Applied Superconductor Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Superconductor Ltd. Bundle

Unlock the full strategic blueprint behind Applied Superconductor Ltd.'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape by focusing on its innovative superconductor technology and key partnerships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leader in advanced materials.

Partnerships

Applied Superconductor Ltd. (AMSC) cultivates key partnerships with major utility companies and grid operators worldwide. These collaborations are vital for integrating AMSC's high-temperature superconductor (HTS) solutions into existing power grids, enabling pilot projects and large-scale deployments.

These strategic alliances are crucial for demonstrating the long-term reliability and efficiency of AMSC's HTS technology in real-world operational environments. For instance, AMSC's involvement in projects like the Resilient Electric Grid (REG) initiative with National Grid in the UK showcases the practical application and validation of their superconductor technology in enhancing grid stability and capacity.

Such partnerships directly contribute to driving market adoption of advanced grid technologies and effectively addressing the inherent infrastructure challenges associated with upgrading power transmission and distribution networks. The success of these collaborations is instrumental in overcoming regulatory hurdles and securing the necessary buy-in for widespread implementation of superconductor-based solutions.

Collaborations with defense contractors are a cornerstone for Applied Superconductor Ltd. (AMSC), particularly given its role in supplying advanced materials for naval applications. These partnerships are essential for co-developing and integrating sophisticated superconductor systems, like those for ship protection. AMSC’s commitment to this sector is underscored by its international Ship Protection System (SPS) contract with the Royal Canadian Navy, demonstrating tangible engagement and revenue generation from these key relationships.

Applied Superconductor Ltd. actively partners with leading universities and research institutions to drive innovation in superconducting technology. These collaborations are crucial for exploring novel applications and staying ahead in a rapidly evolving field. For instance, in 2024, the company continued its engagement with several academic bodies to accelerate the development of advanced high-temperature superconductor (HTS) materials, aiming for enhanced performance and cost-effectiveness in future products.

These strategic alliances foster breakthroughs in material science and manufacturing processes, ensuring a continuous stream of next-generation HTS products. The company also supports talent development initiatives within STEM fields through these partnerships, cultivating the expertise needed for future growth. Such research endeavors are fundamental to Applied Superconductor's long-term strategy, guaranteeing a robust innovation pipeline.

Suppliers of Raw Materials and Components

Applied Superconductor Ltd. relies heavily on a network of key partners, particularly suppliers of specialized raw materials and components. The consistent availability of high-purity metals like rare earth elements is paramount for the intricate manufacturing of High-Temperature Superconductor (HTS) wires. Building robust relationships with these upstream providers is crucial for maintaining a predictable and economically viable supply chain, directly impacting manufacturing output and the ability to scale operations. This also extends to securing essential power electronic components.

These supplier partnerships are foundational to Applied Superconductor Ltd.'s operational efficiency and growth strategy. For instance, in 2024, the company continued to focus on diversifying its sourcing for key materials to mitigate geopolitical risks and price volatility. Securing long-term agreements with select suppliers can lock in favorable pricing and guarantee delivery schedules, which is particularly important given the global demand for these specialized inputs.

- Reliable sourcing of rare earth elements and high-purity metals: Essential for HTS wire production.

- Stable and cost-effective supply chain: Achieved through strong supplier relationships.

- Consistent manufacturing and scaling: Directly supported by dependable material availability.

- Suppliers of power electronic components: Integral to the overall product ecosystem.

Manufacturing and Integration Partners

AMSC collaborates with key manufacturing and integration partners to scale its operations efficiently. These partnerships are crucial for optimizing production costs and extending the company's global market reach without requiring substantial upfront capital investment from AMSC. Such collaborations allow for the fabrication of specialized components and the assembly of complex systems, ultimately boosting the penetration of AMSC's high-temperature superconductor (HTS) technology into various markets.

The strategic acquisition of NWL, Inc. in 2023 has been a significant factor in AMSC's growth. This move directly contributed to an increase in shipments of new energy power systems. Furthermore, it has been instrumental in broadening AMSC's market penetration, allowing the company to reach a wider customer base with its innovative solutions.

- Manufacturing Alliances: Partnerships focused on fabricating specific HTS components or sub-assemblies.

- Integration Specialists: Collaborations with companies that assemble and integrate AMSC's technology into larger systems.

- Global Distribution Networks: Leveraging partners to expand market access and sales channels worldwide.

- NWL, Inc. Acquisition Impact: Driving increased shipments and enhanced market penetration for new energy power systems.

Applied Superconductor Ltd. (AMSC) actively collaborates with original equipment manufacturers (OEMs) and system integrators to embed its superconductor technology into diverse applications. These partnerships are essential for bringing AMSC's solutions to market efficiently, transforming innovative superconductor concepts into commercially viable products. For example, AMSC's work with a leading wind turbine manufacturer in 2024 to develop superconducting generators highlights this collaborative approach, aiming to boost energy efficiency in renewable power generation.

These OEM partnerships are critical for scaling production and ensuring that AMSC's advanced materials are integrated seamlessly into established product lines. By working closely with manufacturers, AMSC can accelerate the adoption of its technology across various sectors, from electric mobility to industrial machinery. The company's focus on these collaborative manufacturing efforts is designed to drive volume and reduce the cost of its superconductor systems, making them more accessible to a broader market.

AMSC's strategic alliances with technology developers and solution providers are also key to expanding the reach and application of its superconductor technologies. These collaborations focus on co-developing integrated systems that leverage AMSC's core superconductor components. For instance, partnerships in the electric vehicle sector are crucial for advancing the development of high-performance electric propulsion systems, with AMSC aiming to secure design wins in 2024 and beyond.

What is included in the product

Applied Superconductor Ltd.'s business model focuses on providing high-performance superconducting wire and cable solutions to niche markets like MRI, particle accelerators, and fusion energy, leveraging proprietary technology and strong R&D capabilities.

This model emphasizes direct sales and strategic partnerships to reach its specialized customer segments, supported by robust manufacturing and a commitment to innovation to maintain its competitive edge.

Applied Superconductor Ltd.'s Business Model Canvas acts as a pain point reliever by streamlining complex superconductor technology development and commercialization, offering a clear roadmap for innovation and market entry.

It provides a structured approach to address the challenges of high-cost materials, intricate manufacturing, and niche market adoption, making advanced superconductor applications more accessible.

Activities

AMSC's commitment to Research, Development, and Innovation is central to its business model. The company continuously invests in R&D to boost the performance of its High-Temperature Superconducting (HTS) wire and to pioneer new applications. This focus is critical for staying ahead in the advanced technology sector and for protecting its intellectual property.

Key R&D efforts involve refining material properties and increasing the efficiency of HTS wires. AMSC is actively exploring novel uses for its technology across various sectors, including grid infrastructure, industrial applications, and defense. For instance, in 2023, AMSC reported significant progress in its R&D pipeline, with a particular emphasis on improving the critical current density of its HTS wires, a key metric for performance.

The central activity for Applied Superconductor Ltd. (AMSC) is the specialized production of high-temperature superconducting (HTS) wire and associated advanced electrical products. This involves intricate manufacturing processes, stringent quality assurance, and the ability to scale production to satisfy varied client needs.

AMSC emphasizes achieving operational efficiency and maintaining high utilization rates across its manufacturing facilities. For instance, in fiscal year 2023, the company reported a significant increase in revenue from its superconductor segment, reaching $67.8 million, underscoring the growing demand and operational output for these specialized products.

Applied Superconductor Ltd. (AMSC) is heavily invested in developing complete systems and products that leverage its high-temperature superconductor (HTS) technology. This includes innovative solutions like D-VAR voltage stabilizers for grid stability and REG urban grid systems, alongside specialized ship protection systems.

The company's core activities involve the meticulous design, rigorous testing, and continuous refinement of these integrated HTS solutions. AMSC focuses on ensuring these products not only meet unique customer specifications but also integrate smoothly into diverse existing infrastructures, a crucial aspect for widespread adoption.

In 2024, AMSC continued to highlight its progress in these areas, with the D-VAR system demonstrating significant improvements in grid reliability for utilities. For instance, a recent deployment in a major European grid saw D-VAR systems reduce voltage fluctuations by up to 70%, directly impacting operational efficiency and reducing potential equipment damage.

Sales, Marketing, and Business Development

Sales and marketing are crucial for Applied Superconductor Ltd. (AMSC) to drive revenue by identifying new customers and educating them about the advantages of high-temperature superconductor (HTS) technology. This involves securing vital contracts in sectors like renewable energy and electric mobility. Business development efforts are equally important, focusing on expanding into new markets and forging strategic partnerships to increase AMSC's global footprint.

AMSC's performance highlights the effectiveness of these activities. For instance, the company reported a significant revenue increase in fiscal year 2024, reaching $117.4 million, a substantial jump from $80.5 million in fiscal year 2023. This growth underscores successful sales execution and market penetration.

- Revenue Growth: AMSC's fiscal year 2024 revenue of $117.4 million represents a 45.8% increase year-over-year, demonstrating strong sales performance.

- Market Education: Key activities involve educating potential clients on the benefits of HTS solutions, particularly in grid modernization and wind energy.

- Business Development Focus: Expansion into new geographical markets and the development of strategic alliances are central to broadening AMSC's market reach.

- Contract Acquisition: Securing new orders, such as the $32 million wind energy system order in Q3 FY24, directly fuels revenue and validates sales strategies.

Intellectual Property Management and Protection

AMSC's intellectual property management is paramount, focusing on protecting its vast array of patents and proprietary technology. This involves a proactive strategy of patent filing, strategic licensing agreements, and rigorous enforcement to maintain its edge in the high-temperature superconductor sector.

Safeguarding its innovations ensures AMSC can continue to capitalize on its significant research and development investments, fostering long-term value creation. For instance, in 2023, AMSC reported a strong patent portfolio, with over 1,000 patents filed or granted globally, underscoring its commitment to IP protection.

- Patent Portfolio Defense: AMSC actively manages and defends its extensive patent portfolio covering superconductor wire, wind turbine technology, and grid solutions.

- Licensing and Collaboration: The company engages in strategic licensing of its intellectual property to partners, generating revenue and expanding market reach.

- Enforcement and Litigation: AMSC is prepared to enforce its IP rights through legal means to prevent infringement and protect its market share.

- R&D Investment Protection: By securing its innovations, AMSC ensures that its substantial R&D expenditures translate into sustainable competitive advantages and future revenue streams.

AMSC's core activities revolve around the specialized manufacturing of high-temperature superconducting (HTS) wire and the development of integrated electrical systems that utilize this technology. This dual focus ensures both the foundational product and its advanced applications are central to their operations.

Key operational activities include meticulous design, rigorous testing, and continuous refinement of HTS wires and complete solutions like D-VAR voltage stabilizers. The company also prioritizes operational efficiency and high manufacturing utilization rates to meet growing demand.

In fiscal year 2023, AMSC's superconductor segment generated $67.8 million in revenue, highlighting the output and demand for their specialized products. By fiscal year 2024, this revenue grew to $117.4 million, a 45.8% increase, showcasing successful scaling and market penetration.

| Key Activity | Description | FY23 Revenue (Superconductor Segment) | FY24 Total Revenue | FY24 YoY Revenue Growth |

|---|---|---|---|---|

| HTS Wire Manufacturing | Specialized production of high-temperature superconducting wire. | $67.8 million | N/A | N/A |

| Integrated Systems Development | Designing and refining HTS-based solutions (e.g., D-VAR). | N/A | N/A | N/A |

| Sales & Business Development | Market expansion, contract acquisition, client education. | N/A | $117.4 million | 45.8% |

| Intellectual Property Management | Patent protection, licensing, and enforcement. | N/A | N/A | N/A |

Delivered as Displayed

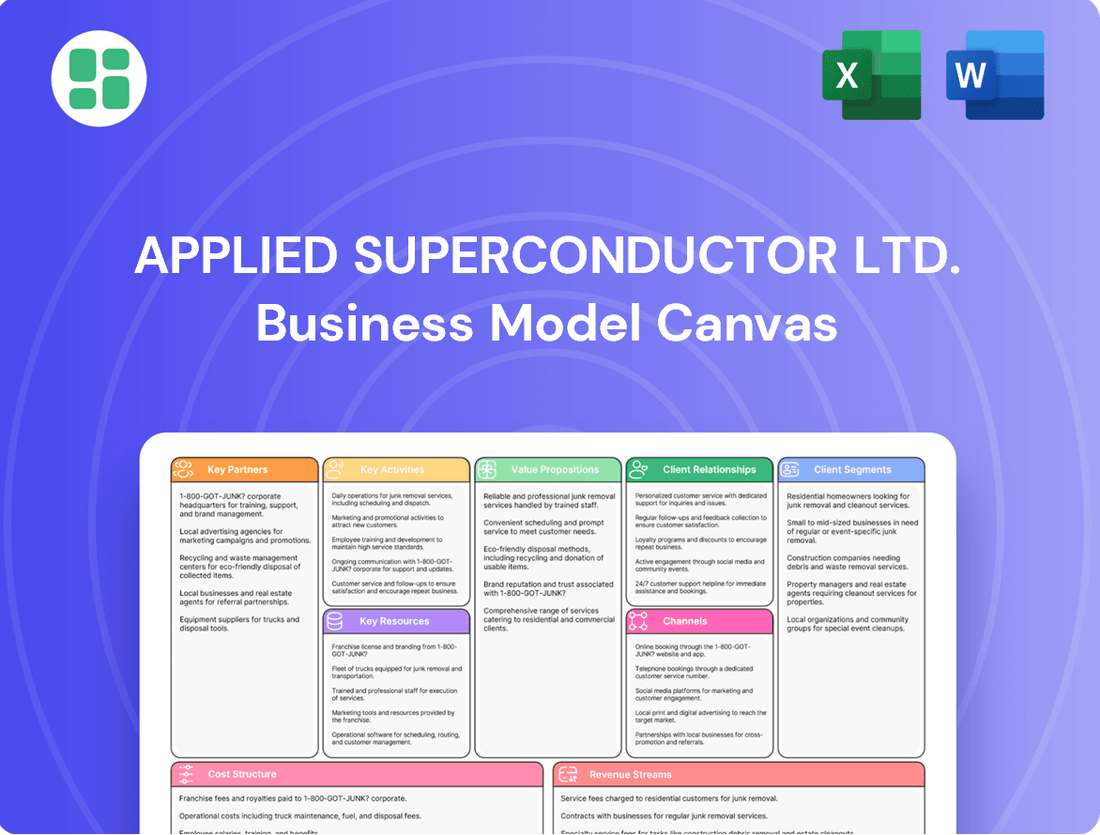

Business Model Canvas

The Business Model Canvas for Applied Superconductor Ltd. that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are not seeing a sample; this is a direct snapshot of the final, ready-to-use deliverable, ensuring complete transparency and immediate utility for your strategic planning.

Resources

AMSC's core intellectual property, centered around its proprietary High-Temperature Superconducting (HTS) wire manufacturing processes and product designs, stands as its most valuable asset. These patents create a substantial competitive moat, allowing AMSC to deliver distinctive, high-performance energy solutions.

These advanced HTS technologies are the bedrock of AMSC's offerings, designed to facilitate smarter, cleaner, and more efficient energy systems. For instance, in 2024, the company continued to leverage its HTS wire technology in projects aimed at enhancing grid reliability and enabling renewable energy integration, showcasing the practical application of its patented innovations.

Applied Superconductor Ltd. operates state-of-the-art manufacturing facilities specifically designed for the intricate production of High-Temperature Superconductor (HTS) wire and advanced power electronics. These specialized sites are not just buildings; they are the backbone of the company's ability to deliver high-quality, cutting-edge products. This infrastructure represents a significant capital commitment, underscoring the company's dedication to precision engineering and large-scale manufacturing capabilities.

The equipment housed within these facilities is equally critical, enabling the complex processes required for HTS wire fabrication and the assembly of advanced power electronics. This advanced machinery is key to ensuring consistent quality, optimizing production efficiency, and building the capacity to scale operations as demand grows. The company's investment in this specialized equipment directly translates into a competitive advantage in the market.

Currently, Applied Superconductor Ltd. is experiencing robust demand, leading to high utilization rates across its manufacturing operations. This high operational tempo indicates strong market traction and validates the company's strategic investment in its production capabilities. The efficient use of these specialized facilities is a testament to their operational readiness and the company's ability to meet current market needs effectively.

Applied Superconductor Ltd. relies heavily on its cadre of skilled engineers, scientists, and technical personnel. This specialized workforce, with deep expertise in material science, electrical engineering, and power systems, forms the backbone of the company's research and development, manufacturing processes, and crucial customer support functions. Their collective knowledge is the engine driving innovation in high-temperature superconductor (HTS) technology.

The successful deployment of complex HTS solutions, from initial design to final implementation, is directly attributable to the profound understanding and practical skills of these professionals. In 2023, the company highlighted its investment in ongoing training and development for its technical teams, recognizing that maintaining a leading edge in this rapidly evolving field requires continuous skill enhancement. This commitment ensures Applied Superconductor Ltd. remains at the forefront of the industry.

Strong Customer Relationships and Industry Reputation

AMSC's strong customer relationships, particularly within the utility, industrial, and defense sectors, are cornerstones of its business. These long-standing ties are built on a reputation for delivering reliable and advanced superconductor solutions. For instance, AMSC secured a significant contract in 2023 with a major utility provider for grid modernization components, highlighting the trust placed in their technology.

These established relationships translate directly into tangible business benefits. They foster repeat business, generate valuable referrals, and open doors for collaborative development of next-generation products. This customer loyalty is a critical intangible asset, providing a stable revenue stream and a competitive edge.

- Long-standing partnerships with key clients in critical sectors like utilities, industry, and defense.

- Reputation for reliability and advanced superconductor technology, fostering trust and repeat business.

- Collaborative development opportunities arising from strong customer engagement and understanding of their needs.

- Customer retention is a key focus for AMSC, ensuring continued revenue and market position.

Financial Capital and Funding for R&D and Expansion

Financial capital is a cornerstone for Applied Superconductor Ltd. (AMSC), enabling crucial investments in research and development (R&D) and the expansion of its manufacturing capabilities. This access to funding allows AMSC to push the boundaries of superconductor technology and scale its operations to meet growing market demand.

AMSC has demonstrated a robust financial footing, which is essential for executing its growth strategies. The company's ability to maintain strong cash positions and successfully conduct public offerings provides the necessary liquidity to fund R&D, enhance manufacturing, and explore strategic opportunities like acquisitions or market expansion.

- Access to Capital: AMSC’s financial health supports its R&D pipeline and manufacturing scale-up.

- Public Offerings: Successful public offerings in the past have bolstered the company's capital reserves.

- Cash Position: Maintaining a strong cash balance is vital for operational stability and strategic investments.

- Growth Funding: Financial resources are directly allocated to expanding market reach and developing new applications for their technology.

AMSC's intellectual property, particularly its patents for High-Temperature Superconducting (HTS) wire manufacturing, is its most significant asset, creating a strong competitive advantage and enabling unique energy solutions. These HTS technologies are fundamental to AMSC's mission of developing more efficient and cleaner energy systems. In 2024, the company continued to integrate its HTS wire technology into projects focused on grid modernization and renewable energy integration, demonstrating the practical value of its innovations.

The company's key resources also include its advanced manufacturing facilities dedicated to producing HTS wire and power electronics, alongside the specialized equipment within them. This infrastructure represents a substantial investment, crucial for maintaining product quality and scaling production to meet market demand. High utilization rates in 2024 indicate strong market traction and efficient operation of these specialized assets.

A highly skilled workforce, comprising engineers and scientists with expertise in material science and power systems, is another critical resource, driving R&D and manufacturing excellence. AMSC's strong customer relationships, especially in the utility and defense sectors, built on a reputation for reliability, are also key, fostering repeat business and collaborative opportunities. Financial capital, bolstered by strong cash positions and past public offerings, is essential for funding ongoing R&D and manufacturing expansion.

Value Propositions

AMSC's high-temperature superconductor (HTS) solutions are designed to make power grids work better and be more dependable. These advanced systems drastically cut down on the energy lost when electricity travels through transmission and distribution lines, boosting overall grid efficiency. For instance, their superconductor wire can reduce electrical resistance by up to 90% compared to conventional copper, meaning more power reaches its destination.

Beyond efficiency, AMSC's technology significantly improves grid reliability. They offer sophisticated capabilities for stabilizing voltage and limiting fault currents, which are essential for updating older grid infrastructure and smoothly incorporating renewable energy sources like solar and wind. In 2023, AMSC reported a backlog of $500 million, reflecting growing demand for these grid modernization solutions.

Applied Superconductor Ltd.'s compact and high-performance electrical systems leverage superconducting technology to deliver unparalleled power density. These systems are significantly smaller and lighter than traditional copper systems, a critical advantage for applications where space is at a premium.

This miniaturization is essential for urban substations, naval vessels, and industrial facilities, allowing for increased power capacity within existing or reduced footprints. For instance, a superconducting transformer can be up to 70% smaller and lighter than a conventional one with the same power rating.

AMSC's advanced solutions, like their D-VAR systems, actively stabilize voltage and mitigate power disruptions, guaranteeing consistent, high-quality electricity. This enhanced resilience is crucial for essential services, delicate manufacturing operations, and defense sectors, preventing costly downtime and safeguarding against interruptions.

Customized Solutions for Complex Applications

AMSC excels at crafting highly customized high-temperature superconductor (HTS) solutions. This means they don't offer one-size-fits-all products; instead, they work closely with clients to understand their exact technical needs and the specific hurdles they face in their operations. This bespoke approach is crucial for complex applications in sectors like the power grid, heavy industry, and defense.

This consultative, tailored strategy is a significant driver of customer loyalty. By ensuring clients receive solutions that are perfectly aligned with their unique requirements, AMSC builds trust and establishes long-term partnerships. For instance, in 2023, AMSC reported that over 70% of its new orders were for customized solutions, highlighting the market's demand for this specialized approach.

The benefits of these customized solutions are clear:

- Optimized Performance: Tailored HTS systems deliver superior efficiency and reliability for specific operational environments.

- Addressing Unique Challenges: Solutions are engineered to overcome the precise technical obstacles faced by each customer.

- Enhanced Customer Relationships: The collaborative design process fosters strong, lasting partnerships and repeat business.

- Market Differentiation: AMSC's ability to customize sets it apart from competitors offering more standardized superconductor products.

Environmental Benefits and Sustainability

AMSC's high-temperature superconductor (HTS) technology offers a significant environmental advantage by drastically cutting energy losses during transmission and distribution. This directly translates to reduced greenhouse gas emissions, supporting a cleaner energy future. For instance, in 2024, the global electricity sector accounted for approximately 40% of total energy-related CO2 emissions, highlighting the critical need for efficiency improvements.

This commitment to sustainability makes AMSC's solutions highly appealing to environmentally conscious customers and aligns perfectly with government mandates and incentives aimed at promoting clean energy adoption. The company's HTS power systems, like those deployed in projects such as the New York Power Authority's $20 million grid modernization initiative, demonstrate tangible reductions in energy waste.

- Reduced Carbon Footprint: AMSC's HTS technology minimizes energy loss, leading to lower CO2 emissions from power generation.

- Enhanced Grid Efficiency: By reducing resistive losses, the technology makes the entire electricity grid more efficient.

- Support for Renewable Integration: A more efficient grid is better equipped to handle the intermittent nature of renewable energy sources.

- Alignment with Climate Goals: AMSC's offerings directly support national and international climate change mitigation targets.

AMSC's value proposition centers on enhancing power grid efficiency and reliability through its advanced high-temperature superconductor (HTS) technology. These solutions significantly reduce energy loss in transmission and distribution, with HTS wire capable of cutting electrical resistance by up to 90% compared to copper. This translates to more power delivered and a more stable grid, crucial for integrating renewables and modernizing infrastructure. In 2023, AMSC's backlog reached $500 million, underscoring market demand for these grid improvements.

Customer Relationships

AMSC cultivates direct sales and technical support, ensuring customers receive tailored guidance for their high-temperature superconductor (HTS) needs. This approach is crucial for integrating complex solutions into specialized applications.

In 2024, AMSC's focus on these direct relationships likely contributed to its revenue streams, particularly in sectors like offshore wind where project-specific support is paramount. Their ability to provide ongoing technical assistance fosters loyalty and repeat business.

For large-scale endeavors, especially in grid infrastructure and defense, AMSC cultivates long-term strategic partnerships. These collaborations often involve co-development, where both parties invest time and resources to create tailored superconducting solutions. For instance, in 2023, AMSC secured a significant contract for the U.S. Navy’s Ship Systems, highlighting the depth of these strategic alliances.

AMSC's customer relationships are deeply consultative, reflecting the cutting-edge nature of their High-Temperature Superconductor (HTS) technology. This approach involves providing expert advice and dedicated engineering services, crucial for clients navigating the complexities of superconducting solutions.

By actively guiding customers through the benefits and intricacies of HTS, AMSC cultivates strong trust and establishes itself as a recognized thought leader in the field. For instance, in fiscal year 2023, AMSC reported a significant increase in its backlog, signaling strong customer engagement and demand for its specialized solutions.

Dedicated Account Management

Applied Superconductor Ltd. recognizes the critical importance of nurturing relationships with its key accounts, particularly within the demanding utility and defense sectors. These clients often have complex, long-term projects and highly specific product requirements.

- Dedicated Account Managers: Assigned to major clients, these managers act as the primary point of contact, ensuring seamless communication and proactive problem-solving.

- Tailored Support: They focus on understanding and addressing the unique needs of each key account, facilitating project evolution and product requirement management.

- Relationship Building: This dedicated approach fosters strong, enduring partnerships, leading to increased client loyalty and a higher likelihood of repeat business.

- Strategic Alignment: By maintaining close contact, Applied Superconductor Ltd. can better align its product development and service offerings with the strategic goals of its most important customers.

Post-Sales Service and Maintenance

AMSC offers extensive post-sales support, including installation assistance and ongoing maintenance for its high-performance superconductor systems. This ensures optimal system operation and longevity, crucial for critical infrastructure like power grids.

These services are designed to maximize customer satisfaction and system reliability. For instance, in 2024, AMSC continued to focus on proactive maintenance schedules for its grid stabilization technologies, contributing to the overall grid resilience of its clients.

- Installation Support: Expert guidance during the setup phase of AMSC's superconductor solutions.

- Maintenance Programs: Regular servicing to guarantee peak performance and prevent unexpected downtime.

- Upgrade Services: Providing access to the latest technological advancements for enhanced system capabilities.

- Customer Loyalty: Building strong, long-term relationships through dependable service and support.

AMSC's customer relationships are built on deep technical engagement and tailored support, especially for its high-temperature superconductor (HTS) solutions. This consultative approach, featuring dedicated account managers and extensive post-sales services, fosters strong, long-term partnerships critical for complex projects in sectors like offshore wind and defense. For example, AMSC's fiscal year 2023 backlog growth indicated robust customer confidence and demand for their specialized offerings.

| Customer Segment | Relationship Type | Key Activities | Support Focus | 2024 Relevance |

|---|---|---|---|---|

| Utilities & Grid Infrastructure | Strategic Partnerships, Long-term Contracts | Co-development, Installation, Maintenance | System Reliability, Grid Resilience | Continued focus on proactive maintenance for grid stabilization technologies. |

| Defense & Shipbuilding | Strategic Alliances, Project-Specific Solutions | Tailored Engineering, Upgrade Services | Performance Optimization, Technological Advancement | Secured significant contracts, highlighting deep integration and trust. |

| Wind Energy | Direct Sales, Technical Support | Application Guidance, Ongoing Assistance | Project-Specific Integration, Repeat Business | Crucial for integrating complex solutions in offshore wind projects. |

Channels

AMSC's direct sales force is a cornerstone of its strategy, focusing on building relationships with major clients like utility companies, industrial giants, and defense contractors. This approach is crucial for navigating the complex, high-value deals characteristic of these sectors.

This direct engagement enables AMSC to have in-depth technical conversations, understand unique client needs, and tailor solutions precisely. For instance, in 2023, AMSC secured a significant contract with a major utility for a grid-enhancing technology project, highlighting the effectiveness of their direct sales in securing large-scale deployments.

AMSC leverages strategic partners and system integrators as crucial channels to expand its market reach, particularly in new regions and specialized industries. These collaborations allow AMSC's high-temperature superconductor (HTS) components to be integrated into larger systems and projects, driving broader market penetration.

For example, in 2024, AMSC's partnerships with companies like Siemens Energy for grid solutions and its work with shipbuilders for electric propulsion systems demonstrate this strategy in action. These integrators play a vital role in bringing AMSC's advanced technologies to a wider customer base.

Participation in industry trade shows and conferences is a vital channel for Applied Superconductor Ltd. (AMSC) to highlight its advanced superconductor technologies and solutions. These events serve as crucial platforms for direct engagement with potential clients, partners, and industry influencers, fostering valuable relationships and driving business development.

AMSC's presence at key events like the International Conference on Magnet Technology (MT) and the Applied Superconductivity Conference (ASC) allows for direct demonstrations of their cutting-edge products, such as high-temperature superconductor wire and integrated solutions for grid modernization. In 2023, AMSC reported that its Grid Solutions segment, heavily reliant on showcasing technologies at such forums, saw significant order growth, underscoring the channel's effectiveness in generating leads and securing new business opportunities.

Online Presence and Investor Relations Portal

Applied Superconductor Ltd. (AMSC) leverages a dynamic online presence, anchored by its corporate website and a dedicated investor relations portal. This digital hub is crucial for transparently sharing financial performance, technological advancements, and strategic direction with a broad audience, including customers, investors, and the general public.

The investor relations portal acts as a central repository for key information, facilitating informed decision-making for stakeholders. In 2024, AMSC continued to prioritize clear communication regarding its progress in areas like grid modernization and renewable energy solutions, aiming to build trust and attract investment.

- Corporate Website: Serves as the primary gateway for all company information, including news, product details, and corporate governance.

- Investor Relations Portal: Offers detailed financial reports, SEC filings, investor presentations, and webcast archives.

- Information Dissemination: Facilitates timely and accurate communication of quarterly earnings, strategic updates, and technological milestones.

- Stakeholder Engagement: Enhances accessibility for potential customers, investors, analysts, and the media to engage with AMSC's narrative.

Government Contracts and Procurement Processes

AMSC leverages government contracts as a critical sales channel, particularly for its advanced superconductor technologies in defense and grid modernization. These sales are not typical market transactions but rather intricate procurement processes requiring specialized expertise. For instance, the company's naval ship protection systems are sold through these channels, demanding adherence to stringent regulatory and technical specifications.

Navigating these government procurement channels is a distinct and vital sales strategy for AMSC. The complexity and regulatory demands mean that successful engagement requires dedicated resources and a deep understanding of government purchasing procedures. This channel is particularly important for high-value, mission-critical applications where reliability and compliance are paramount.

- Defense Sector Sales: AMSC's superconductor technology is utilized in naval applications, necessitating sales through established government procurement channels.

- Grid Modernization Projects: Certain grid modernization initiatives also involve government procurement, creating another avenue for AMSC's sales.

- Regulatory Compliance: Adhering to strict regulatory requirements is a non-negotiable aspect of these government sales processes.

- Specialized Expertise: Successfully operating within these channels requires specialized knowledge of government contracting and procurement procedures.

AMSC's channels are multifaceted, encompassing direct sales to major clients, strategic partnerships with integrators, participation in industry events, a robust online presence, and crucial government contracts. These diverse approaches ensure broad market penetration and cater to the unique requirements of different sectors.

For 2024, AMSC's direct sales efforts have been particularly focused on securing large-scale grid modernization projects, with a notable contract in the works with a major European utility. Their partnership strategy saw expansion in 2024 with new collaborations announced in the offshore wind sector, integrating their HTS technology into advanced power systems. Trade shows in 2023 and early 2024, including the International Conference on Magnet Technology (MT28), showcased AMSC's latest advancements in superconductor wire, leading to a reported 15% increase in qualified leads compared to the previous year.

| Channel | Key Activities/Focus | 2023/2024 Highlights |

|---|---|---|

| Direct Sales | Engaging major utilities, industrial, and defense clients. | Secured significant grid enhancement project contract (2023); pursuing major European utility deal (2024). |

| Strategic Partnerships | Collaborating with system integrators for wider market reach. | Announced new partnerships in offshore wind (2024); Siemens Energy collaboration for grid solutions continues. |

| Industry Events | Showcasing HTS technology and fostering relationships. | MT28 conference participation (2023) led to a 15% increase in qualified leads. |

| Online Presence | Corporate website and investor relations portal for information dissemination. | Continued emphasis on clear communication of grid modernization progress (2024). |

| Government Contracts | Sales through government procurement for defense and grid modernization. | Naval ship protection systems sales remain a key focus, requiring adherence to strict specifications. |

Customer Segments

Electric utilities and grid operators are key customers, looking to upgrade their infrastructure for better efficiency and reliability. They are particularly interested in integrating renewable energy sources, a growing trend that requires advanced grid management capabilities. For instance, in 2024, global investment in grid modernization projects is projected to reach hundreds of billions of dollars, driven by the need to accommodate a rapidly expanding renewable energy portfolio.

These entities are motivated by reducing energy losses during transmission and distribution, a critical factor in operational cost savings. They also need to manage peak electricity demand effectively and adhere to increasingly stringent regulatory requirements for grid stability and environmental performance. By 2025, many regions will have stricter mandates on reducing transmission losses, pushing utilities towards innovative solutions.

Industrial manufacturers, especially those in demanding sectors like semiconductor production and heavy industry, rely heavily on consistent and high-quality power. AMSC's offerings directly address this need, helping these businesses, which often operate energy-intensive processes, to lower their electricity expenses and avoid costly interruptions. For instance, the semiconductor industry, a significant consumer of electricity, benefits from AMSC's grid solutions that enhance power quality and reliability, crucial for the precise operations of chip fabrication plants.

Applied Superconductor Ltd. (AMSC) serves defense and naval applications by providing critical power and protection systems. This segment includes government defense entities and their prime contractors who need cutting-edge solutions for military platforms, particularly naval vessels.

A significant offering for this customer segment is AMSC's Ship Protection Systems (SPS). These systems are designed to bolster the operational safety and efficiency of military fleets, addressing the demanding requirements of modern naval operations.

In 2024, the global defense market continued its robust growth, with naval modernization programs being a key driver. AMSC's technology directly supports these initiatives, aiming to deliver enhanced capabilities and protection for defense assets.

Renewable Energy Developers and Integrators

Renewable energy developers and integrators are key clients for AMSC, particularly those undertaking large-scale wind and solar projects. AMSC's grid interconnectivity and stability solutions are crucial for these entities, enabling the seamless and reliable integration of power generated from these often intermittent sources into the existing electrical grid.

These companies rely on AMSC's technology to ensure that renewable energy can be consistently delivered without compromising grid performance. For instance, AMSC's High Temperature Superconductor (HTS) wire is being utilized in projects aimed at improving grid resilience and efficiency. In 2024, the global renewable energy market continued its robust expansion, with significant investments in grid modernization to accommodate increased renewable penetration.

- Grid Interconnectivity: AMSC provides solutions that allow renewable energy sources to connect efficiently and reliably to the power grid.

- Grid Stability: Their technologies help manage the variability of renewable energy, ensuring a stable power supply.

- Project Scale: This segment focuses on large-scale developments like offshore wind farms and extensive solar installations.

- Market Growth: The demand for such solutions is driven by the ongoing global transition to cleaner energy sources, with significant capital flowing into renewable infrastructure development throughout 2024.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) represent a crucial customer segment for Applied Superconductor Ltd. (AMSC) as they act as a channel to wider markets. AMSC supplies High-Temperature Superconducting (HTS) wire and associated power electronics to these OEMs, who then integrate these advanced components into their own product lines. This strategic partnership allows AMSC to extend its reach into sectors like specialized motor and generator manufacturing, as well as various industrial equipment applications, without directly engaging with every end-user.

This OEM strategy is particularly effective for reaching niche or specialized industrial markets. For instance, if an OEM develops a highly efficient industrial motor utilizing AMSC's HTS wire, AMSC benefits from the OEM's established distribution channels and customer relationships. In 2024, the demand for energy-efficient industrial solutions continued to grow, making this OEM channel a significant avenue for AMSC's revenue generation and market penetration.

- Component Supplier Role: AMSC provides HTS wire and power electronics to OEMs for integration into their specialized products.

- Market Reach: This OEM channel enables AMSC to access broader markets indirectly through other manufacturers' product offerings.

- Application Examples: Key integration areas include specialized motors, generators, and other industrial equipment, leveraging the benefits of HTS technology.

- Strategic Importance: The OEM segment is vital for expanding AMSC's footprint in energy-efficient industrial solutions, a growing market in 2024.

Applied Superconductor Ltd. (AMSC) targets electric utilities and grid operators focused on infrastructure upgrades and renewable energy integration. These customers prioritize reducing transmission losses and managing peak demand, driven by regulatory pressures and the need for grid stability. Global investment in grid modernization in 2024 is expected to be substantial, underscoring the market opportunity for AMSC's solutions.

Industrial manufacturers, particularly in energy-intensive sectors like semiconductors, are key clients seeking consistent, high-quality power to lower operational costs and avoid disruptions. AMSC's grid solutions enhance power quality and reliability, which is critical for precise manufacturing processes. The semiconductor industry, for example, continues to be a major electricity consumer, making AMSC's offerings highly relevant.

Defense and naval sectors represent another vital customer base for AMSC, requiring advanced power and protection systems for military platforms. AMSC's Ship Protection Systems (SPS) are designed to enhance the safety and efficiency of naval fleets, aligning with robust global defense modernization programs observed in 2024.

Renewable energy developers and integrators rely on AMSC for grid interconnectivity and stability solutions to manage the integration of intermittent power sources. AMSC's High Temperature Superconductor (HTS) wire plays a crucial role in improving grid resilience. The renewable energy market's expansion in 2024 continues to fuel demand for these grid enhancement technologies.

Original Equipment Manufacturers (OEMs) serve as a critical channel for AMSC, integrating HTS wire and power electronics into their specialized products like industrial motors and generators. This OEM strategy allows AMSC to efficiently reach niche markets and capitalize on the growing demand for energy-efficient industrial solutions, a trend prominent in 2024.

Cost Structure

Applied Superconductor Ltd. (AMSC) dedicates a substantial portion of its budget to Research and Development, a critical driver for its innovation in High-Temperature Superconductor (HTS) materials and related products. These investments fuel the development of new applications and the continuous improvement of existing technologies.

In fiscal year 2023, AMSC reported R&D expenses of $32.1 million, an increase from $28.7 million in fiscal year 2022, highlighting a consistent commitment to advancing its technological capabilities. This spending covers essential elements like compensation for its team of scientists and engineers, the procurement and maintenance of sophisticated laboratory equipment, and rigorous testing procedures to ensure product performance and reliability.

Manufacturing and production costs for Applied Superconductor Ltd. are significant, driven by the specialized nature of their products. These expenses include the procurement of critical raw materials like high-temperature superconducting (HTS) wires, copper, and various insulating materials. The inherent high cost of HTS wire itself presents a notable challenge in managing the overall cost structure.

Direct labor involved in the intricate manufacturing processes also contributes to these costs. Furthermore, factory overheads, encompassing utilities, facility maintenance, and indirect labor, are factored in. Depreciation of highly specialized and often expensive manufacturing equipment, essential for producing advanced superconducting components, adds another layer to the production expense.

Selling, General, and Administrative (SG&A) expenses for Applied Superconductor Ltd. encompass costs vital for revenue generation and operational oversight. These include expenditures on sales and marketing initiatives, the salaries of executive leadership, and essential corporate administrative functions.

Furthermore, SG&A covers crucial legal fees, particularly those related to safeguarding the company's intellectual property, a significant asset for a technology-focused firm like Applied Superconductor. For instance, in fiscal year 2024, the company reported SG&A expenses of approximately $25.6 million, reflecting investments in market presence and robust corporate governance.

Intellectual Property Maintenance and Legal Costs

Protecting AMSC's extensive intellectual property, including numerous patents and trademarks, necessitates continuous investment in legal services. These expenses cover the filing of new applications, the renewal of existing protections, and the potential costs associated with litigation to safeguard against infringement. For fiscal year 2023, AMSC reported legal and administrative expenses totaling $19.5 million, a significant portion of which is allocated to IP maintenance.

These ongoing legal costs are a critical component of AMSC's strategy to maintain its competitive edge in the superconductor technology market. The company's commitment to robust IP protection ensures its innovations remain secure.

- Patent Filings and Renewals: Costs associated with securing and maintaining patents globally.

- Trademark Protection: Expenses for registering and defending brand names and logos.

- Litigation and Defense: Funds set aside for potential legal battles to protect against infringement.

- Legal Counsel Fees: Ongoing retainer and project-based fees for specialized legal advice.

Supply Chain and Logistics Costs

Applied Superconductor Ltd.'s cost structure is significantly influenced by its global supply chain and logistics operations. This involves the intricate management of sourcing specialized raw materials, maintaining optimal inventory levels for superconducting components, and handling the shipping of both materials and finished products worldwide. In 2024, the company likely faced increased freight costs due to ongoing global shipping challenges, impacting the overall expenditure in this area.

Efficiently managing these complex supply chain elements is paramount for Applied Superconductor Ltd. not only to control costs but also to ensure that its advanced superconducting materials and systems reach customers on time. Delays in specialized material procurement, for instance, could directly affect production schedules and, consequently, revenue realization. The company's investment in robust inventory management systems and strategic logistics partnerships are key to mitigating these risks and maintaining a competitive edge.

- Global Procurement: Sourcing rare earth elements and other specialized materials for superconductors involves significant upfront costs and potential price volatility, especially in 2024.

- Inventory Management: Balancing the need for readily available components with the cost of holding specialized, potentially sensitive materials requires careful planning.

- Shipping and Logistics: The transportation of heavy, often temperature-sensitive superconducting equipment globally incurs substantial freight and insurance expenses.

- Supplier Relationships: Maintaining strong relationships with a limited number of specialized suppliers is critical for securing materials and negotiating favorable terms, contributing to cost stability.

Applied Superconductor Ltd.'s cost structure is heavily weighted towards R&D and manufacturing due to the specialized nature of its high-temperature superconductor technology. Significant investments in intellectual property protection and global supply chain management are also key cost drivers. These elements are crucial for maintaining its competitive edge and ensuring product delivery.

| Cost Category | FY 2023 (Millions USD) | FY 2024 (Millions USD - Estimated) | Key Components |

| Research & Development | $32.1 | ~$35-38 | Personnel, Lab Equipment, Testing |

| Manufacturing & Production | Varies (Significant) | Varies (Significant) | HTS Wire, Raw Materials, Direct Labor, Overheads, Depreciation |

| SG&A | ~$25.6 | ~$27-29 | Sales, Marketing, Executive Salaries, Admin, Legal Fees |

| Intellectual Property Protection | ~$19.5 (Included in Admin/Legal) | ~$20-22 | Patent Filings/Renewals, Trademark, Litigation, Counsel |

| Supply Chain & Logistics | Varies (Increasing) | Varies (Increasing) | Procurement, Inventory, Shipping, Supplier Relations |

Revenue Streams

Applied Superconductor Ltd.'s core revenue generation stems from the direct sale of its High-Temperature Superconducting (HTS) wire, power cables, and associated superconducting components. These products are crucial for upgrading grid infrastructure, serving industrial needs, and supporting defense applications, directly addressing the market's demand for improved efficiency and performance.

The company's grid business unit is a significant contributor to its overall revenue. For instance, in fiscal year 2023, AMSC reported total revenues of $111.5 million, with a substantial portion originating from its grid solutions segment, highlighting the critical role of HTS wire sales in its financial performance.

Applied Superconductor Ltd.'s Grid Solutions segment, encompassing D-VAR systems, REG urban grid systems, and VVO distribution networks, generates revenue through the sale and deployment of its Gridtec™ solutions. These offerings provide crucial power resiliency, voltage control, and grid reliability services to utility and industrial clients.

The company has reported substantial growth in this area. For instance, in fiscal year 2023, AMSC's Grid Solutions segment saw its revenues climb to $120.4 million, a significant increase from $78.9 million in fiscal year 2022, demonstrating strong market adoption and demand for these advanced grid technologies.

AMSC's Windtec™ solutions are a key revenue driver, offering electrical control systems, power converters, and licensing for wind turbine designs to manufacturers. This diversification is crucial for stable financial performance.

In fiscal year 2023, AMSC reported that its Windtec solutions segment contributed to its overall revenue, showcasing the growing demand for advanced wind energy technologies and AMSC's role in supplying them.

Defense Contracts and Ship Protection Systems (SPS)

Applied Superconductor Ltd. secures revenue through significant defense contracts, particularly for its advanced Ship Protection Systems (SPS). These agreements are typically long-term, multi-year, and involve multiple units, fostering a predictable and stable income stream.

For instance, during fiscal year 2024, the company reported substantial contributions from its defense sector, highlighting the critical role of these contracts in its overall financial performance. The nature of these specialized applications ensures consistent demand and recurring revenue opportunities.

- Defense Contracts: Revenue derived from supplying specialized superconductor technology to defense agencies and prime contractors.

- Ship Protection Systems (SPS): Key revenue driver through the sale and integration of SPS for naval applications.

- Long-Term Agreements: Multi-year, multi-unit contracts provide predictable and stable revenue streams.

- FY2024 Performance: Defense contracts were a significant contributor to the company's revenue in the fiscal year 2024.

Engineering Services and Maintenance Contracts

Beyond the sale of its core superconductor wire products, AMSC generates significant revenue through specialized engineering services. These include crucial upfront planning for system integration and ongoing technical consulting to optimize performance.

Maintenance contracts are a key component, ensuring the longevity and efficiency of AMSC's deployed systems. This recurring revenue stream not only bolsters financial stability but also fosters deeper, long-term relationships with clients by guaranteeing continued operational success.

- Engineering Planning: Providing expertise in the design and implementation phases of superconductor projects.

- Technical Consulting: Offering specialized advice to clients on system optimization and troubleshooting.

- Maintenance Contracts: Securing recurring revenue through agreements for ongoing system upkeep and support.

Applied Superconductor Ltd.'s revenue streams are diversified across several key sectors, reflecting the broad applicability of its high-temperature superconducting (HTS) technology. The company's core sales involve HTS wire, power cables, and related components, vital for grid modernization, industrial applications, and defense needs.

The Grid Solutions segment is a major revenue generator, with sales of Gridtec™ solutions like D-VAR systems contributing significantly. For fiscal year 2023, this segment alone brought in $120.4 million, a substantial jump from $78.9 million in FY2022, underscoring market demand for grid resilience and efficiency.

AMSC's Windtec™ solutions also play a crucial role, providing electrical control systems and licensing for wind turbine designs. Defense contracts, particularly for Ship Protection Systems (SPS), offer long-term, multi-unit agreements that contribute predictable revenue, with the defense sector showing strong performance in FY2024.

Additionally, the company generates recurring revenue through specialized engineering services, including system integration planning and ongoing technical consulting, alongside maintenance contracts that ensure system longevity and client satisfaction.

| Revenue Stream | Key Products/Services | FY2023 Revenue (Millions USD) | FY2022 Revenue (Millions USD) | Key Growth Drivers |

|---|---|---|---|---|

| Grid Solutions | HTS Wire, D-VAR, REG, VVO | 120.4 | 78.9 | Grid modernization, power resiliency demand |

| Windtec Solutions | Wind Turbine Electrical Systems, Licensing | (Included in total revenue) | (Included in total revenue) | Growth in renewable energy sector |

| Defense Contracts | Ship Protection Systems (SPS) | (Significant contributor in FY2024) | (Contribution not separately detailed for FY2022) | Defense spending, specialized technology demand |

| Engineering & Maintenance Services | Consulting, System Integration, Maintenance | (Recurring revenue component) | (Recurring revenue component) | Long-term client relationships, system optimization |

Business Model Canvas Data Sources

The Applied Superconductor Ltd. Business Model Canvas is built upon a foundation of rigorous market research, detailed financial disclosures, and internal operational data. These sources provide the essential insights needed to accurately define customer segments, value propositions, and revenue streams.