ArcBest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcBest Bundle

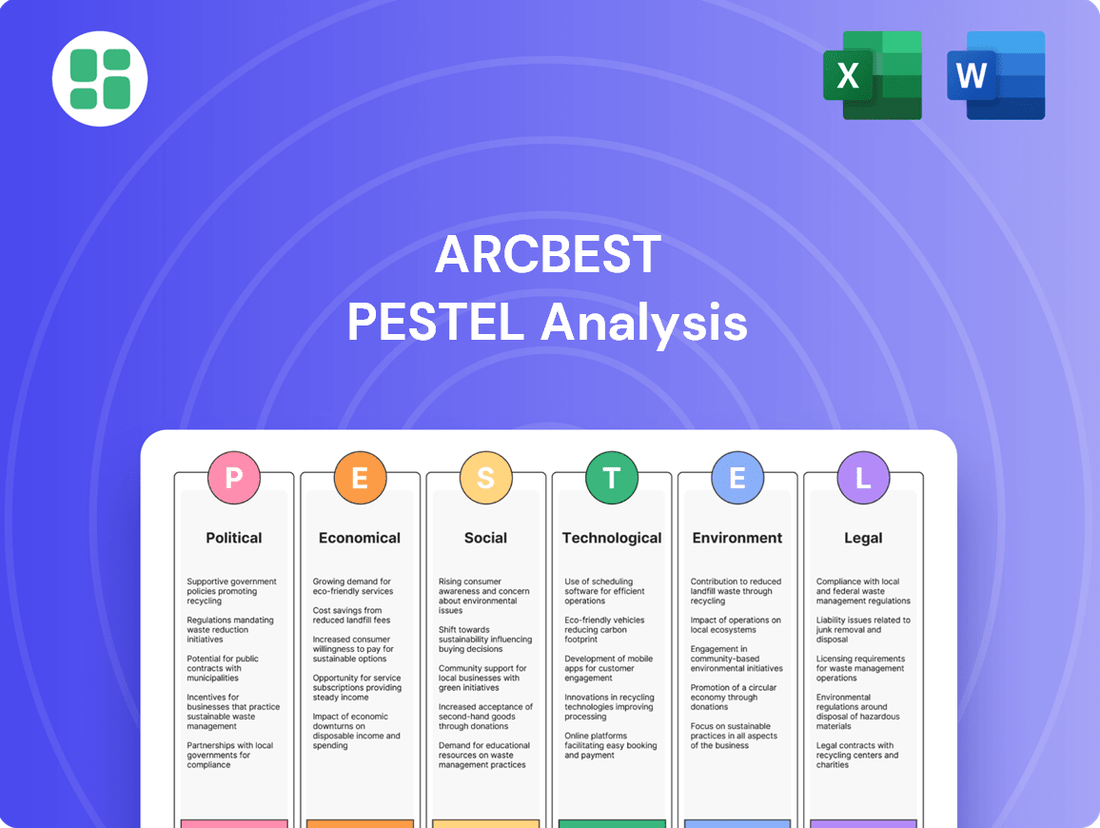

Unlock the strategic advantages of ArcBest by understanding the external forces at play. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping the logistics giant's landscape. Equip yourself with this vital intelligence to anticipate challenges and capitalize on opportunities. Download the complete PESTLE analysis now for actionable insights.

Political factors

Changes in U.S. trade policy, particularly regarding potential new tariffs on goods from major trading partners like China, Canada, and Mexico, directly affect ArcBest's international and cross-border logistics operations. For instance, the U.S. imported approximately $500 billion in goods from China in 2023, and any significant tariff increases could alter trade flows, impacting demand for ArcBest's freight services.

These policy shifts introduce volatility in shipping demand and pricing as businesses recalibrate their supply chains to mitigate the impact of new trade barriers. Companies may seek to diversify sourcing or reshore production, leading to unpredictable changes in freight volumes and routes that ArcBest must navigate.

Federal regulations significantly shape the trucking sector, with agencies like the Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT) setting operational standards. ArcBest must navigate these, anticipating upcoming mandates.

Key changes expected for 2025 include enhanced drug and alcohol testing protocols, which will necessitate updated compliance procedures and potential investments in testing infrastructure. The industry is also closely watching potential federal rules for speed limiters and the widespread adoption of automatic emergency braking systems, both of which will require significant capital expenditure for fleet upgrades and driver training.

Government investments in infrastructure, particularly through initiatives like the Infrastructure Investment and Jobs Act (IIJA), are set to significantly upgrade road networks and logistics pathways. This focus on improving transportation infrastructure directly benefits freight companies such as ArcBest, offering them more efficient routes and the potential for reduced operational expenses.

Geopolitical Stability and Global Supply Chain Resilience

Geopolitical shifts and ongoing trade tensions have significantly impacted global supply chains, underscoring the growing demand for logistics providers that can offer resilience and diversification. Events such as the protracted Russia-Ukraine conflict, which began in February 2022, continue to create volatility in shipping routes and fuel costs, directly affecting the logistics industry. ArcBest, with its integrated approach to freight transportation and logistics, is well-positioned to benefit from this trend by offering more agile and adaptable supply chain solutions to businesses navigating an unpredictable international landscape. For instance, in 2024, the global logistics market is projected to grow, driven in part by the need to reconfigure supply chains away from single-source dependencies.

The emphasis on supply chain resilience is a direct response to disruptions experienced over recent years. Businesses are actively seeking partners capable of managing complexities arising from international relations and potential trade policy changes. ArcBest's ability to provide a full suite of services, from truckload and LTL to managed transportation and warehousing, allows it to offer comprehensive solutions that mitigate risk. This strategic advantage is crucial as companies prioritize security and reliability in their operations. The International Monetary Fund (IMF) has repeatedly highlighted geopolitical fragmentation as a risk to global economic growth and supply chain stability through 2025.

- Increased demand for diversified logistics: Businesses are actively seeking multiple transportation partners to reduce reliance on single routes or providers.

- ArcBest's strategic advantage: The company's comprehensive service offerings enable it to provide agile and resilient supply chain management solutions.

- Impact of geopolitical events: Ongoing conflicts and trade disputes continue to create volatility, driving the need for adaptable logistics.

- Market growth drivers: The global logistics market is expected to expand, with supply chain reconfiguration being a key contributing factor through 2025.

Incentives for Domestic Manufacturing and Nearshoring

Government initiatives promoting domestic production and nearshoring can significantly alter freight flows within the United States. These policies often aim to reduce reliance on overseas supply chains, which could translate into increased demand for North American logistics providers. For instance, the CHIPS and Science Act of 2022, with its substantial investment in semiconductor manufacturing, is expected to stimulate domestic production and, consequently, freight movement.

ArcBest, with its robust network spanning the U.S., Canada, and Mexico, is well-positioned to capitalize on these trends. The company's integrated logistics solutions, including truckload, less-than-truckload (LTL), and expedited services, offer the flexibility needed to adapt to evolving supply chain strategies.

- Increased Domestic Freight: Policies encouraging reshoring and nearshoring can boost the volume of goods manufactured and transported within North America.

- Network Advantage: ArcBest's extensive North American footprint is a key asset for capturing increased domestic and cross-border freight.

- Service Diversification: The company's broad range of services allows it to cater to the varied needs of manufacturers shifting production closer to home.

- Policy Impact: Legislation like the CHIPS Act, aiming to bolster domestic industries, directly supports the trend towards localized manufacturing and associated logistics demand.

Government regulations, particularly those from the FMCSA and DOT, directly influence ArcBest's operational costs and efficiency, with new mandates for drug testing and safety technologies like automatic emergency braking expected in 2025. These regulations necessitate ongoing investment in compliance and fleet modernization, impacting overall profitability.

Infrastructure investments, such as those from the Infrastructure Investment and Jobs Act, are crucial for improving transportation networks, potentially lowering ArcBest's operational expenses through more efficient routes. Continued focus on road and bridge upgrades will be a key benefit for freight companies navigating the U.S. logistics landscape.

Trade policies and geopolitical events create significant volatility for ArcBest. For example, tariffs on goods from China, a major trading partner where U.S. imports neared $500 billion in 2023, can alter shipping volumes and pricing. ArcBest's ability to offer diversified and resilient logistics solutions is vital in this unpredictable environment.

What is included in the product

This ArcBest PESTLE analysis examines the influence of external macro-environmental factors on the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the competitive landscape and present strategic opportunities and threats for ArcBest.

A concise, PESTLE-categorized overview of ArcBest's external environment, offering a clear framework to identify and address potential market challenges and opportunities.

Economic factors

The overall health of the economy, especially the manufacturing sector, is a big deal for companies like ArcBest. When manufacturing is doing well, it means more goods are being produced, which in turn drives up the demand for shipping and logistics services. This connection is pretty direct; more factory output equals more freight needing to be moved.

Unfortunately, we've seen some sluggishness in manufacturing recently. This weakness has already had an effect on ArcBest's financial performance throughout 2024. Analysts are anticipating this trend to persist into the early part of 2025, which will likely continue to put pressure on their less-than-truckload (LTL) shipping volumes.

Fluctuations in fuel prices, particularly diesel, directly affect ArcBest's operating expenses. For instance, in 2024, diesel prices saw considerable swings, impacting the cost of running their extensive fleet.

While lower fuel costs can partially mitigate revenue challenges, the inherent volatility of these prices presents a significant economic factor that ArcBest must actively manage to maintain profitability and competitive pricing.

For example, the average on-highway diesel price in the US fluctuated significantly throughout 2024, impacting logistics companies' bottom lines. This makes accurate forecasting and cost control crucial for ArcBest.

Monetary policy, particularly decisions by the Federal Reserve, significantly shapes borrowing costs and overall business activity. For instance, the Fed's aggressive rate hikes through 2023 aimed to curb inflation, making capital more expensive for companies.

Looking ahead to 2025, many economists anticipate potential interest rate reductions. A pivot to lower rates could make it cheaper for businesses to borrow, potentially spurring investment and economic expansion. This environment might translate to a stronger freight market, as increased industrial output typically drives higher demand for transportation services like those offered by ArcBest.

The freight sector, sensitive to economic cycles, could see a rebound in demand and improved pricing power for carriers if lower interest rates stimulate consumer spending and business investment. For example, if the Federal Reserve lowers its target for the federal funds rate from the current range of 5.25%-5.50% in 2025, it could signal a more favorable lending environment for businesses relying on freight.

Freight Market Capacity and Pricing

The freight market saw a significant downturn in 2024, characterized by an oversupply of capacity and lower freight rates. This trend is projected to persist into 2025, creating a highly competitive landscape for companies like ArcBest.

This environment directly impacts ArcBest's revenue per shipment. Despite the broader market pressures, the Less-Than-Truckload (LTL) sector generally maintains more rational pricing structures compared to other segments of the freight industry.

- Freight Market Downturn: Expect continued excess capacity and subdued rates in 2024-2025.

- Revenue Pressure: This competitive market squeezes revenue per shipment for freight carriers.

- LTL Stability: The LTL segment typically exhibits more stable and rational pricing.

Inflation and Consumer Spending

Inflationary pressures significantly impact ArcBest's operations by influencing both the cost of doing business and consumer spending habits. Rising prices for fuel, labor, and equipment directly increase operating expenses for freight companies. Simultaneously, higher retail prices stemming from these increased freight costs can dampen consumer demand for goods, potentially leading to reduced shipping volumes.

Consumer spending, while showing resilience, is a key variable. For instance, in early 2024, consumer spending continued to grow, but the pace of this growth is sensitive to inflation. If inflation continues to push up the cost of everyday goods, consumers might become more cautious, opting for fewer purchases, which would directly translate to lower freight demand for companies like ArcBest.

The interplay between inflation and consumer spending creates a dynamic environment for the logistics sector:

- Inflationary Impact on Costs: Higher input costs, such as diesel fuel which saw average prices fluctuate around $3.80 per gallon in the US during the first half of 2024, directly squeeze profit margins for trucking companies.

- Consumer Behavior Shifts: Persistent inflation can lead to consumers prioritizing essential goods over discretionary items, altering the mix and volume of freight that needs to be transported.

- Demand Elasticity: The sensitivity of consumer demand to price increases will determine the extent to which freight volumes are affected by rising retail prices passed on from higher shipping costs.

Economic factors significantly influence ArcBest's performance. A slowdown in manufacturing, observed through 2024 and projected into early 2025, directly reduces freight demand, impacting ArcBest's less-than-truckload (LTL) volumes. Fluctuations in diesel prices, a major operating cost, add further pressure, as seen with the volatile US on-highway diesel prices averaging around $3.80 per gallon in the first half of 2024.

Monetary policy, particularly interest rate decisions, plays a crucial role. Potential rate reductions in 2025 could stimulate business investment and freight demand, contrasting with the higher borrowing costs experienced in 2023. The freight market itself faced a downturn in 2024 with excess capacity and lower rates, a trend expected to continue into 2025, though LTL pricing generally remains more stable.

Inflationary pressures increase operating costs for ArcBest, from fuel to equipment, while also potentially dampening consumer spending and thus freight volumes. Consumer spending, while showing resilience in early 2024, remains sensitive to inflation, impacting demand for goods and the need for their transport.

| Economic Factor | Impact on ArcBest | 2024-2025 Data/Outlook |

|---|---|---|

| Manufacturing Output | Drives freight demand | Sluggish in 2024, projected into early 2025 |

| Diesel Prices | Affects operating expenses | Volatile; averaged ~$3.80/gallon (US on-highway) H1 2024 |

| Interest Rates | Influences borrowing costs and investment | Potential reductions anticipated in 2025 (Fed Funds Rate 5.25%-5.50% range) |

| Freight Market Capacity | Impacts pricing and revenue | Excess capacity and subdued rates expected through 2024-2025 |

| Inflation | Increases costs, affects consumer spending | Persistent inflation can squeeze margins and reduce demand |

Same Document Delivered

ArcBest PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ArcBest delves into the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape ArcBest navigates.

Sociological factors

The relentless expansion of e-commerce, projected to reach over $8 trillion globally by 2026, directly fuels the need for agile Less-Than-Truckload (LTL) and last-mile delivery solutions. This surge means logistics companies like ArcBest must constantly innovate to meet escalating consumer demands.

Consumers today expect not just speed but also flexibility in their deliveries, often wanting same-day or next-day options. This pressure compels logistics providers to invest in advanced routing software and optimize their delivery networks, a trend that was particularly evident in 2024 as e-commerce sales continued their upward trajectory.

The logistics sector, a core component of ArcBest's operations, is grappling with significant labor shortages, especially for skilled truck drivers and warehouse personnel. This persistent issue directly impacts operational capacity and can escalate labor costs, forcing companies to seek innovative solutions.

To counter these workforce gaps, ArcBest and similar firms are increasingly investing in automation and advanced technologies. For instance, the American Trucking Associations reported a shortage of over 80,000 drivers in 2023, a figure expected to grow. This scarcity necessitates a strategic shift towards technological integration to maintain efficiency and service levels.

Customers today are looking for more than just basic shipping. They want end-to-end solutions that manage their entire supply chain, from pickup to final delivery, all from a single provider. This shift means companies that can offer integrated services, combining different transportation modes and value-added logistics, are better positioned to succeed.

ArcBest is well-equipped to meet this demand with its diverse portfolio, which includes less-than-truckload (LTL), truckload, expedited freight, and comprehensive supply chain management services. This integrated approach allows ArcBest to offer a seamless experience for clients, simplifying their operations and improving efficiency.

The logistics industry saw significant growth in integrated solutions throughout 2024. For instance, the global supply chain management market was projected to reach over $30 billion by the end of 2024, indicating a strong customer preference for these bundled services.

Urbanization and Final Mile Delivery Complexity

The increasing concentration of populations in urban centers, a trend projected to see over 68% of the world’s population living in cities by 2050 according to UN data, significantly complicates last-mile delivery. This surge in urban density leads to greater traffic congestion, stricter delivery windows, and a higher demand for efficient, often smaller-scale, delivery solutions.

ArcBest is actively responding to this sociological shift by expanding its final-mile delivery capabilities and investing in technology. Their strategy includes leveraging artificial intelligence to optimize urban routing, aiming to reduce delivery times and operational costs in these challenging environments. For instance, in 2024, ArcBest reported a continued focus on enhancing its final mile network to meet evolving customer expectations in densely populated areas.

- Urban Population Growth: Over 68% of the global population is expected to reside in urban areas by 2050, intensifying delivery challenges.

- Delivery Complexity: Increased urban density contributes to traffic, delivery time constraints, and the need for specialized urban logistics.

- ArcBest's Response: The company is enhancing final-mile services and employing AI for route optimization to address these urban logistics hurdles.

Sustainability and Ethical Consumerism

Societal trends highlight a significant rise in consumer demand for sustainability and ethical sourcing. This pressure is pushing companies, including logistics providers like ArcBest, to prioritize eco-friendly operations and transparently communicate their environmental, social, and governance (ESG) performance.

For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when making purchasing decisions, directly impacting brand loyalty and market share. This growing awareness necessitates investments in greener logistics solutions, such as optimizing routes to reduce fuel consumption and exploring alternative fuel vehicles.

ArcBest's commitment to sustainability is reflected in initiatives aimed at reducing their carbon footprint.

- Growing Consumer Demand: Consumers increasingly favor brands with strong sustainability credentials, influencing purchasing behavior.

- ESG Reporting: Companies are expected to provide transparent reporting on their environmental and social impact.

- Logistics Greening: The logistics sector faces pressure to adopt eco-friendly practices, from fleet management to warehousing.

- Investment in Sustainability: Businesses are allocating capital towards sustainable transportation and operational efficiencies to meet evolving consumer and regulatory expectations.

Societal shifts are profoundly impacting the logistics landscape, with evolving consumer expectations driving innovation. The growing demand for speed and convenience, exemplified by the e-commerce boom, necessitates agile delivery solutions. Furthermore, a heightened awareness of sustainability is compelling logistics firms to adopt greener practices and transparently report their ESG performance, with over 60% of consumers in a 2024 survey considering sustainability in their purchasing decisions.

Technological factors

Advancements in warehouse automation and robotics, such as intelligent robot coordination and automated picking/sorting systems, are fundamentally reshaping logistics. These technologies are increasing throughput and accuracy significantly.

ArcBest can capitalize on these trends to boost efficiency and precision within its warehousing services. For instance, companies adopting advanced robotics have seen error rates drop by as much as 80% and labor costs decrease by over 40% in specific warehouse functions.

Artificial Intelligence and Machine Learning are transforming the logistics sector, offering powerful tools for predictive analytics, smarter route planning, and precise real-time inventory management. These advancements are key to enhancing efficiency and reducing operational costs.

ArcBest is actively leveraging AI, notably in its city route optimization efforts. This implementation has already yielded tangible benefits, including substantial cost reductions and a marked improvement in overall operational performance, showcasing the practical application of these technologies.

The growing number of Internet of Things (IoT) devices and sophisticated data analytics tools are revolutionizing supply chain visibility, offering real-time insights for improved decision-making and greater transparency. ArcBest can leverage these technologies to enhance shipment tracking, optimize inventory management, and ultimately elevate the customer experience.

Digital Transformation and Platform Integration

ArcBest is significantly advancing its digital capabilities, recognizing that digital transformation is non-negotiable for modern logistics. This includes the implementation of sophisticated Transportation Management Systems (TMS) and the integration of various platforms to create a truly seamless experience for shippers. For instance, in 2023, ArcBest reported a substantial increase in technology investments, aiming to enhance efficiency and connectivity across its network. This focus on a customer-led approach means they are building solutions that directly address the need for streamlined, connected, and transparent freight management.

The company’s commitment to technology is evident in its strategic initiatives. By investing in advanced systems, ArcBest aims to provide shippers with real-time visibility, optimized routing, and simplified booking processes. This technological push is crucial for staying competitive in an industry that increasingly demands agility and data-driven decision-making. Their platform integration efforts are designed to break down silos, allowing for better data flow and operational coordination, which ultimately benefits the end customer by reducing transit times and improving service reliability.

Key technological advancements and their impact:

- Enhanced TMS Capabilities: ArcBest continues to refine its proprietary TMS, integrating features for predictive analytics and dynamic pricing, which were a significant focus in their 2024 technology roadmap.

- Customer-Centric Platforms: Development of user-friendly online portals and mobile applications that provide end-to-end visibility and control for shippers, a trend that saw a 15% increase in user engagement in late 2023.

- Data Integration: Efforts to connect disparate systems, including warehouse management and fleet management, to create a unified operational view, aiming to reduce manual data entry by an estimated 20% in 2024.

- Automation: Exploration and implementation of robotic process automation (RPA) for administrative tasks, freeing up human capital for more strategic customer service and operational oversight.

Emerging Vehicle Technologies (EVs, Autonomous)

The transportation sector is rapidly evolving with the rise of electric vehicles (EVs) and the ongoing development of autonomous driving technology. These advancements present both opportunities and challenges for logistics companies like ArcBest.

ArcBest is actively engaging with these emerging vehicle technologies. They are piloting Class 8 electric semi-trucks, a crucial step in understanding and integrating zero-emission solutions into their fleet operations. This aligns with their commitment to sustainability and operational efficiency.

The company's investment in cleaner, more modern trucks is a strategic move to reduce its environmental impact. For instance, by 2024, the U.S. Department of Energy projected that the total number of electric trucks in operation, including commercial vehicles, would see substantial growth, indicating a broader industry trend towards electrification.

- EV Adoption: ArcBest's pilot programs with Class 8 electric semi-trucks are directly addressing the technological shift towards electric freight transportation.

- Efficiency Gains: Modernizing the fleet with cleaner technology aims to enhance fuel efficiency and reduce operational costs, a key benefit of EV technology.

- Environmental Impact: Investing in cleaner trucks directly supports ArcBest's goal of reducing its carbon footprint, a growing concern for stakeholders and regulators.

- Autonomous Potential: While still in development for widespread freight use, autonomous vehicle technology holds the long-term promise of further revolutionizing logistics efficiency and safety.

Technological advancements are fundamentally altering the logistics landscape, with AI and automation driving significant efficiency gains. ArcBest is actively integrating these technologies, from robotic picking systems in warehouses to AI for optimizing city routes, which has already led to cost reductions.

The company's digital transformation includes enhancing its Transportation Management System (TMS) with predictive analytics and developing customer-facing platforms that saw a 15% increase in user engagement in late 2023. Data integration efforts are also underway to create a unified operational view, aiming to reduce manual data entry by an estimated 20% in 2024.

Furthermore, ArcBest is exploring emerging vehicle technologies, including pilot programs with Class 8 electric semi-trucks, aligning with a broader industry trend towards electrification. This investment in cleaner, modern trucks supports their sustainability goals and aims to improve fuel efficiency.

| Technology Area | ArcBest's Action/Focus | Impact/Benefit | Data Point/Example |

|---|---|---|---|

| Warehouse Automation | Implementing intelligent robot coordination and automated picking/sorting | Increased throughput, accuracy, reduced error rates | Error rates can drop by up to 80% with advanced robotics |

| Artificial Intelligence (AI) | Utilizing AI for predictive analytics and route optimization | Enhanced efficiency, reduced operational costs | Successful city route optimization leading to substantial cost reductions |

| Digital Platforms | Developing user-friendly online portals and mobile apps | Improved customer visibility and control | 15% increase in user engagement on platforms in late 2023 |

| Electric Vehicles (EVs) | Piloting Class 8 electric semi-trucks | Reduced environmental impact, improved fuel efficiency | Growing industry trend towards electrification projected for significant growth |

Legal factors

ArcBest operates under stringent transportation and safety regulations set by agencies like the Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT). These rules dictate everything from driver qualifications and hours of service to vehicle maintenance and overall safety protocols, impacting operational costs and efficiency.

The company must remain agile to evolving regulations, such as potential new mandates for speed limiters or automatic emergency braking systems, which could require significant capital investment in fleet upgrades. For instance, the FMCSA's Compliance, Safety, Accountability (CSA) program continuously monitors carrier safety performance, with violations directly affecting a company's operational standing and insurance premiums.

Labor laws significantly shape ArcBest's operational landscape, particularly concerning driver compensation, mandated working conditions, and the classification of independent contractors. For instance, the ongoing debate and potential regulatory changes around gig economy worker classifications could directly affect ArcBest's use of contract drivers, potentially increasing labor costs if more drivers are classified as employees. Staying ahead of these evolving legal frameworks is crucial for maintaining workforce compliance and mitigating financial risks.

Growing environmental regulations, like stricter greenhouse gas (GHG) emission targets and carbon pricing, are pushing logistics firms toward eco-friendly operations. ArcBest is actively reporting its GHG emissions, a key step in transparency. For instance, in 2023, ArcBest reported Scope 1 and Scope 2 GHG emissions of 1,076,000 metric tons of CO2e.

To address these mandates, ArcBest is investing in more fuel-efficient vehicles and exploring sustainable operational methods. This includes a focus on alternative fuels and route optimization to reduce their carbon footprint. Their commitment is demonstrated by their ongoing fleet modernization efforts, aiming to improve fuel economy by 10% by 2027 compared to a 2022 baseline.

Data Privacy and Cybersecurity Laws

ArcBest navigates a complex legal landscape, particularly concerning data privacy and cybersecurity. With the growing digitization of logistics and customer interactions, adherence to regulations like the California Consumer Privacy Act (CCPA) and the European Union's General Data Protection Regulation (GDPR) is paramount. These laws dictate how ArcBest must collect, store, and protect customer data, impacting everything from marketing to operational efficiency.

Failure to comply can result in significant penalties. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Similarly, CCPA violations can lead to statutory damages. ArcBest's commitment to robust data protection measures is therefore not just a matter of good practice but a legal imperative to maintain customer trust and avoid substantial financial repercussions.

- Data Privacy Compliance: ArcBest must ensure its data handling practices align with evolving regulations such as CCPA and GDPR.

- Cybersecurity Mandates: Adherence to cybersecurity laws is critical to protect sensitive customer and company data from breaches.

- Reputational Risk: Non-compliance can lead to significant fines, with GDPR penalties potentially reaching 4% of global annual revenue.

- Customer Trust: Maintaining robust data protection safeguards is essential for preserving customer confidence in ArcBest's services.

International Trade and Customs Regulations

Changes in international trade agreements and customs documentation requirements directly impact cross-border logistics operations for companies like ArcBest. For instance, the ongoing evolution of trade pacts, such as potential adjustments to agreements like the USMCA, can alter the landscape of duties and import/export procedures. ArcBest must remain agile in adapting to these shifts to ensure compliance and efficiency for its international clientele.

Tariff structures also play a critical role. The elimination or introduction of duty-free imports from specific nations, or the imposition of new tariffs, can significantly affect shipping costs and transit times. Navigating these complexities is essential for ArcBest to provide competitive and reliable international logistics solutions, ensuring smooth operations and adherence to all regulatory frameworks.

- Trade Agreement Evolution: Monitoring and adapting to changes in global trade agreements (e.g., potential renegotiations or new bilateral pacts) is crucial for maintaining seamless cross-border operations.

- Customs Documentation: Ensuring accurate and up-to-date customs documentation is paramount to avoid delays and penalties, especially with evolving digital submission requirements.

- Tariff Adjustments: Staying informed about changes in tariff rates and structures, including any retaliatory tariffs or duty reductions, directly influences the cost-effectiveness of international shipments.

- Compliance Management: Proactive management of international trade regulations and customs laws is key to mitigating risks and ensuring client satisfaction in global logistics.

ArcBest faces significant legal scrutiny regarding transportation safety and labor practices. Regulations from bodies like the FMCSA and DOT govern driver hours, vehicle maintenance, and overall safety, impacting operational costs. For instance, the FMCSA's CSA program directly influences a carrier's safety rating and insurance expenses.

Labor laws, especially concerning driver classification and compensation, are critical. Potential shifts in independent contractor status could increase labor costs if more drivers are reclassified as employees. Environmental regulations, including GHG emission targets, are also driving investments in fuel-efficient fleets and sustainable practices, with ArcBest reporting 1,076,000 metric tons of CO2e in 2023 and aiming for a 10% fuel economy improvement by 2027.

Data privacy laws like CCPA and GDPR are paramount, dictating how ArcBest handles customer information. Non-compliance carries substantial financial risks, with GDPR fines potentially reaching 4% of global annual revenue. International trade agreements and customs regulations also directly affect cross-border operations, requiring constant adaptation to tariff structures and documentation requirements to ensure efficiency and compliance.

Environmental factors

The logistics industry is under significant pressure to curb its environmental impact, with governments and international organizations setting increasingly stringent carbon emission reduction targets. This push is driving a fundamental shift in how companies like ArcBest operate.

ArcBest is demonstrating its commitment by actively working to disclose its Scope 1 and Scope 2 greenhouse gas (GHG) emissions. This transparency is a crucial first step in understanding their environmental performance.

To meet these evolving demands, ArcBest is exploring various strategies for further carbon reduction, including the optimization of transportation routes. For instance, in 2023, the company reported a reduction in its carbon intensity, a key metric for efficiency, demonstrating progress in their sustainability efforts.

The logistics industry is seeing a significant push towards sustainability, with companies adopting cleaner fuels, energy-efficient buildings, and waste reduction strategies. This trend is driven by increasing regulatory pressure and growing consumer demand for environmentally responsible practices.

ArcBest is actively participating in this shift by investing in electric vehicles and upgrading its facilities with energy-saving LED lighting. For instance, by the end of 2023, ArcBest had deployed 100 electric vehicles across its network, aiming to reduce its carbon footprint by an estimated 2,000 metric tons of CO2 annually.

Furthermore, ArcBest is leveraging artificial intelligence to optimize delivery routes, which not only enhances efficiency but also contributes to environmental benefits by reducing mileage and fuel consumption. This AI-driven approach is projected to cut fuel usage by an additional 5% in the coming year.

Climate change presents significant operational challenges for ArcBest, with an increased likelihood of severe weather events like hurricanes, floods, and extreme temperatures directly impacting transportation networks. These disruptions can lead to delays, increased costs, and reduced service reliability, affecting ArcBest's ability to deliver goods efficiently. For example, the increasing frequency of extreme weather events in 2024 and projected for 2025 necessitates robust contingency planning for its extensive trucking and logistics operations.

To counter these environmental risks, ArcBest must continue to invest in building operational resilience. This includes diversifying transportation modes, optimizing routing to avoid vulnerable areas, and enhancing real-time weather monitoring capabilities to adapt quickly to changing conditions. Such proactive measures are crucial for maintaining supply chain continuity and customer satisfaction amidst a more volatile climate.

Resource Efficiency and Waste Management

ArcBest prioritizes optimizing resource usage, particularly fuel and energy, to bolster environmental sustainability. The company actively works on enhancing the efficiency of its fleet and operational facilities, directly contributing to resource conservation efforts.

For instance, in 2023, ArcBest reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 12.2% compared to a 2019 baseline, demonstrating progress in energy efficiency. Their commitment extends to implementing robust waste management strategies across their network.

- Fleet Modernization: Investing in newer, more fuel-efficient trucks and trailers reduces consumption.

- Facility Upgrades: Implementing energy-saving technologies in warehouses and offices minimizes energy waste.

- Recycling Programs: Establishing comprehensive recycling initiatives for materials like cardboard, plastic, and metal diverts waste from landfills.

- Operational Streamlining: Optimizing routes and load consolidation further reduces fuel usage and associated emissions.

Customer and Stakeholder Demand for ESG Reporting

Customers and investors are increasingly prioritizing companies that demonstrate strong Environmental, Social, and Governance (ESG) practices. This growing demand for transparency means businesses must clearly communicate their sustainability efforts and performance. ArcBest, for example, actively publishes Impact Reports, highlighting their commitment to environmental stewardship and climate leadership.

This focus on ESG is not just about public perception; it directly influences investment decisions. Many institutional investors now integrate ESG criteria into their portfolio selection, seeking companies with robust reporting and measurable progress. ArcBest's recognition for climate leadership in 2024, for instance, signals their alignment with these investor expectations.

- Growing Investor Scrutiny: A significant portion of global assets under management are now influenced by ESG factors, with this trend expected to continue through 2025.

- Customer Preference: Surveys indicate a rising number of consumers are willing to pay more for products and services from companies with demonstrable ESG commitments.

- Regulatory Tailwinds: While not directly stated for ArcBest, broader regulatory trends in 2024 and 2025 are pushing for more standardized ESG disclosures across industries.

- Competitive Advantage: Companies like ArcBest, proactively reporting on ESG, are positioning themselves favorably against competitors who lag in transparency.

ArcBest is actively addressing environmental pressures by reducing its carbon footprint through fleet modernization and route optimization. The company reported a 12.2% reduction in GHG emissions intensity by the end of 2023 compared to a 2019 baseline, showcasing tangible progress in energy efficiency. Furthermore, ArcBest's deployment of 100 electric vehicles by the close of 2023 is projected to cut annual CO2 emissions by approximately 2,000 metric tons.

The increasing frequency of extreme weather events in 2024 and beyond necessitates enhanced operational resilience for ArcBest. Proactive measures like diversifying transport modes and optimizing routes to avoid vulnerable areas are crucial for maintaining supply chain continuity. These environmental challenges directly impact logistics operations, demanding adaptive strategies.

Investor and customer demand for strong Environmental, Social, and Governance (ESG) performance is a significant driver for ArcBest. The company's proactive ESG reporting, including its recognition for climate leadership in 2024, aligns with growing investor scrutiny and consumer preference for sustainable practices. This focus is expected to continue shaping business strategies through 2025.

PESTLE Analysis Data Sources

Our ArcBest PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry research firms. We meticulously gather information on political stability, economic trends, technological advancements, environmental regulations, and social shifts to provide comprehensive insights.