Apollo Global Management Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Global Management Bundle

Apollo Global Management operates in a dynamic financial landscape shaped by intense rivalry and significant buyer power. Understanding the underlying forces is crucial for strategic planning.

The complete report reveals the real forces shaping Apollo Global Management’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The alternative asset management industry, where Apollo Global Management operates, is intensely competitive for top-tier talent. Highly skilled investment managers, analysts, and deal-sourcers are in short supply. This scarcity, driven by high demand across the sector, grants these professionals considerable leverage when negotiating compensation and benefits packages.

Apollo, like its peers, faces significant pressure to attract and retain these essential individuals. In 2023, the average compensation for a senior investment professional at a major alternative asset firm could easily exceed $1 million, including base salary, bonuses, and carried interest, reflecting the high stakes and specialized skills required. This intense competition for human capital directly impacts Apollo's operational costs and its ability to execute its investment strategies effectively.

Sophisticated capital providers, such as large pension funds and sovereign wealth funds, exert considerable influence. These Limited Partners (LPs) are essentially supplying the investable capital, and their substantial commitments give them leverage. In 2024, institutional investors continued to be a dominant force in private markets, often dictating terms for fund allocations.

Their ability to allocate billions means they can negotiate for more favorable fee structures, demand co-investment rights, and insist on enhanced transparency from asset managers like Apollo. This bargaining power indirectly shapes the operational landscape for firms managing these vast pools of capital.

Apollo Global Management, a major player in alternative asset management, depends heavily on specialized data and technology providers. These firms offer critical tools for research, risk assessment, and streamlining operations, essential for Apollo's investment strategies. For instance, the demand for sophisticated AI-driven analytics platforms in finance surged in 2024, with market research indicating a significant increase in spending by asset managers on such technologies.

The bargaining power of these specialized providers can be considerable, particularly when their solutions are unique or deeply embedded within Apollo's existing infrastructure. If a particular data set or analytical software is proprietary and difficult to replicate, the provider can command higher prices or more favorable terms. This is especially true as the complexity of financial markets continues to grow, necessitating ever more advanced technological support.

Legal and Advisory Services

The bargaining power of suppliers in legal and advisory services for firms like Apollo Global Management is significant. These specialized professionals, including top law firms and accounting giants, command high fees due to their critical role in navigating complex regulations and executing large-scale transactions within alternative investments.

The demand for highly specialized expertise in areas like private equity, credit, and real estate means that a limited pool of top-tier advisors exists. This scarcity, coupled with the high stakes of Apollo's operations, grants these service providers considerable leverage in setting terms and pricing.

- High Demand for Niche Expertise: Firms with proven track records in alternative asset structuring and compliance are in high demand.

- Critical Transactional Support: Legal and advisory services are indispensable for due diligence, deal structuring, and regulatory approvals, making their absence a significant risk.

- Reputational Capital: Leading advisory firms lend credibility to Apollo's deals, a factor that enhances their own bargaining position.

- Limited Alternatives for Top-Tier Services: While many legal and accounting firms exist, only a select few possess the deep, sector-specific knowledge required by major alternative asset managers.

Deal Origination Networks

Apollo Global Management's reliance on deal origination networks means these external sources can wield significant bargaining power. If these networks control access to unique or highly desirable investment opportunities, they can dictate terms, impacting Apollo's ability to secure attractive assets. Maintaining strong relationships with these intermediaries is therefore paramount for consistent deal flow.

The power of these "suppliers" of deal flow is amplified when they possess proprietary information or exclusive access to assets not widely available. For instance, specialized boutique investment banks or individual brokers with deep industry connections might command higher fees or preferential treatment for bringing prime deals to Apollo. This dynamic underscores the importance of Apollo's proactive relationship management.

- Deal Origination Networks: External sources of investment opportunities can act as powerful suppliers.

- Access to Unique Assets: Control over exclusive or highly sought-after deals enhances supplier bargaining power.

- Relationship Management: Apollo's ability to maintain strong ties with intermediaries is critical for securing deal flow.

- Intermediary Fees: Specialized networks may leverage their access to negotiate higher fees or better terms.

Apollo Global Management, like other alternative asset managers, faces significant bargaining power from specialized technology and data providers. The increasing reliance on advanced analytics and AI platforms means that firms offering unique or deeply integrated solutions can command premium pricing. For example, spending on financial analytics software by asset managers saw a notable increase in 2024, driven by the need for sophisticated market insights.

This dependence on proprietary technology grants these suppliers leverage, especially when their offerings are difficult to replicate or are essential for Apollo's operational efficiency. The cost of these specialized services directly impacts Apollo's overhead and its ability to maintain a competitive edge in a data-intensive industry.

Legal and advisory firms also exert considerable bargaining power due to their specialized expertise in complex financial transactions and regulatory environments. Top-tier law firms and accounting giants charge substantial fees, reflecting the critical nature of their services in areas like private equity and credit structuring. The limited pool of advisors with deep sector-specific knowledge further amplifies their negotiating position.

The bargaining power of suppliers in the context of Apollo Global Management is evident in the fees charged by specialized technology providers and elite legal/advisory firms. These entities often control unique data sets or offer indispensable expertise, allowing them to set higher prices and terms. For instance, the demand for AI-driven financial analytics surged in 2024, increasing the leverage of providers in this niche.

What is included in the product

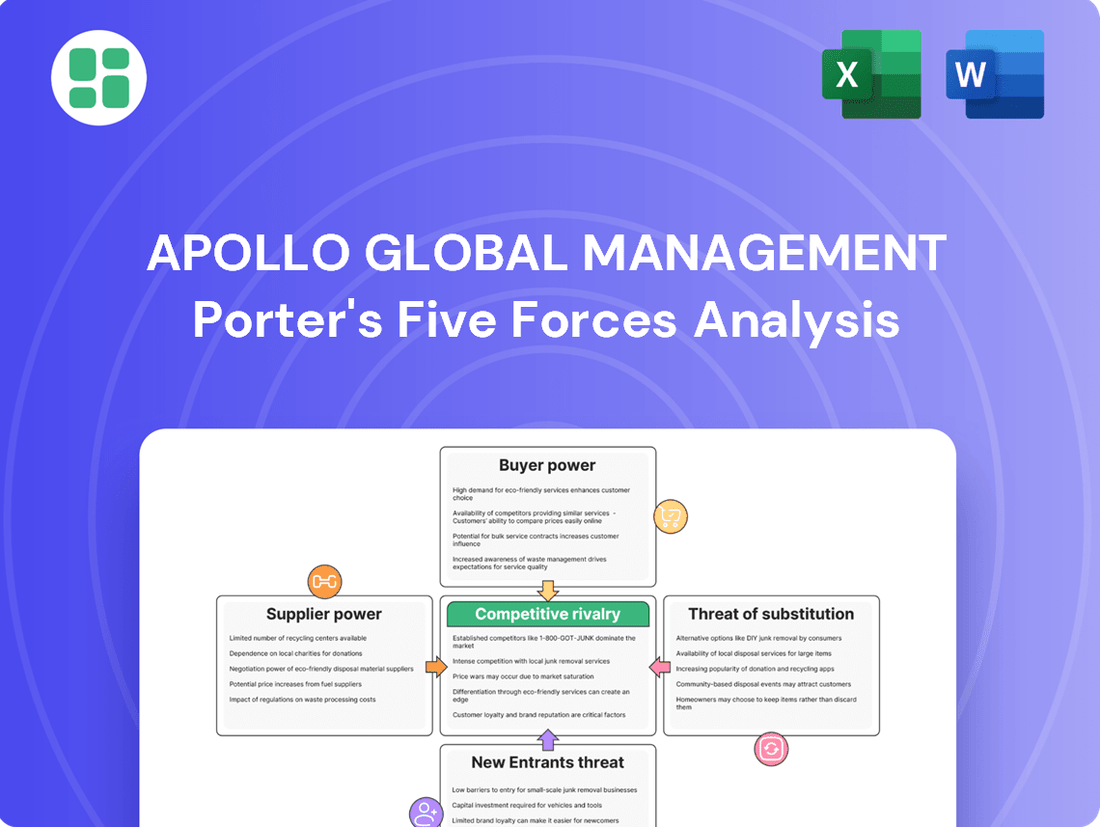

This analysis dissects the competitive forces shaping Apollo Global Management's operating environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify competitive pressures and opportunities within Apollo Global Management's investment landscape, enabling more informed strategic allocation.

Customers Bargaining Power

Apollo Global Management's Limited Partners (LPs) are a formidable force due to their concentration and sophistication. These are not individual investors; they are major institutions like pension funds, university endowments, and sovereign wealth funds, often managing billions of dollars. For instance, as of the first quarter of 2024, Apollo reported approximately $671 billion in assets under management, a significant portion of which comes from these large LPs.

The sheer scale of capital these LPs control gives them considerable leverage. They conduct rigorous due diligence, scrutinizing Apollo's investment strategies, performance history, and fee structures. This deep understanding means they can negotiate favorable terms, including lower management fees and improved transparency, directly impacting Apollo's profitability and operational flexibility.

Limited Partners (LPs) possess significant bargaining power due to the sheer volume of alternative investment options available. In 2024, LPs continue to have a vast menu of choices, ranging from other prominent alternative asset managers like Blackstone and KKR to direct investments, co-investments, and even traditional public markets. This extensive competitive environment empowers LPs to demand more favorable terms from Apollo Global Management.

Investor allocations to alternative asset managers like Apollo are heavily influenced by past performance. Funds that consistently achieve strong risk-adjusted returns tend to attract more capital. For instance, in 2023, private equity funds that outperformed their benchmarks saw significant inflows, while those lagging experienced capital outflows, demonstrating LPs' power to demand superior results.

Increased LP Scrutiny and Demands for Transparency

Limited partners (LPs) are increasingly demanding greater transparency from fund managers like Apollo Global Management. This heightened scrutiny covers everything from management fees and carried interest to the nitty-gritty of underlying portfolio performance. In 2024, this trend has accelerated, with LPs leveraging their collective capital to push for more detailed disclosures and robust governance structures.

This push for transparency isn't just about wanting more information; it's a direct response to evolving regulatory landscapes and the growing sophistication of institutional investors. As LPs become more adept at analyzing fund operations and performance metrics, they are better positioned to negotiate terms and influence fund structures, effectively amplifying their bargaining power.

- Fee Transparency: LPs are demanding clearer breakdowns of all fees charged, including management fees, performance fees, and any other operational expenses.

- Carried Interest Clarity: Detailed explanations of how carried interest is calculated and distributed are now standard requests.

- Portfolio Performance Reporting: Investors expect more granular data on individual portfolio company performance, not just aggregate fund returns.

- Governance and Control: LPs are seeking greater input into fund governance and decision-making processes, giving them more leverage.

Switching Costs (Moderately Low for Large LPs)

While limited partners (LPs) do face some initial due diligence and administrative expenses when considering a change in fund managers or diversifying their portfolios, these costs are typically not prohibitive for large institutional investors. For instance, a 2024 industry survey indicated that while due diligence can add 2-5% to initial investment costs, this is often absorbed within the broader portfolio management budget.

The long-term commitment periods inherent in private fund investments, often spanning 7-10 years, do create a degree of "stickiness." However, the primary driver for LPs remains the pursuit of superior risk-adjusted returns and strategic diversification. This fundamental objective frequently empowers them to absorb or mitigate switching costs, thereby retaining significant flexibility in their investment decisions.

Consequently, the bargaining power of customers, specifically LPs in the context of Apollo Global Management, is considered moderately low due to these manageable switching costs. LPs can and do shift allocations if performance or strategic alignment falters, but the inertia and transaction costs, while present, do not represent an insurmountable barrier.

- Switching Costs: Generally manageable for large institutional investors, often representing a small percentage of initial investment.

- LP Objectives: Pursuit of optimal returns and diversification are key drivers that can outweigh switching costs.

- Flexibility: LPs retain considerable flexibility to reallocate capital based on performance and strategic fit.

The bargaining power of Apollo Global Management's customers, primarily its Limited Partners (LPs), is a significant factor. These sophisticated investors, including large pension funds and endowments, manage vast sums and possess the knowledge to negotiate favorable terms, impacting Apollo's profitability through fee structures and performance demands.

LPs' ability to shift capital to numerous alternative investment managers, or even public markets, in 2024 gives them considerable leverage. Their focus on strong, risk-adjusted returns means they can easily reallocate funds away from underperforming managers, as evidenced by capital flows in 2023 which favored top-tier private equity funds.

| Factor | Description | Impact on Apollo |

| Concentration & Sophistication | LPs are large institutions with deep analytical capabilities. | Enables negotiation of lower fees and better terms. |

| Availability of Alternatives | Numerous competing investment managers and strategies exist. | Increases LP leverage to demand superior performance and terms. |

| Performance Sensitivity | LPs actively shift capital based on past and expected returns. | Pressures Apollo to consistently deliver top-tier, risk-adjusted results. |

| Transparency Demands | LPs require detailed reporting on fees, carried interest, and portfolio performance. | Increases operational complexity and can impact net returns if not managed efficiently. |

Full Version Awaits

Apollo Global Management Porter's Five Forces Analysis

This preview showcases the detailed Porter's Five Forces analysis for Apollo Global Management, offering a comprehensive examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring no discrepancies or placeholder content.

Rivalry Among Competitors

The alternative asset management landscape is a battleground of global titans. Firms like Blackstone, KKR, Carlyle Group, and Ares Management are constantly vying for the same lucrative investment deals and investor dollars. These established players command immense capital and sophisticated strategies, making the competition incredibly fierce.

In 2023, for instance, Blackstone reported over $1 trillion in assets under management, a testament to its scale and reach. Similarly, KKR and Carlyle also manage hundreds of billions, allowing them to pursue large-scale transactions and outbid rivals. This concentration of resources among a few dominant firms intensifies the rivalry for attractive opportunities.

Apollo Global Management operates in a highly competitive landscape, where securing attractive investment opportunities, known as deal flow, and raising capital from a limited number of institutional investors are paramount. This intense rivalry forces firms to differentiate themselves through strong historical performance, specialized investment strategies, favorable fund terms, and robust investor relationships. For instance, in 2024, the private equity industry saw a significant increase in capital raised by firms, with Apollo itself being a major player, highlighting the ongoing battle for investor mandates.

Apollo Global Management, like many in its sector, faces intense competition due to a significant overlap in core asset classes such as private equity, private credit, and real assets. This means that many firms are vying for the same investment opportunities, often with similar strategies.

This product and strategy overlap inherently creates price pressure. For instance, in 2024, the average management fee for private equity funds remained around 2%, with performance fees (carried interest) typically at 20%, a standard benchmark that intensifies competition on deal sourcing and value creation rather than fee structures.

To stand out, firms like Apollo must differentiate themselves. This differentiation often comes through unique investment strategies, deep operational expertise that can truly enhance portfolio companies, or exclusive access to specialized markets or deal flow, which are crucial in a crowded landscape.

Importance of Reputation and Track Record

Apollo Global Management's competitive rivalry is significantly shaped by the paramount importance of reputation and track record. A strong brand, built over years of consistent performance, acts as a powerful magnet for both capital allocators and top-tier talent. This emphasis means firms like Apollo are constantly vying to showcase superior returns, a pursuit that fuels intense competition within the alternative asset management sector.

The ability to attract significant investor capital is directly tied to a firm's historical success. For instance, by the end of 2023, Apollo managed approximately $675 billion in assets, a testament to the trust built through its investment strategies. This scale allows for greater operational efficiencies and deal-making capabilities, further differentiating successful firms from their rivals.

- Brand Strength: Apollo's established brand name is a key differentiator, attracting both limited partners and deal flow.

- Track Record: Consistent generation of alpha and superior risk-adjusted returns are crucial for maintaining competitive positioning.

- Talent Acquisition: A strong reputation is vital for attracting and retaining experienced investment professionals, a critical asset in this industry.

- Investor Confidence: Apollo's $675 billion in AUM as of year-end 2023 underscores the market's confidence in its long-term performance capabilities.

Global Expansion and Diversification

Leading alternative asset managers like Apollo are aggressively pursuing global expansion, aiming to tap into new growth markets and diversify their offerings beyond traditional private equity. This includes significant pushes into private credit, infrastructure, and wealth management solutions. For instance, Apollo's AUM reached $675 billion as of the first quarter of 2024, reflecting this growth trajectory.

This strategic move intensifies competition, as firms like Apollo now vie for deals and investor capital not only within established markets but also in emerging economies and across a broader spectrum of asset classes. The increased overlap in target markets and investor bases naturally heightens the rivalry among major players.

- Global Reach: Firms are establishing offices and investment platforms in key regions worldwide.

- Asset Class Diversification: Expansion into private credit, infrastructure, and real estate broadens competitive arenas.

- Investor Base Competition: Increased overlap in targeting institutional and retail investors globally.

- Talent Acquisition: Competition for skilled professionals across different geographies and specializations is also intensifying.

The competitive rivalry within alternative asset management is fierce, with firms like Apollo Global Management constantly battling for investor capital and attractive deals. This intense competition is driven by a significant overlap in strategies and target asset classes among major players. Firms must differentiate themselves through strong track records, specialized expertise, and robust investor relationships to succeed.

Apollo's $675 billion in assets under management as of Q1 2024 highlights its significant scale, but it also operates in a landscape where competitors like Blackstone, managing over $1 trillion, command even greater resources. This disparity in scale and capital can influence deal-making capabilities and the ability to attract top talent.

The industry sees a constant drive for differentiation, with firms focusing on unique investment strategies, operational enhancements for portfolio companies, or exclusive market access. For example, the standard 2% management fee and 20% carried interest in private equity in 2024 means competition hinges more on deal sourcing and value creation than fee adjustments.

| Firm | AUM (Approx. Q1 2024) | Key Competitors | Competitive Differentiators |

|---|---|---|---|

| Apollo Global Management | $675 Billion | Blackstone, KKR, Carlyle Group, Ares Management | Brand Strength, Track Record, Talent Acquisition, Investor Confidence |

| Blackstone | >$1 Trillion | Apollo, KKR, Carlyle Group, Ares Management | Scale, Diversified Offerings, Global Reach |

| KKR | ~$500 Billion | Apollo, Blackstone, Carlyle Group, Ares Management | Operational Expertise, Sector Specialization |

SSubstitutes Threaten

Investors can easily shift capital to traditional public markets like stocks and bonds, often through low-cost ETFs and mutual funds. These public markets offer greater liquidity and generally lower management fees than alternative investments, making them a strong substitute for capital allocation. For instance, the S&P 500 index saw a significant return of 26.29% in 2023, demonstrating its attractiveness as an alternative to less liquid asset classes.

Large institutional investors are increasingly developing internal expertise to pursue direct investments or co-investments, bypassing traditional fund structures. This trend allows them to reduce fees, directly impacting the demand for services offered by firms like Apollo Global Management.

In 2024, many Limited Partners (LPs) continued to expand their in-house capabilities, aiming to capture more value by managing a larger portion of their private equity allocations directly. This shift represents a significant substitute for the traditional GP-LP relationship, as LPs seek greater control and cost efficiency.

Traditional asset management products like long-only equity and fixed-income funds can act as substitutes for alternative investment strategies offered by firms like Apollo. For instance, investors looking for diversification or specific market exposures might opt for a broad market index fund or a sector-specific ETF instead of a private equity or credit fund, especially if they prioritize liquidity and lower fees. In 2024, the global ETF market alone was projected to exceed $12 trillion in assets under management, demonstrating the significant appeal and accessibility of these traditional products as alternatives.

In-house Management Capabilities of Institutions

Sophisticated institutional investors, such as large pension funds and sovereign wealth funds, are increasingly building out their in-house asset management capabilities. This trend directly substitutes for the services offered by external alternative asset managers like Apollo Global Management. For instance, the California Public Employees' Retirement System (CalPERS) has been actively expanding its internal investment teams to manage a larger portion of its private equity and debt portfolios, aiming to reduce fees and gain greater control.

The ability of these institutions to manage assets internally means they have a viable alternative to outsourcing. This is particularly true for strategies that have become more commoditized or where the complexity can be absorbed by a well-resourced internal team. By bringing management in-house, these investors can potentially achieve cost savings and tailor investment strategies more precisely to their specific liabilities and risk appetites.

- Growing Internal Management: Institutions are investing in talent and technology to replicate the functions of external managers.

- Cost Efficiency Drive: Reducing management fees is a primary motivator for building internal capabilities.

- Control and Customization: In-house management offers greater control over investment decisions and portfolio construction.

- Data-Driven Approach: Advanced analytics and data management are enabling institutions to manage complex assets internally.

New Investment Vehicles and Financial Products

The financial landscape is dynamic, with new investment vehicles and structured products constantly emerging. These innovations often target similar risk-adjusted returns or provide access to alternative assets, but with potentially different liquidity profiles or fee arrangements. For instance, the rise of semi-liquid or retail-focused products, often termed the 'democratization of alternatives,' can directly challenge traditional offerings.

These evolving options present a significant threat of substitution for Apollo Global Management's core business. Investors might be drawn to these newer products if they perceive them as offering comparable or superior value, perhaps through lower fees or greater accessibility. This necessitates continuous innovation and competitive positioning from Apollo.

- Emerging Investment Products The market sees a continuous influx of new investment vehicles and structured products designed to replicate or offer alternatives to existing strategies.

- 'Democratization of Alternatives' This trend makes previously exclusive asset classes more accessible to a broader investor base, potentially diverting capital.

- Liquidity and Fee Structures Substitutes often compete on differing liquidity terms and fee models, influencing investor choice.

- Investor Preference Shifts As new options gain traction, investor preferences can shift away from traditional products, impacting market share.

The threat of substitutes for Apollo Global Management is significant, stemming from both traditional and increasingly innovative financial products. Investors can easily pivot to publicly traded securities like stocks and bonds, often via low-cost ETFs, which offer high liquidity and attractive returns, as evidenced by the S&P 500's 26.29% return in 2023.

Furthermore, the rise of institutional investors building internal asset management capabilities directly substitutes for the services Apollo provides. These entities, like CalPERS, aim to reduce fees and gain greater control by managing allocations in-house, a trend that gained momentum in 2024 as LPs expanded their direct investment efforts.

The increasing accessibility of alternative investments to a broader audience, often termed the 'democratization of alternatives,' also presents a substitution threat. These newer, often more liquid or differently structured products can divert capital from traditional alternative asset managers by offering comparable or superior value propositions.

| Substitute Type | Key Characteristics | 2023/2024 Trend/Data Point |

|---|---|---|

| Public Markets (ETFs/Mutual Funds) | High Liquidity, Lower Fees, Broad Market Access | S&P 500 returned 26.29% in 2023; Global ETF market projected over $12 trillion AUM in 2024. |

| In-House Institutional Management | Reduced Fees, Greater Control, Tailored Strategies | LPs expanding internal capabilities for private equity/debt in 2024. |

| Emerging Alternative Products | Varying Liquidity, Innovative Fee Structures, Increased Accessibility | Growth in semi-liquid and retail-focused alternative products. |

Entrants Threaten

Entering the alternative asset management arena, particularly for firms aiming for significant market presence, necessitates immense seed capital. This upfront investment is crucial for launching funds, building robust operational infrastructure, and crucially, attracting the initial investor base needed to gain traction.

The sheer scale of financial commitment required acts as a significant deterrent for aspiring competitors. For instance, launching a new private equity fund can easily require hundreds of millions, if not billions, in initial capital commitments to be competitive and attractive to institutional investors.

The financial services industry, particularly for asset managers like Apollo Global Management, operates under a stringent regulatory environment. Globally, firms are subject to evolving oversight from bodies like the U.S. Securities and Exchange Commission (SEC), impacting everything from fund disclosures to operational standards.

New entrants face significant hurdles due to these regulations. High compliance costs, extensive licensing requirements, and the necessity for sophisticated risk management frameworks can be prohibitive. For instance, the Dodd-Frank Act in the U.S. introduced numerous complex rules that increased operational burdens for all financial institutions.

New entrants to the private equity and credit landscape face a significant hurdle in establishing the proven track record and reputation that established firms like Apollo Global Management possess. Building investor trust, crucial for attracting substantial capital commitments, is a long-term endeavor built on consistent, strong performance over many years. Without this historical data and an established name, newcomers struggle to compete for limited investor capital.

Apollo, for instance, has navigated economic cycles and delivered returns for its investors for decades, a testament to its operational expertise and strategic acumen. This longevity translates into a deep well of trust with Limited Partners (LPs), who are often allocating billions of dollars. In 2023, Apollo managed approximately $675 billion in assets, a figure that underscores the scale of trust and capital they have accumulated over their history.

Difficulty in Sourcing Proprietary Deal Flow

New firms entering the alternative asset management space face a significant hurdle in sourcing proprietary deal flow. Established players like Apollo Global Management leverage decades of built-up relationships and extensive networks, giving them preferential access to attractive investment opportunities that aren't widely marketed. This makes it challenging for newcomers to deploy capital effectively and generate competitive returns.

For instance, in 2023, Apollo reported record fundraising across several strategies, underscoring the continued demand for their expertise and established origination capabilities. New entrants often rely on secondary markets or less attractive, broadly syndicated deals, which can limit their upside potential compared to firms with direct, proprietary sourcing.

- Limited Network Access: New entrants lack the deep, trusted relationships that provide early access to unique investment opportunities.

- High Origination Costs: Building a robust deal origination pipeline requires significant time, resources, and a proven track record, which new firms have yet to establish.

- Information Asymmetry: Established managers benefit from proprietary information and market intelligence derived from their long-standing presence, creating an uneven playing field.

- Difficulty in Attracting Talent: Top deal originators are often tied to established firms with strong deal flow, making it hard for new entrants to recruit the necessary expertise.

Challenges in Talent Acquisition and Retention

The specialized nature of alternative investments, including private equity and credit, demands a highly skilled and experienced workforce. This creates a significant barrier for new entrants.

Established firms like Apollo Global Management possess a strong advantage in attracting and retaining top talent. They offer competitive compensation packages, clear career progression paths, and the prestige of a proven platform, making it difficult for newcomers to build a comparable team.

For instance, the demand for professionals with expertise in areas like distressed debt or infrastructure investing remains exceptionally high. In 2024, the average compensation for a senior private equity associate in major financial hubs often exceeded $250,000, including bonuses, a figure challenging for nascent firms to match consistently.

- Talent Scarcity: Specialized skills in alternative asset management are in short supply.

- Compensation Wars: Established players outbid new entrants for top talent due to greater financial resources.

- Retention Challenges: New firms struggle to offer the long-term career stability and growth opportunities that experienced professionals seek.

- Brand Reputation: The established track record and brand recognition of firms like Apollo are significant draws for ambitious professionals.

The threat of new entrants for Apollo Global Management is considerably low, primarily due to the immense capital requirements and stringent regulatory landscape. Launching a new alternative asset management firm demands hundreds of millions, if not billions, in seed capital, a substantial barrier for aspiring competitors. Furthermore, navigating complex global regulations, such as those enforced by the SEC, incurs high compliance costs and licensing hurdles, making market entry exceptionally challenging.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Apollo Global Management is built upon a foundation of comprehensive data, including their SEC filings, investor relations materials, and reputable financial news outlets. We also incorporate industry-specific reports and macroeconomic data to contextualize the competitive landscape.