Apollo Global Management Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Global Management Bundle

Unlock the strategic blueprint of Apollo Global Management's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their operational prowess. Discover how they leverage key partnerships and activities to drive growth.

Partnerships

Apollo Global Management actively collaborates with a diverse range of co-investors, such as other institutional funds and high-net-worth individuals. This strategic pooling of capital is crucial for undertaking larger, more intricate transactions, effectively spreading risk and expanding their investment capabilities. For instance, in 2023, Apollo successfully raised over $10 billion for its flagship private equity fund, a significant portion of which was bolstered by co-investments from key partners, enabling them to pursue deals exceeding $500 million.

Apollo Global Management cultivates strategic alliances with major financial institutions, including banks and credit providers. These partnerships are fundamental for securing the substantial debt financing required for their acquisition activities and supporting the ongoing operations of their portfolio companies. For instance, in 2023, Apollo's credit funds, such as Apollo Origination Partnership, actively sourced capital from a diverse range of institutional lenders to fuel their investment strategies.

Apollo Global Management's collaboration with the management teams of its portfolio companies is a cornerstone of its business model. This partnership is crucial for driving value creation, with Apollo offering strategic guidance and operational expertise. For instance, in 2023, Apollo actively worked with management teams across its diverse portfolio to implement operational enhancements and growth strategies, contributing to the firm's overall performance.

Key Partnership 4

Apollo Global Management relies heavily on its relationships with investment banks, brokers, and advisors. These partnerships are crucial for identifying and securing new investment opportunities, often through proprietary deal flow that isn't publicly available. For instance, in 2024, Apollo continued to leverage these networks to source a significant portion of its deal pipeline, particularly in complex carve-outs and distressed situations.

These external partners bring specialized expertise essential for Apollo's success. Their knowledge in mergers and acquisitions, capital markets execution, and corporate restructuring allows Apollo to navigate intricate transactions efficiently. This collaboration ensures that deals are structured optimally and executed smoothly, minimizing risk and maximizing potential returns for Apollo and its investors.

- Deal Sourcing: Investment banks and brokers act as conduits for proprietary deal flow, providing Apollo with access to off-market opportunities.

- Transaction Execution: Advisors facilitate the complex processes involved in M&A, capital raising, and restructurings, ensuring efficient completion.

- Specialized Expertise: Partners offer deep knowledge in niche sectors or specific transaction types, enhancing Apollo's strategic capabilities.

- Market Access: These relationships provide Apollo with broader access to capital markets and potential co-investment partners.

Key Partnership 5

Apollo Global Management cultivates enduring alliances with a diverse array of service providers. These include esteemed legal firms, reputable accounting firms, and specialized consultants, all crucial for maintaining stringent compliance, executing rigorous due diligence, and embedding best operational practices across their portfolio.

These strategic collaborations offer indispensable, specialized expertise that supports every stage of the investment lifecycle, from initial sourcing and evaluation through to active management and eventual exit. For instance, in 2024, Apollo continued to leverage its network of top-tier legal counsel to navigate complex regulatory environments and structure sophisticated transactions, ensuring adherence to evolving global financial standards.

The firm's reliance on these external specialists underscores a commitment to operational excellence and risk mitigation. These partnerships are not merely transactional; they represent a foundational element in Apollo's ability to deliver consistent value and manage diverse investment strategies effectively.

- Legal Counsel: Essential for transaction structuring, regulatory compliance, and dispute resolution.

- Accounting Firms: Critical for financial reporting, audit, and tax advisory services.

- Consultants: Provide specialized expertise in areas such as operational improvement, market analysis, and strategic planning.

- Due Diligence Providers: Offer in-depth analysis of potential investments, covering financial, operational, and commercial aspects.

Apollo's key partnerships extend to co-investors, financial institutions providing debt financing, and the management teams of its portfolio companies. These collaborations are vital for capital pooling, deal execution, and value creation. In 2023, Apollo successfully raised over $10 billion for its flagship private equity fund, with significant co-investment support, and actively worked with portfolio company management to drive growth.

Furthermore, Apollo relies on investment banks, brokers, and advisors for deal sourcing and transaction execution, as well as specialized service providers like legal and accounting firms for due diligence and compliance. For instance, in 2024, Apollo leveraged its network of advisors to source a substantial portion of its deal pipeline and utilized top-tier legal counsel to navigate complex regulatory landscapes.

| Partner Type | Role | Example Contribution (2023-2024) |

|---|---|---|

| Co-investors | Capital Pooling, Risk Sharing | Supported over $10 billion raised for flagship PE fund (2023) |

| Financial Institutions | Debt Financing, Capital Markets Access | Provided substantial debt for acquisitions and portfolio operations |

| Portfolio Management Teams | Operational Enhancement, Growth Strategy | Implemented strategic initiatives across diverse portfolio companies |

| Investment Banks/Brokers | Deal Sourcing, Proprietary Flow | Crucial for sourcing a significant portion of the deal pipeline (2024) |

| Legal/Accounting Firms | Due Diligence, Compliance, Structuring | Ensured regulatory adherence and optimal transaction structuring |

What is included in the product

Apollo Global Management's business model focuses on providing alternative investment solutions to institutional clients, leveraging its expertise in credit, private equity, and real assets to generate attractive risk-adjusted returns.

This model is designed for institutional investors seeking diversified portfolios and capital appreciation, utilizing a robust global network and deep industry knowledge to identify and manage investments.

Apollo Global Management's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex investment strategies.

This allows stakeholders to quickly grasp core components, facilitating efficient decision-making and reducing the friction of understanding intricate financial operations.

Activities

Apollo Global Management's primary engine is its fund management and capital raising. This involves the intricate process of structuring, marketing, and successfully closing new investment funds across a diverse range of asset classes, from private equity to credit and real assets. This continuous cycle ensures a robust pipeline of capital ready to be deployed into promising new ventures and to sustain their existing portfolio companies.

In 2024, Apollo continued to demonstrate its prowess in capital raising, announcing significant milestones. For instance, their Hybrid Value strategy successfully closed at $1.6 billion, exceeding its initial target. This highlights their ability to attract substantial investor commitments, a crucial element for their investment strategy.

Apollo Global Management's key activities center on investment sourcing and rigorous due diligence. This involves actively identifying, evaluating, and thoroughly vetting potential investment opportunities across various sectors. This meticulous process is designed to ensure every potential investment aligns perfectly with Apollo's overarching strategy and defined risk parameters, ultimately aiming to maximize the likelihood of strong financial returns.

In 2024, Apollo continued to demonstrate robust activity in this area. For instance, their credit segment, a significant driver of their business, saw continued deployment of capital into opportunistic credit investments, capitalizing on evolving market conditions. The firm's ability to source and execute complex deals, often in challenging economic environments, underscores the effectiveness of their due diligence framework.

Active portfolio management is central to Apollo's strategy, focusing on hands-on engagement to boost the performance of their investments. This involves implementing strategic plans, streamlining operations, and optimizing financial structures. For instance, in 2023, Apollo's credit segment saw significant growth, with assets under management reaching $357 billion, reflecting successful value creation initiatives.

Value creation initiatives are meticulously designed to unlock the full potential of acquired companies and assets. This encompasses strategic planning, operational enhancements, financial restructuring, and crucial talent management to foster sustainable growth and profitability. Apollo's commitment to these activities is evident in their consistent returns across various market cycles.

Key Activitie 4

Risk management and compliance are paramount, involving constant monitoring and mitigation of financial, operational, and regulatory risks across Apollo Global Management's diverse portfolio of funds and investments. This diligent oversight is crucial for maintaining investor trust and safeguarding the firm's reputation.

Adherence to stringent compliance standards is not just a regulatory necessity but a core strategic activity. For instance, in 2024, the financial services industry, including firms like Apollo, continued to navigate a complex regulatory landscape, with significant focus on areas like ESG (Environmental, Social, and Governance) compliance and data privacy, which directly impact operational risk and investor relations.

- Continuous Risk Assessment: Regularly evaluating market volatility, credit risk, and liquidity across all investment vehicles.

- Regulatory Adherence: Ensuring full compliance with evolving global financial regulations, such as those from the SEC and other international bodies.

- Internal Controls: Implementing robust internal policies and procedures to prevent fraud and operational errors.

- Compliance Training: Providing ongoing education to employees on ethical conduct and regulatory requirements.

Key Activitie 5

Investor relations and reporting are critical for maintaining trust and transparency with Apollo's extensive investor network. This involves delivering clear, consistent updates on fund performance, economic forecasts, and the firm's strategic direction to limited partners.

Key activities include:

- Regular Performance Reporting: Providing detailed reports on fund returns and portfolio company progress to limited partners, ensuring they are well-informed about their investments.

- Market and Strategy Updates: Communicating Apollo's perspective on market trends and outlining strategic initiatives to manage investor expectations and foster confidence.

- Investor Communications: Engaging with investors through various channels, including annual meetings, quarterly calls, and direct outreach, to address inquiries and build strong relationships.

- Capital Raising Support: Facilitating new capital inflows by effectively communicating Apollo's value proposition and investment strategy to prospective investors.

As of the first quarter of 2024, Apollo managed approximately $671 billion in assets under management, a testament to the strong relationships built through diligent investor relations.

Apollo's key activities also encompass strategic partnerships and business development. This involves identifying and cultivating relationships with other financial institutions, corporations, and intermediaries to expand their reach and access new investment opportunities. These collaborations are vital for sourcing deals and co-investing.

In 2024, Apollo continued to expand its strategic footprint. A notable development was the deepening of their relationship with Athene, their retirement services business, which saw significant capital inflows and strategic alignment. This highlights their focus on synergistic growth and long-term value creation through strategic alliances.

Technology and data analytics are increasingly central to Apollo's operations, driving efficiency and informed decision-making. This includes leveraging advanced tools for deal sourcing, portfolio monitoring, and risk assessment. The firm invests in sophisticated platforms to enhance its analytical capabilities and maintain a competitive edge.

In 2024, Apollo's commitment to technological advancement was evident in their continued investment in data infrastructure and AI-driven insights. This focus aims to optimize investment strategies and operational processes, ensuring they can effectively navigate complex market dynamics and deliver superior returns.

Apollo Global Management's key activities revolve around robust fund management and continuous capital raising across diverse asset classes. They excel in structuring and marketing investment funds, ensuring a steady flow of capital for deployment. This core function is supported by meticulous investment sourcing and rigorous due diligence processes, where potential opportunities are thoroughly vetted to align with their strategic objectives and risk parameters.

| Key Activity | Description | 2024 Highlight/Data |

| Fund Management & Capital Raising | Structuring, marketing, and closing investment funds; attracting investor commitments. | Hybrid Value strategy closed at $1.6 billion, exceeding target. |

| Investment Sourcing & Due Diligence | Identifying, evaluating, and vetting potential investment opportunities. | Continued deployment of capital in opportunistic credit investments. |

| Active Portfolio Management | Hands-on engagement to improve investment performance through strategic plans and operational enhancements. | Assets under management in credit segment reached $357 billion in 2023, showing successful value creation. |

| Value Creation Initiatives | Unlocking potential of acquired companies via strategic planning, operational improvements, and financial restructuring. | Consistent returns across various market cycles demonstrate effectiveness. |

| Risk Management & Compliance | Monitoring and mitigating financial, operational, and regulatory risks; adhering to global standards. | Navigating complex regulatory landscape, including ESG and data privacy compliance. |

| Investor Relations & Reporting | Maintaining transparency and trust with investors through performance updates and strategic communications. | Managed approximately $671 billion in AUM as of Q1 2024, reflecting strong relationships. |

| Strategic Partnerships & Business Development | Cultivating relationships with institutions and corporations for deal sourcing and co-investment. | Deepened relationship with Athene, seeing significant capital inflows. |

| Technology & Data Analytics | Leveraging advanced tools for deal sourcing, portfolio monitoring, and risk assessment. | Continued investment in data infrastructure and AI-driven insights. |

Delivered as Displayed

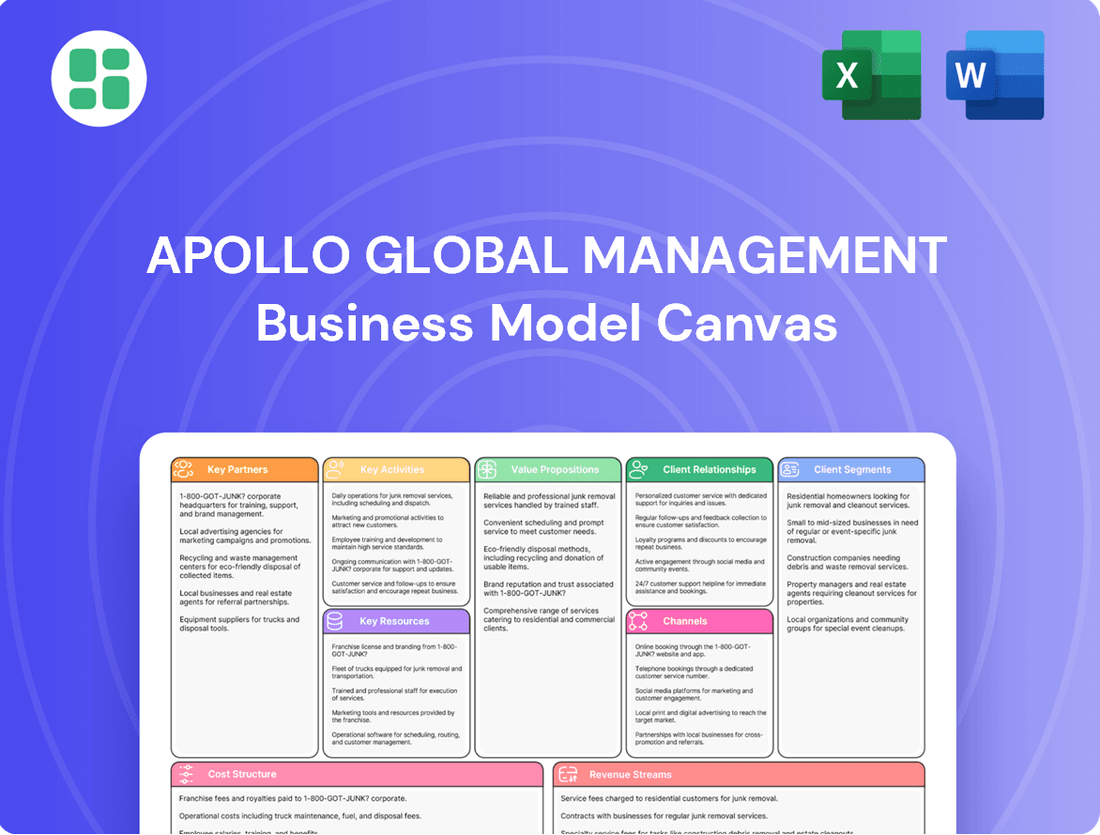

Business Model Canvas

The Apollo Global Management Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This ensures complete transparency, showcasing the full structure and content that will be delivered. You can be confident that the professional layout and detailed information presented here are precisely what you will gain access to, ready for immediate use and customization.

Resources

Apollo Global Management's most crucial resource is its human capital, a deeply experienced team of investment professionals, sector specialists, and operational experts. This collective expertise is fundamental to their success in sourcing deals, conducting thorough due diligence, and actively creating value within their investments, ultimately driving superior returns.

As of the first quarter of 2024, Apollo managed approximately $671 billion in assets. This significant AUM is a direct testament to the trust placed in their highly skilled professionals who navigate complex markets and identify promising investment opportunities across various sectors.

Apollo Global Management's key resource is its substantial financial capital, fueled by a diverse investor base. As of the first quarter of 2024, Apollo reported approximately $671 billion in assets under management (AUM). This vast capital pool grants Apollo the scale and flexibility to pursue significant and intricate investment opportunities across various sectors.

Apollo Global Management's proprietary deal flow and extensive global network are vital key resources, granting access to exclusive investment opportunities. This network, cultivated over years through strong relationships with businesses, advisors, and industry experts, is fundamental to their strategy.

In 2024, Apollo continued to leverage this network, demonstrating its effectiveness in sourcing unique deals. The firm's ability to tap into off-market opportunities, often driven by these deep relationships, is a significant competitive advantage in the alternative asset management space.

Key Resource 4

Apollo Global Management's brand reputation and history of delivering robust, risk-adjusted returns are critical intangible assets. This strong track record acts as a magnet, drawing in both investor capital and high-quality investment prospects, solidifying Apollo's standing in the market.

This reputation directly influences their ability to attract and retain both limited partners and talented investment professionals. For instance, Apollo's Assets Under Management (AUM) reached approximately $671 billion as of March 31, 2024, demonstrating significant investor confidence.

- Brand Reputation: Apollo is recognized for its deep industry expertise and successful deployment of capital across various economic cycles.

- Track Record: The firm has consistently generated strong risk-adjusted returns, a key differentiator in the competitive alternative asset management space.

- Investor Attraction: This performance history is crucial for raising capital for new funds and mandates, as evidenced by their substantial AUM growth.

- Opportunity Sourcing: A strong reputation also enables Apollo to access more attractive investment opportunities that may not be available to less established firms.

Key Resource 5

Apollo Global Management's robust technological infrastructure and advanced data analytics are critical to its success. These capabilities empower sophisticated analysis of market trends, portfolio performance, and potential investment targets, directly supporting informed investment decision-making and effective risk management. In 2024, the firm continued to invest heavily in these areas, recognizing their role in driving operational efficiency and identifying alpha.

These technological assets enable Apollo to process vast datasets, uncovering insights that might otherwise remain hidden. This allows for more precise valuation models, including discounted cash flow (DCF) analyses, and a deeper understanding of macroeconomic factors influencing potential investments.

- Data Analytics: Utilized for identifying undervalued assets and optimizing portfolio allocation.

- Technological Infrastructure: Supports real-time market monitoring and rapid deal execution.

- Risk Management Tools: Employed to stress-test portfolios against various economic scenarios.

- Proprietary Platforms: Enhance operational efficiency across all business segments.

Apollo Global Management's key resources include its skilled workforce, substantial financial capital, and proprietary deal flow. The firm's extensive network and strong brand reputation are also crucial intangible assets. Furthermore, their advanced technological infrastructure and data analytics capabilities provide a significant competitive edge.

| Resource Category | Key Components | Significance |

| Human Capital | Investment professionals, sector specialists, operational experts | Deal sourcing, due diligence, value creation |

| Financial Capital | Assets Under Management (AUM) | Scale and flexibility for investments; $671 billion as of Q1 2024 |

| Networks & Deal Flow | Global network, proprietary deal sourcing | Access to exclusive and off-market opportunities |

| Intangible Assets | Brand reputation, track record of returns | Attracts capital and investment prospects |

| Technology & Data | Advanced analytics, technological infrastructure | Informed decision-making, risk management, operational efficiency |

Value Propositions

Apollo provides investors with crucial access to a wide array of alternative asset classes. This includes private equity, various credit strategies, and real assets, which often exhibit lower correlation to traditional public markets.

This strategic diversification is key to helping investors potentially achieve improved portfolio returns while simultaneously reducing overall volatility. For instance, as of the first quarter of 2024, Apollo managed approximately $671 billion in assets, a significant portion of which is allocated to these diversifying alternative strategies, demonstrating the scale of their offering.

Apollo Global Management offers investors compelling risk-adjusted returns by combining a rigorous investment methodology with specialized industry knowledge and hands-on strategies to enhance asset value. This approach is designed to consistently outperform across different economic environments.

In 2024, Apollo's commitment to active value creation was evident, with their credit strategies, for instance, continuing to navigate complex markets by focusing on resilient sectors. Their diversified platform aims to provide stable, above-market performance for their limited partners.

Apollo Global Management provides companies and projects with substantial capital and strategic resources to fuel growth, navigate restructuring, and address special situations. This encompasses offering adaptable financing options, expert operational advice, and leveraging an extensive network of industry connections to unlock value and drive success.

In 2024, Apollo continued its strategy of deploying capital across various sectors, demonstrating its commitment to supporting businesses through complex financial landscapes. For instance, their private equity funds actively seek opportunities to partner with management teams, providing not just capital but also operational expertise to enhance performance.

Value Proposition 4

Apollo Global Management excels by providing deep expertise in complex, often illiquid markets. This allows them to skillfully navigate intricate deal structures and challenging distressed situations, ultimately unlocking hidden value for their investors.

Their specialized knowledge is a key differentiator, enabling Apollo to pinpoint and capitalize on opportunities that might be missed by less experienced or specialized firms. This proactive approach to identifying overlooked potential is central to their value proposition.

For instance, in 2024, Apollo continued to demonstrate this strength, particularly in sectors undergoing significant transformation. Their ability to manage risk in these environments is a testament to their deep understanding of market dynamics and asset management. The firm reported significant gains in its private equity and credit segments, reflecting successful execution in these complex areas.

- Unlocking Value in Illiquid Markets: Apollo's proven ability to generate returns from assets that are difficult to trade or value.

- Expertise in Distressed Situations: A core competency in identifying and restructuring underperforming companies or assets.

- Specialized Deal Structuring: Crafting unique financial solutions tailored to complex transactions and challenging market conditions.

- Opportunity Identification: Leveraging proprietary research and deep industry knowledge to find undervalued or overlooked investment prospects.

Value Proposition 5

Apollo Global Management prioritizes transparency and dedicated investor service as key value propositions. This means limited partners receive clear, timely, and comprehensive reporting on their investments, fostering trust and strong, long-term relationships.

In 2024, Apollo continued to emphasize its commitment to investor relations. For instance, the firm reported significant growth in its assets under management, reaching over $670 billion by the end of Q1 2024, a testament to the confidence its investors place in its transparent reporting and service model.

- Clear Reporting: Providing detailed and easily understandable updates on fund performance and strategy.

- Timely Communication: Ensuring investors receive information promptly to facilitate informed decision-making.

- Dedicated Service: Offering personalized support and access to Apollo's investment professionals.

- Relationship Building: Cultivating trust through consistent and open communication with limited partners.

Apollo Global Management offers investors access to alternative assets, aiming for better portfolio returns and reduced volatility. Their extensive management of approximately $671 billion in assets as of Q1 2024 underscores their significant presence in these diversifying strategies.

The firm's value proposition centers on delivering strong risk-adjusted returns through specialized knowledge and active value creation. In 2024, Apollo's credit strategies, for example, focused on resilient sectors, aiming for stable performance.

Apollo provides companies with capital and strategic resources for growth and restructuring, demonstrating adaptability. Their private equity funds actively partner with management teams, offering capital and operational expertise, as seen in their 2024 sector deployments.

Apollo's deep expertise in complex, illiquid markets allows them to excel in challenging situations, unlocking value. Their 2024 performance in private equity and credit segments reflects successful navigation of intricate market dynamics and risk management.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Access to Alternative Assets | Provides investors entry into private equity, credit, and real assets. | Significant portion of $671B AUM (Q1 2024) allocated to these strategies. |

| Risk-Adjusted Returns | Combines rigorous methodology with specialized knowledge for enhanced asset value. | Focus on resilient sectors in credit strategies for stable performance. |

| Capital and Strategic Resources | Offers substantial capital and operational advice to companies. | Active partnerships with management teams in private equity. |

| Expertise in Complex Markets | Skillfully navigates illiquid markets and distressed situations. | Demonstrated strength in transforming sectors and managing risk. |

Customer Relationships

Apollo cultivates deep, enduring advisory connections with its institutional clients, such as pension funds, endowments, and sovereign wealth funds. These relationships are founded on a bedrock of trust, a track record of consistent performance, and customized communication strategies designed to address the unique requirements of each investor.

Apollo Global Management cultivates direct and personalized engagement with its clients. Dedicated investor relations teams offer bespoke updates and strategic discussions, ensuring investors feel valued and thoroughly informed about their capital's performance and deployment.

This approach is critical, especially as Apollo managed approximately $671 billion in assets as of March 31, 2024. Such a substantial asset base necessitates a high degree of trust and transparency, which Apollo fosters through its personalized relationship management.

Performance-based relationships are the bedrock of Apollo Global Management's investor engagement. The firm's success hinges on its capacity to deliver superior financial returns, which directly influences its reputation and its ability to attract and retain capital for future investment vehicles. For instance, Apollo's assets under management (AUM) grew to approximately $671 billion as of the first quarter of 2024, a testament to the trust investors place in its performance-driven approach.

The intrinsic link between Apollo's financial outcomes and its standing is undeniable. When Apollo consistently generates strong returns, it not only validates its investment strategies but also strengthens its appeal to a broader investor base, including institutional investors and sovereign wealth funds. This focus on tangible results cultivates long-term partnerships built on mutual financial success.

Customer Relationship 4

Apollo Global Management cultivates robust customer relationships through a commitment to transparency and consistent, detailed reporting. Investors receive regular updates on fund performance, insights into the progress of portfolio companies, and analyses of prevailing market conditions. This open dialogue is crucial for building trust and solidifying long-term partnerships.

For instance, in 2024, Apollo continued its practice of providing quarterly investor reports, often exceeding regulatory requirements. These reports typically include granular data on asset allocation, realized and unrealized gains, and specific operational improvements within their portfolio companies. This level of detail aims to empower investors with a clear understanding of where their capital is deployed and the strategies driving returns.

- Regular Investor Updates: Providing comprehensive quarterly and annual reports detailing fund performance and market outlook.

- Portfolio Company Transparency: Sharing key developments and operational improvements within companies held in their investment portfolios.

- Open Communication Channels: Maintaining accessible lines of communication for investor inquiries and feedback.

- Performance Benchmarking: Clearly illustrating how Apollo's funds perform against relevant industry benchmarks.

Customer Relationship 5

Apollo Global Management fosters deep, collaborative relationships with its portfolio companies, moving beyond a purely transactional capital provider role. They actively engage as strategic advisors, working closely with management teams to drive value creation and ensure sustainable long-term growth.

This partnership model is designed for mutual benefit, focusing on enhancing operational efficiency, pursuing strategic growth initiatives, and ultimately maximizing the success of the businesses within their investment portfolio. For instance, in 2023, Apollo's private equity segment saw significant value creation across its holdings through targeted operational improvements and strategic acquisitions.

- Strategic Partnerships: Apollo acts as a strategic partner, not just a financier, for its portfolio companies.

- Value Creation Focus: The relationship emphasizes collaborative efforts to create long-term value for the underlying businesses.

- Operational Enhancement: Apollo provides expertise and resources to improve operational performance and drive growth.

- Long-Term Success: The goal is to ensure the sustained success and profitability of the companies they invest in.

Apollo's customer relationships are built on a foundation of trust, transparency, and consistent performance, particularly with its institutional clients like pension funds and endowments. The firm prioritizes bespoke communication and detailed reporting, ensuring investors are well-informed about their capital's deployment and performance.

As of March 31, 2024, Apollo managed approximately $671 billion in assets, underscoring the critical need for strong, reliable relationships. This substantial AUM growth reflects investor confidence in Apollo's performance-driven approach, which is further solidified by their commitment to clear, regular updates and open dialogue.

Apollo also cultivates deep partnerships with its portfolio companies, acting as strategic advisors to drive value creation. This collaborative model focuses on operational enhancements and long-term growth, as evidenced by value creation in its private equity segment during 2023.

| Relationship Type | Key Engagement Strategy | 2024 Data/Context |

|---|---|---|

| Institutional Investors | Trust, consistent performance, customized communication | Managed ~$671 billion AUM as of Q1 2024 |

| Portfolio Companies | Strategic advisory, operational enhancement, value creation | Focus on long-term growth and profitability |

| Reporting & Transparency | Detailed quarterly reports, open communication channels | Exceeding regulatory requirements with granular data |

Channels

Apollo Global Management's direct sales and investor relations teams are crucial channels for connecting with institutional investors. These teams actively engage through global meetings, presentations, and roadshows, fostering personalized communication and strong relationships. In 2023, Apollo's assets under management reached $671 billion, highlighting the scale of their investor base and the importance of these direct interactions.

Apollo Global Management actively participates in major financial industry conferences like the Milken Institute Global Conference and the SALT Conference. These events are vital for networking with institutional investors, potential limited partners, and industry peers, fostering relationships that can lead to new capital commitments.

These forums allow Apollo to present its investment strategies and performance, directly engaging with a wide audience of sophisticated investors. In 2023, for instance, Apollo's leadership frequently spoke at these high-profile gatherings, highlighting their focus on private credit and opportunistic investments, which resonated with attendees seeking alternative yield opportunities.

Apollo Global Management leverages proprietary online investor portals and digital communication platforms as a key channel for engaging with its limited partners. These secure, efficient platforms are crucial for distributing essential documents like fund reports, performance updates, and market analysis.

This digital infrastructure ensures that investors receive timely and accessible information, fostering transparency and strengthening relationships. For instance, in 2024, Apollo reported significant growth in assets under management, underscoring the importance of these channels in communicating value to a growing investor base.

Channel 4

Strategic partnerships with placement agents and wealth management firms are key indirect channels for Apollo. These collaborations allow Apollo to tap into existing client bases, effectively extending its market reach to high-net-worth individuals and smaller institutional investors who might not be directly solicited. This approach leverages the established trust and networks of these financial intermediaries.

These partnerships are crucial for accessing a segment of the market that values personalized advice and curated investment opportunities. For instance, by working with wealth managers, Apollo can offer its alternative investment products to a broader audience of affluent clients. In 2023, the global wealth management industry saw significant growth, with assets under management in alternative investments by high-net-worth individuals continuing to climb, indicating a strong demand that these channels can help fulfill.

- Placement Agents: Facilitate access to institutional investors and family offices.

- Wealth Management Firms: Provide access to high-net-worth individuals and their assets.

- Expanded Market Reach: Effectively broadens Apollo's investor base without direct solicitation.

- Leveraged Networks: Utilizes established relationships and trust built by partners.

Channel 5

Channel 5 encompasses Apollo's extensive media relations and thought leadership efforts. These include publishing white papers, market commentaries, and securing interviews to boost brand visibility and attract potential investors.

This strategic communication approach positions Apollo as a prominent voice in the alternative asset management sector. For instance, as of Q1 2024, Apollo reported $671 billion in assets under management, underscoring the importance of effectively communicating their expertise to a broad audience.

- Brand Visibility: Utilizing media and content to increase recognition.

- Investor Attraction: Engaging potential investors through insightful commentary.

- Thought Leadership: Establishing Apollo as a leading expert in alternative assets.

- Market Influence: Shaping perceptions and attracting capital through consistent, high-quality content.

Apollo Global Management utilizes a multi-faceted channel strategy to reach its diverse investor base, from large institutions to high-net-worth individuals. Direct engagement through sales teams and investor relations is paramount for nurturing relationships with key institutional clients.

Conferences and digital platforms serve as vital conduits for broader outreach and information dissemination, ensuring transparency and accessibility for all partners. Strategic alliances with financial intermediaries further amplify Apollo's market presence, tapping into established networks.

Thought leadership and robust media relations solidify Apollo's brand reputation and attract new capital by showcasing expertise. This integrated approach ensures effective communication across all investor segments.

| Channel Type | Key Activities | Investor Segment | 2023/2024 Data Point |

|---|---|---|---|

| Direct Sales & Investor Relations | Global meetings, presentations, roadshows | Institutional Investors | Assets Under Management (AUM) reached $671 billion in 2023 |

| Industry Conferences | Networking, strategy presentations | Institutional Investors, Peers | Active participation in Milken, SALT Conferences |

| Digital Platforms | Investor portals, secure document distribution | Limited Partners (LPs) | Significant AUM growth reported in 2024 |

| Strategic Partnerships | Placement agents, wealth managers | HNI, Smaller Institutions | Growth in HNW alternative investment demand |

| Media & Thought Leadership | White papers, market commentary, interviews | Broad Investor Base | AUM of $671 billion as of Q1 2024 |

Customer Segments

Pension funds are a cornerstone customer for Apollo Global Management, entrusting the firm with substantial assets to secure the financial futures of their beneficiaries. These institutions are particularly drawn to Apollo's expertise in alternative investments, seeking the potential for enhanced yields and diversification beyond traditional markets. In 2024, pension funds continued to allocate significant capital towards private equity and credit strategies, aiming to outpace inflation and meet their actuarial obligations.

Sovereign wealth funds represent a crucial customer segment for Apollo Global Management. These entities, managing national reserves, are actively looking to diversify their portfolios and achieve sustained capital growth. In 2023, sovereign wealth funds globally saw significant inflows, with some estimates suggesting allocations exceeding $9 trillion, underscoring their substantial investment capacity and strategic importance.

These funds typically possess substantial capital to deploy, making them ideal partners for Apollo's large-scale, strategic investment initiatives. Their long-term investment horizons align perfectly with Apollo's focus on generating enduring value across various asset classes, from private equity to credit and real assets.

University endowments and charitable foundations are key clients for Apollo Global Management, seeking to grow their capital for long-term educational and philanthropic goals. These institutions, often managing billions, prioritize capital preservation alongside steady growth, looking for diversified investment strategies that align with their enduring missions.

In 2024, Apollo's alternative asset management, a significant draw for such clients, saw continued strong performance across various strategies. For instance, their private equity funds have historically delivered competitive returns, with many endowments allocating substantial portions of their portfolios to these illiquid, high-growth opportunities.

Customer Segment 4

High-net-worth individuals and family offices are a key customer segment for Apollo Global Management, as they increasingly look for ways to diversify their portfolios beyond traditional stocks and bonds. These sophisticated investors are drawn to alternative investments like private equity, credit, and real assets, seeking potentially higher returns and lower correlation to public markets.

Apollo provides these clients with specialized access to strategies and opportunities that are typically only available to large institutional investors. This includes bespoke solutions and the ability to invest in complex, illiquid assets that can offer significant upside potential.

- Growing Demand: In 2024, the global wealth management industry saw continued strong demand from high-net-worth individuals for alternative investment solutions, with assets under management in private markets for this segment projected to grow significantly.

- Tailored Solutions: Apollo's ability to structure customized investment vehicles and provide direct access to its proprietary investment strategies is a major draw for family offices seeking personalized wealth management.

- Institutional-Grade Access: By offering access to the same sophisticated strategies used by pension funds and endowments, Apollo democratizes opportunities previously out of reach for many individual investors.

- Performance Focus: These clients are driven by the potential for enhanced returns, making Apollo's track record and expertise in generating alpha through alternative asset classes particularly attractive.

Customer Segment 5

Apollo Global Management serves corporations and private companies needing capital for expansion, mergers, or financial overhauls. These businesses are the core of Apollo's investment strategy, representing the underlying assets that drive returns.

For instance, in 2023, Apollo's private equity segment deployed significant capital across various industries, supporting companies undergoing strategic transformations. Their ability to provide not just funding but also operational expertise makes them a valuable partner for these entities.

- Strategic Financing: Apollo offers tailored debt and equity solutions to meet specific corporate needs.

- Operational Support: They bring expertise to enhance efficiency and drive growth within portfolio companies.

- Acquisition Capital: Apollo facilitates mergers and acquisitions by providing the necessary financial backing.

- Restructuring Expertise: They assist companies in navigating complex financial challenges and reorganizations.

Apollo Global Management caters to a diverse client base, including institutional investors like pension funds and sovereign wealth funds, who seek robust returns through alternative investments. University endowments and charitable foundations also rely on Apollo for capital growth to support their long-term missions.

Furthermore, high-net-worth individuals and family offices are a significant segment, attracted by Apollo's access to sophisticated, less correlated investment strategies. The firm also partners with corporations and private companies, providing essential capital for growth and strategic financial maneuvers.

In 2024, the demand for alternative assets remained strong across these segments, with Apollo's expertise in private equity, credit, and real assets proving particularly valuable. For instance, global pension fund allocations to private markets were projected to continue their upward trend, seeking yield enhancement and diversification.

| Customer Segment | Key Motivations | 2024 Trend/Data Point |

|---|---|---|

| Pension Funds | Enhanced yields, diversification, actuarial obligations | Continued significant capital allocation to private equity and credit strategies. |

| Sovereign Wealth Funds | Portfolio diversification, sustained capital growth | Substantial investment capacity, managing over $9 trillion globally in 2023. |

| Endowments & Foundations | Capital preservation, steady growth, mission alignment | Strong performance in Apollo's alternative asset management, attracting significant endowment allocations. |

| High-Net-Worth Individuals & Family Offices | Portfolio diversification, higher potential returns | Growing demand for alternative investment solutions, with projected significant growth in private market assets. |

| Corporations & Private Companies | Expansion capital, M&A financing, financial overhauls | Significant capital deployment in 2023 by Apollo's private equity segment to support company transformations. |

Cost Structure

Employee compensation and benefits are the primary expense for Apollo Global Management. This includes salaries, bonuses, and carried interest for their investment professionals and support staff, reflecting the high demand for talent in the alternative asset sector. For instance, in 2023, Apollo reported total compensation and benefits expenses of $3.6 billion, a significant portion of their overall operating costs.

General and administrative expenses are a core component of Apollo Global Management's cost structure. These encompass essential operational costs such as office rent across its global locations, utilities to power these facilities, and the robust IT infrastructure required for managing complex financial operations and data. Back-office support, including human resources and legal services, also falls under this category.

These administrative outlays are fundamental to maintaining Apollo's extensive global presence and supporting its substantial workforce. For instance, in 2023, Apollo reported $1.1 billion in compensation and benefits, a significant portion of which would be tied to administrative and support functions, underscoring the scale of these necessary expenditures.

Apollo Global Management's cost structure heavily features deal-related expenses. These include significant outlays for due diligence, legal counsel, and advisory services crucial for evaluating and closing investment opportunities. Financing costs also form a substantial part of this category, directly impacting the profitability of each transaction.

4

Apollo Global Management's cost structure heavily relies on expenses associated with attracting and retaining capital. These include significant outlays for marketing, investor relations, and fundraising activities. These costs are crucial for maintaining relationships with existing limited partners and drawing in new investors.

The firm allocates resources to roadshows, industry conferences, and the creation of comprehensive marketing materials. These efforts are designed to showcase Apollo's investment strategies and performance to a global investor base.

- Marketing and Investor Relations: Costs incurred for roadshows, conferences, and marketing collateral aimed at attracting new capital and nurturing existing LP relationships.

- Fundraising Expenses: Direct costs associated with the process of raising new funds, including legal and administrative fees.

- Personnel Costs: Significant investment in a highly skilled workforce, including investment professionals, investor relations teams, and support staff.

- Operational Expenses: General administrative costs, technology investments, and compliance-related expenditures necessary for managing a global alternative asset management business.

5

Apollo Global Management's cost structure heavily features investments in technology and data infrastructure. These are not just operational expenses but strategic imperatives, fueling their competitive edge. For instance, in 2023, Apollo announced significant upgrades to its data analytics capabilities, aiming to leverage AI and machine learning for more precise investment sourcing and risk assessment.

These advancements are crucial for maintaining a sophisticated approach to asset management. The company is channeling resources into building and maintaining advanced analytics platforms, robust cybersecurity measures to protect sensitive data, and efficient operational systems. These investments are designed to directly enhance their investment decision-making processes and overall operational efficiency.

- Technology Investments: Growing expenditure on sophisticated analytics platforms and AI for investment insights.

- Cybersecurity: Increased spending to safeguard proprietary data and client information.

- Operational Systems: Costs associated with enhancing efficiency and scalability of back-office functions.

- Competitive Advantage: These expenditures are directly linked to maintaining and expanding Apollo's market position.

Apollo Global Management's cost structure is dominated by personnel expenses, reflecting the specialized talent required in alternative asset management. In 2023, compensation and benefits reached $3.6 billion, highlighting the significant investment in their investment professionals and support staff.

General and administrative costs, including office leases, utilities, and IT infrastructure, are substantial. These operational necessities support Apollo's global footprint and workforce, with $1.1 billion in compensation and benefits in 2023 likely encompassing many of these administrative functions.

Deal-related expenses, such as due diligence, legal fees, and financing costs, are critical to Apollo's transaction-driven model. Technology investments, including advanced analytics and AI, are also a growing component, crucial for maintaining a competitive edge in sourcing and assessing investments.

| Expense Category | 2023 Actuals (USD Billions) | Significance |

|---|---|---|

| Compensation and Benefits | 3.6 | Primary driver, reflecting talent costs. |

| General & Administrative | 1.1 (Estimated portion of total compensation) | Supports global operations and infrastructure. |

| Deal-Related Expenses | Variable | Essential for transaction execution. |

| Technology Investments | Growing | Fuels competitive advantage through data and AI. |

Revenue Streams

Management fees, typically a percentage of assets under management (AUM), form a stable and recurring revenue stream for Apollo. These fees are charged regardless of fund performance and cover operational costs of the firm. As of the first quarter of 2024, Apollo reported $671 billion in AUM, indicating a substantial base for these fee-based revenues.

Performance fees, often called carried interest, are a crucial revenue source for Apollo, earned when their investment funds surpass a predetermined performance threshold. This income directly reflects the firm's ability to generate superior returns for its investors.

For instance, in the first quarter of 2024, Apollo reported significant inflows from its flagship funds, indicating strong performance and the potential for substantial carried interest in the coming periods. This fee structure aligns Apollo's interests with those of its limited partners, incentivizing successful value creation.

Transaction fees represent a significant revenue driver for Apollo Global Management. These fees encompass advisory services provided during the origination, structuring, and execution of deals, typically earned on a per-transaction basis.

The variability of these fees is directly tied to the volume and complexity of Apollo's deal-making activities. For instance, in 2023, Apollo reported significant growth in its fee-related earnings, partly driven by a robust pipeline of transactions across its various investment strategies.

Revenue Stream 4

Apollo Global Management generates revenue through capital markets and credit fees. These fees arise from arranging financing for their portfolio companies and executing various credit strategies. For instance, in 2023, Apollo's fee-related earnings, which encompass these activities, reached $2.5 billion, demonstrating the significance of this revenue stream.

These fees can take several forms, including origination fees charged when new debt or equity is issued, syndication fees for distributing those securities to other investors, and other service charges related to their credit operations. This diversified approach to fee generation highlights Apollo's active role in facilitating capital for its investments.

Key components of this revenue stream include:

- Origination Fees: Charged for structuring and placing new debt or equity financing.

- Syndication Fees: Earned from distributing financing packages to a wider group of investors.

- Servicing and Advisory Fees: Related to ongoing management and strategic guidance for credit investments.

- Transaction Fees: Associated with specific credit-related deals and restructurings.

Revenue Stream 5

Beyond its primary fee-based income, Apollo Global Management also generates revenue from its own co-investments. These proprietary investments, where Apollo allocates its capital alongside its funds, can yield significant returns. For instance, in 2024, the firm actively participated in several large co-investment opportunities across its credit and private equity segments, contributing to overall profitability.

Specialized advisory services represent another avenue for revenue. Apollo may charge fees for providing distinct strategic or operational guidance to its portfolio companies or even to external third parties. These engagements, while less consistent than management fees, can be substantial, particularly when they involve complex restructuring or carve-out transactions.

- Co-Investment Income: Apollo's direct allocation of its own capital into investment opportunities alongside its managed funds.

- Advisory Fees: Fees earned from providing specialized strategic or operational advice to portfolio companies or external clients.

- Portfolio Company Services: Income derived from services rendered to companies within its investment portfolio, such as transaction advisory or operational support.

Apollo Global Management's revenue streams are diverse, encompassing management fees, performance fees, transaction fees, capital markets and credit fees, co-investment income, and specialized advisory services. These multiple avenues allow the firm to generate income across various market conditions and investment cycles.

Management fees, calculated as a percentage of assets under management (AUM), provide a stable, recurring revenue base. Performance fees, or carried interest, are earned when investment funds exceed specific return targets, directly linking Apollo's compensation to successful value creation. Transaction fees are generated from deal origination, structuring, and execution, reflecting the firm's active deal-making.

Capital markets and credit fees arise from arranging financing and executing credit strategies, while co-investment income comes from Apollo's direct allocation of its own capital. Specialized advisory services offer additional revenue through strategic and operational guidance.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Management Fees | Percentage of AUM | $671 billion AUM (Q1 2024) |

| Performance Fees | Carried interest on fund outperformance | Significant inflows reported in Q1 2024 |

| Transaction Fees | Advisory on deal origination/structuring | Robust pipeline driving fee-related earnings growth in 2023 |

| Capital Markets & Credit Fees | Financing and credit strategy execution | $2.5 billion in fee-related earnings in 2023 |

| Co-Investment Income | Apollo's direct capital allocation | Active participation in large opportunities in 2024 |

| Specialized Advisory Services | Strategic/operational guidance | Substantial fees from complex transactions |

Business Model Canvas Data Sources

The Apollo Global Management Business Model Canvas is informed by extensive financial statements, regulatory filings, and investor relations data. These sources provide a deep understanding of the firm's operational performance and strategic direction.