Applied Superconductor Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Superconductor Ltd. Bundle

Understand the critical political, economic, social, technological, legal, and environmental factors shaping Applied Superconductor Ltd.'s trajectory. Our expertly crafted PESTLE analysis provides a clear, actionable roadmap to navigate these external forces. Gain a competitive advantage by leveraging these deep insights for strategic planning and risk mitigation. Download the full version now to unlock your company's full potential.

Political factors

Government support for grid modernization and clean energy initiatives significantly impacts AMSC. The U.S. Department of Energy (DOE) is a key driver, with substantial investments aimed at upgrading aging infrastructure and integrating renewable energy sources. For instance, the Bipartisan Infrastructure Law, enacted in 2021, allocated billions towards grid modernization, creating a robust market for AMSC's advanced power systems.

Federal programs are channeling significant funding into projects that directly benefit companies like AMSC. These investments, often in the billions, are crucial for developing and deploying technologies that enhance energy independence and support a net-zero future. This strategic government backing creates a favorable environment for AMSC's superconducting wire and grid stabilization solutions.

Applied Superconductor Ltd. (AMSC) operates within a sector significantly impacted by defense spending. Changes in global military budgets and evolving strategic priorities directly affect AMSC's business prospects, particularly its involvement in naval applications. For instance, the U.S. Department of Defense's Fiscal Year 2025 budget request proposed $886 billion, signaling continued investment in national security infrastructure, which could benefit companies like AMSC.

AMSC's specialized offerings, such as ship protection systems and advanced propulsion and power management solutions for naval fleets, position it to capitalize on defense sector investments. The company's focus on enhancing the operational safety and efficiency of navy vessels means that sustained government commitment to modernizing maritime capabilities creates tangible contract opportunities. The U.S. Navy's shipbuilding plan for FY2025, for example, outlines investments in new vessels and upgrades, underscoring the demand for AMSC's technologies.

Government energy policies, particularly those emphasizing grid reliability and the integration of renewable energy sources, directly influence the market for Applied Superconductor Ltd.'s (AMSC) advanced grid technologies. For instance, the Inflation Reduction Act of 2022 in the United States provides significant tax credits and incentives for clean energy projects, which is expected to drive demand for grid modernization solutions like those AMSC offers. This policy environment is crucial for AMSC's growth trajectory.

Shifts in energy regulations, such as expedited permitting processes for new transmission lines or changes in subsidies for energy storage, can significantly impact the pace at which AMSC's technologies are adopted. The Biden administration's goal to achieve a carbon-free electricity sector by 2035, coupled with ongoing efforts to strengthen grid infrastructure against climate-related disruptions, creates a favorable backdrop for AMSC's superconductor wire and grid stabilization systems.

International Trade Relations

Global trade policies, including tariffs and international collaborations, significantly influence AMSC's supply chain and market access across its operational regions in Asia, Australia, Europe, and North America. Geopolitical stability and trade agreements are therefore paramount for the company's ability to procure raw materials and distribute its specialized superconductor materials and electrical protection solutions.

Unfavorable trade relations or increased protectionism could lead to higher operational costs for AMSC due to import duties or restricted market penetration. For instance, the World Trade Organization (WTO) reported a rise in trade-restrictive measures globally in 2023, impacting various sectors, which could indirectly affect AMSC's component sourcing or end-market sales.

- Supply Chain Vulnerability: AMSC's reliance on global suppliers for critical components makes it susceptible to disruptions caused by trade disputes or sanctions, potentially increasing lead times and costs.

- Market Access Challenges: Tariffs or non-tariff barriers imposed by key trading partners could hinder AMSC's ability to compete effectively in international markets, impacting revenue growth.

- Geopolitical Risk: Political instability in regions where AMSC operates or sources materials can disrupt operations, affect demand, and create uncertainty for long-term investments.

Political Stability and Infrastructure Investment

Political stability is a cornerstone for Applied Superconductor Ltd. (AMSC) as it directly impacts the willingness of governments and private entities to commit to large-scale infrastructure projects. For instance, the United States' Infrastructure Investment and Jobs Act of 2021, with its projected $1.2 trillion in funding, signals a commitment to upgrading critical infrastructure, a sector where AMSC's superconducting technologies are relevant. This stability encourages the sustained capital outlays necessary for projects like advanced grid modernization and industrial upgrades.

A predictable political landscape fosters confidence, making it easier for companies like AMSC to secure long-term contracts for their high-temperature superconducting (HTS) wire and solutions. In 2024, ongoing discussions around energy security and grid resilience in both North America and Europe are likely to translate into increased investment in advanced power transmission and distribution systems. For example, the European Union's Green Deal initiatives aim to channel significant investment into sustainable energy infrastructure, creating opportunities for HTS applications.

- Government commitment to infrastructure: The US Infrastructure Investment and Jobs Act allocates substantial funds, creating a favorable environment for grid modernization projects.

- Energy transition policies: European Green Deal targets drive investment in renewable energy integration and grid upgrades, areas where AMSC's HTS solutions can play a role.

- Long-term project viability: Political stability reduces the risk associated with the multi-year capital commitments required for advanced grid and industrial projects.

Government support for grid modernization and clean energy initiatives significantly impacts AMSC. The U.S. Department of Energy (DOE) is a key driver, with substantial investments aimed at upgrading aging infrastructure and integrating renewable energy sources. For instance, the Bipartisan Infrastructure Law, enacted in 2021, allocated billions towards grid modernization, creating a robust market for AMSC's advanced power systems.

Federal programs are channeling significant funding into projects that directly benefit companies like AMSC. These investments, often in the billions, are crucial for developing and deploying technologies that enhance energy independence and support a net-zero future. This strategic government backing creates a favorable environment for AMSC's superconducting wire and grid stabilization solutions.

Applied Superconductor Ltd. (AMSC) operates within a sector significantly impacted by defense spending. Changes in global military budgets and evolving strategic priorities directly affect AMSC's business prospects, particularly its involvement in naval applications. For instance, the U.S. Department of Defense's Fiscal Year 2025 budget request proposed $886 billion, signaling continued investment in national security infrastructure, which could benefit companies like AMSC.

AMSC's specialized offerings, such as ship protection systems and advanced propulsion and power management solutions for naval fleets, position it to capitalize on defense sector investments. The company's focus on enhancing the operational safety and efficiency of navy vessels means that sustained government commitment to modernizing maritime capabilities creates tangible contract opportunities. The U.S. Navy's shipbuilding plan for FY2025, for example, outlines investments in new vessels and upgrades, underscoring the demand for AMSC's technologies.

Government energy policies, particularly those emphasizing grid reliability and the integration of renewable energy sources, directly influence the market for Applied Superconductor Ltd.'s (AMSC) advanced grid technologies. For instance, the Inflation Reduction Act of 2022 in the United States provides significant tax credits and incentives for clean energy projects, which is expected to drive demand for grid modernization solutions like those AMSC offers. This policy environment is crucial for AMSC's growth trajectory.

Shifts in energy regulations, such as expedited permitting processes for new transmission lines or changes in subsidies for energy storage, can significantly impact the pace at which AMSC's technologies are adopted. The Biden administration's goal to achieve a carbon-free electricity sector by 2035, coupled with ongoing efforts to strengthen grid infrastructure against climate-related disruptions, creates a favorable backdrop for AMSC's superconductor wire and grid stabilization systems.

Global trade policies, including tariffs and international collaborations, significantly influence AMSC's supply chain and market access across its operational regions in Asia, Australia, Europe, and North America. Geopolitical stability and trade agreements are therefore paramount for the company's ability to procure raw materials and distribute its specialized superconductor materials and electrical protection solutions.

Unfavorable trade relations or increased protectionism could lead to higher operational costs for AMSC due to import duties or restricted market penetration. For instance, the World Trade Organization (WTO) reported a rise in trade-restrictive measures globally in 2023, impacting various sectors, which could indirectly affect AMSC's component sourcing or end-market sales.

- Supply Chain Vulnerability: AMSC's reliance on global suppliers for critical components makes it susceptible to disruptions caused by trade disputes or sanctions, potentially increasing lead times and costs.

- Market Access Challenges: Tariffs or non-tariff barriers imposed by key trading partners could hinder AMSC's ability to compete effectively in international markets, impacting revenue growth.

- Geopolitical Risk: Political instability in regions where AMSC operates or sources materials can disrupt operations, affect demand, and create uncertainty for long-term investments.

Political stability is a cornerstone for Applied Superconductor Ltd. (AMSC) as it directly impacts the willingness of governments and private entities to commit to large-scale infrastructure projects. For instance, the United States' Infrastructure Investment and Jobs Act of 2021, with its projected $1.2 trillion in funding, signals a commitment to upgrading critical infrastructure, a sector where AMSC's superconducting technologies are relevant. This stability encourages the sustained capital outlays necessary for projects like advanced grid modernization and industrial upgrades.

A predictable political landscape fosters confidence, making it easier for companies like AMSC to secure long-term contracts for their high-temperature superconducting (HTS) wire and solutions. In 2024, ongoing discussions around energy security and grid resilience in both North America and Europe are likely to translate into increased investment in advanced power transmission and distribution systems. For example, the European Union's Green Deal initiatives aim to channel significant investment into sustainable energy infrastructure, creating opportunities for HTS applications.

- Government commitment to infrastructure: The US Infrastructure Investment and Jobs Act allocates substantial funds, creating a favorable environment for grid modernization projects.

- Energy transition policies: European Green Deal targets drive investment in renewable energy integration and grid upgrades, areas where AMSC's HTS solutions can play a role.

- Long-term project viability: Political stability reduces the risk associated with the multi-year capital commitments required for advanced grid and industrial projects.

Government policies directly influence AMSC's market, particularly through funding for grid modernization and clean energy. The U.S. Inflation Reduction Act of 2022, for example, provides significant incentives for clean energy projects, boosting demand for AMSC's grid technologies. Furthermore, defense spending, with the U.S. FY2025 budget request at $886 billion, supports AMSC's naval applications, like ship protection systems.

Trade policies and geopolitical stability are critical for AMSC's supply chain and market access. The World Trade Organization noted an increase in trade-restrictive measures in 2023, which could impact AMSC's sourcing and sales. Political stability, exemplified by the U.S. Infrastructure Investment and Jobs Act of 2021, encourages long-term infrastructure investments, benefiting AMSC's superconducting solutions.

The European Union's Green Deal initiatives are also driving investment in sustainable energy infrastructure, creating opportunities for AMSC's high-temperature superconducting (HTS) wire. A predictable political landscape is essential for AMSC to secure long-term contracts for its advanced grid and industrial projects, as these often require multi-year capital commitments.

| Policy/Initiative | Year | Impact on AMSC | Associated Funding/Budget (USD) |

|---|---|---|---|

| Bipartisan Infrastructure Law | 2021 | Grid modernization, renewable energy integration | $1.2 trillion (Infrastructure Investment and Jobs Act) |

| Inflation Reduction Act | 2022 | Clean energy project incentives, demand for grid tech | Significant tax credits and incentives |

| U.S. DoD FY2025 Budget Request | 2025 | Naval applications, defense spending | $886 billion |

| European Green Deal | Ongoing | Sustainable energy infrastructure, HTS opportunities | Significant investment |

What is included in the product

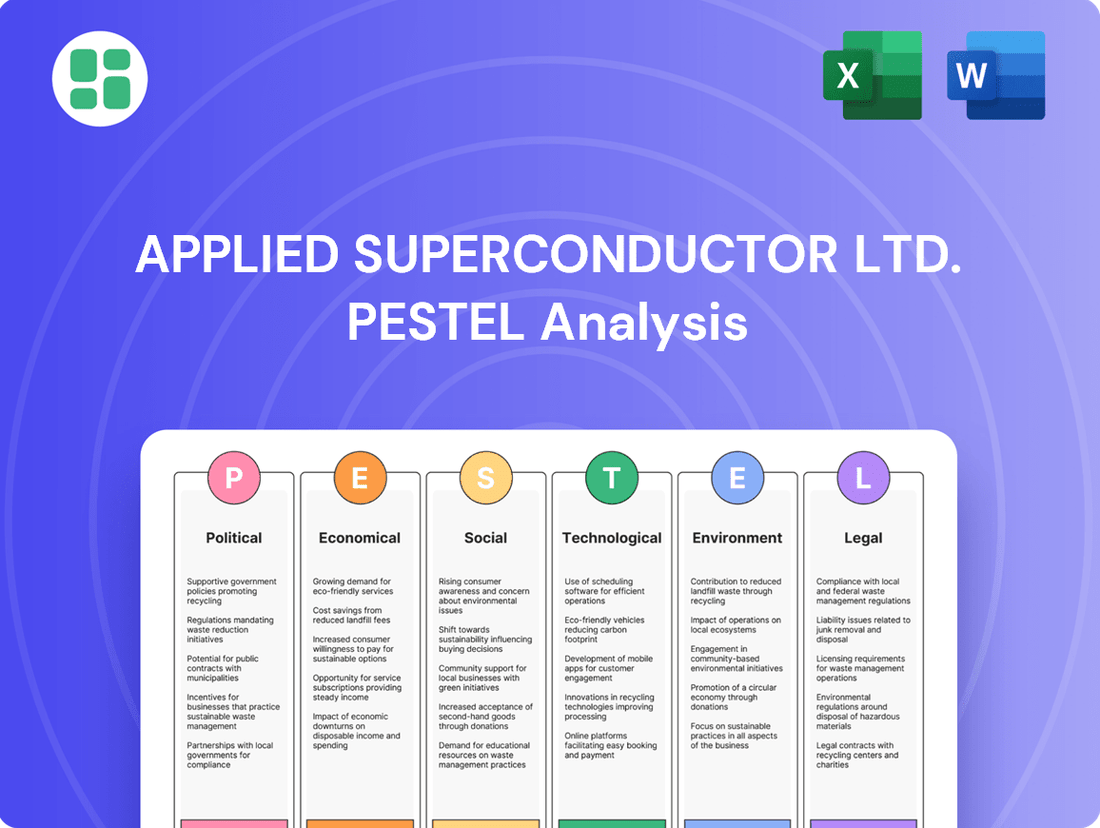

This PESTLE analysis examines the external macro-environmental forces impacting Applied Superconductor Ltd. across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, highlighting both opportunities and threats within the company's operating landscape.

A concise PESTLE analysis for Applied Superconductor Ltd. that cuts through complexity, offering clear insights into political, economic, social, technological, environmental, and legal factors to inform strategic decisions and alleviate the pain of information overload.

Economic factors

Global economic growth significantly influences Applied Superconductor Ltd. (AMSC) by affecting capital spending from key sectors like utilities, industry, and defense. Robust economic expansion generally spurs greater investment in infrastructure, which in turn drives demand for AMSC's advanced superconducting materials and solutions.

For instance, projections from the International Monetary Fund (IMF) in April 2024 estimated global growth at 3.2% for both 2024 and 2025, a slight uptick from 3.1% in 2023. This sustained, albeit moderate, growth suggests a stable environment for infrastructure development, potentially benefiting AMSC.

Conversely, a slowdown in global economic activity, such as the 2.6% growth forecast for 2024 by the World Bank in January 2024, could lead to postponed or canceled projects. This directly impacts AMSC's order pipeline and revenue potential.

Capital expenditure on grid infrastructure is a crucial economic factor for Applied Superconductor Ltd. (AMSC). The willingness and capacity of utility companies to invest in upgrading older power grids, incorporating renewable energy, and improving grid robustness directly influences AMSC's revenue streams.

Significant federal and private sector investments are presently targeting grid modernization efforts, presenting a favorable economic climate for AMSC. For instance, the U.S. Department of Energy's Grid Deployment Office has allocated billions through initiatives like the Grid Resilience and Innovation Partnerships (GRIP) program, aiming to accelerate grid upgrades and clean energy integration, which directly benefits companies like AMSC.

Inflationary pressures can significantly impact Applied Superconductor Ltd. (AMSC) by increasing the cost of essential raw materials and manufacturing processes, directly affecting profit margins. For instance, as of late 2024 and into early 2025, global commodity prices, particularly for metals like copper and rare earths critical for superconductor production, have shown volatility, with some indices indicating a potential uptick of 5-8% year-over-year, which AMSC must absorb or pass on.

Furthermore, rising interest rates, a common response to inflation, can dampen demand for AMSC's solutions. Higher borrowing costs for customers undertaking large-scale infrastructure projects, such as wind farms or grid modernization, may lead to project delays or cancellations, impacting AMSC's order pipeline. In the US, the Federal Reserve's benchmark interest rate remained elevated through much of 2024, hovering around 5.25%-5.50%, making financing more challenging for potential clients.

To navigate these economic headwinds, AMSC must prioritize robust cost management and dynamic pricing strategies. This includes optimizing supply chains, exploring alternative material sourcing, and ensuring that pricing reflects the value and technological advantage of their superconductor systems, thereby protecting profitability in a fluctuating economic landscape.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Applied Superconductor Ltd. (AMSC) given its global footprint. When AMSC converts earnings from international sales back into U.S. dollars, the prevailing exchange rates directly impact its reported revenue and profitability. For instance, a strengthening U.S. dollar against other currencies could reduce the dollar value of foreign sales, while a weaker dollar would have the opposite effect.

The volatility in currency markets requires AMSC to implement robust financial hedging strategies to mitigate potential losses. Such strategies might involve forward contracts or options to lock in exchange rates for future transactions. This proactive approach is crucial for maintaining financial stability and predictable earnings amidst global economic shifts.

For example, in the fiscal year ending March 31, 2024, AMSC reported a significant portion of its revenue originating from international markets. Fluctuations in the Euro and Chinese Yuan, relative to the U.S. dollar, could have materially affected these reported figures. Companies like AMSC often see their earnings per share impacted by these currency movements, underscoring the importance of managing this economic variable.

- Impact on Revenue: A stronger USD can decrease the USD value of foreign sales, while a weaker USD can increase it.

- Cost Implications: Fluctuations also affect the cost of imported components or services if paid in foreign currencies.

- Hedging Necessity: AMSC likely employs financial instruments to hedge against adverse currency movements, aiming to stabilize profitability.

- 2024/2025 Outlook: Continued global economic uncertainty and varying inflation rates across regions suggest ongoing currency volatility, necessitating vigilant management by AMSC.

Competitive Landscape and Pricing

The competitive environment for Applied Superconductor Ltd. (AMSC) is shaped by a few key players in the superconductor and power solutions market. This competition directly impacts AMSC's ability to set prices and secure market share. For instance, while AMSC is a leader in High-Temperature Superconductor (HTS) wire technology, other companies are also developing and commercializing similar solutions, creating a dynamic market. This means AMSC must constantly innovate while also keeping a close eye on the cost-effectiveness of its products to remain competitive.

The high manufacturing cost associated with HTS wires remains a significant hurdle, not just for AMSC but for the broader adoption of superconductor technology. Reducing these costs is a critical factor for gaining a competitive edge. For example, efforts to scale up production and refine manufacturing processes are ongoing industry-wide. AMSC's strategy needs to effectively balance the introduction of cutting-edge superconductor technologies with pricing that is attractive and accessible to a wider range of customers, particularly in sectors like grid modernization and renewable energy integration.

- Market Share Dynamics: AMSC's market share is influenced by the presence of established players in the broader power solutions sector and emerging competitors in the specialized superconductor niche.

- Cost as a Differentiator: The high cost of HTS wire production is a major competitive barrier; therefore, cost reduction is paramount for AMSC to expand its market reach.

- Innovation vs. Affordability: AMSC must strategically balance its investment in developing advanced superconductor applications with the need to offer competitive pricing to secure customer adoption.

Global economic growth directly impacts AMSC's revenue by influencing capital expenditures in sectors like utilities and defense. Sustained growth, as projected by the IMF at 3.2% for 2024 and 2025, supports infrastructure investment, benefiting AMSC. However, economic slowdowns, like the World Bank's 2.6% forecast for 2024, can lead to project delays, affecting AMSC's order pipeline.

Inflationary pressures increase AMSC's raw material and manufacturing costs, potentially squeezing profit margins. For example, commodity prices for critical metals showed volatility in late 2024 and early 2025. Additionally, elevated interest rates, like the US Federal Reserve's 5.25%-5.50% range through 2024, make financing more challenging for AMSC's clients undertaking large projects.

Currency exchange rate fluctuations significantly affect AMSC's reported international earnings. A strong U.S. dollar can reduce the value of foreign sales, while a weak dollar increases it. AMSC must employ robust hedging strategies, such as forward contracts, to mitigate these risks and ensure financial stability amidst global economic shifts.

Preview Before You Purchase

Applied Superconductor Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Applied Superconductor Ltd. covers all critical external factors influencing the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental forces impacting Applied Superconductor Ltd.

Sociological factors

Societies today are deeply reliant on a stable and efficient power supply, making grid reliability a paramount concern. This fundamental need fuels the demand for advanced grid solutions that can prevent outages and ensure consistent energy delivery.

With global populations continuing to grow and energy consumption on the rise, particularly with the immense power needs of burgeoning AI data centers, public expectations for uninterrupted power are only intensifying. For instance, global electricity demand is projected to grow significantly, with estimates suggesting a 20-30% increase by 2030, a trend that directly translates to higher expectations for grid stability.

This consistent societal demand for dependable energy creates a continuous market for grid resilience solutions. Companies like Applied Superconductor Ltd. (AMSC), which specialize in technologies that enhance grid performance and stability, are well-positioned to meet these critical public needs.

Growing public and corporate concern over climate change is significantly boosting demand for energy-efficient technologies. AMSC's grid modernization and renewable integration solutions directly address this trend, aligning with a societal shift towards sustainability. For instance, in 2024, global investment in renewable energy sources reached an estimated $2 trillion, signaling a strong market pull for companies like AMSC.

Applied Superconductor Ltd. (AMSC) relies heavily on a skilled workforce in advanced manufacturing, electrical engineering, and materials science to drive its operations and innovation in superconductor technology. The specialized nature of this field demands a highly trained talent pool, making workforce availability a critical factor for AMSC's success. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 7% growth in electrical engineers, a vital segment for AMSC's R&D and production.

Shortages in these specialized areas, however, pose a significant risk to AMSC's production capacity and its ability to advance research and development. As of early 2025, industry reports indicate persistent talent gaps in niche engineering fields, potentially impacting the pace of new product development and the scaling of manufacturing for their high-performance superconductor wire and cable solutions.

Corporate Social Responsibility (CSR)

Societal expectations are increasingly pushing companies towards greater accountability in their operations. Applied Superconductor Ltd. (AMSC) is subject to these evolving demands, where a strong commitment to corporate social responsibility (CSR) can significantly bolster its market standing. This includes embracing sustainable manufacturing processes and engaging positively with the communities in which it operates.

The growing emphasis on environmental, social, and governance (ESG) factors is a key trend. While specific AMSC ESG data for the 2024-2025 period is not publicly detailed, the broader market sentiment is clear. For instance, a significant majority of global investors, around 80% according to a 2023 survey by PwC, consider ESG factors in their investment decisions. This indicates that AMSC's proactive approach to ethical practices and community involvement could attract socially conscious investors and enhance its brand loyalty among consumers.

- Investor Demand: Investors are prioritizing companies with strong ESG credentials, impacting capital availability and cost.

- Consumer Preferences: Consumers are more likely to support businesses demonstrating ethical sourcing and environmental stewardship.

- Brand Reputation: Positive CSR initiatives can lead to improved public perception and a stronger brand image for AMSC.

- Risk Mitigation: Addressing social and environmental concerns proactively can help AMSC avoid reputational damage and regulatory scrutiny.

Urbanization and Population Density

The relentless march of urbanization, particularly in major global hubs, directly fuels the need for advanced power infrastructure. As cities swell, the physical space available for traditional power lines becomes increasingly constrained, pushing demand towards more efficient, high-density solutions. This trend is particularly pronounced in rapidly developing regions.

High-temperature superconductors (HTS) present a compelling technological answer to these urban power challenges. Their ability to transmit electricity with minimal loss in compact configurations makes them ideal for retrofitting existing urban grids or building new ones that can handle escalating power demands within limited footprints. For instance, the global smart grid market, which often incorporates advanced transmission technologies, was valued at approximately $30 billion in 2023 and is projected to grow significantly, indicating strong investment in grid modernization.

- Urban Population Growth: By 2050, it's estimated that 68% of the world's population will live in urban areas, up from 55% in 2023, according to UN data.

- Increased Power Demand: Urban centers, with their concentration of commercial, residential, and industrial activity, account for a disproportionately high share of global electricity consumption.

- Infrastructure Strain: Aging urban power grids in many developed nations are struggling to cope with peak demand, leading to inefficiencies and potential blackouts.

- HTS Application: Superconducting cables can carry up to ten times more power than conventional copper cables of the same size, making them crucial for dense urban environments.

Societal expectations for grid reliability are paramount, especially with increasing energy demands from sectors like AI data centers. This continuous need for dependable power creates a strong market for grid resilience solutions, benefiting companies like Applied Superconductor Ltd. (AMSC).

The growing public and corporate focus on climate change is driving demand for energy-efficient technologies. AMSC's grid modernization and renewable integration solutions align with this sustainability trend, supported by significant global investment in renewables, which reached an estimated $2 trillion in 2024.

A skilled workforce in advanced manufacturing and engineering is crucial for AMSC's innovation. While the U.S. Bureau of Labor Statistics projected a 7% growth for electrical engineers in 2024, persistent talent shortages in niche fields as of early 2025 could impact R&D and production scaling.

Societal demands for corporate accountability and strong ESG performance are rising, with around 80% of global investors considering ESG factors. AMSC's commitment to CSR and ethical practices can enhance its market standing and attract socially conscious investors.

Technological factors

Ongoing research into high-temperature superconducting (HTS) materials like YBCO and newer nickelates is crucial for Applied Superconductor Ltd. (AMSC). These advancements directly influence how well AMSC's products perform and how much they cost to make. For instance, improvements in YBCO, a widely used HTS material, have led to increased current carrying capacity, a key metric for AMSC's power systems.

Breakthroughs in HTS materials, particularly achieving superconductivity at higher temperatures or even at ambient pressure, could dramatically reshape AMSC's market. Such developments would allow for wider adoption of their technologies, as the need for expensive and complex cooling systems would be significantly reduced, opening up new application areas and lowering operational costs for customers.

Innovations in manufacturing processes for high-temperature superconducting (HTS) wires are a key technological driver for Applied Superconductor Ltd. These advancements are crucial for lowering production costs and enabling larger-scale manufacturing, which directly impacts the affordability and accessibility of their products for industrial use.

Achieving faster production speeds and ensuring consistent high quality are paramount. Historically, the high cost of HTS wire manufacturing has been a significant hurdle to widespread adoption, and process improvements directly address this barrier, making superconducting technologies more viable for a broader range of applications.

Applied Superconductor Ltd.'s (AMSC) advanced solutions are foundational for the evolving smart grid landscape. These grids demand sophisticated control mechanisms, real-time sensing capabilities, and robust communication networks to ensure optimal performance and reliability. AMSC's technology directly addresses these needs, positioning them as a key player in grid modernization efforts.

The ongoing advancement and seamless integration of AMSC's offerings with broader smart grid ecosystems, including energy storage systems and advanced software platforms, significantly bolster their value proposition. This synergy allows for more efficient energy management and grid stability. For instance, the global smart grid market was valued at approximately $32.5 billion in 2023 and is projected to reach over $90 billion by 2030, indicating substantial growth and opportunity for AMSC.

Cybersecurity in Critical Infrastructure

As power grids become increasingly digitized and interconnected, the risk of cyberattacks on critical infrastructure escalates significantly. AMSC, as a key provider of solutions for this sector, faces a growing technological imperative to ensure its systems are inherently robust against these evolving cyber threats.

The development and seamless integration of advanced cybersecurity measures directly into AMSC's product offerings are crucial for maintaining operational integrity and customer trust. This technological focus is not just a competitive advantage but a fundamental requirement for participation in the modern energy landscape.

- Increased Digitization: The global energy sector is rapidly digitizing, with estimates suggesting that by 2025, over 70% of critical infrastructure operations will rely on digital technologies, amplifying the attack surface.

- Cybersecurity Investment: Global spending on cybersecurity for the industrial sector is projected to reach over $14 billion by 2025, highlighting the industry's recognition of this critical technological factor.

- AMSC's Role: AMSC's solutions, such as its Grid Services and Wind Systems, directly interact with and control critical grid components, making cybersecurity a paramount consideration in their design and deployment.

Pace of Innovation and Patent Protection

The superconductor industry is characterized by a relentless pace of innovation, demanding substantial and ongoing investment in research and development for Applied Superconductor Ltd. (AMSC). This rapid evolution means that staying ahead requires not just creating new technologies but also robustly protecting intellectual property through patents. For AMSC, securing and defending patents is paramount to maintaining its competitive advantage in a global landscape of intense research activity.

AMSC's strategy must actively focus on generating new patents while rigorously defending its existing intellectual property portfolio. This is crucial as the company operates in a sector where technological breakthroughs can quickly render existing solutions obsolete. For instance, in 2023, AMSC reported approximately $55 million in R&D expenses, underscoring the significant financial commitment required to fuel this innovation pipeline.

- Continuous R&D Investment: AMSC's commitment to innovation requires significant financial allocation towards research and development, as evidenced by its substantial R&D spending in 2023.

- Patent Portfolio Strength: Maintaining a strong and defensible patent portfolio is critical for AMSC to protect its technological advancements and market position.

- Global Competition: The superconductor field is highly competitive globally, making patent protection a key differentiator for AMSC.

- Technological Obsolescence: The rapid pace of innovation necessitates constant development to avoid being outpaced by competitors and new technologies.

Technological advancements in superconductor materials, particularly higher critical temperatures and current densities, directly impact Applied Superconductor Ltd.'s (AMSC) product performance and cost-effectiveness. Innovations in manufacturing processes are also key, aiming to reduce production costs and scale up output, making superconducting technologies more accessible for broader industrial adoption.

The increasing digitization of power grids presents both opportunities and challenges. AMSC's solutions are integral to smart grid modernization, but this also necessitates robust cybersecurity measures to protect against escalating cyber threats. Continuous investment in R&D and the protection of intellectual property through patents are vital for AMSC to maintain its competitive edge in this rapidly evolving technological landscape.

| Technological Factor | Description | Impact on AMSC | Data/Trend (2024-2025 Focus) |

|---|---|---|---|

| Superconductor Material Advancements | Development of HTS materials with higher critical temperatures and current densities. | Improved product performance, reduced cooling needs, lower operational costs for customers. | Ongoing research into nickelates and enhanced YBCO performance. |

| Manufacturing Process Innovations | Improvements in HTS wire production speed, consistency, and cost reduction. | Lower product pricing, increased market accessibility, enabling larger-scale deployments. | Focus on reducing HTS wire manufacturing costs, a historical barrier. |

| Smart Grid Integration | Seamless integration of AMSC's technologies with smart grid ecosystems. | Enhanced grid efficiency, stability, and value proposition for AMSC's offerings. | Smart grid market projected to exceed $90 billion by 2030 (from ~$32.5 billion in 2023). |

| Cybersecurity in Digitized Grids | Ensuring AMSC's systems are robust against evolving cyber threats. | Crucial for operational integrity, customer trust, and market participation. | Industrial cybersecurity spending projected to exceed $14 billion by 2025. |

| R&D and Intellectual Property | Continuous investment in R&D and strong patent protection. | Maintaining competitive advantage, protecting technological breakthroughs from competitors. | AMSC's 2023 R&D expenses were approximately $55 million. |

Legal factors

AMSC navigates a complex regulatory landscape within the energy sector, with strict adherence to grid reliability standards, safety protocols, and operational guidelines being critical. For instance, the Federal Energy Regulatory Commission (FERC) in the US continually updates grid modernization rules, impacting how technologies like AMSC’s superconducting systems must integrate and perform.

Shifts in these government-mandated regulations can directly necessitate costly product redesigns or significantly alter the market appetite for specific technological solutions. A recent example could be new cybersecurity mandates for grid infrastructure, requiring enhanced protective measures for all connected components.

The evolving nature of energy policy, particularly concerning renewable energy integration and grid resilience, presents both challenges and opportunities for AMSC. For example, the Inflation Reduction Act of 2022, with its substantial clean energy tax credits, could boost demand for grid-enhancing technologies that AMSC offers, provided they meet specific eligibility criteria.

Applied Superconductor Ltd.'s (AMSC) business model relies heavily on protecting its patents and proprietary technologies, particularly its high-temperature superconducting innovations. Effective intellectual property laws and their rigorous enforcement are paramount to preventing unauthorized use and maintaining a competitive edge. The company's significant investment in R&D, evidenced by its substantial patent portfolio, underscores this dependency.

The potential for costly legal disputes over patent infringement poses a significant risk. Such litigation can divert critical financial resources and management attention away from core business operations and innovation. For instance, in 2023, the global legal spend on intellectual property disputes reached billions, highlighting the financial implications of such challenges.

Environmental regulations, covering aspects like emissions, waste disposal, and the sourcing of materials, directly impact Applied Superconductor Ltd.'s (AMSC) manufacturing processes and product development. For instance, stricter rules on hazardous waste management could increase operational expenses for AMSC's superconductor production facilities.

Compliance with these evolving environmental laws, both in the US and in countries where AMSC operates or sells, is a critical operational requirement. Failure to comply can lead to significant fines and reputational damage, potentially affecting AMSC's market access and profitability.

The increasing focus on sustainability means AMSC must also consider reporting on its environmental footprint. For example, many publicly traded companies are now required to disclose their carbon emissions, a trend that will likely grow, influencing investor perception and AMSC's ESG (Environmental, Social, and Governance) ratings.

Government Contracts and Procurement Laws

For Applied Superconductor Ltd. (AMSC), particularly in its defense and government-related sectors, navigating complex procurement laws is paramount. These regulations dictate how contracts are awarded, managed, and fulfilled, directly impacting AMSC's ability to secure and execute vital projects. For instance, the U.S. government's defense spending for fiscal year 2025 is projected to be around $886 billion, highlighting the significant market opportunities but also the rigorous compliance demands.

AMSC must meticulously adhere to specific contract terms, reporting mandates, and quality control standards inherent in government agreements. Failure to comply can lead to contract termination, penalties, or exclusion from future bidding processes. The company’s commitment to ethical practices and transparent operations is therefore a critical factor for sustained success in this arena.

- Defense Procurement Regulations: AMSC must comply with regulations like the Federal Acquisition Regulation (FAR) in the U.S., which governs how the government buys goods and services.

- Contractual Obligations: Adherence to specific performance metrics, delivery schedules, and intellectual property clauses within government contracts is non-negotiable.

- Quality Assurance and Compliance: Stringent quality control measures and certifications are often required, especially for critical defense applications.

- Ethical Standards and Reporting: Government contracts typically demand a high level of ethical conduct and detailed reporting on project progress and financials.

International Trade Laws and Sanctions

AMSC's global business hinges on navigating a complex web of international trade laws and sanctions. Staying compliant with export controls, particularly concerning advanced technologies like superconductors, is paramount to avoid severe penalties. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List and Export Administration Regulations (EAR), which directly impact companies like AMSC involved in high-tech exports. Failure to adhere can result in hefty fines, potentially reaching millions of dollars, and significant operational disruptions.

The company must actively monitor and adapt to evolving international legal frameworks. This includes understanding the nuances of sanctions imposed by major economic blocs, such as the European Union and the United States, on specific countries or entities. In 2024, ongoing geopolitical tensions continue to shape these sanctions regimes, requiring diligent due diligence in all international transactions to prevent inadvertent violations. AMSC's proactive approach to legal compliance is therefore a critical risk mitigation strategy.

- Compliance with international trade laws and export controls is essential for AMSC's global supply chain integrity.

- Violating economic sanctions can lead to substantial financial penalties and operational shutdowns.

- AMSC must remain vigilant regarding updates to regulations from bodies like the US BIS.

- Proactive legal monitoring helps mitigate risks associated with evolving international trade policies.

AMSC's reliance on intellectual property necessitates robust patent protection and enforcement to maintain its competitive advantage in superconductor technology. The company’s significant investment in R&D, reflected in its extensive patent portfolio, underscores this critical legal dependency.

Navigating government procurement laws, especially in the defense sector, requires strict adherence to regulations like the Federal Acquisition Regulation (FAR). For instance, the projected US defense spending for fiscal year 2025, around $886 billion, signifies substantial market opportunities but also demands rigorous compliance with contractual obligations and quality standards.

Compliance with international trade laws and export controls is vital for AMSC's global operations, as violations of economic sanctions can result in severe financial penalties. Companies like AMSC must actively monitor evolving regulations from bodies such as the US Bureau of Industry and Security (BIS) to mitigate risks and ensure supply chain integrity.

Environmental factors

Global initiatives to address climate change are significantly boosting the market for energy-efficient solutions. Governments worldwide are setting ambitious decarbonization targets, with many aiming for net-zero emissions by 2050. This policy landscape directly fuels demand for advanced technologies like those offered by AMSC.

AMSC's high-temperature superconductor (HTS) technology plays a crucial role in this transition. By minimizing energy loss during transmission and facilitating the seamless integration of renewable sources such as wind and solar, AMSC's solutions actively support global efforts to reduce greenhouse gas emissions. For instance, the International Energy Agency (IEA) reported that renewable energy accounted for over 80% of new electricity capacity additions globally in 2023, highlighting the trend AMSC is positioned to capitalize on.

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, are significantly exposing the vulnerabilities of current power grids. This trend directly amplifies the need for solutions that can bolster grid reliability and resilience, making technologies that prevent and mitigate outages increasingly vital.

AMSC's advanced grid solutions are positioned to address these critical infrastructure challenges. For instance, in 2024, the US experienced over $50 billion in weather and climate disasters, many of which caused widespread power disruptions, underscoring the market demand for AMSC's grid hardening technologies.

Applied Superconductor Ltd.'s reliance on specific raw materials for High-Temperature Superconductor (HTS) wire production, such as rare earth elements, presents a significant environmental factor. The availability and sustainable sourcing of these materials are crucial for consistent production and long-term operational viability. For instance, disruptions in the supply of yttrium, a key component, could impact manufacturing schedules.

Ensuring an ethically sourced and stable supply chain for critical materials is paramount. Companies are increasingly scrutinized for their environmental, social, and governance (ESG) practices, making responsible procurement a strategic imperative. A commitment to sustainable resource utilization not only mitigates supply chain risks but also positively influences brand perception among environmentally conscious stakeholders.

Energy Efficiency and Carbon Footprint

Applied Superconductor Ltd.'s (AMSC) core business directly addresses environmental concerns by focusing on energy efficiency. Their solutions, like superconducting wire and power systems, are designed to reduce energy loss in electricity transmission and distribution. This translates into a lower demand for power generation, which in turn lowers carbon emissions. For instance, by minimizing wasted electricity, AMSC's technology contributes to a cleaner energy grid.

The environmental benefit of AMSC's products is significant, as they help to reduce the overall carbon footprint associated with electricity consumption. Less energy wasted means less fossil fuel burned to generate that energy. This aligns with global efforts to combat climate change and transition to more sustainable energy sources.

AMSC also faces scrutiny regarding its own operational carbon footprint. Companies are increasingly expected to demonstrate their commitment to environmental sustainability through their internal practices. This includes managing emissions from manufacturing processes, transportation, and facilities. As of early 2025, many companies in the advanced materials sector are reporting on their Scope 1 and Scope 2 emissions, aiming for reductions in line with international climate goals.

Key environmental considerations for AMSC include:

- Energy Efficiency Enhancement: AMSC's core technology directly contributes to reducing energy waste in power grids, thereby lowering associated carbon emissions.

- Reduced Carbon Footprint: By enabling more efficient electricity transmission, AMSC's products help decrease the reliance on carbon-intensive energy generation.

- Operational Sustainability: The company is expected to manage and reduce its own environmental impact from its manufacturing and business operations.

- Market Demand for Green Technologies: Growing global emphasis on sustainability drives demand for AMSC's energy-saving solutions.

Waste Management and Product Lifecycle

The environmental footprint of Applied Superconductor Ltd. (AMSC) products, particularly superconducting wires and components, extends beyond their operational phase to their end-of-life. This necessitates careful consideration of how High-Temperature Superconductor (HTS) materials and associated components are disposed of or recycled. For instance, the rare earth elements and other specialized materials used in HTS wires require specific handling to minimize environmental harm and recover valuable resources.

Developing robust, sustainable lifecycle management strategies for AMSC's product portfolio is crucial. This approach can foster a more circular economy by emphasizing reuse, refurbishment, and recycling of materials. Such strategies not only address environmental concerns but also help AMSC stay ahead of evolving global environmental regulations, which are increasingly focused on product stewardship and waste reduction. For example, the European Union's Green Deal initiative is driving stricter regulations on waste management and the circular economy, impacting manufacturers worldwide.

- End-of-Life Management: AMSC's HTS materials and components require specialized disposal or recycling protocols to manage environmental impact and resource recovery.

- Circular Economy Integration: Implementing sustainable lifecycle strategies can align AMSC with circular economy principles, promoting material reuse and reducing waste.

- Regulatory Compliance: Proactive lifecycle management is essential for adhering to increasingly stringent global environmental regulations, such as those stemming from the EU's Green Deal.

- Resource Recovery: The recovery of rare earth elements and other valuable materials from retired superconducting products presents an opportunity for both environmental benefit and economic advantage.

Global climate initiatives are a significant tailwind for Applied Superconductor Ltd. (AMSC), as governments push for decarbonization and grid resilience. AMSC's superconductor technology directly supports this by enhancing energy efficiency and integrating renewables, aligning with targets like the International Energy Agency's report of over 80% new electricity capacity from renewables in 2023.

The increasing frequency of extreme weather events, exacerbated by climate change, highlights the vulnerability of existing power grids. For instance, the US faced over $50 billion in weather and climate disasters in 2024 alone, causing widespread power disruptions. This underscores the critical need for AMSC's grid hardening solutions.

AMSC's reliance on materials like rare earth elements for HTS wire production introduces environmental considerations regarding sourcing and availability. Ethical and sustainable procurement practices are vital, especially as stakeholders increasingly scrutinize ESG performance. A stable supply chain for components like yttrium is crucial for consistent manufacturing.

The company's core business inherently offers environmental benefits by reducing energy loss in transmission, thereby lowering carbon emissions. However, AMSC must also manage its own operational footprint, with many companies in early 2025 reporting Scope 1 and 2 emissions reductions to meet climate goals.

| Environmental Factor | Impact on AMSC | Supporting Data/Context (2023-2025) |

|---|---|---|

| Climate Change Initiatives | Increased demand for energy-efficient solutions | IEA: Over 80% of new electricity capacity additions globally in 2023 were from renewables. |

| Extreme Weather Events | Amplified need for grid resilience and reliability | US: Over $50 billion in weather/climate disasters in 2024 caused widespread power disruptions. |

| Raw Material Sourcing | Supply chain risks and ESG scrutiny for rare earth elements | Yttrium availability is critical for HTS wire production. |

| Operational Footprint | Expectation to reduce emissions from manufacturing and operations | Companies reporting Scope 1 & 2 emissions reductions in early 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Applied Superconductor Ltd. is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.