Arch Capital Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arch Capital Group Bundle

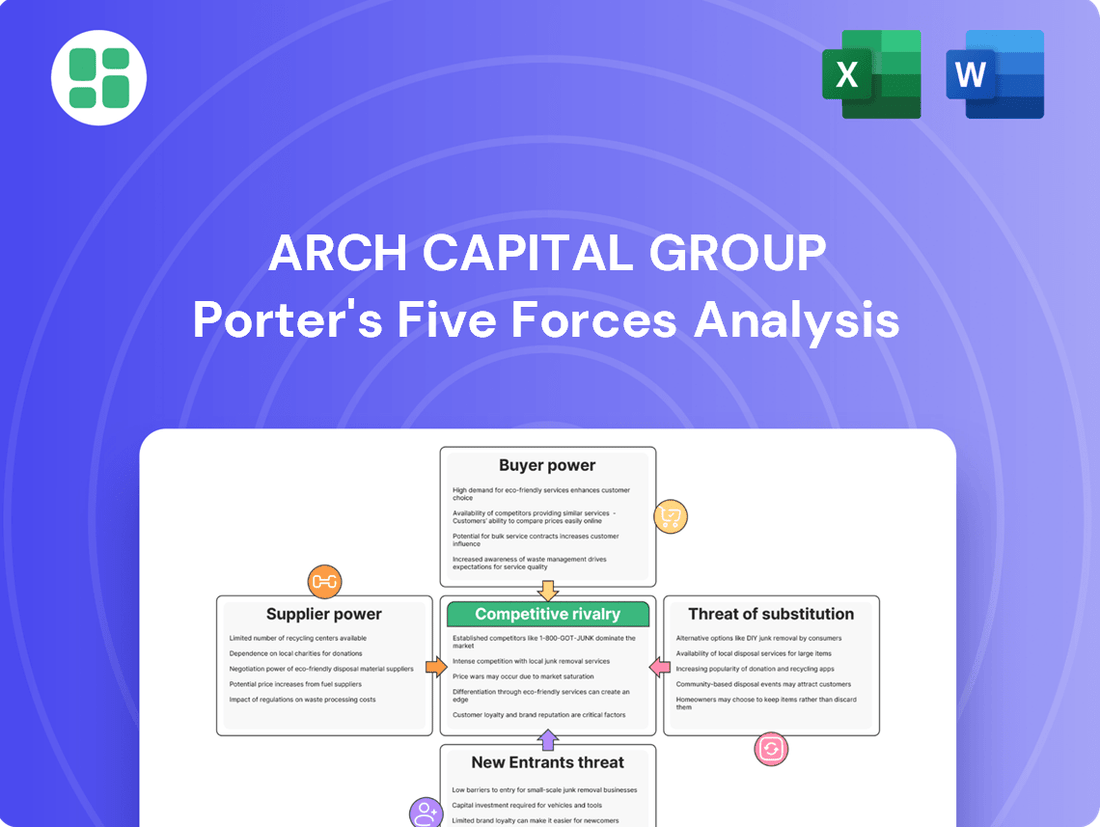

Arch Capital Group operates in a complex insurance landscape shaped by intense rivalry and significant buyer power, as evidenced by our Porter's Five Forces analysis. Understanding the threats of new entrants and substitute products is crucial for navigating this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Arch Capital Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of key suppliers, like retrocessionaires for Arch Capital Group's reinsurance business or specialized technology providers, directly influences their bargaining power. When a few dominant suppliers control essential services or capital, they gain leverage to set terms and pricing, potentially increasing costs for Arch Capital.

For instance, in the reinsurance market, while there are numerous participants, a significant portion of capacity can be concentrated among a smaller group of major reinsurers. However, global reinsurance capital has experienced substantial growth, reaching an estimated $677 billion in 2023 according to industry reports, which can dilute the power of any single supplier and offer Arch Capital more options.

The bargaining power of suppliers for Arch Capital Group is significantly influenced by switching costs. If Arch Capital faces substantial hurdles in changing its suppliers, such as the complex integration of new underwriting software or the need to build new relationships with retrocessionaires, suppliers gain leverage. For instance, the time and resources required to re-evaluate and onboard new reinsurers can be considerable, making it less appealing to switch.

Conversely, if Arch Capital can easily transition to alternative suppliers with minimal disruption and cost, its own bargaining power is strengthened. The availability of multiple, comparable retrocessionaires or technology providers with similar capabilities reduces the reliance on any single supplier, thereby diminishing supplier power.

Arch Capital Group's suppliers, particularly those providing specialized actuarial models or proprietary risk assessment software, hold significant bargaining power if their offerings are highly unique and difficult for Arch to replicate or substitute. For instance, if a supplier offers a cutting-edge AI-driven underwriting platform that demonstrably improves loss ratios, Arch may have fewer alternatives, thus strengthening the supplier's position.

However, the evolving Insurtech landscape is democratizing access to advanced tools. By mid-2024, many Insurtech startups are offering cloud-based, scalable solutions for data analytics and risk modeling, potentially reducing the reliance on a few highly specialized providers. This trend could gradually dilute the bargaining power derived from input uniqueness for companies like Arch.

Threat of Forward Integration by Suppliers

Suppliers might leverage their position by integrating forward into Arch Capital Group's insurance operations, effectively becoming a competitor. This would significantly boost their bargaining power by controlling both the supply of necessary inputs and the distribution of the final product.

While a theoretical threat, the significant capital requirements and stringent regulatory environment within the insurance sector make complete forward integration by most suppliers a challenging proposition. For instance, establishing a licensed insurance entity requires substantial financial reserves and adherence to complex compliance frameworks, which many suppliers may not possess or be willing to undertake.

- Capital Intensity: The insurance industry demands significant capital for solvency and operational stability. For example, in 2024, regulatory capital requirements for insurers continue to be substantial, making it difficult for suppliers to match.

- Regulatory Hurdles: Obtaining and maintaining licenses to underwrite insurance is a complex and costly process, involving ongoing compliance with various governmental bodies.

- Industry Expertise: Successful insurance underwriting requires specialized actuarial, risk management, and claims handling expertise, which is distinct from the core competencies of most potential suppliers.

Importance of Supplier's Input to Arch Capital's Cost or Differentiation

The bargaining power of suppliers for Arch Capital Group hinges significantly on how critical their inputs are to Arch's cost structure or its ability to differentiate its insurance and reinsurance products. If a supplier provides a component that represents a substantial portion of Arch's expenses, or if that component is essential for offering unique risk management solutions, that supplier gains leverage.

This is especially true for specialized data providers and analytical service firms that are crucial for sophisticated risk modeling. For instance, in 2023, the global market for big data and business analytics services, which underpins much of this specialized input, was valued at over $300 billion, indicating the significant investment and reliance companies like Arch place on such services.

- Criticality of Input: The more vital a supplier's product or service is to Arch Capital's core operations, whether for cost efficiency or product uniqueness, the stronger the supplier's bargaining position.

- Cost Component: If a supplier's offering constitutes a large percentage of Arch Capital's overall operating costs, the supplier can exert greater influence over pricing and terms.

- Differentiation Factor: Suppliers of specialized data, advanced analytics, or proprietary modeling software that enable Arch Capital to offer superior risk assessment and underwriting capabilities hold considerable power.

- Industry Reliance: The insurance and reinsurance sector's increasing reliance on advanced technology and data analytics means suppliers of these specialized services are becoming increasingly important, potentially increasing their bargaining power.

The bargaining power of suppliers for Arch Capital Group is influenced by the concentration of suppliers and switching costs. While the reinsurance market has many players, concentrated capacity among a few reinsurers can increase their leverage. However, the substantial growth in global reinsurance capital, estimated at $677 billion in 2023, offers Arch more options, diluting individual supplier power.

High switching costs, such as integrating new underwriting software or establishing relationships with new retrocessionaires, empower suppliers. Conversely, Arch's ability to easily switch providers with minimal disruption strengthens its position.

Suppliers offering unique, hard-to-replicate inputs, like advanced AI underwriting platforms, hold significant power. The growing Insurtech sector, with startups offering scalable data analytics tools by mid-2024, is beginning to reduce reliance on highly specialized providers, potentially weakening this aspect of supplier power.

| Factor | Impact on Arch Capital | Supporting Data/Trend |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant suppliers | Global reinsurance capital reached $677 billion in 2023. |

| Switching Costs | Higher costs empower suppliers; lower costs empower Arch | Integration of new software or onboarding reinsurers involves significant time and resources. |

| Input Uniqueness | Stronger supplier power for proprietary or advanced solutions | Insurtech growth by mid-2024 offers more accessible advanced tools. |

| Criticality of Input | Greater supplier leverage if input is vital to operations or differentiation | The big data and business analytics market exceeded $300 billion in 2023. |

What is included in the product

This analysis delves into the competitive forces impacting Arch Capital Group, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Arch Capital Group's Porter's Five Forces.

Customers Bargaining Power

Arch Capital's customer base, encompassing corporations, institutions, and individuals, shows a spectrum of price sensitivity. For standardized insurance offerings, particularly in competitive markets, customers are often quite attuned to premium costs.

However, when Arch provides intricate or specialized risk management solutions, the value derived from customized coverage and expert advice can significantly lessen a customer's focus on price alone. This is particularly true for clients seeking protection against unique or high-impact risks.

For instance, in the commercial property insurance sector, where many providers offer similar coverage, price is a major determinant. Yet, for cyber insurance or complex liability coverage, where the expertise and tailored policy structure are paramount, clients may prioritize robust protection over the absolute lowest premium.

Customer concentration significantly impacts Arch Capital Group's bargaining power. If a small number of large clients or brokers account for a substantial portion of its written premiums, these dominant customers can wield considerable influence over pricing and contract terms, potentially driving down profitability.

For instance, in 2023, Arch Capital's top ten clients represented a notable percentage of its gross written premiums, indicating a degree of customer concentration that necessitates careful relationship management and value proposition reinforcement to mitigate potential price pressures.

Conversely, a more diversified customer base, spread across numerous smaller entities and diverse geographic regions, dilutes the leverage of any single customer. This fragmentation empowers Arch Capital by reducing the impact of individual client demands and enhancing its ability to maintain favorable pricing structures.

Customer switching costs are a crucial factor in assessing the bargaining power of customers for Arch Capital Group. When it's difficult or expensive for clients to move to a competitor, their ability to demand lower prices or better terms diminishes.

For simpler insurance products, switching might be as easy as comparing quotes online, leading to higher customer bargaining power. However, for Arch Capital Group's more specialized offerings, like complex commercial insurance or reinsurance, the costs of switching can be substantial. These can include the time and resources needed to re-underwrite risks, potential gaps in coverage during the transition, and the loss of established relationships and expertise.

In 2024, the insurance industry continued to see a push for digital platforms that can simplify policy management and comparisons. Yet, for businesses with intricate risk profiles, the administrative hurdles and the need for specialized knowledge often outweigh the benefits of a quick digital switch, thereby limiting their bargaining power with providers like Arch Capital Group.

Availability of Substitute Products for Customers

Customers can opt for alternatives to traditional insurance, like self-insurance, forming captive insurance companies, or utilizing other risk transfer methods. This broadens their choices beyond standard policies.

The growing interest in alternative risk transfer solutions, especially for complex or hard-to-insure risks, significantly increases customer leverage. For instance, the alternative risk transfer market, excluding traditional reinsurance, saw substantial growth, with some estimates suggesting it approached $50 billion globally by 2023, indicating a strong customer appetite for diverse solutions.

Arch Capital Group needs to focus on differentiating its product and service offerings to keep clients from exploring these substitute options. This differentiation could involve specialized underwriting, superior claims handling, or innovative risk management services.

- Availability of Substitutes: Customers can choose self-insurance, captives, or alternative risk transfer mechanisms instead of traditional insurance.

- Customer Empowerment: Increased demand for alternative risk transfer, particularly for challenging risks, gives customers more bargaining power.

- Arch Capital's Strategy: Arch Capital must differentiate its offerings to retain clients who might consider these substitutes.

- Market Trends: The alternative risk transfer market demonstrates a growing customer preference for non-traditional insurance solutions.

Customer Information and Transparency

The insurance industry, including companies like Arch Capital Group, is experiencing a significant shift due to increased customer information and transparency. Digital platforms and sophisticated data analytics are arming consumers with more knowledge about pricing, coverage details, and competitor offerings. This empowers them to make more informed decisions and actively seek out the best value.

This heightened transparency directly impacts the bargaining power of customers. With readily available comparative data, individuals and businesses can more effectively negotiate for better premiums and policy terms. For instance, the rise of online insurance comparison sites in 2024 allows consumers to see side-by-side quotes from multiple providers, putting pressure on insurers to remain competitive.

- Increased Data Availability: Digitalization has led to a wealth of consumer data, making it easier for customers to understand market benchmarks.

- Price Sensitivity: Greater transparency highlights price differences, making customers more sensitive to variations in premiums.

- Negotiation Leverage: Informed customers can leverage their knowledge to push for better terms, increasing their bargaining power.

Arch Capital Group faces varying customer bargaining power depending on the product and market segment. For standardized offerings, price sensitivity is high, amplified by increased transparency and readily available comparison tools in 2024. However, for specialized and complex risk solutions, the value of tailored expertise and robust coverage often outweighs price considerations, reducing customer leverage.

| Factor | Impact on Arch Capital's Customer Bargaining Power | 2024 Trend/Data Point |

|---|---|---|

| Price Sensitivity | High for standard products, lower for specialized solutions. | Online comparison sites in 2024 intensified price pressure on commoditized insurance. |

| Customer Concentration | High concentration of large clients increases leverage. | Arch Capital's top clients represented a significant portion of premiums in 2023, necessitating careful management. |

| Switching Costs | Low for simple products, high for complex ones. | Despite digital platforms, the complexity of underwriting for specialized risks maintains high switching costs for clients. |

| Availability of Substitutes | Growing, particularly alternative risk transfer. | The alternative risk transfer market, excluding traditional reinsurance, neared $50 billion globally by 2023. |

| Information Transparency | Increased customer knowledge empowers negotiation. | Digitalization in 2024 made comparative data more accessible, enhancing customer negotiation power. |

Preview Before You Purchase

Arch Capital Group Porter's Five Forces Analysis

This preview showcases the complete Arch Capital Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the insurance and financial services sector. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The global insurance and reinsurance industry is experiencing a moderate growth rate. While certain sectors like life and annuities show modest gains, the property and casualty (P&C) segment faces headwinds. For instance, in 2024, global insurance premium growth is projected to be around 3-4%, with P&C growth potentially lagging due to economic uncertainties and increased catastrophe losses.

This slower growth environment naturally intensifies competitive rivalry. Companies like Arch Capital must work harder to capture market share, as the overall pie isn't expanding rapidly. This necessitates a strong focus on disciplined underwriting practices and astute strategic deployment of capital, rather than simply benefiting from broad market expansion.

Arch Capital Group operates within a crowded landscape, with intense competition across its core segments: insurance, reinsurance, and mortgage insurance. The sheer number of global and regional players means Arch must constantly adapt to a dynamic market.

Key rivals include well-established, diversified insurers such as Chubb, which reported gross premiums written of $47.1 billion in 2023, and Travelers, with $37.5 billion in net written premiums for the same year. In the reinsurance sector, Arch contends with giants like Swiss Re and Munich Re, both significant global entities with substantial market share.

This diversity in competitors, ranging from broad-based insurers to highly specialized reinsurers, creates a multifaceted competitive environment. Each competitor leverages distinct business models and geographic footprints, intensifying the rivalry as they vie for market share and profitability.

The insurance and reinsurance sectors are characterized by substantial fixed costs. These include significant capital infusions mandated by regulators, ongoing investments in sophisticated IT infrastructure for risk modeling and claims processing, and the continuous need for specialized actuarial and legal expertise. For instance, in 2024, major reinsurers continued to allocate billions towards digital transformation initiatives to enhance efficiency and data analytics capabilities.

These high upfront and ongoing costs, coupled with stringent regulatory environments and the inherent complexity of managing long-term liabilities, erect formidable exit barriers. Companies often find it more viable to persevere through market downturns rather than incur substantial losses by exiting, which in turn fuels sustained and often intense competitive rivalry among established players like Arch Capital Group.

Product Differentiation

Arch Capital Group actively pursues product differentiation to counter commoditization in the insurance market. They achieve this through a broad spectrum of risk management solutions, specialized underwriting expertise, and a focus on cultivating robust client relationships. This approach aims to move beyond simple price competition by offering unique value propositions.

Despite these efforts, the competitive landscape presents ongoing challenges. As rivals also invest heavily in technological advancements and personalized product offerings, Arch Capital faces continuous pressure to innovate. This dynamic necessitates a persistent drive to maintain and enhance their distinctiveness, thereby avoiding a slide into pure price-based rivalry.

- Differentiation Strategy: Arch Capital leverages diverse risk management solutions and specialized underwriting.

- Client Relationships: Strong client ties are a key element in their differentiation approach.

- Competitive Pressure: Competitors' investments in technology and tailored offerings intensify differentiation challenges.

- Innovation Imperative: Continuous innovation is crucial to avoid commoditization and price-based competition.

Market Conditions and Underwriting Cycle

The insurance and reinsurance sectors are inherently cyclical, oscillating between periods of hardening, characterized by rising premiums and stricter policy terms, and softening, marked by falling rates and more lenient conditions. Arch Capital Group actively manages its exposure to these cycles, employing disciplined underwriting practices to identify and capitalize on profitable opportunities, even when market competition intensifies for premium volume, especially within property catastrophe reinsurance.

Arch Capital's strategy of 'cycle management' is crucial for navigating these market dynamics. For instance, during a hardening market, the company can leverage its strong capital position to secure higher-yielding business. Conversely, in a softening market, it maintains underwriting discipline to avoid unprofitable growth. This approach aims to deliver consistent returns by adapting to prevailing market conditions.

- Market Cycle Impact: Insurance and reinsurance markets are known for their cyclical nature, with periods of high and low rates influencing profitability.

- Arch Capital's Strategy: The company focuses on disciplined underwriting and 'cycle management' to navigate these fluctuations effectively.

- Profitability Focus: Arch Capital seeks profitable growth opportunities, even when competition for premium volumes increases, particularly in property catastrophe reinsurance.

The competitive rivalry within the insurance and reinsurance sectors is intense, driven by a large number of global and regional players. Arch Capital Group competes with established giants like Chubb and Travelers in insurance, and Swiss Re and Munich Re in reinsurance, each possessing significant market share and diverse strategies.

High fixed costs, including regulatory capital requirements and technology investments, create substantial exit barriers, encouraging existing firms to remain active competitors. This sustained presence, coupled with a moderate global insurance growth rate of around 3-4% projected for 2024, means companies must actively differentiate themselves to capture market share.

Arch Capital counters commoditization through specialized underwriting and strong client relationships, but faces pressure from rivals investing in similar technological advancements and personalized offerings. This necessitates continuous innovation to maintain a competitive edge and avoid succumbing to price-based competition.

| Competitor | 2023 Gross Premiums Written (GPW) / Net Written Premiums (NWP) | Key Segment |

| Chubb | $47.1 billion (GPW) | Insurance |

| Travelers | $37.5 billion (NWP) | Insurance |

| Swiss Re | Not specified, but a major global reinsurer | Reinsurance |

| Munich Re | Not specified, but a major global reinsurer | Reinsurance |

SSubstitutes Threaten

Self-insurance and captive insurance are significant substitutes for traditional insurance, particularly for large corporations. These strategies allow businesses to retain risk internally, offering potential cost savings and greater control over claims management. For example, the UK's ongoing efforts to enhance its captive insurance market demonstrate a clear trend towards these alternative risk transfer mechanisms.

The growing sophistication and demand for Alternative Risk Transfer (ART) mechanisms like catastrophe bonds (CAT bonds), industry loss warranties (ILWs), and parametric solutions present a significant threat to traditional insurance and reinsurance models. These instruments enable businesses to shift specific risks directly to the capital markets, circumventing established intermediaries.

For instance, the global catastrophe bond market issuance reached a record $17.1 billion in 2023, demonstrating a clear appetite for ART. This trend allows companies to access capacity and tailor coverage for natural catastrophes and increasingly, non-catastrophe perils, directly from investors.

The increasing sophistication of risk mitigation technologies and services presents a significant threat of substitutes for traditional insurance offerings. For instance, advancements in predictive analytics and real-time monitoring through IoT devices empower businesses to proactively identify and address potential hazards, thereby diminishing the reliance on insurance for certain risk transfers. In 2024, the global market for risk management software and services was projected to reach over $50 billion, highlighting a substantial shift towards prevention over pure indemnification.

As clients increasingly invest in these preventative solutions, the demand for indemnity-focused insurance products may naturally decline. This trend could lead to a greater emphasis on advisory, consulting, and risk-prevention services within the financial sector. For Arch Capital Group, this means a potential erosion of market share for its core insurance products if it does not adapt its service portfolio to include these evolving risk management solutions.

Government Programs and Social Safety Nets

Government programs and social safety nets can indeed act as substitutes, particularly impacting segments like mortgage insurance. For example, the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) loan programs can divert market share from private mortgage insurers. This is especially true when affordability becomes a concern for borrowers.

These government-backed alternatives can limit the addressable market for private insurers like Arch Capital Group in specific areas. For instance, in 2023, FHA-insured loans accounted for approximately 10% of all single-family home purchase originations, a significant portion that bypasses private mortgage insurance markets.

- Government-backed mortgage programs like FHA and VA loans offer alternatives to private mortgage insurance.

- These programs can reduce demand for private mortgage insurance, especially during economic downturns or periods of high housing costs.

- In 2023, FHA loans represented around 10% of single-family home purchase originations, illustrating the scale of this substitute effect.

- Certain government-sponsored disaster relief programs can also reduce reliance on private disaster insurance coverage.

Derivatives and Financial Hedging Instruments

Financial derivatives and hedging instruments offer alternative ways for companies to manage risks like currency fluctuations or interest rate changes, potentially reducing reliance on traditional insurance. For instance, in 2024, the global derivatives market continued to be a massive arena for risk management, with notional amounts outstanding in over-the-counter (OTC) derivatives reaching trillions of dollars, as reported by the Bank for International Settlements (BIS).

These financial tools can act as substitutes for certain insurance functions, especially for large corporations and financial institutions that can leverage their expertise and scale. For example, a company might use currency futures to hedge against foreign exchange risk instead of purchasing a specialized currency insurance policy. The International Swaps and Derivatives Association (ISDA) regularly publishes data on the growth and activity within these markets, reflecting their increasing importance in corporate finance strategies.

- Derivatives as Risk Management Tools: Companies utilize financial derivatives to mitigate risks such as interest rate volatility, currency exchange rate fluctuations, and commodity price swings.

- Substitution for Insurance: In specific contexts, particularly for financial institutions, derivatives can serve as an alternative to traditional insurance products for managing financial exposures.

- Market Size and Activity: The global derivatives market remains substantial, with trillions of dollars in notional amounts outstanding, indicating significant use in hedging strategies.

- Impact on Insurance Demand: The availability and sophistication of these financial instruments can influence the demand for certain types of specialized insurance coverage.

The availability of sophisticated risk mitigation technologies and services presents a growing threat of substitutes for traditional insurance. Businesses are increasingly investing in preventative measures, such as advanced analytics and IoT monitoring, to reduce their exposure to potential hazards. This shift towards proactive risk management can diminish the need for indemnity-focused insurance products.

Financial derivatives and hedging instruments offer alternative avenues for managing specific financial risks, potentially displacing certain insurance offerings. For instance, companies might employ currency futures to hedge against exchange rate volatility instead of purchasing specialized currency insurance. The sheer volume of activity in the derivatives market underscores its role as a substitute risk management tool.

Government-backed programs, particularly in areas like mortgage insurance, can also serve as substitutes. Initiatives from entities like the FHA can divert market share from private insurers, especially when economic conditions make private options less accessible. These programs highlight how non-private solutions can impact the addressable market for insurance companies.

| Substitute Category | Example | 2023/2024 Data Point |

| Alternative Risk Transfer (ART) | Catastrophe Bonds | Global CAT bond issuance reached $17.1 billion in 2023. |

| Risk Mitigation Technology | Risk Management Software | Global market projected over $50 billion in 2024. |

| Government Programs | FHA Mortgage Insurance | FHA loans accounted for ~10% of single-family home purchases in 2023. |

| Financial Derivatives | OTC Derivatives | Trillions of dollars in notional amounts outstanding globally. |

Entrants Threaten

The insurance and reinsurance sectors demand immense financial backing. Companies need substantial reserves to cover potential claims and comply with strict solvency regulations, creating a significant hurdle for newcomers.

This capital intensity means new entrants must commit vast sums, making it challenging to challenge established firms like Arch Capital Group. As of March 2025, Arch Capital reported approximately $24.3 billion in capital, illustrating the scale of financial resources required to operate effectively in this market.

The insurance industry, including segments where Arch Capital Group operates, faces substantial regulatory complexity worldwide. Navigating intricate licensing requirements, adhering to solvency frameworks such as Solvency II in Europe, and complying with evolving consumer protection and data privacy statutes demand significant investment and specialized knowledge, acting as a considerable deterrent to newcomers.

In the risk management sector, brand reputation and trust are foundational. Arch Capital Group, like many established insurers, has cultivated decades of credibility and deep client relationships, presenting a significant hurdle for newcomers aiming to establish similar rapport quickly.

Customers in this industry often prioritize financial stability and a history of reliable claims payment. For instance, in 2024, insurance industry surveys consistently show that over 70% of commercial clients consider an insurer's financial strength rating a primary factor in their selection process, a benchmark that new entrants struggle to meet without a proven track record.

Access to Distribution Channels and Expertise

New entrants into the insurance market, like Arch Capital Group, confront substantial hurdles in establishing robust distribution channels. Building relationships with brokers, agents, and direct sales forces takes considerable time and investment, a significant barrier for newcomers seeking to reach a broad customer base. For instance, in 2024, the average time for a new insurance agency to become profitable often extends beyond two years, highlighting the investment required in channel development.

Furthermore, the acquisition of specialized expertise presents another formidable challenge. Profitable risk assessment and management demand deep actuarial, underwriting, and claims handling knowledge. Incumbent firms, such as Arch Capital Group, possess decades of experience and data, creating a steep learning curve and a competitive moat for new entrants aiming to compete effectively in diverse insurance lines.

- Distribution Network Development: New entrants must invest heavily in building and maintaining relationships with brokers, agents, and direct sales teams, a process that can take years to yield significant returns.

- Expertise Acquisition: Gaining the necessary actuarial, underwriting, and claims handling skills to accurately price risk and manage claims efficiently is a complex and resource-intensive undertaking.

- Incumbent Advantage: Established players benefit from accumulated data, brand recognition, and existing client relationships, which new entrants struggle to replicate quickly.

- Regulatory Compliance: Navigating complex and varied regulatory landscapes across different jurisdictions adds another layer of difficulty and cost for new market participants.

Economies of Scale and Data Advantages

New entrants face significant hurdles due to the substantial economies of scale enjoyed by established players like Arch Capital Group. These scale advantages translate into lower per-unit costs across critical functions such as underwriting, claims handling, and investment management, making it difficult for smaller, newer companies to compete on price.

Furthermore, incumbents possess vast troves of historical data, a critical asset in the insurance industry. This data, when analyzed using sophisticated tools and artificial intelligence, enables more precise risk assessment and pricing. New entrants, lacking this extensive data history and the analytical capabilities to leverage it, are at a distinct disadvantage in underwriting accuracy and competitive pricing.

- Economies of Scale: Arch Capital benefits from lower operational costs per policy due to its size.

- Data Advantage: Access to extensive historical data allows for superior risk modeling and pricing.

- AI and Analytics: Advanced analytics are key to leveraging data for competitive underwriting.

- Barriers to Entry: The combination of scale and data creates a significant barrier for new insurers.

The threat of new entrants in the insurance and reinsurance sectors, where Arch Capital Group operates, is generally moderate. This is primarily due to the significant capital requirements, with Arch Capital reporting approximately $24.3 billion in capital as of March 2025, illustrating the immense financial backing needed. New players must also navigate complex regulatory environments and build trust and distribution networks, which are time-consuming and costly endeavors.

Established players like Arch Capital benefit from economies of scale and a substantial data advantage, enabling more accurate risk assessment and pricing. For instance, in 2024, commercial clients overwhelmingly prioritized financial strength, a benchmark difficult for newcomers to achieve quickly. The expertise required in actuarial science and underwriting further solidifies the position of incumbents.

| Barrier to Entry | Impact on New Entrants | Supporting Data/Fact |

|---|---|---|

| Capital Intensity | High hurdle due to substantial reserve requirements and solvency regulations. | Arch Capital's capital base of ~$24.3 billion (March 2025) indicates significant financial resources needed. |

| Regulatory Complexity | Demands significant investment in compliance and specialized knowledge. | Navigating global licensing and solvency frameworks like Solvency II is costly. |

| Brand Reputation & Trust | Challenging for new entrants to establish credibility and client relationships. | Over 70% of commercial clients in 2024 surveys cited financial strength as a primary selection factor. |

| Distribution Channels | Requires considerable time and investment to build broker and agent networks. | New insurance agencies in 2024 often took over two years to achieve profitability due to channel development. |

| Expertise & Data | Newcomers lack the actuarial and underwriting experience and historical data of incumbents. | Incumbents possess decades of data for superior risk modeling and pricing. |

Porter's Five Forces Analysis Data Sources

Our Arch Capital Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Arch Capital's SEC filings, investor presentations, and annual reports. We also leverage industry-specific market research from reputable firms and financial data from platforms like S&P Capital IQ to ensure a robust competitive assessment.