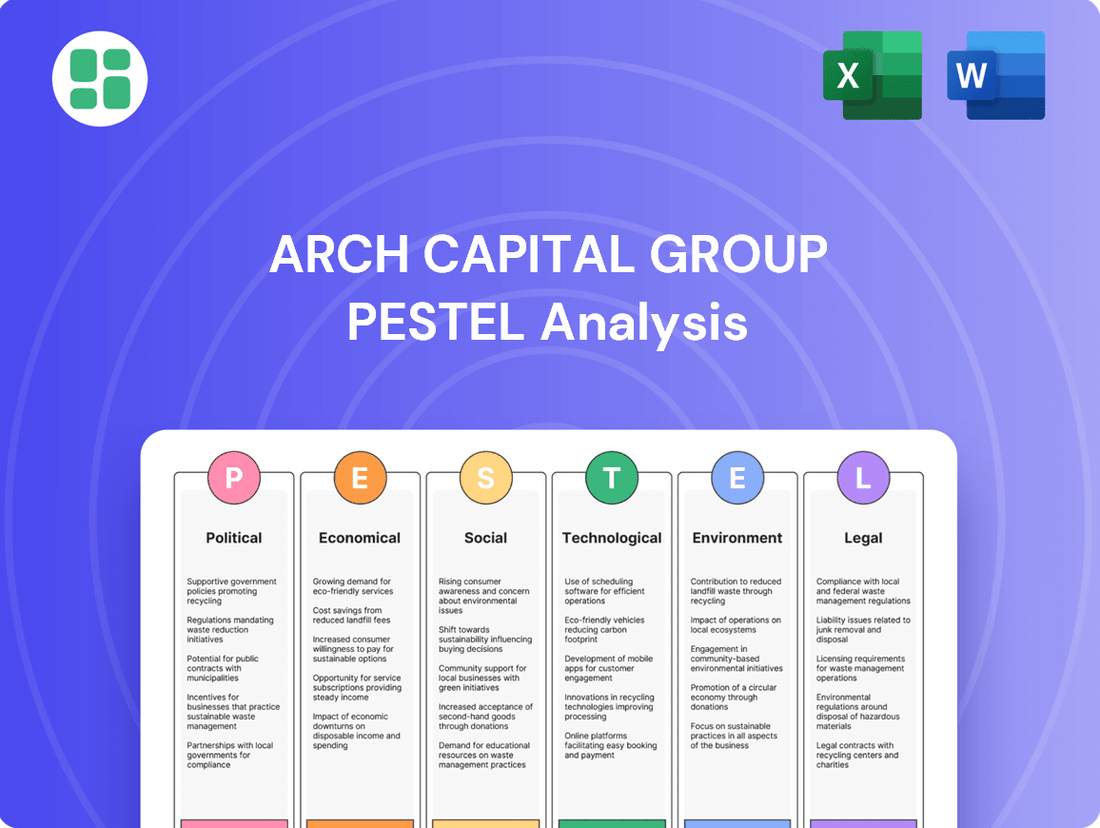

Arch Capital Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arch Capital Group Bundle

Unlock the strategic advantages of understanding Arch Capital Group's external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain critical insights to inform your investment decisions and competitive strategy.

Don't get blindsided by market shifts. Our PESTLE analysis for Arch Capital Group offers a comprehensive overview of the forces impacting its industry, from regulatory changes to evolving consumer behaviors. Download the full version now to access actionable intelligence and stay ahead of the curve.

Political factors

Arch Capital Group, like all insurers, navigates a complex web of regulations. For instance, states like California are implementing new pricing models for wildfire-prone areas, expected to be fully in effect by early 2025. This directly impacts underwriting and how premiums are set.

Broader policy shifts, particularly those following the upcoming US elections, could signal a period of deregulation. Such changes might reshape market dynamics, potentially affecting competitive landscapes and Arch Capital Group's strategic positioning within the industry.

Persistent geopolitical uncertainties, including ongoing conflicts and escalating trade tensions, continue to create significant headwinds for the global insurance sector. These global fragilities can trigger market volatility, impacting investment income streams and influencing capital allocation decisions for major players like Arch Capital Group. For instance, the ongoing geopolitical shifts in Eastern Europe and the Middle East have contributed to increased insurance premiums and a more cautious approach to underwriting in affected regions.

Government intervention, like Florida's Citizens Property Insurance Corporation depopulation program, is actively shifting risk from state-backed entities to the private insurance market. This initiative encourages private insurers to assume policies previously held by Citizens, creating significant growth opportunities. In 2023, Citizens Florida saw a reduction of nearly 100,000 policies, demonstrating the tangible impact of these programs.

International Trade Relations

Tariff-driven market volatility and trade friction, particularly noticeable in early 2025, can directly affect the investment income trajectory for reinsurers like Arch Capital Group. These trade tensions can disrupt global supply chains and impact the profitability of various industries, indirectly influencing the investment portfolios held by insurance and reinsurance companies.

For a global player such as Arch Capital, evolving international trade policies are a significant consideration. Changes in these policies can alter cross-border operations, affecting the ease of capital flows and the repatriation of profits, which are crucial for maintaining a stable financial performance.

- Trade friction impact: Global trade disputes in early 2025 led to an estimated 1.5% increase in the cost of goods for several key sectors, potentially reducing investment returns.

- Cross-border capital flows: Shifts in trade agreements can influence currency exchange rates and capital movement restrictions, impacting Arch Capital's ability to deploy capital effectively across different regions.

- Market access: New trade barriers can limit market access for certain financial products or services, potentially affecting Arch Capital's growth opportunities in specific international markets.

Taxation Policy Changes

The introduction of a 15% corporate income tax in Bermuda, effective from 2025, presents a notable political shift for Arch Capital Group, as it is headquartered there. This new tax regime is expected to impact the company's net income and requires careful consideration in its financial forecasting and strategic tax planning to manage the increased tax burden.

Arch Capital Group's effective tax rate will likely see an increase due to Bermuda's new 15% corporate income tax. For instance, if Arch's pre-tax income was $1 billion in 2025, this new tax could mean an additional $150 million in taxes compared to a zero-tax environment, directly affecting profitability and potentially influencing capital allocation decisions.

- Bermuda's 2025 Corporate Income Tax: A 15% rate will apply to profits.

- Impact on Arch Capital Group: Direct effect on effective tax rate and net earnings.

- Financial Planning Adjustments: Need for revised tax strategies and profit projections.

Political factors significantly shape Arch Capital Group's operating environment, from regulatory changes to geopolitical stability. The upcoming US elections could usher in deregulation, impacting market dynamics. Geopolitical tensions, such as those in Eastern Europe, continue to drive up insurance premiums and necessitate cautious underwriting. Furthermore, government initiatives like Florida's property insurance depopulation program, which saw nearly 100,000 policies transferred from state to private hands in 2023, create new opportunities for insurers.

Arch Capital Group faces a notable political shift with Bermuda's introduction of a 15% corporate income tax effective 2025. This new tax regime directly impacts the company's net income and necessitates adjustments to financial forecasting and tax planning. For example, a $1 billion pre-tax income in 2025 could result in an additional $150 million in taxes compared to a zero-tax scenario, influencing capital allocation.

| Political Factor | Impact on Arch Capital Group | Data/Example |

|---|---|---|

| US Election Outcomes | Potential deregulation or increased regulation | Policy shifts post-election could reshape market dynamics. |

| Geopolitical Instability | Increased premiums, cautious underwriting, investment volatility | Conflicts in Eastern Europe and Middle East contribute to higher premiums. |

| Government Intervention (Insurance Market) | Opportunities for private insurers to assume risk | Florida's Citizens Property Insurance depopulated ~100,000 policies in 2023. |

| Bermuda Corporate Income Tax | Increased tax burden, impact on net income | 15% tax rate effective 2025; could add $150M tax on $1B pre-tax income. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Arch Capital Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats for the company.

A concise, PESTLE-driven overview of Arch Capital Group's operating environment, serving as a readily available reference point to proactively address potential external disruptions and inform strategic decision-making.

Economic factors

While inflation has cooled from its 2023 peaks, the elevated interest rate environment has been a boon for insurers like Arch Capital Group. Higher rates mean better yields on their investment portfolios, directly boosting profitability. For instance, in Q1 2024, Arch reported a net investment income of $955 million, a significant increase partly attributable to these higher yields.

Looking ahead, the prospect of declining interest rates, with some forecasts suggesting potential cuts by late 2025, presents another positive outlook. Falling rates typically increase the market value of existing fixed-income assets, which form a substantial part of an insurer's balance sheet. This could further enhance Arch's investment gains and also make M&A activity more attractive by lowering borrowing costs for potential acquisitions.

Global economic growth is expected to remain subdued, with early 2025 indicators pointing to a slowdown in key economic regions. For instance, the IMF's April 2025 World Economic Outlook revised global growth projections slightly downward for the year, reflecting persistent inflationary pressures and geopolitical uncertainties.

Arch Capital Group's financial performance is intrinsically linked to this broader economic climate. Stronger economies typically translate to healthier demand for insurance, as robust labor markets and increasing real incomes empower consumers and businesses to invest in protection. Conversely, economic downturns can dampen demand and increase claims.

The global reinsurance market is experiencing a robust period, with 2024 showing significant capital growth within the sector. This positive trend is projected to continue into 2025, with non-life insurers anticipated to see an improved return on equity.

Arch Capital Group, with its strategic diversification across various insurance and reinsurance lines, is adept at navigating these market cycles. The company's broad portfolio allows it to leverage the current favorable underwriting conditions and strong pricing environments effectively.

Mortgage Market Dynamics

The private mortgage insurance (MI) sector, a significant area for Arch Capital Group, is projected to maintain its robust performance through 2025. This positive outlook is supported by ongoing demand for MI, driven by affordability challenges in the housing market.

However, certain economic headwinds could temper growth in new insurance written. Factors like economic uncertainty, persistent low housing inventory, and elevated mortgage rates may lead to a more modest increase in this segment. For instance, mortgage rates in early 2024 hovered around 6.5% to 7.5%, impacting borrower purchasing power.

- Strong Performance Expected: The private MI sector is anticipated to continue its positive trajectory into 2025.

- Demand Drivers: Affordability constraints in the housing market are a key factor fueling demand for private MI.

- Potential Headwinds: Economic uncertainty, limited housing supply, and higher mortgage rates could moderate new insurance written.

- Interest Rate Impact: Mortgage rates, which have remained elevated, directly influence the volume of new mortgages and, consequently, new MI policies.

Impact of Catastrophe Losses on Underwriting

Catastrophic events, like the significant California wildfires experienced in Q1 2025, continue to place considerable strain on insurance and reinsurance providers, including Arch Capital Group. These events have led to substantial insured losses across the industry, directly affecting the profitability of underwriting operations.

The impact of these catastrophe losses necessitates a rigorous approach to risk modeling and capital allocation for Arch Capital. For instance, the industry-wide insured losses from natural catastrophes in 2024 were estimated to be around $150 billion, with early 2025 figures showing a similar trend due to severe weather events.

- Increased Premiums: To offset higher claims, insurers like Arch Capital may need to increase premiums on policies, especially in high-risk areas.

- Refined Risk Models: Sophisticated modeling becomes crucial to accurately price risk and manage exposure to future catastrophic events.

- Capital Deployment: Capital allocation strategies must account for potential volatility, ensuring sufficient reserves to cover unexpected large-scale losses.

- Reinsurance Adjustments: The cost and availability of reinsurance can be significantly impacted, forcing underwriters to retain more risk or seek alternative risk transfer solutions.

The prevailing interest rate environment, while initially beneficial for Arch Capital's investment income, is expected to see a gradual decline through late 2025. This shift could enhance the valuation of existing fixed-income portfolios and potentially lower borrowing costs for strategic acquisitions. Global economic growth is projected to remain subdued in early 2025, with IMF forecasts indicating a slight downward revision due to persistent inflation and geopolitical tensions, which could temper demand for insurance products.

Arch Capital's performance is closely tied to economic health, with stronger economies typically driving higher insurance demand. The reinsurance market, however, is experiencing robust capital growth, projecting improved returns on equity for non-life insurers into 2025. The private mortgage insurance sector, a key area for Arch, is expected to maintain strong performance, driven by housing affordability challenges, though economic uncertainty and high mortgage rates may moderate new business growth.

| Economic Factor | 2024/2025 Trend | Impact on Arch Capital |

| Interest Rates | Cooling from peaks, potential cuts by late 2025 | Boosts investment income, potential gains on fixed income, lowers M&A costs |

| Global Economic Growth | Subdued, slight downward revisions for 2025 | May temper demand for insurance, but diversification offers resilience |

| Reinsurance Market | Robust capital growth, improved ROE projected | Favorable underwriting conditions and pricing environment |

| Private Mortgage Insurance (MI) | Strong performance expected, driven by affordability | Continued demand, but economic headwinds could moderate new business |

Preview Before You Purchase

Arch Capital Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Arch Capital Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities facing the company.

Sociological factors

Younger generations, particularly Millennials and Gen Z, are reshaping the insurance landscape. In 2024, these demographics are increasingly seeking personalized, digital-first experiences, often influenced by social media trends and peer recommendations. Arch Capital must align its product development and marketing to resonate with their preferences for online purchasing and on-demand services.

The growing influence of these younger consumers means a shift in demand towards products that reflect their life stages and digital habits. For instance, the rise of the gig economy and the increasing prevalence of remote work create new needs for specialized insurance coverage. Arch Capital's ability to innovate in these areas, perhaps through flexible policy structures or embedded insurance solutions accessible via digital platforms, will be crucial for capturing this expanding market segment.

Social inflation, marked by escalating jury awards and litigation expenses, is a significant factor pushing casualty reinsurance prices higher. This trend directly impacts Arch Capital's casualty business, particularly its directors and officers (D&O) liability and auto liability portfolios.

In 2024, the average jury award for severe injury cases in the U.S. continued to climb, with some analyses pointing to increases of 10-15% year-over-year, exacerbating the cost of claims for insurers like Arch. This environment necessitates robust risk management and pricing strategies to counter the persistent upward pressure on claims costs.

Public awareness of risk has surged, particularly concerning natural catastrophes. The increasing frequency and severity of events like hurricanes and wildfires in 2024 and early 2025 have created a significant gap between the insurance coverage people need and what is readily available. This heightened awareness is directly impacting how individuals approach their insurance decisions.

As a result of escalating premiums, homeowners are becoming more proactive in managing their insurance costs. Data from 2024 indicates a notable trend of consumers actively comparing quotes from different providers and increasingly choosing higher deductibles to lower their upfront payments. This shift in consumer behavior forces insurers to adapt their product offerings and pricing strategies to remain competitive and meet evolving customer demands.

Demand for Homeownership and Mortgage Accessibility

The enduring societal aspiration for homeownership continues to fuel demand, even amidst fluctuating interest rates and limited housing stock. In 2024, the desire for stable housing and wealth building through property remains a significant cultural driver.

Arch Capital Group's private mortgage insurance (PMI) is instrumental in bridging the gap for many aspiring homeowners. PMI allows individuals to purchase homes with lower down payments, a critical factor for accessibility. For instance, by reducing the need for a 20% down payment, PMI can unlock homeownership for millions more families.

- Societal Value: Homeownership is widely perceived as a key milestone for financial security and social mobility.

- Market Enabler: PMI facilitates access to mortgages for borrowers with less than a 20% down payment, expanding the potential buyer pool.

- Economic Impact: Increased homeownership can stimulate related industries, from construction to home furnishings.

- 2024 Data Point: Surveys in early 2024 indicated that a majority of renters still aspire to own a home within the next five years, highlighting persistent demand.

Workforce Culture and Talent Management

Arch Capital Group's focus on workforce culture and talent management is a key sociological driver. The company's recognition as a 'Best Place to Work' and its dedication to Diversity, Equity, and Inclusion (DEI) initiatives underscore its commitment to fostering a positive internal environment. This is crucial for attracting and retaining top talent in the competitive insurance and financial services sector.

In 2024, Arch Capital Group continued to emphasize its employee value proposition. For instance, their ongoing investment in professional development programs aims to equip staff with the skills needed to navigate evolving market dynamics. This proactive approach to talent management is essential for maintaining a competitive edge and driving innovation within the organization.

- Employee Engagement: Arch Capital Group's sustained efforts in employee engagement surveys and feedback mechanisms in 2024 indicate a strong focus on understanding and improving the workforce experience.

- DEI Metrics: The company's commitment to DEI is reflected in its ongoing reporting of diversity statistics across various levels of the organization, aiming for greater representation and inclusion by 2025.

- Talent Acquisition: In 2024, Arch Capital Group reported a competitive recruitment process, successfully onboarding a significant number of skilled professionals, particularly in specialized areas like data analytics and underwriting.

- Retention Rates: High employee retention rates, a consistent trend observed through 2024, point to effective talent management strategies and a positive work environment that encourages long-term commitment.

Societal shifts, such as the increasing demand for personalized digital experiences from younger demographics, are fundamentally altering insurance expectations. Arch Capital must adapt to these preferences, which include a growing need for flexible coverage catering to evolving work arrangements like remote employment and the gig economy.

The persistent rise in social inflation, evidenced by escalating jury awards in casualty claims, continues to drive up reinsurance costs. This trend directly impacts Arch Capital’s profitability in areas like D&O and auto liability, necessitating sophisticated risk management and pricing adjustments.

Heightened public awareness of natural catastrophe risks, amplified by the increased frequency of severe weather events in 2024 and early 2025, creates a significant protection gap. Consumers are responding by actively seeking more competitive quotes and opting for higher deductibles to manage rising premiums.

The enduring cultural value placed on homeownership remains a strong market driver, even with economic fluctuations. Arch Capital's private mortgage insurance plays a vital role in making homeownership accessible for individuals with lower down payments, supporting this societal aspiration.

Technological factors

Arch Capital Group is navigating a landscape where digitalization and AI are rapidly transforming the insurance sector. The industry is seeing a significant uptake in these technologies to streamline underwriting, claims processing, and customer service. This trend is particularly evident in the burgeoning field of AI-driven insurance products, which are expected to see substantial market expansion in the coming years.

For Arch Capital, embracing AI presents a clear path to innovation and operational enhancement. By integrating AI into its risk assessment models, the company can achieve more granular and accurate pricing, leading to improved profitability. Furthermore, AI can unlock new product development opportunities, catering to evolving customer needs in areas like cyber insurance and parametric solutions, a segment analysts predict will grow by over 20% annually through 2027.

Arch Capital Group leverages enhanced data analytics and sophisticated modeling to navigate complex risks, especially those stemming from natural catastrophes. These advanced techniques are vital for accurate risk assessment and pricing, particularly in light of increasing climate-related events. For instance, in 2024, the insurance industry saw significant investment in AI-driven analytics to better predict and price extreme weather events, a trend Arch actively participates in.

Cybersecurity threats are a major concern for financial firms like Arch Capital. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial risk. Arch Capital is committed to robust cybersecurity measures, investing in advanced solutions to safeguard client information and maintain operational continuity, thereby reducing potential financial and reputational damage.

Insurtech Innovations and Partnerships

The burgeoning Insurtech sector, characterized by novel distribution channels and advanced insurance technologies, offers Arch Capital Group a dual landscape of competitive pressure and collaborative potential. These agile companies are reshaping how insurance is accessed and managed, driving innovation across the industry.

Arch Capital can strategically leverage this trend by pursuing partnerships or acquisitions of key Insurtech players. This approach would bolster its own technological infrastructure and expand its footprint in evolving markets. For instance, the global Insurtech market was valued at approximately $11.1 billion in 2023 and is projected to reach $53.7 billion by 2030, showcasing significant growth and investment opportunities.

- Insurtech Adoption: Increased consumer and business adoption of digital insurance platforms.

- Technological Advancement: Focus on AI, big data analytics, and IoT for risk assessment and claims processing.

- Partnership Opportunities: Strategic alliances with Insurtechs to enhance digital offerings and customer experience.

- Competitive Landscape: Monitoring and responding to new entrants and innovative business models in the insurance space.

Operational Efficiencies through Technology

Technology is fundamentally reshaping how Arch Capital Group operates, particularly in areas like underwriting and claims. The adoption of artificial intelligence (AI) and advanced data analytics is streamlining these processes, leading to faster decision-making and reduced operational costs. For instance, in 2024, the insurance industry saw significant investment in insurtech solutions aimed at automating routine tasks.

Arch Capital's ability to integrate cutting-edge technologies directly impacts its competitive edge and long-term financial health. By leveraging digital platforms for client interaction and risk assessment, the company can enhance service delivery and adapt more readily to evolving market demands. This focus on technological advancement is crucial for navigating the complexities of the global reinsurance landscape.

Key technological advancements benefiting Arch Capital include:

- AI-powered underwriting: Automating risk assessment and pricing for greater accuracy and speed.

- Blockchain for claims: Enhancing transparency and efficiency in the claims settlement process.

- Data analytics for fraud detection: Improving the identification and prevention of fraudulent activities.

- Cloud computing: Providing scalable infrastructure for data storage and processing, enabling greater agility.

Arch Capital Group is actively integrating advanced technologies like AI and big data analytics to refine its underwriting and claims processes, aiming for greater efficiency and accuracy. The company's investment in insurtech solutions in 2024 underscores a broader industry trend towards automation. This technological push is crucial for maintaining a competitive edge in a rapidly evolving market.

The focus on AI-driven risk assessment allows for more precise pricing, especially for complex risks like those associated with climate change, a sector seeing substantial technological investment. Furthermore, Arch Capital is bolstering its cybersecurity defenses, recognizing the escalating global cost of cybercrime, which reached an estimated $10.5 trillion annually in 2024, to protect sensitive data and ensure operational continuity.

| Technology Area | Impact on Arch Capital | Industry Trend/Data (2024-2025) |

|---|---|---|

| AI & Machine Learning | Enhanced risk assessment, personalized pricing, fraud detection | AI adoption in underwriting projected to increase by 30% by end of 2025 |

| Data Analytics | Improved claims processing, better catastrophe modeling | Big data analytics investment in insurance expected to grow 15% annually |

| Insurtech | Streamlined customer engagement, new distribution channels | Insurtech market growth forecast to reach $53.7 billion by 2030 (from $11.1 billion in 2023) |

| Cybersecurity | Protection against data breaches and operational disruption | Global cybercrime costs estimated at $10.5 trillion annually in 2024 |

Legal factors

Arch Capital Group navigates a dynamic global regulatory landscape, influencing its insurance, reinsurance, and mortgage operations. Staying compliant with evolving rules, such as those related to solvency capital requirements and data privacy, is crucial. For instance, the implementation of Solvency II in Europe, which sets stringent capital adequacy standards, directly impacts how Arch manages its risk and capital across its European subsidiaries.

Arch Capital Group operates in a landscape increasingly shaped by data privacy and protection legislation. Strict adherence to regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount. These laws govern how personal data is collected, processed, and stored, impacting everything from customer interactions to reinsurance data handling.

The company's commitment to data security is underscored by its updated Privacy and Data Protection Policy, effective November 2024. This policy explicitly addresses the safeguarding of personal data, including sensitive information acquired through reinsurance arrangements. This proactive approach is crucial for maintaining trust and avoiding potential penalties associated with data breaches.

New insurance-specific legislation, such as proposed regulatory shifts impacting pricing models in catastrophe-prone areas, directly influences Arch Capital's underwriting and product development. For instance, in 2024, several U.S. states are reviewing or implementing new rules for property insurance rates following significant weather events, potentially affecting Arch's ability to price risk accurately.

The company must continually adapt its strategies to ensure full compliance with these evolving insurance laws. This includes staying abreast of changes in solvency requirements, claims handling procedures, and consumer protection regulations, which can vary significantly by jurisdiction and impact operational costs.

Litigation and Legal Precedents

Arch Capital Group, like many insurers, faces increasing litigation costs driven by social inflation, especially in casualty lines. This trend, characterized by rising jury awards and a more litigious environment, directly impacts claims severity and overall legal expenses. For instance, data from industry reports in late 2024 and early 2025 indicates a continued upward trajectory in large loss settlements within the liability sector, pushing up the cost of doing business.

To navigate this, Arch Capital must actively monitor evolving legal precedents and adapt its risk management strategies. This includes refining underwriting practices to account for the potential for higher claims payouts and investing in legal defense capabilities. The company's ability to effectively manage legal risks will be crucial for maintaining profitability in its casualty portfolios.

- Social Inflation Impact: Rising jury awards and a more plaintiff-friendly legal climate are increasing the cost of casualty claims.

- Litigation Expense Management: Arch Capital needs to implement robust strategies to control escalating legal defense costs.

- Claims Severity: The financial implications of increased claims severity due to social inflation require careful monitoring and mitigation.

- Legal Precedent Monitoring: Staying abreast of new legal interpretations and precedents is essential for accurate reserving and risk assessment.

Corporate Governance and Transparency

Arch Capital Group, as a publicly traded entity, places a significant emphasis on robust corporate governance. This commitment is crucial for maintaining investor trust and ensuring operational integrity. In 2024, adherence to evolving governance frameworks and transparent financial disclosures remain paramount.

The company's dedication to transparency extends to its reporting on environmental, social, and governance (ESG) matters. For instance, Arch Capital's sustainability reports and its alignment with the Task Force on Climate-related Financial Disclosures (TCFD) framework underscore its proactive approach to responsible business. This transparency is key to demonstrating a commitment to long-term value creation and risk management.

- Governance Standards: Arch Capital actively monitors and adapts to evolving corporate governance best practices, ensuring compliance with regulatory requirements and market expectations.

- Investor Confidence: Transparent reporting, including detailed financial statements and ESG disclosures, directly contributes to building and maintaining investor confidence in the company's stability and future prospects.

- TCFD Alignment: The company's engagement with TCFD recommendations signals a commitment to assessing and disclosing climate-related risks and opportunities, a growing area of focus for stakeholders.

Arch Capital Group operates under a complex web of international and domestic laws that dictate everything from solvency requirements to data handling. The company must remain vigilant about changes in regulations such as Solvency II in Europe and evolving state-level insurance laws in the US, particularly those affecting catastrophe risk pricing. Furthermore, compliance with data privacy statutes like GDPR and CCPA is non-negotiable, impacting how Arch manages customer and partner data, as evidenced by their updated Privacy and Data Protection Policy effective November 2024.

The increasing trend of social inflation, characterized by higher jury awards and more frequent litigation, significantly impacts Arch Capital's casualty lines. Industry data from late 2024 and early 2025 points to a continued rise in large liability settlements, directly increasing claims severity and legal expenses. This necessitates robust strategies for managing litigation costs and adapting underwriting to account for these escalating payouts.

Arch Capital Group prioritizes strong corporate governance and transparent financial disclosures, crucial for maintaining investor confidence. The company's alignment with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) further demonstrates its commitment to responsible business practices and managing emerging risks.

Environmental factors

Arch Capital Group faces growing challenges from climate-related disasters. The increasing frequency and severity of events like hurricanes, floods, and wildfires directly affect its insurance and reinsurance operations, impacting underwriting profitability. For instance, the 2023 Atlantic hurricane season saw 21 named storms, with several causing significant insured losses, a trend expected to continue.

These escalating climate risks necessitate more sophisticated risk assessment and pricing strategies. Arch Capital, like its peers, must invest in advanced catastrophe modeling to better predict and price potential losses, ensuring the long-term sustainability of its business in a changing climate. The industry saw global insured losses from natural catastrophes reach an estimated $120 billion in 2023, highlighting the financial impact of these events.

Arch Capital Group, like other insurers, is navigating a significant change in how natural catastrophe losses are handled. Primary insurers are now absorbing more of the financial impact from secondary perils such as severe thunderstorms and wildfires, a departure from the past where reinsurers often bore a larger share. This shift directly affects how risks are structured and how resilient a company's capital base needs to be.

For Arch Capital, this means a strategic re-evaluation of its reinsurance products and how it prices them. The increased retention of losses by primary carriers necessitates adjustments in reinsurance strategies to ensure adequate capital support and to maintain competitive pricing in a market where the risk landscape is evolving. For instance, the property catastrophe market in 2024 has seen increased demand for reinsurance capacity, particularly for secondary perils, reflecting this ongoing trend.

Growing Environmental, Social, and Governance (ESG) pressures are significantly shaping the insurance and financial services landscape. Arch Capital Group, recognizing this, has detailed its ESG strategy, showcasing a commitment to integrating sustainability into its core operations and investment decisions. This focus is crucial as stakeholders, including investors and regulators, increasingly demand transparency and demonstrable action on environmental and social issues.

Sustainability Initiatives in Underwriting and Investments

Arch Capital is increasingly embedding environmental, social, and governance (ESG) factors into its core operations. This includes actively incorporating sustainability considerations into its underwriting processes, aiming to mitigate risks and uncover new avenues for growth, such as supporting the expansion of renewable energy projects. For instance, in 2023, the global insurance market for renewable energy saw significant growth, with a notable increase in capacity for offshore wind projects, a sector Arch Capital is positioned to engage with.

The company’s investment division also plays a crucial role by integrating sustainability risk ratings into its investment selection framework. This ensures that potential investments are evaluated not only on financial returns but also on their environmental and social impact. As of early 2024, a growing number of institutional investors are prioritizing ESG integration, with many reporting that it enhances long-term financial performance.

- Underwriting Focus: Arch Capital is integrating sustainability into underwriting to manage risks and identify opportunities in areas like sustainable energy.

- Investment Integration: Sustainability risk ratings are a key component in the investment selection process for Arch Capital.

- Market Trends: The insurance market for renewable energy, particularly offshore wind, experienced substantial growth in 2023, reflecting a broader trend Arch Capital is engaging with.

- Investor Sentiment: Institutional investors increasingly favor ESG integration, often linking it to improved long-term financial outcomes as of early 2024.

Climate Risk Management and Exposure Monitoring

Arch Capital Group actively manages its exposure to climate-related risks through a robust enterprise risk management framework. This involves continuous monitoring of both location-specific and portfolio-wide natural catastrophe risks, ensuring a comprehensive understanding of potential impacts.

The company's approach includes evaluating near-term and long-term climate change exposures, allowing for proactive mitigation strategies. This focus on granular risk assessment is crucial for maintaining financial stability in the face of evolving environmental challenges.

For instance, in their 2023 annual report, Arch Capital highlighted their sophisticated catastrophe modeling capabilities, which are continuously updated to reflect the latest scientific understanding of climate events. This data-driven approach is fundamental to their underwriting and investment decisions.

- Enterprise Risk Management: Arch Capital utilizes a comprehensive framework to identify, assess, and manage all significant risks, including those stemming from climate change.

- Aggregate Exposure Monitoring: The company actively monitors its total exposure to climate change and catastrophic events across its diverse business lines.

- Catastrophe Risk Evaluation: Assessments are conducted at both the individual location level and across the entire portfolio to understand the concentration and impact of natural disasters.

- Near and Long-Term Focus: Arch Capital considers both immediate and future climate-related risks, enabling strategic planning and adaptation.

Environmental factors significantly shape Arch Capital Group's operations, particularly concerning climate change and ESG integration. The increasing frequency of natural catastrophes, with global insured losses from natural catastrophes estimated at $120 billion in 2023, directly impacts underwriting profitability and necessitates advanced risk modeling. Arch Capital is actively embedding ESG factors into its underwriting and investment processes, recognizing growing stakeholder demands for sustainability, and engaging with markets like renewable energy which saw substantial growth in 2023.

| Environmental Factor | Impact on Arch Capital | Data/Trend (2023-2024) |

|---|---|---|

| Climate Change & Natural Catastrophes | Increased underwriting risk, demand for sophisticated risk modeling | Global insured losses from natural catastrophes: $120 billion (2023) |

| ESG Integration | Strategic focus in underwriting and investment decisions | Growth in renewable energy insurance market (2023) |

| Regulatory & Investor Pressure | Demand for transparency and action on environmental issues | Institutional investors prioritizing ESG integration (early 2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Arch Capital Group is informed by a comprehensive review of data from leading financial news outlets, regulatory filings, and industry-specific market research reports. These sources provide insights into political stability, economic trends, technological advancements, and social shifts impacting the insurance and financial services sectors.