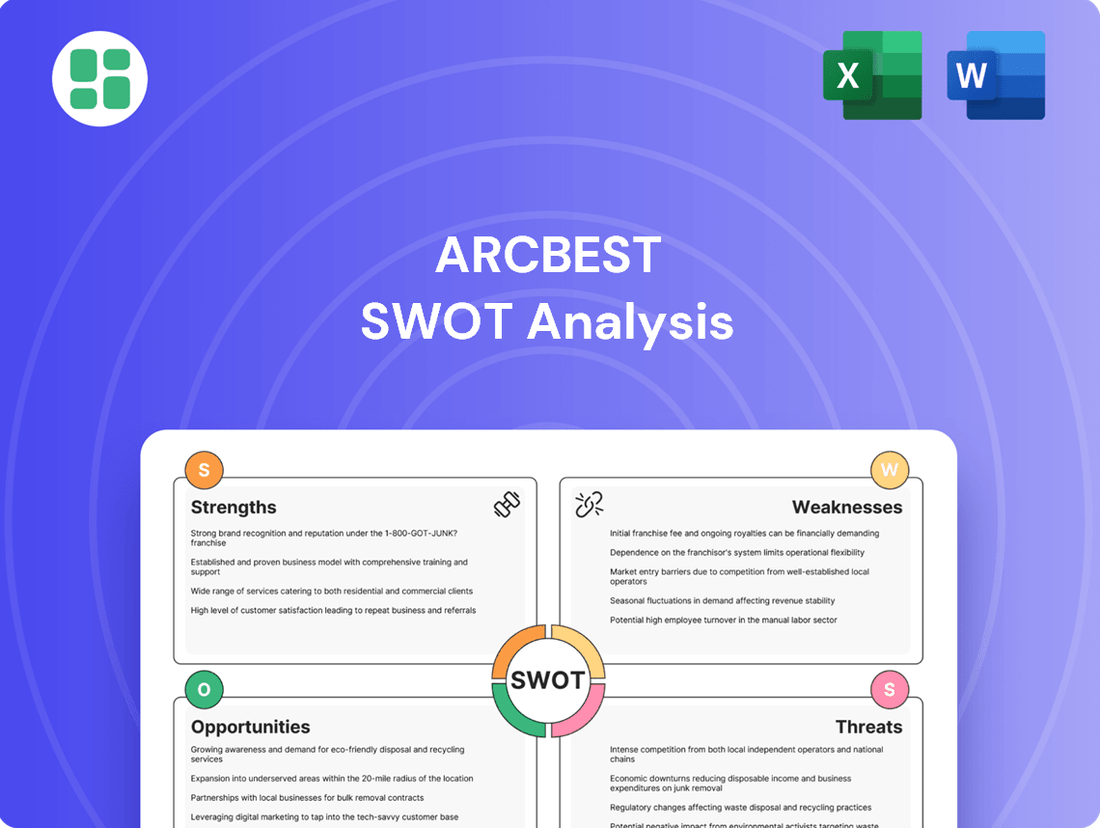

ArcBest SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcBest Bundle

ArcBest leverages its robust operational network and diversified service offerings, including LTL, truckload, and logistics, to maintain a strong market presence. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for strategic advantage.

Want the full story behind ArcBest's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ArcBest's extensive less-than-truckload (LTL) network, anchored by ABF Freight, is a significant strength. With 240 service centers and over 9,500 doors across North America, this infrastructure allows for efficient and widespread freight handling, supporting diverse industry needs.

This robust LTL foundation is complemented by a comprehensive suite of integrated logistics services. ArcBest provides truckload, expedite, final mile, warehousing, intermodal, and international solutions, positioning the company as a single-source provider for complex supply chain requirements.

ArcBest's dedication to fostering deep customer relationships and adopting a customer-centric approach is a significant strength. This focus has translated into impressive customer loyalty, with a remarkable 95% retention rate among its top 50 clients. This high retention underscores the company's ability to consistently meet and exceed client expectations.

By positioning itself as a trusted partner rather than just a service provider, ArcBest effectively solves complex logistics challenges for its clients. This differentiation is crucial in a competitive market, allowing the company to build enduring partnerships that weather changing industry dynamics.

ArcBest's dedication to technology and innovation is a significant strength, evident in their substantial investments in advanced platforms. For instance, the company is actively developing and deploying proprietary technologies such as the Vaux™ Freight Movement System, Vaux Smart Autonomy, and Vaux Vision™. These systems leverage artificial intelligence and machine learning to refine operations.

These cutting-edge solutions are designed to boost efficiency and optimize the entire logistics process. By utilizing AI for tasks like demand forecasting and route optimization, ArcBest aims to achieve greater productivity and enhance the overall quality of their services. This focus on technological advancement positions them well for future growth and operational excellence.

Disciplined Capital Allocation and Shareholder Returns

ArcBest showcases financial strength with its disciplined approach to capital allocation. The company prioritizes significant organic investments, focusing on essential areas like revenue equipment and real estate to fuel future growth.

Alongside these investments, ArcBest actively returns value to its shareholders. In the first quarter of 2025, the company returned over $24 million to shareholders, building on a strong 2024 where more than $85 million was returned. This dual strategy of reinvesting in the business and rewarding shareholders highlights a commitment to sustainable long-term value creation.

- Disciplined Capital Allocation: Significant organic investments in revenue equipment and real estate.

- Shareholder Returns (Q1 2025): Over $24 million returned to shareholders.

- Shareholder Returns (2024): Exceeded $85 million in total returns.

- Balanced Strategy: Supports long-term growth while rewarding investors.

Focus on Productivity and Cost Control

ArcBest's dedication to productivity and cost control is a significant strength, particularly in navigating challenging market conditions. The company's City Route Optimization (CRO) initiative, for example, has demonstrably driven substantial operational savings. This focus on efficiency is reflected in key performance indicators, such as improvements in shipments per employee per day, showcasing a tangible enhancement in operational output.

These operational efficiencies serve as a crucial buffer against market headwinds and rising input costs. For instance, in the first quarter of 2024, ArcBest reported a consolidated operating income of $112.6 million, a notable figure that underscores the positive impact of their cost management strategies on overall profitability, even amidst economic fluctuations. This proactive approach to managing expenses and optimizing workflows directly contributes to the resilience and improved margins observed in certain business segments.

- Enhanced Operational Efficiency: Initiatives like City Route Optimization (CRO) have yielded significant cost savings.

- Productivity Gains: Metrics such as shipments per employee per day demonstrate improved output.

- Margin Improvement: Operational efficiencies help mitigate market challenges and input cost increases, boosting margins in specific segments.

- Financial Resilience: In Q1 2024, ArcBest achieved an operating income of $112.6 million, highlighting the effectiveness of their cost control measures.

ArcBest's robust less-than-truckload (LTL) network, powered by ABF Freight, is a core strength. This extensive infrastructure, featuring 240 service centers and over 9,500 doors across North America, ensures efficient freight handling for a wide array of industries.

The company's commitment to customer relationships is a significant asset, evidenced by a remarkable 95% retention rate among its top 50 clients, demonstrating their ability to consistently meet and exceed expectations and solidify long-term partnerships.

ArcBest is heavily investing in technology and innovation, developing proprietary AI and machine learning systems like the Vaux™ Freight Movement System. These advancements are designed to boost efficiency and optimize logistics operations.

Financially, ArcBest exhibits a disciplined approach to capital allocation, prioritizing organic investments in assets like revenue equipment and real estate. This focus on growth is balanced with significant shareholder returns, with over $24 million returned in Q1 2025 and more than $85 million in 2024.

The company's emphasis on productivity and cost control, exemplified by initiatives like City Route Optimization (CRO), has led to tangible operational savings and improved efficiency metrics, such as shipments per employee per day. This focus contributed to a consolidated operating income of $112.6 million in Q1 2024, showcasing resilience and enhanced margins.

| Strength Area | Key Metric/Initiative | Data Point | Impact |

|---|---|---|---|

| Network Strength | ABF Freight Service Centers | 240 | Widespread freight handling capability |

| Customer Focus | Top 50 Client Retention Rate | 95% | Strong customer loyalty and partnerships |

| Technology Investment | Proprietary Systems | Vaux™ Freight Movement System, Vaux Smart Autonomy, Vaux Vision™ | AI-driven efficiency and optimization |

| Financial Strategy | Shareholder Returns (Q1 2025) | > $24 million | Commitment to investor value |

| Operational Efficiency | Consolidated Operating Income (Q1 2024) | $112.6 million | Demonstrates effectiveness of cost control |

What is included in the product

Analyzes ArcBest’s competitive position through key internal and external factors, including its strong asset-light model and diverse service offerings, while also considering potential threats from economic downturns and increasing competition.

ArcBest's SWOT analysis offers a clear, actionable roadmap to navigate industry complexities and capitalize on emerging opportunities.

Weaknesses

ArcBest faced revenue headwinds in early 2025, with overall per-day revenue dipping in the first quarter compared to the prior year. Both its core Asset-Based (LTL) and Asset-Light divisions experienced these declines.

Specifically, the Asset-Based segment saw a 3.0% per-day revenue decrease. The Asset-Light segment, which includes brokerage and logistics services, experienced a more pronounced drop of 9.5% per-day.

These revenue contractions are indicative of a tougher freight market characterized by softer demand and increased competitive pressures across the industry.

The ongoing softness in the freight market, largely due to a sluggish manufacturing sector, has directly impacted ArcBest's operational efficiency. This is evident in the declining tonnage and the average weight of shipments handled by the company.

Specifically, in the first quarter of 2025, ArcBest's Asset-Based segment experienced a notable drop. Total tonnage per day fell by 4.3%, and the average weight per shipment decreased by 3.9%. This trend suggests a market where customers are sending smaller, lighter freight, which typically translates to lower revenue per unit for carriers.

While the Asset-Light segment shows improvement, it still incurred a non-GAAP operating loss of $1.2 million in the first quarter of 2025. This ongoing challenge stems from a softer rate environment, which reduced revenue per shipment. Additionally, a greater proportion of managed transportation business, characterized by smaller shipments, further impacted the segment's revenue metrics.

These persistent operating losses in the Asset-Light segment could potentially hinder ArcBest's overall profitability. The segment's performance is closely tied to market conditions and the strategic balance between managed and owned transportation services.

Increased Operating Costs and Margin Compression

ArcBest is grappling with escalating operating expenses, notably in areas like insurance and healthcare. These increases, alongside annual labor cost hikes tied to union agreements, are squeezing profitability. For instance, the company reported that its operating ratio in the Asset-Based segment worsened, indicating that costs are rising faster than revenue. This trend puts pressure on margins, especially during softer market conditions.

The company's ability to manage these rising costs is crucial. In 2023, for example, the Asset-Based segment's operating ratio stood at 94.2%, a slight increase from 93.7% in 2022, highlighting the persistent challenge of cost control in a competitive landscape.

- Rising Insurance and Healthcare Costs: These are significant drivers of increased operating expenses.

- Union Labor Cost Increases: Annual adjustments mandated by union contracts contribute to higher labor costs.

- Margin Compression: The combination of rising costs and a soft market environment has led to reduced profit margins, particularly in the Asset-Based division.

- Operating Ratio Deterioration: An increase in the operating ratio signifies that operating expenses are growing at a faster pace than revenue.

Missed Analyst Expectations

ArcBest faced a setback in Q1 2025, with both its earnings per share (EPS) and quarterly revenue falling short of what analysts had predicted. For instance, the company reported an EPS of $0.35, missing the consensus estimate of $0.42. Similarly, revenue came in at $1.15 billion, below the expected $1.18 billion.

While ArcBest did manage to turn a profit in Q1 2025, a notable improvement from a loss in the prior year, this performance did not entirely meet market expectations. Such misses can potentially dampen investor sentiment and influence the company's stock valuation in the short term.

- Missed Q1 2025 EPS: Reported $0.35 versus analyst consensus of $0.42.

- Missed Q1 2025 Revenue: Reported $1.15 billion versus analyst consensus of $1.18 billion.

- Impact on Investor Confidence: Failure to meet expectations can lead to decreased investor confidence.

- Stock Performance: Missed estimates may negatively affect the company's stock price.

ArcBest's core Asset-Based segment experienced a 3.0% per-day revenue decrease in early 2025, alongside a more significant 9.5% drop in its Asset-Light division. This decline is attributed to a challenging freight market with reduced demand and heightened competition. The company also saw a 4.3% fall in tonnage per day and a 3.9% decrease in average shipment weight within its Asset-Based operations during Q1 2025, indicating a shift towards smaller, less lucrative shipments.

Full Version Awaits

ArcBest SWOT Analysis

This is the same ArcBest SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The preview below is taken directly from the full ArcBest SWOT report you'll get. Purchase unlocks the entire in-depth version.

Opportunities

ArcBest's continued investment in and deployment of advanced technologies, including AI, machine learning, and its proprietary Vaux™ platform, offers substantial opportunities for operational enhancement. These technologies are key to improving demand forecasting accuracy and optimizing delivery routes, directly impacting efficiency and service quality.

For instance, in 2023, ArcBest reported capital expenditures of $340.1 million, with a significant portion allocated to technology and equipment upgrades aimed at boosting productivity and service levels. This strategic allocation is expected to drive further cost reductions and elevate the customer experience through more streamlined operations.

ArcBest is strategically targeting expansion within the small and middle market segments to fuel growth. By increasing its sales presence in these areas, the company aims to onboard new customers and diversify its revenue base, moving beyond a heavy reliance on larger clients. This focus is expected to unlock significant future volume increases.

In 2023, ArcBest's less-than-truckload (LTL) segment, a key area for serving smaller shippers, demonstrated resilience. While specific data for small and middle market penetration isn't publicly detailed, the company's overall LTL revenue for the first nine months of 2023 was $2.7 billion, indicating a substantial operational base to build upon in these targeted segments.

ArcBest is anticipating a rebound in the freight market, with expectations for a recovery to begin later in 2025. This optimism is fueled by early signs of year-over-year growth in spot rates, with contract rates also projected to see gradual increases.

A broader economic upturn, especially a strengthening US industrial sector, would be a significant catalyst. Such a recovery would ease current pricing pressures and lead to improved tonnage and shipment volumes across both ArcBest's owned fleet and its third-party logistics services.

This potential market recovery presents a substantial opportunity for ArcBest to enhance its financial performance, as improved freight demand directly translates to better utilization and pricing power for its services.

Strategic Facility Enhancements and Network Expansion

ArcBest's strategic facility enhancements and network expansion represent a significant opportunity. The company is in the midst of a multi-year roadmap that has already seen numerous remodels and expansions, adding hundreds of doors to its network. These investments are crucial for improving operational efficiency and accommodating future growth.

These ongoing capital expenditures are designed to modernize ArcBest's infrastructure, enabling ABF Freight to handle greater shipping volumes more effectively. By expanding capacity and upgrading facilities, ArcBest is positioning itself to capitalize on improving market demand and deliver superior service. For instance, in 2023, ArcBest invested $193.8 million in property, plant, and equipment, a substantial portion of which supports these network improvements.

- Facility Modernization: Hundreds of doors added to the network through remodels and expansions.

- Capacity Expansion: Positions ABF Freight to handle increased volumes efficiently.

- Improved Service: Enhanced facilities support top-notch service delivery as demand rises.

- Employee Workspace: Investments also contribute to safer and more comfortable working environments.

Growth in Managed Transportation Solutions

ArcBest's Managed Transportation solution, a key component of its Asset-Light segment, is experiencing robust demand and significant growth. This service is crucial for clients aiming to streamline their supply chains and achieve cost efficiencies, positioning it as a high-value offering.

The company's strategic focus on this area allows for deeper engagement with customers, fostering stronger relationships and expanding its overall service capabilities. This growth is a testament to the increasing need for sophisticated logistics management in today's complex supply chain environment.

- Double-digit growth in demand for Managed Transportation solutions.

- Customers benefit from supply chain optimization and cost reduction.

- Strengthens customer relationships and broadens service portfolio.

ArcBest's ongoing investment in technology, like its Vaux™ platform, offers a significant avenue for growth by enhancing operational efficiency and customer service. The company's strategic push into the small and middle market segments presents a clear opportunity to diversify its customer base and increase revenue streams.

Anticipated freight market recovery, particularly a rebound in US industrial activity expected later in 2025, could significantly boost ArcBest's volumes and pricing power. Furthermore, the robust demand for its Managed Transportation solutions highlights a key growth area within its asset-light offerings, driving deeper customer relationships and expanding service capabilities.

| Opportunity Area | Key Driver | 2023 Data Point |

|---|---|---|

| Technology Investment | Operational Efficiency & Customer Service | $340.1M Capital Expenditures |

| Market Expansion | Revenue Diversification | Resilient LTL segment performance |

| Market Recovery | Increased Volumes & Pricing Power | Projected rebound later in 2025 |

| Managed Transportation | Supply Chain Optimization & Growth | Double-digit demand growth |

Threats

A significant threat to ArcBest is the continued weakness in the US industrial and manufacturing sectors. This directly impacts key metrics like weight per shipment and overall tonnage, especially for their Asset-Based LTL operations, ultimately leading to reduced revenue and profitability. For instance, if manufacturing output, which has seen fluctuations, continues to decline, it would directly translate to fewer goods being shipped, hitting ArcBest's core business.

The broader freight market is currently experiencing a soft rate environment, with an oversupply of truckload capacity. This situation directly impacts ArcBest by putting downward pressure on its pricing across all services, potentially reducing revenue per shipment.

This excess capacity and soft pricing environment are particularly challenging for ArcBest's asset-light segment, making it harder to maintain healthy profit margins. For instance, the average spot market truckload rate for dry van loads in early 2024 hovered around $2.00 per mile, a notable decrease from the highs seen in previous years, impacting revenue generation.

Furthermore, a significant pricing gap between less-than-truckload (LTL) and truckload services can incentivize shippers to move heavier LTL shipments into the more cost-effective truckload market. This trend could divert volume away from ArcBest's core LTL operations, further pressuring its revenue streams and market share.

ArcBest is contending with a significant headwind from rising operating expenses. These include the impact of union contracts that necessitate higher wages, alongside steadily increasing insurance and healthcare costs. For instance, the Teamsters' national freight agreement, ratified in 2023, is expected to add substantial labor costs for many carriers in the sector, which could affect companies like ArcBest.

These escalating costs pose a direct threat to ArcBest's profitability. Without the ability to pass these increases onto customers through pricing adjustments or achieve substantial improvements in operational efficiency, profit margins could shrink. The company's pricing power will be a critical factor in mitigating these impacts.

Furthermore, the logistics industry faces persistent challenges in securing and retaining a qualified workforce. Difficulty in finding and keeping drivers and other essential personnel can disrupt operations and add to recruitment and training expenses, further compounding the issue of rising labor costs.

Geopolitical Changes and Trade Policy Uncertainty

Geopolitical shifts and evolving trade policies present significant challenges for ArcBest. The potential for new tariffs or changes to existing trade agreements can disrupt established international shipping routes and increase operational costs. For instance, ongoing discussions around trade relations between major economic blocs in 2024 and 2025 could introduce new barriers or incentives affecting cross-border freight volumes.

Uncertainty in the global trade environment directly impacts supply chain stability. Fluctuating import and export volumes, driven by policy shifts, can create unpredictable demand patterns for logistics services. ArcBest must navigate this volatility, adapting its network and capacity to manage risks associated with changing trade landscapes, which could affect their international freight segment.

- Trade Policy Volatility: The ongoing evolution of international trade agreements and the potential imposition of new tariffs in 2024-2025 create an unpredictable operating environment for global logistics providers.

- Supply Chain Disruptions: Fluctuations in import/export volumes due to trade policy changes can lead to instability in freight demand, impacting ArcBest's ability to forecast and manage capacity efficiently.

- Increased Operational Costs: Tariffs or new trade regulations could directly increase the cost of moving goods across borders, potentially squeezing profit margins for logistics companies like ArcBest.

Intense Competition in the Logistics Industry

The logistics industry is a crowded marketplace, with many companies vying for market share. This means ArcBest faces constant pressure on pricing, as competitors often undercut each other to win business. For instance, the less-than-truckload (LTL) segment, a core area for ArcBest, saw freight rates fluctuate significantly in 2024 due to this competitive dynamic.

To stand out, ArcBest needs to continuously innovate and offer superior service. This includes investing in technology for better tracking and efficiency, as well as developing specialized solutions that competitors don't offer. The company's focus on integrated solutions, combining LTL, truckload, and other services, is a key differentiator in this challenging environment.

- Intense Competition: The logistics sector is highly fragmented with numerous established players and emerging entrants.

- Pricing Pressures: Fierce competition often forces companies like ArcBest to offer competitive pricing, impacting profit margins.

- Need for Innovation: Continuous investment in technology and service enhancement is crucial to attract and retain customers in this dynamic market.

- Service Differentiation: ArcBest must highlight its unique value proposition, such as its integrated logistics capabilities, to gain an edge.

The ongoing softness in the industrial and manufacturing sectors presents a significant threat, directly reducing shipment volumes and revenue for ArcBest's core LTL operations. This economic environment, characterized by fluctuating manufacturing output, means fewer goods are being transported, impacting tonnage and profitability. For example, a continued slowdown in durable goods orders in late 2024 could directly translate to lower freight demand.

The freight market is grappling with an oversupply of truckload capacity, leading to a soft rate environment that pressures pricing across all of ArcBest's services. This excess capacity, particularly evident in the spot market where rates saw a notable dip in early 2024, makes it challenging to maintain healthy profit margins, especially for their asset-light segment. The pricing gap between LTL and truckload can also incentivize shippers to shift heavier LTL freight to truckload, diverting volume from ArcBest's core business.

ArcBest faces rising operating expenses, including increased labor costs due to union contracts and higher insurance and healthcare expenditures. The 2023 Teamsters national freight agreement, for instance, is anticipated to significantly increase labor costs for carriers in the sector. Without the ability to fully pass these costs onto customers or achieve substantial efficiency gains, profit margins are at risk. Additionally, the persistent challenge of securing and retaining qualified drivers and personnel adds to recruitment and training expenses.

Geopolitical shifts and evolving trade policies introduce considerable uncertainty, potentially disrupting international shipping routes and increasing operational costs through new tariffs or altered trade agreements. Fluctuations in import/export volumes, driven by policy changes in 2024-2025, can create unpredictable demand patterns for logistics services. This volatility necessitates continuous adaptation of networks and capacity to manage risks associated with changing global trade landscapes.

SWOT Analysis Data Sources

This ArcBest SWOT analysis is built upon a foundation of reliable data, including their official financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and actionable strategic overview.