Archer Aviation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archer Aviation Bundle

Archer Aviation faces moderate bargaining power from suppliers due to the specialized nature of eVTOL components, while the threat of new entrants is significant given the nascent but rapidly growing market. Buyer power is also a key consideration, as early adopters will have choices as the market matures.

The complete report reveals the real forces shaping Archer Aviation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Archer Aviation's reliance on specialized suppliers for key eVTOL components, such as advanced battery systems and electric motors, positions these suppliers favorably. The emerging eVTOL market often means a constrained pool of qualified providers for cutting-edge technology, amplifying supplier leverage.

For instance, the battery technology crucial for eVTOL performance is a rapidly evolving field. Companies that have mastered high-energy-density, fast-charging battery solutions can command premium pricing and favorable terms. Archer's 2023 financial reports indicate significant investments in research and development, partly to secure these critical, specialized components.

Archer's strategic move to acquire a composite manufacturing facility in 2023 demonstrates an effort to internalize production for certain components, thereby reducing its dependence on external suppliers and mitigating their bargaining power in that specific segment.

Suppliers of certified aerospace-grade components wield significant bargaining power, largely driven by the rigorous regulatory landscape governing electric vertical takeoff and landing (eVTOL) aircraft. For Archer Aviation's Midnight aircraft, every component must adhere to Federal Aviation Administration (FAA) standards, a requirement that narrows the field of qualified suppliers and consequently enhances their negotiation leverage.

Suppliers possessing proprietary technology or robust intellectual property in critical components like advanced battery systems or sophisticated flight control software can exert significant bargaining power. This allows them to charge premium prices and impose stricter supply terms on companies like Archer Aviation. For instance, a sole provider of a unique, high-density battery crucial for electric vertical takeoff and landing (eVTOL) aircraft could dictate terms due to limited alternatives.

Supplier Concentration

Supplier concentration is a key factor in Archer Aviation's bargaining power of suppliers. If a limited number of companies supply critical eVTOL components, these suppliers gain considerable leverage. This can translate into higher prices, less favorable delivery terms, and stricter quality demands for Archer.

Archer Aviation must navigate these concentrated supplier relationships with care. For instance, if a single supplier provides a proprietary battery system essential for its aircraft, that supplier's bargaining power is amplified. Archer's strategy must include diversifying its supplier base where possible and building strong, long-term partnerships to mitigate these risks.

- High Supplier Concentration: The eVTOL industry relies on specialized components, and the number of qualified suppliers for certain critical parts, like advanced battery systems or high-performance electric motors, may be limited.

- Impact on Pricing and Terms: A concentrated supplier market can empower suppliers to dictate pricing and delivery schedules, potentially increasing Archer Aviation's cost of goods sold and impacting production timelines.

- Strategic Sourcing: Archer's ability to secure favorable terms and maintain production efficiency will depend on its success in identifying and cultivating relationships with multiple suppliers for key components, or developing in-house capabilities for critical technologies.

Switching Costs for Archer

Archer Aviation faces significant switching costs when sourcing critical components for its electric vertical takeoff and landing (eVTOL) aircraft. These costs involve not just the price of new parts but also the substantial expenses related to redesigning existing systems, undergoing rigorous re-certification processes with aviation authorities, and potentially re-tooling manufacturing lines. This makes it challenging and expensive for Archer to shift to alternative suppliers once a relationship is established, thereby enhancing the bargaining power of its current component providers.

The high barriers to changing suppliers mean that Archer is somewhat locked into its existing partnerships. This situation can lead to suppliers dictating terms, potentially impacting Archer's cost structure and operational flexibility. For instance, if a key battery supplier were to increase prices significantly, Archer's ability to quickly find and integrate a new, equally qualified supplier would be severely limited by the aforementioned redesign and re-certification hurdles.

- High Redesign Costs: Modifying aircraft systems to accommodate components from a new supplier can require extensive engineering work, potentially costing millions of dollars.

- Re-certification Expenses: Aviation safety regulations demand thorough testing and approval for any significant change in aircraft components, adding substantial time and financial burden.

- Manufacturing Re-tooling: Adapting production lines for new parts necessitates investment in new machinery and training, further increasing the cost of switching.

- Strategic Partnerships: To mitigate supplier power, Archer relies on long-term agreements and strategic collaborations that foster mutual investment and commitment, aiming to stabilize supply chains and costs.

Suppliers of specialized eVTOL components, particularly those with proprietary technology or those meeting stringent aerospace certifications, hold considerable bargaining power over Archer Aviation. This leverage is amplified by the limited number of qualified providers for cutting-edge technologies like advanced battery systems and sophisticated flight control software.

Archer's 2023 annual report highlighted significant R&D spending, partly aimed at securing these critical components and exploring alternative sourcing strategies. The high costs associated with redesigning systems and re-certifying components with aviation authorities, such as the FAA, create substantial switching costs, further entrenching supplier influence.

For example, securing a reliable supply of high-density batteries is paramount. Companies mastering this technology can dictate terms, as seen in the broader electric vehicle market where battery costs remain a significant factor. Archer's strategic acquisition of a composite manufacturing facility in 2023 also reflects an effort to reduce reliance on external suppliers for certain parts.

| Component Category | Supplier Power Drivers | Archer's Mitigation Strategy |

|---|---|---|

| Advanced Battery Systems | Proprietary technology, high energy density, limited qualified suppliers | Long-term partnerships, R&D investment, exploring alternative battery chemistries |

| Electric Motors & Powertrain | Specialized aerospace-grade certification, unique performance specifications | Supplier diversification, strategic sourcing agreements, potential in-house development |

| Flight Control Software | Proprietary IP, deep integration with aircraft systems, regulatory approval | Collaborative development, exploring open-source alternatives where feasible |

| Composite Materials | Specific aerospace certifications, manufacturing expertise | In-house manufacturing (acquired facility), dual-sourcing for standard materials |

What is included in the product

This analysis unpacks the competitive forces impacting Archer Aviation, detailing buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the urban air mobility sector.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Archer Aviation's competitive landscape to identify and address key pain points.

Customers Bargaining Power

The urban air mobility market, where Archer Aviation operates, is still very much in its infancy. This means early customers, such as airlines like United Airlines which has placed a significant order for Archer's Midnight aircraft, hold a degree of influence. These foundational partnerships are crucial for Archer's growth and market validation, giving these initial adopters some leverage.

Customers for eVTOL services, especially major airlines and logistics companies, place an immense premium on safety, dependability, and seamless operations. Archer Aviation's progress in achieving stringent FAA certification directly influences its negotiation leverage; a strong safety record is non-negotiable.

These demanding requirements mean customers possess significant bargaining power. For instance, a large potential customer like United Airlines, which has invested in Archer, will expect demonstrable safety protocols and operational readiness before committing to large-scale purchases. Any hint of safety concerns could drastically impact demand, giving customers considerable sway in pricing and contract terms.

Archer Aviation's initial customer concentration could significantly impact its bargaining power. If a few major airlines or logistics firms represent a large portion of early orders, these key customers could leverage their volume to negotiate favorable pricing, demand specific aircraft customizations, or secure exclusive operational rights. This concentration risk is a critical factor for any emerging aerospace company.

Archer's strategy to broaden its customer base across both commercial passenger transport and defense sectors aims to dilute this potential customer concentration. By securing partnerships with entities like the United States Air Force and various commercial airlines, Archer seeks to avoid over-reliance on a single customer segment, thereby strengthening its overall market position and reducing individual customer leverage.

Price Sensitivity and Viability

The price sensitivity of passengers is a critical factor influencing the bargaining power of air taxi operators, who are Archer Aviation's direct customers. If passengers find the cost of eVTOL rides too high, operators will have less leverage to negotiate prices with aircraft manufacturers like Archer. For instance, early projections for urban air mobility services often cited prices comparable to ride-sharing or premium taxis, but sustained demand will hinge on affordability.

The overall economic viability of urban air mobility services directly impacts the willingness of customers to pay for aircraft and related services. If the cost of operations, including aircraft acquisition, maintenance, and pilot salaries, remains high, ticket prices will reflect that. In 2024, several eVTOL companies are actively conducting flight tests and seeking certification, with the ultimate goal of achieving cost-effective operations that can attract a broad customer base.

- Passenger Price Sensitivity: The ultimate willingness of consumers to pay for air taxi services will determine the bargaining power of the operators who purchase aircraft from companies like Archer.

- Economic Viability of UAM: The success and affordability of urban air mobility services are directly linked to the cost of eVTOL aircraft and their operation, influencing customer demand and operator purchasing power.

- 2024 Market Outlook: As of 2024, the eVTOL industry is focused on achieving certification and demonstrating operational efficiency, which are key to establishing competitive pricing for passengers and ensuring the economic viability of the sector.

Availability of Alternatives

Customers looking for ways to get around cities already have options. Think about traditional cars, ride-sharing services, or even helicopters for very specific, high-end needs. These existing choices directly impact how much power customers have when considering new options like Archer Aviation's eVTOLs.

Customers will naturally weigh the benefits of eVTOLs against these established methods. They'll be looking at the price, how quickly they can get to their destination, and how easy it is to use. This comparison is crucial; if the cost or inconvenience of eVTOLs isn't significantly better than what's already available, customers might be hesitant to place large orders, limiting Archer's bargaining power.

- Cost Comparison: Ground transportation costs can range from a few dollars for public transit to much higher for premium services. Archer's pricing for urban air mobility will be benchmarked against these existing costs.

- Speed and Convenience: While eVTOLs promise faster travel times by bypassing traffic, the overall convenience, including airport access and boarding procedures, will be compared to the door-to-door service of ride-sharing.

- Niche Helicopter Market: For specialized transport, helicopters are a benchmark. However, their high operating costs and noise levels present an opportunity for eVTOLs to offer a more accessible alternative.

Archer Aviation's early customers, particularly major airlines like United Airlines, hold significant bargaining power due to their foundational role and substantial order commitments. This leverage is amplified by the critical importance of safety and operational reliability in the nascent urban air mobility sector. For instance, United Airlines' 2021 order for 100 Archer Midnight aircraft, with an option for 100 more, underscores their influential position in shaping early market dynamics and contract terms.

| Customer Type | Influence Factor | Example/Data Point |

|---|---|---|

| Major Airlines (e.g., United Airlines) | Order Volume & Early Adoption | Order for 100 Archer Midnight aircraft (2021), with option for 100 more. |

| Defense Sector (e.g., US Air Force) | Strategic Partnerships & Funding | US Air Force contract for Archer's Midnight aircraft, valued up to $142 million. |

| Commercial Operators | Price Sensitivity & Operational Viability | Success hinges on eVTOL affordability, comparable to premium ground transport. |

What You See Is What You Get

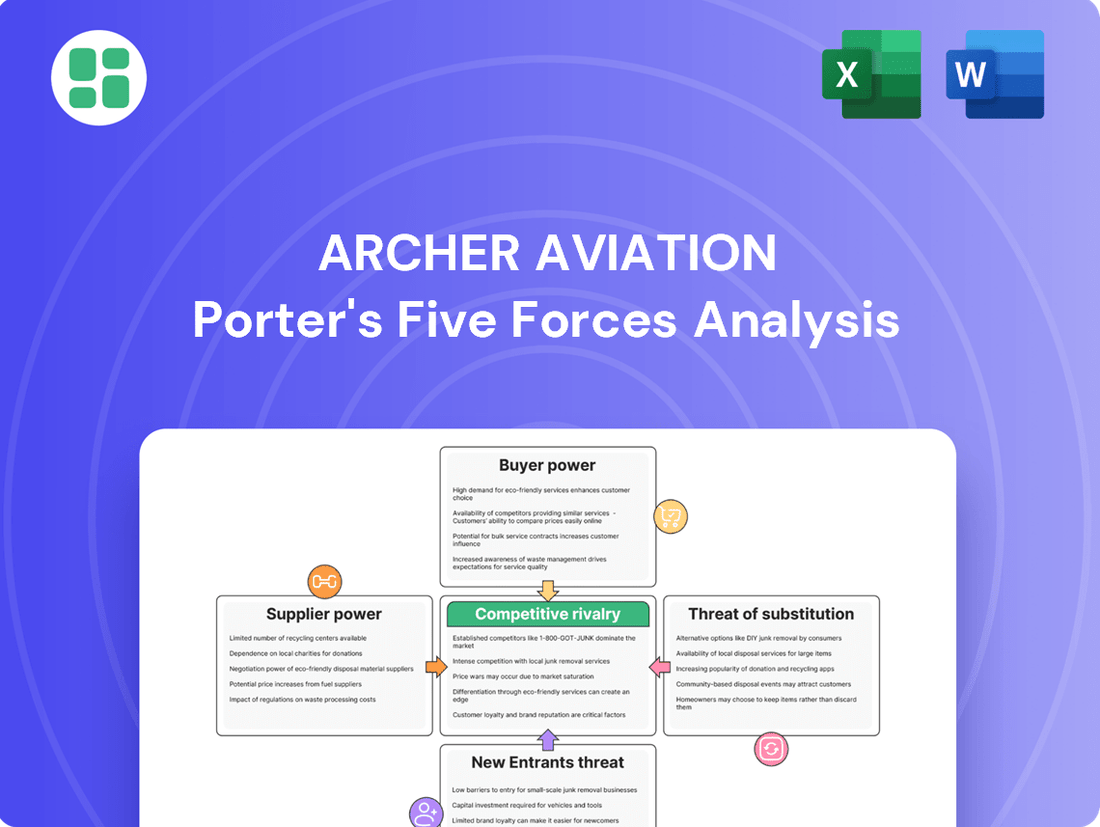

Archer Aviation Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Archer Aviation, detailing the competitive landscape of the electric vertical takeoff and landing (eVTOL) aircraft industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This is the complete, ready-to-use analysis file, professionally formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The electric vertical takeoff and landing (eVTOL) aircraft market is experiencing a surge in competition, with many companies actively developing and seeking to commercialize their designs. Key players like Joby Aviation, Lilium, Vertical Aerospace, and EHang are all pushing forward with their own unique approaches to urban air mobility.

This intense rivalry is fueled by the diverse technological pathways and business models being explored by these companies. Some focus on passenger transport, while others target cargo or specialized services, creating a broad spectrum of competitive strategies.

Archer Aviation is positioned as a significant contender, demonstrating notable progress in both aircraft design and the crucial certification processes required for commercial operation. As of early 2024, Archer has secured substantial pre-order commitments, indicating market interest and its competitive standing.

The competition to be the first to receive FAA certification and launch commercial operations is incredibly intense, offering substantial rewards for early market entrants. This first-mover advantage can secure crucial routes, forge key partnerships, and build essential public confidence.

Archer Aviation is aggressively pursuing commercial flights, targeting a late 2025 or early 2026 launch. This timeline places Archer in a direct race against rivals like Joby Aviation, both vying for the coveted position of being among the first to offer electric vertical takeoff and landing (eVTOL) services.

Archer Aviation is actively differentiating its electric vertical takeoff and landing (eVTOL) aircraft through advanced design, extended range capabilities, and enhanced payload capacity. Key technological advancements include sophisticated noise reduction systems and the integration of AI-driven flight controls, aiming to set them apart in a burgeoning market.

The competitive landscape is characterized by intense research and development as companies vie for technological supremacy. While Archer highlights its 12-motor configuration, designed for superior redundancy and safety, rivals like Joby Aviation are pursuing different strategies, focusing on propulsion system efficiency and unique design philosophies, fueling a dynamic R&D race.

Capital Intensity and Funding

The electric vertical takeoff and landing (eVTOL) sector is incredibly capital-intensive, meaning companies need vast sums of money to develop and certify their aircraft. This high barrier to entry intensifies competition, not just among eVTOL makers but also for the limited pool of investment capital and strategic alliances. Companies that can secure significant funding and key partnerships gain a substantial advantage.

Archer Aviation, for instance, has demonstrated a strong ability to attract capital and build strategic relationships. As of early 2024, the company had secured over $1 billion in liquidity. This financial backing is crucial for navigating the lengthy and expensive process of aircraft development and certification.

- Capital Requirements: eVTOL development demands hundreds of millions, if not billions, of dollars for research, design, testing, and certification.

- Funding Landscape: Competition for venture capital and strategic corporate investment is fierce, favoring well-positioned companies.

- Archer's Financial Strength: Archer's over $1 billion in liquidity, bolstered by partnerships with giants like Stellantis and United Airlines, provides a significant competitive edge.

- Partnership Value: These collaborations offer not only capital but also manufacturing expertise, distribution channels, and operational validation, crucial for market entry.

Regulatory Progress and Milestones

Regulatory certification stands as a significant hurdle and a key competitive differentiator in the electric vertical takeoff and landing (eVTOL) sector. Companies that successfully navigate the FAA's rigorous approval process first are positioned to capture market share and establish early leadership.

Archer Aviation is actively progressing through the final stages of its FAA Type Certification, demonstrating advancements in compliance verification documents and pilot training programs. These efforts are crucial for its competitive positioning.

- Certification Pace: Achieving FAA Type Certification is a primary competitive advantage, with early movers gaining market access and credibility.

- Archer's Progress: Archer is in the final certification phase, focusing on compliance verification and pilot training, vital for its market entry.

- Competitive Impact: Successful certification unlocks commercial operations, directly influencing market share and investor confidence.

The competitive rivalry within the eVTOL market is intense, with numerous companies like Joby Aviation and Lilium vying for dominance. Archer Aviation distinguishes itself through a 12-motor design for enhanced redundancy and is actively pursuing FAA certification, aiming for commercial operations by late 2025 or early 2026.

This race for early market entry is critical, as the first to achieve certification and launch services will likely secure significant advantages in routes and partnerships. Archer's progress in certification, coupled with over $1 billion in liquidity as of early 2024 and strategic backing from industry giants, positions it strongly against its rivals.

| Competitor | Key Differentiator | Certification Status (Early 2024) | Funding (Approx.) |

|---|---|---|---|

| Archer Aviation | 12-motor design, noise reduction | Final certification phase | >$1 Billion liquidity |

| Joby Aviation | Propulsion efficiency, unique design | Advanced certification stages | >$2 Billion raised |

| Lilium | Ducted electric jet engines | Progressing through certification | >$700 Million raised |

| Vertical Aerospace | Modular design, multiple configurations | In certification process | >$500 Million raised |

SSubstitutes Threaten

The primary substitutes for urban air mobility (UAM) are the established ground transportation networks. Think about cars, ride-sharing services like Uber and Lyft, buses, and trains. These are the everyday ways people get around cities.

For shorter trips within urban areas, these traditional options often win on price and sheer availability. If eVTOL services can't match or beat the cost and convenience of a taxi or a subway ride, they'll struggle to gain traction. For instance, in 2024, the average cost per mile for ride-sharing services in major U.S. cities remained significantly lower than projected UAM fares.

The widespread infrastructure and user familiarity with ground transport present a substantial barrier. Unless UAM can offer a compelling value proposition, such as drastically reduced travel times for specific routes, these substitutes will continue to dominate the urban mobility landscape.

For specific uses like executive travel or specialized charter flights, traditional aircraft such as helicopters and small private jets act as substitutes for eVTOLs. While eVTOLs boast benefits like quieter operation, reduced emissions, and potentially more economical running costs on urban routes, the existing infrastructure and greater operational adaptability of helicopters present a persistent consideration.

Emerging mobility solutions present a significant threat of substitution for Archer Aviation's electric vertical takeoff and landing (eVTOL) aircraft. Innovative transportation options like enhanced high-speed rail networks or the development of hyperloop technology could offer competitive alternatives for inter-city and regional travel, potentially capturing market share from eVTOL services. For instance, ongoing investments in high-speed rail, such as the California High-Speed Rail project aiming for speeds over 200 mph, indicate a growing focus on faster ground transportation. Archer needs to ensure its eVTOLs provide a demonstrably superior combination of speed, convenience, and cost to remain attractive against these evolving ground-based transit systems.

Cost-Benefit Analysis for Consumers

The threat of substitutes for Archer Aviation's eVTOL services hinges significantly on how consumers perceive value. If the elevated price of air taxi travel doesn't clearly surpass the advantages of time saved, enhanced convenience, or ecological benefits over current ground transportation, individuals will likely stick with more affordable and established options.

For instance, a typical ride-sharing service in a major metropolitan area might cost $20-$50 for a 30-minute trip. In contrast, early eVTOL services are projected to be considerably more expensive, potentially in the hundreds of dollars for similar distances, especially during initial rollout phases. This price disparity creates a substantial barrier if the perceived benefits don't justify the premium.

Consider the following factors influencing consumer choice:

- Cost Comparison: Current ground transportation costs versus projected eVTOL fares. For example, a 2024 study indicated that average taxi fares in the US are around $2.50 per mile, while eVTOLs are anticipated to start at $5-$10 per mile.

- Time Savings vs. Cost: The actual time saved by avoiding ground traffic congestion needs to be substantial enough to warrant the higher price.

- Convenience and Accessibility: The ease of booking, proximity of vertiports, and overall user experience compared to existing ride-hailing apps.

- Environmental Benefits: While eVTOLs promise zero direct emissions, the overall lifecycle impact and the perceived environmental consciousness of consumers will play a role.

Infrastructure and Accessibility

The current scarcity of dedicated vertiports and charging infrastructure presents a significant challenge for Archer Aviation. This lack of widespread accessibility makes conventional ground transportation modes, like cars and public transit, far more convenient for the average traveler. Until a robust network of urban air mobility (UAM) hubs is established and seamlessly integrated into urban planning, the established ease of use and ubiquity of existing transportation systems will continue to serve as a powerful substitute for electric vertical takeoff and landing (eVTOL) services.

This infrastructure gap directly impacts the perceived value proposition of UAM. For instance, as of early 2024, the development of vertiports is still in its nascent stages, with many cities actively planning or piloting limited facilities. This contrasts sharply with the deeply entrenched and highly accessible nature of road networks and existing public transport systems, which have benefited from decades of investment and development. The convenience factor of being able to depart from and arrive at readily available ground transportation points remains a formidable barrier for nascent air mobility solutions.

- Vertiport Development: Cities like Los Angeles and Miami are in various stages of planning and developing vertiport infrastructure, but widespread availability is years away.

- Charging Network: The charging infrastructure for eVTOL aircraft is currently non-existent on a commercial scale, relying on specialized, limited-use charging solutions during testing phases.

- Ground Transport Dominance: Traditional transportation networks offer unparalleled accessibility, with millions of miles of roads and extensive public transit systems globally.

- Consumer Convenience: The immediate convenience of hopping into a car or boarding a bus without needing to travel to a specialized hub remains a key advantage for existing transport options.

The threat of substitutes for Archer Aviation's eVTOL services is significant, primarily stemming from established ground transportation and emerging high-speed transit. Consumers weigh cost, time savings, and convenience, and current ground options often hold an advantage. For example, in 2024, ride-sharing costs per mile remained substantially lower than projected eVTOL fares, making traditional transport more appealing for many urban journeys.

The lack of widespread vertiport infrastructure further strengthens the position of substitutes. Until eVTOLs can offer comparable accessibility and convenience to readily available ground networks, consumers will likely favor the latter. This infrastructure gap means that for most people, hailing a taxi or catching a bus is still far easier than accessing an eVTOL service.

Emerging alternatives like enhanced high-speed rail also pose a threat, especially for inter-city travel. Projects like the California High-Speed Rail, aiming for speeds over 200 mph, highlight a growing investment in faster ground-based transit. Archer's eVTOLs must deliver a clear superiority in speed, convenience, and cost to compete effectively against these evolving transport solutions.

| Transportation Mode | Estimated Cost per Mile (USD) | Typical Travel Time (5 miles) | Accessibility |

|---|---|---|---|

| Ride-Sharing (e.g., Uber/Lyft) | $2.50 - $4.00 | 15-25 minutes | High (on-demand, extensive network) |

| Public Transit (Bus/Subway) | $0.50 - $2.00 | 20-40 minutes | High (fixed routes, scheduled) |

| Archer eVTOL (Projected) | $5.00 - $10.00 | 5-10 minutes | Low (requires vertiport access) |

| High-Speed Rail (Future) | Varies (competitive with airfare) | Varies (inter-city focus) | Moderate (station-based) |

Entrants Threaten

The development, testing, certification, and manufacturing of eVTOL aircraft require substantial capital, presenting a significant hurdle for newcomers. Archer Aviation has raised over $1 billion in liquidity and secured substantial funding from partners like Stellantis, underscoring the immense financial commitment needed.

The path to market for new entrants in the electric vertical takeoff and landing (eVTOL) sector, like Archer Aviation, is heavily guarded by stringent regulatory hurdles and certification requirements. Obtaining crucial approvals from aviation authorities such as the Federal Aviation Administration (FAA) is an exceptionally complex, lengthy, and expensive undertaking.

New players must navigate a steep learning curve, demanding substantial investment in research and development, rigorous testing, and adherence to exacting safety and airworthiness standards that can span several years. For instance, the FAA's type certification process for new aircraft designs is notoriously demanding, often requiring billions of dollars in investment and a decade or more of development, as seen with previous advanced aircraft programs.

The significant technological complexity inherent in designing and manufacturing advanced electric Vertical Take-Off and Landing (eVTOL) aircraft presents a substantial barrier to new entrants. This complexity spans cutting-edge aerospace engineering, sophisticated battery technology, and advanced autonomous flight systems. Archer Aviation, for instance, has invested heavily in developing proprietary technologies and securing intellectual property, creating a steep learning curve and high upfront investment for any potential competitor aiming to match their capabilities.

Infrastructure Development and Partnerships

Building a comprehensive urban air mobility (UAM) ecosystem is a substantial hurdle for new entrants. This includes not only the aircraft themselves but also the critical infrastructure like vertiports, charging stations, and advanced air traffic management systems. For instance, Archer Aviation is actively partnering with companies like United Airlines and Stellantis to develop this necessary infrastructure, highlighting the scale of investment and collaboration required.

Securing the necessary partnerships is a monumental task. New players must forge relationships with city governments for landing rights and zoning, real estate developers for vertiport locations, and established aviation entities for operational integration. Archer Aviation's strategic alliances, such as its deal with United Airlines for up to 100 aircraft, demonstrate the importance of these foundational agreements.

- Infrastructure Needs: UAM requires significant investment in vertiports, charging networks, and air traffic control systems, presenting a high barrier to entry.

- Partnership Complexity: New entrants must navigate complex negotiations with city planners, real estate developers, and established aviation companies to build operational networks.

- Capital Requirements: The combined cost of aircraft development and infrastructure build-out necessitates substantial capital, making it difficult for smaller, unestablished companies to compete.

Brand Building and Public Trust

Building brand recognition and public trust is a significant hurdle for new entrants in the nascent air taxi industry. Established companies like Archer Aviation are investing heavily in demonstrating the safety and viability of their electric vertical takeoff and landing (eVTOL) aircraft through extensive test flights and public showcases. For instance, Archer completed its initial hover testing of its Maker aircraft in 2022 and has continued to progress through its flight test program, aiming for commercial operations by 2025.

This proactive approach to establishing credibility creates a substantial barrier for newcomers. New players must not only develop their technology but also overcome the inherent skepticism associated with a novel transportation system. Archer's partnerships, such as its collaboration with Stellantis for manufacturing, also contribute to its perceived stability and trustworthiness, making it harder for unproven entrants to attract investment and public acceptance.

- Brand Building: Archer's ongoing flight test program and public demonstrations are key to establishing consumer and regulatory confidence.

- Public Trust: Demonstrating safety and reliability is paramount, requiring significant investment in testing and validation.

- Market Acceptance: New entrants face the challenge of gaining public acceptance for air taxi services, a hurdle already being addressed by pioneers.

- Partnerships: Strategic alliances, like Archer's with Stellantis, bolster a company's credibility and operational capacity, creating a higher entry barrier.

The threat of new entrants for Archer Aviation is considerably low due to massive capital requirements, stringent regulatory approvals, and the complex technology involved in eVTOL development. Archer's substantial funding, exceeding $1 billion, and its ongoing progress in FAA certification processes, including rigorous flight testing of its Maker aircraft, highlight the immense investment and time needed to enter this market.

New competitors must also overcome significant hurdles in building out the necessary urban air mobility infrastructure, such as vertiports and charging networks, which Archer is actively developing through strategic partnerships. Furthermore, establishing brand recognition and public trust in a novel transportation sector demands extensive validation and safety demonstrations, areas where Archer is proactively investing.

| Barrier Type | Description | Archer Aviation Example |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and infrastructure. | Raised over $1 billion in liquidity; Stellantis partnership for manufacturing. |

| Regulatory Hurdles | Complex and lengthy certification processes with aviation authorities. | Ongoing FAA type certification process for its aircraft. |

| Technological Complexity | Advanced aerospace engineering, battery tech, and autonomous systems. | Investment in proprietary technologies and intellectual property. |

| Infrastructure Development | Need for vertiports, charging stations, and air traffic management. | Partnerships to develop UAM ecosystem infrastructure. |

| Brand & Trust Building | Establishing credibility and public acceptance for air taxis. | Extensive test flights and public showcases of Maker aircraft. |

Porter's Five Forces Analysis Data Sources

Our Archer Aviation Porter's Five Forces analysis is built upon a foundation of verified data, including SEC filings, investor presentations, and industry-specific market research reports. We also incorporate insights from aviation trade publications and macroeconomic data to provide a comprehensive view of the competitive landscape.