ArcBest Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcBest Bundle

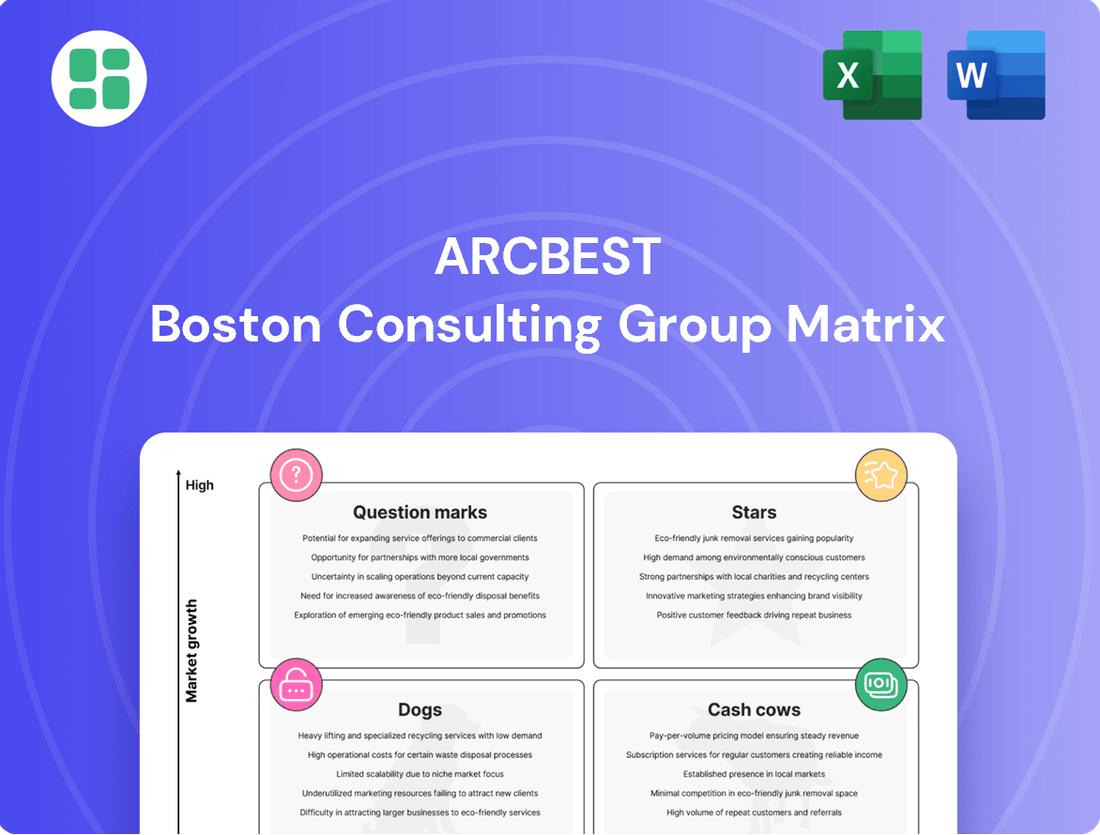

ArcBest's BCG Matrix offers a powerful lens to understand its diverse business portfolio. By categorizing its services into Stars, Cash Cows, Dogs, and Question Marks, you can quickly grasp their market share and growth potential. This preview highlights the strategic implications, but for a truly actionable roadmap, dive into the full report.

Purchase the complete ArcBest BCG Matrix to unlock detailed quadrant placements and data-driven insights. Understand where to invest for future growth and which segments are generating stable returns, empowering you to make informed strategic decisions.

Stars

ArcBest's Vaux Smart Autonomy system, featuring Vaux Vision™, is a prime example of a potential star in the BCG matrix. This innovative technology integrates autonomous mobile robot forklifts with intelligent software and remote teleoperation, aiming to transform material handling in warehouses and distribution centers.

While currently in pilot phases and demanding significant investment, its advanced nature in the fast-paced logistics technology sector suggests strong future growth potential. If market adoption gains momentum, Vaux could emerge as a leader in autonomous warehouse solutions.

The demand for expedited freight is surging, driven by consumer expectations for speed and the critical need for supply chain agility. ArcBest's strategic emphasis on these time-critical services, which typically command higher prices, positions them advantageously in a rapidly expanding market. For instance, the expedited freight market was valued at over $75 billion globally in 2023 and is projected to grow significantly.

Managed Transportation Solutions, a key component of ArcBest's strategy, experienced a notable surge in 2024. Revenue for this segment climbed by an impressive 22%, showcasing strong market demand.

This growth is fueled by businesses increasingly relying on ArcBest's expertise to streamline their intricate supply chains. The demand for efficient logistics solutions is on the rise, making this a prime area for ArcBest's continued investment and development.

Digital and AI-Driven Logistics Platforms

ArcBest is heavily investing in digital and AI-driven logistics platforms, focusing on areas like advanced demand forecasting and real-time shipment visibility. These technologies are crucial for optimizing routes and improving overall supply chain efficiency. The market for digitized logistics solutions is experiencing robust growth as businesses increasingly prioritize supply chain modernization.

ArcBest's strategic investments in AI and machine learning are designed to give these digital platforms a competitive edge. For instance, by enhancing predictive analytics for demand, ArcBest can better manage capacity and reduce transit times. The company's commitment to technological innovation in this high-growth sector positions these platforms as a significant contributor to future revenue streams.

- Market Growth: The global logistics technology market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, driven by the demand for supply chain digitization.

- AI Investment: ArcBest reported significant capital expenditures in technology in its 2023 annual report, with a notable portion allocated to AI and machine learning initiatives aimed at enhancing operational capabilities.

- Efficiency Gains: Studies show that AI-powered route optimization can lead to fuel savings of up to 10-15% and a reduction in delivery times by 5-10%.

- Customer Demand: A recent industry survey indicated that over 70% of shippers consider real-time visibility and predictive analytics as key factors when selecting logistics partners.

Final Mile Delivery Solutions

Final mile delivery solutions represent a key growth area for ArcBest, firmly positioning it within the 'Star' category of the BCG matrix. The surge in e-commerce, projected to reach over $7 trillion globally by 2025, fuels this demand for efficient last-mile services.

ArcBest's investment in its final mile capabilities, including its Panther Premium Logistics brand, allows it to capitalize on this expanding market. This segment is characterized by high growth potential and increasing competition, making strategic execution crucial.

- Market Growth: The global last-mile delivery market is anticipated to grow at a CAGR of approximately 15% from 2024 to 2030.

- E-commerce Influence: Online retail sales continue to be the primary driver, with a significant portion of delivery costs concentrated in the final mile.

- ArcBest's Position: ArcBest's dedicated final mile network is well-suited to capture market share in this high-demand sector.

- Investment Focus: Continued investment in technology and infrastructure will be vital for maintaining a competitive edge in this dynamic segment.

ArcBest's strategic focus on expedited freight and managed transportation solutions positions these segments as strong contenders for the 'Star' category in the BCG matrix. The company's 2024 performance, with a 22% revenue surge in Managed Transportation Solutions, highlights robust market demand for their expertise in navigating complex supply chains.

Furthermore, ArcBest's significant investments in digital and AI-driven logistics platforms, aimed at enhancing demand forecasting and real-time visibility, are crucial for optimizing operations in a sector that prioritizes supply chain modernization. These technological advancements are key to capturing market share in high-growth areas.

The company's final mile delivery capabilities, exemplified by its Panther Premium Logistics brand, are also well-positioned as stars. Driven by the e-commerce boom, this segment is experiencing rapid expansion, with the global last-mile delivery market expected to grow at a CAGR of approximately 15% from 2024 to 2030.

| BCG Category | ArcBest Segment | Market Growth | Relative Market Share | Rationale |

|---|---|---|---|---|

| Stars | Expedited Freight | High | Strong (Implied by strategic focus and market demand) | Surging consumer demand for speed and supply chain agility. |

| Stars | Managed Transportation Solutions | High | Strong (Evidenced by 22% revenue growth in 2024) | Increasing reliance on ArcBest's expertise for supply chain streamlining. |

| Stars | Digital & AI-Driven Logistics Platforms | High | Growing (Due to investment in AI/ML) | Crucial for optimizing routes, improving efficiency, and meeting shipper demands for visibility. |

| Stars | Final Mile Delivery | Very High (Driven by e-commerce) | Strong (Through Panther Premium Logistics) | Capitalizing on the expanding e-commerce market and demand for last-mile services. |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Provides strategic insights for Stars, Cash Cows, Question Marks, and Dogs within ArcBest's portfolio.

The ArcBest BCG Matrix provides a clear, one-page overview, instantly clarifying business unit positioning and alleviating strategic confusion.

Cash Cows

ABF Freight, ArcBest's asset-based less-than-truckload (LTL) division, is a mature but dominant player in its sector. While the broader LTL market is expected to reach $245.56 billion by 2025, ABF Freight's extensive network and operational history position it as a steady cash generator. This consistent financial contribution allows ArcBest to fund growth initiatives in other business segments.

ArcBest's core asset-based operations, largely driven by ABF Freight, are the company's undisputed cash cows. This segment consistently generates the lion's share of ArcBest's revenue and operating income, underscoring its foundational importance. For instance, in the first quarter of 2024, ABF Freight reported total revenue of $548.2 million, contributing significantly to ArcBest's overall performance.

The strength of this segment lies in its robust infrastructure, featuring an extensive network of service centers and a highly experienced workforce. This established foundation ensures a steady and dependable flow of revenue, even when the broader economic landscape experiences volatility. This operational efficiency allows ABF Freight to produce substantial cash, reinforcing its status as a reliable cash generator for ArcBest.

ArcBest's established logistics solutions, such as traditional truckload brokerage and intermodal services, represent its cash cows. These are not the fastest-growing segments, but they are dependable.

These services benefit significantly from ArcBest's extensive customer network and well-established relationships. This allows them to generate consistent revenue streams that contribute positively to the company's overall profitability.

By utilizing existing infrastructure and the trust built with customers, these offerings provide a reliable source of cash flow for ArcBest. For instance, in the first quarter of 2024, ArcBest's Total Revenue reached $1.17 billion, with its Asset-Light segment, which includes brokerage, showing resilience.

Real Estate and Terminal Network

ArcBest's extensive network of terminals and real estate functions as a significant Cash Cow within its operations. These physical assets are fundamental to its Less-Than-Truckload (LTL) services, providing a stable and enduring foundation for freight movement and logistics. This infrastructure, while not a product, is a high-market-share component that consistently generates value through operational efficiency.

The company's investment in its terminal network is a testament to its strategic focus on core competencies. For instance, in 2023, ArcBest continued to invest in its network, enhancing capacity and efficiency, which directly supports its LTL business. This ongoing commitment ensures their ability to handle a substantial volume of freight, reinforcing its position as a leader in the LTL market.

- Terminal Network: ArcBest operates a robust network of terminals strategically located across the United States, enabling efficient cross-docking and consolidation of LTL shipments.

- Real Estate Holdings: The company owns a significant portion of its terminal facilities, providing long-term cost stability and control over its operational footprint.

- Operational Efficiency: This infrastructure directly contributes to ArcBest's ability to offer reliable and timely LTL services, a key driver of its consistent revenue generation.

- Market Share: The established network represents a substantial barrier to entry for competitors and solidifies ArcBest's strong market share in the LTL sector.

Customer Retention from Top Accounts

ArcBest's top 50 customers represent a significant pillar of stability, demonstrating a high retention rate that fuels consistent revenue. These enduring partnerships, cultivated within a mature segment of the logistics industry, translate into predictable cash flows. This loyalty highlights the robust value proposition of ArcBest's core services.

The focus on retaining these key accounts minimizes the need for extensive new customer acquisition efforts. This efficiency translates into lower marketing and sales expenditures, directly contributing to the profitability of these established relationships. In 2023, ArcBest reported that its top 100 customers accounted for approximately 30% of its total revenue, underscoring the importance of customer retention.

- High Retention of Top Accounts: ArcBest maintains strong relationships with its largest clients.

- Predictable Revenue Streams: These long-term partnerships generate consistent and recurring income.

- Lower Acquisition Costs: Retaining existing customers is more cost-effective than acquiring new ones.

- Mature Industry Stability: Operations in established market segments provide a reliable cash flow base.

ArcBest's asset-based Less-Than-Truckload (LTL) operations, primarily through ABF Freight, are its core cash cows. This segment consistently generates substantial revenue and operating income, forming the bedrock of the company's financial stability. For example, in Q1 2024, ABF Freight's revenue was $548.2 million, a testament to its ongoing market strength.

The company's established logistics solutions, including traditional truckload brokerage and intermodal services, also function as dependable cash cows. While not experiencing rapid growth, these offerings benefit from strong customer relationships and existing infrastructure, ensuring consistent revenue streams. In the first quarter of 2024, ArcBest's total revenue reached $1.17 billion, highlighting the contribution of these stable segments.

ArcBest's extensive terminal network and owned real estate are crucial cash cow assets, underpinning its LTL services. This physical infrastructure provides operational efficiency and a competitive advantage, allowing for consistent freight movement and value generation. The company's continued investment in its network, as seen in 2023, reinforces its market leadership and revenue generation capability.

The loyalty of ArcBest's top customers is a significant driver of its cash cow status. With a high retention rate among its largest clients, the company benefits from predictable revenue and lower customer acquisition costs. In 2023, the top 100 customers contributed approximately 30% of total revenue, demonstrating the financial stability derived from these enduring partnerships.

| Segment | Role in BCG Matrix | Key Characteristics | Q1 2024 Revenue Contribution (Approx.) |

| ABF Freight (LTL) | Cash Cow | Mature, dominant market player, extensive network, steady cash generation | $548.2 million |

| Traditional Brokerage & Intermodal | Cash Cow | Dependable, benefits from existing infrastructure and customer relationships | Part of Asset-Light segment |

| Terminal Network & Real Estate | Cash Cow Asset | Underpins LTL operations, operational efficiency, competitive advantage | N/A (Asset value) |

| Top Customer Relationships | Cash Cow Driver | High retention, predictable revenue, lower acquisition costs | Top 100 customers ~30% of total revenue (2023) |

Preview = Final Product

ArcBest BCG Matrix

The ArcBest BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

ArcBest has strategically pruned less profitable truckload volumes within its asset-light segment. This move suggests these specific freight lanes or business types were not meeting profitability targets. For instance, in the first quarter of 2024, ArcBest reported a focus on optimizing its network, which included shedding less efficient freight.

Outdated or inefficient legacy IT systems at ArcBest, despite ongoing tech investments, could be classified as Dogs. These systems, if not actively upgraded or integrated, drain resources on maintenance without driving growth. For instance, in 2023, ArcBest reported significant investments in technology, but any systems not part of this modernization effort might represent a drag on efficiency and competitive edge.

In the logistics sector, underutilized or obsolete equipment like trucks and trailers can be classified as 'Dogs' in the BCG Matrix. These assets represent a drain on resources, incurring maintenance and depreciation expenses without contributing significantly to revenue or market growth.

For instance, if a logistics company has a fleet of older trucks that are frequently out of service or not generating enough miles, they fall into this category. In 2024, the average age of a commercial truck in the US was around 7 years, and older units often have higher repair costs and lower fuel efficiency, making them prime examples of 'Dogs' if not managed effectively.

Non-Core, Low-Volume Niche Services

ArcBest's portfolio might include specialized, low-volume services that don't fit neatly into its core integrated logistics model. These could be services with limited demand and little potential for expansion.

If these niche offerings have a small market share and low growth prospects, they would be classified as Dogs in the BCG Matrix. Such services often drain resources without contributing significantly to overall revenue or strategic advantage.

- Low Market Share: These services likely represent a very small fraction of ArcBest's total revenue, possibly less than 1% each.

- Minimal Growth: The market for these niche services is probably stagnant or declining, with little expectation of future expansion.

- Resource Drain: Despite low returns, maintaining these services requires dedicated resources, potentially impacting investment in more promising areas.

Specific Less Efficient Freight Handling Facilities

Specific less efficient freight handling facilities, often experimental or pilot operations, can be viewed as potential Dogs within the ArcBest BCG Matrix. These facilities might incur non-cash lease-related impairment charges, as seen in 2023, indicating they are not meeting operational targets or expected returns.

Such underperforming facilities represent investments with low effective market share in terms of throughput or profitability. They require careful management to either improve efficiency or be divested to reallocate resources to more promising ventures.

- Underperforming Pilot Facilities: These are operations that haven't achieved expected efficiency or market penetration.

- Impairment Charges: Non-cash lease-related impairment charges, like those noted in 2023, signal financial underperformance.

- Low Market Share: Facilities with minimal throughput or profitability are categorized as having low effective market share.

- Resource Reallocation: Identifying and addressing these Dog assets is crucial for optimizing capital allocation within ArcBest's portfolio.

ArcBest’s 'Dogs' likely encompass underperforming legacy IT systems and niche, low-volume services with minimal growth potential. These segments consume resources without contributing significantly to market share or profitability. For example, in 2023, ArcBest reported substantial technology investments, but any systems not part of this modernization effort could represent a drag.

Older, less efficient equipment, such as trucks with high maintenance costs and low fuel efficiency, also fall into this category. In 2024, the average age of a commercial truck in the US was around 7 years, highlighting the potential for older assets to become 'Dogs' if not actively managed or replaced.

Underperforming pilot facilities or specialized services that haven't achieved expected efficiency or market penetration are also potential 'Dogs'. These may incur impairment charges, as seen with lease-related charges in 2023, signaling financial underperformance and a need for resource reallocation.

| Category | Description | ArcBest Relevance | Example | Financial Implication |

| Legacy IT Systems | Outdated technology draining resources | Systems not part of modernization efforts | Software with high maintenance costs | Reduced operational efficiency |

| Niche Services | Low-volume offerings with limited growth | Specialized freight lanes with low demand | Experimental pilot operations | Resource drain without significant ROI |

| Obsolete Equipment | Underutilized or inefficient assets | Older trucks with high repair costs | Fleet units with low mileage | Increased operating expenses |

Question Marks

ArcBest's international air and ocean freight services operate within a global market that's seen significant fluctuations. For instance, ocean freight rates, as tracked by the Freightos Baltic Index, experienced considerable volatility throughout 2023 and into early 2024, reflecting shifts in consumer demand and supply chain disruptions.

These international segments, while offering substantial growth opportunities, are characterized by intense competition from established global players. ArcBest's market share in these highly competitive arenas might be nascent, positioning these services as potential Stars or Question Marks within the BCG framework, necessitating strategic capital allocation to build market presence and capture a larger share of the expanding global trade volume.

ArcBest is actively exploring the future of sustainable logistics by piloting Class 8 Electric Vehicle (EV) Semis in its over-the-road operations. This move signifies a strategic investment in a market segment poised for substantial growth.

While the electric vehicle market for freight is in its early stages with negligible current market share, these pilots are crucial for ArcBest. They represent a significant investment to assess the commercial viability and scalability of this technology, aiming to identify potential future 'Stars' in their portfolio.

ArcBest's strategic expansion into new geographic markets or corridors, particularly those exhibiting high growth potential but where the company's market share is currently nascent, would classify these ventures as Question Marks within the BCG Matrix. These initiatives demand substantial capital and operational resources to establish a foothold and build market presence. For instance, if ArcBest is targeting emerging logistics hubs in Southeast Asia or expanding its cross-border services into previously underserved regions in South America, these would represent classic Question Mark scenarios.

The success of these expansions hinges on ArcBest's ability to effectively penetrate these new markets and achieve profitability. This often involves significant upfront investment in infrastructure, sales teams, and marketing efforts. For example, in 2024, many logistics companies are evaluating opportunities in markets like India, which is projected to see continued strong growth in freight volumes, or exploring enhanced capabilities for e-commerce fulfillment in rapidly urbanizing areas across Africa. Successfully navigating these new territories requires careful planning and execution to convert these Question Marks into Stars or Cash Cows.

Specialized Solutions for Emerging Industries

ArcBest's commitment to tackling complex customer needs often leads to the development of specialized logistics solutions for burgeoning industries. Think about areas like advanced manufacturing or specific, high-growth e-commerce segments. These are sectors where unique shipping and supply chain demands are common.

While these specialized offerings represent significant future potential, they typically begin with a relatively small market share. This means they require dedicated investment and focused efforts to gain traction and become substantial revenue drivers for ArcBest. For instance, in 2024, the global advanced manufacturing market was projected to reach over $3.5 trillion, highlighting the vast opportunity for specialized logistics providers.

- Emerging Industries: Focus on sectors like advanced manufacturing, specialized e-commerce niches, and potentially renewable energy logistics.

- Low Market Share: These solutions initially capture a small portion of their respective markets, requiring strategic development.

- Targeted Investment: Significant R&D and market penetration efforts are necessary to build these offerings.

- High Growth Potential: Despite their current size, these sectors are expected to expand rapidly, offering substantial future returns.

Strategic Acquisitions in New Service Areas

ArcBest's strategic vision involves expanding its service offerings through acquisitions, particularly in burgeoning markets or those with advanced technologies. These new ventures, even if operating in high-growth sectors, might initially fall into the question mark category if their integration is incomplete or their market dominance within ArcBest's broader structure is yet to be established.

For instance, if ArcBest acquired a specialized last-mile delivery technology firm in 2024, this entity would likely be a question mark. While the last-mile delivery market is projected for significant expansion, the acquired company's ability to achieve substantial market share and profitability within ArcBest's existing network would be uncertain until full integration and performance are proven.

- Potential for High Growth: New service areas, especially those leveraging emerging technologies or addressing unmet market needs, represent significant growth opportunities.

- Uncertain Market Position: Acquired entities may operate in rapidly evolving markets where their competitive advantage and market share are not yet solidified.

- Resource Allocation Dilemma: Significant investment may be required to nurture these question marks, balancing the potential rewards against the inherent risks.

- Strategic Integration Focus: Successful integration of new service areas is crucial for transforming question marks into stars or cash cows.

Question Marks represent business units or services with low market share in high-growth industries. ArcBest's international freight expansion and specialized logistics solutions for emerging sectors like advanced manufacturing are prime examples. These ventures require substantial investment to gain traction and compete effectively. Successfully nurturing these areas is key to future growth.

| Business Unit/Service | Industry Growth | Market Share | Investment Need | Potential |

| International Air & Ocean Freight | High | Low to Moderate | High | Star or Question Mark |

| Specialized Logistics (e.g., Advanced Manufacturing) | High | Low | High | Star or Question Mark |

| New Geographic Market Expansion | High | Low | High | Star or Question Mark |

| Acquired Tech Firms (e.g., Last-Mile Delivery) | High | Uncertain | High | Star or Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.