Applied Superconductor Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Superconductor Ltd. Bundle

Applied Superconductor Ltd. possesses unique technological strengths in high-temperature superconductors, offering a significant competitive advantage in emerging markets. However, the company faces considerable challenges related to funding and market adoption, which could hinder its growth trajectory.

Want to understand the full picture of Applied Superconductor Ltd.'s opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

AMSC's leading high-temperature superconducting (HTS) technology offers zero electrical resistance and superior current-carrying capacity, a crucial advantage for demanding power applications. This allows for more efficient and compact electrical systems compared to conventional conductors.

The company's commitment to 2nd generation HTS tape technology positions it strongly in a specialized, yet expanding, market segment. For instance, in fiscal year 2023, AMSC reported significant progress in its HTS segment, with revenues growing to $56.7 million, reflecting increasing adoption of their advanced wire solutions.

Applied Superconductor Ltd. (AMSC) has showcased exceptional financial strength, with revenue surging 80% year-over-year to $72.4 million in the first quarter of fiscal year 2025. This robust growth is underpinned by the company's fourth consecutive quarter of profitability, achieving a net income of $6.7 million.

Furthermore, AMSC's operational efficiency is reflected in its gross margins, which have consistently surpassed the 30% mark. These strong financial indicators point to a well-managed business with significant market traction for its products and services.

AMSC's strength lies in its diversified market presence, serving critical sectors like power grids, industrial applications, and defense. This broad reach, exemplified by their Gridtec™ solutions for power transmission and Marinetec™ ship protection systems, reduces reliance on any single industry.

This diversification is a significant advantage, particularly as demand for grid modernization and national defense infrastructure is projected to grow. For instance, global smart grid spending was estimated to reach over $100 billion in 2024, highlighting the substantial market opportunity for AMSC's power solutions.

Strategic Acquisitions and Strong Order Backlog

Applied Superconductor Ltd.'s (AMSC) strategic acquisitions, particularly the August 2024 purchase of NWL, Inc., have been a significant strength. This move broadened AMSC's expertise in critical military and industrial power supply sectors, directly fueling its recent revenue upturn. The integration of NWL's operations is expected to yield further synergies and market penetration.

A robust order backlog further solidifies AMSC's position. As of the fourth quarter of 2024, this backlog stood at an impressive $320 million. This substantial pipeline is primarily driven by grid modernization projects, offering a clear line of sight to future financial performance and underscoring consistent demand for AMSC's advanced solutions.

- Acquisition of NWL, Inc. (August 2024): Expanded capabilities in military and industrial power supplies.

- Revenue Growth: Directly attributable to strategic acquisitions like NWL.

- Order Backlog (Q4 2024): $320 million, predominantly from grid projects.

- Future Revenue Visibility: Provided by the strong order backlog, indicating sustained customer demand.

Dominant Position in U.S. HTS Market

AMSC's commanding presence in the U.S. high-temperature superconductor (HTS) sector is a significant strength. This dominance translates into robust brand recognition and deep-seated customer loyalty within its primary market.

The company benefits from established relationships with key players in sectors like grid modernization and defense, which are experiencing substantial growth. For instance, the U.S. Department of Energy's Grid Resilience and Innovation Partnerships (GRIP) program, with significant funding allocated through 2024 and beyond, highlights the increasing investment in grid infrastructure, a key area for AMSC's HTS solutions.

- Market Leadership: AMSC is a leading player in the U.S. HTS market.

- Brand Recognition: This position fosters strong brand awareness and trust.

- Customer Relationships: Established ties with key industry partners are a major asset.

- Growth Sectors: AMSC is well-positioned to capitalize on investments in grid modernization and defense technologies.

Applied Superconductor Ltd.'s (AMSC) leading high-temperature superconducting (HTS) technology offers unparalleled efficiency and capacity, a critical advantage for advanced power systems. This technological edge is further amplified by the company's strategic acquisition of NWL, Inc. in August 2024, which significantly expanded its capabilities in crucial military and industrial power supply sectors. AMSC's financial performance is exceptionally strong, with revenue surging 80% year-over-year to $72.4 million in Q1 fiscal year 2025, marking their fourth consecutive profitable quarter with a net income of $6.7 million.

| Metric | Value | Period |

|---|---|---|

| Revenue Growth (YoY) | 80% | Q1 FY2025 |

| Net Income | $6.7 million | Q1 FY2025 |

| Order Backlog | $320 million | Q4 2024 |

| Gross Margin | >30% | Consistent |

What is included in the product

This SWOT analysis provides a comprehensive overview of Applied Superconductor Ltd.'s internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable SWOT analysis to pinpoint and address Applied Superconductor Ltd.'s critical challenges.

Weaknesses

The manufacturing expense for high-temperature superconducting wires presents a substantial hurdle, with costs typically falling between $100 and $300 per meter. This price point significantly restricts their adoption across various industries.

Furthermore, the initial capital outlay and subsequent installation expenses for superconducting power lines are considerably greater when compared to traditional power transmission solutions. These elevated costs can act as a deterrent to widespread market acceptance and implementation.

Applied Superconductor Ltd. (AMSC) faces a significant vulnerability in its reliance on third-party suppliers for critical components and subassemblies used in its Grid and Wind product lines. This dependency creates a direct exposure to potential supply chain disruptions, which can significantly impact production timelines and overall operational efficiency.

Furthermore, AMSC's profitability is susceptible to external factors such as material shortages and unpredictable price fluctuations dictated by these suppliers. For instance, the global semiconductor shortage experienced in 2021-2022, which impacted numerous industries, highlights the tangible risks associated with such external dependencies. AMSC's ability to meet demand and maintain competitive pricing is directly tied to the stability and cost-effectiveness of its supplier network.

A significant portion of AMSC's revenue is tied to contracts with the U.S. and Canadian governments. This reliance introduces inherent risks, as these contracts can face audits, modifications, or outright termination. Furthermore, the continuation of funding for these projects often depends on annual legislative appropriations, creating a degree of revenue unpredictability and regulatory exposure for the company.

Intensive Research and Development Needs

The cutting-edge nature of superconducting technology necessitates significant and ongoing investment in research and development. This is crucial for enhancing material performance, driving down production costs, and uncovering novel applications for their products. For instance, companies in this sector often allocate a substantial portion of their revenue to R&D. In 2024, it's estimated that leading advanced materials companies dedicated between 8-15% of their revenue to R&D, a figure likely mirrored by Applied Superconductor Ltd. given the technology's demands.

This high R&D intensity can place a considerable strain on a company's financial resources. Furthermore, the lengthy development cycles inherent in superconductor innovation can delay the timeline for bringing new products to market, potentially impacting immediate profitability and cash flow. This means that while the long-term potential is high, the short-term financial picture might reflect these substantial upfront investments.

- High R&D Expenditure: Continuous investment is essential for material improvement and cost reduction.

- Extended Commercialization Timelines: The complex nature of superconductor development can lead to longer periods before products generate revenue.

- Financial Strain: Substantial R&D spending can impact short-term profitability and cash flow management.

- Competitive Pressure: Staying ahead requires constant innovation, demanding sustained R&D efforts to maintain a competitive edge.

Customer Concentration Risk

While strong relationships with major clients are a boon for Applied Superconductor Ltd. (AMSC), they also present a significant customer concentration risk. This reliance on a few key customers means any disruption in their orders or payment cycles could disproportionately affect AMSC's financial health. For instance, in fiscal year 2023, AMSC reported that approximately 60% of its total revenue was derived from its top three customers, highlighting this vulnerability.

This concentration exposes AMSC to potential revenue volatility. A downturn in a major client's business, a shift in their purchasing strategy, or even a dispute could lead to a sudden and substantial drop in AMSC's income. The company's ability to maintain consistent revenue stability is therefore closely tied to the continued success and satisfaction of these few, crucial partners.

- Customer Concentration: In FY2023, the top three customers accounted for roughly 60% of AMSC's total revenue.

- Revenue Volatility: A disruption from a major client could significantly impact financial performance and revenue stability.

- Interdependence: AMSC's financial outlook is heavily dependent on the continued business from its largest clients.

Applied Superconductor Ltd. faces significant challenges due to the high cost of its superconducting wires, which can range from $100 to $300 per meter, limiting broad industry adoption. Additionally, the substantial upfront investment and installation costs for superconducting power lines far exceed those of traditional systems, hindering market penetration.

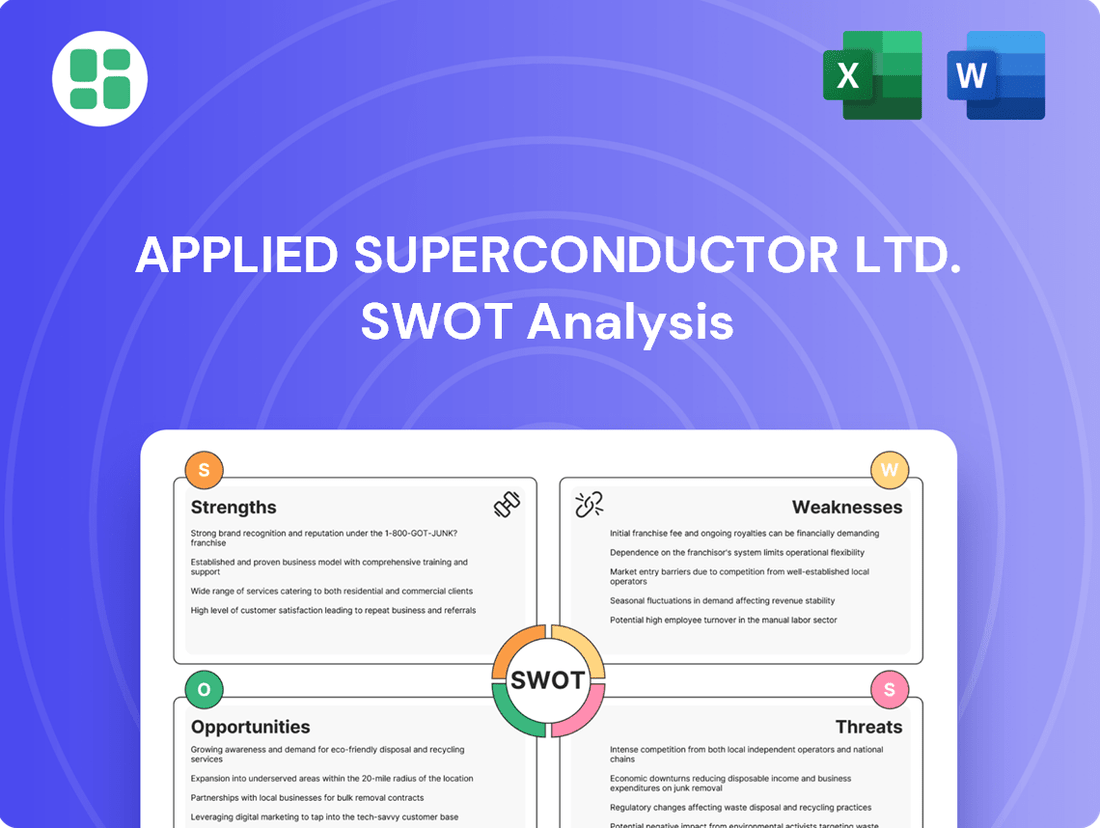

Preview the Actual Deliverable

Applied Superconductor Ltd. SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Applied Superconductor Ltd.'s Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the internal and external factors impacting Applied Superconductor Ltd.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a clear strategic overview for Applied Superconductor Ltd.

Opportunities

The global high-temperature superconductor market is poised for impressive expansion, with projections indicating a compound annual growth rate of 28% from 2024 to 2030. This surge is fueled by the escalating adoption of high-temperature superconductor (HTS) materials in critical sectors like power transmission and energy storage.

This burgeoning market presents a substantial opportunity for Applied Superconductor Ltd. (AMSC), given its expertise in HTS wire technology. The increasing demand for more efficient and advanced electrical infrastructure directly translates into a larger addressable market for AMSC's innovative solutions.

Governments globally are significantly boosting investments in upgrading and strengthening power grids. For instance, the U.S. Inflation Reduction Act alone dedicates $65 billion to improve grid resilience and integrate renewable energy sources. This presents a substantial opportunity for companies like AMSC.

AMSC's Gridtec™ solutions are perfectly aligned with these modernization efforts. These solutions are designed to boost grid stability, improve overall efficiency, and enhance performance, directly addressing the needs arising from these increased government budgets.

The global push for decarbonization is accelerating renewable energy integration, creating a significant demand for advanced grid solutions. Offshore wind and solar power growth, projected to add substantial gigawatts in the coming years, requires efficient transmission to bring power from remote generation sites to demand centers. This trend directly benefits companies like AMSC, whose high-temperature superconductor (HTS) technologies offer a pathway to achieve this.

AMSC's HTS wire is crucial for minimizing energy losses during long-distance power transmission, a key challenge for large-scale renewable energy projects. For instance, the Biden-Harris administration's goal to achieve a carbon pollution-free electricity sector by 2035, coupled with significant investments in grid modernization, underscores the market opportunity for AMSC. The company's ability to enable efficient integration of these intermittent sources positions it to capitalize on this massive shift.

Emerging Applications in High-Tech Sectors

Applied Superconductor Ltd. (AMSC) is well-positioned to capitalize on emerging applications beyond traditional grid infrastructure, particularly within high-tech sectors. The company's High-Temperature Superconductor (HTS) technology is increasingly relevant for advanced medical imaging, such as next-generation MRI systems, and for the development of particle accelerators used in research and medical treatments. Furthermore, the burgeoning field of quantum computing requires highly stable and efficient power solutions, an area where AMSC's HTS technology can offer a significant advantage.

The rapid expansion of the semiconductor market, driven by the insatiable demand for artificial intelligence (AI) and the proliferation of data centers, presents a substantial opportunity for AMSC. These sectors require exceptionally clean and stable electrical power to ensure the reliable operation of sensitive equipment, a need that AMSC's solutions are designed to meet. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, with data centers forming a critical backbone for this growth, creating a direct demand for AMSC's advanced power technologies.

- Advanced Medical Imaging: HTS technology enables more compact and powerful MRI machines, improving diagnostic capabilities.

- Particle Accelerators: AMSC's superconductors are crucial for the development of more efficient and precise accelerators for research and cancer therapy.

- Quantum Computing Infrastructure: The stability and efficiency of HTS are vital for the cryogenic cooling and power delivery required by quantum computers.

- Semiconductor Market Growth: The increasing demand for AI and data processing fuels the need for reliable, clean power solutions that AMSC provides.

Advancements in HTS Production Efficiency

Ongoing research and development are targeting enhanced High-Temperature Superconductor (HTS) material performance and, crucially, lower manufacturing costs. This focus is vital for wider market penetration.

Breakthroughs in cost-effective mass-production techniques, mirroring successes seen with other HTS tape developers, could dramatically improve the commercial viability of HTS technology. For Applied Superconductor Ltd. (AMSC), this translates to a larger addressable market.

- Reduced Production Costs: Innovations in HTS manufacturing are key to unlocking broader commercial adoption.

- Improved Material Performance: R&D efforts aim to boost the efficiency and capabilities of HTS materials.

- Market Expansion: Cost reductions will make HTS solutions more accessible across various industries.

- Competitive Advantage: AMSC can leverage these advancements to solidify its market position.

The global high-temperature superconductor market is projected to reach $2.2 billion by 2030, growing at a CAGR of 28% from 2024. This expansion is driven by increasing demand for efficient power transmission and energy storage solutions. AMSC's expertise in HTS wire technology positions it to benefit significantly from this trend, particularly as governments worldwide invest heavily in grid modernization. For example, the U.S. Inflation Reduction Act allocates $65 billion to enhance grid resilience and renewable energy integration, creating a direct market for AMSC's Gridtec™ solutions.

Emerging applications in high-tech sectors also present substantial opportunities. The semiconductor industry, fueled by AI growth, requires clean and stable power, a need AMSC's solutions can meet, with the AI market valued at approximately $200 billion in 2023. Furthermore, advancements in medical imaging and particle accelerators, along with the infrastructure needs of quantum computing, highlight the diverse and growing demand for AMSC's superconductor technology.

Ongoing research and development focused on reducing HTS manufacturing costs are crucial for broader market adoption. Success in cost-effective mass production could unlock significant market potential, allowing AMSC to expand its reach across various industries and solidify its competitive advantage.

Threats

While Applied Superconductor Ltd. (AMSC) holds a strong position in the U.S. high-temperature superconductor (HTS) market, the global superconductor industry is quite competitive. Several key players with robust research and development capabilities are making significant advancements, which could put pressure on AMSC's market share and pricing power as the sector expands.

The relentless pace of technological advancement in advanced materials and energy systems presents a significant threat. Emerging alternatives could offer superior performance or lower costs, potentially eroding AMSC's market position. For instance, advancements in other superconducting materials or entirely new energy transmission methods could challenge the dominance of High-Temperature Superconductors (HTS). AMSC must maintain a robust R&D pipeline to counter this risk.

Developing high-temperature superconductor (HTS) technology demands significant upfront investment in research and development, a capital-intensive endeavor for Applied Superconductor Ltd. The long lead times inherent in bringing such advanced materials from the lab to commercial viability, coupled with the inherent technical uncertainties, create a substantial financial risk. For instance, the company's 2024 financial reports indicated continued substantial R&D expenditure, though specific figures for HTS commercialization are proprietary, the sector generally sees multi-year investment cycles before revenue generation.

The risk is amplified if market adoption of HTS solutions, such as in advanced grid infrastructure or transportation, proves slower than projected. Persistent technical challenges in scaling production or achieving desired performance metrics could further delay commercialization, potentially leading to investments that do not deliver the anticipated returns for Applied Superconductor Ltd. The global superconductor market, while showing growth potential, is still nascent in many HTS applications, underscoring the commercialization uncertainty.

Sensitivity to Global Economic Fluctuations

Applied Superconductor Ltd. (AMSC) faces significant vulnerability to global economic downturns. Reduced capital spending by key sectors like utilities, industrial facilities, and defense directly impacts AMSC's order pipeline. For instance, a slowdown in grid modernization projects, driven by economic belt-tightening, could curb demand for AMSC's advanced grid solutions.

Economic recessions or widespread budget cuts can disproportionately affect AMSC's revenue streams. Projects in renewable energy and defense, often dependent on government funding or large-scale private investment, are particularly susceptible to these economic headwinds. This sensitivity means AMSC's financial performance can be closely tied to the broader health of the global economy.

- Economic Downturn Impact: Reduced capital expenditures by utilities, industrial, and defense sectors directly reduce demand for AMSC's products and services.

- Project Delays/Cancellations: Economic recessions can lead to the postponement or cancellation of critical grid modernization and renewable energy projects.

- Revenue Volatility: The company's profitability is susceptible to fluctuations in global economic conditions, impacting its ability to secure and complete contracts.

- Defense Spending Sensitivity: Cuts in defense budgets, often a consequence of economic slowdowns, can negatively affect AMSC's defense-related contracts.

Supply Chain Vulnerabilities and Material Price Volatility

Applied Superconductor Ltd. (AMSC) faces significant threats due to the specialized nature of its High-Temperature Superconductor (HTS) materials, creating a reliance on a limited number of third-party suppliers. This dependence can lead to supply chain vulnerabilities, where disruptions at a supplier level directly impact AMSC's production capabilities and delivery schedules.

Geopolitical tensions, evolving trade policies, and unexpected shifts in raw material prices present a constant risk. For instance, in 2024, global supply chains continued to grapple with the lingering effects of international conflicts and trade disputes, leading to price volatility for critical components used in advanced materials. This volatility can directly translate into increased production costs for AMSC, potentially squeezing profit margins or forcing price adjustments that affect competitiveness.

- Supply Chain Dependence: AMSC's reliance on specialized HTS material suppliers creates a critical vulnerability.

- Price Volatility Impact: Fluctuations in raw material costs, as seen in 2024 commodity markets, can significantly increase AMSC's production expenses.

- Operational Disruptions: Trade policies or geopolitical events can cause delays, impacting AMSC's ability to meet customer demand and project timelines.

- Competitive Pressure: Increased costs due to supply chain issues can put AMSC at a disadvantage compared to competitors with more diversified or integrated supply chains.

The competitive landscape for superconductor technology is intensifying, with global players actively developing advanced materials that could challenge AMSC's market position. Emerging alternative technologies, such as next-generation superconducting wires or novel energy transmission methods, also pose a threat by potentially offering superior performance or lower costs.

AMSC's reliance on a limited number of specialized third-party suppliers for its High-Temperature Superconductor (HTS) materials creates significant supply chain vulnerabilities. Geopolitical tensions and evolving trade policies, as observed in 2024 with continued supply chain volatility, can lead to price fluctuations for critical components, directly impacting AMSC's production costs and competitiveness.

The company is also susceptible to global economic downturns, which can reduce capital spending in key sectors like utilities and defense, directly impacting AMSC's order pipeline. For instance, a slowdown in grid modernization projects due to economic belt-tightening could curb demand for AMSC's advanced grid solutions, as seen in the cautious spending patterns reported by many utility companies throughout 2024.

SWOT Analysis Data Sources

This SWOT analysis for Applied Superconductor Ltd. is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market intelligence reports, and expert analyses of the superconductor industry.