Archer Aviation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archer Aviation Bundle

Archer Aviation is poised to revolutionize urban air mobility, boasting significant strengths in its innovative eVTOL design and strategic partnerships. However, understanding the full scope of its potential challenges and opportunities requires a deeper dive.

Want the full story behind Archer's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Archer Aviation benefits from being an early entrant in the burgeoning electric vertical takeoff and landing (eVTOL) aircraft sector, positioning itself to be among the first to launch commercial air taxi services. This pioneering status allows them to influence industry standards and secure a substantial market share as the sector matures.

The company's strategic focus on urban air mobility and establishing an air taxi network has cultivated a distinct brand identity within this nascent industry. As of Q1 2024, Archer reported significant progress in its flight testing program, demonstrating key capabilities essential for commercial operations.

Archer Aviation's strategic partnerships are a significant strength, evidenced by United Airlines' substantial order for 200 Midnight aircraft. This, along with agreements with international entities like Abu Dhabi Aviation, Ethiopian Airlines, Japan Airlines, and Sumitomo, underscores broad market acceptance and trust in Archer's eVTOL technology.

The company's impressive indicative order book, exceeding $6 billion, directly reflects strong commercial demand. This robust backlog not only validates Archer's innovative approach but also provides a crucial foundation for future revenue and operational scaling, positioning it favorably in the burgeoning urban air mobility market.

Archer Aviation has achieved significant milestones in regulatory approvals, securing Part 135 Air Carrier, Part 145 Repair Station, and Part 141 Pilot Training Academy certifications. These advancements are critical for establishing the operational framework necessary for commercial eVTOL services.

The finalization of airworthiness criteria for its Midnight aircraft by the FAA represents a major step towards Type Certification. This clears a significant hurdle, paving the way for the company to move closer to launching its planned air taxi services in 2025.

Robust Funding and Financial Backing

Archer Aviation boasts a robust financial foundation, holding over $1.4 billion in cash and committed capital as of its latest reports. This significant liquidity is bolstered by a recent $850 million funding round, demonstrating strong investor confidence.

This substantial financial backing, notably supported by major automotive manufacturer Stellantis, is crucial for Archer. It allows the company to confidently fund its capital-intensive operations, from advanced aircraft development and manufacturing scale-up to the eventual commercial rollout of its electric vertical takeoff and landing (eVTOL) aircraft.

- Over $1.4 billion in cash and committed capital.

- Recent $850 million funding round secured.

- Stellantis among key strategic investors.

- Adequate capital for development and manufacturing.

Diversification into Defense Applications

Archer Aviation's strategic move into defense applications is a significant strength, opening up new avenues for revenue and technological application. This diversification leverages their electric vertical takeoff and landing (eVTOL) expertise beyond the nascent air taxi market.

Securing contracts with the U.S. Air Force, such as their participation in the Agility Prime program, demonstrates clear validation and potential for substantial government funding. Partnerships, like the one with Anduril Industries for hybrid VTOL development, further solidify this defense sector engagement.

This dual focus offers potential for faster market entry in some defense segments due to different regulatory environments compared to commercial aviation. It also provides Archer with valuable real-world operational data and feedback, enhancing their overall technology development.

- Defense Contracts: Archer has secured contracts with the U.S. Air Force, indicating strong government interest and potential for significant order volumes.

- Strategic Partnerships: Collaborations with defense technology firms like Anduril Industries are crucial for adapting eVTOL technology to military requirements.

- Dual Revenue Streams: Diversification into defense applications provides an additional revenue stream, reducing reliance solely on the commercial air taxi market.

- Accelerated Development: The defense sector's unique regulatory pathways may allow for quicker testing and deployment of certain eVTOL capabilities.

Archer Aviation's strengths are anchored in its early market positioning and robust strategic partnerships. The company's substantial order book, exceeding $6 billion as of early 2024, showcases significant commercial interest in its Midnight aircraft. Key partnerships with major airlines like United Airlines, which has ordered 200 aircraft, and international entities such as Japan Airlines and Ethiopian Airlines, validate Archer's technology and market potential.

The company has made considerable progress on regulatory fronts, obtaining crucial certifications like Part 135 Air Carrier and Part 145 Repair Station, essential for operational launch. Furthermore, the FAA's finalization of airworthiness criteria for the Midnight aircraft in early 2024 is a critical step towards Type Certification, expected to enable commercial services in 2025.

Archer also benefits from substantial financial backing, with over $1.4 billion in cash and committed capital as of its latest reports, augmented by an $850 million funding round. This strong liquidity, supported by investors like Stellantis, provides the necessary capital for advanced development and manufacturing scale-up.

| Metric | Value | As Of |

|---|---|---|

| Indicative Order Book | Over $6 billion | Early 2024 |

| United Airlines Order | 200 Midnight aircraft | Confirmed |

| Cash & Committed Capital | Over $1.4 billion | Latest Reports (Q1 2024) |

| Recent Funding Round | $850 million | Secured |

| Key Certifications Secured | Part 135, Part 145, Part 141 | Achieved |

What is included in the product

Analyzes Archer Aviation’s competitive position through key internal and external factors, detailing its technological strengths and market opportunities against potential regulatory and manufacturing challenges.

Identifies critical market opportunities and competitive threats, enabling proactive risk mitigation for Archer Aviation's eVTOL development.

Weaknesses

Archer Aviation, as a pre-revenue company in the capital-intensive aerospace sector, faces a significant weakness in its high cash burn rate and the current lack of substantial revenue generation. This means the company is spending a lot of money to develop its technology and infrastructure without a corresponding income stream to offset these costs.

The financial projections indicate a substantial negative free cash flow, with expectations of losing over half a billion dollars annually through 2027. This necessitates continuous reliance on equity financing to sustain operations and development efforts.

This ongoing need for external funding, primarily through equity, poses a risk of shareholder dilution. As more shares are issued to raise capital, the ownership stake of existing shareholders is reduced, potentially impacting the value of their holdings.

Archer's ambitious growth trajectory, particularly its plans for manufacturing and air taxi operations, necessitates substantial capital. The company has historically relied on significant funding rounds, with notable investments like the $215 million raised in August 2023, to fuel its development.

This ongoing requirement for external capital, while essential for progress, presents a clear weakness. Each new funding round, especially if equity-based, carries the inherent risk of diluting the ownership stake of existing shareholders, potentially impacting their long-term returns.

Archer Aviation faces intense regulatory hurdles, particularly concerning the final FAA Type Certification for its Midnight aircraft. This process is inherently complex and time-consuming, with any unforeseen delays in this critical phase posing a significant risk to Archer's projected commercial launch timelines. Such delays could also introduce considerable volatility for investors awaiting the operationalization of their eVTOL services.

Limited Patent Portfolio Compared to Peers

Archer Aviation's patent portfolio, reportedly encompassing around 27 patents, appears modest when contrasted with its industry competitors. This limited intellectual property protection could present a vulnerability, potentially increasing exposure to infringement claims or hindering its ability to establish a strong competitive moat in the fast-paced electric vertical takeoff and landing (eVTOL) sector.

A less robust patent landscape might also mean fewer exclusive rights to key technologies, potentially impacting Archer's long-term market positioning and its capacity to license its innovations or defend against rivals developing similar solutions.

- Limited IP Protection: Archer's approximately 27 patents offer less comprehensive coverage than many established players in the aerospace and advanced mobility sectors.

- Competitive Disadvantage: A smaller patent portfolio could limit Archer's ability to differentiate its technology and secure exclusive rights, potentially ceding ground to competitors with stronger IP.

- Increased Legal Risk: Fewer patents may translate to a higher risk of facing intellectual property disputes or challenges from other companies operating in the eVTOL space.

Infrastructure and Operational Challenges

Archer Aviation faces significant hurdles in building the necessary infrastructure for its electric vertical takeoff and landing (eVTOL) aircraft. The widespread adoption of urban air mobility hinges on the development of vertiports, robust charging networks, and sophisticated air traffic management systems, all of which are currently in nascent stages of development. This lack of foundational infrastructure represents a critical weakness for scaling operations effectively.

Scaling Archer's services also presents considerable operational challenges. Establishing a comprehensive ecosystem for aircraft maintenance, including specialized technicians and parts availability, is essential. Furthermore, securing a sufficient pool of trained and certified pilots for eVTOL operations will require substantial investment in training programs and recruitment efforts, adding to the logistical and financial complexities.

- Infrastructure Gaps: The current lack of dedicated vertiports and advanced air traffic control systems for eVTOLs poses a significant barrier to entry and scalability.

- Maintenance Ecosystem: Developing a reliable and cost-effective maintenance network for eVTOLs, which are technologically advanced aircraft, is a complex undertaking.

- Pilot Shortage: The specialized training and certification required for eVTOL pilots may lead to a bottleneck in operational capacity, impacting service availability.

Archer Aviation's reliance on external funding, particularly equity financing, is a significant weakness given its pre-revenue status and high operational costs. The company's substantial cash burn, projected to exceed $500 million annually through 2027, necessitates continuous capital raises, leading to potential shareholder dilution and increased financial risk.

The company's intellectual property portfolio, with approximately 27 patents, appears limited compared to established aerospace firms, potentially hindering its ability to secure exclusive rights and defend against competitors in the rapidly evolving eVTOL market.

Archer faces considerable challenges in building the necessary infrastructure, such as vertiports and charging networks, which are still in early development stages. Furthermore, scaling operations will require significant investment in maintenance ecosystems and training specialized pilots, adding to operational complexities and costs.

Same Document Delivered

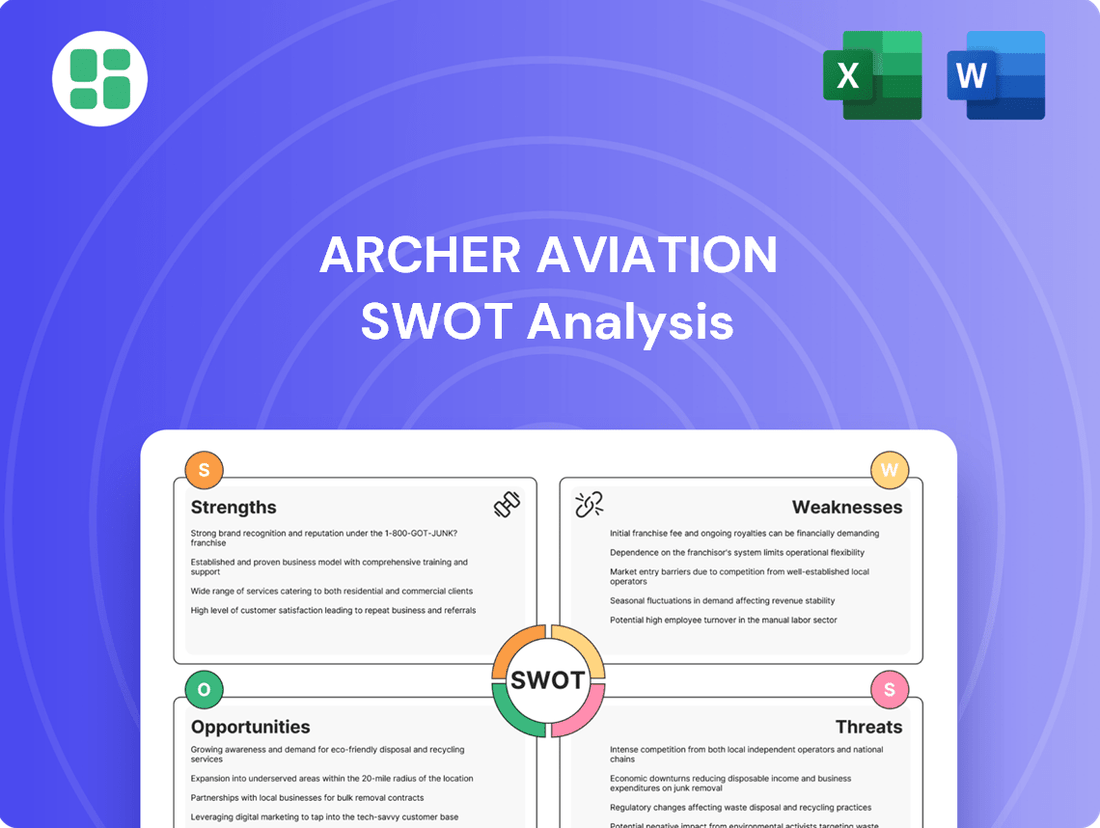

Archer Aviation SWOT Analysis

This is the actual Archer Aviation SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering detailed insights into Archer's strategic positioning in the burgeoning eVTOL market.

Opportunities

The urban air mobility (UAM) sector is poised for significant expansion, with market projections indicating a substantial rise. Estimates suggest the UAM market could reach $10.37 billion by 2029, with some forecasts even placing its potential at $1.5 trillion by 2040.

This rapid growth is fueled by increasing urbanization worldwide and a growing need for quicker, more efficient, and environmentally friendly transportation solutions within cities.

This burgeoning market presents a vast opportunity for companies like Archer Aviation, as it creates a substantial potential customer base for their planned air taxi services.

Archer Aviation is strategically targeting international markets to broaden its reach and accelerate the adoption of its electric vertical takeoff and landing (eVTOL) aircraft. The company has firm plans to commence air taxi services in the United Arab Emirates by the fourth quarter of 2025, marking a significant step in its global rollout.

Further bolstering its international ambitions, Archer has secured agreements for operations in key regions including Japan, Indonesia, and Ethiopia. These ventures are crucial as they allow Archer to access diverse markets, many of which may offer more adaptable regulatory frameworks, thereby speeding up the commercial deployment of its innovative air mobility solutions.

Ongoing advancements in battery technology are a significant opportunity, promising to boost the efficiency and extend the operational range of Archer's electric vertical takeoff and landing (eVTOL) aircraft. This translates to more practical and longer flights, making the service more appealing to a wider customer base.

The integration of artificial intelligence (AI) and automation into flight controls and manufacturing processes presents another major opportunity. AI can optimize flight paths, enhance safety through predictive maintenance, and streamline production, ultimately reducing operational costs and improving overall aircraft performance and reliability.

These technological leaps are crucial for Archer's success. For instance, battery energy density improvements, projected to reach over 500 Wh/kg by 2025, directly impact eVTOL range and payload capabilities. Similarly, AI-driven manufacturing can cut production times by an estimated 20-30%, making Archer's aircraft more cost-competitive.

Potential for Defense and Logistics Applications

Archer Aviation's eVTOL technology extends beyond passenger transport, offering significant potential in defense and cargo logistics. The company is actively pursuing these avenues through strategic partnerships and existing contracts.

This dual-use capability is crucial for diversifying Archer's revenue streams. It allows them to leverage their aircraft for a wider array of applications, including advanced logistics operations that may operate beyond visual line of sight (BVLOS).

- Defense Applications: eVTOLs can be utilized for reconnaissance, troop transport, and medical evacuation in challenging environments.

- Logistics and Cargo: Archer's aircraft can facilitate rapid delivery of goods, particularly in urban areas or for time-sensitive cargo.

- Partnerships: Archer has secured contracts and partnerships, such as with the U.S. Department of Defense, to explore these non-passenger applications. For instance, a contract with the U.S. Air Force could validate the military utility of their Midnight aircraft.

- Revenue Diversification: By tapping into the defense and logistics sectors, Archer can create multiple income streams, reducing reliance solely on the urban air mobility passenger market.

Strategic Alliances and Industry Consolidation

The evolving electric vertical takeoff and landing (eVTOL) sector is poised for significant consolidation. Companies demonstrating strong business models and secure funding are best positioned to navigate this landscape, potentially emerging as leaders through strategic mergers or acquisitions. Archer's established partnerships with major players like Stellantis and United Airlines, alongside its collaboration with Palantir for advanced AI integration, provide a robust foundation to capitalize on this consolidation trend.

These strategic alliances are crucial for Archer's growth and market positioning. By aligning with established aerospace and automotive giants, Archer gains access to manufacturing expertise, supply chain efficiencies, and significant capital infusion. For instance, Stellantis's commitment to investing up to $150 million in Archer by 2024 underscores the confidence in their joint venture to scale production of the Midnight aircraft. This collaborative approach not only strengthens Archer's competitive edge but also positions it favorably to absorb or integrate promising technologies from smaller, less capitalized eVTOL startups as the market matures.

- Strategic Partnerships: Archer has secured key alliances with Stellantis for manufacturing and United Airlines for its go-to-market strategy.

- AI Integration: Collaboration with Palantir enhances Archer's operational efficiency and data analytics capabilities through AI software.

- Market Consolidation Advantage: Strong partnerships and technological advancements position Archer to benefit from industry consolidation, potentially leading to acquisitions or technology integration.

- Funding and Scalability: Partnerships provide access to capital and manufacturing expertise, crucial for scaling production amidst market consolidation.

Archer Aviation is well-positioned to capitalize on the rapidly expanding urban air mobility market, which is projected to reach $10.37 billion by 2029. The company's strategic international expansion, including planned operations in the UAE by late 2025 and agreements in Japan, Indonesia, and Ethiopia, diversifies its revenue streams and accesses potentially more favorable regulatory environments. Advances in battery technology and AI integration are further enhancing the efficiency and cost-effectiveness of Archer's eVTOL aircraft, making them more competitive and appealing to a broader customer base.

Threats

Archer Aviation faces significant headwinds from a crowded eVTOL market. Competitors such as Joby Aviation, Lilium, EHang, and even established aerospace giants like Airbus are all actively pursuing similar goals, creating a highly competitive landscape. This intense rivalry means Archer must constantly innovate and execute flawlessly to maintain its edge.

The threat of competitors achieving certification or securing key partnerships ahead of Archer is a substantial risk. For instance, Joby Aviation, a leading competitor, has made substantial progress in its certification efforts with the FAA, aiming for commercial operations by 2025. Should a competitor gain regulatory approval or lock in exclusive deals with airlines or infrastructure providers first, it could significantly disadvantage Archer's market entry and growth prospects.

The path to commercialization for Archer Aviation is significantly impacted by the Federal Aviation Administration's (FAA) rigorous Type Certification process. Delays here, which are common in novel aviation technologies, could push back planned launch dates and dampen investor enthusiasm. For instance, the FAA's certification timelines for new aircraft designs can stretch for years, a factor that investors closely monitor.

Furthermore, the global regulatory landscape for electric vertical takeoff and landing (eVTAl) aircraft is still taking shape. As these frameworks evolve, Archer Aviation may face the need for costly adjustments to its aircraft designs or operational strategies to meet varying international standards, adding another layer of uncertainty to its expansion plans.

Public skepticism regarding the safety, noise levels, and overall viability of urban air mobility (UAM) presents a significant threat to Archer Aviation's growth. Concerns about the reliability of eVTOL technology could slow down regulatory approvals and consumer adoption. For instance, a recent survey indicated that while interest in UAM is growing, a substantial portion of the public still harbors reservations about the safety of flying vehicles in urban environments.

Any high-profile incidents or accidents involving eVTOLs, even those not directly involving Archer, could severely damage public trust and create a ripple effect across the entire industry. Such events could lead to stricter regulations, increased insurance costs, and a general reluctance from potential passengers to embrace this new mode of transport. The industry is closely watching the outcomes of early-stage testing and certification processes, as a single major setback could significantly impact investment and deployment timelines.

High Operating Costs and Pricing Sensitivity

Archer Aviation faces a significant hurdle with high operating costs stemming from the complex development, certification, production, and ongoing operation of its eVTOL aircraft. These substantial initial expenses could position early services as a premium offering, potentially hindering broader market adoption.

Achieving price parity with established urban transit options presents a challenge. Elevated operational expenses, including electricity for charging, pilot compensation, and rigorous maintenance schedules, could compress profit margins and impede market penetration efforts. For instance, the cost of specialized pilot training and the ongoing maintenance of advanced avionics and battery systems contribute to this cost structure.

- High Development & Certification Costs: The rigorous FAA certification process alone can cost hundreds of millions of dollars.

- Operational Expenses: Electricity for charging, pilot salaries, and specialized maintenance for eVTOLs are significant ongoing costs.

- Pricing Sensitivity: Early adopters may tolerate higher prices, but widespread adoption hinges on competitive pricing against existing transport.

- Scalability Challenges: Scaling production while managing these costs is critical for Archer to achieve its commercialization goals.

Macroeconomic Risks and Funding Challenges

Broader macroeconomic shifts, like a potential economic slowdown in 2024 or 2025, could significantly impact Archer Aviation's ability to secure crucial future funding. A general cooling of investor appetite for high-growth, speculative companies, a trend that has been observed periodically, would present a formidable obstacle.

Furthermore, the financial health of key investors poses a direct threat. For instance, if major backers like Stellantis, which reported a net loss of €1.9 billion in the first half of 2023, experience continued financial difficulties, their capacity and willingness to provide ongoing support to Archer could diminish substantially.

- Economic Downturns: A recession in major markets could reduce overall investment capital available for early-stage aerospace companies.

- Investor Sentiment Shifts: A move away from speculative growth stocks could make it harder for Archer to attract new investors or retain existing ones.

- Backer Financial Health: Financial struggles of strategic partners, such as Stellantis' reported losses, directly impact their ability to fund Archer's ambitious plans.

The intense competition in the burgeoning eVTOL sector poses a significant threat, with numerous players vying for market dominance. Archer must navigate this crowded landscape, where rivals like Joby Aviation, with its FAA certification progress targeting 2025 commercial operations, could gain a crucial first-mover advantage. This competitive pressure necessitates continuous innovation and flawless execution to maintain a leading position.

Regulatory hurdles, particularly the FAA's stringent Type Certification process, represent a substantial risk, with potential for delays that could impact launch timelines and investor confidence. Evolving international regulations also introduce uncertainty, potentially requiring costly design or operational adjustments for global expansion.

Public perception regarding safety and the overall viability of urban air mobility could slow adoption and regulatory approvals. Any high-profile incidents within the eVTOL industry, regardless of direct involvement, could erode public trust, leading to stricter regulations and increased operational costs.

High operating costs associated with development, certification, and production present a challenge to achieving price competitiveness with existing transit options. For example, specialized pilot training and advanced system maintenance contribute to elevated expenses, potentially limiting early market penetration.

| Threat Category | Specific Threat | Impact on Archer Aviation | Key Competitor Example | Relevant Data/Context |

|---|---|---|---|---|

| Market Competition | Crowded eVTOL Market | Risk of losing market share and first-mover advantage. | Joby Aviation | Joby targeting 2025 commercial operations. |

| Regulatory Environment | FAA Type Certification Delays | Postponement of launch dates, reduced investor enthusiasm. | N/A | Certification timelines can span years for novel aviation. |

| Public Perception | Skepticism on Safety & Viability | Slowdown in regulatory approvals and consumer adoption. | N/A | Surveys indicate public reservations about urban air travel safety. |

| Operational Costs | High Development & Operating Expenses | Difficulty in achieving price parity with existing transport. | N/A | Costs include specialized training and advanced avionics maintenance. |

SWOT Analysis Data Sources

This Archer Aviation SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a robust understanding of the competitive landscape and Archer's position within it.