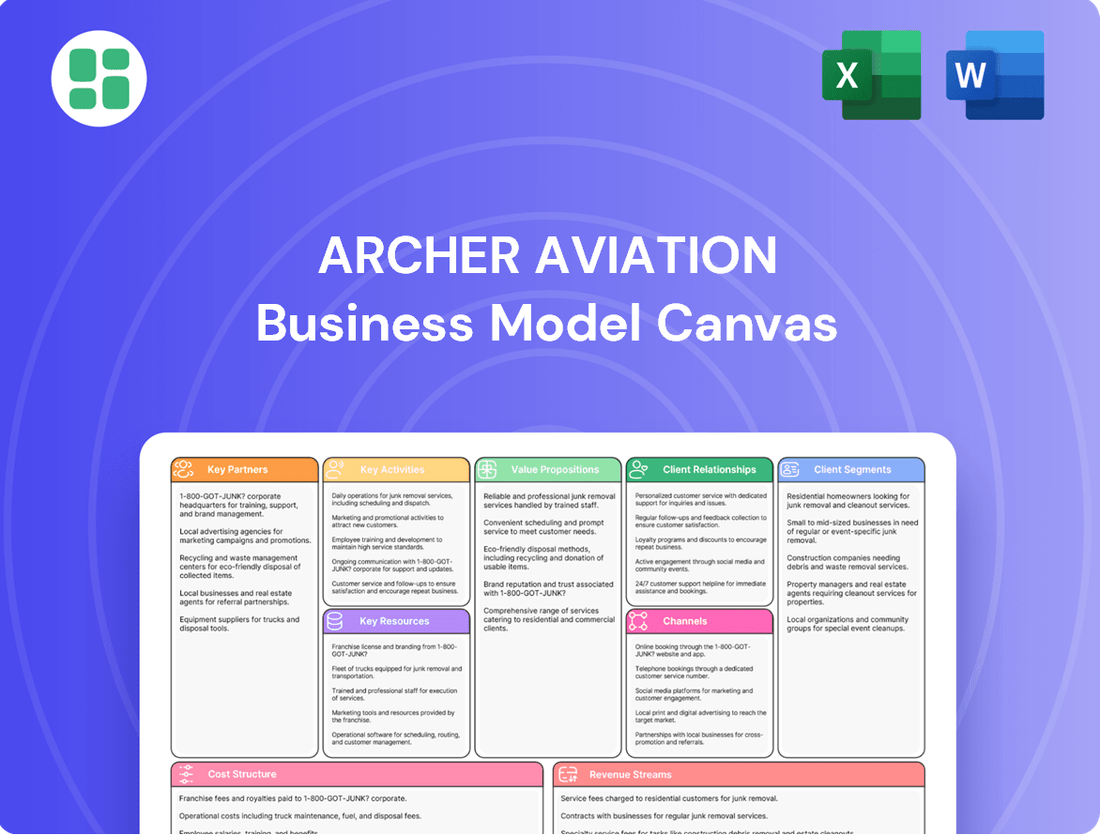

Archer Aviation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archer Aviation Bundle

Unlock the comprehensive strategic blueprint behind Archer Aviation's innovative business model. This detailed Business Model Canvas reveals how they are revolutionizing urban air mobility, from their key partnerships to revenue streams.

Dive deeper into Archer Aviation’s real-world strategy with the complete Business Model Canvas. This downloadable file offers a clear, professionally written snapshot of their value proposition, customer segments, and cost structure, highlighting what makes this company thrive.

Want to see exactly how Archer Aviation operates and scales its business in the burgeoning eVTOL market? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking or strategic planning.

Partnerships

Archer Aviation's strategic manufacturing partnership with Stellantis is a cornerstone of its business model. Stellantis serves as the exclusive contract manufacturer for Archer's Midnight eVTOL aircraft, a crucial role in bringing the aircraft to market at scale.

This collaboration is designed to leverage Stellantis's extensive experience in high-volume automotive manufacturing and its robust supply chain capabilities. By partnering with Stellantis, Archer aims to significantly reduce manufacturing costs and accelerate the scaling of its production process, a vital step for commercial viability.

Stellantis's commitment extends beyond manufacturing expertise, as demonstrated by its substantial investment in Archer. This financial backing, including a $150 million investment announced in 2023, underscores Stellantis's belief in Archer's technology and the burgeoning urban air mobility sector.

Archer Aviation's strategic partnerships with leading airline operators like United Airlines are foundational to its business model. United has not only placed substantial orders for Archer's Midnight aircraft but also acts as a significant long-term investor, underscoring a deep commitment to the nascent eVTOL sector.

These alliances are critical for the rollout of air taxi networks in major urban hubs, including New York City, San Francisco, and Los Angeles, and are expanding globally with agreements in Abu Dhabi, Indonesia, and Ethiopia.

The collaboration with airlines like Abu Dhabi Aviation and Ethiopian Airlines is designed to create a seamless integration of electric vertical takeoff and landing (eVTOL) services with conventional air travel, promising to dramatically reduce overall door-to-door travel times for passengers.

Archer Aviation is strategically expanding into the defense sector via an exclusive partnership with Anduril Industries, creating a new venture called Archer Defense. This collaboration is focused on creating advanced hybrid-propulsion Vertical Take-Off and Landing (VTOL) aircraft tailored for military needs, such as reconnaissance and logistical support missions.

This move into defense is already yielding significant results, with Archer securing substantial contracts from the U.S. Air Force. These contracts, valued at up to $142 million, specifically cover the delivery of Archer's Midnight aircraft, along with comprehensive pilot training and essential maintenance development programs. This diversification represents a key strategic pivot for Archer's business model.

Infrastructure and Vertiport Developers (Atlantic Aviation, Signature Aviation, Skyports/Groupe ADP, Modern Aviation, Air Pegasus, Jetex)

Archer Aviation is forging key partnerships with prominent infrastructure and vertiport developers like Atlantic Aviation, Signature Aviation, Skyports/Groupe ADP, Modern Aviation, Air Pegasus, and Jetex to build its urban air mobility (UAM) network.

These collaborations are crucial for transforming existing aviation assets, such as helipads and airport terminals, into operational vertiports. This involves the development and electrification of these sites to support Archer's electric vertical takeoff and landing (eVTOL) aircraft.

- Infrastructure Development: Partnerships focus on the physical creation and upgrading of vertiports, ensuring they meet the specific requirements for eVTOL operations.

- Electrification: A key aspect involves electrifying these vertiport locations to enable efficient charging of Archer's Midnight aircraft.

- Market Readiness: These collaborations are vital for establishing the necessary takeoff and landing infrastructure, ensuring Archer's air taxi services are operationally ready in target cities.

Technology and Software Providers (Palantir Technologies)

Archer Aviation is forging key partnerships with technology and software providers, notably Palantir Technologies. This collaboration is vital for embedding sophisticated software and artificial intelligence into Archer's electric vertical takeoff and landing (eVTOL) aircraft and broader operational systems.

The integration of Palantir's advanced AI, such as its Foundry platform, is designed to optimize flight operations, manage complex air traffic networks, and enhance overall system safety and efficiency. This strategic alliance is foundational for Archer's vision of scalable and safe urban air mobility.

- Palantir Technologies Partnership: Focuses on AI-driven software for flight operations, network management, and autonomous capabilities.

- Enhanced Efficiency and Safety: Aims to leverage AI for optimized flight paths, predictive maintenance, and secure data handling in eVTOL operations.

- Future-Proofing Technology: This collaboration ensures Archer's systems are built with cutting-edge software, crucial for the evolving landscape of advanced air mobility.

Archer Aviation's key partnerships are central to its strategy for scaling eVTOL production and operations. The collaboration with Stellantis, announced in 2023 with a $150 million investment, positions Stellantis as the exclusive contract manufacturer for Archer's Midnight aircraft, leveraging automotive manufacturing expertise.

Airline partnerships, including United Airlines, are critical for market entry and scaling, with United placing significant orders and investing in Archer. These alliances extend globally, with agreements in Abu Dhabi, Indonesia, and Ethiopia to establish air taxi networks.

Diversification into the defense sector through Archer Defense, a partnership with Anduril Industries, aims to develop VTOL aircraft for military applications, evidenced by up to $142 million in U.S. Air Force contracts for Midnight aircraft and training.

Infrastructure development is supported by partnerships with vertiport developers like Atlantic Aviation and Signature Aviation, focusing on electrifying and upgrading sites for eVTOL operations.

Technology integration, particularly with Palantir Technologies, is vital for optimizing flight operations and safety through AI-driven software solutions.

| Partner | Role | Key Contribution/Investment |

|---|---|---|

| Stellantis | Exclusive Contract Manufacturer | $150 million investment (2023); Automotive manufacturing expertise |

| United Airlines | Airline Operator & Investor | Significant aircraft orders; Long-term investor |

| Anduril Industries | Defense Sector Partner (Archer Defense) | Development of military VTOL aircraft; U.S. Air Force contracts (up to $142 million) |

| Atlantic Aviation, Signature Aviation, etc. | Vertiport Developers | Infrastructure development and electrification for eVTOL operations |

| Palantir Technologies | Technology & Software Provider | AI-driven software for flight operations and network management |

What is included in the product

Archer Aviation's business model focuses on developing and operating electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility, targeting both commercial passenger transport and cargo delivery services.

This model emphasizes a vertically integrated approach, encompassing aircraft design, manufacturing, and the creation of a proprietary charging and maintenance infrastructure to support its future airline operations.

Archer Aviation's Business Model Canvas offers a clear, one-page snapshot that quickly identifies how their electric vertical takeoff and landing (eVTOL) aircraft will alleviate urban congestion and reduce travel times.

This concise format allows for rapid understanding and comparison of Archer's strategy, highlighting how their innovative approach tackles the pain points of inefficient urban mobility.

Activities

Archer Aviation's primary focus is the ongoing research, design, and development of its electric vertical takeoff and landing (eVTOL) aircraft, specifically the Midnight model. This intensive process involves refining aircraft performance, enhancing safety systems, and improving sustainability to align with rigorous aviation regulations and the burgeoning urban air mobility market.

The company is actively working on advancing its eVTOL technology. For instance, as of early 2024, Archer has made significant strides in its flight test program for the Midnight aircraft, aiming to validate its design and operational capabilities. This development is crucial for achieving type certification, a key hurdle for commercial eVTOL operations.

A core activity for Archer Aviation is the manufacturing of its Midnight electric vertical takeoff and landing (eVTOL) aircraft. The company is focused on rapidly scaling production to meet anticipated demand.

Archer is establishing a substantial manufacturing facility in Georgia, a project bolstered by the significant involvement of Stellantis. This facility is designed for high-volume output, with ambitious targets of producing up to 650 aircraft annually by the year 2030.

To achieve these long-term production goals, Archer plans to deliver approximately 10 Midnight aircraft in 2025. These initial units will be crucial for ongoing testing and the commencement of initial deployment phases.

A core activity for Archer Aviation is securing certifications from aviation regulators, primarily the Federal Aviation Administration (FAA). This involves a rigorous process to ensure the safety and airworthiness of their aircraft and operations.

Key certifications include Part 135 Air Carrier, Part 141 Pilot Training, and Part 145 Repair Station certificates. These are essential for launching commercial passenger services and maintaining the aircraft fleet.

The company is heavily focused on achieving Type Certification for its Midnight aircraft, with a target expected by late 2025. This milestone is critical for commercial viability and represents a significant regulatory hurdle.

Urban Air Mobility Network Planning and Establishment

Archer Aviation is actively engaged in the strategic planning and physical establishment of urban air mobility (UAM) networks. This crucial activity underpins their business model by creating the necessary infrastructure and operational framework for their electric vertical takeoff and landing (eVTOL) aircraft.

The company is focusing on key metropolitan areas worldwide, including major US cities like New York, Los Angeles, and San Francisco, alongside international hubs such as Abu Dhabi. This targeted approach aims to build a robust foundation for scalable UAM operations.

Key components of this network development include:

- Vertiport Identification and Development: Archer collaborates with city planners and real estate partners to secure optimal locations for vertiports, the landing and takeoff sites for their aircraft.

- Operational Protocol Creation: The company is defining safety standards, air traffic management integration, and customer service protocols to ensure seamless and efficient air taxi services.

- Ecosystem Integration: Archer works to integrate its UAM services into existing urban transportation networks, offering passengers convenient connections and a viable alternative to ground travel.

- Market Expansion Strategy: By establishing these initial networks, Archer is laying the groundwork for future expansion into additional domestic and international markets, aiming to solidify its position as a leader in the UAM sector.

Pilot Training and Operations

Archer Aviation's key activities include developing a skilled workforce through comprehensive pilot training programs. This focus is critical for the safe and efficient operation of their electric vertical takeoff and landing (eVTOL) aircraft. By establishing robust training protocols, Archer aims to ensure a consistent supply of qualified pilots ready for commercial deployment.

A significant milestone for Archer was receiving Part 141 certification from the Federal Aviation Administration (FAA) for its pilot training program. This certification is a vital step, validating the quality and structure of their training curriculum and paving the way for future commercial operations. It signifies Archer's commitment to regulatory compliance and operational readiness.

- Archer's pilot training program is FAA Part 141 certified.

- This certification is essential for commercial eVTOL operations.

- The activity focuses on creating a pipeline of skilled eVTOL pilots.

Archer Aviation's key activities center on the design, development, and manufacturing of its Midnight eVTOL aircraft, aiming for commercial launch. This includes rigorous testing and securing crucial aviation certifications from bodies like the FAA, such as type certification expected by late 2025. The company is also actively building urban air mobility networks in key cities, identifying vertiport locations and establishing operational protocols.

Furthermore, Archer is investing heavily in pilot training, having achieved FAA Part 141 certification for its program. This ensures a pipeline of qualified pilots for future operations. The company's manufacturing expansion in Georgia is a critical activity, with a goal of producing up to 650 aircraft annually by 2030, and plans to deliver around 10 Midnight aircraft in 2025.

| Key Activity | Description | Status/Target |

|---|---|---|

| eVTOL Development | Design, testing, and refinement of the Midnight eVTOL aircraft. | Ongoing flight tests, targeting late 2025 for Type Certification. |

| Manufacturing Scale-up | Building production capacity for eVTOL aircraft. | Georgia facility under development, aiming for 650 aircraft/year by 2030; 10 aircraft planned for 2025 delivery. |

| Regulatory Certification | Obtaining necessary approvals from aviation authorities (e.g., FAA). | Pursuing Part 135, 141, 145 certificates and Type Certification. |

| UAM Network Establishment | Planning and developing infrastructure for air taxi services. | Focus on key cities like New York, Los Angeles, San Francisco; identifying vertiports and operational frameworks. |

| Pilot Training | Developing and certifying pilot training programs. | FAA Part 141 certified program; crucial for operational readiness. |

Full Document Unlocks After Purchase

Business Model Canvas

The Archer Aviation Business Model Canvas preview you're viewing is the identical document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is complete, you'll gain full access to this same professionally structured and formatted Business Model Canvas.

Resources

Archer's Midnight eVTOL aircraft represents its core intellectual property, featuring a unique design, advanced electric powertrain, and robust safety systems. This technology enables efficient vertical takeoffs and landings, crucial for urban environments.

The Midnight aircraft is engineered for quiet operation and zero emissions, aligning with sustainability goals for urban air mobility. This technological foundation is key to Archer's business model, offering a cleaner alternative to traditional transport.

As of late 2024, Archer has successfully completed several key flight tests with its Maker demonstrator aircraft, a precursor to Midnight, showcasing its capabilities and further validating its technology. The company also secured significant funding rounds throughout 2024, demonstrating investor confidence in its proprietary eVTOL technology.

Archer Aviation's manufacturing capabilities are anchored by its substantial facility in Covington, Georgia. This site is specifically engineered for high-volume production, with the capacity to manufacture hundreds of aircraft each year.

Further bolstering its production infrastructure, Archer recently acquired an advanced composites manufacturing facility located in Long Beach, California. This strategic move significantly enhances its ability to implement cost-reduction strategies and develop new aircraft models.

Archer Aviation relies heavily on its highly specialized team of engineers, aerospace experts, and aviation professionals. This skilled workforce is the bedrock for designing, developing, and testing their innovative eVTOL aircraft.

The expertise of these individuals is crucial for navigating the complex process of aircraft certification and ensuring the safe, efficient operation of air taxi services. Their knowledge directly impacts Archer's ability to bring its vision to market.

As of early 2024, Archer reported having over 500 employees, with a significant portion dedicated to engineering and technical roles, underscoring the company's commitment to building a robust talent pool for advanced aerospace development.

Strategic Partnerships and Investor Capital

Archer Aviation's strategic partnerships and investor capital are vital. Financial and strategic backing from major players like Stellantis, United Airlines, and other institutional investors provides not only substantial capital but also invaluable manufacturing expertise. This collaborative approach is essential for scaling production and navigating complex industry challenges.

Archer has consistently maintained a strong liquidity position, a critical factor for funding its ambitious growth plans. As of the first quarter of 2024, the company reported approximately $620 million in cash and cash equivalents, underscoring its ability to finance extensive research and development, navigate the rigorous certification processes, and support its production ramp-up.

- Stellantis Investment: In 2023, Stellantis invested $150 million in Archer, with an additional $50 million committed.

- United Airlines Order: United Airlines has placed an order for up to 200 of Archer's Midnight aircraft, with an initial deposit.

- Other Investors: Archer has secured capital from a diverse range of investors, including ARK Invest, Fidelity Management & Research Company, and Mubadala Capital.

- Liquidity Position: The company's robust cash reserves provide runway for key development milestones in 2024 and beyond.

Regulatory Certifications and Approvals

Regulatory certifications are critical for Archer Aviation's business model. Achieving the FAA Part 135 Air Carrier and Part 141 Pilot Training Certificates are not just bureaucratic steps; they are foundational for launching commercial air taxi operations. These approvals signal to the public and regulatory bodies that Archer meets stringent safety and operational standards.

These certifications are invaluable intangible assets that build trust and enable Archer to legally operate its services. As of early 2024, Archer was actively working towards these approvals, which are essential for scaling its business and demonstrating its readiness for commercial deployment.

- FAA Part 135 Air Carrier Certification: Essential for operating commercial passenger flights.

- FAA Part 141 Pilot Training Certificate: Necessary for establishing and running pilot training programs.

- Building Public Trust: Regulatory approvals are key to public acceptance of eVTOL technology.

- Operational Readiness: These certifications confirm Archer's capability to safely conduct commercial air taxi services.

Archer's proprietary eVTOL technology, epitomized by the Midnight aircraft, forms the core of its intellectual property. This includes its unique design, advanced electric propulsion system, and safety features, all crucial for urban air mobility. The company's commitment to quiet, zero-emission flights further solidifies its technological advantage.

Archer's manufacturing prowess is centered in its Covington, Georgia facility, designed for high-volume production, and enhanced by its recent acquisition of an advanced composites plant in Long Beach, California. These facilities are key to scaling operations and implementing cost efficiencies.

The company's skilled workforce, comprising over 500 employees as of early 2024, with a strong emphasis on engineering talent, is fundamental to its innovation and certification efforts. This human capital is essential for navigating the complexities of aerospace development and regulatory approval.

Archer's strategic partnerships, notably with Stellantis and United Airlines, coupled with substantial investor capital, provide critical financial and operational support. As of Q1 2024, Archer reported approximately $620 million in cash and cash equivalents, ensuring runway for development and production.

| Key Resource | Description | Significance | 2024 Data Point |

|---|---|---|---|

| Proprietary eVTOL Technology | Midnight aircraft design, electric powertrain, safety systems | Enables efficient, quiet, zero-emission urban air mobility | Successful flight tests of Maker demonstrator |

| Manufacturing Facilities | Covington, GA & Long Beach, CA facilities | Supports high-volume production and cost reduction | Acquisition of advanced composites plant |

| Skilled Workforce | Engineers, aerospace experts, aviation professionals | Drives innovation, development, and certification | Over 500 employees in early 2024, with focus on engineering |

| Strategic Partnerships & Capital | Stellantis, United Airlines, investor funding | Provides capital, manufacturing expertise, and market access | $620 million cash and equivalents as of Q1 2024 |

Value Propositions

Archer Aviation's electric vertical takeoff and landing (eVTOL) aircraft offer a dramatic reduction in travel times, turning lengthy ground commutes into swift aerial journeys. Imagine transforming a frustrating one-to-two-hour drive into a mere 5-15 minute flight.

This value proposition is especially potent for airport connectivity, bridging city centers and terminals far more efficiently than cars stuck in traffic. Archer's service bypasses congestion entirely, delivering unparalleled convenience and saving valuable time for passengers.

Archer Aviation's Midnight eVTOL aircraft are designed for sustainable urban travel, being fully electric. This means zero operational emissions, directly addressing environmental concerns and contributing to cleaner air in cities.

The aircraft are also engineered for significantly reduced noise compared to conventional helicopters. This quiet operation is a key benefit for urban environments, minimizing noise pollution and enhancing the passenger experience.

By offering a greener and quieter alternative, Archer Aviation's value proposition directly appeals to cities and commuters prioritizing environmental responsibility and improved urban living conditions.

Archer Aviation's commitment to enhanced safety and reliability is a cornerstone of its business model, aiming to instill confidence in the nascent urban air mobility sector. The company's aircraft are engineered with multiple redundant systems, featuring multiple engines and propellers, designed to meet safety standards akin to those of commercial aviation. This focus is paramount for gaining regulatory approval and fostering public acceptance.

Premium Door-to-Door Travel Experience

Archer Aviation's premium door-to-door travel experience focuses on creating a seamless, high-quality journey that enhances existing air travel. This service is designed to significantly cut down overall travel times from origin to destination, offering unparalleled convenience and efficiency.

This premium positioning targets customers who value speed and are willing to invest in a superior travel solution. For instance, in 2024, the demand for expedited travel options continues to grow, with many consumers prioritizing time savings over cost, especially for business or time-sensitive personal trips.

- Seamless Integration: The service is built to complement, not replace, traditional air travel, offering a smooth transition from ground to air and back.

- Time Efficiency: By focusing on reducing door-to-door journey times, Archer aims to reclaim valuable hours for its passengers.

- Premium Offering: The emphasis is on a high-quality, comfortable, and efficient experience, justifying a premium price point.

- Target Market: Initially, the service will appeal to individuals and businesses for whom time is a critical factor and who can afford the associated costs.

Diversified Defense Capabilities

For the defense sector, Archer provides adaptable, budget-friendly, and quiet Vertical Take-Off and Landing (VTOL) aircraft. These are crucial for military operations, offering a significant upgrade over traditional methods.

Archer’s hybrid-propulsion aircraft are engineered for diverse military needs, including transporting supplies, conducting surveillance, and enabling swift troop movements. This technology presents a revolutionary approach to military aviation.

- Scalable Solutions: Archer's eVTOL aircraft can be scaled to meet various defense requirements, from small reconnaissance missions to larger cargo transport.

- Cost-Effectiveness: The operational costs of Archer's electric propulsion systems are projected to be significantly lower than traditional jet fuel-powered military aircraft.

- Low Noise Signature: The reduced noise profile of Archer's aircraft offers a tactical advantage for stealth operations and minimizes environmental impact.

- Transformative Military Applications: These capabilities are designed to revolutionize logistics, reconnaissance, and rapid deployment strategies for armed forces.

Archer Aviation's eVTOL aircraft offer drastically reduced travel times, transforming hours of ground travel into minutes of flight. This is particularly impactful for airport connectivity, bypassing urban congestion entirely. In 2024, urban air mobility is gaining traction, with companies like Archer focusing on efficient, time-saving solutions for commuters and businesses.

Customer Relationships

Archer Aviation cultivates strategic partnerships and joint ventures, notably with United Airlines and Stellantis. These aren't just transactional; they involve deep collaboration, investment, and shared development to advance urban air mobility.

For instance, United Airlines’ investment in Archer, announced in 2021 with a $1 billion order for 100 aircraft, underscores this collaborative approach. Stellantis’ commitment, including a significant investment and manufacturing collaboration, further solidifies Archer’s strategic alignment with major automotive players.

Archer Aviation's relationships with government entities, particularly the U.S. Department of Defense (DoD) and the Federal Aviation Administration (FAA), are foundational to its business model. These partnerships are crucial for navigating the complex regulatory landscape and unlocking significant defense sector opportunities.

Close collaboration with the DoD focuses on developing and certifying military applications for Archer's electric vertical takeoff and landing (eVTOL) aircraft. This includes joint efforts in flight testing and data sharing, which are vital for demonstrating the technology's capabilities and ensuring its suitability for defense missions. Archer's agreement with the U.S. Air Force, for instance, highlights this commitment to defense integration.

Working with the FAA is paramount for achieving type certification, the official approval required for commercial operation of aircraft. Archer's ongoing engagement ensures its eVTOL designs meet stringent safety standards, paving the way for both civilian and potential military deployment. This regulatory alignment is a key enabler for market entry and scaling operations.

Archer Aviation actively cultivates relationships with key early adopters through its 'Launch Edition' programs. A prime example is their collaboration with Abu Dhabi Aviation, which serves as a critical partner for testing and refining commercial deployment strategies before full certification.

These initiatives are designed to establish comprehensive playbooks for future operations, allowing Archer to build essential operational expertise. This early engagement also provides a pathway for generating initial revenue streams, demonstrating the commercial viability of their electric vertical takeoff and landing (eVTOL) aircraft.

Direct Engagement with Operators and Infrastructure Partners

Archer actively cultivates direct relationships with key players in the nascent air taxi ecosystem, including future operators and vital infrastructure partners. This proactive approach is crucial for building the necessary ground support systems. For instance, Archer has partnered with Atlantic Aviation and Jetex, prominent fixed-base operators (FBOs), to develop and electrify vertiport facilities. This collaboration ensures that the physical infrastructure needed to launch and sustain its air taxi network is being established in parallel with aircraft development.

These partnerships are foundational to Archer's go-to-market strategy, guaranteeing that when their aircraft are ready, the operational environment will also be prepared. By working hand-in-hand with infrastructure providers, Archer can influence the design and capabilities of vertiports, optimizing them for electric vertical takeoff and landing (eVTOL) operations. This direct engagement mitigates risks associated with infrastructure availability and readiness, a critical factor for any new transportation system.

- Direct Collaboration: Archer works directly with companies like Atlantic Aviation and Jetex to plan and build vertiport infrastructure.

- Infrastructure Electrification: The focus is on electrifying these vertiports to support Archer's electric aircraft.

- Ecosystem Development: These partnerships are key to building the complete air taxi ecosystem, not just the aircraft.

- Operational Readiness: Ensuring ground infrastructure is ready is vital for the successful launch and scaling of air taxi services.

Investor Relations and Transparency

Archer Aviation prioritizes robust investor relations, recognizing its importance for a pre-revenue company. They actively engage with a broad base of investors, understanding that sustained confidence is key to their growth trajectory.

- Investor Engagement: Archer Aviation provides regular financial updates and shareholder letters, ensuring investors are well-informed about the company's progress and strategic direction.

- Transparency Efforts: Participation in investor conferences and roadshows is a core component of Archer's strategy to maintain transparency and foster trust with its financial stakeholders.

- Confidence Building: By consistently communicating its long-term vision and financial health, Archer aims to sustain investor confidence, which is vital for securing future funding rounds.

- 2024 Focus: Throughout 2024, Archer has emphasized clear communication regarding its manufacturing progress and certification milestones, directly addressing investor queries and concerns.

Archer Aviation fosters deep relationships with strategic partners like United Airlines and Stellantis, involving significant investment and collaborative development to advance urban air mobility. These alliances are critical for scaling production and market penetration. The company also prioritizes direct engagement with future operators and infrastructure providers, such as Atlantic Aviation and Jetex, to build out the necessary vertiport network for its electric vertical takeoff and landing (eVTOL) aircraft.

Channels

Archer Aviation's direct sales channel focuses on providing its Midnight eVTOL aircraft to commercial airline partners and other air mobility operators worldwide. This approach is designed to secure substantial fleet orders, representing a core revenue driver for the company.

A prime example of this strategy is the significant order placed by United Airlines, highlighting the potential for large-scale fleet acquisitions. These direct sales are crucial for Archer's business model, enabling them to scale production and meet the growing demand for advanced air mobility solutions.

Archer plans to establish and manage its own air taxi network, branded as Archer Air, within major urban centers. This direct operational approach gives Archer complete oversight of the entire customer journey, from booking to arrival, ensuring a consistent and high-quality experience. This strategy aims to generate recurring service revenue, which will be a significant addition to their aircraft manufacturing business.

By controlling the operational side, Archer can directly capture revenue from passenger fares, enhancing profitability beyond just aircraft sales. This integrated model is crucial for building a robust and scalable air mobility ecosystem. Archer's focus on key metropolitan areas means they are targeting high-demand routes where the convenience of air taxi services will be most valued.

Archer Aviation secures defense contracts directly with government bodies such as the U.S. Department of Defense and the U.S. Air Force. These agreements focus on providing specialized electric vertical takeoff and landing (eVTOL) aircraft tailored for military operational needs, including development, delivery, and ongoing support.

This direct sales channel allows Archer to leverage its eVTOL technology for critical defense applications, potentially involving significant procurement orders. For instance, Archer has received substantial funding and commitments, including a $142 million contract from the U.S. Air Force as part of its Agility Prime program, underscoring the government's interest in this advanced aerial mobility solution for defense purposes.

Vertiport Infrastructure Partnerships

Archer Aviation actively forms strategic alliances with established aviation infrastructure players and dedicated vertiport developers. These partnerships are crucial for securing the necessary physical locations for their electric vertical takeoff and landing (eVTOL) aircraft to operate. By collaborating, Archer gains access to existing airport facilities and new vertiport sites, building out the essential network for urban air mobility.

These collaborations are fundamental to Archer's strategy, enabling the rapid deployment of its air taxi services within metropolitan areas. For instance, in 2024, Archer announced a significant partnership with United Airlines, which included plans to develop vertiports in key markets. This type of agreement allows Archer to leverage established aviation expertise and infrastructure, streamlining the process of creating a functional air taxi ecosystem.

- Key Partnerships: Archer collaborates with existing airport operators and specialized vertiport developers to establish operational sites.

- Network Expansion: These alliances facilitate the creation of the physical takeoff and landing infrastructure required for air taxi services in urban settings.

- Strategic Advantage: Partnering with infrastructure providers allows Archer to accelerate the build-out of its network and reduce upfront capital expenditure on real estate development.

Digital Platforms and Booking Systems

Once Archer Aviation begins commercial operations, passengers will likely book their journeys through intuitive digital platforms. These systems could be standalone Archer apps or seamlessly integrated into existing travel or ride-sharing applications, offering unparalleled convenience for booking.

This digital-first approach is crucial for customer acquisition and ease of use, streamlining the entire process from initial search to final confirmation. For instance, if Archer partners with a major ride-sharing service, it could tap into millions of existing users, significantly accelerating market penetration.

- Digital Booking Channels: Passengers will book flights via Archer's proprietary app or integrated third-party platforms.

- Ease of Access: The system aims to provide a user-friendly experience, similar to booking a taxi or airline ticket.

- Potential Partnerships: Integration with existing ride-sharing or airline apps could leverage vast user bases.

- Customer Convenience: Digital booking simplifies the entire passenger journey, from discovery to payment.

Archer Aviation's channel strategy encompasses direct sales of its Midnight eVTOL aircraft to operators, alongside establishing and operating its own air taxi service. Additionally, the company pursues defense contracts and forms strategic partnerships for vertiport infrastructure. Digital booking platforms will facilitate passenger access.

| Channel Type | Description | Key Partnerships/Examples | Revenue Stream |

| Direct Aircraft Sales | Selling Midnight eVTOL aircraft to commercial airlines and air mobility operators. | United Airlines (significant fleet order) | Aircraft Manufacturing Revenue |

| Owned Air Taxi Operations | Operating Archer Air service in urban centers. | Internal Operations | Passenger Fare Revenue |

| Defense Contracts | Supplying eVTOL aircraft for military applications. | U.S. Air Force ($142 million Agility Prime contract) | Defense Procurement Revenue |

| Infrastructure Partnerships | Collaborating with vertiport developers and airport operators. | United Airlines (vertiport development) | Network Access & Scalability |

| Digital Booking | Passenger booking via proprietary app or integrated third-party platforms. | Potential ride-sharing app integrations | Passenger Service Revenue |

Customer Segments

Premium Business and Leisure Travelers represent a key customer segment for Urban Air Mobility (UAM) services. These individuals, often affluent, prioritize efficiency and are willing to pay a premium for significant time savings and a more comfortable, less stressful travel experience, especially when navigating congested urban environments. For example, a typical airport transfer in a major city can take over an hour by car, whereas UAM could reduce this to under 15 minutes.

This segment values the ability to bypass ground traffic, making them ideal candidates for services like airport shuttles or quick inter-city hops. Their demand is driven by the need to maximize productivity or leisure time, viewing UAM as a direct solution to the inefficiencies of traditional transportation. By 2024, the global business travel market alone was valued in the hundreds of billions, indicating a substantial pool of potential UAM users seeking faster transit options.

Major airlines and emerging air mobility operators are key customers for Archer Aviation. These companies, like United Airlines which has placed a substantial order for Archer's Midnight aircraft, are looking to integrate electric vertical takeoff and landing (eVTOL) services into their existing routes or establish entirely new urban air taxi networks. For instance, United has committed to purchasing up to 200 Midnight aircraft, signaling strong demand for this innovative transport solution.

These customers acquire Archer's aircraft primarily to broaden their service portfolios and improve the overall passenger experience. By offering eVTOL flights, they can provide faster, more convenient travel options, particularly in congested urban environments. This strategic move allows them to tap into new markets and differentiate themselves in the evolving transportation landscape.

The U.S. Department of Defense and its various military branches are a key customer segment for Archer Aviation's eVTOL technology. They are actively seeking innovative vertical lift solutions that offer enhanced capabilities for logistics, intelligence, surveillance, and reconnaissance (ISR) missions. The military's interest stems from the potential for these aircraft to provide cost-effective and discreet aerial support in challenging operational environments.

In 2024, the U.S. military continued to invest heavily in advanced aerial mobility technologies, with a significant portion of defense budgets allocated to modernizing platforms and exploring new capabilities. Archer's eVTOLs align with this strategic push for agility and reduced logistical footprints, potentially offering a more sustainable and efficient alternative to traditional rotorcraft for certain missions.

International Governments and Aviation Authorities

International governments and aviation authorities represent a crucial customer segment for Archer Aviation. These entities are actively exploring and seeking to implement advanced air mobility (AAM) solutions to modernize their transportation networks and improve urban connectivity. Archer works closely with these bodies to ensure its aircraft and operational plans meet stringent regulatory requirements, facilitating market entry and the eventual deployment of air taxi services.

Archer's engagement with these governmental and aviation bodies is vital for several reasons:

- Regulatory Approval and Certification: Gaining type certification for its Midnight aircraft from aviation regulators like the FAA is paramount. As of mid-2024, Archer is progressing through its certification program, aiming for type certification by late 2024 or early 2025. This process is a collaborative effort with aviation authorities worldwide.

- Market Access and Policy Development: Archer partners with governments to shape policies that support the safe and efficient integration of AAM into existing airspace and urban environments. This includes establishing operational frameworks and safety standards.

- Infrastructure Planning and Support: Many governments are investing in vertiport infrastructure as part of broader smart city and sustainable transportation initiatives. Archer's technology is a key component in these plans, with potential government backing for deployment.

- Strategic Partnerships for National Deployment: Archer seeks partnerships with international governments looking to establish national AAM programs, leveraging Archer's technology for public transport, emergency services, or defense applications. For instance, discussions are ongoing with several countries in Europe and Asia interested in early AAM adoption.

Infrastructure and Real Estate Developers

Infrastructure and Real Estate Developers are key customers for Archer Aviation, particularly for its charging solutions. These companies are crucial for building out the physical network required for electric vertical takeoff and landing (eVTOL) aircraft operations. By 2024, the demand for advanced charging infrastructure is expected to surge as the eVTOL industry matures.

These developers, including Fixed-Base Operators (FBOs) and real estate firms with suitable properties, represent a significant market. They are not just buyers of Archer's charging technology but also essential partners in establishing vertiports. For instance, a firm developing a new urban mobility hub would integrate Archer's charging systems as a core component.

- Vertiport Development: Real estate developers are actively seeking opportunities to build vertiports in strategic urban and suburban locations.

- Charging Infrastructure Demand: The growth of eVTOLs directly drives demand for advanced, high-power charging solutions that Archer provides.

- Partnership Opportunities: Archer collaborates with these entities to ensure seamless integration of charging capabilities into new or existing infrastructure projects.

- Market Growth: The global vertiport market is projected to reach billions of dollars by the late 2020s, highlighting the scale of this customer segment.

Archer Aviation's customer segments are diverse, encompassing both direct users of its air mobility services and entities that facilitate or integrate these services. This includes premium travelers seeking efficient urban transit, major airlines and air mobility operators looking to expand their offerings, and government entities, particularly the U.S. Department of Defense, exploring advanced aerial capabilities.

Furthermore, infrastructure developers and real estate firms are crucial partners, essential for building the necessary vertiport and charging networks. These segments collectively represent the market demand and operational backbone for Archer's electric vertical takeoff and landing (eVTOL) aircraft.

The company's strategy involves catering to these varied needs, from providing a premium travel experience to supporting large-scale fleet operations and infrastructure development, all aimed at establishing a robust urban air mobility ecosystem.

| Customer Segment | Key Needs/Drivers | Archer's Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|

| Premium Travelers | Time savings, comfort, stress reduction | Faster, more convenient urban transit | Global business travel market valued in hundreds of billions |

| Airlines/Air Mobility Operators | Fleet expansion, new service offerings | Innovative eVTOL aircraft (e.g., Midnight) for new routes | United Airlines order for up to 200 Midnight aircraft |

| U.S. Department of Defense | Advanced vertical lift, logistics, ISR | Cost-effective, discreet aerial support | Continued significant investment in advanced aerial mobility |

| Governments/Aviation Authorities | Modernized transport, regulatory frameworks | Collaboration on certification and policy development | FAA type certification progress for Midnight aircraft |

| Infrastructure/Real Estate Developers | Charging solutions, vertiport development | Integration of advanced charging systems | Global vertiport market projected to reach billions by late 2020s |

Cost Structure

Archer Aviation's cost structure heavily features Research and Development (R&D) expenses. This is essential for advancing their electric Vertical Take-Off and Landing (eVTOL) aircraft technology, encompassing everything from aerodynamic design and battery systems to advanced flight control software.

As a company not yet generating revenue from aircraft sales, substantial R&D investment is a cornerstone of their strategy. This commitment fuels the innovation necessary to bring their eVTOLs to market and, critically, to achieve the stringent regulatory certifications required for commercial operation.

For instance, in the first quarter of 2024, Archer reported R&D expenses of $77.1 million. This figure underscores the significant capital allocation required to develop and certify their Midnight aircraft, a key component of their business model.

Archer Aviation's manufacturing and production costs are significant, encompassing raw materials like advanced composites, the procurement of specialized components, and the intricate processes of its assembly line operations. Labor at their manufacturing facilities also contributes a substantial portion to these expenses.

The company's ambition to scale production to hundreds of aircraft annually necessitates considerable capital expenditure. For instance, in 2023, Archer continued to invest heavily in its advanced manufacturing facility in Covington, Georgia, a key step towards achieving high-volume production.

Archer Aviation faces significant expenses in its certification and regulatory compliance efforts with aviation authorities like the FAA. This involves meticulous flight testing, extensive documentation, and rigorous compliance verification, all crucial for bringing a new aircraft type to market.

The certification process is a substantial financial undertaking. For instance, the FAA's Part 23 certification for small aircraft, which Archer's eVTOLs will likely fall under, can cost millions of dollars in testing and validation alone, with the overall process potentially extending over several years.

Operational and Infrastructure Development Costs

Archer Aviation's cost structure heavily features significant investments in operational and infrastructure development to establish its urban air mobility (UAM) network. This includes the substantial capital required for building and equipping vertiports, which are essential landing and charging stations for their electric vertical takeoff and landing (eVTOL) aircraft.

Beyond vertiports, costs extend to the development and implementation of advanced charging infrastructure, ensuring efficient power-up for the eVTOL fleet. Furthermore, setting up sophisticated airspace management systems is crucial for safe and coordinated operations in urban environments. The initial phase also necessitates significant expenditure on hiring and training specialized operational staff, from pilots to ground crew and maintenance technicians.

- Vertiport Development: Costs associated with land acquisition, construction, and integration of charging and passenger facilities.

- Charging Infrastructure: Investment in high-power charging stations and grid integration to support rapid eVTOL turnaround.

- Airspace Management Systems: Development and deployment of technology for safe, efficient, and automated air traffic control in UAM corridors.

- Initial Operational Staff: Expenses for recruiting, training, and compensating pilots, maintenance personnel, and operational support teams.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are crucial for Archer Aviation's operations. These encompass overhead costs like employee salaries, marketing initiatives, legal counsel, and the general administrative functions required to keep the company running smoothly.

As Archer moves towards commercialization and expands its market presence, these SG&A expenses are projected to increase. For instance, in 2024, the company was focused on building out its team and infrastructure to support its ambitious growth plans.

- Personnel Costs: Salaries and benefits for administrative, sales, and support staff are a significant component.

- Marketing and Sales: Investments in brand building, customer acquisition, and sales channel development are essential for market penetration.

- General and Administrative: This includes rent, utilities, IT infrastructure, and professional services like legal and accounting.

- Scaling Impact: As Archer scales operations and prepares for aircraft certification and initial deliveries, these costs will naturally rise to support expanded activities.

Archer Aviation's cost structure is dominated by substantial Research and Development (R&D) investments, essential for advancing its eVTOL technology and achieving regulatory certification. Manufacturing and production costs are also significant, reflecting the complexity of building advanced aircraft and scaling production. Additionally, the company incurs substantial expenses for certification and regulatory compliance, as well as for developing the necessary operational infrastructure, including vertiports and charging stations. Finally, Sales, General, and Administrative (SG&A) expenses support the company's overall operations and growth initiatives.

| Cost Category | Key Components | 2023/Q1 2024 Data Points |

|---|---|---|

| Research & Development | Aircraft design, battery systems, flight software | $77.1 million (Q1 2024 R&D expenses) |

| Manufacturing & Production | Advanced materials, specialized components, labor, facility investment | Continued investment in Covington, Georgia facility (2023) |

| Certification & Regulatory | Flight testing, documentation, compliance verification | Millions of dollars for FAA Part 23 certification |

| Operational Infrastructure | Vertiport development, charging infrastructure, airspace management, staff training | Capital expenditure for building UAM networks |

| SG&A | Personnel costs, marketing, legal, administrative overhead | Increased focus on team and infrastructure expansion (2024) |

Revenue Streams

Archer Aviation's primary future revenue stream is the direct sale of its Midnight eVTOL aircraft. These sales are targeted towards commercial airline partners and other air mobility operators looking to build out their fleets.

These are expected to be substantial, high-volume orders as companies invest in establishing or expanding their air taxi services. Archer has secured significant pre-order commitments, including a notable order for up to 100 aircraft from United Airlines.

Archer Aviation's primary revenue stream once operational will be from its air taxi services, essentially charging passengers fares for convenient flights within urban areas and to airports. This represents a direct, recurring service revenue from the end consumer.

These fares will be structured for short, efficient journeys, making urban travel quicker than traditional ground transportation. For instance, in 2024, the nascent air taxi industry is seeing fare estimates that reflect the premium nature of this service, with projections for some routes falling in the range of $150-$250 per passenger for a typical inter-city hop.

Archer Aviation secures substantial revenue through contracts with the U.S. Department of Defense and other government entities. These agreements focus on the development, production, and ongoing support of their electric vertical takeoff and landing (eVTOL) aircraft, specifically tailored for military use cases.

These government contracts are crucial, providing significant financial backing for Archer's research and development initiatives and early-stage manufacturing efforts. For instance, in 2024, Archer announced a contract with the U.S. Air Force for an additional $5 million, building on previous awards.

Strategic Partnership Payments and Milestones

Archer Aviation's strategic partnership payments are crucial for its pre-revenue phase. These agreements with major players like Stellantis and United Airlines provide essential capital. Upfront payments and future milestone achievements directly fund the company's progress in developing and manufacturing its electric vertical takeoff and landing (eVTOL) aircraft.

These partnerships are structured to provide financial support at various stages of Archer's development. For instance, Stellantis, a global automotive giant, has committed significant investment and resources. United Airlines has also made substantial commitments, including a significant deposit for future aircraft orders, underscoring their belief in Archer's technology and market potential.

- Upfront Payments: Initial capital infusions from partners to secure collaboration.

- Milestone Payments: Funds released upon achieving specific development or production targets.

- Potential Royalties: Future revenue sharing based on the success and deployment of Archer's aircraft.

Ancillary Services and Support

Archer Aviation is strategically positioning itself to generate revenue beyond aircraft sales through a suite of ancillary services. These offerings are designed to support the operational lifecycle of their electric vertical takeoff and landing (eVTOL) aircraft, ensuring continued performance and customer satisfaction.

Future revenue streams are anticipated to include comprehensive maintenance, repair, and overhaul (MRO) services, crucial for the longevity and safety of their eVTOL fleet. Additionally, Archer plans to establish pilot training programs, addressing the growing need for skilled operators in the advanced air mobility sector. The company may also explore software licensing for its sophisticated air mobility systems, further diversifying its income potential.

- Maintenance, Repair, and Overhaul (MRO): Providing essential upkeep for the eVTOL fleet to ensure operational readiness and safety.

- Pilot Training Programs: Developing and delivering specialized training to certify pilots for eVTOL operations.

- Software Licensing: Offering licenses for proprietary advanced air mobility system software.

Archer Aviation's revenue model is multi-faceted, encompassing direct aircraft sales, air taxi services, government contracts, and strategic partnership payments. These streams are designed to provide both initial capital and long-term recurring income as the advanced air mobility market matures.

The company is actively pursuing government contracts, notably with the U.S. Department of Defense, to fund development and production. In 2024, Archer received an additional $5 million contract from the U.S. Air Force, highlighting the financial importance of these agreements.

Strategic partnerships with industry leaders like Stellantis and United Airlines provide crucial upfront capital and milestone payments, directly fueling Archer's progress. United Airlines' commitment includes substantial deposits for future aircraft orders, demonstrating strong market confidence.

Beyond aircraft sales, Archer anticipates revenue from ancillary services such as maintenance, pilot training, and software licensing, creating a comprehensive ecosystem of income generation.

| Revenue Stream | Description | Key Backers/Examples | 2024 Relevance |

|---|---|---|---|

| Aircraft Sales | Direct sale of Midnight eVTOL aircraft to commercial operators. | United Airlines (up to 100 aircraft order) | Securing pre-orders and production capacity planning. |

| Air Taxi Services | Fares charged to passengers for urban air mobility flights. | Projected fares of $150-$250 per passenger for inter-city hops. | Market validation and operational planning for service launch. |

| Government Contracts | Development, production, and support for military eVTOL applications. | U.S. Air Force ($5 million additional contract in 2024) | Critical funding for R&D and early manufacturing. |

| Partnership Payments | Upfront capital and milestone payments from strategic partners. | Stellantis, United Airlines | Essential pre-revenue funding and validation. |

| Ancillary Services | Maintenance, pilot training, software licensing. | Planned offerings to support eVTOL operations. | Future revenue diversification and ecosystem development. |

Business Model Canvas Data Sources

The Archer Aviation Business Model Canvas is built using extensive market research, competitive analysis, and internal financial projections. These sources ensure each canvas block is filled with accurate, up-to-date information on the eVTOL industry.