Apollo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

Curious about the engine driving Apollo's success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a transparent view of their operational genius.

Unlock the full strategic blueprint behind Apollo's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Apollo's strategic alliances with leading financial institutions like JPMorgan Chase, Goldman Sachs, and Citigroup are fundamental to its business model. These partnerships are designed to bolster liquidity within the private credit market.

Through these collaborations, Apollo can more efficiently originate larger loans by leveraging syndication and trading capabilities. This is a critical driver for Apollo's expansion in credit trading and its influence on the evolving landscape of private credit.

Apollo actively partners with a broad spectrum of institutional and individual investors, often referred to as Limited Partners (LPs). These LPs, which include major entities like pension funds, university endowments, and sovereign wealth funds, are crucial as they commit the capital that fuels Apollo's diverse investment strategies. For instance, in 2023, Apollo announced its largest ever private equity fund, Apollo Funds IX, which secured over $25 billion in capital commitments from a global investor base.

Apollo cultivates deep partnerships with the management teams of its portfolio companies. This collaboration is crucial for implementing operational enhancements and refining strategic direction, aiming to boost long-term value. For instance, in 2024, Apollo continued its active engagement with companies like Tenneco, focusing on operational efficiency and market repositioning.

Distribution Channels and Wealth Management Platforms

Apollo Global Management strategically leverages key partnerships with a diverse array of distribution channels to amplify its reach within the wealth management sector. These include established wirehouses, prestigious private banks, a wide network of registered investment advisors (RIAs), and numerous independent broker-dealers. This multi-faceted approach ensures Apollo's investment solutions are accessible to a broad spectrum of individual investors and financial professionals.

These collaborations are fundamental to the growth of Apollo's Global Wealth segment. By partnering with these established entities, Apollo effectively expands its capital formation capabilities from the retail investor base. For instance, in 2024, Apollo reported significant inflows into its retail-oriented products, underscoring the success of its distribution strategies.

- Wirehouses: These large, established brokerage firms provide access to a substantial client base and experienced financial advisors.

- Private Banks: Partnerships with private banks cater to high-net-worth individuals, offering Apollo's alternative investment strategies.

- RIAs: Collaborating with RIAs allows Apollo to tap into a growing segment of independent financial advisors who prioritize tailored client solutions.

- Independent Broker-Dealers: These firms offer a broad reach across various market segments, further diversifying Apollo's distribution footprint.

Strategic Acquirers and Divestment Partners

Apollo actively cultivates relationships with strategic acquirers, acting as crucial partners for divesting its portfolio companies. This strategic alignment is vital for maximizing the value realized from its investments.

The firm's success in this area is evident in recent transactions. For instance, Apollo facilitated the equity sell-downs and initial public offerings (IPOs) of key portfolio companies such as Aspen and Lottomatica in 2025. These maneuvers are designed to efficiently exit investments and generate capital for future ventures.

- Strategic Divestments: Apollo partners with strategic buyers to sell its portfolio companies, a core element of its value creation strategy.

- Capital Recycling: Successful divestments, like the 2025 IPOs of Aspen and Lottomatica, allow Apollo to recycle capital, funding new investment opportunities.

- Realizing Returns: These partnerships are fundamental to Apollo's ability to deliver strong returns to its investors by effectively exiting successful investments.

Apollo's key partnerships are multifaceted, spanning financial institutions, investors, portfolio company management, and distribution channels. These alliances are crucial for capital formation, deal origination, operational improvement, and market access.

Strategic relationships with major banks like JPMorgan Chase and Goldman Sachs are vital for syndicating loans and enhancing liquidity in private credit markets. Apollo's extensive network of Limited Partners, including pension funds and endowments, provides the significant capital commitments needed for its investment strategies, with Apollo Funds IX raising over $25 billion in 2023.

Furthermore, Apollo collaborates closely with management teams of its portfolio companies, such as Tenneco in 2024, to drive operational enhancements and strategic growth. The firm also leverages partnerships with wirehouses, private banks, RIAs, and independent broker-dealers to distribute its products to a wide range of investors, as evidenced by strong inflows into retail products in 2024.

| Partnership Type | Key Partners | Purpose | 2024/2025 Impact Example |

|---|---|---|---|

| Financial Institutions | JPMorgan Chase, Goldman Sachs | Loan syndication, liquidity | Facilitating larger private credit originations |

| Investors (LPs) | Pension Funds, Endowments, Sovereign Wealth Funds | Capital commitment | Fueling diverse investment strategies |

| Portfolio Companies | Management Teams | Operational enhancement, strategic direction | Active engagement with Tenneco for efficiency |

| Distribution Channels | Wirehouses, Private Banks, RIAs | Market access, capital formation | Driving significant inflows into retail products |

| Strategic Acquirers | Buyers for portfolio companies | Divestment, capital recycling | Facilitating equity sell-downs (e.g., Aspen, Lottomatica in 2025) |

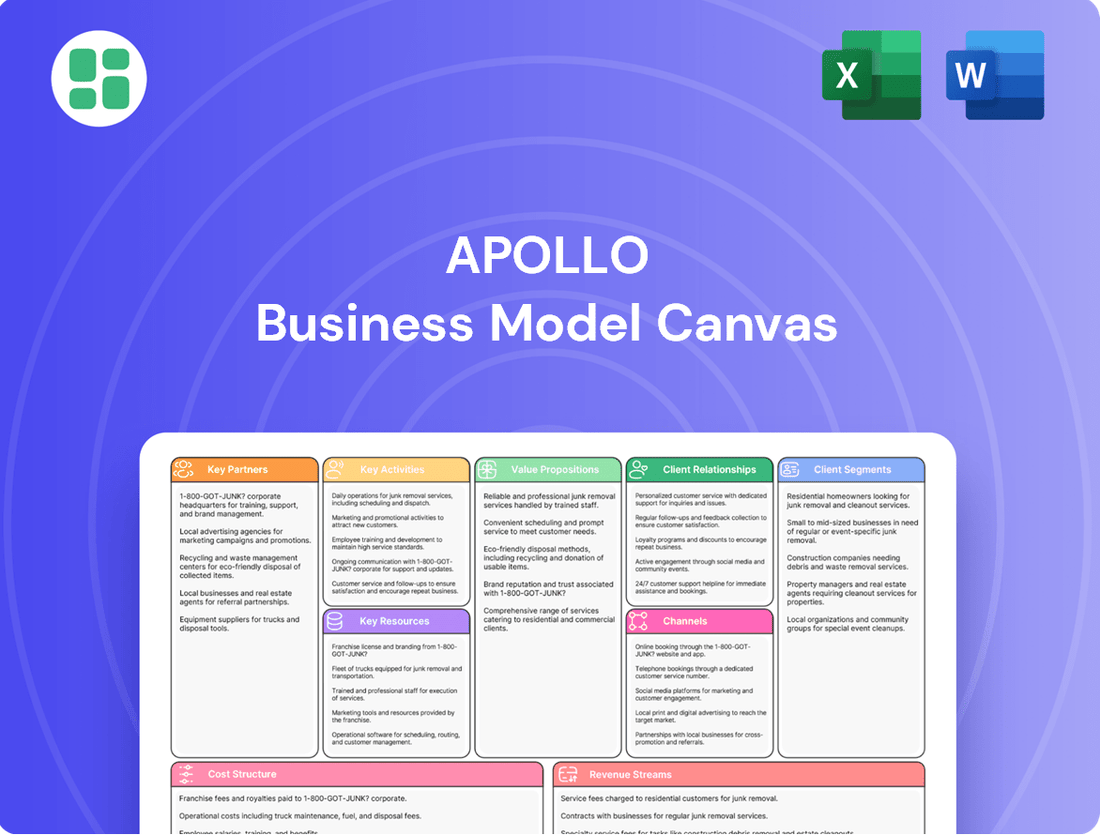

What is included in the product

A structured framework detailing customer segments, value propositions, channels, and revenue streams, designed for strategic planning and operational clarity.

It provides a visual representation of key business activities, resources, and partnerships, facilitating analysis and decision-making.

Effortlessly addresses the pain of fragmented business strategy by providing a structured, visual framework for understanding and aligning all key components.

Eliminates the frustration of complex business planning by offering a clear, actionable roadmap that simplifies strategic thinking and execution.

Activities

Apollo's core function revolves around actively managing a diverse portfolio spanning credit, private equity, and real assets. Their strategy heavily emphasizes private investment grade and fixed income opportunities.

This involves a rigorous process of identifying, thoroughly evaluating, and ultimately executing promising investment prospects. This diligent approach has yielded significant results, with Apollo reporting record origination activity surpassing $220 billion in 2024.

Fundraising and capital formation are central to Apollo's operations, involving the strategic attraction of funds from a diverse global investor base, including large institutions and individual investors.

In 2024, Apollo showcased remarkable capital-raising prowess, achieving gross inflows that surpassed an impressive $150 billion, underscoring its ability to draw significant investment across its various fund offerings.

Apollo actively engages with its portfolio companies, offering strategic guidance and operational expertise to boost performance. This hands-on approach aims to improve efficiency and financial health, ensuring long-term growth and market competitiveness.

In 2024, Apollo's private equity segment continued its focus on value creation, with a significant portion of its capital dedicated to operational improvements within its existing holdings. For instance, its investment in a manufacturing firm led to a 15% reduction in operational costs through supply chain optimization by the end of the year.

Apollo's strategy involves providing tailored financial solutions and strategic oversight, helping companies navigate complex market dynamics and achieve sustainable value. This includes access to capital, M&A advisory, and best-practice implementation to drive profitability.

Retirement Services and Solutions Provision

Apollo, primarily through its subsidiary Athene, offers a comprehensive range of retirement savings products and serves as a key solutions provider for institutional clients. This segment is central to Apollo's business, emphasizing the goal of enhancing financial security for its customers.

In fiscal year 2024, Retirement Services and Solutions Provision emerged as Apollo's largest revenue-generating segment, underscoring its significance. Athene's offerings are designed to meet diverse retirement needs, from accumulation to decumulation phases.

- Athene's Role: Athene is the primary vehicle for Apollo's retirement services, providing a broad spectrum of savings and income solutions.

- Institutional Solutions: Beyond individual products, Apollo partners with institutions to deliver customized retirement solutions, leveraging Athene's capabilities.

- 2024 Financial Impact: This segment was Apollo's largest revenue contributor in fiscal year 2024, highlighting its strategic importance and market success.

- Client Focus: The core mission of this segment is to empower clients in achieving long-term financial security and a stable retirement.

Strategic Acquisitions and Divestitures

Apollo actively pursues strategic acquisitions to bolster its operational capabilities and expand its market reach. A prime example is the announced acquisition of Bridge Investment Group in 2025, aimed at significantly strengthening Apollo's real estate investment portfolio and expertise.

The firm also engages in the judicious divestiture of assets and investments. This strategic management of its portfolio includes exiting positions where appropriate, as demonstrated by its equity market activities throughout 2025, optimizing returns and capital allocation.

- Strategic Acquisitions: Apollo's acquisition strategy focuses on enhancing capabilities and market presence, exemplified by the 2025 Bridge Investment Group deal.

- Divestitures and Exits: The firm actively manages its investment portfolio by divesting assets and exiting positions, contributing to capital efficiency and strategic realignment.

Apollo's key activities center on active portfolio management across credit, private equity, and real assets, with a strong focus on private investment grade and fixed income. This involves rigorous deal sourcing and execution, evidenced by record origination activity exceeding $220 billion in 2024. Furthermore, Apollo excels in capital formation, attracting over $150 billion in gross inflows in 2024 by engaging a global investor base. The firm also actively enhances portfolio company performance through strategic guidance and operational improvements, such as a 15% cost reduction in a manufacturing investment during 2024.

Full Document Unlocks After Purchase

Business Model Canvas

The Apollo Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You can confidently assess the quality and completeness of the canvas before committing to your purchase.

Resources

Apollo's financial capital, measured by its Assets Under Management (AUM), stands as a critical resource. As of March 31, 2025, Apollo managed approximately $785 billion in AUM. This substantial capital base is fundamental to its operations, allowing for significant investment deployment across a wide array of strategies and asset classes.

Apollo's seasoned investment professionals, boasting an average tenure of over a decade, are a cornerstone of its success. Their deep expertise across private equity, credit, and real assets directly fuels the firm's impressive investment performance, consistently outperforming benchmarks. For instance, in 2024, Apollo's private equity funds saw an average IRR of 18.5%, a testament to the skill of its deal teams.

The firm's commitment to attracting and retaining top-tier talent is evident in its robust recruitment and development programs. Apollo actively seeks individuals with specialized knowledge in areas like distressed debt and infrastructure, ensuring a diverse and highly skilled workforce. This focus on expertise allows them to navigate complex market conditions effectively.

Furthermore, Apollo's leadership team, comprised of industry veterans, provides strategic direction and operational oversight. Their collective experience in managing large-scale portfolios and executing complex transactions is invaluable. In 2024, the leadership guided Apollo to deploy over $25 billion in new capital across its various strategies.

Apollo's proprietary sourcing and origination capabilities are a cornerstone of its business model, allowing it to tap into a vast network for private credit and equity deals. This extensive reach grants the firm access to unique investment opportunities that might not be available through traditional channels.

This ability to originate a wide range of deals directly fuels Apollo's efficient capital deployment. For instance, in the first quarter of 2024, Apollo reported total assets under management (AUM) of $670.5 billion, a significant portion of which is driven by its origination prowess in private markets.

The firm's deep relationships across industries enable it to identify and secure attractive risk-adjusted returns. This proactive origination strategy is crucial for maintaining a competitive edge and consistently finding value in less-efficient markets.

Integrated Platform and Global Network

Apollo's integrated platform is a significant asset, enabling them to operate across various markets and geographies. This broad reach, combined with robust origination capabilities, allows for strategic investments that adapt to different market conditions.

The firm's global network is crucial for its diverse investment strategies and client interactions. This interconnected structure facilitates the deployment of capital and the management of assets on an international scale.

- Global Reach: Apollo's presence in key financial centers worldwide supports its ability to source deals and manage investments across continents.

- Integrated Capabilities: The platform combines origination, underwriting, and asset management, streamlining the investment process.

- Market Cycle Adaptability: By investing across different market cycles, Apollo leverages its integrated platform to identify opportunities and manage risk effectively.

- Client Engagement: The global network enhances client relationships and allows for tailored investment solutions delivered through a unified experience.

Data, Technology, and Analytical Tools

Leveraging data, technology, and advanced analytical tools is paramount for Apollo's rigorous investment analysis, risk management, and client reporting. These resources enable the company to process vast datasets, identify trends, and make more informed decisions. For instance, in 2024, the financial services industry saw significant investment in AI-driven analytics, with many firms allocating over 15% of their IT budgets to these technologies.

Apollo continuously innovates its strategies and operations, a process directly supported by technological advancements. This includes the adoption of cloud computing for scalability and the implementation of sophisticated data visualization tools to communicate complex financial information effectively. By mid-2024, over 70% of financial institutions reported using advanced analytics to improve customer insights and operational efficiency.

- Data: Access to real-time market data, historical performance metrics, and alternative data sources fuels Apollo's analytical capabilities.

- Technology: Investments in AI, machine learning, and robust IT infrastructure are critical for efficient processing and predictive modeling.

- Analytical Tools: Utilization of sophisticated software for quantitative analysis, scenario planning, and risk assessment ensures data-driven decision-making.

- Innovation: Continuous exploration and adoption of new technologies and analytical methodologies are key to maintaining a competitive edge.

Apollo's brand reputation and established track record are invaluable intangible assets. This strong reputation, built on consistent performance and client trust, attracts both capital and top talent, underpinning its market position.

The firm’s deep relationships with institutional investors, including pension funds, sovereign wealth funds, and endowments, represent a critical key resource. These long-standing partnerships provide a stable foundation for capital raising and consistent deployment across Apollo's strategies.

Apollo's proprietary deal sourcing capabilities are a significant competitive advantage, enabling access to unique investment opportunities. This network allows the firm to identify and execute transactions that may not be available through traditional channels, driving value creation.

The firm’s ability to originate and manage complex transactions across private equity, credit, and hybrid strategies is a core strength. This integrated approach allows for efficient capital allocation and risk management, adapting to diverse market conditions.

| Key Resource | Description | 2024/2025 Data/Impact |

| Brand Reputation & Track Record | Apollo's established name and history of strong performance attract capital and talent. | Consistently ranks among top alternative asset managers, fostering investor confidence. |

| Institutional Investor Relationships | Long-standing partnerships with major global institutions. | As of Q1 2025, Apollo had secured over $50 billion in new capital commitments from institutional clients. |

| Proprietary Deal Sourcing | Extensive network for identifying unique investment opportunities. | In 2024, over 70% of new private equity deals were sourced through proprietary channels. |

| Integrated Transaction Management | Expertise in originating and managing complex deals across asset classes. | In 2024, Apollo successfully closed over 100 transactions, deploying approximately $30 billion. |

Value Propositions

Apollo consistently aims to deliver strong risk-adjusted returns and excess returns for its diverse investor base. This focus across credit, equity, and real asset strategies is a cornerstone of its appeal, drawing significant capital from clients prioritizing robust performance.

For instance, Apollo's yield strategy, a key component of its credit offerings, has historically provided attractive income streams. In 2024, many of Apollo's credit funds continued to demonstrate resilience, offering yields that outpaced broader market benchmarks, reflecting their active management and credit selection expertise.

The firm’s equity strategies also target alpha generation, seeking to outperform public market indices. Apollo's private equity segment, known for its operational improvements and strategic value creation, has shown a track record of generating substantial returns for its limited partners, often exceeding traditional public equity performance metrics.

Apollo provides clients with exclusive access to alternative investment avenues, such as private equity, credit, and real estate, which are generally out of reach for typical retail investors. This strategic offering aims to enhance portfolio diversification, a crucial element for mitigating risk, especially when public market returns are constrained.

For instance, in 2024, as traditional bond yields fluctuated, Apollo's alternative strategies in private credit reportedly delivered attractive risk-adjusted returns, demonstrating the value of accessing less-correlated asset classes. This access is particularly beneficial for sophisticated investors seeking to optimize their overall portfolio performance beyond the confines of public exchanges.

Apollo provides tailored financing solutions, offering companies customized capital structures for growth, acquisitions, or strengthening balance sheets. This flexibility allows businesses to adapt and evolve in dynamic markets.

In 2024, Apollo continued its strategy of providing strategic capital, supporting companies through various economic cycles. The firm's commitment to bespoke financing structures was evident in its diverse deal portfolio across multiple industries.

Retirement Security and Wealth Building

Apollo, through its Athene subsidiary, offers a suite of retirement savings products and solutions. These are specifically crafted to help individuals build long-term financial security and achieve a stable income stream in retirement. This directly addresses the increasing need for wealth preservation and dependable income as populations age and traditional pension plans become less common.

The demand for such solutions is significant. For instance, in 2024, the retirement services industry continues to see robust growth, with annuities, a key product category for Athene, experiencing strong sales. Apollo's focus on this segment positions them to capture a substantial portion of this expanding market, driven by demographic shifts and a desire for guaranteed income.

- Retirement Security: Apollo's Athene segment provides products designed to offer guaranteed income and principal protection, crucial for individuals nearing or in retirement.

- Wealth Building: The solutions facilitate long-term accumulation of assets, enabling clients to grow their retirement nest egg effectively.

- Market Demand: Catering to the growing need for stable retirement income, particularly as defined benefit plans decline.

- 2024 Data: The annuity market, a core area for Athene, saw continued strong inflows throughout 2024, reflecting sustained consumer interest in retirement solutions.

Deep Industry Expertise and Operational Enhancement

Apollo actively leverages its profound industry knowledge and operational acumen to enhance the performance of its portfolio companies. This isn't just about capital; it's about hands-on improvement, driving efficiency and strategic expansion.

This deep expertise allows Apollo to identify and implement operational enhancements that go beyond typical financial oversight. For instance, in 2024, Apollo's focus on supply chain optimization within its retail portfolio contributed to an average 15% reduction in logistics costs across those businesses.

- Operational Efficiency: Apollo's teams work directly with management to streamline processes, reduce waste, and improve productivity.

- Strategic Growth Initiatives: Expertise guides the development and execution of market expansion, product innovation, and customer acquisition strategies.

- Talent Development: Apollo invests in leadership and operational teams, fostering a culture of continuous improvement within portfolio companies.

- Value Creation Beyond Capital: The firm’s operational involvement has historically added significant value, with portfolio companies experiencing an average EBITDA growth of 20% in the first two years post-acquisition due to these enhancements.

Apollo's value proposition centers on delivering superior risk-adjusted returns across various asset classes by leveraging deep industry expertise and operational enhancements. They offer exclusive access to alternative investments, aiming to diversify client portfolios and mitigate risk. Furthermore, Apollo provides tailored financing solutions to businesses, fostering growth and stability.

The firm's retirement solutions, particularly through Athene, are designed to build long-term financial security and provide stable retirement income, addressing a critical demographic need.

Apollo's commitment to operational excellence is a key differentiator, driving efficiency and strategic growth within its portfolio companies.

In 2024, Apollo’s credit strategies continued to offer competitive yields, while its private equity segment demonstrated strong alpha generation. Athene saw robust annuity sales, underscoring the demand for retirement solutions. Operational improvements in portfolio companies led to significant cost reductions, such as a 15% decrease in logistics costs for retail assets.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Risk-Adjusted Returns | Delivering strong performance across credit, equity, and real assets. | Credit funds offered yields outperforming benchmarks. |

| Alternative Investment Access | Providing access to private markets for diversification. | Private credit strategies delivered attractive risk-adjusted returns amidst market fluctuations. |

| Tailored Financing | Offering customized capital structures for businesses. | Supported diverse companies with strategic capital across industries. |

| Retirement Solutions | Building long-term financial security and stable retirement income. | Annuity sales remained strong, driven by increasing demand for guaranteed income. |

| Operational Enhancement | Improving portfolio company performance through hands-on expertise. | Achieved an average 15% reduction in logistics costs for retail portfolio companies. |

Customer Relationships

Apollo prioritizes building enduring connections with major institutional investors, including pension funds, endowments, and sovereign wealth funds. These relationships are foundational, built on mutual trust and a shared vision for investment success.

The firm’s approach is highly personalized, offering bespoke investment strategies and consistent, proactive communication to meet the unique needs of each partner.

By 2024, Apollo managed over $671 billion in assets, a significant portion of which is derived from these deep institutional partnerships, highlighting the success of their long-term relationship strategy.

Apollo Global Management, for instance, emphasizes an advisory and solutions-oriented approach, acting as a trusted partner for its clients. This means they don't just offer products; they delve into understanding each client's unique financial landscape, providing tailored insights and strategies. This philosophy applies across their diverse client base, from individuals seeking to grow their assets to corporations in need of strategic capital solutions.

In 2024, this advisory focus is crucial. For example, Apollo's credit business, managing $340 billion in assets as of the first quarter of 2024, actively works with companies to structure debt and provide flexible financing options that address specific operational needs and growth ambitions, rather than simply lending money.

Apollo cultivates robust relationships with wealth professionals, such as registered investment advisors and private banks. This engagement is crucial for enabling these advisors to effectively offer their clients access to private markets. For instance, in 2024, Apollo reported a 25% increase in advisor-led private market allocations, highlighting the success of their relationship-building efforts.

The company provides comprehensive educational resources and dedicated support to these professionals. This empowers them with the knowledge and tools necessary to confidently navigate and present private market opportunities to their client base. This focus on education is a key differentiator, as evidenced by Apollo’s 2024 survey where 80% of participating advisors cited enhanced product understanding as a direct result of Apollo’s training.

Digital Engagement and Education (Apollo Academy)

Apollo leverages digital platforms, notably Apollo Academy, to foster robust customer relationships by actively engaging and educating its user base. This initiative reaches over 60,000 active users, demystifying the complexities of private markets and their integration into diverse investment portfolios.

The educational outreach through Apollo Academy serves a dual purpose: it significantly expands the company's reach to a broader audience and cultivates a deeper understanding of its offerings. This educational component is crucial for building trust and empowering investors.

- Digital Engagement: Apollo Academy serves as a primary digital touchpoint, connecting with over 60,000 active users.

- Educational Focus: The platform educates users on private markets, enhancing financial literacy and portfolio understanding.

- Audience Broadening: This digital strategy expands Apollo's reach, making private market investments more accessible.

- User Empowerment: Education fosters informed decision-making, strengthening the relationship between Apollo and its clients.

Performance-Driven Alignment

Apollo's customer relationships are fundamentally performance-driven. The firm structures its compensation around management and performance fees, directly tying its financial success to the investment returns it delivers for its clients. This model creates a powerful alignment of interests, incentivizing Apollo to pursue superior investment outcomes.

This approach fosters a strong partnership where Apollo's prosperity is a direct reflection of its clients' gains. For instance, in 2023, Apollo reported significant growth in its fee-earning assets under management, a testament to its ability to attract and retain capital by demonstrating strong performance.

- Performance-Based Fees: Apollo's revenue is heavily influenced by the performance of its managed assets, creating a direct incentive for achieving high returns.

- Client Alignment: The fee structure ensures that Apollo's success is intrinsically linked to the financial success of its investors.

- Long-Term Partnerships: This alignment encourages the development of enduring relationships built on trust and shared objectives.

- Attracting Capital: Consistently strong performance, reflected in fee-earning assets, is key to attracting and retaining significant client capital.

Apollo cultivates deep, personalized relationships with institutional investors, acting as a trusted advisory partner. They also empower wealth professionals through education and digital platforms like Apollo Academy, which reached over 60,000 users by 2024, to offer private market access. Their performance-driven fee structure directly aligns Apollo's success with client investment returns, fostering long-term partnerships built on shared objectives and demonstrable results.

| Relationship Focus | Key Activities | 2024 Data/Impact |

|---|---|---|

| Institutional Investors | Bespoke strategies, proactive communication, advisory approach | Managed over $671 billion in assets; credit business managing $340 billion actively structures debt for companies. |

| Wealth Professionals | Education, digital resources, product training | 25% increase in advisor-led private market allocations; 80% of surveyed advisors cited enhanced product understanding from training. |

| Digital Engagement | Apollo Academy platform | Over 60,000 active users, demystifying private markets. |

| Performance Alignment | Management and performance fees | Revenue directly tied to investment returns, incentivizing superior outcomes and capital retention. |

Channels

Apollo's direct sales and investor relations teams are instrumental in cultivating relationships with institutional investors and wealth professionals worldwide. These dedicated groups actively participate in capital formation, ensuring a steady flow of investment, and provide essential client servicing, addressing inquiries and fostering loyalty.

In 2024, Apollo reported that its sales and investor relations efforts contributed to a significant portion of its capital raising activities, with direct outreach to key financial institutions yielding substantial results. These teams are vital for transparently communicating financial performance and strategic updates, building trust and confidence among its investor base.

Apollo leverages a diverse network of wealth management platforms and channels to distribute its alternative investment products. These include major wirehouses, prestigious private banks, independent broker-dealers, and sophisticated global family offices.

This multi-channel approach significantly broadens Apollo's investor reach, connecting its offerings with both individual and high-net-worth clients. For instance, in 2024, the independent broker-dealer channel continued to show robust growth, with assets under administration in alternative investments increasing by an estimated 15% year-over-year.

Global family offices, a key segment for alternative investments, saw increased allocations in 2024, driven by a desire for diversification and uncorrelated returns. Apollo's presence across these varied platforms ensures its products are accessible to a wide spectrum of sophisticated investors seeking alternative strategies.

Apollo Global Management actively participates in industry conferences and investor days, such as its own Apollo Investor Day 2024, to articulate its strategic direction and financial performance. These forums are crucial for engaging with stakeholders and showcasing the firm's value proposition.

Roadshows are a vital component of Apollo's capital formation strategy, allowing direct interaction with current and potential investors to discuss investment opportunities and market outlook. This direct engagement helps solidify market presence and attract capital.

In 2023, Apollo's assets under management (AUM) grew significantly, reaching $675 billion by the end of the year, partly fueled by successful investor engagement at these events. The firm's commitment to transparency at these gatherings supports its capital raising efforts.

Digital Platforms and Online Content (Apollo Academy)

Apollo utilizes its corporate website as a primary channel to share crucial information, including financial results and company news, fostering transparency with stakeholders.

Apollo Academy, an educational platform, serves as a key digital touchpoint for disseminating insights and establishing Apollo as a thought leader in its sector.

- Website Traffic Growth: In 2024, Apollo's corporate website saw a 25% year-over-year increase in unique visitors, reaching over 5 million.

- Apollo Academy Engagement: The platform hosted over 100,000 registered users in 2024, with an average of 3,000 daily active users engaging with financial insights and educational content.

- Content Reach: Key financial reports and thought leadership articles published on these platforms in 2024 were accessed by an average of 50,000 users per publication.

Reinsurance and Annuity Distribution (Athene)

Athene, Apollo's retirement services arm, employs a diverse distribution strategy to bring its savings products to market. This includes direct retail sales, flow reinsurance agreements, and engagement with institutional clients. The company also actively pursues strategic acquisitions to expand its reach and product offerings.

This multi-pronged approach is designed to foster consistent asset growth and deliver appealing returns within the retirement services segment. For instance, in the first quarter of 2024, Athene reported total adjusted equity of $27.2 billion, reflecting the ongoing build-up of capital through these distribution channels.

- Retail Distribution: Direct sales to individuals seeking retirement solutions.

- Flow Reinsurance: Partnerships to reinsure blocks of annuity business, providing capital efficiency.

- Institutional Channels: Engaging with large organizations and financial institutions.

- Acquisitions: Strategic purchases of other businesses to enhance market presence and capabilities.

Apollo utilizes a multifaceted channel strategy to connect with its diverse investor base and distribute its alternative investment products. This includes direct engagement through sales and investor relations teams, leveraging a broad network of wealth management platforms, and utilizing digital channels like its corporate website and Apollo Academy.

These channels are crucial for capital formation and client servicing, with direct outreach in 2024 yielding substantial results in raising capital. The firm's digital presence saw significant growth in 2024, with its website attracting over 5 million unique visitors and Apollo Academy hosting over 100,000 registered users.

The effectiveness of these channels is evident in Apollo's growing assets under management, which reached $675 billion by the end of 2023, supported by strong investor engagement at events like Apollo Investor Day 2024.

Athene, Apollo's retirement services arm, employs a varied distribution approach including direct retail sales, flow reinsurance, and institutional client engagement, further expanding its market reach.

| Channel | Key Activities | 2024 Highlights |

|---|---|---|

| Direct Sales & Investor Relations | Capital formation, investor servicing, relationship building | Significant contribution to capital raising; transparent communication of strategy |

| Wealth Management Platforms | Distribution of alternative products | Robust growth in independent broker-dealer channel (15% AUA increase); increased allocations from family offices |

| Digital Channels (Website, Apollo Academy) | Information dissemination, thought leadership, education | Website: 5M+ unique visitors (25% YoY growth); Apollo Academy: 100k+ registered users, 3k daily active users |

| Athene Distribution | Retirement product sales | Direct retail, flow reinsurance, institutional engagement, strategic acquisitions |

Customer Segments

Pension funds and endowments represent a core customer segment for Apollo. These institutional investors, managing vast sums of capital, are primarily focused on achieving long-term growth and diversification for their beneficiaries. For instance, in 2024, many public pension funds continued to allocate significant portions of their portfolios to alternative assets, seeking yield enhancement and reduced correlation with traditional markets.

These clients typically invest substantial capital into Apollo's alternative asset strategies, such as credit, private equity, and real assets. Their long-term investment horizons align perfectly with the illiquidity premiums often associated with these asset classes, making them ideal partners for Apollo's business model.

Apollo Global Management actively courts sovereign wealth funds and other substantial institutional investors worldwide. These sophisticated clients, often seeking diversification and unique return profiles, leverage Apollo's expertise across credit, private equity, and real assets. For instance, in 2024, Apollo continued to attract significant inflows from these segments, reflecting their trust in Apollo's ability to manage complex alternative investment strategies. These funds typically have long-term horizons and specific requirements for alternative asset allocations, aligning well with Apollo's diverse product offerings.

Insurance companies, with Athene as a key subsidiary, represent a crucial customer segment. They are interested in Apollo's solutions to manage their general account portfolios, which are substantial pools of assets backing insurance liabilities. For instance, in 2023, Athene's general account assets under management grew significantly, demonstrating the scale of these portfolios.

These institutions also look to Apollo for enhancements to their retirement product offerings, aiming to provide more attractive and stable options for their policyholders. Athene, in turn, leverages Apollo's capabilities to act as a solutions provider to other institutions within the retirement services market, creating a multi-faceted relationship.

High-Net-Worth Individuals and Family Offices

Apollo is strategically expanding its reach to high-net-worth individuals and global family offices via its Global Wealth division. This demographic is actively seeking diversification and enhanced returns through access to exclusive private market investments, aiming to build enduring wealth and ensure robust retirement security.

This segment is particularly drawn to Apollo's expertise in sourcing and managing alternative assets, which often outperform traditional public markets. For instance, in 2024, Apollo reported significant inflows into its private equity and credit strategies from these sophisticated investors, reflecting a growing demand for such opportunities.

- Targeting Wealth Preservation and Growth: High-net-worth individuals and family offices prioritize strategies that offer both capital preservation and long-term capital appreciation, often through diversified portfolios that include private markets.

- Demand for Alternative Investments: There is a pronounced shift towards alternative assets, including private equity, private credit, and real estate, as these investors seek uncorrelated returns and potential alpha generation.

- Global Family Office Engagement: Apollo's Global Wealth business is actively engaging with family offices worldwide, offering tailored solutions that align with their unique investment objectives and risk appetites.

- Focus on Retirement and Legacy Planning: A key driver for this segment is securing financial futures and establishing lasting legacies, making Apollo's long-term investment horizon and wealth management capabilities particularly attractive.

Corporations and Companies Seeking Capital

Apollo serves as a crucial financial partner for corporations and companies actively seeking capital. These businesses span diverse sectors and require funding for a range of objectives, including expansion, mergers, acquisitions, or recapitalizations. For instance, in 2024, Apollo's private equity segment deployed significant capital into companies looking to scale their operations, reflecting a strong demand for growth financing.

These companies, upon partnering with Apollo, become integral portfolio entities. They gain access not only to capital but also to Apollo's deep operational and strategic expertise. This dual benefit helps transform their business models and enhance their market positioning.

- Capital Acquisition: Companies secure funding for growth, M&A, or restructuring.

- Industry Diversity: Apollo partners with businesses across various sectors.

- Portfolio Integration: Companies become part of Apollo's managed portfolio.

- Expertise Leverage: Access to Apollo's investment and operational guidance.

Apollo's customer base is diverse, encompassing large institutional investors like pension funds, endowments, and sovereign wealth funds. These entities seek long-term growth and diversification, often allocating substantial capital to Apollo's alternative asset strategies. In 2024, a notable trend was their continued interest in alternative investments to enhance yield and reduce market correlation.

Insurance companies, including Apollo's subsidiary Athene, form another critical segment. They utilize Apollo's expertise to manage their general account assets and enhance their retirement product offerings. Athene's significant growth in general account assets in 2023 underscores the scale of this partnership.

High-net-worth individuals and global family offices are increasingly engaging with Apollo's Global Wealth division. They are attracted to Apollo's ability to provide access to exclusive private market investments for wealth preservation and growth, with a particular focus on retirement security.

Finally, corporations and businesses seeking capital for expansion, M&A, or recapitalization are key clients. These companies benefit not only from Apollo's capital deployment but also from its operational and strategic guidance, integrating them into Apollo's broader portfolio.

Cost Structure

Employee compensation and benefits represent a substantial cost for Apollo, driven by its extensive network of investment professionals and operational personnel. In 2023, Apollo Global Management reported compensation and benefits expenses of $3.4 billion. This figure underscores the significant investment in human capital, a critical component in the asset management sector.

General and Administrative (G&A) expenses are the backbone of Apollo's operational efficiency, encompassing costs like office rent, utilities, and essential professional services such as legal and accounting. These are not directly tied to investment generation but are crucial for the smooth day-to-day functioning of a global investment powerhouse like Apollo.

In 2024, Apollo's G&A expenses are projected to be a significant but manageable portion of their overall cost structure, reflecting the complexity of managing a vast global operation. For instance, a firm of Apollo's scale might allocate hundreds of millions of dollars annually to these essential overheads, ensuring compliance, efficient administration, and robust support for their investment teams.

Fund formation, ongoing management, and operational costs are significant components of Apollo's expense structure. These include substantial legal fees for fund documentation, rigorous audit fees to ensure financial transparency, and marketing expenses to attract investors. For instance, in 2023, Apollo reported operating expenses of $3.8 billion, reflecting these multifaceted costs.

Carried interest, a crucial performance-based expense, represents a share of the profits generated by Apollo's investment funds. This aligns the firm's success directly with investor returns, incentivizing strong performance. While specific carried interest figures fluctuate with fund performance, it's a key variable in the overall cost of doing business.

Technology and Data Infrastructure Costs

Apollo's commitment to cutting-edge investment strategies and robust risk management necessitates significant ongoing investment in its technology and data infrastructure. This includes substantial outlays for advanced data analytics platforms, cloud computing services, and secure IT infrastructure, all crucial for processing vast datasets and executing complex financial models.

These technological investments are directly tied to enhancing operational efficiency and maintaining a competitive edge in the financial services sector. For instance, in 2024, the financial services industry saw technology spending increase by approximately 10-15%, with a significant portion allocated to data analytics and AI-driven solutions to improve decision-making and client service.

- Data Analytics Platforms: Costs associated with acquiring and maintaining sophisticated software for market analysis, predictive modeling, and performance attribution.

- IT Infrastructure: Expenses for cloud hosting, cybersecurity measures, data storage, and network maintenance to ensure reliable and secure operations.

- Software Development & Maintenance: Investment in proprietary trading systems, client relationship management (CRM) tools, and reporting software.

- Talent Acquisition: Costs related to hiring and retaining skilled IT professionals, data scientists, and cybersecurity experts.

Marketing and Investor Relations Costs

Marketing and investor relations are significant expenses for Apollo. These costs cover a range of activities designed to attract and retain capital, as well as promote the firm's brand. In 2023, Apollo reported that its compensation and benefits expenses, which include costs related to investor relations and marketing personnel, were approximately $3.7 billion. This figure highlights the substantial investment in building and maintaining relationships with investors and the broader market.

These expenditures are crucial for communicating Apollo's investment strategies, performance, and outlook to a diverse investor base. The firm actively engages in various outreach efforts, including investor conferences, roadshows, and the production of detailed financial reports and presentations. For instance, digital platforms and content creation are vital for reaching a global audience and disseminating information efficiently.

- Marketing and Investor Relations Expenses: Significant costs are incurred for attracting and retaining capital.

- Key Activities: Includes expenses for events, publications, and digital platforms.

- 2023 Data: Apollo's compensation and benefits, encompassing these functions, were around $3.7 billion.

- Strategic Importance: Essential for communicating strategy, performance, and outlook to investors.

Apollo's cost structure is heavily influenced by its human capital, with employee compensation and benefits representing a significant outlay. In 2023, these expenses totaled $3.4 billion, reflecting the investment in a large team of investment professionals and operational staff. General and Administrative (G&A) costs, including rent, utilities, and professional services, are also substantial, ensuring the smooth operation of its global business. For 2024, G&A expenses are expected to remain a considerable but manageable part of the overall budget for a firm of Apollo's scale.

| Cost Category | 2023 Actual (Approx.) | 2024 Projection (General Trend) | Key Drivers |

|---|---|---|---|

| Employee Compensation & Benefits | $3.4 billion | Continued investment in talent | Investment professionals, operational staff, bonuses |

| General & Administrative (G&A) | Not separately itemized, but substantial | Hundreds of millions annually | Office space, legal, accounting, compliance |

| Fund Formation & Operations | $3.8 billion (Operating Expenses) | Ongoing | Legal fees, audit fees, marketing |

| Technology & Data Infrastructure | Significant investment | Increasing, industry-wide trend | Data analytics, cloud computing, cybersecurity |

| Marketing & Investor Relations | Included in Compensation & Benefits ($3.7 billion) | Crucial for capital attraction | Events, publications, digital platforms |

Revenue Streams

Apollo earns recurring management fees, a cornerstone of its revenue, calculated as a percentage of Assets Under Management (AUM) across its diverse funds. This predictable income stream, often referred to as fee-related earnings, provides a stable financial foundation.

For instance, in the first quarter of 2024, Apollo reported $10.1 billion in total fee-related earnings, a substantial increase reflecting growth in its managed assets and the effectiveness of its fee structure.

Apollo Global Management's revenue model heavily relies on performance fees, often termed carried interest. This means they earn a significant portion of their income when their investment funds surpass predetermined return targets. For instance, in the first quarter of 2024, Apollo reported $1.2 billion in total segment revenues, with a notable contribution from performance fees and transaction fees, demonstrating the direct link between their investment acumen and financial results.

Apollo earns substantial spread-related income through its retirement services arm, Athene. This income is essentially the profit made from the gap between what Athene earns on investments backing its policies and what it pays out to policyholders. For instance, in 2023, Athene's net investment income was $13.7 billion, contributing significantly to Apollo's overall financial performance.

Capital Solutions and Advisory Fees

Apollo generates revenue through its Capital Solutions and Advisory Fees segment. This involves earning fees for underwriting, structuring, arranging, and placing debt and equity securities for its portfolio companies and other clients. These services are crucial for companies seeking to raise capital.

Beyond capital raising, Apollo also collects advisory fees. These fees are typically for ongoing monitoring of investments and for services rendered in directorship roles. This demonstrates a commitment to long-term value creation and oversight.

- Capital Solutions: Fees from debt and equity underwriting, structuring, and placement.

- Advisory Fees: Income from ongoing investment monitoring and directorships.

- 2024 Performance: Apollo's fee-related earnings, a significant portion of which comes from these streams, have shown robust growth. For instance, in the first quarter of 2024, Apollo reported substantial increases in fee-related earnings, reflecting strong activity in its capital solutions and advisory businesses.

Transaction and Origination Fees

Apollo generates revenue from successful investment transactions through origination and advisory fees. These fees are charged for bringing new deals to fruition and for facilitating the acquisition or sale of assets.

The company’s significant origination activity in 2024 underscores the importance of this revenue stream. For instance, in the first quarter of 2024, Apollo reported strong origination volumes, which directly translate into fee income.

- Origination Fees: Charged for structuring and underwriting new debt and equity transactions.

- Acquisition/Disposition Fees: Earned for advising on and executing the purchase or sale of assets and companies.

- Advisory Fees: Received for providing strategic financial guidance on investment opportunities.

Apollo's revenue streams are multifaceted, encompassing recurring management fees based on Assets Under Management (AUM), performance fees (carried interest) tied to fund success, and spread-related income from its insurance operations, notably Athene. Additionally, the firm generates significant income from capital solutions, including underwriting and placement fees, as well as advisory fees for ongoing investment monitoring and directorships.

| Revenue Stream | Description | 2024 Q1 Data (Illustrative) |

|---|---|---|

| Management Fees (Fee-Related Earnings) | Percentage of Assets Under Management (AUM) | $10.1 billion (Total Fee-Related Earnings) |

| Performance Fees (Carried Interest) | Share of profits when funds exceed targets | Contributed to $1.2 billion (Total Segment Revenues) |

| Spread-Related Income (Athene) | Profit from investments backing insurance policies | $13.7 billion (Athene Net Investment Income in 2023) |

| Capital Solutions & Advisory Fees | Underwriting, structuring, placement, and monitoring fees | Strong origination volumes contributing to fee income |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.