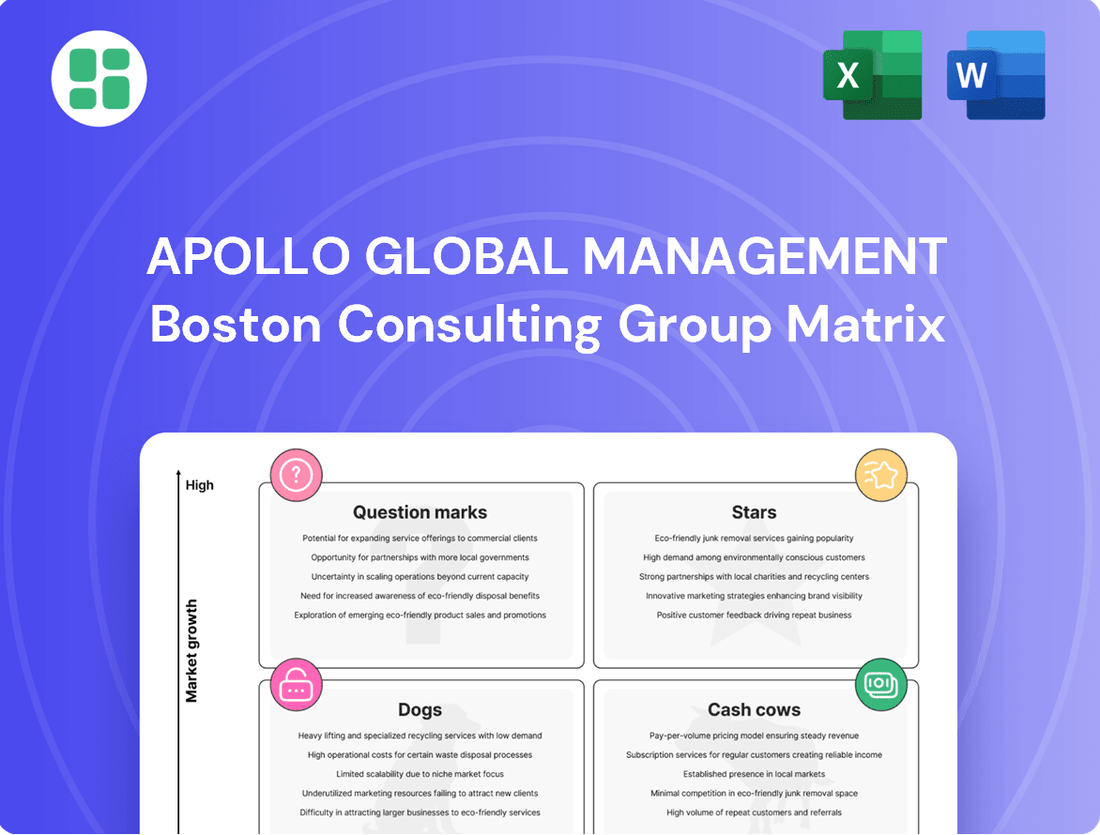

Apollo Global Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Global Management Bundle

Apollo Global Management's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for informed capital allocation and future growth initiatives.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Athene, Apollo's retirement services arm, has shown robust and steady expansion. Gross organic inflows saw a substantial increase, and earnings tied to investment spreads also grew considerably.

As of June 30, 2025, Athene represented a significant portion of Apollo's overall Assets Under Management (AUM) and its fee-generating AUM. This provides a reliable source of income through its perpetual capital structure.

With its leading position in annuity sales and this strong financial performance, Athene is clearly a high-growth, high-market-share player within Apollo's diverse business operations.

Apollo's direct origination in private credit is a major engine for growth, consistently producing significant deal volume and robust fund performance. This strategy, emphasizing proprietary deal sourcing, allows Apollo to capture attractive yields and maintain a strong position in a rapidly expanding market. The firm's ability to offer flexible financing solutions meets a growing need among borrowers, fueling its market share gains.

Apollo Global Management's Hybrid Value strategy is a key component, offering flexible capital solutions that have yielded impressive results. Over the past twelve months, this business segment has delivered robust returns, reflecting its strong investment performance.

This strategy addresses a significant and growing demand for innovative financing options for both companies and their shareholders. Its ability to provide tailored debt and equity capital across diverse market conditions positions it as a leading and expanding offering within Apollo's portfolio.

Global Wealth Channel Expansion

Apollo Global Management is actively broadening its global wealth distribution network, anticipating substantial organic capital inflows in the upcoming years. This strategic move is designed to capture a larger share of the burgeoning market for alternative investments among affluent individuals, thereby solidifying Apollo’s position in making private markets more accessible.

The significant capital accumulation from this channel underscores its robust growth trajectory and expanding market reach. For instance, by the end of 2023, Apollo reported a notable increase in its retail and high-net-worth investor base, contributing to a significant portion of its overall capital raises for the year.

- Global Wealth Channel Growth: Apollo’s expansion targets significant cumulative organic capital raises, leveraging the increasing demand for alternative investments from wealthy individuals.

- Market Positioning: The firm aims to be a leader in democratizing private markets by making these opportunities accessible to a broader affluent investor base.

- Capital Inflows: Substantial inflows demonstrate the channel's high growth potential and increasing penetration within the target demographic.

- 2023 Performance: Apollo saw a marked increase in its retail and high-net-worth investor base in 2023, a key driver of its capital raising success.

Infrastructure and Renewable Energy Investments

Apollo Global Management views infrastructure and renewable energy as key growth areas, fitting into the Stars category of the BCG Matrix due to their high market growth and Apollo's strong position. The firm has made significant moves, including acquiring Argo Infrastructure Partners, to bolster its capabilities in these capital-intensive sectors.

This strategic focus allows Apollo to tap into the substantial funding needs for the global energy transition and the expansion of digital infrastructure. In 2024, the global renewable energy market alone was projected to reach over $1.5 trillion, highlighting the immense opportunity.

- High Growth Potential: The renewable energy sector is experiencing rapid expansion, driven by climate initiatives and technological advancements.

- Capital Intensive Nature: Infrastructure projects, especially in renewables, require significant upfront investment, aligning with Apollo's expertise in credit and private equity.

- Strategic Acquisitions: The acquisition of Argo Infrastructure Partners in 2023, managing approximately $30 billion in assets, demonstrates Apollo's commitment to scaling its infrastructure platform.

- Demand for Sustainable Solutions: Increasing investor and societal demand for ESG-compliant and resilient infrastructure creates a favorable market environment.

Apollo's infrastructure and renewable energy investments are prime examples of its Stars within the BCG Matrix. These sectors boast high market growth, and Apollo has strategically positioned itself to capitalize on this, as evidenced by its acquisition of Argo Infrastructure Partners in 2023, which managed around $30 billion in assets.

The global renewable energy market's projected growth to over $1.5 trillion in 2024 underscores the immense potential. Apollo's focus on these capital-intensive areas aligns perfectly with its core strengths in credit and private equity, meeting the significant funding demands for the global energy transition and digital infrastructure expansion.

| Business Segment | BCG Category | Market Growth | Apollo's Position | Key Data Point |

|---|---|---|---|---|

| Infrastructure & Renewables | Star | High | Strong | Argo Infrastructure Partners acquisition (2023) |

| Global renewable energy market projected >$1.5 trillion (2024) | ||||

| Argo AUM: ~$30 billion |

What is included in the product

This BCG Matrix overview details Apollo Global Management's business units, classifying them by market share and growth potential to guide strategic resource allocation.

The Apollo Global Management BCG Matrix simplifies complex portfolios, easing the pain of strategic decision-making by clearly identifying growth opportunities and areas for divestment.

Cash Cows

Apollo's established private equity funds are true cash cows, boasting significant assets under management built over 30 years. These mature funds reliably generate management and performance fees, indicating a strong market position in a stable asset class.

While the growth rate for traditional private equity may not match newer ventures, these funds provide consistent, dependable earnings for Apollo. Their substantial historical performance further solidifies their role as reliable income generators.

Apollo's Core Credit Platform is a true cash cow, generating substantial and stable fee-related earnings. This broad and deep platform spans various credit strategies, from investment grade to non-investment grade, offering consistent revenue streams. As of the first quarter of 2024, Apollo reported approximately $671 billion in credit assets under management, highlighting its significant market share and the platform's role as a reliable capital generator.

Athene's legacy annuity business, a significant component of Apollo Global Management, functions as a classic cash cow within the BCG framework. Its established portfolio, particularly traditional annuities, consistently delivers predictable earnings through spread-related income and stable cash inflows.

This segment benefits from a conservative investment strategy, heavily weighted towards investment-grade assets, which ensures a robust and reliable stream of cash flow. The mature nature of these annuity products also means reduced promotional spending is required, leading to inherently high profit margins.

In 2024, Athene's annuity business continued to be a primary driver of Apollo's financial performance, contributing significantly to fee-related earnings and net investment income, underscoring its cash-generating capabilities.

Fee-Related Earnings (FRE) Base

Apollo's fee-related earnings (FRE) base is a cornerstone of its financial strength, demonstrating consistent year-over-year growth. This stability is primarily fueled by management fees generated from its substantial assets under management (AUM).

The firm boasts a robust FRE margin, a testament to its operational efficiency and the advantages of scale derived from its diverse asset management operations. In 2023, Apollo reported FRE of $1.7 billion, a significant increase from the previous year, highlighting this consistent income stream.

- Strong FRE Growth: Apollo's FRE has shown consistent expansion, providing a reliable revenue source.

- High FRE Margin: The firm maintains a healthy FRE margin, indicative of efficient operations and scale.

- AUM Driven: Management fees from a large and growing AUM are the primary drivers of this stable income.

- Financial Stability: This consistent earnings stream underpins Apollo's financial stability and capacity for strategic investments.

Perpetual Capital Vehicles

Perpetual capital vehicles represent a significant strength for Apollo Global Management, functioning as true cash cows within their business. These structures, characterized by their unlimited duration, provide a remarkably stable and predictable revenue stream, largely insulated from the cyclical nature of traditional fundraising. This stability is a key differentiator.

Apollo's commitment to these perpetual structures means a substantial portion of their fee-generating Assets Under Management (AUM) is locked in for the long haul. For instance, as of the first quarter of 2024, Apollo reported over $670 billion in AUM, with a growing emphasis on such long-term capital solutions.

- Perpetual Capital AUM: A substantial and growing segment of Apollo's total AUM.

- Stable Revenue: Generates consistent management fees without fundraising pressure.

- Reduced Capital Formation Costs: Less need for ongoing investor acquisition for these specific assets.

- Long-Term Focus: Aligns with Apollo's strategy of building enduring businesses.

Apollo's established private equity funds are true cash cows, boasting significant assets under management built over 30 years. These mature funds reliably generate management and performance fees, indicating a strong market position in a stable asset class. While the growth rate for traditional private equity may not match newer ventures, these funds provide consistent, dependable earnings for Apollo. Their substantial historical performance further solidifies their role as reliable income generators.

Apollo's Core Credit Platform is a true cash cow, generating substantial and stable fee-related earnings. This broad and deep platform spans various credit strategies, from investment grade to non-investment grade, offering consistent revenue streams. As of the first quarter of 2024, Apollo reported approximately $671 billion in credit assets under management, highlighting its significant market share and the platform's role as a reliable capital generator.

Athene's legacy annuity business, a significant component of Apollo Global Management, functions as a classic cash cow within the BCG framework. Its established portfolio, particularly traditional annuities, consistently delivers predictable earnings through spread-related income and stable cash inflows. This segment benefits from a conservative investment strategy, heavily weighted towards investment-grade assets, which ensures a robust and reliable stream of cash flow. The mature nature of these annuity products also means reduced promotional spending is required, leading to inherently high profit margins. In 2024, Athene's annuity business continued to be a primary driver of Apollo's financial performance, contributing significantly to fee-related earnings and net investment income, underscoring its cash-generating capabilities.

Perpetual capital vehicles represent a significant strength for Apollo Global Management, functioning as true cash cows within their business. These structures, characterized by their unlimited duration, provide a remarkably stable and predictable revenue stream, largely insulated from the cyclical nature of traditional fundraising. This stability is a key differentiator. Apollo's commitment to these perpetual structures means a substantial portion of their fee-generating Assets Under Management (AUM) is locked in for the long haul. For instance, as of the first quarter of 2024, Apollo reported over $670 billion in AUM, with a growing emphasis on such long-term capital solutions.

| Apollo Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Established Private Equity Funds | Cash Cow | Mature, stable, reliable fee generation | 30+ years of operation |

| Core Credit Platform | Cash Cow | Broad strategies, stable fee-related earnings | ~$671 billion AUM (Q1 2024) |

| Athene Annuity Business | Cash Cow | Predictable earnings, conservative investments, high margins | Significant contributor to FRE & Net Investment Income in 2024 |

| Perpetual Capital Vehicles | Cash Cow | Unlimited duration, stable revenue, long-term AUM | Growing emphasis on long-term capital solutions within ~$670 billion AUM (Q1 2024) |

Full Transparency, Always

Apollo Global Management BCG Matrix

The Apollo Global Management BCG Matrix you are previewing is the definitive, fully formatted report you will receive upon purchase. This comprehensive document, meticulously crafted for strategic insight, contains no watermarks or demo content and is ready for immediate application in your business planning.

Dogs

Certain niche or older funds within Apollo's diverse portfolio, particularly those focused on highly saturated or declining sub-markets, could be classified as dogs in the BCG matrix. These funds may face challenges in attracting new capital and generating competitive returns, leading to a low market share and minimal contribution to overall profitability.

For instance, a hypothetical legacy real estate debt fund struggling in a market facing oversupply and rising interest rates might represent such a dog. In 2024, Apollo's strategic review would likely assess if such a fund's assets under management (AUM) have stagnated or declined, perhaps falling below a certain threshold, and if its expense ratio significantly outweighs its generated income.

Legacy non-core holdings within Apollo Global Management's portfolio, if viewed through a BCG matrix lens, would likely fall into the 'dog' category. These are typically smaller, less strategic investments that no longer fit the firm's primary focus on high-growth sectors.

These assets often demand management attention without offering substantial upside, and they are not drawing significant new investment. For instance, if Apollo had a small stake in a mature, low-growth industrial company that doesn't align with its current private equity or credit strategies, it would fit this description.

By the end of 2023, Apollo managed $675 billion in assets, and while the majority is strategically aligned, a small portion could represent these legacy assets. Divesting such holdings can free up capital and management resources for more promising opportunities.

Segments of Apollo Global Management's business that focus on highly commoditized or overly competitive traditional investment strategies could be classified as dogs in a BCG matrix. These areas, while present, often yield very low profit margins and find it difficult to capture substantial market share due to intense competition. For instance, in 2024, certain traditional private equity or credit strategies might face this challenge, where differentiation is minimal and fees are pressured.

These dog-like segments, while not necessarily incurring losses, typically operate at or near breakeven points. They can also represent an inefficient use of capital, as the returns generated may not justify the investment required. In 2024, Apollo, like many large asset managers, continually evaluates its portfolio to identify and potentially divest or restructure such low-performing or capital-intensive business lines to reallocate resources more effectively.

Investments with Protracted Realization Cycles

Investments with protracted realization cycles, often found in older private equity or real asset portfolios, can be categorized as dogs within the BCG Matrix framework. These assets might have encountered unexpected headwinds, such as adverse market shifts or operational issues, which have significantly lengthened the time needed to liquidate them and diminished anticipated returns. For instance, a private equity fund launched in 2018 might still be holding onto a portfolio company in a declining industry, facing prolonged negotiations for a sale.

These assets can become a drain on management resources and capital, failing to generate the expected liquidity or profits. A prime example could be a real estate development project stalled by regulatory hurdles or construction delays, tying up significant capital. Apollo Global Management, like other alternative asset managers, must continually assess these situations.

- Extended Holding Periods: Investments held for over 7-10 years without a clear exit path.

- Underperforming Returns: Internal rates of return (IRRs) significantly below the fund’s target, potentially in the low single digits or negative.

- Capital Consumption: Ongoing capital calls for operational support or debt servicing without commensurate value creation.

- Market Mismatch: Assets in sectors experiencing structural decline or facing intense competition, making them difficult to sell at a favorable valuation.

Early-Stage Ventures with Stagnant Growth

Early-stage ventures that fail to gain market traction or demonstrate significant growth are categorized as Dogs within Apollo Global Management's BCG Matrix framework. These investments, despite initial promise, become cash traps if they consistently exhibit low market share and a lack of growth momentum. For instance, a hypothetical tech startup Apollo invested in during 2023, aiming to disrupt the smart home market, might be considered a Dog if its user adoption rates remained below 5% by mid-2024, significantly trailing competitors who have captured over 20% market share.

These ventures typically warrant an immediate review for potential exit strategies rather than continued capital infusion. The rationale is to cut losses and reallocate resources to more promising areas of the portfolio. For example, if a venture-backed company in the renewable energy sector, which received Series A funding in 2022, has not achieved its projected revenue targets for three consecutive quarters and its market share has plateaued at 2% by the end of 2024, it would likely be flagged for divestment.

- Stagnant Market Share: Ventures with less than 10% market share in their respective industries by 2024.

- Low Growth Rate: Companies experiencing an annual revenue growth rate below 5% in 2024.

- Negative Cash Flow: Investments consistently burning cash without a clear path to profitability within the next 18-24 months.

- Exit Consideration: A strategic review for sale or liquidation if turnaround prospects are deemed minimal.

Funds or business segments within Apollo Global Management that exhibit low market share and minimal growth potential are classified as Dogs in the BCG Matrix. These are typically mature or declining assets that offer little prospect for future returns and may even consume valuable resources. For instance, a legacy fund focused on a saturated market segment, with assets under management (AUM) that have stagnated or declined, would fit this description. By the end of 2023, Apollo managed $675 billion in AUM, and while the vast majority is strategically sound, a small portion could represent these less productive assets.

These 'dog' investments often require ongoing management attention without generating significant profits, representing an inefficient use of capital. For example, a hypothetical private equity investment in a declining retail sub-sector that has not seen substantial appreciation or cash flow generation by mid-2024 would be a prime candidate for this classification. Apollo's strategic reviews in 2024 would likely focus on identifying such underperformers to potentially divest or restructure.

The core issue with these 'dog' assets is their inability to compete effectively or adapt to changing market dynamics, leading to low profitability and limited strategic value. By the end of 2023, Apollo's focus remained on growth-oriented strategies, implying a continuous effort to prune less viable parts of its extensive portfolio. Identifying and addressing these 'dogs' is crucial for reallocating capital to higher-growth opportunities and maximizing overall portfolio performance.

| Category | Characteristics | Example within Apollo's Portfolio (Hypothetical) | 2024 Strategic Consideration |

| Dogs | Low Market Share, Low Growth Potential, Low Profitability | Legacy real estate debt fund in a saturated market; Small stake in a mature, low-growth industrial company. | Divestment, Restructuring, Capital Reallocation |

Question Marks

Apollo Global Management's strategic focus on emerging digital infrastructure, including data centers, positions them within a high-growth sector characterized by substantial future capital needs. For instance, the global data center market was valued at approximately $240 billion in 2023 and is projected to reach over $400 billion by 2028, indicating significant expansion potential.

Within this dynamic landscape, Apollo's investments in digital infrastructure can be viewed as question marks on the BCG Matrix. While the market itself exhibits strong growth prospects, Apollo's current market share and established dominance in this specific, rapidly evolving segment might still be in the early stages of development. These ventures require considerable capital deployment to achieve scale and secure a leading market position.

Apollo's recent strategic move to establish an office in Seoul, South Korea, and forge partnerships with local entities signals a clear intent to tap into promising, high-growth geographic markets. This expansion is a testament to their ambition to diversify and capture new opportunities beyond their traditional strongholds.

While these emerging markets present substantial growth potential, Apollo's initial market share is expected to be modest. The company will need to invest considerable resources and time to build brand recognition, cultivate local relationships, and understand the nuances of these new territories before achieving significant market penetration.

Apollo's foray into tokenized feeder funds and private credit ETFs signals a strategic move into burgeoning financial sectors. These offerings aim to tap into new investor pools and broaden market access, reflecting Apollo's adaptability in a dynamic financial environment.

While these innovative products are positioned in high-growth areas, their current market penetration is likely modest. For instance, the tokenization of assets is still in its early stages, with the global tokenized assets market projected to reach $5.5 trillion by 2027, according to a report by the Boston Consulting Group. This indicates substantial room for Apollo's initiatives to scale.

Significant marketing and investor education will be crucial for these products to achieve substantial scale and transition into market leaders. Their success will hinge on demonstrating value and navigating the regulatory landscape, a common challenge for novel financial instruments.

Strategic Acquisitions in New Verticals

Strategic acquisitions in new verticals, exemplified by Apollo's purchase of Bridge Investment Group, represent a classic "question mark" in the BCG matrix. These moves are designed for rapid expansion and capability enhancement, like bolstering Apollo's real estate equity platform and strengthening origination. The significant capital investment and strategic intent signal high potential for future growth, aiming to capture immediate scale in previously less-penetrated markets.

While these acquisitions are positioned for high growth, their success is not yet guaranteed, placing them firmly in the question mark category. The integration process and the realization of anticipated synergies are ongoing, meaning their ultimate market position and profitability remain uncertain. For instance, Apollo's acquisition of Bridge Investment Group, completed in early 2023 for approximately $1.1 billion, is a prime example of this strategy, aiming to leverage Bridge's expertise in residential rental strategies and its significant origination pipeline.

- Bridge Investment Group Acquisition: Apollo acquired Bridge Investment Group for roughly $1.1 billion in early 2023.

- Strategic Rationale: The move aimed to expand Apollo's real estate equity platform and enhance its origination capabilities.

- Question Mark Status: The long-term success and full synergy realization are still developing, making it a high-potential but unproven venture.

- Focus on Integration: Current efforts are concentrated on integrating Bridge's operations and realizing the expected benefits for Apollo's overall strategy.

Impact Investing Platform (AIM)

The Apollo Impact Mission (AIM) platform, part of Apollo Global Management, targets private equity-style investments aimed at generating significant social and environmental impact alongside financial returns. This segment of the impact investing market, while expanding rapidly, remains relatively new. For instance, the global impact investing market was estimated to be around $1.16 trillion in assets under management by the end of 2023, showcasing substantial growth potential.

Within this burgeoning market, AIM is positioned to capture share by offering structured, private equity-like opportunities. The platform’s success hinges on its ability to demonstrate a clear, repeatable model for achieving both financial performance and measurable impact outcomes. Continued strategic investment is crucial for AIM to solidify its market position and achieve the scale necessary to drive substantial change.

- Market Potential: The global impact investing market is experiencing robust growth, with assets projected to continue their upward trajectory.

- AIM's Position: As a player in a relatively nascent segment, AIM is focused on building its market share through a distinct value proposition.

- Investment Focus: The platform seeks private equity-like opportunities to deliver scalable social and environmental impact.

- Future Growth: Continued investment is essential for AIM to prove its model and achieve scale in the impact investing landscape.

Apollo's strategic investments in areas like digital infrastructure, tokenized assets, and impact investing are classic "question marks." These ventures operate in high-growth markets but require significant capital and time to establish market share and achieve profitability. For example, the global digital infrastructure market is expanding rapidly, with data centers alone projected to exceed $400 billion by 2028. Similarly, while the tokenized assets market is anticipated to reach $5.5 trillion by 2027, Apollo's current penetration in these nascent sectors is likely modest, necessitating ongoing investment to build scale and brand recognition.

| Investment Area | Market Growth Potential | Apollo's Current Market Share | Capital Needs | Strategic Outlook |

|---|---|---|---|---|

| Digital Infrastructure | High (e.g., Data Centers >$400B by 2028) | Developing/Low | Substantial | Focus on scaling and market penetration |

| Tokenized Assets & Private Credit ETFs | High (Tokenized Assets ~$5.5T by 2027) | Nascent/Low | Significant | Requires investor education and regulatory navigation |

| Impact Investing (AIM Platform) | Growing (>$1.16T AUM by 2023) | Emerging/Modest | Ongoing | Demonstrate repeatable impact and financial model |

BCG Matrix Data Sources

Our Apollo Global Management BCG Matrix draws from a robust blend of financial disclosures, industry-specific market research, and competitive landscape analysis to provide strategic clarity.