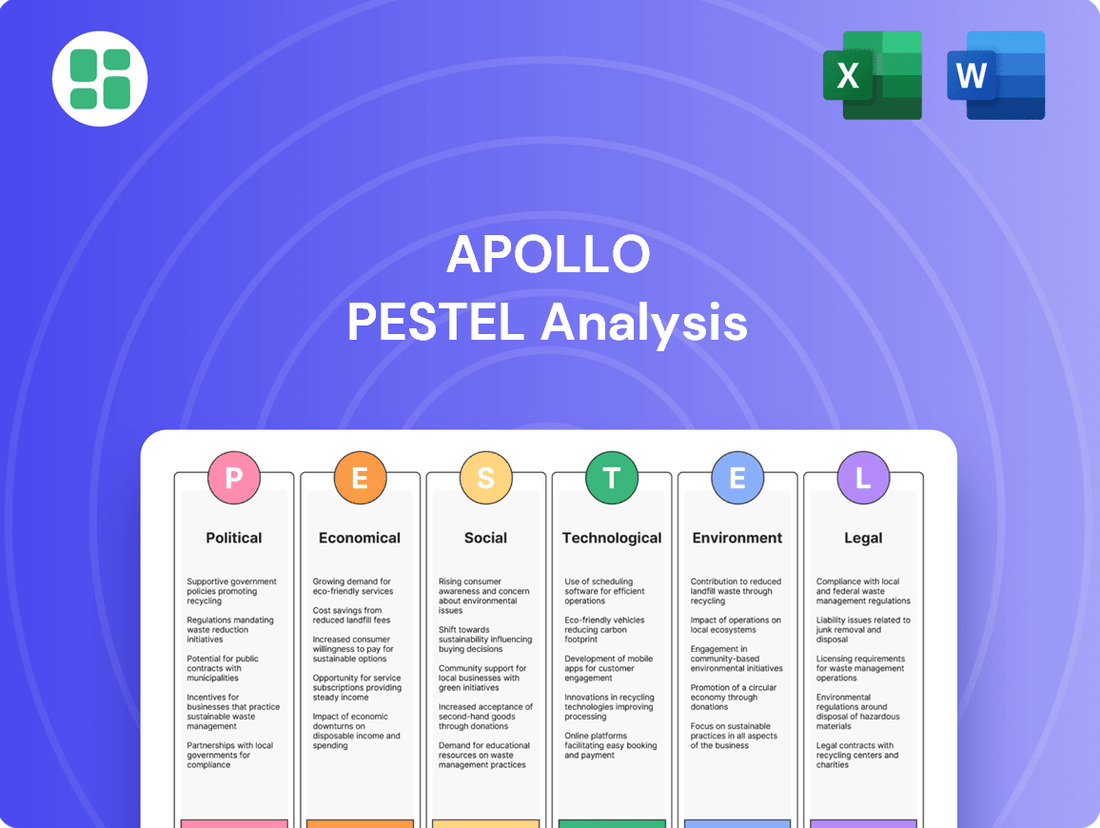

Apollo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

Uncover the critical external factors shaping Apollo's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your own market approach. Download the full analysis now and gain a significant competitive advantage.

Political factors

The upcoming US presidential election in late 2024, and the subsequent implementation of policies by the incoming administration, pose a significant risk of geopolitical volatility. Historically, shifts in US trade policies, including tariff adjustments and changes to immigration regulations, have directly impacted global supply chains and market sentiment. For instance, the trade disputes initiated in 2018 led to considerable market fluctuations. Apollo, as a global alternative investment manager, must prepare for potential disruptions to cross-border investments and sector-specific stability, as these political decisions can swiftly alter investment flows and risk appetites.

The alternative asset management sector, where Apollo operates, faces continuous shifts in financial regulations impacting the broader financial services industry. These evolving rules can directly influence capital requirements, reporting obligations, and the types of investment activities firms like Apollo can undertake.

For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine rules around private fund disclosures, aiming for greater transparency. Apollo, managing over $670 billion in assets as of Q1 2024, must adapt its compliance frameworks to meet these updated standards, which can affect operational costs and investment flexibility.

Staying informed and compliant with these regulatory changes is paramount for Apollo to maintain its operational licenses and ensure adherence to legal frameworks across its varied investment strategies, including private equity, credit, and real assets.

Government infrastructure spending, particularly through initiatives like the United States' Bipartisan Infrastructure Law, is a significant tailwind for Apollo. This law, enacted in 2021, allocated over $1.2 trillion for infrastructure improvements, creating substantial opportunities in real assets. Apollo's focus on infrastructure aligns perfectly with these federal spending priorities, offering a robust pipeline for investment.

Apollo can strategically position itself to benefit from these government-backed projects. By leveraging its deep expertise in real asset management, the firm can capitalize on the increased demand for infrastructure development. This approach not only presents attractive investment returns but also supports broader national economic development goals.

International Tax Regime Shifts

International tax regime shifts are significantly impacting global business operations and talent mobility. For instance, the UK's recent overhaul of its tax rules for wealthy foreign residents, effective April 2025, aims to broaden the tax base by introducing a residence-based system for all income and capital gains, moving away from the previous remittance basis for non-domiciled individuals. This change could alter the attractiveness of the UK as a base for high-net-worth individuals and, consequently, for companies seeking to attract top-tier talent.

Apollo's strategic expansion into Zurich in 2024, partly influenced by such global tax policy adjustments, underscores the critical need for companies to proactively adapt. By understanding and responding to evolving governmental policies, firms like Apollo can better optimize their talent acquisition strategies and enhance client access in key international markets. This adaptability is crucial for maintaining a competitive edge in a dynamic global landscape.

- UK Tax Overhaul (April 2025): Transition to a residence-based system for all income and capital gains, impacting foreign residents.

- Talent Mobility Impact: Changes in tax policies can influence where global talent chooses to live and work.

- Apollo's Zurich Expansion (2024): A strategic move partly driven by the need to navigate international tax and regulatory environments.

- Strategic Adaptation: Companies must align their operational and talent strategies with evolving governmental fiscal policies.

Convergence of Public and Private Markets

Political and regulatory shifts are actively encouraging the blending of public and private financial markets. This is often seen in strategic alliances between alternative investment firms and established financial institutions. For instance, by mid-2024, regulators in several key jurisdictions were exploring frameworks to facilitate greater integration, aiming to boost overall market liquidity.

These policy-driven changes are creating novel pathways for deploying capital and fostering collaborative ventures. The objective is frequently to enhance market stability and broaden investment opportunities for a wider range of participants.

Apollo's strategic moves, such as its efforts to syndicate and trade private credit, directly mirror this evolving political and economic environment. By Q1 2025, Apollo reported a significant increase in its private credit origination volume, a testament to the growing acceptance of these market structures.

- Regulatory Support: Policymakers are increasingly designing regulations to support the integration of private and public capital pools.

- Liquidity Enhancement: A key political driver is the desire to improve market liquidity and resilience through diverse funding sources.

- Apollo's Strategy: Apollo's expansion into private credit syndication aligns with these trends, leveraging new market access.

The political landscape presents both opportunities and challenges for Apollo. Upcoming elections, like the US presidential election in late 2024, can introduce geopolitical volatility and impact trade policies, potentially affecting global supply chains and market sentiment. Regulatory environments are continuously evolving, with bodies like the SEC refining rules for private fund disclosures, demanding adaptability from firms managing substantial assets, such as Apollo's over $670 billion as of Q1 2024.

What is included in the product

The Apollo PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting Apollo across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Apollo PESTLE Analysis provides a clear, summarized version of complex external factors, alleviating the pain point of information overload during strategic planning and decision-making.

Economic factors

Credit markets demonstrated remarkable strength heading into 2025, continuing a trend observed throughout 2024. Spreads in various credit segments, including investment-grade and high-yield bonds, tightened significantly, with some reaching multi-year lows. For instance, the average spread on the Bloomberg U.S. Corporate Bond Index was hovering around 110 basis points in early 2025, a notable compression from previous years.

This robust credit environment provides Apollo with opportunities to capture attractive yields, especially within its private credit strategies. The ability to deploy capital efficiently in this market is a key advantage, allowing for the sourcing of compelling risk-adjusted returns. Apollo's focus on private credit, which often offers illiquidity premiums, is particularly well-positioned.

However, the prevailing tight spreads necessitate an even more disciplined approach to risk management and due diligence. While yields are attractive, the narrow gap between borrowing costs and potential returns means that thorough analysis is crucial to avoid mispriced risk and ensure that investments deliver on their promised risk-adjusted performance. This heightened scrutiny is paramount to maintaining portfolio integrity.

Apollo's chief economist forecasts a slight deceleration in U.S. economic growth for 2025. Despite this, the economy is projected to maintain enough momentum to undergird corporate financial health.

While a recession isn't on the horizon, the firm anticipates challenges stemming from both supply and demand dynamics. Interest rates are expected to remain elevated longer than initially anticipated, driven by stubborn inflation and a resilient labor market.

For context, the U.S. GDP growth was 2.5% in 2024, and projections for 2025 hover around 1.8% to 2.2%, indicating a moderation but not a contraction. Inflation, measured by the Consumer Price Index (CPI), averaged 3.4% in 2024 and is expected to remain above the Federal Reserve's 2% target, potentially around 2.8% in 2025, necessitating sustained higher interest rates.

Sustained higher interest rates present a significant headwind for companies with fragile credit profiles, especially those already burdened by low interest coverage ratios or substantial debt. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level not seen in decades, increasing borrowing costs for many businesses.

Apollo's investment approach needs to be keenly aware of these risks. This means a strategic pivot towards prioritizing investment-grade credit and senior-secured debt, which offer greater protection in a rising rate environment. This focus aims to sidestep potential defaults and capitalize on opportunities arising from market dislocations.

Demand for Digital Infrastructure

The global economy is experiencing a massive surge in demand for digital infrastructure, particularly data centers. This trend is projected to necessitate over $2 trillion in financing within the next five years, highlighting a significant investment opportunity. Apollo's expertise in real assets and credit is well-positioned to capitalize on this growth by funding technology-centric infrastructure projects.

Key drivers behind this demand include the proliferation of cloud computing, artificial intelligence, and the Internet of Things (IoT). These technologies require robust and scalable data storage and processing capabilities. The ongoing digital transformation across industries is fueling the need for more data centers, creating a substantial market for infrastructure development and financing.

- Data Center Capacity Growth: Global data center capacity is expected to grow significantly, driven by increased data generation and consumption.

- AI and Cloud Computing: The exponential growth of AI workloads and cloud services is a primary catalyst for data center expansion.

- Investment Requirements: Over $2 trillion in financing is anticipated for digital infrastructure over the next five years.

- Apollo's Opportunity: Apollo's real assets and credit divisions can target investments in this high-growth sector.

Buoyant Private Equity Market

The private equity landscape is particularly robust, with buyout funds leading the charge in capital attraction throughout 2024. This strong investor confidence is fueling a dynamic deal environment, creating fertile ground for firms like Apollo to execute strategic acquisitions and leverage market upturns for profitable exits. The expectation of central bank rate cuts and a strengthening stock market are key catalysts for this buoyant activity.

This positive trend translates into significant opportunities for capital deployment and value creation within the private equity sector.

- Global Private Equity Growth: Buyout funds are attracting the most capital in 2024, signaling strong investor appetite.

- Catalysts for Deal Flow: Expected central bank rate cuts and a rising stock market are boosting M&A activity.

- Apollo's Opportunity: This environment allows Apollo to actively deploy capital and pursue profitable exit strategies via acquisitions and IPOs.

The economic outlook for 2025 suggests a moderation in U.S. GDP growth, projected between 1.8% and 2.2%, down from an estimated 2.5% in 2024. Inflation is expected to remain above the Federal Reserve's target, around 2.8% in 2025, contributing to sustained higher interest rates, with the Fed's benchmark rate likely to stay in the 5.25%-5.50% range seen in early 2024.

These elevated rates pose a challenge for highly leveraged companies, increasing borrowing costs and potentially impacting interest coverage ratios. Consequently, Apollo's strategy will likely emphasize investment-grade and senior-secured debt, offering greater capital preservation in this environment.

The digital infrastructure sector, particularly data centers, presents a significant growth opportunity, requiring an estimated $2 trillion in financing over the next five years, driven by AI and cloud computing demands.

The private equity market, led by buyout funds, is experiencing robust capital attraction in 2024, supported by anticipated central bank rate cuts and a strengthening stock market, creating favorable conditions for Apollo's deal execution and exit strategies.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | Impact on Apollo |

|---|---|---|---|

| U.S. GDP Growth | 2.5% | 1.8% - 2.2% | Moderating growth necessitates focus on resilient sectors. |

| U.S. Inflation (CPI) | 3.4% | ~2.8% | Sustained higher rates impact borrowing costs for companies. |

| Federal Funds Rate | 5.25% - 5.50% | Likely to remain elevated | Favors senior secured debt and investment grade credit. |

| Digital Infrastructure Financing Need | N/A | >$2 Trillion (next 5 yrs) | Significant opportunity in data centers and tech infrastructure. |

| Private Equity Capital Attraction | Strong (Buyout Funds Leading) | Expected to remain robust | Supports Apollo's deployment and exit strategies. |

Preview the Actual Deliverable

Apollo PESTLE Analysis

The preview shown here is the exact Apollo PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Apollo PESTLE Analysis document you’ll download after payment.

Sociological factors

Investors are increasingly looking at Environmental, Social, and Governance (ESG) factors when making decisions, pushing for more sustainable investment choices and clearer information. This trend is reshaping how companies operate and attract capital.

Apollo has actively adapted to this shift by enhancing its sustainability data systems and ESG reporting capabilities. By 2024, the company was providing ESG reports for over 150 financial products, demonstrating a commitment to meeting these growing investor and regulatory expectations.

Societal pressure for net-zero economies is driving significant investment in climate and energy transition. Apollo Global Management is a prime example, having deployed approximately $30 billion in 2024 towards these initiatives, with a clear ambition to reach $100 billion by 2030.

This strategic allocation reflects a broader trend where investors increasingly favor portfolios that actively address climate change and champion sustainable practices, signaling a fundamental shift in capital allocation priorities.

The world's population is getting older, with the number of people aged 65 and over expected to reach 1.6 billion by 2050. This demographic shift creates a growing demand for financial products that ensure security during retirement. Apollo's subsidiary, Athene, is well-positioned to meet this need by offering a range of retirement savings solutions.

Athene's role extends beyond individual savings; it also serves as a key provider of retirement solutions to institutions. This dual approach allows Apollo to capitalize on the increasing need for financial planning and security in an aging global society. For instance, Athene's annuity products provided significant inflows in recent periods, demonstrating market demand.

Corporate Social Responsibility and Employee Engagement

Apollo's commitment to corporate social responsibility significantly influences employee engagement. Initiatives like Apollo Empower, focused on enhancing job quality, compensation, and training within its portfolio, directly address employee well-being and professional development. This focus on improving the employee experience is crucial in today's market, where workers increasingly seek purpose-driven employment.

The company's emphasis on employee volunteerism further underscores its dedication to social impact. In 2024 alone, Apollo staff dedicated over 20,000 hours to community service, demonstrating a tangible commitment that resonates with employees who value corporate citizenship. This active participation fosters a sense of pride and belonging, strengthening the connection between employees and the organization's mission.

- Apollo Empower's focus on job quality and training directly impacts employee satisfaction and retention.

- Over 20,000 employee volunteer hours contributed in 2024 highlights a strong societal expectation for corporate community involvement.

- This engagement in social responsibility initiatives can lead to higher morale and a more committed workforce.

Public Perception and Reputation

Apollo's public perception and reputation are paramount as a major global alternative investment manager. Their commitment to sustainability reporting, climate-focused investments, and various social initiatives is key to fostering trust among institutional and individual investors. These investors are increasingly focused on a company's wider societal contributions, making Apollo's proactive approach vital for maintaining a positive image.

For instance, in 2024, Apollo announced its intention to invest $100 billion in sustainable finance by 2030, demonstrating a tangible commitment to environmental and social governance (ESG) principles. This aligns with growing investor demand; a 2024 survey by PwC found that 70% of investors consider ESG factors when making investment decisions.

- Reputation Management: Apollo actively manages its public image through ESG initiatives and transparent communication.

- Investor Trust: Proactive engagement in sustainability and social impact builds crucial trust with a diverse investor base.

- Transparency: Open governance practices reinforce credibility and a positive corporate reputation.

- Market Alignment: Apollo's focus on sustainability resonates with the growing trend of ESG-conscious investing, with significant capital allocation planned for green initiatives.

Societal shifts significantly influence investment strategies, with a growing emphasis on ESG principles. Apollo's proactive stance in sustainability and social impact, including substantial climate investments and employee engagement programs, directly addresses these evolving expectations. This commitment not only shapes its public perception but also solidifies investor trust in a market increasingly driven by ethical considerations.

Technological factors

The relentless advancement of computing power, especially with the rise of generative AI, is driving a massive surge in demand for data centers and the broader digital infrastructure ecosystem. This growth is creating substantial investment avenues for real assets, with global data center construction expected to see significant capital infusion through 2025 and beyond, as companies race to house the processing power needed for these new technologies.

Apollo is heavily investing in advanced data analytics to improve its ESG reporting, recognizing the increasing need for detailed and timely disclosures. This focus on data engineering is crucial for accurately measuring and reporting on environmental impact and social metrics across their vast investment portfolio, ensuring greater transparency for stakeholders.

Fintech is a game-changer for climate finance, making it easier to handle all the complex sustainability data. Apollo is actively using these new fintech tools to build better ways to see what's happening with climate risks. This includes creating transparency tools, advanced climate risk modeling, and the digital backbone needed to really understand and manage those long-term dangers.

By embracing fintech, Apollo aims to get a real-time handle on things like carbon pricing and how well investments are performing against sustainability goals. For instance, the global green bond market was projected to reach $1 trillion in 2023, highlighting the growing need for sophisticated digital platforms to manage these investments effectively.

Blockchain and Tokenization of Private Credit

Apollo is actively embracing blockchain technology, particularly in its efforts to tokenize private credit. This move is designed to streamline processes like loan origination and investor onboarding, potentially slashing administrative expenses by as much as 30%.

The tokenization of private credit deals, a key initiative for Apollo, promises to automate crucial steps, including the disbursement of interest payments. This automation not only enhances efficiency but also provides investors with real-time insights into deal performance, a significant improvement for typically illiquid assets.

- Efficiency Gains: Automation of loan origination, investor onboarding, and interest payments can reduce administrative costs by up to 30%.

- Enhanced Transparency: Real-time performance monitoring offers greater visibility into private credit deals.

- Improved Liquidity: Tokenization aims to make traditionally illiquid private credit markets more accessible and liquid.

Cybersecurity and Data Protection

As Apollo's operations heavily depend on digital platforms for everything from investment analysis to client communication, cybersecurity and data protection are absolutely critical. Protecting sensitive financial information and proprietary data from cyber threats is key to maintaining client confidence and ensuring smooth operations in today's interconnected financial world.

The increasing sophistication of cyberattacks means that robust defenses are non-negotiable. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2024, a significant increase that underscores the financial impact of inadequate security.

- Regulatory Fines: Non-compliance with data protection regulations like GDPR can result in substantial fines, potentially impacting profitability and operational continuity.

- Client Trust: A single major security incident could severely damage Apollo's reputation and erode client trust, leading to significant business losses.

- Intellectual Property: Safeguarding proprietary algorithms and investment strategies is crucial for maintaining a competitive edge in the financial industry.

Technological advancements are reshaping finance, with generative AI driving demand for data centers and digital infrastructure, creating investment opportunities in real assets. Apollo is leveraging fintech for climate finance, enhancing transparency and risk modeling, as the green bond market grows. Blockchain adoption, particularly for tokenizing private credit, promises significant efficiency gains and improved liquidity in traditionally illiquid markets.

Legal factors

Apollo navigates a complex and ever-changing financial regulatory landscape. New rules around capital requirements and investor protection are frequently introduced, directly affecting its credit, private equity, and real asset divisions. For instance, the ongoing adjustments to Basel III, which impact bank lending and indirectly influence credit markets where Apollo is active, underscore this dynamic. Staying compliant is paramount for maintaining market access and operational integrity.

Regulators and investors are increasingly demanding more thorough ESG disclosures. Apollo is enhancing its sustainability reporting, which now includes Scope 3 greenhouse gas emissions, and is creating new reporting structures for its portfolio companies. This proactive approach ensures compliance with existing and upcoming legal requirements for environmental and social transparency.

Apollo, as a global alternative investment manager, navigates a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across numerous jurisdictions. These legal frameworks are paramount for preventing financial crime and ensuring the integrity of capital flows. For instance, the Bank Secrecy Act in the United States mandates robust customer due diligence, a standard mirrored by similar legislation in the EU and Asia, impacting how Apollo vets its diverse investor base.

Failure to comply with AML/KYC requirements can result in severe penalties, including substantial fines and reputational damage, which could deter future investment. In 2024, regulators globally continued to emphasize enhanced due diligence, particularly for cross-border transactions and investments in alternative assets, areas where Apollo is a significant player. This ongoing regulatory scrutiny necessitates continuous investment in compliance technology and personnel.

Tax Law Changes and Jurisdictional Impact

Changes in tax laws significantly influence Apollo's investment strategies and profitability. For instance, the US corporate tax rate reduction from 35% to 21% enacted in late 2017 had a broad impact on multinational corporations, and ongoing discussions around global minimum taxes, such as the OECD's Pillar Two initiative, continue to shape international tax landscapes. Apollo must remain agile, adjusting its investment structures and operational frameworks to navigate these evolving tax regimes across its global footprint.

Jurisdictional tax differences create complexities and opportunities for Apollo. Variations in capital gains taxes, dividend withholding taxes, and tax incentives for specific industries or regions require meticulous planning to optimize after-tax returns. As of 2024, countries are actively implementing digital services taxes and reviewing corporate tax residency rules, further complicating cross-border investment management. Apollo's legal and financial teams are tasked with ensuring full compliance while seeking efficient tax outcomes.

- Global Tax Reforms: The OECD's Two-Pillar Solution, aiming for a 15% global minimum corporate tax, is being implemented by numerous countries, impacting how multinational companies like Apollo structure their international operations and report profits.

- Domestic Tax Adjustments: In 2024, many nations are reviewing or adjusting their domestic tax codes, including potential changes to capital gains tax rates and incentives for research and development, directly affecting investment valuations and operational costs for Apollo.

- Compliance Burden: The increasing complexity of international tax regulations and reporting requirements necessitates significant investment in compliance infrastructure and expertise for Apollo to avoid penalties and maintain its reputation.

- Tax Treaty Network: Apollo's ability to leverage tax treaties between countries remains crucial for minimizing double taxation on its investments, with ongoing negotiations and updates to these treaties requiring constant monitoring.

Legal Frameworks for Digital Assets and Tokenization

The evolving legal landscape for digital assets presents a significant challenge for companies like Apollo exploring tokenization, particularly in areas like private credit. As of mid-2025, regulatory bodies globally are still refining their approaches, creating a complex environment for compliance. For instance, the U.S. Securities and Exchange Commission (SEC) continues to clarify its stance on whether certain tokens constitute securities, impacting how they can be offered and traded. This uncertainty demands careful legal navigation to avoid potential enforcement actions.

Navigating these nascent frameworks requires Apollo to stay abreast of a patchwork of regulations. This includes understanding evolving blockchain governance rules, which vary by jurisdiction, and ensuring robust intellectual property protection for tokenization technologies. The global digital asset market, valued in the trillions of dollars by early 2025, underscores the economic imperative to get this right, but also the heightened risk associated with non-compliance.

- Securities Law Compliance: Ensuring tokenized assets adhere to existing securities regulations, as interpreted by bodies like the SEC, is paramount.

- Blockchain Regulation: Adapting to diverse and developing rules governing distributed ledger technology and smart contracts across different markets.

- Intellectual Property: Safeguarding proprietary tokenization platforms and processes against infringement in a rapidly innovating space.

- Cross-Border Considerations: Addressing the complexities of differing legal treatments of digital assets in international transactions.

The global regulatory environment continues to tighten, impacting financial institutions like Apollo. For instance, the ongoing implementation of Basel III finalization rules, with phased introductions through 2025, affects capital adequacy ratios for banks, indirectly influencing credit markets. Furthermore, the increasing scrutiny on data privacy, driven by regulations like the EU's GDPR and similar frameworks emerging globally, necessitates robust data governance and security measures for Apollo's operations and client data protection.

Antitrust and competition laws are also a significant legal consideration. As Apollo expands its market presence and engages in strategic acquisitions, it must navigate various jurisdictions' antitrust reviews, which can impact deal timelines and structures. For example, in 2024, several major financial services mergers faced prolonged regulatory scrutiny, highlighting the importance of proactive compliance with competition authorities.

| Regulatory Area | Impact on Apollo | Key Developments (2024-2025) |

|---|---|---|

| Capital Requirements | Affects lending capacity and risk management strategies. | Phased implementation of Basel III finalization impacting bank lending; potential for new liquidity rules. |

| Data Privacy | Requires enhanced data security and client consent protocols. | Increased enforcement of GDPR-like regulations; emergence of new national data localization laws. |

| Antitrust & Competition | Influences M&A activity and market expansion strategies. | Heightened regulatory review of large financial sector transactions; focus on market concentration. |

Environmental factors

Apollo is actively investing in climate solutions, allocating around $30 billion in 2024 to climate and energy transition projects. This substantial commitment is part of a broader strategy to deploy $100 billion by 2030, underscoring the firm's role in financing decarbonization efforts and sustainable infrastructure globally.

This strategic focus aligns with increasing environmental regulations and market demand for sustainable investments. By channeling capital into these sectors, Apollo is positioning itself to capitalize on the global shift towards a lower-carbon economy, addressing critical environmental challenges while seeking attractive financial returns.

Apollo is actively guiding its portfolio companies toward net-zero emissions, creating detailed roadmaps for decarbonization and managing Scope 3 greenhouse gas emissions. This focus integrates sustainability into supply chain planning, with initiatives prioritized by their financial return on investment.

Apollo has significantly enhanced its sustainability risk assessment, applying these methods to a wider array of investment strategies. This includes a more comprehensive approach to understanding how climate change, both in terms of physical impacts and the transition to a low-carbon economy, could influence asset values under different global warming projections.

The firm has also expanded its Scope 3 greenhouse gas (GHG) emissions reporting, a critical step in providing a fuller picture of its environmental footprint. For instance, by 2024, many large asset managers are aiming to report on a substantial portion of their Scope 3 emissions, reflecting growing regulatory pressure and investor demand for transparency.

Investment in Climate Technologies and Infrastructure

Apollo recognizes the vast gap between current climate technologies and what's needed for a net-zero future, driving significant investment in innovation and infrastructure. This commitment is demonstrated through substantial deals in renewable energy assets. For instance, in 2024, Apollo closed a significant investment in a portfolio of solar and battery storage projects, aiming to accelerate the deployment of clean energy solutions.

The firm is strategically financing initiatives like residential solar deployment, understanding its role in the broader energy transition. This focus supports the growing demand for distributed energy resources. Apollo's investments are designed to capitalize on the expanding market for sustainable infrastructure and technologies.

- Investment in Solar and Battery Storage: Apollo has actively funded projects to expand renewable energy capacity and grid stability.

- Residential Solar Financing: The company is providing capital to increase the adoption of solar power at the household level.

- Addressing the Net-Zero Transition: Investments are strategically aligned with the global imperative to reduce carbon emissions.

Operational Carbon Neutrality

Apollo achieved operational carbon neutrality for its Scope 1 and 2 emissions in 2024. This was accomplished through investments in carbon removal projects, effectively offsetting its direct environmental impact. This milestone underscores Apollo's dedication to sustainability and responsible corporate citizenship.

This commitment to carbon neutrality directly supports Apollo's broader environmental, social, and governance (ESG) strategy. By managing its direct emissions, Apollo aims to mitigate climate-related risks and enhance its long-term resilience. The company's 2024 performance in this area is a key indicator of its progress towards its stated sustainability targets.

- 2024 Carbon Neutrality: Scope 1 and 2 emissions offset via carbon removal projects.

- ESG Integration: Operational carbon neutrality supports broader sustainability goals.

- Risk Mitigation: Demonstrates proactive management of climate-related operational risks.

Apollo's environmental strategy centers on significant investment in climate solutions, with a $30 billion allocation in 2024 towards energy transition projects, aiming for $100 billion by 2030. This focus is driven by increasing environmental regulations and market demand for sustainable investments, positioning Apollo to benefit from the global shift to a lower-carbon economy.

The firm is actively guiding its portfolio companies towards net-zero emissions, including managing Scope 3 emissions by integrating sustainability into supply chain planning. Apollo has also enhanced its sustainability risk assessment, applying it to various investment strategies to understand climate change impacts on asset values.

Achieving operational carbon neutrality for Scope 1 and 2 emissions in 2024 through carbon removal projects highlights Apollo's commitment to sustainability and responsible corporate citizenship, directly supporting its broader ESG strategy and mitigating climate-related risks.

| Environmental Focus Area | 2024 Investment/Target | Key Initiatives | 2024 Achievement |

|---|---|---|---|

| Climate & Energy Transition | $30 billion allocated | Renewable energy assets, solar and battery storage projects | Continued deployment towards $100 billion by 2030 |

| Decarbonization of Portfolio | N/A | Net-zero roadmaps, Scope 3 emissions management | Integration into supply chain planning |

| Operational Emissions | N/A | Carbon removal projects | Scope 1 & 2 operational carbon neutrality |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures every insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable data.