Arch Capital Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arch Capital Group Bundle

Arch Capital Group demonstrates robust financial strength and a diversified product portfolio, key strengths that position it favorably in the specialty insurance and reinsurance markets. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Arch Capital Group's strengths, potential vulnerabilities, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Arch Capital Group's diversified business model, spanning insurance, reinsurance, and mortgage insurance, creates a robust and balanced risk profile. This multi-faceted approach allows the company to navigate different market conditions effectively, capitalizing on opportunities across various segments while mitigating the impact of downturns in any single area. For instance, in 2023, Arch reported gross written premiums of $28.9 billion, with significant contributions from its various insurance and reinsurance segments, underscoring the breadth of its operations.

Arch Capital Group has shown consistently strong financial performance, with operating earnings per share in Q4 2024 and Q1 2025 frequently exceeding analyst expectations. This robust profitability underscores the company's operational efficiency and market positioning.

The company's capital position is a significant strength, with a substantial capital base reported at approximately $23.5 billion as of December 31, 2024, and further strengthening to $24.3 billion by March 31, 2025. This healthy capital cushion provides ample financial flexibility and stability.

Arch Capital Group's disciplined underwriting and robust risk management are significant strengths. This approach consistently yields attractive combined ratios, often outperforming industry averages in both insurance and reinsurance. For instance, in the first quarter of 2024, Arch reported a strong combined ratio, demonstrating their ability to manage risk effectively even in volatile markets.

Market Leading Capabilities and Strategic Acquisitions

Arch Capital Group boasts market-leading capabilities as a global specialty insurer, fostering strong relationships with its distribution partners. This established presence is a significant advantage in a competitive landscape.

Strategic acquisitions have been a key driver of Arch's growth and market positioning. For instance, the acquisition of a portion of Allianz's US middle market and entertainment insurance business in 2024 further solidified its industry standing and contributed to substantial premium increases. This move alone added an estimated $500 million in gross written premiums.

These strategic moves underscore Arch's commitment to expanding its reach and enhancing its service offerings. The company's ability to integrate acquired businesses effectively allows it to leverage new market opportunities and achieve synergistic growth.

- Market Leadership: Recognized global specialty insurer with top-tier capabilities.

- Strategic Acquisitions: Integration of Allianz's US middle market and entertainment insurance business in 2024.

- Premium Growth: Acquisitions contributed to significant increases in gross written premiums, with the Allianz deal adding approximately $500 million.

- Distribution Strength: Strong relevance and partnerships within its distribution networks.

Conservative Investment Strategy

Arch Capital Group's conservative investment strategy is a key strength. Unlike some competitors who lean heavily on investment income, Arch prioritizes its underwriting results. This means their financial stability isn't as dependent on market fluctuations.

The company actively manages its investment portfolio with a focus on moderately low duration and investment leverage. This prudent approach helps mitigate risks associated with interest rate changes. For instance, as of the first quarter of 2024, Arch maintained a significant portion of its investment portfolio in short-to-intermediate duration fixed income securities, enhancing its resilience.

This strategy positions Arch Capital Group favorably to capitalize on strong underwriting conditions. Furthermore, with expectations for potentially lower short-term interest rates by the end of 2025, their less duration-sensitive portfolio could offer an advantage. This allows them to be more agile in adjusting to evolving market dynamics.

Key aspects of their conservative investment approach include:

- Focus on Underwriting Profitability: Less reliance on investment income for overall financial performance.

- Moderately Low Duration: Reduced sensitivity to interest rate increases, offering stability.

- Controlled Investment Leverage: Minimizing risk exposure from borrowed funds in their investment portfolio.

- Strategic Positioning for Rate Environment: Prepared to benefit from anticipated shifts in short-term interest rates by late 2025.

Arch Capital Group's diversified business model, spanning insurance, reinsurance, and mortgage insurance, creates a robust and balanced risk profile, allowing it to navigate different market conditions effectively. This multi-faceted approach is evidenced by its $28.9 billion in gross written premiums in 2023, with significant contributions from various segments.

The company consistently demonstrates strong financial performance, with operating earnings per share frequently exceeding analyst expectations in late 2024 and early 2025, highlighting operational efficiency. Arch's capital position is a significant strength, reported at approximately $23.5 billion as of December 31, 2024, and strengthening to $24.3 billion by March 31, 2025, providing substantial financial flexibility.

Disciplined underwriting and robust risk management are core strengths, consistently yielding attractive combined ratios that often outperform industry averages. This is further bolstered by strategic acquisitions, such as the 2024 deal for a portion of Allianz's US middle market and entertainment insurance business, which added an estimated $500 million in gross written premiums and solidified its market standing.

| Metric | Value (as of Q1 2025) | Significance |

|---|---|---|

| Gross Written Premiums (2023) | $28.9 billion | Demonstrates broad operational scope. |

| Capital Base (Q1 2025) | $24.3 billion | Indicates strong financial stability and flexibility. |

| Allianz Acquisition Impact | ~$500 million in GWP | Highlights successful strategic growth and market expansion. |

What is included in the product

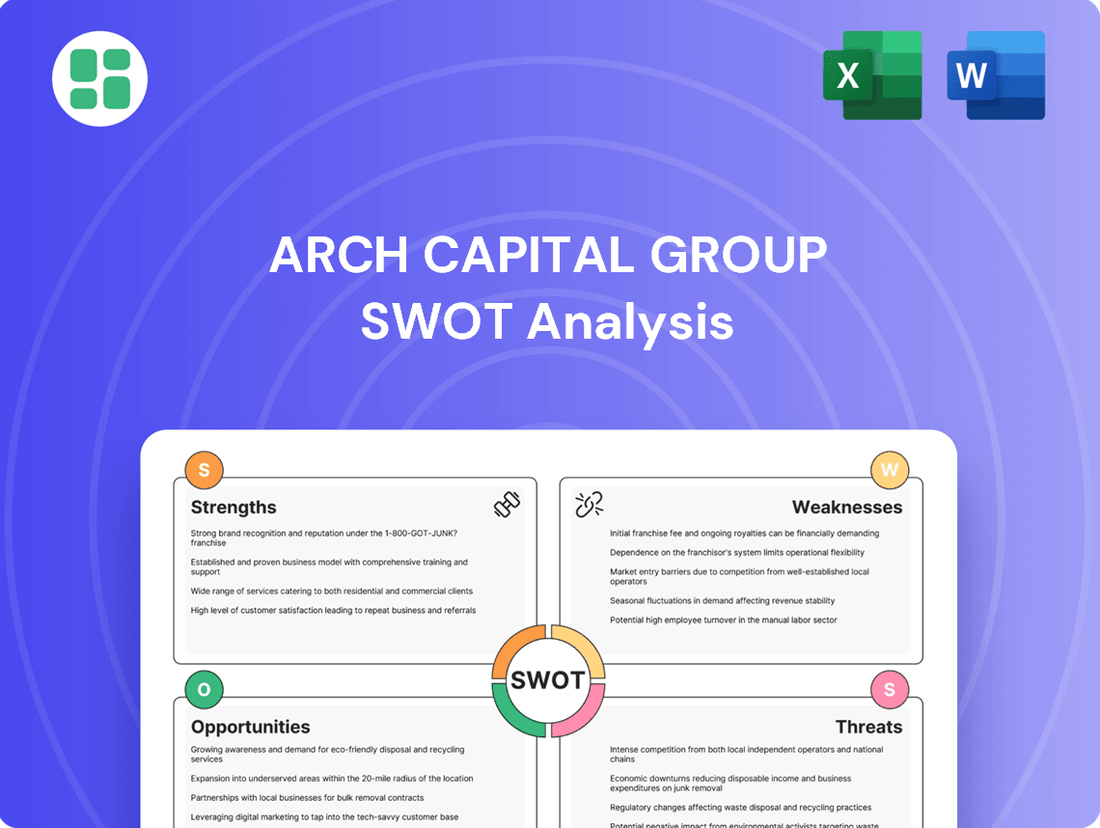

Offers a full breakdown of Arch Capital Group’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear framework to identify and address Arch Capital Group's potential market vulnerabilities and competitive threats.

Weaknesses

Arch Capital Group, despite robust risk management, faces significant exposure to catastrophe losses. For instance, the California wildfires in early 2025 are estimated to have caused losses between $450 million and $550 million for the company.

The escalating frequency and severity of natural disasters present an ongoing threat, potentially leading to unpredictable earnings and affecting the company's ability to maintain underwriting profitability.

Arch Capital Group's organic premium growth, while robust overall, has seen a slowdown in specific areas like Other Liability - Claims Made. This moderation is attributed to less favorable market dynamics and heightened competition, impacting the pace of expansion in these segments.

The Property and Casualty (P&C) insurance landscape has intensified, presenting a significant challenge for insurers aiming to sustain rapid growth across all product lines without compromising profitability. This competitive pressure can constrain premium increases.

Changes in tax legislation, particularly concerning Bermuda's economic transition adjustment and the OECD's evolving stance, pose a significant weakness for Arch Capital Group. These shifts could elevate the company's effective tax rate by an estimated 2-3 percentage points.

This potential tax increase directly threatens Arch Capital's profitability, likely impacting net income and earnings per share negatively. Specifically, a higher cash tax burden anticipated in 2025 and 2026 could place considerable pressure on the company's operating earnings per share.

Challenges in Mortgage Insurance Market Share Growth

Arch Capital Group faces hurdles in expanding its footprint in the private mortgage insurance market. Executives describe the sector as increasingly homogeneous, making differentiation and aggressive market share gains challenging without compromising pricing strategies. This environment discourages price wars, as the company prioritizes maintaining a robust and high-quality portfolio of insured loans.

The company's cautious approach to market share growth is also influenced by the need to avoid actions that could dilute the quality of its business. In 2024, the private mortgage insurance market saw continued competition, with established players and new entrants vying for business. Arch's strategy reflects a commitment to sustainable growth over rapid, potentially margin-eroding expansion.

- Homogeneous Market Dynamics: The private mortgage insurance market is characterized by a lack of significant product differentiation, making it difficult for companies like Arch to gain market share through unique offerings.

- Price Sensitivity Concerns: Aggressively pursuing higher market share could force Arch to reduce prices, potentially impacting profitability and the perceived quality of its business.

- Focus on Quality Book: Arch aims to avoid competitive pricing that could compromise the resilience and high-quality nature of its existing mortgage insurance portfolio.

Downward Revisions in Earnings Expectations

Analysts have recently adjusted their earnings per share (EPS) forecasts for Arch Capital Group downwards. For instance, some analysts revised their 2024 EPS estimates to around $6.20-$6.50, a decrease from earlier projections that were closer to $6.70-$7.00. This recalibration is largely attributed to expectations of elevated catastrophe losses impacting the second half of 2024 and into 2025, alongside a potential uptick in expense ratios and moderated net investment income.

These downward revisions signal potential headwinds for Arch Capital, particularly concerning its core underwriting profitability. The anticipated higher catastrophe losses, which can fluctuate significantly quarter-to-quarter, may put pressure on the company's ability to maintain its historical underwriting margins. Furthermore, an increase in the expense ratio, even if marginal, can directly impact the bottom line.

The market's reaction to such revisions often involves a reassessment of the company's valuation, potentially leading to short-term stock price volatility. Investors and analysts closely monitor these expectation shifts as they provide insights into the company's operational performance and its resilience against industry-wide challenges.

Arch Capital Group faces significant exposure to catastrophe losses, with estimated losses from California wildfires in early 2025 ranging from $450 million to $550 million. The increasing frequency and severity of natural disasters pose an ongoing threat, potentially leading to unpredictable earnings and impacting underwriting profitability. Changes in tax legislation, particularly concerning Bermuda's economic transition adjustment and the OECD's evolving stance, could elevate Arch's effective tax rate by an estimated 2-3 percentage points, negatively impacting net income and earnings per share.

| Weakness | Impact | Data/Context |

| Catastrophe Loss Exposure | Unpredictable earnings, reduced profitability | Estimated $450M-$550M losses from early 2025 California wildfires |

| Tax Legislation Changes | Increased effective tax rate (2-3 pp), negative impact on EPS | OECD stance, Bermuda economic transition adjustment |

| Private Mortgage Insurance Market Challenges | Difficulty in aggressive market share gains, focus on quality over volume | Homogeneous market, price sensitivity concerns |

Same Document Delivered

Arch Capital Group SWOT Analysis

This is the actual Arch Capital Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Arch Capital Group.

Opportunities

The property and casualty (P&C) insurance sector is currently experiencing a strong pricing cycle, which is a significant opportunity for Arch Capital Group. This favorable environment, characterized by robust underwriting results and a defensive economic stance, allows for continued premium growth. In 2024, the P&C industry has demonstrated resilience, with many carriers reporting improved profitability driven by higher rates and disciplined underwriting.

Arch Capital Group can capitalize on industry consolidation trends by pursuing strategic acquisitions. This approach mirrors its successful integration of Allianz's mortgage insurance operations, a move that enhanced its market standing. Such acquisitions can provide significant capital and cycle management advantages, reinforcing Arch's competitive edge.

Arch Capital anticipates sustained expansion in its casualty insurance segments and the U.S. middle market. These areas present compelling prospects for both increased pricing and premium volume, driven by favorable market conditions.

The company's established leadership in these markets, coupled with robust ties to its distribution network, provides a significant advantage. This allows Arch to be among the first to access many profitable business opportunities as they emerge.

In the first quarter of 2024, Arch reported strong performance in its insurance segment, with gross written premiums in liability lines showing robust year-over-year growth, reflecting the ongoing demand and pricing power in these casualty areas.

Potential Benefits from Lower Interest Rates

Analysts are forecasting a dip in short-term interest rates by the close of 2025. This shift could prove advantageous for Arch Capital Group, considering its current investment portfolio's moderate duration and leverage levels.

A reduction in interest rates generally translates to an uplift in earnings generated from bond investment portfolios. This increased income stream can directly contribute to Arch Capital's overall profitability, enhancing its financial performance.

- Enhanced Investment Income: Lower rates can increase the yield on Arch Capital's fixed-income investments.

- Reduced Borrowing Costs: If Arch Capital utilizes leverage, lower rates would decrease the cost of its financing.

- Favorable Market Conditions: A lower rate environment often stimulates economic activity, potentially leading to increased demand for insurance products.

Leveraging Technology and AI in Insurance

The insurance industry is ripe for technological advancement, with AI poised to transform operations. Global insurance premiums are anticipated to reach an impressive $8.5 trillion by 2032, highlighting the scale of this evolving market. Arch Capital Group can capitalize on this by integrating AI to streamline underwriting, personalize customer experiences, and improve claims processing, thereby boosting efficiency and competitiveness.

Embracing digital innovation presents a significant opportunity for Arch Capital Group to refine its risk management strategies. Advanced analytics powered by AI can identify emerging risks and fraud patterns more effectively than traditional methods. This technological adoption is crucial for meeting the increasingly sophisticated demands of today's insurance consumers who expect seamless digital interactions and tailored solutions.

Key areas where Arch Capital Group can leverage technology and AI include:

- Enhanced Underwriting: Utilizing AI algorithms to analyze vast datasets for more accurate risk assessment and pricing.

- Streamlined Claims Processing: Implementing AI-powered tools to automate claims handling, reducing processing times and improving customer satisfaction.

- Personalized Customer Engagement: Deploying AI-driven chatbots and recommendation engines to offer customized products and support.

- Fraud Detection: Employing machine learning to identify and prevent fraudulent activities in real-time.

Arch Capital Group is well-positioned to benefit from the ongoing strong pricing cycle in the property and casualty insurance market, which is expected to continue through 2024 and into 2025, driving improved underwriting results and premium growth.

The company can leverage industry consolidation by pursuing strategic acquisitions, similar to its successful integration of Allianz's mortgage insurance operations, to expand its market presence and gain capital advantages.

Continued expansion in casualty insurance and the U.S. middle market offers opportunities for both increased pricing and premium volume, supported by Arch's established market leadership and strong distribution ties.

A projected dip in short-term interest rates by the end of 2025 could boost Arch's investment income, given its portfolio's moderate duration and leverage, potentially enhancing overall profitability.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| Favorable Pricing Cycle | Strong pricing power in P&C insurance | Continued premium growth and enhanced underwriting profitability |

| Industry Consolidation | Acquisition of complementary businesses | Market share expansion and operational synergies |

| Market Expansion | Growth in casualty and U.S. middle market segments | Increased premium volume and pricing opportunities |

| Interest Rate Environment | Potential decrease in short-term rates | Boost in investment income from fixed-income portfolios |

Threats

The escalating frequency and intensity of natural disasters, a trend amplified by climate change, present a substantial and persistent threat to Arch Capital Group and the broader insurance and reinsurance sector. These events directly translate into significant catastrophe-related losses, driving up the cost of reinsurance and placing considerable strain on underwriting margins. For instance, the widespread damage from the California wildfires in early 2025 resulted in billions of dollars in insured losses, underscoring the financial impact of such extreme weather events.

Arch Capital Group's registration in Bermuda exposes it to potential regulatory shifts. Changes in international financial regulations or those specifically impacting offshore domiciles could create compliance challenges and affect operational costs.

The insurance industry is increasingly focused on consumer protection, leading to evolving regulatory landscapes worldwide. These changes can necessitate adjustments to product offerings, pricing strategies, and claims handling processes, impacting profitability.

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, introduce significant uncertainty. These events can disrupt global supply chains, trigger economic volatility, and increase the frequency and severity of insured events, complicating Arch Capital's risk modeling and capital allocation strategies across its international operations.

Arch Capital Group, like all insurers, faces risks from decelerating global growth projected for early 2025. This slowdown, potentially fueled by tariff-driven market volatility and weaker performance in key economies, could dampen demand for insurance products and pressure premium rates.

The insurance sector's natural cyclicality presents another threat. Periods of 'soft' markets, characterized by lower premiums and intense competition, can erode profitability. For instance, the property casualty market has historically experienced these cycles, impacting underwriting margins.

Social Inflation and Rising Litigation Costs

The casualty reinsurance market, a key area for Arch Capital Group, is grappling with escalating social inflation and litigation expenses. This includes the concerning trend of 'nuclear verdicts' and generally higher legal fees, which directly inflate the severity of claims. For instance, the average jury award in large tort cases has seen a significant uptick, impacting the profitability of liability insurance portfolios.

These trends necessitate a swift adaptation from insurers like Arch. They must proactively adjust their strategies to manage the increased claims costs. This often translates into the need for premium rate increases to maintain underwriting profitability in these volatile liability lines.

- Rising Litigation Expenses: Increased legal costs and prolonged litigation cycles contribute to higher claims payouts.

- Nuclear Verdicts: The frequency and size of exceptionally large jury awards in liability cases are a significant concern.

- Impact on Profitability: These factors directly threaten the profitability of liability insurance and reinsurance lines.

- Need for Adaptation: Insurers must adjust pricing and risk management strategies to counter these inflationary pressures.

Intensifying Competition and Pricing Pressures

While Arch Capital Group has historically demonstrated robust pricing power, the property and casualty (P&C) insurance market is experiencing intensified competition. This heightened rivalry can potentially temper the rate of pricing increases, impacting Arch's profitability, particularly in segments where market capacity is ample. For instance, in the first half of 2024, global P&C insurance premium growth showed signs of moderation compared to the previous year, a trend that could pressure margins.

The increasing number of market participants, including traditional insurers, reinsurers, and alternative capital providers, creates a more crowded landscape. This can lead to a situation where achieving profitable growth necessitates a careful balance between maintaining competitive pricing and preserving market share. In 2024, reports indicated that some lines of business, such as cyber insurance, saw an influx of new capacity, leading to more aggressive pricing from competitors.

- Increased Competition: The P&C market faces more players, including alternative capital, leading to a more crowded environment.

- Pricing Pressure: Intensifying competition can moderate pricing gains, potentially impacting Arch's premium growth rates.

- Margin Squeeze: In lines with abundant capacity, achieving profitable growth may require sacrificing some market share if pricing is not managed effectively.

- Market Dynamics: The overall capacity in certain P&C segments, like cyber, saw an increase in early 2024, contributing to competitive pricing pressures.

Arch Capital Group faces significant threats from escalating litigation expenses and the increasing prevalence of "nuclear verdicts," which directly inflate claims severity in liability lines. This trend, evident in rising average jury awards in large tort cases, necessitates strategic adjustments to pricing and risk management to maintain underwriting profitability. The need for premium rate increases in these volatile lines is paramount to counter these inflationary pressures.

Intensified competition within the property and casualty market, fueled by traditional insurers and alternative capital providers, presents another key threat. This can temper pricing gains, particularly in segments with ample capacity, potentially squeezing profit margins. For instance, the cyber insurance market in early 2024 saw increased capacity, leading to more aggressive competitor pricing, impacting Arch's ability to achieve profitable growth without careful market share management.

The escalating frequency and severity of natural disasters, exacerbated by climate change, pose a persistent threat, leading to substantial catastrophe-related losses. The billions in insured losses from events like the early 2025 California wildfires highlight the financial impact and strain on underwriting margins, underscoring the need for robust risk modeling and capital allocation strategies.

SWOT Analysis Data Sources

This Arch Capital Group SWOT analysis is built upon a foundation of credible data, drawing from their official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure an accurate and insightful assessment.