Arch Capital Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arch Capital Group Bundle

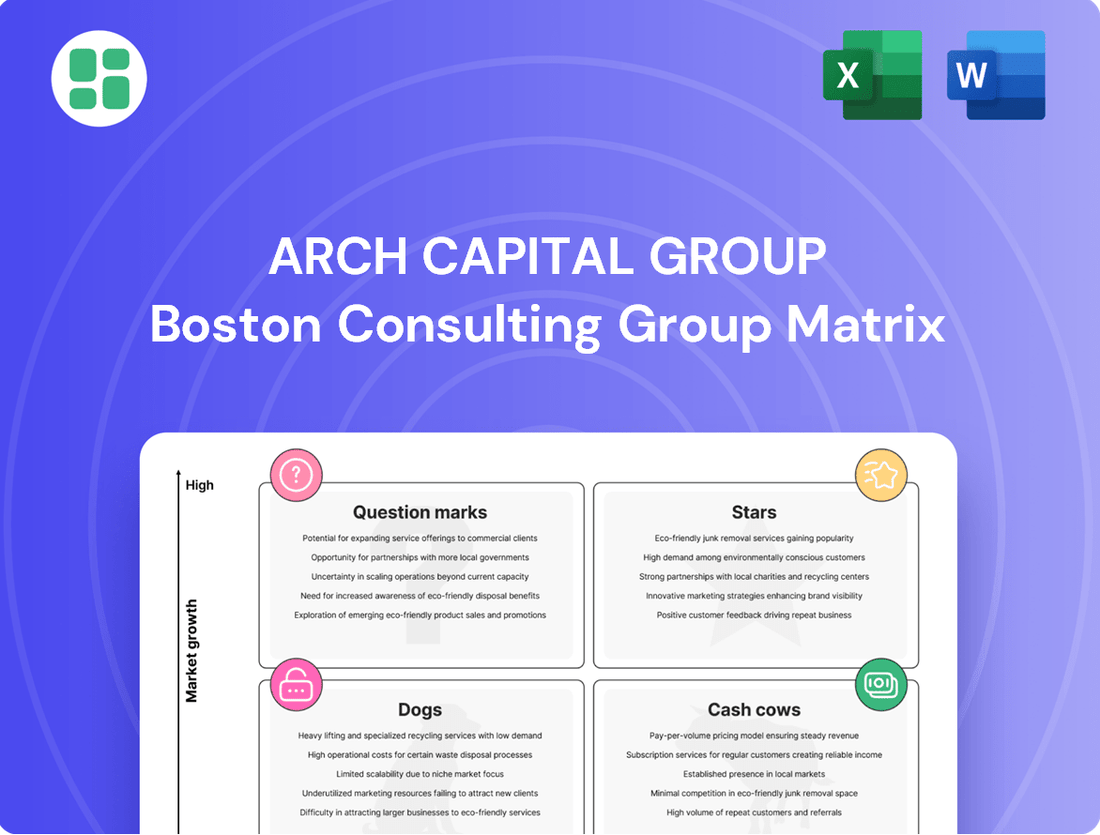

Curious about Arch Capital Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio is performing in the market. Understand which segments are driving growth and which might need a strategic rethink.

Unlock the full potential of this analysis by purchasing the complete Arch Capital Group BCG Matrix. You'll gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment and resource allocation decisions.

Don't miss out on the actionable intelligence that the full report provides. It's your roadmap to optimizing Arch Capital Group's product portfolio for sustained success and competitive advantage.

Stars

Arch Capital Group's acquisition of Allianz's U.S. middle market and entertainment insurance business in August 2024 has significantly boosted its Insurance segment's gross written premiums. This strategic move has effectively broadened Arch's footprint within the U.S. middle market, a sector demonstrating substantial growth potential.

The integration of this acquired business is expected to drive continued expansion and market share gains for Arch. As the operations are fully absorbed, Arch is well-positioned to leverage the high growth trajectory of this newly expanded segment.

Arch Capital Group strategically emphasizes specialty casualty insurance, particularly professional liability and excess and surplus (E&S) lines. This focus allows them to capitalize on their deep underwriting knowledge, leading to superior risk selection and ultimately, better returns. These areas are experiencing robust growth, driven by specific market needs and Arch's established expertise within these specialized niches.

The company's deliberate capital allocation towards segments offering the most attractive risk-adjusted returns suggests a significant and profitable market share in these high-demand specialty casualty areas. For instance, in 2024, Arch continued to demonstrate strength in its U.S. specialty segments, which often include these casualty lines, contributing meaningfully to its overall underwriting profitability.

Arch Capital Group has strategically increased its capacity in property catastrophe reinsurance, a move that underscores the segment's high-growth potential despite a competitive landscape. This expansion reflects Arch's confidence in its sophisticated modeling and portfolio management capabilities to capitalize on market opportunities and solidify its position.

The company's resilience, demonstrated by its ability to achieve solid results even when facing significant catastrophe losses, speaks volumes about its underwriting expertise and established market presence. For instance, in 2024, Arch reported strong performance in its property catastrophe book, even amidst a year marked by several major weather events, highlighting their robust risk management strategies.

Other Liability - Occurrence (Insurance)

Arch Capital Group's Other Liability - Occurrence insurance segment is currently a strong contender, exhibiting significant growth. This performance is driven by successful new business initiatives and advantageous adjustments in premium rates observed over the past few quarters. It suggests Arch is effectively expanding its footprint within the expanding liability insurance sector.

The consistent upward trend in net premiums written for this specific line of business highlights its increasing importance and potential to evolve into an even more prominent Star for Arch Capital Group. For instance, in the first quarter of 2024, Arch reported substantial growth in its insurance segment, with specific lines contributing to this positive momentum.

- Growth Drivers: New business acquisition and favorable rate environment are fueling expansion.

- Market Position: Arch is likely gaining market share in a growing liability insurance market.

- Financial Indicator: Increasing net premiums written underscore its Star potential.

- Performance Snapshot: The segment contributed positively to Arch's overall insurance results in early 2024.

Strategic Investments in Data & Analytics

Arch Capital Group's strategic investments in data and analytics are crucial for identifying and capitalizing on growth. These capabilities, not products themselves, offer a significant competitive advantage, enabling targeted expansion into profitable markets.

This foundational investment directly supports the growth of existing and nascent business lines within Arch Capital.

- Data-driven underwriting: Enabling more precise risk assessment and pricing.

- Market intelligence: Identifying emerging trends and underserved segments.

- Operational efficiency: Streamlining processes and reducing costs.

Arch Capital Group's specialty casualty insurance, particularly professional liability and excess and surplus (E&S) lines, are strong performers. This focus leverages deep underwriting knowledge for superior risk selection and returns, capitalizing on robust growth driven by specific market needs and Arch's expertise. For instance, in 2024, Arch's U.S. specialty segments, including these casualty lines, contributed significantly to underwriting profitability.

The Other Liability - Occurrence segment is also a strong contender, showing significant growth due to successful new business initiatives and favorable rate adjustments. This indicates Arch is effectively expanding its presence in the growing liability insurance market. The consistent increase in net premiums written for this line highlights its growing importance and potential to become a prominent Star for Arch Capital Group.

Arch's strategic investments in data and analytics are foundational, providing a competitive edge by enabling precise risk assessment and identification of profitable market expansion opportunities. These capabilities directly support the growth of both existing and emerging business lines within the company.

| Business Segment | BCG Category | Key Growth Drivers | 2024 Performance Indication |

|---|---|---|---|

| Specialty Casualty (Prof. Liability, E&S) | Star | Deep underwriting expertise, market needs, favorable rates | Meaningful contribution to underwriting profitability |

| Other Liability - Occurrence | Star | New business initiatives, favorable rate environment | Substantial growth in net premiums written |

| Property Catastrophe Reinsurance | Star | Increased capacity, sophisticated modeling, market opportunities | Solid results despite catastrophe losses |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Arch Capital Group's business units, highlighting strategic insights for each quadrant.

A clear visual of Arch Capital Group's business units in the BCG matrix, eliminating confusion about strategic positioning.

Cash Cows

Arch Capital Group's U.S. Primary Mortgage Insurance segment is a clear cash cow. It consistently generates robust underwriting income, evidenced by its exceptionally low combined ratios, often in the low 50s. This stability is further supported by remarkably low delinquency rates, even amidst economic shifts.

While new mortgage originations can fluctuate with economic conditions, this segment remains a highly profitable and stable cash generator for Arch. Its dominant market share in a mature, though cyclical, industry solidifies its position as a reliable performer.

Established Property & Short-Tail Specialty Insurance in North America are Arch Capital Group's cash cows. These mature lines are significant contributors to the company's premium volume and underwriting income, demonstrating a strong presence in established market segments.

While growth might be moderate compared to emerging areas, these segments boast high market share, ensuring a consistent and substantial cash flow for Arch. The company's commitment to disciplined underwriting in these established lines underpins their continued profitability.

Arch Capital Group's diversified reinsurance portfolio, notably its non-property catastrophe lines, has been a consistent performer, generating robust underwriting profits for years. This stability is a hallmark of a strong cash cow.

This segment holds a leading market share in multiple reinsurance sub-sectors, ensuring a steady stream of reliable cash flow for Arch. Its mature and profitable nature solidifies its cash cow status.

As of year-end 2023, Arch's Bermuda operations, which house a significant portion of its diversified reinsurance business, reported gross written premiums of $13.9 billion, with a substantial portion attributed to these stable lines.

Investment Income from Large Asset Base

Arch Capital Group's substantial asset base is a significant driver of its investment income, acting as a reliable cash cow. This large pool of invested assets consistently contributes to the company's earnings, providing a stable revenue stream irrespective of market volatility. The effective management of these investments ensures dependable financial returns.

As of the first quarter of 2024, Arch Capital Group reported total invested assets of approximately $66.4 billion. This impressive figure underscores the scale of its asset base and its capacity to generate substantial investment income. The company's disciplined approach to asset allocation and risk management further solidifies this income stream.

- Significant Investment Income: Arch Capital's large asset base generates considerable investment income, a key contributor to its financial performance.

- Stable Revenue Stream: This income acts as a consistent and reliable revenue source, characteristic of a cash cow, even amidst changing interest rate environments.

- Prudent Portfolio Management: The company's careful management of its investment portfolio ensures predictable and steady financial contributions.

- Q1 2024 Asset Base: By the end of the first quarter of 2024, Arch Capital held approximately $66.4 billion in invested assets, highlighting the scale of this cash cow.

Favorable Prior Year Loss Reserve Development

Arch Capital Group's consistent favorable development of prior year loss reserves across its segments is a significant factor in its strong performance, acting as a quiet engine of profitability. This trend systematically lowers the company's loss ratio, which in turn releases capital and bolsters earnings. It’s a testament to their robust underwriting and disciplined approach to setting aside funds for future claims, particularly from their well-established business lines.

This favorable development isn't just a statistical anomaly; it represents a steady, non-premium-driven inflow of cash. For instance, in 2024, Arch reported significant favorable prior year reserve development, contributing positively to their overall financial results. This consistent release of capital from mature books of business provides a reliable source of funds, enhancing their financial flexibility and capacity for strategic investments.

- Consistent Favorable Reserve Development: Arch's history shows a pattern of prior year loss reserves developing favorably, meaning fewer claims were ultimately paid out than initially estimated.

- Reduced Loss Ratio: This favorable development directly contributes to a lower loss ratio, a key metric indicating the efficiency of an insurer's underwriting.

- Capital Release and Profitability Boost: The difference between initial reserve estimates and actual payouts effectively becomes a profit, releasing capital that can be reinvested or returned to shareholders.

- Indicator of Sound Practices: This trend reflects strong underwriting discipline and accurate reserving, particularly in mature lines of business, providing a stable cash inflow independent of new premium generation.

Arch Capital Group's established Property & Short-Tail Specialty Insurance in North America represent significant cash cows. These mature lines contribute substantially to premium volume and underwriting income, showcasing a strong market presence.

Despite potentially moderate growth, these segments boast high market share, ensuring consistent and substantial cash flow for Arch. The company's disciplined underwriting in these established areas underpins their ongoing profitability.

As of year-end 2023, Arch's U.S. mortgage insurance segment continued to be a robust cash cow, demonstrating exceptionally low combined ratios, often in the low 50s, and remarkably low delinquency rates, even during economic shifts.

Arch's diversified reinsurance portfolio, particularly its non-property catastrophe lines, has consistently generated strong underwriting profits, solidifying its cash cow status. These segments hold leading market shares in various sub-sectors, providing a steady and reliable cash flow.

| Segment | Key Characteristics | Contribution to Cash Flow | 2023/2024 Data Point |

|---|---|---|---|

| U.S. Primary Mortgage Insurance | Low combined ratios, low delinquency rates | Consistent underwriting income | Combined ratios in the low 50s |

| North America Property & Short-Tail Specialty Insurance | High market share, mature lines | Substantial premium volume and underwriting income | Significant contributor to premium volume |

| Diversified Reinsurance (Non-Property Catastrophe) | Leading market share in sub-sectors, stable performance | Robust underwriting profits, steady cash flow | Bermuda operations gross written premiums: $13.9 billion (year-end 2023) |

Preview = Final Product

Arch Capital Group BCG Matrix

The Arch Capital Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in the final downloadable file, ensuring you get a professional, ready-to-use strategic analysis.

Dogs

Arch Capital Group's international mortgage originations likely represent a 'Dog' in their BCG matrix. In Q1 2025, both gross and net premiums written in this segment declined, directly linked to reduced mortgage origination volumes internationally. This suggests these markets are experiencing sluggish growth, and Arch may hold a smaller market share or face competitive hurdles.

Arch Capital Group's reinsurance segment saw a contraction in certain specialty lines during Q1 2025, primarily driven by the non-renewal of structured deals and a reduction in overall share. This strategic move implies these specific structured reinsurance products or segments are no longer achieving Arch's desired profitability thresholds.

The decision to step back from or discontinue these particular structured deals points towards them being classified as low-growth, low-margin business areas. Consequently, Arch is actively de-emphasizing these segments to focus resources on more profitable and higher-growth opportunities within its reinsurance portfolio.

Arch Capital Group faces significant hurdles in London's specialty lines market. Increased competition is squeezing profitability, making it tough to achieve strong growth. This competitive pressure means these segments, despite potential, are currently yielding low returns for Arch, placing them in the 'Dogs' category of the BCG matrix.

Legacy Products with Declining Demand

Arch Capital Group's legacy products with declining demand represent older insurance or reinsurance offerings that are struggling to keep pace with market evolution. These products likely exhibit slow growth and a shrinking market presence. For instance, in 2024, the broader insurance industry saw a continued shift towards digital platforms and specialized coverages, potentially leaving less adaptable legacy products behind.

These underperforming assets can become cash traps if resources are disproportionately allocated to them. Effective management strategies would involve either a controlled divestiture or a strategic minimization of their footprint to free up capital for more promising ventures within Arch Capital Group's portfolio.

- Low Growth Prospects: These products are characterized by minimal expansion opportunities in the current market landscape.

- Declining Market Share: Competitors offering more innovative or specialized solutions are likely capturing a larger portion of the market.

- Potential Cash Traps: Continued investment in these products without a clear path to revitalization can drain financial resources.

- Strategic Management: Options include divestment, phasing out, or a significant overhaul to align with market demands.

Underperforming Niche Insurance Lines

Arch Capital Group's diversified portfolio likely includes niche insurance lines that are currently underperforming. These might be segments facing significant competitive pressures, adverse claims development, or a lack of sufficient scale to achieve profitability. For instance, certain specialty liability coverages or niche property lines could be experiencing these challenges.

The company's strategic approach of reallocating capital away from less fruitful ventures implies that such underperforming niche areas exist. This suggests a deliberate move to divest or reduce exposure in segments where market share is low and growth prospects are dim, allowing for a focus on more promising opportunities within their broader insurance offerings. This capital discipline is crucial for maximizing overall shareholder value.

- Low Market Share: Specific niche lines may struggle to gain significant traction against larger, more established competitors.

- Intense Competition: In some specialized markets, the number of players can drive down pricing and profitability.

- Unfavorable Claims Trends: Emerging risks or evolving legal landscapes can lead to higher-than-expected claims in certain niche areas.

- Lack of Scale: Smaller niche operations may not achieve the economies of scale necessary for efficient operations and competitive pricing.

Arch Capital Group's legacy products, facing declining demand and struggling to adapt to market evolution, are positioned as 'Dogs'. The broader insurance industry in 2024 saw a shift towards digital and specialized coverages, leaving less adaptable legacy products behind. These can become cash traps if resources are not managed effectively.

Niche insurance lines experiencing significant competitive pressures or unfavorable claims development also fall into the 'Dog' category. Arch's strategy of reallocating capital away from less fruitful ventures highlights these underperforming niche areas where market share and growth prospects are dim.

Arch's international mortgage originations likely represent a 'Dog' due to declining gross and net premiums written in Q1 2025, indicating sluggish growth and potential competitive hurdles in these markets. Similarly, certain specialty lines within their reinsurance segment, specifically structured deals that are no longer meeting profitability thresholds, are being de-emphasized, classifying them as 'Dogs'.

London's specialty lines market presents challenges for Arch due to intense competition squeezing profitability and hindering growth, resulting in low returns for these segments. These factors collectively place these business areas within the 'Dogs' quadrant of the BCG matrix, necessitating strategic management through divestiture or minimization.

| Segment | BCG Category | Reasoning |

| International Mortgage Originations | Dog | Declining premiums in Q1 2025 indicate sluggish growth and competitive pressures. |

| Certain Structured Reinsurance Deals | Dog | Non-renewal and reduced share suggest these lines no longer meet profitability targets. |

| Legacy Products | Dog | Declining demand and slow adaptation to market shifts, such as digital platforms. |

| Underperforming Niche Insurance Lines | Dog | Face intense competition, adverse claims, or lack of scale, leading to low profitability. |

Question Marks

Arch Capital Group, as a global insurer and reinsurer, is actively exploring new frontiers. Recent, smaller-scale entries into emerging markets, such as select countries in Southeast Asia or parts of Africa, exemplify this strategy. These ventures are characterized by their potential for rapid expansion but currently represent a modest market share for Arch, necessitating ongoing investment to establish a stronger foothold and client network.

Arch Capital Group's emerging risk solutions, like advanced cyber and climate risk insurance, represent a potential star in the BCG matrix. These innovative products address rapidly evolving threats, offering high growth prospects as markets mature. For instance, the global cyber insurance market is projected to reach $20.4 billion by 2025, indicating substantial upside.

However, these are question mark segments due to their nascent nature. Arch is actively building market share and refining pricing strategies in these complex areas. The inherent uncertainty in predicting advanced cyber-attacks and the long-term impacts of climate change create a volatile but potentially lucrative landscape for Arch's offerings.

Arch Capital Group's digital insurance platform initiatives likely represent a Stars or Question Marks in their BCG matrix. Many insurers are channeling significant investment into digital transformation and insurtech, aiming to capture new customer segments and streamline operations. For instance, the global insurtech market was valued at approximately $11.4 billion in 2023 and is projected to grow substantially, indicating a high-growth environment.

If Arch has launched or is heavily investing in new digital platforms or direct-to-consumer/broker solutions, these ventures would fit the profile of a Star or Question Mark. These initiatives typically target high growth potential but may currently have low market penetration as they are often new entrants or in early stages of development. The success of these digital platforms hinges on their ability to gain traction and market share in a rapidly evolving digital landscape.

Specific Casualty Lines with Inflation Adjustment Concerns

Certain casualty lines, despite overall growth, face significant inflation adjustment concerns. Arch Capital Group's Q1 2025 earnings call specifically flagged the 'casualty line market turn and inflation adjustment' as a key discussion point. This suggests that as inflation persists, the long-term profitability of some newer or rapidly expanding casualty sub-segments remains uncertain.

These inflation-sensitive areas within casualty are essentially question marks for the business. Their future success hinges on the ability to accurately price risk and manage claims costs in an inflationary environment. Consequently, they require close monitoring and potentially substantial investment to ensure their viability and contribution to Arch Capital's market share.

- Inflationary Impact on Liability Reserves: Rising costs for medical care, legal services, and repair expenses directly increase the ultimate cost of settling liability claims, potentially eroding prior favorable reserve development.

- Pricing Lag in New Business: Newly introduced or rapidly growing casualty products may not have fully incorporated the current inflation rate into their pricing, leading to initial profitability challenges.

- Uncertainty in Long-Term Claims: For casualty lines with long tail claims, like general liability or workers compensation, inflation over many years can significantly amplify initial estimates.

Targeted Middle Market Expansion Beyond Allianz Acquisition

Arch Capital Group might be looking to expand further into the middle market, building on its successful Allianz acquisition. These new ventures, while drawing on Arch's established strengths, would likely start with a small footprint in promising, fast-growing niches. This positions them as Question Marks in the BCG matrix, needing strategic investment to grow into market leaders.

For instance, Arch could target specialized middle-market insurance segments like cyber liability for rapidly growing tech startups or parametric insurance for climate-vulnerable businesses. In 2024, the middle market insurance sector continued to show robust growth, with cyber insurance premiums alone projected to exceed $10 billion globally. Arch's strategic entry into these areas, even with initial low market share, could capitalize on their high growth potential.

- Targeted Middle Market Expansion: Arch's strategy involves identifying and entering specific, high-growth sub-segments within the broader middle market.

- Leveraging Existing Expertise: The expansion efforts will build upon Arch's core competencies and operational experience gained from previous acquisitions and operations.

- BCG Matrix Classification: New ventures are expected to begin as Question Marks, characterized by low market share in high-growth markets, necessitating focused investment.

- Potential for Star Growth: Successful development of these Question Mark initiatives could transform them into Stars, generating significant revenue and market dominance.

Arch Capital Group's ventures into new, rapidly expanding niches within the middle market, such as specialized cyber liability for tech startups or parametric insurance for climate-vulnerable businesses, are classified as Question Marks. These initiatives, while promising, begin with a low market share but operate in high-growth environments, exemplified by the middle market insurance sector's continued robust growth in 2024 and global cyber insurance premiums projected to exceed $10 billion.

These Question Mark segments require strategic investment to build market presence and capitalize on their inherent growth potential, aiming to eventually transition into Stars. Arch's approach involves leveraging existing expertise to target these specific, high-growth sub-segments.

The success of these new ventures hinges on their ability to gain traction and market share, transforming from Question Marks into dominant players. This strategic focus on emerging opportunities within the middle market underscores Arch's commitment to expanding its portfolio in dynamic insurance landscapes.

Arch Capital Group's investment in emerging risk solutions, like advanced cyber and climate risk insurance, also falls into the Question Mark category. These areas, while offering high growth potential as markets mature, are characterized by their nascent nature and the inherent uncertainty in predicting evolving threats, such as the global cyber insurance market's projected $20.4 billion valuation by 2025.

| BCG Category | Arch Capital Group Segment | Characteristics | Market Growth | Arch's Share |

| Question Mark | Emerging Market Ventures | High potential, low current share, requires investment | High | Low |

| Question Mark | Advanced Cyber & Climate Risk Insurance | Nascent, evolving threats, uncertain long-term impact | High | Low to Moderate |

| Question Mark | Digital Insurance Platforms | New entrants, early stage, high growth potential | High | Low |

| Question Mark | Inflation-Sensitive Casualty Lines | Uncertain profitability due to inflation, requires careful pricing | Moderate to High | Moderate |

| Question Mark | Targeted Middle Market Expansion | Specific high-growth niches, initial low footprint | High | Low |

BCG Matrix Data Sources

Our BCG Matrix is built on robust financial statements, comprehensive market research, and competitor analysis to provide strategic insights.