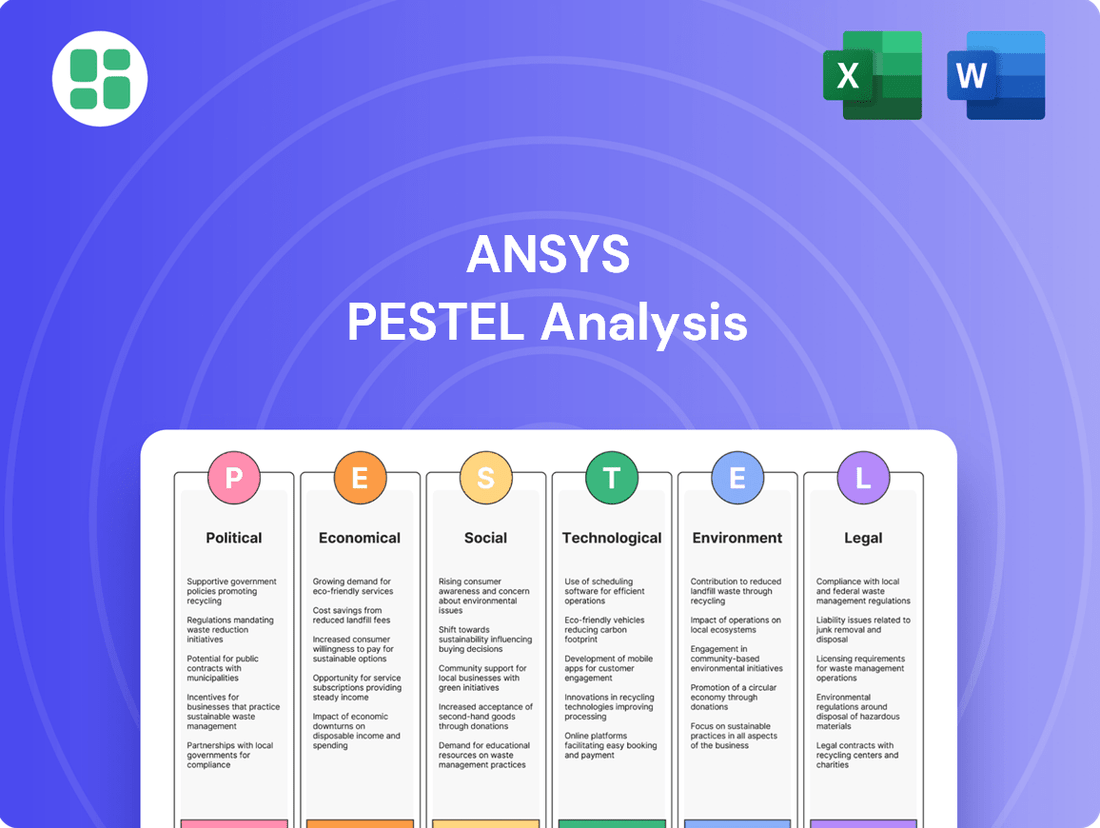

Ansys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansys Bundle

Unlock the hidden forces shaping Ansys's trajectory with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this engineering simulation giant. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Purchase the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Government regulations on software development, data security, and intellectual property rights significantly shape Ansys' operational landscape. Compliance with diverse international standards, such as GDPR for data privacy and various IP laws, is a constant requirement, impacting development cycles and potentially increasing costs. For instance, the increasing scrutiny on data handling globally means Ansys must continuously adapt its software to meet stringent privacy requirements in key markets like the EU and the US.

Ansys' global operations mean it's significantly influenced by international trade policies and sanctions. Changes in tariffs or the imposition of economic sanctions can directly affect Ansys' ability to sell its software and services in certain regions, impacting revenue streams.

Geopolitical tensions, particularly between major economies like the U.S. and China, pose a considerable risk. These tensions can lead to delays or outright blockages of crucial mergers and acquisitions, restrict market access for technology firms, and disrupt the flow of essential components for hardware used in simulations, affecting companies like Ansys.

A prime example is the ongoing regulatory review of the proposed Synopsys-Ansys merger, which has experienced delays, notably concerning approval from Chinese authorities. This situation underscores how international trade dynamics and political considerations can directly impact strategic growth initiatives and market penetration for major technology players.

Government funding for research and development in engineering and technology directly impacts the demand for simulation software like Ansys. For instance, the U.S. government's commitment to advancing semiconductor manufacturing through initiatives like the CHIPS and Science Act, which allocated billions in funding, stimulates R&D in areas where Ansys' tools are crucial for design and testing.

Policies encouraging digital transformation and the adoption of advanced manufacturing techniques, such as those seen in the European Union's Industry 5.0 strategy, create a fertile ground for Ansys. These initiatives often come with direct or indirect financial support for companies investing in simulation and digital twin technologies, bolstering Ansys' market penetration.

Conversely, a reduction in government R&D budgets or a shift in policy away from technological advancement could temper the growth trajectory for simulation software providers. For example, if a major economy were to significantly cut funding for aerospace or automotive R&D, it could lead to a slowdown in the adoption of advanced simulation tools in those sectors.

Intellectual Property Protection Laws

Intellectual property (IP) protection is a cornerstone for Ansys, a company whose value is deeply rooted in its advanced simulation software and proprietary algorithms. Strong IP laws are crucial for safeguarding these innovations from piracy and unauthorized replication, thereby enabling Ansys to maintain its competitive edge and revenue streams. For instance, in 2023, the global software market experienced significant losses due to piracy, underscoring the importance of robust legal protections.

Weak or inconsistently enforced IP laws in certain international markets present a tangible risk to Ansys. Such environments can foster software piracy, leading to direct revenue erosion and creating an uneven playing field where competitors can leverage Ansys's technology without proper licensing. This can also hinder Ansys's ability to invest in future research and development, as the return on innovation is diminished.

- Global IP Enforcement Challenges: Regions with lax IP enforcement can see piracy rates exceeding 50%, directly impacting software vendors like Ansys.

- Legal Recourse and Costs: While strong IP laws provide recourse, pursuing legal action against infringers is often costly and time-consuming for companies.

- Impact on R&D Investment: The perceived security of IP directly influences a company's willingness to commit substantial resources to developing new technologies.

- Market Access and Partnerships: Ansys's ability to expand into new markets or form strategic partnerships is often contingent on the strength of local IP protection frameworks.

Political Stability and Geopolitical Risks

Political instability and geopolitical risks present significant challenges for Ansys. For instance, ongoing conflicts or sudden policy changes in major economies where Ansys operates, such as the United States or European Union member states, could directly affect demand for their simulation software and consulting services. This uncertainty can also deter capital investment, impacting Ansys's strategic growth initiatives.

Geopolitical tensions, including trade disputes or sanctions, can also impede Ansys's international business. These factors can disrupt supply chains for hardware components used in simulation, limit access to certain markets, and complicate international collaborations or acquisitions. For example, the complex geopolitical landscape in Asia could affect Ansys's ability to expand its customer base or secure partnerships in that region.

- Geopolitical shifts impacting global trade agreements could alter Ansys's revenue streams from key international markets.

- Increased political instability in regions with a high concentration of manufacturing or R&D could reduce demand for simulation software.

- Government regulations on data privacy and cybersecurity, influenced by political considerations, can add compliance costs for Ansys.

- National security concerns might lead to restrictions on technology exports, potentially affecting Ansys's sales in sensitive sectors.

Government policies directly influence Ansys's market by either fostering or hindering technological adoption. For example, government initiatives promoting digital transformation and advanced manufacturing, like the EU's Industry 5.0 strategy, create a favorable environment for simulation software. Conversely, shifts in R&D funding or trade policies can impact Ansys's revenue and strategic growth.

Geopolitical tensions and trade disputes pose risks by potentially disrupting market access and supply chains. For instance, U.S.-China trade relations can affect technology exports and international collaborations, impacting Ansys's global operations. The ongoing review of the Synopsys-Ansys merger by various regulatory bodies, including Chinese authorities, highlights these political complexities.

Intellectual property (IP) protection is critical for Ansys's business model, as its value lies in proprietary software and algorithms. Robust IP laws safeguard these innovations, but weak enforcement in some regions can lead to piracy, directly impacting revenue. In 2023, global software piracy caused billions in losses, underscoring the need for strong legal frameworks.

Government investment in R&D, particularly in sectors like aerospace and semiconductors, directly drives demand for Ansys's simulation tools. The U.S. CHIPS and Science Act, with its multi-billion dollar funding for semiconductor research, exemplifies how government support can boost the market for advanced engineering software.

| Political Factor | Impact on Ansys | Example/Data (2023-2025) |

|---|---|---|

| Government R&D Funding | Drives demand for simulation software | US CHIPS Act allocated $52.7 billion for semiconductor manufacturing and R&D, boosting demand for simulation tools in this sector. |

| Trade Policies & Sanctions | Affects market access and revenue | Geopolitical tensions between major economies can lead to restrictions on technology exports, impacting Ansys's sales in sensitive markets. |

| IP Protection Laws | Safeguards proprietary technology | Global software piracy losses were estimated to be over $60 billion in 2023, highlighting the importance of strong IP enforcement for Ansys. |

| Data Privacy Regulations (e.g., GDPR) | Increases compliance costs and development requirements | Ansys must continuously adapt its software to meet evolving data privacy standards in key markets like the EU and the US. |

What is included in the product

This Ansys PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework that simplifies complex external factors, enabling teams to focus on strategic responses rather than getting bogged down in data interpretation.

Economic factors

Global economic health is a significant factor for Ansys, as it directly impacts how much companies invest in research, new product creation, and the software licenses Ansys provides. When the global economy is strong, businesses tend to spend more on these areas, boosting Ansys's revenue. Conversely, economic slowdowns can cause companies to cut back on investments in simulation and design tools.

The latest financial reports show a positive trend for Ansys. For the first quarter of 2025, Ansys announced an 8% increase in revenue. This growth suggests that, despite varying market conditions, companies are continuing to prioritize and invest in the advanced simulation capabilities that Ansys offers, indicating resilience in demand for their solutions.

Ansys' success hinges on robust R&D investment across key sectors. Industries like automotive and aerospace, facing intense competition and regulatory pressures, are prioritizing innovation. For instance, the automotive sector's R&D spending is projected to reach over $200 billion globally by 2025, much of which fuels digital simulation and virtual testing.

The electronics industry's rapid pace of technological advancement, driven by demand for faster, smaller, and more efficient devices, necessitates substantial R&D. Similarly, the healthcare sector's pursuit of novel treatments and medical devices, with global healthcare R&D expenditure expected to exceed $250 billion in 2024, directly translates to increased reliance on simulation tools for design and validation.

Companies are increasingly embracing digital transformation, with a significant portion of their R&D budgets allocated to virtual prototyping and digital twins. This trend is expected to continue, as businesses seek to accelerate product development cycles and reduce physical testing costs, thereby sustaining demand for Ansys' advanced simulation software solutions.

Ansys, as a global software provider, faces currency exchange rate fluctuations that directly impact its financial reporting. When Ansys converts earnings from its international operations into U.S. dollars, a stronger dollar can reduce the reported value of those earnings, while a weaker dollar can inflate them.

For instance, if Ansys generates a significant portion of its revenue in Euros and the Euro weakens against the U.S. dollar, the reported revenue in dollars will be lower, even if the Euro-denominated sales remain stable. This volatility can affect profitability margins and make financial forecasting more challenging.

In 2024, the U.S. dollar experienced periods of strength against various global currencies, a trend that continued into early 2025. This environment necessitates Ansys to actively manage its foreign currency exposures through hedging strategies to mitigate potential negative impacts on its reported financial results.

Competitive Landscape and Pricing Pressures

The simulation software market is a dynamic arena, with Ansys facing formidable rivals such as Siemens and Dassault Systèmes. This intense competition naturally translates into significant pricing pressures, compelling Ansys to consistently deliver cutting-edge innovation and tangible value to preserve its market share and pricing leverage. For instance, in the first quarter of 2024, Ansys reported a 10% year-over-year increase in revenue, reaching $538 million, demonstrating its ability to navigate this competitive environment.

The strategic landscape is further shaped by consolidation. A notable example is the pending acquisition of Ansys by Synopsys, a move anticipated to significantly bolster Synopsys's market position and potentially alter competitive dynamics. This trend underscores the industry's drive towards creating larger, more integrated entities capable of offering comprehensive solutions.

Key competitive factors influencing Ansys include:

- Market Share: Competitors like Siemens Digital Industries Software and Dassault Systèmes hold substantial market shares, necessitating continuous product development and customer engagement from Ansys.

- Innovation Cycles: The rapid pace of technological advancement demands ongoing investment in R&D to maintain a competitive edge in simulation capabilities.

- Pricing Strategies: Balancing competitive pricing with the value proposition of advanced simulation tools is crucial for Ansys's profitability.

- Mergers and Acquisitions: Industry consolidation, such as the proposed Synopsys acquisition, reshapes the competitive landscape and strategic alliances.

Inflation and Operational Costs

Persistent inflation presents a significant challenge for Ansys, directly impacting its operational expenditures. Increased costs for employee compensation, essential for retaining skilled software engineers, and the rising price of energy to power its extensive data centers, are key concerns. Furthermore, the expenses associated with software development, including licensing of third-party tools and cloud infrastructure, are also subject to inflationary pressures.

While Ansys, as a software provider, typically enjoys healthy profit margins, sustained inflation could begin to chip away at its profitability. The company must navigate this economic headwind by implementing strategic pricing adjustments to offset rising costs. Simultaneously, Ansys is likely focusing on driving internal efficiencies to mitigate the impact of inflation on its bottom line.

For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% in April 2024 compared to the previous year, indicating ongoing inflationary trends that would affect Ansys's cost structure. Similarly, energy prices, a direct operational cost for data centers, have experienced volatility, with crude oil prices fluctuating significantly throughout 2024, impacting electricity costs.

- Employee Salaries: Rising cost of living necessitates competitive salary increases to attract and retain specialized engineering talent.

- Data Center Energy Costs: Increased electricity prices directly inflate the operational expenses for Ansys's cloud-based services and internal infrastructure.

- Software Development Expenses: Higher costs for third-party software licenses and cloud computing resources contribute to increased R&D expenditures.

- Profitability Impact: Sustained inflation necessitates careful pricing strategies and efficiency improvements to maintain healthy profit margins.

Global economic health significantly influences Ansys's revenue, as companies increase R&D spending during strong economic periods. For Q1 2025, Ansys reported an 8% revenue increase, reflecting continued investment in simulation tools despite economic fluctuations. Industries like automotive and aerospace, expecting over $200 billion in R&D spending by 2025, drive demand for Ansys's solutions.

Currency exchange rates impact Ansys's reported financials. The U.S. dollar's strength in 2024 and early 2025 means international earnings translate to fewer dollars, necessitating active currency risk management. For example, a stronger dollar can reduce the reported value of Euro-denominated sales.

Inflation, with the U.S. CPI at 3.4% year-over-year in April 2024, raises Ansys's operational costs, particularly for employee compensation and data center energy. The company must balance these rising expenses with strategic pricing and efficiency measures to protect profit margins.

| Economic Factor | Impact on Ansys | Supporting Data (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives R&D investment and software license sales. | Q1 2025 Revenue: +8% year-over-year. |

| Currency Fluctuations | Affects reported international earnings. | USD strength in 2024-early 2025. |

| Inflation | Increases operational costs (salaries, energy). | US CPI: 3.4% (April 2024); volatile energy prices. |

| Industry R&D Spending | Key driver of demand for simulation software. | Automotive R&D: projected >$200 billion by 2025. |

Full Version Awaits

Ansys PESTLE Analysis

The preview shown here is the exact Ansys PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive look at Ansys's strategic environment. This is the real, ready-to-use document you’ll get upon purchase, with no hidden surprises.

Sociological factors

Ansys' success is intrinsically linked to a robust global supply of engineers and scientists skilled in simulation technologies. The increasing demand for these professionals, particularly in sectors like automotive, aerospace, and electronics, directly fuels Ansys' market growth. For instance, the global engineering services market was valued at approximately $1.5 trillion in 2023 and is projected to expand significantly, with simulation software being a key component.

The quality and accessibility of Science, Technology, Engineering, and Mathematics (STEM) education worldwide are crucial for cultivating the future workforce Ansys needs. A strong STEM pipeline ensures a steady stream of individuals capable of mastering and innovating with advanced simulation tools. Reports from 2024 indicate a continued global emphasis on strengthening STEM education, with many countries investing heavily in curriculum development and teacher training to meet future workforce demands.

Recognizing this, Ansys actively invests in academic programs and provides resources to universities and students. These initiatives, such as their Ansys academic product licensing and grants, aim to foster early adoption and expertise in simulation, thereby nurturing the talent pool essential for their long-term business strategy. By 2025, Ansys aims to have provided its software to over 5,000 universities globally, further solidifying its commitment to STEM education.

Societal trends are increasingly pushing industries towards digital transformation, with digital twins emerging as a key technology. This shift encourages greater adoption of simulation software like Ansys, as businesses aim to virtualize their product development and operational processes.

The global market for digital twins is projected for substantial growth, with some estimates suggesting it could reach over $100 billion by 2027, highlighting the immense opportunity for simulation providers like Ansys.

This widespread industry adoption of digital transformation, fueled by the promise of enhanced efficiency and innovation through digital twins, directly translates into increased demand for advanced simulation solutions, creating a fertile ground for Ansys's offerings.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024, fundamentally alters how engineering teams interact with simulation software. This shift means Ansys must prioritize cloud-based platforms and robust collaboration tools to enable seamless access and utilization for geographically dispersed teams. For instance, a 2023 Gartner survey indicated that 51% of knowledge workers were expected to be in hybrid or fully remote roles by the end of 2024, highlighting the sustained demand for flexible work arrangements.

This evolving work environment necessitates Ansys to enhance its cloud-native offerings and ensure its software supports concurrent usage and data sharing among distributed engineers. The ability for teams to collaborate on complex simulations regardless of location is now a key differentiator. A 2024 report by Statista projected the global cloud computing market to reach over $1.3 trillion, underscoring the significant investment and reliance on cloud infrastructure across industries, including engineering and design.

Focus on Sustainability in Product Design

Societal expectations are increasingly prioritizing sustainability, directly influencing product development. Consumers and stakeholders alike are demanding products that are not only functional but also environmentally responsible, pushing businesses to integrate eco-friendly practices from the outset.

Ansys' simulation software plays a crucial role in this shift by allowing companies to refine designs for minimal environmental impact. This includes reducing material waste, optimizing energy efficiency during product use, and lowering overall carbon emissions throughout the product lifecycle. For instance, by 2024, the global market for sustainable goods was projected to reach over $150 billion, highlighting the significant economic driver behind these societal demands.

- Consumer Demand: A 2023 survey indicated that 71% of consumers are willing to pay more for sustainable products.

- Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, incentivizing sustainable design.

- Corporate Responsibility: Many companies are setting ambitious net-zero targets, making sustainable product design a strategic imperative.

- Ansys' Role: Simulation tools help achieve these goals by enabling virtual prototyping and testing for reduced environmental footprint.

User Experience and Accessibility of Complex Software

Users increasingly expect sophisticated software, even for complex engineering, to be intuitive. This trend directly impacts Ansys, pushing for simpler workflows and improved user interfaces to attract a wider audience, not just seasoned simulation experts.

The demand for accessibility means Ansys must invest in features that lower the learning curve. For instance, advancements in AI-driven meshing and automated setup processes, seen in releases leading up to 2025, aim to make simulation more approachable.

- Growing User Expectations: A 2024 survey indicated that 70% of engineers consider user-friendliness a critical factor when selecting new software.

- Broadening Adoption: Ansys' focus on simplifying complex tasks is key to expanding its market share beyond traditional mechanical engineers into areas like product design and electronics.

- Competitive Landscape: Competitors are also prioritizing user experience, making Ansys' continued investment in intuitive design essential for maintaining its market position.

Societal shifts towards sustainability are profoundly influencing product development cycles, pushing companies to prioritize eco-friendly designs. Ansys' simulation capabilities are instrumental in this transition, enabling businesses to virtually optimize products for reduced material waste and lower energy consumption throughout their lifecycle. By 2024, the global market for sustainable goods was projected to exceed $150 billion, underscoring the significant economic influence of these environmental considerations.

The increasing demand for user-friendly software, even for complex engineering tasks, directly impacts Ansys by necessitating simpler workflows and enhanced interfaces. This trend aims to broaden the user base beyond seasoned experts, making simulation more accessible. A 2024 survey revealed that 70% of engineers consider user-friendliness a critical factor in software selection.

The pervasive adoption of remote and hybrid work models, a trend continuing through 2024, requires Ansys to focus on cloud-based platforms and collaboration tools for dispersed engineering teams. This shift is supported by the global cloud computing market, projected to surpass $1.3 trillion by 2024, highlighting the critical role of cloud infrastructure in modern engineering workflows.

Technological factors

Ansys is significantly leveraging advancements in AI and machine learning to enhance its simulation offerings. Tools like Ansys SimAI, launched in 2023, demonstrate this by using AI to accelerate the creation of simulation models, reportedly reducing setup time by up to 70% for certain applications. This integration allows for more intelligent, faster, and accurate simulations, fundamentally transforming engineering design and optimization workflows.

The increasing reliance on cloud computing and high-performance computing (HPC) is a significant technological driver for simulation software. These advancements are crucial for managing the immense computational power needed for intricate engineering simulations.

Ansys is actively adapting to this trend by bolstering its cloud-based solutions and enhancing its software's compatibility with GPU acceleration and cloud-connected compute. This strategic move allows engineers to explore a greater number of design iterations much faster, potentially reducing design cycles from hours to mere minutes.

The advancement of digital twin technology presents a substantial technological catalyst for Ansys. Their sophisticated simulation software is instrumental in the creation and ongoing management of these virtual replicas of physical assets, facilitating accurate real-time performance forecasting and proactive maintenance strategies across diverse industrial sectors.

By enabling the mirroring of physical systems, digital twins allow for rigorous testing and optimization in a virtual environment before implementation in the real world. This significantly reduces development cycles and minimizes the risk of costly errors. For instance, the global digital twin market was valued at approximately $6.7 billion in 2022 and is projected to reach over $62 billion by 2030, showcasing its rapid expansion and Ansys's pivotal role within it.

Cybersecurity Threats and Data Protection

As simulation data increasingly resides in the cloud and becomes a cornerstone of R&D, cybersecurity threats loom larger for Ansys. Protecting intellectual property and sensitive customer data is paramount, demanding continuous investment in advanced security protocols to maintain the integrity and confidentiality of simulation outcomes. For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting the significant resources companies like Ansys must allocate.

Ansys must bolster its defenses against evolving cyber threats, which can compromise proprietary simulation models and client-specific data. This involves implementing multi-layered security strategies, including encryption, access controls, and regular vulnerability assessments. The increasing sophistication of ransomware attacks, which saw a 72% rise in reported incidents in 2023 according to IBM's X-Force Threat Intelligence Index, underscores the urgency.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million, a figure Ansys must strive to avoid through robust cybersecurity.

- Cloud Security Investments: Ansys's reliance on cloud platforms necessitates significant expenditure on securing these environments against unauthorized access and data exfiltration.

- Intellectual Property Protection: Safeguarding Ansys's core simulation algorithms and customer-generated design data is critical for maintaining its competitive edge.

- Regulatory Compliance: Adhering to data protection regulations like GDPR and CCPA requires stringent security measures and ongoing compliance efforts.

Integration with Other Design and Manufacturing Software

Ansys's ability to seamlessly integrate with other design and manufacturing software is a significant technological advantage. This interoperability extends to Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM), Product Lifecycle Management (PLM), and Model-Based Systems Engineering (MBSE) tools, enabling end-to-end solutions for customers. For instance, Ansys's 2024 R1 release further enhanced its connections with leading CAD platforms, streamlining data transfer and reducing manual effort in simulation setup.

This seamless integration directly impacts workflow efficiency and data consistency throughout the entire product development lifecycle. By reducing the friction between different software stages, Ansys empowers engineers to iterate faster and with greater confidence. A 2024 industry survey indicated that companies with strong simulation software integration reported a 15% reduction in product development cycles.

The technological focus on interoperability is critical for Ansys to maintain its competitive edge. Key aspects include:

- Enhanced Workflow Efficiency: Direct data exchange between Ansys tools and CAD/PLM systems minimizes rework and accelerates design validation.

- Improved Data Consistency: Ensuring that simulation parameters and results are accurately transferred and maintained across platforms reduces errors.

- End-to-End Solution Delivery: Facilitating a connected digital thread from initial design to final manufacturing supports comprehensive product development.

- Support for MBSE: Integration with MBSE tools allows for the incorporation of system-level requirements and behaviors directly into simulation workflows.

Ansys is heavily investing in artificial intelligence and machine learning to enhance its simulation capabilities, as seen with Ansys SimAI. This technology is expected to significantly speed up simulation model creation, potentially reducing setup times by up to 70% for specific applications, leading to more efficient engineering design processes.

Legal factors

Ansys' business model is heavily reliant on its proprietary software, making intellectual property (IP) and copyright laws absolutely critical. Protecting its valuable algorithms and simulation technologies from unauthorized duplication and distribution is fundamental to its revenue streams and competitive advantage.

The company actively pursues legal avenues to combat software piracy and any form of unauthorized usage. This includes initiating copyright infringement lawsuits, a common strategy for software-centric businesses to safeguard their IP assets and deter potential infringers.

Ansys operates within a complex web of software licensing and compliance regulations, demanding strict adherence from both the company and its users. Failure to comply can result in significant legal challenges, hefty financial penalties, and a tarnished reputation for all involved parties.

For instance, software piracy and unauthorized use remain persistent issues. In 2023, the Business Software Alliance (BSA) reported that global software piracy rates stood at 37%, costing industries billions. Ansys, like other software providers, must actively monitor and enforce its licensing terms to mitigate these risks and protect its intellectual property.

Global data privacy regulations like GDPR and CCPA significantly influence Ansys' operations, particularly concerning its cloud-based offerings. These laws dictate how Ansys must handle customer data, requiring robust security protocols and clear communication about data usage. For instance, GDPR mandates strict consent for data processing, impacting Ansys' ability to leverage customer interaction data for service improvement.

Compliance with these evolving regulations necessitates substantial investment in data protection infrastructure and ongoing training for personnel. Ansys must ensure its data handling practices are transparent and secure to maintain customer trust and avoid potential penalties, which can be substantial, as seen with GDPR fines reaching up to 4% of global annual revenue.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Ansys, especially given its role in the semiconductor and engineering software markets. Large mergers and acquisitions, like the proposed Synopsys acquisition of Ansys, face intense scrutiny from regulators worldwide. These reviews aim to prevent monopolies and ensure a level playing field for competitors.

For instance, the Synopsys-Ansys deal, valued at approximately $35 billion, is undergoing review by bodies such as the U.S. Federal Trade Commission (FTC) and the European Commission. These agencies assess whether the combination would substantially lessen competition. Failure to satisfy these concerns could result in mandated divestitures of certain business units or, in extreme cases, the outright blocking of the transaction.

The regulatory landscape is dynamic, with increased focus on tech mergers. In 2023, the FTC challenged several significant tech deals, signaling a more assertive stance. Ansys must navigate these complex legal frameworks to ensure its strategic growth initiatives, including potential acquisitions or partnerships, comply with global antitrust regulations.

- Rigorous antitrust reviews: Major transactions like the Synopsys acquisition of Ansys are subject to extensive examination by global regulatory bodies.

- Fair competition mandate: Antitrust laws are designed to prevent anti-competitive practices and ensure market fairness.

- Potential remedies: Regulators can impose conditions such as divestitures or, in some cases, block mergers that threaten competition.

- Increased regulatory scrutiny: The current environment shows a trend of heightened oversight on significant technology sector mergers.

Export Control Regulations on Technology

Ansys' sophisticated simulation software, crucial for sectors like defense, aerospace, and semiconductors, faces significant hurdles due to export control regulations. These rules can limit sales and technology transfers to specific nations or organizations, directly impacting market access and revenue streams.

Geopolitical tensions further amplify these restrictions, creating a complex and evolving regulatory landscape. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) maintains the Entity List, which restricts exports to designated companies. As of late 2024, the number of entities on this list continues to grow, reflecting ongoing global strategic competition.

- Export Control Impact: Ansys' advanced simulation tools, vital for defense and high-tech industries, are subject to international export regulations.

- Geopolitical Influence: Rising geopolitical tensions in 2024-2025 are leading to stricter enforcement and broader application of these controls.

- Market Access Restrictions: Regulations can prevent Ansys from selling to or partnering with entities in countries deemed high-risk, potentially limiting growth opportunities.

- Compliance Costs: Adhering to these complex and frequently updated export laws incurs significant compliance costs for Ansys.

Ansys' commitment to intellectual property protection is paramount, especially concerning its advanced simulation software. The company actively defends its patents and copyrights against infringement, a critical strategy given the high value of its technological innovations.

Global data privacy laws, such as the EU's GDPR and California's CCPA, significantly shape how Ansys handles customer data. Compliance requires robust data security measures and transparent data usage policies, impacting cloud service operations and customer trust.

Antitrust regulations are particularly relevant for Ansys, especially in light of its proposed $35 billion acquisition by Synopsys. Regulatory bodies like the FTC and European Commission are scrutinizing this deal to ensure it does not stifle competition in the semiconductor and engineering software markets.

Export controls, driven by geopolitical considerations, can restrict Ansys' ability to sell its sophisticated simulation tools to certain countries or entities. This necessitates careful navigation of international trade laws and compliance with lists like the US Entity List, which expanded in 2024.

Environmental factors

The increasing global focus on environmental responsibility is significantly shaping industry demand for sustainable product design. Consumers and regulators alike are pushing for products that minimize their ecological footprint across their entire lifecycle. This trend is expected to accelerate, with projections indicating the global green building materials market alone could reach over $400 billion by 2027, demonstrating a clear market appetite for eco-conscious solutions.

Ansys simulation software is instrumental in meeting this demand. By allowing engineers to virtually test and refine designs, Ansys helps optimize for reduced material consumption, enhanced energy efficiency, and minimized waste generation. For instance, using simulation to predict the performance of recycled materials in new applications can significantly cut down on virgin resource extraction and associated emissions, a critical aspect of sustainable development.

Global environmental regulations are intensifying, compelling manufacturers to embrace sustainable practices and minimize their carbon emissions. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, imposes stricter standards on industrial emissions and product lifecycle management, impacting companies operating within or selling to the EU market.

Ansys' advanced simulation software plays a crucial role in this transition. By enabling companies to virtually test and optimize manufacturing processes and product designs, Ansys tools help reduce material waste, energy consumption, and overall environmental impact, thereby facilitating compliance with stringent regulations.

For example, Ansys Fluent can simulate airflow and combustion to optimize burner efficiency, reducing NOx emissions, a key regulatory concern. In 2024, many industries are investing heavily in digital twins and simulation to meet evolving environmental standards, with the simulation software market projected to grow significantly, driven by these regulatory pressures.

The substantial energy demands of High-Performance Computing (HPC) for complex simulations are a key environmental factor for Ansys. Running these powerful computations, whether on-premises or via cloud services, contributes to a significant carbon footprint.

Ansys is therefore motivated to innovate in creating more energy-efficient simulation algorithms. This focus not only reduces environmental impact but also offers cost savings for users, aligning with growing corporate sustainability goals. For instance, by 2025, the global data center energy consumption is projected to reach 1.3% of total global electricity usage, highlighting the importance of efficiency.

Corporate Social Responsibility and Environmental Reporting

Companies are facing growing pressure to showcase robust corporate social responsibility (CSR), with environmental stewardship being a key component. This trend directly impacts how businesses operate and are perceived in the market.

Ansys' simulation software plays a crucial role in helping its customers meet their sustainability targets. For instance, by enabling more efficient product design and manufacturing processes, Ansys solutions can contribute to reduced energy consumption and waste for its clients. This capability can significantly bolster Ansys' own brand image and attractiveness to environmentally conscious customers and investors alike.

The market is increasingly rewarding companies with strong environmental, social, and governance (ESG) credentials. In 2023, ESG-focused funds saw continued inflows, with global sustainable fund assets reaching over $3.7 trillion, demonstrating a clear investor preference for responsible businesses. Ansys' alignment with these trends positions it favorably.

- Growing Investor Demand: Over 70% of institutional investors consider ESG factors when making investment decisions, according to a 2024 survey by PwC.

- Regulatory Tailwinds: Many governments worldwide are implementing stricter environmental regulations, creating a demand for solutions that facilitate compliance and sustainability.

- Customer Preference: Consumers are increasingly choosing brands that demonstrate a commitment to environmental protection, influencing B2B purchasing decisions as well.

- Reputational Benefits: Strong environmental reporting and CSR initiatives enhance brand loyalty and can mitigate reputational risks associated with environmental impact.

Impact of Climate Change on Product Requirements

Climate change is significantly reshaping product development. Extreme weather events, like the record-breaking heatwaves and intensified storms seen in 2024, directly impact how products must perform. This necessitates designs that can withstand greater environmental stresses, leading to a demand for more robust and resilient materials and engineering solutions.

Simulation tools are becoming indispensable for addressing these challenges. By modeling how products will behave under various climate-related scenarios, engineers can optimize designs for durability and reliability. This is crucial for sectors like construction and automotive, where infrastructure and vehicles must endure harsher conditions, thereby boosting the need for advanced simulation software like Ansys.

- Increased demand for weather-resilient materials: Manufacturers are seeking materials that can withstand higher temperatures and moisture levels, a trend amplified by climate change impacts observed throughout 2024.

- Focus on energy efficiency in product design: With rising energy costs and climate regulations, products are increasingly designed for lower energy consumption, a key area where simulation can optimize performance.

- Growth in demand for simulation software: The need to test product resilience against climate-related stresses is driving a projected 10-15% annual growth in the engineering simulation market through 2025.

Environmental factors are increasingly driving innovation and market demand, pushing for sustainable product designs and manufacturing processes. This shift is underscored by growing investor interest in ESG credentials, with global sustainable fund assets exceeding $3.7 trillion in 2023, and over 70% of institutional investors considering ESG factors in 2024.

Ansys' simulation software is pivotal in addressing these environmental pressures by enabling engineers to optimize designs for reduced material usage, enhanced energy efficiency, and minimized waste, directly supporting compliance with stricter global regulations like the EU's Green Deal.

The energy consumption of High-Performance Computing (HPC) for simulations presents an environmental challenge, motivating Ansys to develop more energy-efficient algorithms, a crucial step as global data center energy usage is projected to reach 1.3% of total global electricity by 2025.

Climate change impacts, such as extreme weather events observed in 2024, are also necessitating more resilient product designs, further increasing the demand for advanced simulation tools to test durability and energy efficiency, with the engineering simulation market expected to grow 10-15% annually through 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources, including government statistics, international economic organizations, and leading industry research firms. This comprehensive approach ensures that each factor—political, economic, social, technological, legal, and environmental—is informed by current, verifiable information.