Apollo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

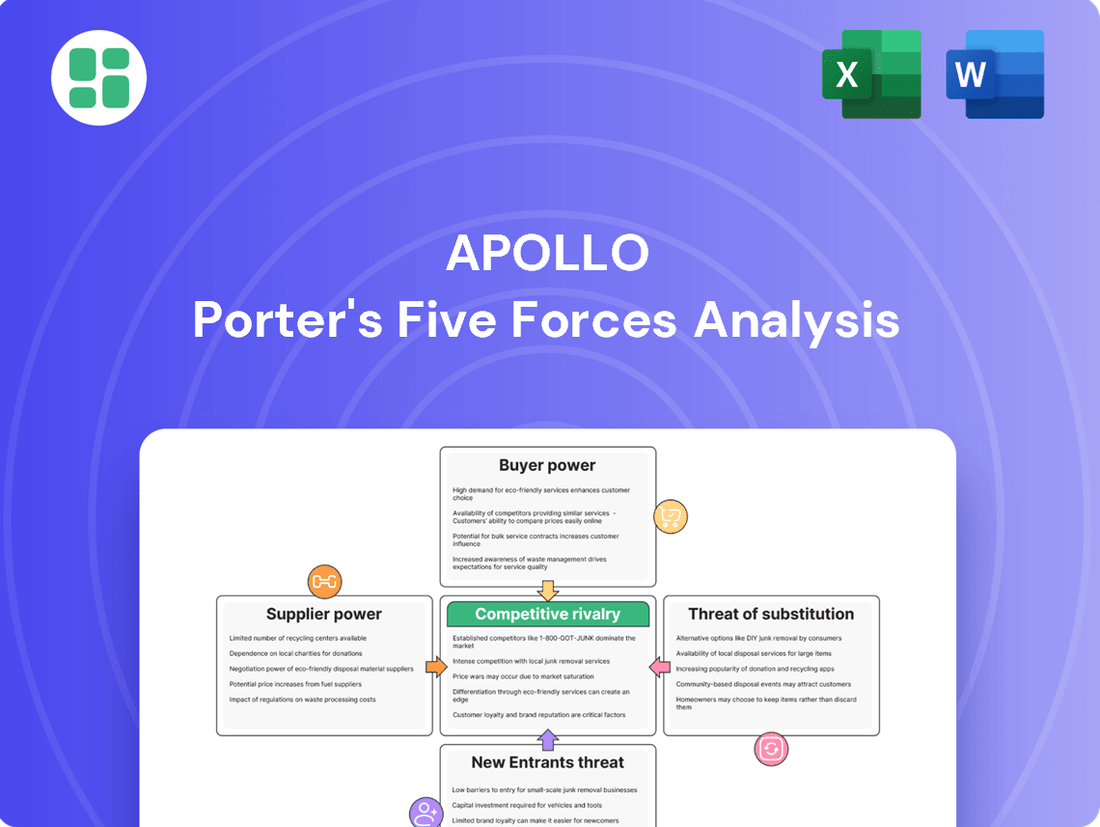

The Apollo Porter's Five Forces Analysis reveals the intricate web of competitive pressures shaping its market. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Apollo’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the realm of alternative investments, the bargaining power of suppliers, particularly in talent acquisition and retention, is a significant factor. The specialized knowledge required for deal origination and portfolio management in areas like private equity or venture capital means that experienced professionals are in high demand. This scarcity directly translates to their ability to negotiate favorable terms, impacting compensation and firm profitability.

As of early 2024, the competition for top talent in alternative asset management remains intense. For instance, average compensation packages for private equity professionals with 5-10 years of experience can easily exceed $300,000 annually, including base salary, bonus, and carried interest. This high cost of talent, driven by the specialized skills and proven track records of these individuals, underscores their substantial bargaining power.

Proprietary data and analytics providers hold significant sway, particularly when their offerings are crucial for uncovering alpha in alternative investments. Firms like Apollo rely on unique market data and advanced analytics, making it difficult to substitute these specialized research platforms. This dependence allows these providers to exert considerable bargaining power, directly impacting operational costs and a firm's competitive advantage.

Technology and software vendors hold significant bargaining power over Apollo, especially those offering proprietary trading platforms or specialized risk management systems. In 2024, the increasing reliance on AI-driven analytics and cloud infrastructure means Apollo is dependent on a select group of providers for its core operations. These vendors can dictate terms, as switching costs for mission-critical software are substantial, potentially impacting Apollo's operational efficiency and profitability.

Legal, Regulatory, and Compliance Services

The financial sector's heavy regulation means top-tier legal, compliance, and auditing services are essential. This necessity, combined with specialized knowledge and strict rules, gives firms in these areas considerable leverage, directly affecting companies' operating costs.

For instance, in 2024, the global legal services market was valued at over $700 billion, with a significant portion dedicated to financial compliance and regulatory advisory. The complexity of regulations like MiFID II or Dodd-Frank necessitates deep expertise, making it difficult for financial institutions to switch providers without substantial disruption and cost.

Key aspects influencing this bargaining power include:

- High Switching Costs: Transitioning between legal and compliance providers involves extensive knowledge transfer and potential regulatory re-approval processes, making it costly and time-consuming.

- Specialized Expertise: The intricate and ever-evolving nature of financial regulations requires highly specialized knowledge that is not easily replicated.

- Risk Mitigation: Engaging reputable legal and compliance firms is crucial for avoiding hefty fines and reputational damage, reinforcing their indispensable role.

Financial Intermediaries and Placement Agents

Financial intermediaries and placement agents, while not traditional suppliers, can wield significant bargaining power over Apollo. Their expertise in connecting Apollo with specific limited partners (LPs) or sourcing lucrative deal opportunities is crucial for capital raising and investment success.

These agents' extensive networks and proven ability to facilitate capital flows grant them leverage in negotiating fees. For instance, in 2024, placement agent fees for private equity funds typically ranged from 1% to 2% of committed capital, with top-tier agents commanding the higher end due to their access to institutional investors.

- Network Access: Placement agents provide access to a curated list of LPs, saving Apollo significant time and resources in investor outreach.

- Deal Sourcing: Consultants can identify proprietary deal flow, giving Apollo a competitive edge in acquisitions.

- Fee Negotiation: The value of these services translates into bargaining power for agents during fee discussions.

- Market Intelligence: Agents often possess deep insights into LP sentiment and market trends, which can influence deal terms.

The bargaining power of suppliers for Apollo is substantial, particularly concerning specialized talent and proprietary data crucial for alternative investments. High demand for experienced professionals in private equity, with compensation packages in early 2024 often exceeding $300,000 annually, highlights this leverage.

Furthermore, exclusive data analytics providers and critical technology vendors, essential for competitive edge and operational efficiency, can dictate terms due to high switching costs. This dependence allows these suppliers to exert significant influence on Apollo's operational expenses and strategic execution.

| Supplier Type | Key Influence Factor | 2024 Impact Example |

|---|---|---|

| Talent (PE Professionals) | Scarcity and specialized skills | Annual compensation > $300k |

| Data Providers | Proprietary market data | Crucial for alpha generation |

| Technology Vendors | Mission-critical software/AI | High switching costs |

| Legal/Compliance Firms | Regulatory expertise | Global legal services market > $700B |

| Placement Agents | LP networks and deal sourcing | Fees of 1-2% of committed capital |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Apollo's specific industry context.

Quickly identify and address competitive threats with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Large institutional investors, including pension funds, sovereign wealth funds, and endowments, represent a significant portion of Apollo's client base. These sophisticated entities manage vast sums of capital, granting them substantial leverage in negotiations. Their ability to allocate or withdraw large amounts of money means they can often dictate terms related to management fees, performance fees, and other fund-specific conditions, influencing Apollo's revenue streams.

Clients today have a vast selection of alternative investment managers, not just direct rivals but also large, diversified financial firms. This wide availability empowers them to scrutinize performance metrics, fee schedules, and unique investment approaches. For instance, as of early 2024, the global alternative investment market was valued at an estimated $14.5 trillion, with significant growth projected, offering clients more leverage than ever before.

This extensive choice directly translates into increased bargaining power for customers. They can readily compare offerings and demand better terms, such as reduced management fees or performance-based incentives. The ability to switch providers easily if expectations aren't met means Apollo must continuously demonstrate value and competitive pricing to retain and attract clients in this dynamic landscape.

Client relationships at Apollo are intrinsically tied to investment performance. If returns fall short of expectations, clients can withdraw capital or withhold new investments, a clear demonstration of their leverage.

This dynamic compels Apollo to prioritize generating strong returns and consistently maintaining an impressive track record to retain and attract capital. For instance, in 2024, many alternative asset managers faced pressure as public market volatility impacted private market valuations, highlighting the critical nature of performance in maintaining client trust and capital commitments.

Transparency and Reporting Demands

Sophisticated institutional investors, a key customer segment for asset managers like Apollo, are increasingly vocal about their reporting needs. These investors, including large pension funds and endowments, demand granular detail on portfolio performance, risk exposures, and adherence to specific Environmental, Social, and Governance (ESG) mandates. Their capacity to shift assets to managers who provide this level of transparency directly enhances their bargaining power.

This trend is evident in the growing emphasis on ESG integration within investment portfolios. For instance, by mid-2024, a significant portion of institutional capital was being allocated with ESG considerations, forcing asset managers to adapt their reporting frameworks to meet these evolving client expectations. Apollo, like its peers, must demonstrate robust ESG data and reporting capabilities to retain and attract these influential clients.

- Increased Demand for ESG Reporting: Institutional investors are prioritizing ESG factors, influencing manager selection and demanding detailed reporting on these metrics.

- Transparency as a Differentiator: High levels of operational and reporting transparency are becoming a competitive advantage, empowering clients to choose providers that meet their standards.

- Data-Driven Investment Decisions: Sophisticated investors leverage detailed data to scrutinize managers, thereby increasing their leverage in fee negotiations and service level agreements.

Long-Term Capital Commitments

Clients' long-term capital commitments, while substantial, offer a critical bargaining chip. The decision to renew or allocate new capital to Apollo's subsequent funds hinges on demonstrated past performance and a positive client experience. For instance, as of Q1 2024, Apollo reported $675 billion in assets under management (AUM), a significant portion of which represents these long-term commitments.

This ongoing reliance on client satisfaction directly influences Apollo's future AUM growth trajectory. Clients evaluate not only financial returns but also the alignment of interests and the overall service provided. A strong client retention rate, crucial for sustained growth, means Apollo must consistently deliver value and maintain trust.

- Client Leverage: The ability to re-up or allocate new capital provides clients with significant leverage.

- Performance Dependency: Future capital allocation is directly tied to satisfaction with past performance.

- AUM Growth Impact: Client retention and new allocations are vital for Apollo's ongoing AUM expansion.

- Client Experience Matters: Beyond returns, the overall client experience and alignment of interests are key decision factors.

Customers, particularly large institutional investors, wield considerable power due to their substantial capital allocations and the wide array of alternative investment managers available. This extensive choice, coupled with a growing demand for transparency and ESG reporting, allows clients to negotiate favorable terms and exert pressure on Apollo to consistently deliver strong performance and superior service. The ability for clients to easily switch providers if their expectations are not met underscores their significant bargaining power.

| Customer Segment | Leverage Factors | Impact on Apollo |

|---|---|---|

| Institutional Investors (Pension Funds, Endowments) | Large capital commitments, ability to allocate/withdraw significant sums | Dictate terms on fees, demand detailed ESG and performance reporting |

| Sophisticated Investors | Access to vast market data, ability to compare managers | Increased scrutiny of performance metrics and fee structures, driving fee pressure |

| Clients with Long-Term Commitments | Decision to renew or allocate new capital to future funds | Directly influences Apollo's AUM growth and retention rates; requires consistent value delivery |

Same Document Delivered

Apollo Porter's Five Forces Analysis

This preview showcases the complete Apollo Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises or placeholders. You can confidently expect to download this comprehensive analysis, ready for immediate application to your strategic decision-making.

Rivalry Among Competitors

The alternative asset management landscape is a battleground for titans, with giants like Blackstone, KKR, Carlyle, and Ares Management wielding significant influence and capital. These established behemoths fiercely compete across diverse sectors including private equity, credit, and real assets, constantly seeking to attract investor capital and secure prime investment deals. For instance, as of early 2024, Blackstone reported over $1 trillion in assets under management, underscoring the sheer scale and competitive firepower present.

Competitive rivalry in the asset management sector, including firms like Apollo, is intensely driven by a firm's track record and investment performance. Firms constantly strive to demonstrate superior returns, as this is absolutely critical for attracting new capital and retaining existing investors in a market that is highly sensitive to performance. Apollo's own emphasis on generating strong returns underscores this dynamic.

Firms like Apollo Global Management are locked in a fierce battle for elite investment professionals, the kind who can identify and close profitable deals. This intense competition for talent directly impacts operational costs, as compensation packages for top performers continue to rise. In 2024, the demand for experienced dealmakers in private equity remained exceptionally high, with recruitment firms reporting significant salary increases for senior roles.

Beyond talent, securing exclusive investment opportunities, or deal flow, is another critical battleground. Access to proprietary deal sourcing and the ability to win competitive auctions for attractive assets are paramount. This scarcity of high-quality deal flow necessitates strategic moves, including acquisitions, to gain an edge and expand market reach.

Diversification of Investment Strategies

The competitive landscape for investment firms like Apollo is intensifying as many players, including Apollo itself, broaden their strategic focus. This diversification means firms are no longer competing solely within a single asset class but are vying for capital across credit, private equity, and real assets simultaneously. For instance, in 2024, major alternative asset managers reported significant inflows into private credit, a sector where Apollo also has a strong presence, highlighting this overlap.

This cross-asset competition directly impacts market share and client acquisition. When firms offer a wider array of products, they can attract a more diverse client base, leading to increased pressure on competitors to match these comprehensive offerings. This dynamic is evident as many firms expand their real estate and infrastructure funds, areas where Apollo has also been actively investing and raising capital.

- Increased Competition Across Asset Classes: Firms like Apollo are actively managing portfolios in private equity, credit, and real assets, leading to direct competition for investor capital and deal flow in each segment.

- Broader Market Share Capture: Diversification allows competitors to offer integrated solutions, appealing to a wider range of investor needs and thus capturing a larger portion of the overall alternative investment market.

- Client Acquisition Pressure: The ability to provide comprehensive investment strategies puts pressure on less diversified competitors to expand their own offerings or risk losing clients to firms with a broader product suite.

Global Reach and Market Penetration

Competitive rivalry is intensified by the global expansion strategies of major players. Firms are actively entering new markets and cultivating regional knowledge to access varied investor pools and investment opportunities. This push for international presence means companies like Apollo must continually adapt and innovate to maintain their competitive edge.

This global reach translates into intense competition for market share across diverse economic landscapes. For instance, in 2024, major asset managers continued their aggressive expansion into emerging markets, with significant capital inflows reported in regions like Southeast Asia and Latin America. This global footprint necessitates a deep understanding of local regulatory environments and investor preferences.

- Global Expansion: Leading firms are prioritizing international growth to diversify revenue streams and tap into new investor bases.

- Regional Specialization: Competitors are developing tailored strategies and expertise for specific geographic markets to enhance their penetration.

- Market Penetration: The drive to establish a presence in new geographies heightens rivalry, forcing firms like Apollo to compete on a broader international stage.

The competitive rivalry among alternative asset managers, including Apollo, is fierce and multi-faceted. It's a constant race for investor capital, top talent, and exclusive investment opportunities. Firms are increasingly broadening their offerings across asset classes like private equity, credit, and real assets, leading to direct competition for market share and clients.

This intense competition is further amplified by global expansion strategies, as firms vie for dominance in diverse economic landscapes and tap into new investor pools. In 2024, the demand for experienced dealmakers in private equity saw significant salary increases, reflecting the high stakes in acquiring top talent.

Firms like Apollo must continuously innovate and adapt to maintain their edge in this dynamic environment, where performance, talent acquisition, and deal flow are paramount.

| Competitor | Assets Under Management (Approx. Q1 2024) | Key Asset Classes | Talent Focus |

|---|---|---|---|

| Blackstone | $1 Trillion+ | Private Equity, Real Estate, Credit, Hedge Funds | Dealmakers, Sector Specialists |

| KKR | $578 Billion+ | Private Equity, Infrastructure, Real Estate, Credit | Investment Professionals, Operations Experts |

| Carlyle | $425 Billion+ | Private Equity, Credit, Investment Solutions | Industry Veterans, Capital Raisers |

| Ares Management | $427 Billion+ | Credit, Private Equity, Real Estate | Credit Analysts, Deal Originators |

SSubstitutes Threaten

Institutional investors can readily deploy capital into public markets, such as equities and fixed income, via traditional asset managers or low-cost index funds. These public market avenues provide significant liquidity and often boast lower expense ratios compared to many alternative investments, acting as a direct substitute for capital that might otherwise flow into less liquid asset classes.

Institutional investors, like large pension funds and sovereign wealth funds, are increasingly opting for direct investments. For instance, by 2024, many of these entities are expanding their internal teams to manage private equity and real estate portfolios directly, bypassing traditional fund managers.

This trend directly substitutes the need for external alternative asset managers such as Apollo. As these institutions build out their in-house expertise, their reliance on third-party managers for sourcing and executing deals diminishes, impacting potential fee income for firms like Apollo.

The proliferation of low-cost passive investment vehicles like Exchange Traded Funds (ETFs) and index funds presents a significant competitive force. These options provide investors with broad market exposure at a fraction of the cost typically associated with actively managed funds.

For instance, in 2024, the average expense ratio for passive equity ETFs hovered around 0.18%, a stark contrast to the 0.70% or higher often seen in actively managed funds. This cost advantage makes passive strategies an attractive alternative for investors allocating capital, even if they don't directly replicate the intricate strategies of alternative investment firms.

Traditional Bank Lending and Capital Markets

For companies needing funds, traditional bank loans and public markets for debt and equity are direct substitutes for private credit and equity from firms like Apollo. The ease and cost of these conventional avenues directly influence the appeal of alternative financing. As of the first half of 2024, global investment-grade corporate bond issuance reached approximately $1.5 trillion, demonstrating robust activity in public debt markets.

When banks offer competitive rates and terms, or when public markets are receptive to new issuances, the demand for private capital solutions can diminish. For instance, a significant drop in benchmark interest rates, like the Federal Funds Rate, could make traditional bank lending more attractive, thereby reducing the perceived necessity for private credit facilities.

- Bank Lending: Traditional bank loans remain a primary source of capital for many businesses.

- Capital Markets: Public debt and equity markets offer alternatives for companies meeting certain size and creditworthiness criteria.

- Interest Rate Sensitivity: The attractiveness of these traditional options is heavily influenced by prevailing interest rates and market conditions.

Real Estate Investment Trusts (REITs) and Public Infrastructure Funds

Investors looking for exposure to real assets often consider Real Estate Investment Trusts (REITs) and public infrastructure funds as viable substitutes. These publicly traded options provide a level of liquidity and transparency that is generally absent in private real asset investments. This makes them a competitive choice for capital that might otherwise be allocated to direct real estate or private infrastructure projects.

The accessibility of REITs and infrastructure funds means they directly vie for investor dollars that could be channeled into less liquid private markets. For instance, as of late 2024, the global REIT market capitalization stood in the trillions, offering a substantial pool of capital that competes with private real asset funds for investor allocations.

- Liquidity Advantage: Publicly traded REITs and infrastructure funds can be bought and sold on major exchanges, offering investors a quick exit strategy unavailable in most private placements.

- Transparency and Regulation: These public vehicles are subject to stringent regulatory oversight and reporting requirements, providing investors with greater transparency into their holdings and performance.

- Diversification Benefits: Investors can gain diversified exposure to various real estate sectors or infrastructure assets through a single public fund, a benefit that can be more complex to achieve with direct private investments.

- Competitive Capital Allocation: The ease of access and transparency of public funds means they actively compete for investor capital that might otherwise be directed towards private real estate or infrastructure development.

The threat of substitutes for firms like Apollo primarily stems from readily accessible public markets and alternative investment vehicles. Investors can easily deploy capital into equities and fixed income through low-cost index funds and ETFs, offering substantial liquidity and lower fees compared to many alternative investments. For instance, in 2024, passive equity ETFs had average expense ratios around 0.18%, a significant contrast to higher fees in actively managed funds.

Entrants Threaten

Launching a new alternative investment firm, especially one aiming to compete in areas like private equity or credit, demands immense seed capital. We're talking millions, often hundreds of millions, just to establish operations, build a team, and begin fundraising. For instance, a firm looking to manage a $500 million fund might need $5-10 million in operating capital before even seeing a dollar of investor money.

Beyond initial setup, attracting significant commitments from sophisticated institutional investors like pension funds, endowments, and sovereign wealth funds presents a formidable hurdle. These investors conduct rigorous due diligence, often requiring a proven track record and substantial assets under management (AUM) from a firm before entrusting them with capital. As of early 2024, the average minimum commitment for a new private equity fund can easily exceed $10 million, effectively shutting out smaller players.

Investors in alternative assets, particularly those seeking significant capital commitments, place immense value on a proven track record and a strong reputation. This is a substantial barrier for new entrants. Apollo Global Management, for instance, has cultivated a reputation for consistent performance and operational excellence over decades, instilling confidence in its limited partners.

New firms entering the alternative asset space simply cannot replicate this established trust and history. Without a substantial and verifiable history of successful investments and robust returns, it is exceptionally challenging for them to attract the substantial capital required to compete effectively. This lack of a proven track record directly hinders their ability to secure the necessary funding to scale and challenge established players like Apollo.

The alternative investment industry faces significant barriers to entry due to stringent regulatory and compliance requirements. New firms must invest heavily in legal and compliance infrastructure to navigate a complex web of global regulations, licensing, and ongoing reporting obligations. For instance, firms operating in the European Union must adhere to frameworks like MiFID II, which imposes extensive rules on trading, transparency, and investor protection, adding substantial operational costs and complexities for newcomers.

Difficulty in Sourcing Proprietary Deal Flow

The difficulty in sourcing proprietary deal flow presents a significant barrier for new entrants aiming to compete with established players like Apollo. Access to unique, high-quality investment opportunities is the lifeblood of any investment firm, and replicating the extensive networks and deep relationships that Apollo has cultivated over decades is a formidable challenge.

New firms struggle to gain traction in private markets where relationships and trusted intermediaries are paramount. Established firms leverage their long-standing connections with business owners, advisors, and other market participants to gain early access to potential deals, often before they become widely known. This informational advantage is difficult to overcome.

- Proprietary Deal Flow: Access to exclusive, off-market investment opportunities is a key differentiator.

- Network Effects: Established firms benefit from vast networks built over years, creating a significant advantage in deal origination.

- Relationship Capital: Trust and long-term relationships with deal sources are hard for newcomers to build quickly.

- Market Entry Barrier: The inability to consistently source quality deals hinders new entrants from effectively competing.

Talent Scarcity and Retention Challenges

The threat of new entrants is amplified by significant talent scarcity and retention challenges within the investment management industry. Attracting and keeping top-tier investment professionals, who often command high compensation and possess strong existing networks, presents a substantial hurdle. For instance, in 2024, the demand for experienced ESG analysts and alternative investment specialists continued to outpace supply, driving up recruitment costs for all firms, including new entrants.

New firms find it particularly difficult to compete with established players that offer a compelling combination of proven platforms, extensive resources, and clear career progression opportunities. These established firms can leverage their brand recognition and existing client relationships to attract talent that might otherwise be swayed by the allure of a startup. In 2023, the average compensation for a senior portfolio manager at a top-tier asset manager exceeded $300,000 annually, a figure that new entrants may struggle to match without significant initial funding and a clear path to profitability.

- Talent Acquisition Costs: New entrants face higher recruitment costs due to intense competition for skilled professionals.

- Retention Difficulties: Established firms offer more attractive compensation packages and career paths, making it harder for new firms to retain talent.

- Network Effects: Experienced professionals' existing client and industry networks are a significant asset that new entrants lack.

- Platform and Resource Disparity: Established firms provide robust infrastructure and resources that new entrants may not initially possess.

The threat of new entrants in the alternative investment space is significantly mitigated by the sheer capital requirements and the established reputation of firms like Apollo. New ventures need substantial seed funding, often in the tens of millions, just to get off the ground, a barrier that deters many. Furthermore, institutional investors, who are the primary capital providers, demand a proven track record and deep trust, which newcomers simply cannot offer initially.

The difficulty in sourcing proprietary deal flow and building extensive networks is another major hurdle. Established players like Apollo have cultivated decades-long relationships that provide access to exclusive investment opportunities. New firms struggle to replicate this, making it challenging to compete for quality assets and generate attractive returns.

Talent acquisition and retention also pose significant challenges for new entrants. Competing with established firms for top investment professionals, who often command high salaries and benefit from robust career paths, is costly and difficult. In 2024, the demand for specialized talent in areas like private credit and infrastructure continued to drive up compensation, making it harder for new firms to attract and retain the necessary expertise.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, leveraging information from company annual reports, industry-specific market research, and publicly available financial statements to provide a comprehensive view of competitive dynamics.