Archer Aviation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archer Aviation Bundle

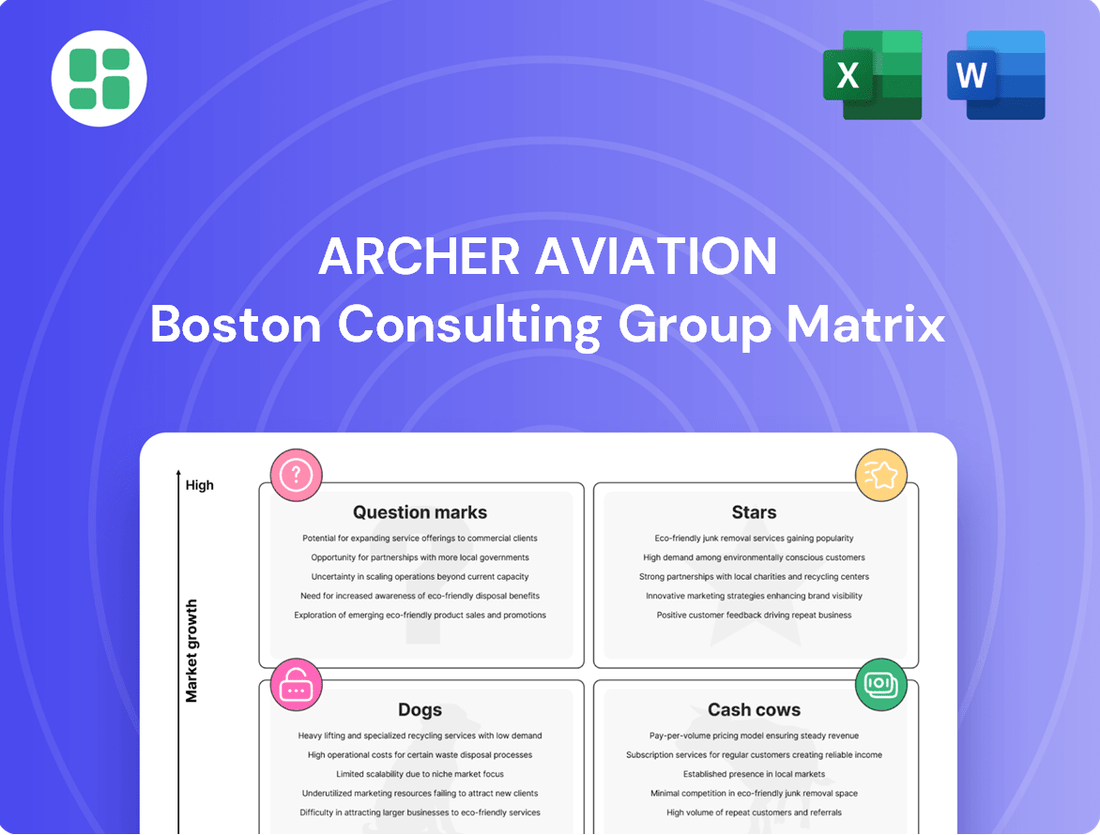

Curious about Archer Aviation's strategic product positioning? This preview offers a glimpse into how their innovative eVTOLs might fit into the BCG Matrix, but the full report unlocks the complete picture. Discover which ventures are poised for rapid growth and which require careful consideration.

Gain a clear view of where Archer Aviation's key initiatives stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a comprehensive breakdown and actionable strategic insights to navigate the future of air mobility.

Stars

If Archer Aviation achieves FAA Type Certification for its Midnight eVTOL by late 2025 and successfully scales production, it would likely be classified as a Star in a BCG Matrix. The eVTOL market is poised for substantial expansion, with projections indicating a global market size of approximately $170 billion by 2034, fueled by the growing demand for urban air mobility solutions.

Archer's ambitious production targets, aiming for two aircraft per month by the close of 2025 and scaling to 650 annually by 2030, are designed to capture a significant portion of this rapidly developing sector. This aggressive ramp-up, coupled with successful certification, positions Midnight for high growth and a strong market share.

Archer's planned air taxi services in key global markets like the UAE, potentially launching by late 2025, and in US cities such as New York and Los Angeles by 2026, position them as a Star if they secure substantial early market share. These ambitious network operations are designed to revolutionize urban transit by offering swift, efficient flights, tackling the significant growth potential within heavily congested metropolitan environments.

Archer's defense program, particularly its partnership with Anduril Industries for hybrid VTOL aircraft, positions it strongly within the military aviation sector. This strategic alliance taps into a significant market for advanced aerial systems, potentially leading to multi-billion dollar programs of record.

The dual-use nature of Archer's eVTOL technology allows it to address the burgeoning military drone and advanced aviation market. This segment benefits from substantial government investment and a clear demand for innovative vertical take-off and landing solutions in defense contexts.

A key indicator of this segment's potential is the U.S. Air Force's contract for Midnight eVTOLs, specifically for battlefield applications. This contract validates the high growth trajectory and significant market potential for Archer's defense-oriented offerings.

Proprietary eVTOL Technology and Intellectual Property

Archer Aviation's proprietary eVTOL technology, particularly its 12-rotor design and advanced noise-reduction systems, positions it strongly within the emerging urban air mobility market. This core intellectual property is fundamental to the performance and safety of its Midnight aircraft, a critical factor for long-term market dominance.

As the eVTOL industry matures and potential standardization emerges, Archer's unique technological approach could solidify its position as a Star. If this technology becomes a widely adopted standard or is licensed extensively, it would secure a significant market share in a rapidly expanding technological sector.

- Proprietary 12-Rotor Design: Enhances lift, efficiency, and redundancy.

- Noise-Reduction Technology: Crucial for urban acceptance and operational viability.

- Intellectual Property Portfolio: Protects key innovations and provides a competitive edge.

Global Certification Alliances and Early Market Penetration

Archer Aviation's strategic formation of a five-country certification alliance—encompassing the U.S., U.K., Australia, Canada, and New Zealand—along with its early international partnerships, positions it strongly for global market penetration. This proactive approach to navigating varied regulatory landscapes and establishing an international footprint from the outset grants Archer a significant competitive advantage, potentially classifying its global market penetration as a Star within the BCG Matrix.

This multi-jurisdictional strategy is crucial for a nascent industry like eVTOLs, where regulatory approval is a primary bottleneck. By engaging with multiple aviation authorities concurrently, Archer can streamline its certification process and prepare for a coordinated international launch. For example, in 2024, Archer continued to advance its certification efforts with the FAA in the U.S., a critical step that often serves as a benchmark for other regulatory bodies.

- Global Certification Alliance: Archer's five-country alliance (U.S., U.K., Australia, Canada, New Zealand) facilitates a more efficient path to international market entry by addressing diverse regulatory requirements upfront.

- Early International Partnerships: Establishing these partnerships in 2024 and beyond allows Archer to build foundational relationships and understand market-specific nuances for eVTOL operations.

- Competitive Advantage: This early international engagement is projected to secure Archer a leading position in the nascent global eVTOL market, differentiating it from competitors focused solely on single-market approvals.

- Market Penetration Potential: The ability to achieve certification and commence operations across multiple key markets simultaneously significantly amplifies Archer's revenue potential and market share capture in the coming years.

Archer Aviation's Midnight eVTOL, if it successfully achieves FAA Type Certification by late 2025 and scales production, is positioned as a Star in the BCG Matrix due to its participation in a high-growth market and its potential for significant market share. The company's aggressive production targets, aiming for two aircraft per month by the end of 2025 and scaling to 650 annually by 2030, are designed to capture a substantial portion of the expanding urban air mobility sector. Archer's planned air taxi services in key global markets, potentially launching by late 2025, further solidify its Star status by targeting high-demand, congested metropolitan areas.

| Metric | Archer Aviation Target/Projection | Market Context |

|---|---|---|

| FAA Type Certification | Late 2025 | Critical for commercial operations and market entry |

| Production Ramp-up | 2 aircraft/month by late 2025; 650 aircraft/year by 2030 | Aims to meet projected demand in a rapidly growing sector |

| Global eVTOL Market Size | Projected $170 billion by 2034 | Indicates significant growth potential for market leaders |

| Initial Operations | UAE by late 2025; US cities by 2026 | Targets key urban centers with high demand for air mobility |

What is included in the product

Archer Aviation's BCG Matrix analyzes its eVTOL aircraft as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

Archer Aviation's BCG Matrix offers a clear, actionable roadmap for strategic investment, relieving the pain of resource allocation uncertainty.

Cash Cows

Archer Aviation's current R&D and prototyping capabilities are a potential, though not yet realized, cash cow. If Archer were to leverage its advanced facilities and expertise in electric vertical takeoff and landing (eVTOL) technology for external contract work or consulting, it could generate stable, albeit low-growth, revenue. This would involve offering specialized engineering services or access to their prototyping infrastructure to other aerospace or technology companies.

Archer Aviation's strategic partnership with Stellantis, a global automotive leader, is a key element in its manufacturing strategy. Stellantis brings significant expertise in advanced manufacturing technologies and production scale, crucial for setting up Archer's facility in Covington, Georgia. This collaboration is designed to streamline production and reduce costs, accelerating Archer's path to commercialization.

While the partnership currently functions as a cost-saving and scaling enabler, it holds the potential to become a cash cow in the future. If Archer were to reach a mature state and optimize its manufacturing processes to a high degree of efficiency, it could leverage this expertise to offer manufacturing services to other companies. This would involve generating stable, albeit low-growth, profits from its established, highly efficient production capabilities.

In a future, more developed eVTOL market, Archer Aviation might see minor ancillary services, like specialized maintenance training or licensing less critical patents, as potential cash cows. These would represent low-growth but steady income, needing minimal new investment to maintain.

Currently, Archer is heavily invested in its core mission: developing and certifying its eVTOL aircraft, the Midnight. This strategic focus means these ancillary services are not a primary revenue driver today, with the company prioritizing its main product development and regulatory approvals.

Pre-Commercial Flight Demonstration Contracts

Pre-commercial flight demonstration contracts represent a potential Cash Cow for Archer Aviation. These early, limited agreements for demonstration flights or specific use cases, distinct from full commercial air taxi operations, could evolve into a stable, albeit low-growth, revenue source. This strategy involves offering niche services that utilize Archer's existing aircraft without the substantial capital expenditure associated with a full-scale network rollout.

These types of contracts are typically secured with government entities or large corporations, providing a predictable income stream. For instance, Archer announced in early 2024 a contract with the U.S. Department of Defense for a demonstration of its Midnight aircraft, highlighting the government sector's interest in advanced aerial mobility capabilities.

- Niche Services: Focus on specialized demonstration flights and specific use cases.

- Low-Growth Potential: Anticipated to generate stable but not rapidly expanding revenue.

- Predictable Income: Contracts with government and corporate clients offer reliable earnings.

- Leveraging Existing Assets: Utilizes current aircraft technology without immediate large-scale investment.

Data Analytics and AI Software Development (for internal use)

Archer Aviation's focus on data analytics and AI software development for internal use, particularly through its collaboration with Palantir, positions this area as a potential cash cow. This partnership aims to optimize operations and flight data, enhancing efficiency and safety within Archer's own processes.

While the primary goal is internal improvement, the sophisticated AI-powered aviation software platform being developed has the potential for external monetization. If Archer were to license this platform to other emerging aviation companies, it could create a significant stream of stable, high-margin, low-growth revenue.

- Palantir Partnership: Archer is leveraging Palantir's advanced data analytics capabilities to refine its operations and flight data management.

- Internal Efficiency Gains: The immediate benefit is improved operational efficiency and enhanced safety protocols for Archer's eVTOL aircraft.

- Potential Software Licensing: The developed AI software could be a valuable asset, offering licensing opportunities to other companies in the burgeoning advanced air mobility sector.

- Future Revenue Stream: Successful licensing could establish a predictable, low-growth, high-margin income source, characteristic of a cash cow.

Archer Aviation's manufacturing expertise, honed through its partnership with Stellantis, is poised to become a cash cow. By optimizing production processes for its eVTOL aircraft, Archer can eventually offer these highly efficient manufacturing capabilities as a service to other companies in the aerospace sector.

This would translate into a stable, low-growth revenue stream derived from leveraging its established, cost-effective production infrastructure. For example, Archer's Covington, Georgia facility aims for high-volume production, setting the stage for potential future service offerings.

| Potential Cash Cow Area | Current Status | Future Potential | Key Enablers |

| Manufacturing Services | Developing efficient production for eVTOLs | Stable, low-growth revenue from licensing manufacturing expertise | Stellantis partnership, Covington facility optimization |

| Ancillary Services | Minimal focus currently | Low-growth, steady income from maintenance training or patent licensing | Mature eVTOL market, established IP |

| AI Software Platform | Internal optimization via Palantir | High-margin, low-growth revenue from software licensing | Palantir collaboration, proprietary data analytics |

Preview = Final Product

Archer Aviation BCG Matrix

The Archer Aviation BCG Matrix preview you're currently viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no demo content, and no altered data – just the complete, professionally formatted strategic analysis ready for your immediate use. You're seeing the exact file that will be delivered, ensuring full transparency and immediate applicability for your business planning and decision-making processes.

Dogs

The Maker prototype, an earlier iteration for Archer Aviation, likely falls into the 'Dog' category within a BCG Matrix analysis. While it served a vital role in early development and achieving initial transition flights, its ongoing utility is questionable as the company focuses on the more advanced Midnight aircraft.

Maintaining and storing these legacy prototypes, like Maker, incurs costs without generating new revenue or market share. As the Midnight aircraft moves closer to commercialization and production, the Maker's contribution to future value or market positioning diminishes significantly, making it an obsolete asset.

Launching pilot programs in niche markets presents a significant risk for Archer Aviation, potentially leading to "Dogs" in their BCG matrix if these initiatives fail to gain traction. These programs could drain valuable resources without yielding substantial market adoption or profitability, ultimately facing discontinuation.

For instance, an attempt to establish air taxi services in a smaller, less populated city with limited demand for such a novel transportation mode might not prove economically viable. If these niche programs, like a specific route or a unique service model, do not resonate with the intended customer base, they represent a classic "Dog" scenario, consuming capital without generating returns.

Future diversification attempts by Archer Aviation into non-core areas that struggle to gain significant market traction or achieve steady revenue streams would fall into the Dogs category of the BCG Matrix. These could involve ventures outside of their primary eVTOL manufacturing and air taxi services, potentially diverting resources and attention from their core objectives. Such initiatives would likely exhibit both low market share and low growth potential, representing a drain on capital without a clear path to profitability.

Infrastructure Investments in Non-Strategic Locations

Infrastructure investments in non-strategic locations, such as vertiports in areas with projected low passenger demand, would fall into the Dog quadrant for Archer Aviation. These ventures, while requiring substantial capital, would likely yield minimal returns and fail to support the growth of a robust air taxi network. For instance, if a planned vertiport in a region with less than 10,000 projected daily passenger trips by 2028 fails to materialize, it would represent a significant capital misallocation.

Such underperforming assets would tie up capital, hindering Archer's ability to invest in more promising markets or accelerate the development of its core technology. The company needs to conduct rigorous market analysis to ensure that any infrastructure development aligns with realistic demand forecasts. Failing to do so could lead to a situation where capital is locked into assets that do not contribute to the overall success of the electric vertical takeoff and landing (eVTOL) aircraft deployment.

- Low Demand Vertiports: Investments in vertiports with projected passenger volumes significantly below industry breakeven points, potentially less than 50 daily flights.

- Unfeasible Operational Conditions: Vertiport locations with challenging airspace regulations, limited accessibility, or high operating costs that deter airlines and passengers.

- Capital Misallocation: Funds directed towards infrastructure projects that do not support Archer's strategic goals or generate sufficient revenue, impacting overall financial health.

Outdated Manufacturing Processes or Facilities

If Archer Aviation's manufacturing infrastructure or processes become obsolete due to rapid technological advancements or competitive pressures, they could be classified as a Dog in the BCG Matrix. Maintaining inefficient or outdated production lines would result in higher costs and lower output compared to industry leaders, hindering scalability and profitability. This would necessitate significant investment to update or divest these assets.

- Cost Inefficiency: Outdated facilities often lead to higher per-unit production costs, making Archer's eVTOLs less competitive on price.

- Limited Throughput: Older machinery may have lower production capacity, capping Archer's ability to meet growing demand.

- Technological Lag: Failure to adopt newer manufacturing techniques could put Archer at a disadvantage in terms of product quality and innovation speed.

Assets like Archer Aviation's Maker prototype, while foundational, become Dogs as newer, more advanced models like Midnight take precedence. These older assets consume resources for maintenance and storage without contributing to current market share or future revenue, representing a drain on capital.

Pilot programs in niche markets that fail to gain traction also fall into the Dog quadrant. For example, an air taxi service in a low-demand city could tie up capital without generating sufficient revenue, mirroring the characteristics of a Dog asset.

Infrastructure investments in non-strategic, low-demand locations, such as vertiports projected to handle minimal passenger traffic, also represent potential Dogs. These ventures risk becoming capital sinks if they don't align with realistic demand forecasts and Archer's core business objectives.

Obsolete manufacturing processes or facilities that lead to cost inefficiencies and limited throughput can also be classified as Dogs. These assets hinder scalability and competitiveness, requiring significant investment to update or divest.

| Asset Category | BCG Matrix Quadrant | Rationale | Example |

|---|---|---|---|

| Legacy Prototypes | Dog | Low market share, low growth potential; incur maintenance costs without generating new revenue. | Maker prototype |

| Underperforming Niche Programs | Dog | Consume capital without significant market adoption or profitability. | Air taxi service in a low-demand city |

| Non-Strategic Infrastructure | Dog | Low return on investment; fail to support core business growth. | Vertiports with projected low passenger demand |

| Obsolete Manufacturing | Dog | High costs, low output; hinder scalability and profitability. | Outdated production lines |

Question Marks

The Midnight eVTOL aircraft from Archer Aviation currently sits firmly in the Question Mark quadrant of the BCG matrix. This is primarily due to its pre-revenue status for air taxi services, despite the substantial growth potential of the eVTOL market, which is forecast to reach $170 billion by 2034.

Archer's market share is presently minimal as the Midnight aircraft navigates the crucial FAA Type Certification process. Commercial operations are slated to commence in late 2025 in the UAE, followed by the US in early 2026, marking a pivotal moment for the company.

Significant capital investment is essential to finalize certification and scale production capabilities. This positions Midnight as a high-risk, high-reward venture, demanding substantial resources to achieve its ambitious commercial launch targets.

Archer Aviation's ambition to build a global urban air mobility (UAM) network is a classic Question Mark. While the UAM market is projected to reach $200 billion by 2035, Archer's current market share is negligible, reflecting the immense uncertainty surrounding its expansion strategy. Successfully replicating its model across diverse international markets demands navigating complex regulatory landscapes and significant capital investment, estimated to be in the billions for comprehensive global rollout.

The challenge lies in scaling operations beyond initial launch cities like Los Angeles and Chicago to establish a truly widespread network. This requires overcoming substantial logistical hurdles, securing necessary certifications in various jurisdictions, and developing robust charging and maintenance infrastructure. The high upfront costs and unproven long-term profitability of UAM services contribute to the high risk associated with this global expansion.

Archer Aviation's nascent defense program, centered on hybrid electric vertical takeoff and landing (eVTOL) aircraft for military applications, is currently positioned as a Question Mark within the BCG framework. This initiative has secured early-stage contracts, including a notable agreement with the U.S. Air Force, highlighting initial validation and market interest.

The program's potential for significant growth is acknowledged, given the military's increasing demand for advanced aerial mobility solutions. However, its long-term market share and profitability within the defense sector remain uncertain, as the competitive landscape and adoption rates are yet to be fully established.

This strategic diversification necessitates substantial investment in research and development, alongside the production of defense-specific aircraft variants. Archer aims for this segment to evolve into a Star, leveraging its technological advancements to capture a dominant position in future military eVTOL markets.

International Market Entry Strategies (beyond initial UAE focus)

Archer Aviation is actively pursuing expansion into new international territories, notably Indonesia and Ethiopia, signaling a strategic move beyond its initial UAE partnership. These markets are identified for their substantial growth potential in urban air mobility (UAM), driven by increasing urbanization and the need for efficient transportation solutions.

Archer's success in these diverse markets hinges on several critical factors. Navigating complex local regulatory frameworks will be paramount, as will the development of necessary ground infrastructure to support eVTOL operations. Furthermore, understanding and responding to the competitive landscape in each region will be key to securing a meaningful market share.

- Indonesia: Archer has partnered with local entities to explore UAM deployment, recognizing Indonesia's archipelago nature and dense urban centers as prime candidates for aerial transport solutions.

- Ethiopia: In Ethiopia, Archer's strategy involves collaboration with local stakeholders to establish a foundational UAM ecosystem, aiming to leapfrog traditional infrastructure limitations.

- Investment: These international ventures require significant upfront capital investment, with the long-term return dependent on regulatory approvals, infrastructure readiness, and market adoption rates.

- Market Dynamics: Archer must adapt its entry strategy to the unique economic and social conditions of each new market to effectively compete and establish a sustainable presence.

Autonomous Flight Capabilities and Future Integrations

Archer Aviation's pursuit of fully autonomous flight capabilities for its Midnight eVTOL aircraft is a classic BCG Matrix Question Mark, demanding substantial investment with uncertain future returns. This advanced technology, while holding the promise of enhanced operational efficiency and scalability for Urban Air Mobility (UAM) services, remains in its nascent stages of development and faces significant hurdles in obtaining regulatory certification. The company is channeling considerable resources into research and development for these autonomous systems, anticipating a future where they can reduce operating costs and expand service reach, but immediate profitability from this specific capability is not expected.

The path to market for autonomous passenger flight is complex, requiring not only technological maturity but also widespread public trust and a robust regulatory framework. Archer's progress in this area is critical for long-term competitive advantage, but the timeline for widespread adoption and the associated market acceptance are still largely undefined. For context, the global autonomous vehicle market, which shares some technological underpinnings, was projected to reach hundreds of billions of dollars by the late 2020s, but the specific eVTOL segment is even more nascent.

- Autonomous Flight R&D: Archer is investing heavily in developing the hardware and software for autonomous eVTOL operations, a key factor for future operational cost reduction.

- Regulatory Uncertainty: Achieving certification for autonomous passenger flight in the UAM sector is a lengthy and complex process, with timelines still being established by aviation authorities.

- Market Acceptance: Building public confidence in riding in autonomous aircraft is a significant challenge that will influence the pace of adoption for these capabilities.

- Scalability Potential: If successful, autonomous flight could dramatically increase the scalability and efficiency of Archer's UAM network, a major long-term strategic goal.

Archer Aviation's Midnight eVTOL aircraft is a prime example of a Question Mark in the BCG matrix. Its potential is immense, with the urban air mobility market projected to reach $170 billion by 2034, yet its current market share is negligible as it undergoes the critical FAA Type Certification process.

The company's expansion into new international markets like Indonesia and Ethiopia, alongside its defense program and pursuit of autonomous flight, also fall into the Question Mark category. These ventures require significant capital investment with uncertain future returns, dependent on regulatory approvals, infrastructure readiness, and market adoption.

| Initiative | BCG Quadrant | Key Characteristics | Market Potential | Current Status |

| Midnight eVTOL (Air Taxi) | Question Mark | Pre-revenue, high growth market, minimal market share | $170 billion by 2034 | Awaiting FAA Type Certification, commercial ops late 2025 (UAE), early 2026 (US) |

| Global UAM Network Expansion | Question Mark | High investment, complex regulations, unproven profitability | $200 billion by 2035 | Expansion into Indonesia, Ethiopia; requires navigating local regulations and infrastructure development. |

| Defense Program | Question Mark | Early-stage contracts, growing military demand, uncertain market share | Significant, but undefined | Secured early-stage contracts with U.S. Air Force; requires R&D and defense-specific variants. |

| Autonomous Flight Capabilities | Question Mark | Nascent technology, high R&D investment, regulatory hurdles | Potential for scalability and cost reduction | Significant resources into R&D for hardware and software; regulatory certification is complex. |

BCG Matrix Data Sources

Our Archer Aviation BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.