ArcBest Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcBest Bundle

ArcBest navigates a complex logistics landscape, facing intense rivalry among carriers and the constant pressure of customer price sensitivity. Understanding these forces is crucial for any stakeholder in the transportation sector.

The complete report reveals the real forces shaping ArcBest’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ArcBest's reliance on suppliers for critical assets like trucks and trailers, especially for its Asset-Based LTL segment, highlights the potential for supplier bargaining power. The market for new Class 8 trucks, a key component for their operations, can be sensitive to manufacturing capacity and the cost of raw materials, granting these suppliers a degree of leverage. For example, in 2024, the average price of a new Class 8 truck continued to be influenced by these factors, though some stabilization was noted compared to earlier periods.

Fuel is a major cost for logistics firms like ArcBest, so when fuel prices swing wildly, it really hits their bottom line. Even with fuel surcharges in place, if energy prices stay high or keep bouncing around, the companies selling that fuel gain more leverage.

ArcBest's own financial statements have shown that drops in fuel costs can actually cancel out gains from higher rates per hundredweight, clearly demonstrating the power fuel suppliers hold in the market. For instance, in the first quarter of 2024, while ArcBest reported increased operating revenue, the volatile nature of fuel costs played a significant role in influencing their net income, underscoring the sensitivity to this supplier input.

ArcBest's significant investment in advanced technologies, such as its Vaux Vision™ platform, directly increases the bargaining power of its technology and software providers. These specialized suppliers offer critical, often proprietary, solutions essential for ArcBest's operational efficiency, supply chain visibility, and automation efforts. The high switching costs associated with integrating and adapting new IT infrastructure means these providers hold considerable leverage.

Labor market dynamics and unionized workforce

The bargaining power of suppliers within the trucking industry is significantly influenced by labor market dynamics, particularly the availability of skilled drivers and the presence of a unionized workforce. ArcBest, with its substantial employee base of 14,000, is directly impacted by these factors. A shortage of qualified drivers, a persistent issue in the logistics sector, can elevate the leverage of individual workers and unions.

Union contracts, such as those in place with ABF Freight, play a crucial role in shaping labor costs. These agreements often stipulate predetermined wage and benefit increases, granting organized labor considerable power to negotiate employee compensation. For instance, in 2024, the trucking industry continued to grapple with driver shortages, with estimates suggesting a deficit of over 70,000 drivers. This scarcity amplifies the bargaining position of unions and their members.

- Skilled Driver Availability: A tight labor market for truck drivers, a recurring challenge in 2024, directly strengthens the bargaining power of this essential supplier group.

- Unionized Workforce Impact: Collective bargaining agreements, like those at ABF Freight, provide unions with significant leverage over wage and benefit structures, increasing labor costs for companies.

- Wage Pressures: In 2024, reports indicated that average truck driver wages saw increases, reflecting the ongoing demand and the power of organized labor to secure better compensation.

Real estate and facility providers' regional power

ArcBest's reliance on real estate and facility providers for its extensive network of service centers and campuses grants these suppliers significant bargaining power, particularly in geographically constrained markets. When suitable properties are limited or in high demand, lessors or sellers can dictate higher lease rates or impose more stringent contract terms.

This dependency is amplified by ArcBest's continuous capital expenditures in real estate for its Asset-Based operations. For instance, in 2023, ArcBest reported capital expenditures of $310.7 million, a portion of which was allocated to property, plant, and equipment, underscoring the importance of these supplier relationships.

- Geographic Concentration: In markets with few available industrial properties, real estate suppliers gain leverage.

- Investment Dependence: ArcBest's ongoing investments in facilities increase its reliance on property acquisition and leasing.

- Market Scarcity: Limited supply of suitable real estate in key operational areas can drive up costs for ArcBest.

The bargaining power of suppliers for ArcBest is a significant factor, particularly concerning essential inputs like trucks, fuel, and skilled labor. In 2024, the continued demand for new Class 8 trucks, coupled with raw material costs, maintained leverage for truck manufacturers. Similarly, volatile fuel prices in early 2024 directly impacted ArcBest's profitability, demonstrating the power of energy suppliers.

Labor, especially skilled truck drivers, represents another area where supplier power is pronounced. The persistent driver shortage in 2024, estimated at over 70,000, coupled with unionized workforces at entities like ABF Freight, grants significant leverage to drivers and unions regarding wages and benefits. This was reflected in reported increases in average truck driver wages throughout 2024.

Furthermore, ArcBest's investment in technology and real estate also contributes to supplier bargaining power. Specialized technology providers hold sway due to high integration costs, while limited availability of suitable industrial properties in key markets can increase leverage for real estate suppliers.

| Supplier Category | Key Factors Influencing Bargaining Power (2024) | Impact on ArcBest |

|---|---|---|

| Truck Manufacturers | Manufacturing capacity, raw material costs, demand for new Class 8 trucks | Potential for higher equipment costs and longer lead times |

| Fuel Suppliers | Global energy prices, geopolitical events, supply/demand dynamics | Direct impact on operating costs, mitigated partially by fuel surcharges |

| Skilled Drivers/Labor Unions | Driver shortages (estimated >70,000 in 2024), union contracts, wage demands | Increased labor costs due to higher wages and benefits, potential for operational disruptions |

| Technology Providers | Proprietary solutions, integration complexity, switching costs | Higher software and IT service costs, dependence on key vendors |

| Real Estate Providers | Market scarcity in key locations, demand for industrial properties | Increased lease or purchase costs for service centers and facilities |

What is included in the product

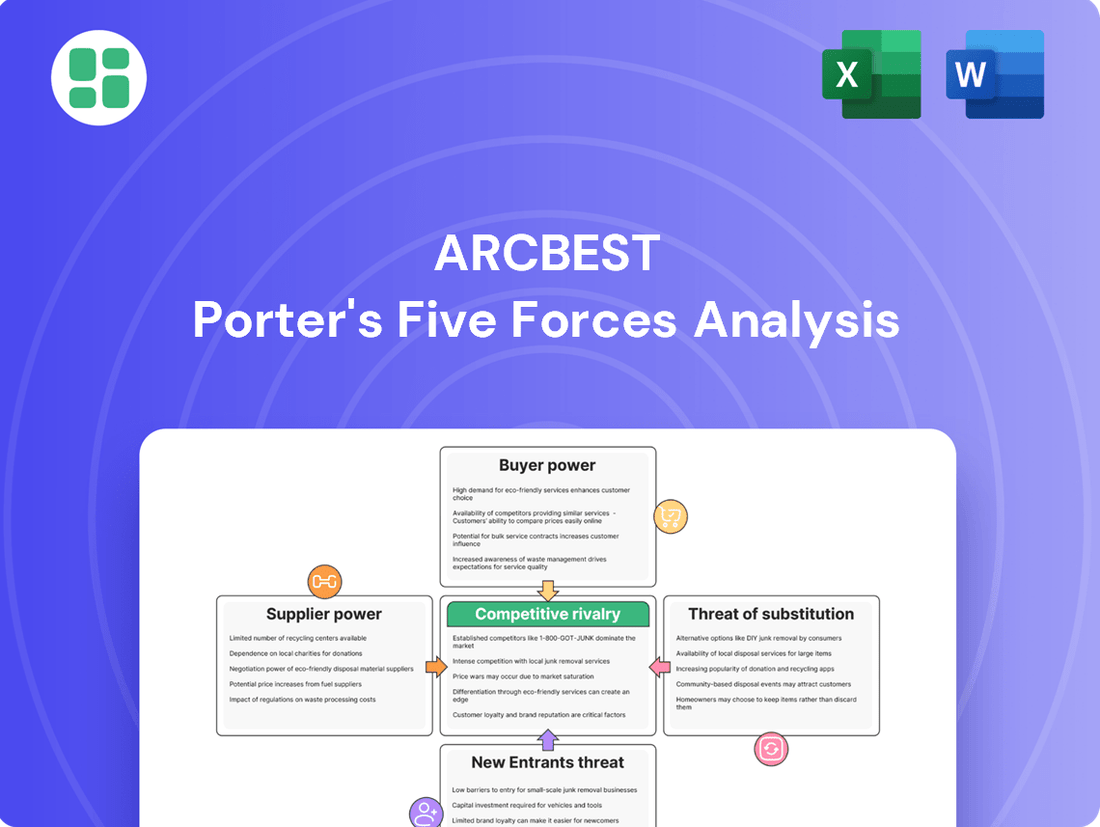

This analysis unpacks the competitive forces shaping ArcBest's industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all to understand ArcBest's strategic positioning.

A visual representation of competitive intensity—helping to pinpoint and alleviate pressure points in the freight and logistics industry.

Customers Bargaining Power

ArcBest caters to a broad spectrum of clients, from small businesses to major corporations, utilizing services like less-than-truckload (LTL), full truckload, expedited freight, and comprehensive supply chain solutions. This wide variety of customers, especially within the general logistics sector, typically dilutes the leverage of any individual client. For instance, while the overall logistics market is vast, a single small shipper has minimal power to dictate terms.

However, the dynamic shifts for significant volume shippers. These larger entities, by virtue of their substantial freight volumes, can command more favorable pricing and service agreements. In 2024, major shippers in industries like retail and manufacturing often leverage their consistent demand for transportation services to negotiate better rates, sometimes achieving discounts of 5-10% compared to smaller shippers, depending on contract specifics and market conditions.

In a soft freight market characterized by oversupply, customers wield considerable influence, pushing down prices and affecting per-shipment revenue. This environment directly benefits buyers who can negotiate more favorable terms.

ArcBest has experienced this firsthand, reporting a 10.7% decrease in total revenue for the first quarter of 2024 compared to the same period in 2023, largely due to this unfavorable rate environment and a weaker manufacturing sector. This decline in revenue per shipment highlights customers' strong price sensitivity.

The US logistics market is intensely competitive, featuring many providers like UPS, FedEx, XPO Logistics, and J.B. Hunt. This wide array of choices significantly boosts customer bargaining power, allowing them to easily switch suppliers for more favorable pricing or service terms. ArcBest operates within this dynamic environment, where customer options are plentiful.

Low switching costs for non-integrated services

For many standard freight transportation needs, especially in truckload or less-than-truckload (LTL) segments, customers can switch providers with relative ease. This is because the costs associated with changing carriers for these transactional services are often minimal. In 2024, the freight market has seen fluctuating capacity, which can further embolden customers to seek the best rates, making switching more attractive.

While ArcBest strives to cultivate strong customer loyalty through integrated solutions and dedicated service, the accessibility of comparing pricing and service levels for straightforward shipments remains a significant factor. This ease of comparison is amplified when there is ample capacity in the market, as it gives customers more options and leverage.

- Low Switching Costs: Customers can easily move between carriers for basic freight services.

- Rate Comparison: The ability to readily compare pricing empowers customers in transactional shipments.

- Market Capacity: Excess capacity in 2024 can increase customer bargaining power by providing more choices.

Customer demand for integrated and flexible solutions

Customers are increasingly seeking integrated and flexible logistics solutions, moving beyond a sole focus on price. This shift means they value partners who can manage their entire supply chain, offering a comprehensive suite of services. ArcBest's strategy, including its investment in technology like Vaux, aims to meet this demand by providing a more holistic and valuable offering.

- Customer demand for integrated solutions: Businesses now prioritize logistics providers that can manage multiple aspects of their supply chain, from transportation to warehousing and final-mile delivery.

- Flexibility in a dynamic market: The ability to adapt to changing market conditions, such as disruptions or shifts in consumer demand, is a key factor for customers when selecting a logistics partner.

- ArcBest's strategic response: By offering a broad range of services and leveraging technology, ArcBest seeks to become an indispensable partner, thereby reducing the bargaining power of individual customers who might otherwise switch based on price alone.

- Value beyond price: In 2024, the emphasis for many shippers is on reliability and end-to-end visibility, making the total value proposition more important than just the cost of a single shipment.

Customers' bargaining power is a significant force within the logistics industry, impacting companies like ArcBest. While individual small shippers have minimal leverage, large volume shippers can negotiate better rates, a trend amplified in 2024's competitive market. ArcBest's first-quarter 2024 revenue decline of 10.7% reflects this customer price sensitivity, particularly in a market with oversupply.

| Factor | Impact on ArcBest | 2024 Relevance |

|---|---|---|

| Customer Volume | Large shippers gain negotiating power. | Major shippers leverage consistent demand for better rates. |

| Market Conditions | Oversupply increases customer leverage. | Soft freight market benefits buyers seeking favorable terms. |

| Switching Costs | Low costs for standard services empower customers. | Ease of comparison and switching is high for transactional shipments. |

Preview the Actual Deliverable

ArcBest Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details ArcBest's competitive landscape through Porter's Five Forces, analyzing threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the freight transportation industry. This comprehensive assessment provides actionable insights into ArcBest's strategic positioning and potential challenges.

Rivalry Among Competitors

The U.S. logistics landscape is a battleground with a vast array of direct and indirect competitors. ArcBest navigates a market populated by giants like Old Dominion Freight Line, XPO Logistics, and J.B. Hunt, alongside numerous specialized Less-Than-Truckload (LTL) carriers and truckload providers. This sheer volume of players creates a fragmented environment where intense rivalry is the norm, as each company fights for a slice of the market.

The ongoing freight recession, particularly evident in 2024, has created a surplus of transportation capacity, especially in truckload and less-than-truckload (LTL) services. This oversupply directly translates to significant downward pressure on freight rates, intensifying competition among carriers who often resort to price cuts to secure business.

ArcBest's financial disclosures for 2024 have consistently highlighted this challenging market. For instance, the company reported a notable decrease in revenue per shipment, a direct consequence of the soft rate environment driven by this excess capacity.

The logistics industry, especially less-than-truckload (LTL) services, is feeling the pinch from a sluggish manufacturing sector and overall slower economic expansion. This environment naturally fuels more aggressive competition as businesses vie for a smaller pool of available freight.

In such a climate, companies like ArcBest face heightened competitive rivalry. For instance, ArcBest reported a revenue decline in Q1 2024, partly due to these market headwinds. This trend continued into early 2025, underscoring the intense pressure on market share.

Differentiated services and technological innovation as competitive tools

To sidestep intense price wars, logistics firms are increasingly focusing on unique service offerings and cutting-edge technology. ArcBest, for instance, is investing heavily in tech like Vaux, its proprietary asset-light platform, and enhancing its broader supply chain management capabilities. This strategic shift aims to carve out a competitive advantage that extends well beyond traditional Less-Than-Truckload (LTL) services, making innovation and service excellence crucial battlegrounds.

This differentiation strategy is evident in the market's response. As of late 2024, companies prioritizing specialized solutions and technology integration are showing stronger revenue growth compared to those solely competing on price. For example, the broader freight industry saw a slight uptick in demand for specialized logistics services in the first half of 2024, indicating a market shift.

- Differentiated Services: ArcBest's expansion into managed transportation and project logistics offers higher margins than standard LTL.

- Technological Investment: The company's commitment to digital platforms like Vaux aims to improve efficiency and customer experience, a key differentiator.

- Customer Service Focus: Superior responsiveness and tailored solutions are becoming as important as transit times in securing customer loyalty.

High fixed costs and exit barriers

Logistics companies, particularly those with substantial physical assets like ArcBest's ABF Freight, face substantial fixed costs. These include investments in terminals, a large fleet of trucks and trailers, and a significant employee base. For instance, maintaining and upgrading a large freight network requires continuous capital expenditure, creating a high cost of doing business.

The specialized nature of these assets, such as refrigerated trailers or heavy-duty trucks, further contributes to high exit barriers. Selling off such specialized equipment quickly and at a favorable price can be challenging, making it difficult for companies to leave the market without incurring substantial losses. This immobility of capital discourages new entrants and forces existing players to remain competitive.

Consequently, these high fixed costs and exit barriers intensify competitive rivalry. Companies are compelled to operate at or near capacity to spread these fixed costs over a larger revenue base. This often leads to aggressive pricing and service competition, especially during periods of lower demand, as firms strive to cover their ongoing operational expenses and avoid the significant penalties associated with exiting the industry.

- High Fixed Costs: Logistics firms like ArcBest invest heavily in terminals, equipment, and labor, leading to substantial ongoing expenses regardless of shipment volume.

- Specialized Assets: The industry relies on specialized vehicles and infrastructure, making assets less fungible and increasing the cost of exiting the market.

- Intensified Rivalry: High exit barriers encourage companies to stay and compete fiercely, even in challenging economic conditions, to cover their fixed cost base.

The competitive rivalry within the U.S. logistics sector is exceptionally fierce, driven by a fragmented market and excess capacity, particularly in 2024. Companies like ArcBest face intense pressure from major players such as Old Dominion Freight Line and XPO Logistics, as well as numerous smaller LTL and truckload carriers. This intense competition is further exacerbated by a freight recession that has led to lower freight rates, forcing many companies, including ArcBest, to focus on differentiation through technology and specialized services to maintain profitability and market share.

ArcBest's strategic investments in technology, such as its Vaux platform, and its expansion into higher-margin services like managed transportation are crucial for navigating this competitive landscape. The company's Q1 2024 results, showing a revenue decline partly due to market headwinds, underscore the ongoing challenges. As of late 2024, the industry's shift towards specialized solutions suggests that innovation and superior customer service are becoming key battlegrounds for securing customer loyalty and achieving sustainable growth, rather than solely competing on price.

| Competitor | Primary Service | 2024 Market Share (Est.) | Key Differentiator |

|---|---|---|---|

| Old Dominion Freight Line | LTL | ~10-12% | Network density, service reliability |

| XPO Logistics | LTL, Truckload, Intermodal | ~8-10% | Technology integration, broad service offering |

| J.B. Hunt | Truckload, Intermodal, LTL | ~7-9% | Intermodal strength, supply chain solutions |

| ArcBest | LTL, Managed Transportation, Project Logistics | ~3-4% | Technology (Vaux), specialized services, customer focus |

SSubstitutes Threaten

The threat of substitutes for ArcBest's services is significant, particularly for certain freight types. For instance, rail intermodal presents a viable substitute for long-haul truckload shipments, offering cost advantages on longer routes. In 2024, the rail intermodal sector continued to grow, with freight volumes showing resilience despite economic fluctuations, indicating its ongoing appeal as an alternative to trucking.

Air freight serves as a substitute for time-sensitive shipments where speed is paramount, though it comes at a higher cost. Similarly, ocean shipping is the primary substitute for international bulk cargo, providing economies of scale for large volumes. While ArcBest does offer intermodal and international capabilities, customers retain the option to engage specialized providers for these specific transportation modes, thereby increasing the substitutability.

Large shippers increasingly bring logistics in-house, creating a direct substitute for companies like ArcBest. This trend is fueled by a desire for greater cost control and operational flexibility. For instance, major e-commerce players, including Amazon, have heavily invested in their own private fleets and logistics networks, demonstrating the viability of this substitution strategy.

For smaller, lighter, or highly time-sensitive shipments, customers may increasingly turn to parcel carriers like FedEx and UPS, or other express delivery services. This shift presents a substitution threat to ArcBest's traditional less-than-truckload (LTL) and freight services.

While ArcBest does provide final mile delivery, the inherent ease and often lower cost of parcel services for certain shipment profiles create a viable alternative. For instance, in 2024, the global parcel delivery market continued its robust growth, with e-commerce driving significant volume, making these services readily accessible and competitive for smaller businesses and individual shippers.

Digital freight matching platforms and brokerage services

Digital freight matching platforms and technology-driven brokerage services are increasingly offering shippers direct access to a vast carrier network and competitive pricing. These digital solutions can function as viable substitutes for traditional relationships with asset-based carriers or established 3PLs, especially for securing truckload capacity. For instance, by mid-2024, platforms like Uber Freight and Convoy reported significant growth in load volumes, demonstrating their increasing appeal to shippers seeking efficiency and transparency.

These platforms streamline the booking process and provide real-time visibility, directly challenging the need for traditional brokerage models. The ease of use and potential cost savings offered by these digital alternatives can significantly reduce reliance on incumbent service providers. In 2023, the digital freight brokerage market saw substantial investment, with companies like CH Robinson investing heavily in their digital capabilities to compete.

- Increased Carrier Access: Digital platforms connect shippers with a broader pool of carriers, bypassing traditional gatekeepers.

- Enhanced Transparency: Real-time tracking and pricing information are readily available, unlike many traditional methods.

- Potential Cost Savings: Competitive bidding on these platforms can drive down freight costs for shippers.

- Efficiency Gains: Automation in booking and payment processes reduces administrative burdens.

Emerging technologies like autonomous vehicles and drones

Emerging technologies like autonomous vehicles and drones pose a long-term substitution threat to traditional freight transportation. These advancements could significantly alter the cost structure and efficiency of logistics. While widespread commercial adoption for freight is still developing, these innovations have the potential to reshape the industry. ArcBest is actively exploring these possibilities, for instance, through piloting technologies like Vaux.

The potential impact is substantial. For example, by 2024, the global autonomous trucking market is projected to reach billions, indicating a significant investment and development trajectory. This suggests that by the time these technologies mature, they could offer a more cost-effective and potentially faster alternative to current methods, directly challenging ArcBest's existing service models.

- Autonomous Trucking Market Growth: The global autonomous trucking market was valued at approximately $2.7 billion in 2023 and is expected to grow significantly by 2030.

- Drone Delivery Advancements: Companies are increasingly investing in drone technology for last-mile delivery, with regulatory frameworks evolving to support broader commercial use.

- Potential Cost Savings: Studies suggest autonomous freight could reduce operational costs by as much as 45% in the long run due to factors like reduced labor and optimized fuel efficiency.

The threat of substitutes for ArcBest's services is multifaceted, encompassing alternative transportation modes and evolving logistics models. Rail intermodal, parcel carriers, and in-house logistics operations by large shippers all represent significant competitive alternatives. Furthermore, digital freight matching platforms are increasingly offering shippers direct access to capacity, potentially disintermediating traditional providers.

Emerging technologies like autonomous vehicles also present a long-term substitution risk, promising future cost efficiencies. For example, the autonomous trucking market was valued at approximately $2.7 billion in 2023, indicating substantial investment and future potential for disruption. The global parcel delivery market's robust growth in 2024, driven by e-commerce, also highlights the accessibility and competitiveness of these services for certain shipment types.

| Substitute Type | Key Characteristics | Impact on ArcBest | Example Data/Trends (2023-2024) |

|---|---|---|---|

| Rail Intermodal | Cost-effective for long-haul, slower transit | Threat to long-haul truckload volumes | Resilient freight volumes in 2024, indicating continued appeal. |

| Parcel Carriers (FedEx, UPS) | Fast, efficient for small/light shipments | Threat to LTL and smaller freight services | Global parcel market continued robust growth in 2024, driven by e-commerce. |

| In-house Logistics | Greater control, flexibility for large shippers | Loss of business from major clients | Major e-commerce players heavily investing in private fleets. |

| Digital Freight Matching | Transparency, efficiency, broader carrier access | Disintermediation risk, price pressure | Platforms like Uber Freight and Convoy reporting significant load volume growth by mid-2024. |

| Autonomous Vehicles | Long-term potential for cost savings, efficiency | Future disruption of traditional trucking models | Global autonomous trucking market projected to reach billions by 2030; potential cost reduction of up to 45%. |

Entrants Threaten

The logistics industry, particularly the asset-based Less-Than-Truckload (LTL) sector where ArcBest's ABF Freight operates, presents a formidable barrier to new entrants due to immense capital requirements. Establishing a robust network necessitates significant investment in terminals, a modern fleet of trucks and trailers, and advanced tracking and management technology. For instance, acquiring a new tractor-trailer can cost upwards of $150,000, and building a network of terminals across the country easily runs into tens or hundreds of millions of dollars.

These substantial upfront costs act as a powerful deterrent, effectively limiting the pool of potential competitors. New companies must secure considerable financing to even begin operations, let alone compete on a national scale with established players like ArcBest. This economic hurdle makes it exceedingly difficult for smaller or less-capitalized firms to enter and disrupt the market, thus protecting incumbent firms.

Established players like ArcBest benefit significantly from economies of scale and scope. This means they can produce goods or services at a lower per-unit cost due to their large operational size, and also achieve cost efficiencies by offering a diverse range of related services. For instance, ArcBest's integrated logistics solutions, encompassing truckload, LTL, and specialized freight, create a cost advantage that is difficult for newcomers to replicate.

New entrants face a substantial hurdle in matching these cost efficiencies and the breadth of services offered by incumbents. The capital investment required to build a comparable operational scale and service portfolio is immense, making it challenging to compete effectively on price or service offerings from the outset. This existing infrastructure and integrated model act as a significant barrier.

ArcBest's 'full suite' of services is a prime example of leveraging economies of scope. By providing a comprehensive range of transportation and logistics solutions under one roof, they can offer bundled pricing and streamlined operations that are more attractive and cost-effective for customers than piecemeal solutions. This comprehensive offering makes it harder for new, specialized entrants to gain traction.

Incumbent logistics providers, like ArcBest, have cultivated deep customer loyalty over years of reliable service and customized solutions. This makes it challenging for newcomers to gain traction.

ArcBest specifically highlights its strong customer relationships and a high retention rate among its key clients. This established trust and proven performance act as a significant hurdle for any new entrant attempting to disrupt the market.

Regulatory hurdles and compliance complexities

The transportation and logistics sector faces significant regulatory hurdles. For instance, in 2024, companies must adhere to stringent safety standards like those mandated by the Federal Motor Carrier Safety Administration (FMCSA), which includes hours-of-service regulations for drivers. Environmental regulations, such as emissions standards for fleets, also add complexity and cost.

Navigating this intricate web of rules, from securing operating authority to complying with various state and federal labor laws, demands substantial investment in expertise and resources. This complexity acts as a considerable barrier to entry for potential new competitors aiming to establish themselves in the market.

Securing the necessary permits and licenses is a critical, often time-consuming, and resource-intensive step for any new entrant. For example, obtaining interstate operating authority and specific state permits can involve detailed applications and adherence to capital requirements, effectively limiting the ease with which new players can enter the industry and compete with established firms like ArcBest.

- Extensive Safety Regulations: Compliance with FMCSA safety mandates remains a key barrier.

- Environmental Compliance Costs: Meeting emissions standards for fleets increases operational expenses.

- Labor Law Navigation: Adhering to diverse labor regulations requires specialized knowledge.

- Permitting and Licensing Burden: The process of obtaining necessary operating authorities is complex and costly.

Talent acquisition and skilled labor shortage

The threat of new entrants is significantly influenced by the persistent challenge of talent acquisition and the ongoing skilled labor shortage within the logistics sector. Attracting and retaining a qualified workforce, particularly experienced truck drivers and adept logistics professionals, remains a critical hurdle for any company looking to enter the market.

New entrants would find it difficult to recruit and train a substantial, competent team, especially considering the existing competition for talent and the widespread labor shortages. This scarcity of essential skills acts as a substantial entry barrier, making it harder for new players to establish a solid operational foundation.

- Skilled Labor Scarcity: The trucking industry, for instance, faced a shortage of approximately 78,000 drivers in 2023, according to the American Trucking Associations. This deficit makes it challenging for new companies to build a reliable fleet.

- Training Costs: Onboarding and training new drivers and logistics personnel involve considerable investment in time and resources, which can be prohibitive for startups.

- Retention Challenges: Existing companies often offer competitive wages and benefits to retain their skilled workforce, creating a high bar for new entrants to match.

The threat of new entrants into the LTL sector, where ArcBest operates, is significantly mitigated by the immense capital required for infrastructure and fleet acquisition. For example, a new tractor-trailer can cost upwards of $150,000, and building a national network of terminals easily runs into tens or hundreds of millions of dollars, creating a substantial financial barrier.

Economies of scale and scope enjoyed by established players like ArcBest, offering integrated logistics solutions, present a cost advantage that is difficult for newcomers to replicate. Furthermore, deep-rooted customer loyalty and established relationships, evidenced by high client retention rates, make it challenging for new entrants to gain market share.

Stringent regulatory compliance, encompassing safety standards from bodies like the FMCSA and environmental regulations, along with the complex process of obtaining permits and licenses, adds significant cost and complexity for new competitors. The ongoing skilled labor shortage, with an estimated 78,000 driver shortage in 2023, further complicates talent acquisition for new entrants.

| Barrier Type | Key Factors | Impact on New Entrants | Example Data (2024/2023) |

| Capital Requirements | Fleet Acquisition, Terminal Networks | High investment needed, limits competition | Tractor-trailer cost: $150,000+ |

| Economies of Scale/Scope | Integrated Services, Operational Size | Cost advantage for incumbents | ArcBest's 'full suite' of services |

| Customer Loyalty | Reliable Service, Customization | Difficult to gain market share | High client retention rates |

| Regulatory Hurdles | Safety, Environmental, Labor Laws | Increased cost and complexity | FMCSA safety mandates, emissions standards |

| Labor Shortages | Skilled Drivers, Logistics Professionals | Challenges in talent acquisition | ~78,000 driver shortage (2023) |

Porter's Five Forces Analysis Data Sources

Our ArcBest Porter's Five Forces analysis is built upon a foundation of industry-specific data from sources like transportation trade publications, financial analyst reports, and publicly available company filings. We also incorporate macroeconomic indicators and government transportation statistics to provide a comprehensive view of the competitive landscape.