing.

Ardagh actively works to mitigate customer power by fostering strong, long-term relationships and offering highly tailored packaging solutions. This focus on customization and partnership makes it more difficult and costly for customers to consider alternative suppliers, thereby strengthening Ardagh's position.

Customers in the beverage and food sectors, especially those selling high-volume consumer products, are frequently very sensitive to price. This is because these markets are highly competitive and often operate with thin profit margins. This price sensitivity puts pressure on Ardagh Group to keep its pricing competitive, even when its own costs for raw materials or energy increase.

For instance, Ardagh Group's ability to pass on increased input costs to its customers was a key driver for its revenue growth in the metal packaging segment during the first quarter of 2025. This highlights how customer price sensitivity directly impacts Ardagh's financial performance.

Threat of Backward Integration by Customers

The threat of customers integrating backward into packaging production is a key consideration for Ardagh Group. While large beverage and food companies possess the scale to consider such a move, the significant capital investment, specialized technical knowledge, and established economies of scale in metal and glass packaging manufacturing present substantial hurdles. For instance, setting up a modern glass bottle manufacturing facility can cost hundreds of millions of dollars, a prohibitive expense for many potential entrants.

This high barrier to entry effectively limits the bargaining power of Ardagh's customers. They would need to overcome:

- Significant capital expenditure: Building new plants requires massive upfront investment.

- Specialized manufacturing expertise: Operating advanced packaging machinery demands skilled labor and know-how.

- Achieving economies of scale: Competing on cost requires high-volume production, which Ardagh has already optimized.

In 2024, the global packaging market, valued at over $1 trillion, continues to be dominated by established players like Ardagh due to these inherent complexities, further solidifying Ardagh's position and mitigating the threat of backward integration by its customer base.

Availability of Substitute Packaging for Customers

Customers have a growing array of packaging options beyond traditional metal and glass, including plastics, cartons, and flexible materials. This broad availability directly impacts Ardagh Group's bargaining power by offering consumers alternatives.

The rising consumer preference for sustainable packaging solutions is a significant driver in these choices. Many consumers perceive glass and aluminum as more environmentally friendly, which can bolster demand for Ardagh's products. However, the landscape is evolving with innovations like bio-based plastics and the development of robust reusable packaging systems. These emerging alternatives are poised to further enhance customer leverage by providing more choices that align with sustainability goals.

- Increased Material Choice: Customers can select from glass, metal, plastic, carton, and flexible packaging.

- Sustainability as a Driver: Consumer demand for eco-friendly options influences packaging material selection.

- Emerging Alternatives: Bio-based plastics and reusable systems are gaining traction, offering new choices.

- Impact on Leverage: These alternatives can shift power towards customers, potentially impacting Ardagh's pricing and terms.

Ardagh Group's customers, particularly large beverage and food brands, wield considerable bargaining power due to their significant purchase volumes and price sensitivity. This power is somewhat tempered by the substantial switching costs associated with changing packaging suppliers and the high capital investment required for backward integration into packaging production.

The availability of diverse packaging materials, including plastics and cartons, alongside growing consumer demand for sustainable options, further enhances customer leverage. Ardagh counters this by focusing on tailored solutions and long-term relationships to mitigate price pressures.

| Factor | Ardagh Group Impact | Customer Bargaining Power |

|---|---|---|

| Customer Concentration & Volume | High reliance on key accounts | Strong |

| Switching Costs | High for custom packaging | Moderate |

| Threat of Backward Integration | High capital and expertise barriers | Low to Moderate |

| Availability of Substitutes | Growing material diversity | Moderate to High |

Full Version Awaits

Ardagh Group SA Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Ardagh Group SA Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the packaging industry.

Rivalry Among Competitors

The metal and glass packaging sector is home to several substantial global entities, creating a landscape of significant competitive rivalry for Ardagh Group SA. Key players such as Crown Holdings, Ball Corporation, and O-I Glass operate on a similar scale, boasting considerable resources and market presence.

This concentration of large competitors means Ardagh Group faces a highly competitive environment. For instance, in 2023, Crown Holdings reported revenues of approximately $13.1 billion, while Ball Corporation's revenue for the same period was around $12.3 billion, underscoring the financial muscle of its main rivals and the intensity of the market.

The global metal packaging market is expected to see a compound annual growth rate (CAGR) of 3.7% between 2025 and 2030. Similarly, the container glass market is projected to grow at a CAGR of 4.6% from 2025 to 2029. While these figures indicate a growing market, the moderate growth rates mean companies must actively compete for existing business rather than simply capitalizing on overall market expansion.

Ardagh Group SA actively pursues product differentiation and innovation, particularly focusing on sustainability in its packaging solutions. This strategy aims to set its offerings apart in a competitive market. For instance, Ardagh has been investing in smart packaging technologies, incorporating elements like QR codes, NFC chips, and augmented reality (AR) capabilities to enhance consumer engagement and product traceability. They are also a leader in lightweighting glass and metal packaging and developing eco-friendly coatings, which are crucial differentiators.

However, this drive for innovation is mirrored by Ardagh's competitors, who are also heavily investing in similar advancements. This creates a dynamic environment where continuous innovation is not just a strategy but a necessity to maintain market position. For example, in 2023, the global smart packaging market was valued at approximately $30 billion and is projected to grow significantly, indicating a strong industry-wide focus on these differentiating technologies. This ongoing pursuit of novel solutions by rivals intensifies the pressure on Ardagh to consistently develop and implement cutting-edge packaging that offers tangible benefits to customers and end-consumers.

Exit Barriers

The metal and glass packaging industry, where Ardagh Group operates, presents substantial exit barriers. These are primarily driven by the immense capital investment required for manufacturing facilities, specialized machinery, and long-term supply agreements. For instance, a modern glass container plant can cost hundreds of millions of dollars to build and equip.

These high fixed costs strongly discourage companies from exiting the market, even when facing economic headwinds. Consequently, players tend to remain and compete, which can perpetuate intense rivalry. This situation often leads to a market structure dominated by a few large, established companies.

- High Capital Investment: Building and equipping new manufacturing plants for metal and glass packaging involves hundreds of millions of dollars in upfront costs.

- Specialized Equipment: The machinery used is highly specific to packaging production, making it difficult to repurpose or sell at a significant loss.

- Long-Term Contracts: Many packaging companies operate under long-term supply agreements with major beverage and food producers, creating a commitment that hinders quick exits.

- Industry Consolidation: The significant exit barriers contribute to a consolidated market, with companies like Ardagh Group being major players.

Competitive Strategies and Sustainability Focus

Competitive rivalry in the packaging sector is intensifying as players like Ardagh Group SA focus on expanding their product offerings, adopting sustainable production methods, and forming strategic alliances. This push for differentiation is driven by evolving market demands.

Ardagh's commitment to its sustainability roadmap, which includes ambitious targets for emissions reduction and increased use of renewable electricity, is a key element in navigating this competitive landscape. For instance, Ardagh aims to reduce its absolute Scope 1 and 2 GHG emissions by 42% by 2030 compared to a 2021 baseline.

- Product Portfolio Expansion Competitors are broadening their product ranges to capture wider market segments.

- Sustainable Production Methods A significant trend involves investing in eco-friendly manufacturing processes and materials.

- Strategic Partnerships Collaborations are being formed to enhance market reach and technological capabilities.

- Ardagh's Sustainability Roadmap Targets include a 42% reduction in absolute Scope 1 and 2 GHG emissions by 2030 (vs. 2021 baseline) and sourcing 50% of electricity from renewable sources by 2030.

The competitive rivalry for Ardagh Group SA is intense due to a concentrated market with large, well-resourced global players like Crown Holdings and Ball Corporation. These competitors, with revenues in the billions as of 2023, engage in a constant race for market share, driven by moderate industry growth rates. Ardagh's efforts in product differentiation, such as smart packaging and lightweighting, are met with similar innovations from rivals, making continuous R&D a necessity to maintain its standing.

The market's high exit barriers, stemming from substantial capital investments in manufacturing and long-term contracts, discourage companies from leaving, thus sustaining fierce competition. This environment compels Ardagh and its peers to focus on expanding offerings, adopting sustainable practices, and forging strategic alliances to gain an edge.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

| Crown Holdings | $13.1 billion | Product innovation, sustainability |

| Ball Corporation | $12.3 billion | Sustainable packaging solutions, global expansion |

| O-I Glass | (Specific 2023 data not readily available, but a major player) | Glass packaging innovation, lightweighting |

SSubstitutes Threaten

The primary substitutes for Ardagh Group's metal and glass packaging are plastic, carton, and flexible packaging solutions. These alternatives are gaining traction due to evolving consumer preferences and sustainability initiatives. For instance, the global bioplastics market was valued at approximately $11.5 billion in 2023 and is projected to grow significantly, presenting a direct challenge to traditional materials.

Substitutes such as plastic and flexible packaging can present a significant threat to Ardagh Group's metal and glass packaging business. These alternatives often boast lower production costs or offer distinct functional advantages, like being lightweight or easily resealable, which can appeal to certain consumer segments and product types.

The rising costs of raw materials essential for metal and glass packaging, such as aluminum and sand, can further amplify the attractiveness of these substitutes. If the price-performance ratio of plastic and flexible packaging becomes more favorable due to these cost pressures, it could lead to a greater shift in market demand away from traditional packaging formats.

Customer willingness to switch away from Ardagh Group's products, primarily glass and metal packaging, is influenced by a growing demand for sustainable alternatives. Consumers are increasingly prioritizing eco-friendly materials, prompting businesses to explore options beyond traditional packaging.

While glass and aluminum boast high recyclability rates, customer adoption of substitutes hinges on several factors. Brand perception plays a significant role; consumers may be hesitant to switch if a new material is perceived as less premium or reliable. Supply chain adjustments are also critical, as companies need assurance of consistent availability and cost-effectiveness for any new packaging solutions.

The availability of suitable substitute technologies directly impacts switching behavior. Innovations in biodegradable plastics or advanced paper-based packaging could offer viable alternatives, especially if they can match the performance and aesthetic qualities of glass and metal. For instance, the global bioplastics market is projected to reach over $70 billion by 2027, indicating a strong trend towards alternative materials.

Innovation in Substitute Materials

The packaging industry is experiencing a surge of innovation, with new materials like edible packaging, water-soluble films, and mono-material solutions gaining traction. These developments are making substitutes increasingly attractive and viable alternatives to traditional packaging. For instance, advancements in flexible and bio-based materials are offering enhanced recyclability and sustainability, directly challenging existing market norms.

These emerging materials pose a significant threat to Ardagh Group SA by offering competitive advantages in terms of environmental impact and potentially cost. The increasing adoption of these innovative substitutes could lead to a shift in consumer preference and regulatory pressure, impacting demand for Ardagh's current product offerings.

- Edible Packaging: Innovations in edible films and coatings offer a unique selling proposition, reducing waste and appealing to eco-conscious consumers.

- Water-Soluble Films: These films dissolve in water, eliminating disposal issues and presenting a novel solution for single-use packaging applications.

- Mono-Material Solutions: The push for mono-material packaging, designed for easier recycling, directly competes with multi-material packaging solutions that may be more complex to process.

- Bio-Based Materials: The development of packaging derived from renewable resources, such as plant starches or algae, offers a sustainable alternative with a lower carbon footprint.

Environmental Concerns and Regulatory Push

Growing environmental awareness is a significant factor pushing for substitutes. Stricter regulations, like those mandating waste reduction and higher recycled content in packaging, are influencing material choices. For instance, policies promoting the circular economy, while often favoring materials like metal and glass, also encourage shifts away from single-use plastics towards reusable packaging systems.

These regulatory trends directly impact the packaging industry. By 2024, many regions have seen increased enforcement of Extended Producer Responsibility (EPR) schemes, which place the onus on producers for the end-of-life management of their products. This can make alternative, more easily recyclable or reusable packaging solutions more attractive.

- Regulatory Push: Policies aiming to reduce plastic waste and increase recycled content are becoming more prevalent globally.

- Circular Economy Focus: Emphasis on circularity favors materials with established recycling infrastructure and promotes reusable packaging models.

- Consumer Demand: A growing segment of consumers actively seeks products with environmentally friendly packaging, influencing brand choices.

The threat of substitutes for Ardagh Group's metal and glass packaging is substantial, driven by innovations in plastics, cartons, and flexible packaging. These alternatives often present advantages in terms of cost, weight, or specific functionalities, appealing to a broad range of consumer and product needs. For example, the global market for flexible packaging, a key substitute, was projected to reach over $300 billion by 2024, highlighting its significant market presence and growth potential.

Customer willingness to switch is increasingly influenced by sustainability concerns and evolving regulatory landscapes. While glass and aluminum are highly recyclable, the perceived environmental benefits and convenience of newer materials, coupled with growing demand for eco-friendly options, are pushing brands to explore alternatives. This shift is further amplified by the rising costs of raw materials for traditional packaging, making substitutes more economically attractive.

Emerging substitute technologies, such as advanced bioplastics and mono-material solutions designed for easier recycling, directly challenge Ardagh's core offerings. The global bioplastics market, for instance, was expected to exceed $70 billion by 2027, indicating a strong trend towards alternative materials that offer a lower environmental footprint and potentially competitive performance metrics.

| Substitute Category | Key Advantages | Market Trend/Data (2024 Projections) | Impact on Ardagh |

|---|---|---|---|

| Plastic Packaging | Lightweight, versatile, often lower cost | Global plastic packaging market projected to grow, with increased focus on recycled content. | Direct competition, especially for beverage and food containers. |

| Carton Packaging | Good barrier properties, renewable materials | Growing demand for paper-based packaging solutions, driven by sustainability. | Alternative for dry goods, aseptic packaging. |

| Flexible Packaging | Lightweight, cost-effective, high barrier properties | Significant market growth, projected over $300 billion by 2024. | Strong competitor across various product categories, offering convenience. |

| Bio-based & Edible Packaging | Enhanced sustainability, waste reduction | Rapid innovation and increasing consumer interest in novel eco-friendly options. | Emerging threat, potentially disrupting traditional markets if performance and cost become competitive. |

Entrants Threaten

The metal and glass packaging sector demands substantial capital investment, with new entrants needing significant funds for manufacturing plants, sophisticated machinery, and cutting-edge technology. For instance, establishing a new glass bottling facility can easily cost hundreds of millions of dollars. This high barrier effectively deters smaller companies or those without access to considerable financial resources from entering the market.

New entrants face substantial hurdles due to evolving regulatory compliance and sustainability standards. For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) aims for increased recycled content and reduced packaging waste, requiring significant upfront investment in compliant technologies and processes for any new player in the packaging industry.

Established players like Ardagh Group SA benefit from deeply entrenched distribution channels and robust, long-standing relationships with major global brands. For instance, Ardagh's significant presence across Europe and North America means they have established supply chains and preferred supplier status with many key customers in the food and beverage sectors.

New entrants would find it incredibly difficult and costly to replicate these extensive networks and secure similar contracts. Ardagh's strategy of direct sales and forging strategic partnerships further solidifies their position, making it a formidable barrier for newcomers seeking to gain market access and compete for significant business.

Proprietary Technology and Expertise

Ardagh Group benefits significantly from its deep-seated proprietary technology and accumulated expertise, making it challenging for new entrants. Years of innovation in areas like glass and metal packaging manufacturing processes have built substantial operational know-how. For instance, Ardagh's investment in advanced furnace technology and specialized coating applications represents a significant hurdle for newcomers seeking to match their efficiency and product quality.

The threat of new entrants is somewhat mitigated by the high capital investment required for cutting-edge packaging technology. Ardagh Group's continuous investment in research and development, including proprietary material science and automation, creates a competitive moat. In 2024, the packaging industry saw continued emphasis on sustainable materials and advanced manufacturing techniques, areas where established players like Ardagh have a significant head start.

- Proprietary Technologies: Ardagh possesses patented processes in areas such as lightweighting glass bottles and developing advanced barrier coatings for metal cans, which are difficult and costly to replicate.

- Accumulated Expertise: Decades of operational experience have allowed Ardagh to optimize production, reduce waste, and ensure consistent quality, a learning curve that new entrants must overcome.

- Continuous Innovation: Ongoing R&D in areas like smart packaging and enhanced recyclability requires substantial and sustained investment, creating a barrier to entry for companies lacking significant financial backing and technical depth.

- Intellectual Property: The company holds numerous patents related to packaging design and manufacturing, protecting its market position and requiring potential entrants to navigate complex licensing or develop entirely novel solutions.

Brand Loyalty and Customer Expectations

Major brand owners, like Coca-Cola or Nestlé, typically prioritize packaging partners with a solid history of delivering exceptional quality and reliability. Ardagh Group's stated ambition to be the preferred packaging partner for the world's leading brands underscores the critical role of trust, consistent service, and superior product standards in this industry. Newcomers face a significant hurdle in replicating the established relationships and meeting the stringent quality demands that major clients expect, which are built over years of proven performance.

Building brand loyalty and meeting high customer expectations presents a considerable barrier for potential new entrants into the packaging sector. Established players like Ardagh Group have cultivated deep relationships with major consumer goods companies, often based on a long history of dependable supply and consistent product quality. For instance, in 2023, Ardagh Group reported revenues of approximately €11.5 billion, demonstrating its scale and the trust placed in it by its extensive customer base. New entrants would need substantial investment and time to achieve a similar level of credibility and operational excellence to attract and retain these demanding clients.

- Established Relationships: Major brand owners often have long-standing partnerships with existing packaging suppliers, built on trust and consistent performance.

- Quality and Reliability Demands: Leading brands require packaging that meets stringent quality, safety, and aesthetic standards, a benchmark difficult for new entrants to immediately achieve.

- Scale and Capacity: Ardagh Group's significant production capacity and global reach are crucial for serving large-volume clients, a capability that new, smaller entrants would struggle to match.

- Brand Reputation: Ardagh's reputation as a reliable supplier is a significant asset, making it challenging for new companies to gain traction with risk-averse major brand owners.

The threat of new entrants for Ardagh Group is generally moderate, primarily due to the significant capital requirements and established customer relationships. The sheer cost of building new, state-of-the-art manufacturing facilities, coupled with the need for advanced technology and regulatory compliance, acts as a substantial deterrent. For example, setting up a modern glass manufacturing plant can easily run into hundreds of millions of dollars, a prohibitive cost for many potential competitors.

Furthermore, Ardagh benefits from deeply entrenched distribution networks and long-standing partnerships with major global brands. Replicating these extensive supply chains and securing similar high-volume contracts requires considerable time, investment, and proven reliability. Newcomers face a steep climb to gain the trust and meet the stringent quality demands of industry giants.

Ardagh's proprietary technologies and accumulated operational expertise also present a significant barrier. Decades of innovation in areas like lightweighting and advanced coatings create a competitive advantage that is difficult and costly for new players to match. In 2024, the ongoing drive for sustainability and advanced manufacturing techniques further favors established players like Ardagh who have already invested heavily in these areas.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of establishing manufacturing facilities and acquiring advanced technology. | Significant deterrent due to substantial financial outlay. |

| Distribution Channels & Relationships | Established networks and long-term contracts with major brands. | Difficult and time-consuming for new entrants to replicate. |

| Proprietary Technology & Expertise | Patented processes and accumulated operational know-how. | Creates a competitive moat, requiring significant R&D investment for new players. |

| Brand Reputation & Reliability | Proven track record of quality and consistent supply. | Challenging for new entrants to build trust with risk-averse major clients. |

Porter's Five Forces Analysis Data Sources

Our Ardagh Group SA Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Ardagh's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.