Apollo Global Management PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Global Management Bundle

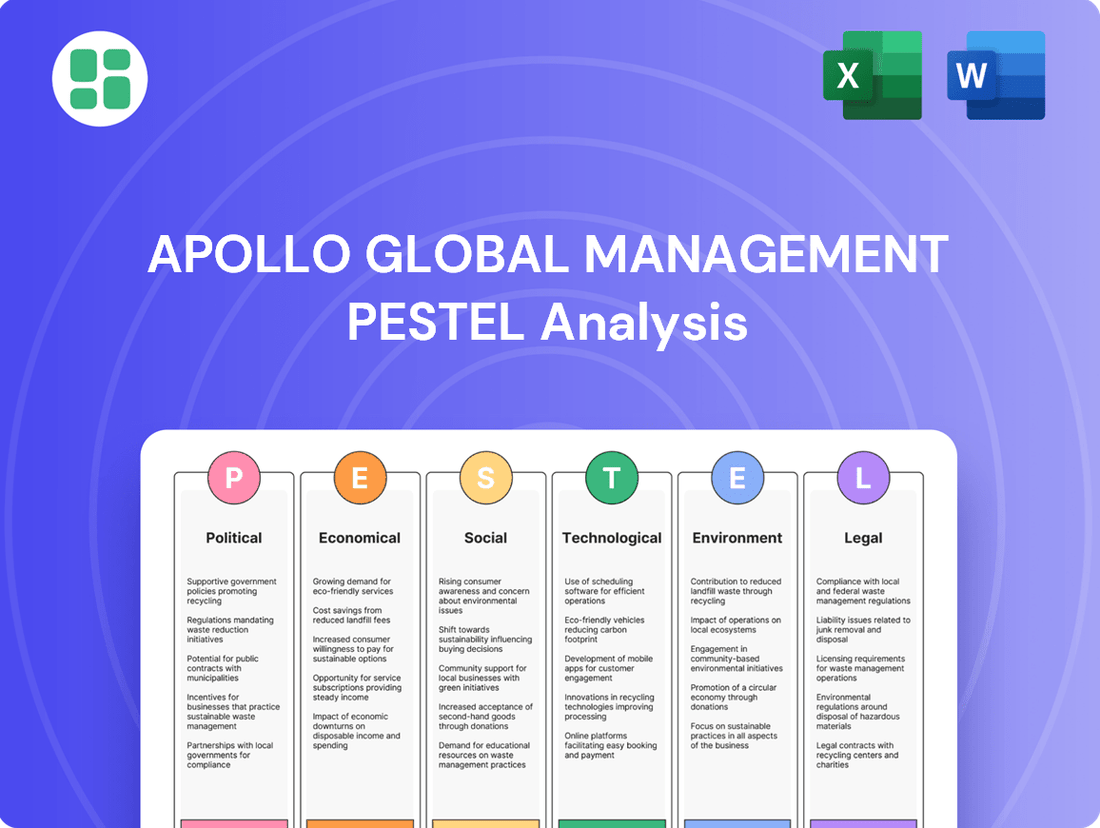

Gain a significant advantage with our meticulously crafted PESTLE Analysis for Apollo Global Management. Uncover the critical political, economic, social, technological, legal, and environmental factors influencing their strategic direction and future growth. Equip yourself with actionable intelligence to refine your own market approach.

Don't let external shifts catch you off guard. Our comprehensive PESTLE Analysis for Apollo Global Management provides the deep insights you need to anticipate challenges and capitalize on opportunities. Download the full version now and unlock a clearer path to informed decision-making.

Political factors

Apollo Global Management, like its peers in the alternative asset management sector, is navigating increased governmental and regulatory oversight worldwide. This scrutiny focuses on areas such as the transparency of their operations, the structure and justification of fees charged to investors, and the potential for systemic risk stemming from their substantial investments in less liquid markets. For instance, the Securities and Exchange Commission (SEC) in the US has been actively proposing new rules for private fund advisors, aiming to enhance disclosure and reduce conflicts of interest, which could impact Apollo's reporting and operational procedures.

Shifts in government policies directly shape Apollo's strategic direction and operational models. Changes in tax legislation, particularly concerning the taxation of carried interest or capital gains, can have a material effect on both the firm's profitability and the net returns delivered to its investors. As of early 2024, discussions around potential adjustments to carried interest taxation persist in various jurisdictions, highlighting the sensitivity of Apollo's business model to these political winds.

Global political tensions and evolving trade policies present significant challenges for Apollo Global Management. Increased protectionism and ongoing trade disputes, such as those impacting global supply chains in 2024, can introduce considerable volatility into international markets. This directly affects Apollo's cross-border investments and the operational stability of its diverse portfolio companies.

Shifts in international trade agreements and the imposition of new tariffs, as highlighted in various economic forecasts for 2024-2025, can directly increase operating costs for businesses within Apollo's portfolio. Furthermore, these changes may restrict market access, thereby injecting further uncertainty and potential underperformance into investments. Apollo's strategic planning actively considers these geopolitical risks to mitigate their impact.

Central bank decisions, like those from the Federal Reserve, significantly shape the cost of borrowing and the availability of funds in financial markets. For Apollo Global Management, these monetary policy shifts directly affect their credit and real asset investments, influencing how much it costs their portfolio companies to secure financing and the overall value of their assets.

The trajectory of interest rate adjustments in 2025 will be particularly crucial for the credit sector. For instance, if the Federal Reserve implements a series of rate cuts, as many economists anticipate for 2025, it could lower borrowing costs for businesses and potentially boost valuations for companies Apollo invests in, especially those with significant debt.

Influence of Political Advisory Roles

Apollo Global Management's strategic engagement with politically influential figures, such as former U.S. Senator Joe Manchin, underscores a calculated approach to navigating the energy sector. This advisory role offers a distinct advantage in understanding and anticipating policy shifts, crucial for investments in a heavily regulated industry.

These relationships provide Apollo with invaluable foresight into potential regulatory changes and can significantly smooth the path for deal origination and execution within complex markets. For instance, during 2024, the energy sector faced ongoing debates around climate policy and domestic production incentives, areas where Manchin's expertise would be particularly relevant.

- Policy Insight: Access to experienced political advisors aids in forecasting regulatory environments impacting energy investments.

- Deal Facilitation: Political connections can streamline negotiations and approvals in regulated sectors.

- Strategic Opportunity: Leveraging political acumen helps identify and capitalize on opportunities shaped by government policy.

Evolving Public-Private Partnerships and Infrastructure Spending

Government initiatives focused on infrastructure development and public-private partnerships (PPPs) are creating substantial investment avenues for Apollo, especially within its real assets and credit divisions. These policies are designed to unlock significant capital for large-scale projects, fitting perfectly with Apollo's strategic emphasis on the Global Industrial Renaissance, a movement that necessitates trillions in capital investment.

The Biden administration, for instance, has allocated substantial funds towards infrastructure. The Infrastructure Investment and Jobs Act (IIJA), passed in 2021, is set to invest around $1.2 trillion, with a significant portion dedicated to modernizing roads, bridges, public transit, and broadband. This creates a fertile ground for Apollo's expertise in financing and managing such complex, long-term assets.

- Infrastructure Investment and Jobs Act (IIJA): Approximately $1.2 trillion allocated for infrastructure improvements in the US.

- Global Industrial Renaissance: Requires trillions in capital investment, directly benefiting firms like Apollo involved in real assets and credit.

- Public-Private Partnerships (PPPs): Increasing government reliance on PPPs to fund and execute infrastructure projects.

Increased regulatory scrutiny globally, particularly from bodies like the SEC, is a significant political factor for Apollo. New rules proposed in 2024 and expected to evolve through 2025 aim to enhance transparency and reduce conflicts of interest in private fund management, directly impacting Apollo's operational and reporting frameworks.

Changes in tax policies, especially concerning carried interest and capital gains, remain a key political consideration. Discussions in 2024 and projections for 2025 indicate ongoing sensitivity to these fiscal adjustments, which can materially affect both Apollo's profitability and investor returns.

Government initiatives like the US Infrastructure Investment and Jobs Act (IIJA), with its approximately $1.2 trillion allocation, are creating substantial investment opportunities in real assets and credit. These public-private partnership (PPP) focused policies align with Apollo's strategy to fund large-scale projects, particularly within the context of the Global Industrial Renaissance requiring trillions in capital.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Apollo Global Management, covering political, economic, social, technological, environmental, and legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for Apollo's operations and future growth.

A PESTLE analysis for Apollo Global Management serves as a pain point reliver by offering a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders understand the external landscape.

Economic factors

The prevailing interest rate environment is a critical factor for Apollo Global Management. Higher rates, such as those seen throughout much of 2023 and into 2024, directly influence Apollo's credit segment and the cost of capital for its portfolio companies. For instance, a higher interest rate environment can boost spread-related income for its retirement services arm, Athene, by allowing for greater investment yields.

However, these elevated rates also present challenges. They increase the borrowing costs for companies within Apollo's investment portfolio, potentially impacting profitability and cash flow. Furthermore, higher rates can sometimes lead to increased asset prepayments, which can affect the timing and yield of certain investments within Apollo's credit strategies.

Looking ahead to 2025, the anticipated trajectory of interest rates is a key consideration. Expectations of potential rate cuts by major central banks in 2025 could alleviate some funding pressures for Apollo and its investments. Such a shift could also lead to a broader recovery and improved valuations across various credit market segments, benefiting Apollo's diverse investment strategies.

Apollo Global Management's investment performance is intrinsically linked to global economic expansion. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a generally supportive environment for Apollo's diverse portfolio.

A robust US economy, a key driver for many of Apollo's investments, underpins strong corporate fundamentals and earnings growth. This positive outlook directly benefits Apollo's private equity and credit strategies by fostering an environment conducive to value creation and debt repayment.

Despite these positive trends, persistent market volatility and the ever-present risk of economic slowdowns globally pose significant challenges. These factors can directly impact investment income and overall fund performance, requiring Apollo to maintain agile strategies to navigate potential downturns.

Persistent inflation remains a significant concern, with the US CPI showing a 3.3% annual increase as of May 2024, still above the Federal Reserve's 2% target. This erodes the real value of investments and can dampen consumer spending, a crucial factor for many of Apollo's portfolio companies.

Apollo's strategic outlook closely monitors inflation trends. Prolonged high inflation could necessitate further monetary tightening by central banks, potentially leading to economic slowdowns and impacting asset valuations, thereby influencing Apollo's investment strategies.

Capital Flows and Investor Demand for Alternative Assets

Apollo's growth hinges on consistent investor appetite, with pension funds, endowments, and sovereign wealth funds being key sources. Global wealth channels are also becoming increasingly significant for capital raising.

The first half of 2025 saw record inflows into Apollo's funds, underscoring robust investor demand. This surge is particularly notable in credit and hybrid asset classes, which are appealing due to their attractive yields and diversification potential.

- Record Inflows: Apollo experienced substantial capital inflows in Q1 and Q2 2025, signaling strong investor confidence.

- Product Demand: Investor interest is particularly high for Apollo's credit and hybrid investment products.

- Drivers of Demand: Attractive yields and the diversification benefits offered by these assets are key factors driving investor demand.

- AUM Growth: Sustained capital flows are critical for Apollo's ability to expand its assets under management (AUM).

Mergers, Acquisitions, and IPO Activity

A notable rebound in mergers, acquisitions (M&A), and initial public offering (IPO) activity is a strong indicator of growing market confidence and enhanced liquidity. This surge creates valuable exit opportunities for Apollo's existing private equity portfolio companies, allowing them to realize returns. Furthermore, it paves the way for new deal origination, as a more robust M&A and IPO market generally translates to increased transaction volumes.

Projections for 2025 suggest a significant recovery in corporate transaction activity. For instance, global M&A deal values are anticipated to climb, with some analysts forecasting a return to pre-downturn levels, driven by pent-up demand and strategic repositioning. This trend is particularly beneficial for alternative asset managers like Apollo, as it signals a more favorable environment for executing and exiting private market investments.

- M&A Deal Value Growth: Expected to see a substantial year-over-year increase in global M&A deal values in 2025, potentially exceeding $3 trillion.

- IPO Market Recovery: The number of IPOs is projected to rise significantly in 2025, offering Apollo enhanced avenues for liquidity events.

- Increased Private Equity Exits: A more active M&A landscape directly correlates with improved exit multiples and faster realization timelines for private equity funds.

- Strategic Buyer Activity: Corporate acquirers are expected to be more active, driven by the need for growth, consolidation, and technology acquisition, benefiting Apollo's investment strategies.

Economic growth is a bedrock for Apollo's performance, with the IMF projecting global growth at 3.2% for 2024, a positive signal for asset appreciation. A strong US economy, in particular, fuels corporate earnings and debt repayment, directly benefiting Apollo's private equity and credit strategies. However, global economic slowdowns remain a persistent risk, necessitating agile management of Apollo's investment portfolio.

Inflationary pressures, with US CPI at 3.3% annually as of May 2024, continue to impact real investment values and consumer spending, potentially affecting portfolio company revenues. Persistent high inflation could trigger further central bank tightening, risking economic slowdowns and influencing asset valuations, a key consideration for Apollo's investment decisions.

The interest rate environment significantly shapes Apollo's operations. Higher rates, prevalent in 2023-2024, boost yield for its retirement services like Athene but increase borrowing costs for portfolio companies. Anticipated rate cuts in 2025 could ease funding pressures and improve credit market valuations, benefiting Apollo's diverse strategies.

| Economic Indicator | Value/Projection | Impact on Apollo |

|---|---|---|

| Global GDP Growth (IMF Projection) | 3.2% (2024) | Supports asset appreciation and investment opportunities. |

| US CPI (Annual Increase) | 3.3% (May 2024) | Erodes real investment value; potential impact on consumer spending. |

| Federal Funds Rate (Target Range) | 5.25%-5.50% (as of June 2024) | Influences cost of capital and investment yields; potential for future cuts. |

Preview Before You Purchase

Apollo Global Management PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Apollo Global Management delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of the external forces shaping Apollo Global Management's business landscape. Understand the critical influences that drive its growth and present potential challenges.

Sociological factors

The global population is aging, with projections indicating that by 2050, nearly 1 in 6 people worldwide will be 65 or older, a significant increase from 1 in 11 in 2015. This demographic shift directly fuels a growing demand for retirement services and long-term savings solutions, a core area of focus for Apollo Global Management's Athene business.

This sustained demographic trend is a key driver for Athene's growth trajectory, as an increasing number of individuals seek reliable income streams in their later years. Furthermore, elevated interest rates, a factor observed throughout 2023 and into early 2024, enhance the attractiveness of annuities and related investment strategies, bolstering demand for Athene's offerings.

Societal demand for sustainable and ethical business practices is increasingly shaping investment strategies. Apollo Global Management, like many firms, is responding to this by integrating Environmental, Social, and Governance (ESG) factors into its investment analysis and portfolio management.

This focus means Apollo is not just looking at financial returns but also at the potential for positive social and environmental impact. The firm's 2024 Impact Report underscores this commitment, detailing how ESG considerations are woven into their operations and investment decisions across their entire network.

Apollo Global Management's ability to attract and retain top talent is paramount in the highly competitive global financial services landscape. Success hinges on securing skilled professionals for critical functions like deal sourcing, rigorous due diligence, effective portfolio management, and robust client relations. The firm actively cultivates an entrepreneurial growth mindset and prioritizes empowering its workforce to foster this talent.

In 2024, the financial services sector continues to grapple with talent shortages, particularly for specialized roles. For instance, a significant demand persists for professionals with expertise in private equity, credit analysis, and ESG integration, areas where Apollo is heavily invested. Firms like Apollo are increasingly focusing on competitive compensation packages, including performance-based bonuses and long-term incentives, alongside opportunities for career advancement and professional development to secure and keep these essential individuals.

Public Perception and Reputation of Private Equity

Public perception of private equity significantly shapes regulatory attitudes and investor confidence. Concerns about job displacement during restructurings or perceived wealth concentration can lead to stricter oversight. For instance, in 2024, surveys indicated a growing public unease regarding the impact of PE on employment in certain sectors, prompting discussions about enhanced disclosure requirements.

Apollo Global Management, like its peers, faces scrutiny regarding its societal contributions. Demonstrating positive impacts, such as investments in sustainable infrastructure or job growth within portfolio companies, is crucial for reputation management. In 2025, Apollo highlighted its commitment to ESG principles across its operations, aiming to counter negative stereotypes often associated with the industry.

- Public Opinion Trends: In 2024, a significant portion of the public expressed skepticism about private equity's role in corporate governance and its impact on workers, according to industry sentiment reports.

- Regulatory Scrutiny: The perceived lack of transparency in some private equity deals has led to calls for increased regulatory oversight, with proposed legislation in 2025 targeting disclosure standards.

- Reputation Management: Firms like Apollo are increasingly investing in corporate social responsibility initiatives and transparent reporting to build trust and mitigate reputational risks.

- Investor Relations: Positive public perception can translate into stronger investor relations, attracting capital from institutions and individuals who prioritize ethical and sustainable investment practices.

Shifting Investor Behavior Towards Private Markets

Investor sentiment is increasingly favoring private markets. Many are seeking diversification beyond traditional stocks and bonds, especially as public market valuations appear stretched. This shift is driven by the allure of potentially higher, uncorrelated returns that private equity, private credit, and real estate can offer.

Apollo Global Management, recognizing this trend, is actively expanding its presence in global wealth management channels. By forging strategic partnerships and integrating private assets into a wider array of investment vehicles, Apollo aims to capture this growing demand. For instance, by 2024, private markets are projected to represent a significant portion of institutional allocations, with some estimates suggesting over $15 trillion in assets under management globally by 2025.

- Increased Demand: Retail and institutional investors are allocating more capital to private markets for diversification.

- Return Potential: The search for yield in a low-interest-rate environment (though rates have risen) continues to drive interest in private assets.

- Apollo's Strategy: Apollo is enhancing its distribution networks to reach a broader investor base for its private market offerings.

- Market Growth: Global private market assets under management are expected to continue their upward trajectory, potentially exceeding $15 trillion by 2025.

Societal expectations for ethical conduct and transparency continue to grow, influencing how financial institutions operate and are perceived. Apollo Global Management is actively addressing this by enhancing its ESG reporting and community engagement initiatives, aiming to build trust and align with evolving public values.

The increasing demand for sustainable investment options presents a significant opportunity for firms like Apollo. By demonstrating a commitment to positive social and environmental impact, Apollo can attract a broader base of investors and stakeholders who prioritize these factors in their financial decisions.

Public perception of private equity remains a critical factor, with ongoing discussions about its impact on employment and economic inequality. Apollo's efforts to highlight job creation within its portfolio companies and its contributions to economic development are key to shaping a more favorable public narrative.

| Societal Factor | Impact on Apollo Global Management | 2024/2025 Data/Trend |

|---|---|---|

| Aging Population | Increased demand for retirement solutions (Athene). | Global population aged 65+ projected to reach nearly 1 in 6 by 2050. |

| ESG Awareness | Integration of ESG into investment strategies; reputational enhancement. | Apollo's 2024 Impact Report details ESG integration. |

| Talent Acquisition | Need for specialized financial professionals (PE, credit, ESG). | Ongoing talent shortages in specialized financial roles in 2024. |

| Public Perception of PE | Potential for increased regulatory scrutiny; need for reputation management. | Public skepticism regarding PE's impact on employment noted in 2024 sentiment reports. |

| Investor Preference | Growing interest in private markets for diversification and returns. | Private market AUM projected to exceed $15 trillion by 2025. |

Technological factors

Apollo Global Management is increasingly integrating advanced data analytics and artificial intelligence (AI) into its investment processes. This technological shift is crucial for improving how Apollo finds potential deals, performs thorough due diligence, and manages its existing investments more effectively. For instance, AI can sift through vast datasets to identify patterns and opportunities that human analysts might miss, streamlining the initial stages of investment.

By leveraging these sophisticated tools, Apollo aims to gain a significant competitive advantage in today's data-intensive financial markets. The firm is focusing on AI-driven insights to better understand market trends and predict future performance, which is vital for optimizing portfolio management. This adoption of technology is not just about efficiency; it's about making more informed, data-backed decisions to drive superior returns.

Cybersecurity risks are a paramount concern for Apollo Global Management, given its role as a financial institution handling extensive sensitive investor and proprietary data. The firm must maintain robust defenses against an ever-evolving threat landscape, which saw global cybercrime costs projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures.

Effective data protection and stringent cybersecurity protocols are not merely operational necessities but critical components for safeguarding assets, preserving client trust, and ensuring compliance with increasingly complex global data privacy regulations like GDPR and CCPA.

Apollo Global Management is actively championing the digital transformation of its portfolio companies. This strategic push aims to boost operational efficiencies, deepen customer engagement, and uncover novel revenue streams, ultimately enhancing the long-term value and market competitiveness of its investments.

For instance, in 2024, Apollo's commitment to technology is evident in its investments across various sectors. While specific portfolio company digital spend figures are often proprietary, the broader trend shows a significant increase in IT and software spending within private equity-backed firms, with many reporting efficiency gains exceeding 15% post-digitalization initiatives.

Blockchain and Asset Tokenization Potential

Blockchain technology and asset tokenization hold significant potential to reshape financial markets by enhancing liquidity and broadening access to alternative investments. Apollo Global Management might investigate these advancements for future fund designs and asset management innovations, particularly in making private credit a more liquid asset. For instance, the global tokenized assets market is projected to reach $16 trillion by 2030, indicating substantial growth and adoption potential.

The integration of blockchain could streamline processes, reduce transaction costs, and create new avenues for capital formation. Apollo's exploration in this area could lead to more efficient management of its diverse asset portfolio, including private equity and real estate. The increasing institutional interest in digital assets, with significant capital inflows observed throughout 2024, underscores the growing relevance of this technological shift.

Key areas for Apollo's potential engagement with blockchain and tokenization include:

- Increased Liquidity for Private Assets: Tokenizing illiquid assets like private debt or real estate could allow for fractional ownership and easier trading, thereby boosting market liquidity.

- Enhanced Operational Efficiency: Blockchain’s distributed ledger technology can automate and secure various financial operations, from settlement to compliance, reducing overhead for Apollo.

- New Investment Products: The technology enables the creation of innovative investment vehicles and strategies, potentially attracting a wider investor base to Apollo's offerings.

Investment in Technology-Driven Infrastructure

Apollo Global Management is making significant investments in technology-driven infrastructure, particularly data centers, acknowledging the substantial capital expenditure involved. This strategic move is part of their broader 'Global Industrial Renaissance' theme, aiming to benefit from the escalating need for digital infrastructure.

The financing for these large-scale projects is primarily sourced through Apollo's expertise in private credit and project finance. For instance, in 2024, Apollo committed billions to digital infrastructure projects, reflecting a growing trend in the alternative asset management sector. This investment strategy is designed to capture the long-term growth potential of digital transformation.

- Data Center Growth: The global data center market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, driven by cloud computing and AI.

- Apollo's Infrastructure Focus: Apollo manages over $60 billion in infrastructure assets, with a growing allocation towards digital infrastructure since 2022.

- Private Credit Role: Private credit funds are increasingly funding infrastructure projects, with total private debt raised for infrastructure exceeding $100 billion globally in 2023.

Technological advancements are reshaping Apollo's investment strategies, with AI and data analytics driving deal sourcing and due diligence. The firm is also actively promoting digital transformation within its portfolio companies to boost efficiency and competitiveness. Furthermore, emerging technologies like blockchain and asset tokenization present opportunities for increased liquidity and new investment products, with the tokenized assets market projected to hit $16 trillion by 2030.

Legal factors

Apollo Global Management, operating as a global alternative asset manager, navigates a complex web of evolving regulatory compliance requirements across numerous international jurisdictions. This necessitates a deep understanding and adherence to varying legal frameworks, impacting everything from fund structuring to investor disclosures.

The firm faces stringent reporting standards for its assets under management, investment performance metrics, and comprehensive risk management frameworks. For instance, in 2023, Apollo reported approximately $675 billion in assets under management, each segment subject to specific regulatory reporting. This demands robust internal controls and a commitment to transparency to meet the expectations of regulators and investors alike.

As Apollo Global Management continues its growth trajectory, particularly through strategic acquisitions like the announced $1.3 billion deal for Sun Life's U.S. annuity business in early 2024, it faces increasing scrutiny under anti-trust and competition laws globally. These regulations are designed to prevent market monopolization and ensure fair competition, impacting Apollo's ability to integrate new businesses and expand its service offerings.

The acquisition of Bridge Investment Group, for instance, required significant regulatory review, highlighting how competition authorities assess the combined market share and potential impact on pricing and innovation. Such approvals can influence deal structures and completion timelines, adding a layer of complexity to Apollo's expansion strategies as it navigates diverse legal frameworks across different jurisdictions.

Operating globally, Apollo Global Management must navigate a complex web of data privacy regulations. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict rules on how personal data is collected, processed, and stored.

Compliance is paramount for Apollo, especially when managing sensitive investor and client financial information. Failure to adhere to these regulations can lead to significant legal penalties and reputational damage. In 2023, fines under GDPR alone exceeded €1.5 billion across various sectors, highlighting the financial risks involved.

Legal Frameworks for Cross-Border Investments

Apollo Global Management’s global investment strategy necessitates a deep understanding of diverse legal frameworks governing cross-border transactions. This includes scrutiny of foreign investment review processes, adherence to capital controls, and navigating international tax treaties, all of which significantly impact deal structuring and execution. For instance, in 2024, many countries continued to refine their foreign direct investment (FDI) screening mechanisms, with a notable increase in reviews of technology and infrastructure deals, directly affecting Apollo’s potential acquisitions and partnerships.

Compliance with these intricate legal landscapes is paramount for Apollo’s international expansion and sustained profitability. Failure to adhere to regulations concerning repatriation of profits, intellectual property protection, or anti-corruption laws can lead to substantial fines, reputational damage, and the disruption of investment pipelines. The evolving nature of international trade law and sanctions regimes, particularly in light of geopolitical shifts observed throughout 2024 and into early 2025, demands continuous legal vigilance.

- Foreign Investment Reviews: Many nations, including the United States (CFIUS) and the European Union, intensified scrutiny of FDI in strategic sectors during 2024, impacting deal timelines and approval rates for large asset managers like Apollo.

- Capital Controls: Emerging markets, in particular, often maintain capital controls that can restrict the flow of funds in and out of the country, requiring careful planning for Apollo’s portfolio management and divestments.

- International Tax Treaties: The effective utilization of double taxation agreements and other tax treaties is critical for optimizing Apollo's global tax liabilities, with ongoing discussions in 2024-2025 around base erosion and profit shifting (BEPS) continuing to shape these frameworks.

Litigation and Legal Disputes

Apollo Global Management, like other major financial firms, navigates a landscape where litigation and legal disputes are an inherent risk. These can stem from various sources, including the complex nature of its investment activities, contractual obligations, and day-to-day operations. For instance, in 2023, Apollo, along with other private equity firms, faced scrutiny and potential legal challenges related to certain investment practices and disclosures, highlighting the ongoing need for robust legal risk management.

Effectively managing these legal challenges is paramount to safeguarding Apollo's financial health and its hard-earned reputation. The firm's ability to anticipate, address, and resolve legal matters directly impacts its operational continuity and investor confidence. For example, a significant legal settlement or adverse ruling could lead to substantial financial penalties and reputational damage, impacting future business opportunities.

- Litigation Exposure: Apollo faces potential lawsuits related to its diverse investment strategies, including private equity, credit, and real assets.

- Contractual Disputes: Disagreements arising from complex investment agreements, fund formation, or client relationships can lead to legal action.

- Regulatory Scrutiny: Increased regulatory oversight in the financial sector means Apollo must proactively manage compliance and potential disputes with governing bodies.

- Reputational Risk: Legal battles can negatively impact public perception and trust, affecting investor relations and talent acquisition.

Apollo Global Management must navigate evolving global legal frameworks, including intensified foreign investment reviews and capital controls, which impacted deal timelines and approvals throughout 2024. The firm's global operations also require adherence to diverse data privacy regulations like GDPR and CCPA, with significant penalties for non-compliance, as evidenced by over €1.5 billion in GDPR fines in 2023.

Antitrust and competition laws are increasingly relevant as Apollo pursues strategic acquisitions, such as its announced $1.3 billion deal for Sun Life's U.S. annuity business in early 2024, necessitating careful regulatory scrutiny. Furthermore, Apollo faces inherent litigation risks stemming from its complex investment activities and contractual obligations, with ongoing vigilance required to manage potential disputes and protect its reputation.

| Legal Factor | 2023/2024 Impact/Data Point | Implication for Apollo |

|---|---|---|

| Regulatory Compliance | Apollo reported $675 billion AUM in 2023, subject to diverse international regulations. | Requires robust internal controls and transparency to meet diverse jurisdictional requirements. |

| Antitrust Scrutiny | Announced $1.3 billion acquisition of Sun Life's U.S. annuity business in early 2024. | Increased oversight on market share and fair competition impacts integration and expansion strategies. |

| Data Privacy | GDPR fines exceeded €1.5 billion in 2023 across sectors. | Strict adherence to data privacy laws like GDPR and CCPA is crucial to avoid significant financial and reputational penalties. |

| Litigation Risk | Firms like Apollo faced scrutiny over investment practices in 2023. | Proactive legal risk management is essential to mitigate financial losses and maintain investor confidence. |

Environmental factors

Climate change presents significant risks to Apollo's real assets, including physical damage to properties from extreme weather events and transition risks arising from new environmental regulations. For instance, the increasing frequency of natural disasters in 2024 directly impacts the insurability and value of real estate holdings.

Conversely, these challenges create substantial opportunities, particularly in green infrastructure and renewable energy projects. Apollo's commitment to climate scenario analysis, as demonstrated by its focus on energy transition investments, positions it to capitalize on the growing demand for sustainable assets.

The firm actively incorporates environmental risk flagging into its investment decision-making processes. This proactive approach is crucial as global investment in green infrastructure is projected to reach trillions by 2030, offering a clear avenue for growth.

Apollo Global Management has strategically committed to significant investments in the energy transition and decarbonization efforts. The firm aims to deploy $30 billion in clean energy and climate transition solutions by 2025, with a further target of $100 billion by 2030. This ambitious capital allocation underscores Apollo's position as a key financial player supporting global decarbonization initiatives.

Apollo Global Management is intensifying its efforts to quantify and disclose its carbon footprint, encompassing Scope 1, 2, and increasingly, Scope 3 emissions. This focus reflects a broader industry trend toward greater environmental accountability.

The firm has set ambitious targets for carbon-neutral operations across Scope 1 and 2 emissions. This commitment is supported by the provision of more detailed Environmental, Social, and Governance (ESG) disclosures to its investors, underscoring Apollo's dedication to transparency in its sustainability initiatives.

Regulatory Pressure for Green Investments and Disclosure

Governments worldwide are intensifying their focus on climate-related financial risks, pushing institutions like Apollo Global Management to be more transparent. This means more demand for clear reporting on how climate change might impact investments. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations continue to gain traction, with many major economies aligning their regulatory frameworks with its guidance.

This growing regulatory pressure directly encourages Apollo to bolster its sustainable investing capabilities and improve its environmental, social, and governance (ESG) disclosures. As of early 2025, many large asset managers are reporting significant inflows into ESG-focused funds, reflecting investor demand driven partly by these regulatory shifts. Apollo’s strategic expansion into areas like renewable energy infrastructure and sustainable credit aligns with this trend, aiming to capture capital flowing towards greener opportunities.

- Increased Regulatory Scrutiny: Regulators are mandating greater disclosure of climate-related financial risks, impacting how firms like Apollo manage and report on their portfolios.

- Capital Allocation Shift: There's a clear directive for capital to be channeled into sustainable investments, creating opportunities and challenges for alternative asset managers.

- ESG Reporting Enhancement: Apollo is incentivized to improve its ESG data collection and reporting to meet evolving regulatory expectations and investor demands.

- Growth in Sustainable Finance: The global sustainable finance market is projected to continue its robust growth, with estimates suggesting trillions in assets under management by 2025-2026.

Resource Scarcity and Sustainable Resource Use

Growing concerns about resource scarcity, particularly in areas like water and critical minerals essential for technology and energy transitions, are reshaping investment landscapes. This scarcity directly influences opportunities within sectors dedicated to sustainable resource management and the development of circular economy models. Apollo Global Management, through its sustainable investing platform, actively targets investments in sustainable resource use, acknowledging the long-term value creation potential inherent in these forward-thinking approaches.

The increasing demand for resources, coupled with environmental pressures, highlights the strategic importance of efficient and responsible resource utilization. For instance, the International Energy Agency (IEA) projects that demand for critical minerals like lithium and cobalt, vital for electric vehicle batteries, could increase by over 40 times by 2040 under a net-zero emissions scenario. This trend underscores the financial sector's role in financing solutions that address these growing needs sustainably.

- Growing Demand: Projections indicate a significant surge in demand for critical minerals, essential for green technologies.

- Investment Focus: Apollo's strategy prioritizes investments in companies and projects focused on sustainable resource management.

- Circular Economy: The firm recognizes the financial benefits and resilience offered by circular economy principles in resource utilization.

- Value Creation: Sustainable resource use is identified as a key driver for long-term value creation in the current economic climate.

Apollo Global Management is strategically aligning its investments with global decarbonization efforts, targeting $30 billion in clean energy and climate transition solutions by 2025 and $100 billion by 2030.

The firm is enhancing its environmental, social, and governance (ESG) disclosures, driven by increasing regulatory scrutiny and investor demand for transparency on climate-related financial risks, with many economies adopting TCFD recommendations.

Growing concerns over resource scarcity, particularly for minerals crucial to green technologies, are shaping Apollo's investment focus towards sustainable resource management and circular economy models.

The demand for critical minerals like lithium and cobalt is projected to surge significantly by 2040, highlighting the financial sector's role in funding sustainable solutions for resource needs.

| Environmental Factor | Apollo's Strategy/Action | Key Data/Projection |

| Climate Change & Transition Risks | Investing in green infrastructure & renewable energy. Focus on energy transition. | Target of $30B in clean energy by 2025, $100B by 2030. |

| Regulatory Pressure & Disclosure | Improving ESG reporting, adopting TCFD recommendations. | Growing global alignment with TCFD guidance. |

| Resource Scarcity | Investing in sustainable resource management & circular economy. | Critical mineral demand (e.g., lithium, cobalt) could rise over 40x by 2040. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Apollo Global Management is built on a foundation of data from reputable financial news outlets, regulatory filings, and economic forecasting agencies. We integrate insights from governmental reports, industry-specific publications, and market research to ensure a comprehensive view of the macro-environmental landscape.