Apollo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

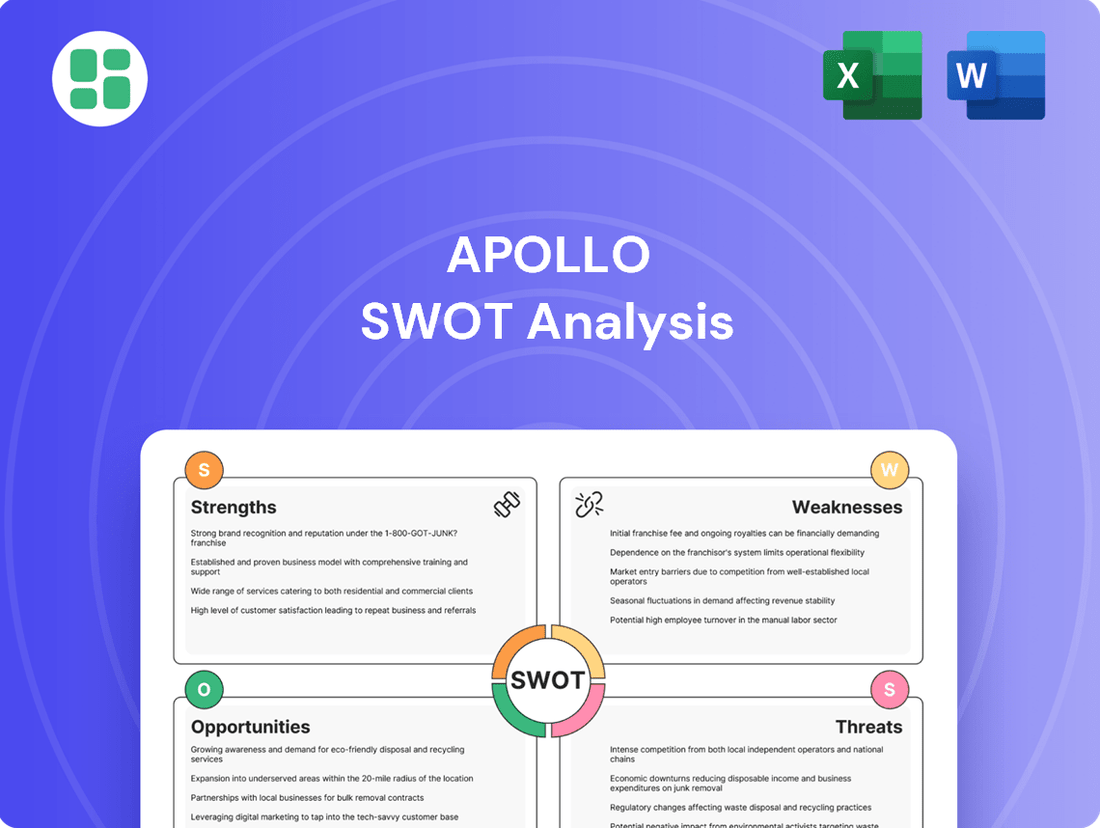

The Apollo SWOT analysis reveals a company with significant technological strengths and a strong market presence, but also highlights potential threats from emerging competitors. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want to truly grasp Apollo's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to unlock in-depth insights, actionable strategies, and a professional assessment designed to inform your next move.

Strengths

Apollo Global Management's strength lies in its remarkably diversified investment strategies, spanning credit, private equity, and real assets. This broad approach allows them to navigate different market cycles effectively, generating consistent returns for their clients. For instance, as of the first quarter of 2024, Apollo managed $675 billion in assets under management, showcasing the scale and breadth of their operations across these varied sectors.

This diversification acts as a significant buffer against sector-specific downturns, providing resilience to their overall portfolio. The firm's strategic advantage is further amplified by its flexibility to invest across a company's entire capital structure, from senior debt to equity, enabling opportunistic plays that can enhance returns even in challenging economic environments.

Apollo has shown impressive growth in its assets under management, hitting around $785 billion by the end of March 2025. This represents a solid 17% jump compared to the previous year.

The company also saw record organic inflows, bringing in over $150 billion during 2024 and an additional $43 billion in the first quarter of 2025. This strong performance highlights significant investor trust and the success of their capital-raising initiatives.

Athene, Apollo's retirement services arm, is a powerhouse, significantly boosting the firm's earnings. It focuses on offering retirement savings products and solutions tailored for institutions.

This segment has experienced impressive growth, attracting $71 billion in inflows over the twelve months concluding in Q1 2025. Athene's investment strategy is notably cautious, with a remarkable 97% of its assets held in investment-grade securities, underscoring a commitment to stability and risk management.

Extensive Global Origination Capabilities and Strategic Partnerships

Apollo's extensive global origination capabilities are a significant strength, allowing it to source a wide range of investment opportunities across various asset classes. This broad reach ensures a consistent pipeline of potential deals, a crucial advantage in today's competitive market.

The firm's strategic partnerships further amplify this strength. For instance, the recent extension of its partnership with Mubadala and ongoing collaborations with major financial institutions like JPMorgan Chase and Goldman Sachs are vital. These alliances enable Apollo to offer tailored private debt and equity financing solutions on a global scale, while also boosting liquidity within private credit markets.

These collaborations are not just about deal flow; they are about creating sophisticated financing structures. For example, in 2024, Apollo continued to leverage these relationships to facilitate complex transactions, demonstrating their ongoing value. By working with these partners, Apollo can access deeper pools of capital and expertise, which is critical for executing large-scale, bespoke financings.

- Global Origination Network: Apollo's ability to source deals worldwide across diverse asset classes provides a substantial competitive edge.

- Strategic Alliances: Partnerships with entities like Mubadala, JPMorgan Chase, and Goldman Sachs enhance deal execution and market access.

- Private Credit Liquidity: Collaborations contribute to increased liquidity in the private credit markets, benefiting both Apollo and its partners.

- Bespoke Financing Solutions: The firm leverages its network to offer customized debt and equity solutions for global clients.

Experienced Leadership and Clear Growth Strategy

Apollo's leadership, spearheaded by CEO Marc Rowan, is a significant strength. Rowan's emphasis on a disciplined 'purchase price matters' philosophy positions the firm to capitalize on market opportunities, particularly during periods of volatility. This strategic focus is crucial for navigating complex economic landscapes and ensuring value creation.

The firm's clear and aggressive growth strategy is a key differentiator. Apollo has outlined ambitious five-year targets, aiming to double its Assets Under Management (AUM) to $1.5 trillion by 2029. This expansion is coupled with substantial projected annual growth in both fee-related earnings and spread-related earnings, underscoring a robust plan for sustained performance.

Key growth targets include:

- Doubling AUM to $1.5 trillion by 2029.

- Achieving significant annual growth in fee-related earnings.

- Driving substantial annual growth in spread-related earnings.

Apollo's diversified investment strategies across credit, private equity, and real assets provide significant resilience, enabling them to perform well across various market conditions. Their scale is evident, managing approximately $785 billion in assets as of Q1 2025, a substantial increase from the previous year.

The firm's strategic advantage is further enhanced by its flexibility to invest across a company's entire capital structure, from debt to equity, allowing for opportunistic investments that can boost returns even in challenging economic climates. This adaptability is a core strength in their investment approach.

| Metric | Q1 2025 (Approx.) | Year-over-Year Growth |

|---|---|---|

| Assets Under Management (AUM) | $785 billion | ~17% |

| Organic Inflows (2024) | >$150 billion | N/A |

| Organic Inflows (Q1 2025) | $43 billion | N/A |

What is included in the product

Delivers a strategic overview of Apollo’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical strategic challenges.

Weaknesses

Apollo's reliance on performance fees presents a notable weakness, as this income stream can be quite cyclical. For instance, in the first quarter of 2025, the firm experienced a dip in its principal investing income, which is heavily influenced by these realized performance fees. This dependence means that a portion of Apollo's earnings is directly tied to market performance, introducing an element of unpredictability into its financial results.

While Apollo's overall assets under management (AUM) continued to grow, the company faced a notable revenue dip in its retirement services segment during the fourth quarter of 2024 and the first quarter of 2025. This decline was primarily driven by reduced premium inflows within this specific business line.

This revenue volatility highlights a key weakness: the reliance on fluctuating premium volumes in its insurance-related retirement offerings. Despite a growing asset base, maintaining stable revenue streams from these segments remains a challenge for Apollo, particularly when market conditions impact customer decisions on premium payments.

Apollo, as a global alternative investment manager, faces significant headwinds from macroeconomic uncertainties. Fluctuations in inflation and interest rates, key concerns throughout 2024 and projected into 2025, directly impact the valuation of its diverse assets and can dampen investor appetite for new capital raises. For instance, the Federal Reserve's interest rate policy, a major driver of market sentiment, can create volatility across Apollo's credit and equity portfolios, potentially affecting its ability to achieve projected returns.

Integration Risks from Acquisitions

Apollo's growth strategy heavily relies on strategic acquisitions, like its purchase of Bridge Investment Group in late 2023 for $1.1 billion. However, integrating these new entities presents significant challenges. Potential weaknesses include difficulties in merging different corporate cultures, which can lead to employee dissatisfaction and reduced productivity.

Operational complexities are another major concern. Merging IT systems, compliance frameworks, and business processes across acquired companies can be a lengthy and costly endeavor. For instance, the successful integration of Bridge Investment Group will require careful alignment of their real estate investment strategies with Apollo's broader alternative asset management platform.

There's also the risk of talent dilution or a slowdown in deal flow if the integration process is not managed effectively. This could impact Apollo's ability to capitalize on future opportunities and maintain its competitive edge in the dynamic alternative investment landscape.

- Cultural Clashes: Mismatched corporate cultures can hinder collaboration and employee retention post-acquisition.

- Operational Complexities: Integrating diverse IT systems, compliance, and business processes requires significant resources and expertise.

- Talent Dilution: Key personnel from acquired companies might leave if integration is poorly handled, impacting expertise and deal sourcing.

- Synergy Realization: Failure to achieve expected cost savings or revenue enhancements from acquisitions can undermine their strategic value.

Intense Competition in Alternative Asset Management

The alternative asset management landscape is incredibly crowded, with many players competing for investor dollars. Apollo's ambitious expansion efforts are likely to amplify this competitive pressure, necessitating ongoing innovation and unique approaches to secure its market standing and attract capital.

In 2023, the global alternative assets market reached an estimated $14.4 trillion, a figure projected to grow significantly. This growth attracts new entrants and intensifies the battle for market share among established firms like Apollo.

- Intensifying Competition: The sheer number of firms offering alternative investments means Apollo must constantly differentiate itself.

- Capital Acquisition Challenges: Attracting and retaining institutional and high-net-worth capital becomes more difficult in a crowded market.

- Pressure for Performance: Competitors' successes can create benchmarks that Apollo must meet or exceed to maintain investor confidence.

Apollo's reliance on performance fees, while potentially lucrative, introduces earnings volatility. This is evident in periods like Q1 2025 where realized performance fees influenced principal investing income. Such dependence directly links a portion of Apollo's revenue to market fluctuations, creating an inherent unpredictability in financial outcomes.

Same Document Delivered

Apollo SWOT Analysis

The preview you see is the actual Apollo SWOT analysis document you’ll receive upon purchase. We believe in transparency, so you know exactly what you're getting. No surprises, just professional quality analysis.

Opportunities

Apollo is strategically broadening its reach into global wealth channels, a move designed to make private markets accessible to a much larger group of investors, from high-net-worth individuals to the mass affluent. This initiative taps into a significant, largely untapped market, offering a substantial avenue for growing Assets Under Management (AUM) and diversifying Apollo's client roster beyond its current institutional focus.

The global market for private credit is experiencing robust growth, driven by a secular shift in corporate financing towards private market solutions. Companies are increasingly seeking bespoke debt and equity financing that traditional public markets may not efficiently provide. This trend creates significant opportunities for firms like Apollo, which are well-equipped to offer these specialized financial products.

Apollo is strategically positioned to benefit from this growing demand, particularly within its private credit segment. By offering attractive alternatives to public equities and catering to the financing needs of large corporate borrowers, Apollo can capture a substantial share of this expanding market. For instance, Apollo's assets under management in credit strategies reached $347 billion as of December 31, 2023, demonstrating its significant presence and capacity in this area.

Apollo is well-positioned to capitalize on the global industrial renaissance, a trend driving significant demand for capital in infrastructure and the clean energy transition. These sectors are projected to require trillions in investment over the coming decade.

The need for robust physical and digital infrastructure, including the burgeoning data center market, presents a substantial opportunity. Furthermore, the global shift towards cleaner energy sources necessitates massive capital deployment, a space where Apollo's origination and financing expertise can be highly effective.

For instance, the International Energy Agency's 2024 report estimates that global clean energy investment will reach $2 trillion in 2024, a critical area for Apollo's strategic focus. This aligns directly with Apollo's core strengths in providing privately originated, investment-grade financing solutions to meet these large-scale capital requirements.

Leveraging Technology for Financial Solutions

Apollo is actively investing in cutting-edge fintech solutions, exemplified by its launch of Lyra. This initiative aims to deliver unique client-servicing capabilities and boost operational efficiency within its asset management divisions.

This strategic technological push is designed to deepen client relationships, simplify internal processes, and solidify Apollo's competitive position in the dynamic financial sector. For instance, Lyra's platform is expected to automate significant portions of client onboarding and reporting, freeing up human capital for higher-value advisory services.

- Fintech Investment: Apollo's commitment to technology is evident in its substantial investments in fintech, with Lyra being a prime example of its venture into differentiated client solutions.

- Efficiency Gains: The adoption of these technologies is projected to streamline asset management operations, potentially reducing operational costs by an estimated 10-15% in the initial rollout phase.

- Client Engagement: Enhanced digital platforms are crucial for improving client interaction and providing personalized financial advice, a key differentiator in today's market.

- Competitive Edge: By embracing innovation, Apollo aims to stay ahead of competitors and adapt to the evolving demands of the financial services industry, a trend that saw digital asset management grow by over 20% globally in 2024.

Geographic Expansion into High-Potential Markets

Apollo is actively pursuing geographic expansion into markets demonstrating significant growth potential. This strategy aims to tap into new sources of capital and broaden its client base. By establishing a presence in regions like the UK and Japan, Apollo is positioning itself to serve a wider array of investors, including private banks, family offices, and insurance companies.

The company's commitment to global reach is further evidenced by the opening of new offices, such as the recent Zurich location. This move is designed to capture demand for alternative investments in key European financial centers. Such diversification not only enhances revenue streams but also reduces reliance on any single geographic region, thereby mitigating regional economic risks.

- UK Expansion: Apollo's strategic focus on the UK market aims to leverage the country's robust financial sector and growing appetite for alternative assets.

- Japan Entry: Targeting Japan signifies Apollo's intent to access Asia's expanding wealth management landscape and diverse investor base.

- Zurich Office: The establishment of a Zurich office provides a crucial hub for serving continental European clients and capitalizing on the region's strong private banking and insurance sectors.

- Diversified Capital Sources: This global push allows Apollo to tap into capital from a wider range of institutional and high-net-worth investors, strengthening its funding capabilities.

Apollo is expanding its reach into global wealth channels, making private markets accessible to a broader investor base, including high-net-worth and mass affluent individuals. This strategy taps into a significant, underserved market, offering a substantial opportunity for AUM growth and client diversification beyond its current institutional focus.

The company is well-positioned to capitalize on the global industrial renaissance, particularly in infrastructure and the clean energy transition, sectors projected to require trillions in investment. Apollo's expertise in originating and financing large-scale projects, such as those in the data center market and renewable energy, aligns perfectly with these capital demands.

Apollo's investment in fintech, exemplified by its Lyra platform, aims to enhance client servicing and operational efficiency. This technological push is designed to deepen client relationships and streamline processes, providing a competitive edge in the evolving financial services landscape. Global digital asset management saw over 20% growth in 2024, underscoring the importance of such initiatives.

Geographic expansion into high-growth markets like the UK and Japan, along with new offices such as the one in Zurich, allows Apollo to tap into new capital sources and diversify its client base. This global strategy aims to capture demand for alternative investments in key financial centers.

| Opportunity Area | Description | Key Data/Metric |

|---|---|---|

| Global Wealth Channels | Broadening access to private markets for HNW and mass affluent investors. | Significant untapped market potential for AUM growth. |

| Industrial Renaissance & Clean Energy | Capitalizing on demand for infrastructure and clean energy investments. | Global clean energy investment projected to reach $2 trillion in 2024 (IEA). |

| Fintech Advancement | Leveraging technology like Lyra for client servicing and operational efficiency. | Digital asset management grew over 20% globally in 2024. |

| Geographic Expansion | Entering new markets like the UK and Japan, opening offices in Zurich. | Strengthening global presence to access diverse capital pools. |

Threats

Apollo, like other alternative asset managers, faces the ongoing challenge of evolving regulatory landscapes. Changes in tax laws, such as the UK's recent overhaul of its non-domicile tax regime, could potentially influence client investment decisions and capital flows into Apollo's funds. This regulatory flux requires constant adaptation and strategic planning to mitigate potential impacts on operations and profitability.

Persistent inflation, as seen with the US Consumer Price Index (CPI) hovering around 3.4% in early 2024, presents a significant threat. This environment, coupled with the Federal Reserve's hawkish stance, suggests interest rates might remain elevated for an extended period. For Apollo, this translates to potential headwinds for its credit investments, particularly those with less robust credit profiles, as higher borrowing costs can strain borrowers' ability to service debt.

Furthermore, prolonged inflationary pressures can erode the real value of returns, especially for Apollo's alternative assets with long investment horizons. For instance, if inflation outpaces the nominal returns on private equity or real estate funds, the actual purchasing power of those gains diminishes, impacting overall investor sentiment and potentially Apollo's ability to attract capital for these strategies.

Apollo faces a significant threat from both established traditional asset managers and other alternative investment firms vying for market share. As traditional players like BlackRock and Vanguard increasingly allocate capital to private markets, they bring substantial scale and client relationships, intensifying competition for deals and talent. This pressure could impact Apollo's ability to command its current fee structures and secure the most attractive investment opportunities, particularly as the alternative asset management industry continues to grow, with assets under management in private markets projected to reach $23 trillion by 2027, up from $12 trillion in 2022.

Geopolitical Risks and Global Trade Disruptions

Geopolitical tensions and the potential for global trade disruptions, including new tariffs, can introduce significant volatility into financial markets. For instance, the ongoing trade disputes between major economies in early 2024 have already demonstrated the market's sensitivity to such events, leading to fluctuations in commodity prices and equity valuations.

These disruptions directly affect investment performance by creating unpredictable market conditions. They can also severely impact the supply chains of portfolio companies, leading to increased costs and delayed production, as seen with disruptions affecting semiconductor manufacturing in Southeast Asia during 2024.

- Increased Market Volatility: Global trade disputes, exemplified by ongoing tariff discussions in early 2024, can lead to sharp market swings, impacting investor confidence.

- Supply Chain Vulnerabilities: Disruptions like those affecting critical component sourcing in 2024 highlight the fragility of global supply chains, potentially increasing operational costs for businesses.

- Uncertainty in Operating Environment: Shifting trade policies and geopolitical instability create a challenging landscape for strategic planning and long-term investment decisions.

Dependence on Key Personnel and Investment Performance

Apollo Global Management's performance is intrinsically linked to its key investment professionals and their track record. A significant departure of a star manager or a sustained period of underperformance in its flagship funds could directly affect investor trust and, consequently, its Assets Under Management (AUM). For instance, in the alternative asset management sector, investor confidence is paramount, and any perceived instability in leadership or investment strategy can lead to capital withdrawal.

The firm's ability to consistently generate strong returns is a critical differentiator. A dip in investment performance, especially compared to peers, can make it harder to attract new capital and retain existing investors. In 2023, while many alternative asset managers saw robust growth, maintaining that momentum in 2024 and beyond hinges on delivering competitive alpha across Apollo's diverse strategies, from private equity to credit and hybrid strategies.

- Dependence on Key Personnel: Apollo's strategic direction and fund performance are heavily influenced by its top investment professionals.

- Investment Performance Impact: A sustained decline in fund returns could erode investor confidence and hinder AUM growth.

- Talent Retention: Attracting and retaining top talent in a competitive market is crucial for maintaining Apollo's edge.

- Market Volatility: External market conditions can significantly impact investment performance, posing a challenge to consistent returns.

Apollo faces intensified competition as traditional asset managers increasingly enter the alternative space. This influx, with private markets projected to reach $23 trillion by 2027, pressures Apollo's fee structures and deal flow. Geopolitical instability and trade disputes, evident in early 2024, create market volatility and supply chain risks for portfolio companies, impacting overall investment performance.

A significant threat to Apollo lies in its reliance on key investment professionals; the departure of top talent could impact investor confidence and AUM. Furthermore, sustained underperformance relative to peers in 2024 would make capital attraction and retention more challenging, especially given the sector's focus on delivering alpha across diverse strategies.

SWOT Analysis Data Sources

This Apollo SWOT analysis is built upon a robust foundation of data, drawing from Apollo's official financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded strategic perspective.