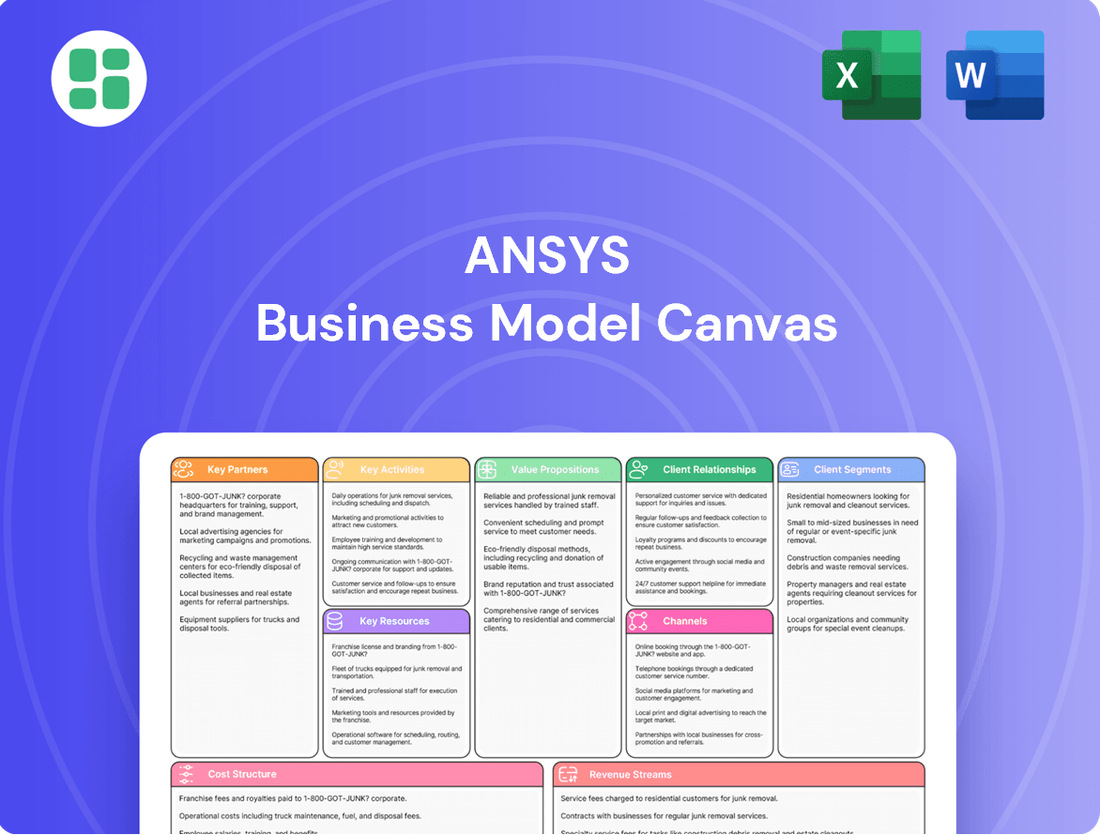

Ansys Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansys Bundle

Unlock the strategic blueprint of Ansys's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Ansys crafts its value proposition, identifies key customer segments, and builds robust revenue streams. Discover the core activities and partnerships that drive their market leadership.

Ready to dissect Ansys's winning formula? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their operations, from cost structure to key resources. Download it now to gain actionable insights for your own strategic planning and competitive analysis.

Partnerships

Ansys actively cultivates partnerships with software integrators and Independent Software Vendors (ISVs) to embed its simulation capabilities into diverse engineering ecosystems. These collaborations are crucial for ensuring Ansys solutions integrate smoothly with Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and Computer-Aided Engineering (CAE) platforms, as well as Product Lifecycle Management (PLM) systems.

By working with ISVs, Ansys expands its market reach and offers customers more holistic digital solutions. For instance, Ansys's 2023 revenue reached $2.2 billion, a testament to the value derived from these integrated workflows. These partnerships enable users to seamlessly incorporate advanced simulation into their existing digital threads, enhancing productivity and innovation.

Ansys's key partnerships with hardware vendors, especially those focused on high-performance computing (HPC) and graphics processing units (GPUs), are vital. For instance, collaborations with NVIDIA have been instrumental in accelerating Ansys's simulation software through CUDA-enabled GPUs, significantly reducing computation times for complex engineering problems. In 2023, NVIDIA reported a substantial increase in demand for its data center GPUs, a trend that directly benefits Ansys by ensuring access to cutting-edge processing power for its users.

Furthermore, Ansys's alliances with major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are fundamental. These partnerships allow Ansys to deliver its simulation tools as scalable, accessible services in the cloud. This move caters to the increasing market preference for pay-as-you-go engineering solutions, enabling businesses of all sizes to leverage advanced simulation without massive upfront hardware investments. The cloud computing market continued its robust growth in 2024, with significant investments in HPC capabilities, further solidifying the importance of these cloud partnerships for Ansys.

Ansys cultivates deep relationships with academic and research institutions worldwide. These collaborations are vital for driving innovation in simulation technology and developing future engineering talent. In 2024, Ansys continued its commitment to education, providing software access to thousands of universities, enabling students and researchers to explore advanced simulation capabilities.

These partnerships extend beyond simple software provision. Ansys actively engages in joint research initiatives, pushing the boundaries of what's possible with simulation. This collaborative approach ensures that Ansys remains at the forefront of scientific advancement while equipping the next generation of engineers with essential, in-demand skills.

Industry Associations and Consortia

Ansys actively participates in industry associations and consortia to remain at the forefront of technological advancements and market needs. These collaborations are crucial for understanding emerging standards and challenges within key sectors like automotive and aerospace.

Through these partnerships, Ansys gains insights that directly inform the development of its simulation software, ensuring its continued relevance and effectiveness. For instance, engagement in automotive consortia helps Ansys align its solutions with the industry's rapid shift towards electric vehicles and autonomous driving technologies.

- Industry Standards Alignment: Partnerships ensure Ansys's simulation tools meet and anticipate evolving industry benchmarks, crucial for sectors like aerospace where safety and performance standards are paramount.

- Market Trend Identification: Engaging with consortia provides early visibility into disruptive trends, such as the increasing demand for advanced battery simulation in the automotive sector, allowing Ansys to proactively develop relevant solutions.

- Collaborative Solution Development: These alliances foster joint development efforts, enabling Ansys to create more targeted and impactful simulation capabilities that address specific industry pain points.

Value-Added Resellers (VARs) and Consulting Firms

Ansys relies heavily on a global network of Value-Added Resellers (VARs) and consulting firms to expand its market reach and offer localized support. These partners are crucial for Ansys's strategy, particularly in reaching small and medium-sized businesses (SMBs) that might not engage directly with Ansys.

These VARs and consulting firms provide essential services such as specialized expertise, implementation assistance, customer training, and initial technical support. This collaborative approach allows Ansys to extend its sales and service capabilities significantly, ensuring customers receive tailored solutions and prompt assistance.

- Global Reach: VARs and consulting partners extend Ansys's presence into diverse geographical markets, enhancing market penetration.

- Specialized Expertise: Partners bring niche industry knowledge and technical skills, enabling tailored solutions for complex customer needs.

- Customer Support: They offer first-line technical assistance and training, improving customer satisfaction and adoption rates.

Ansys's strategic alliances with technology providers, including hardware manufacturers and cloud service providers, are foundational. These collaborations ensure Ansys's simulation software leverages the latest advancements in computing power and accessibility. For instance, partnerships with NVIDIA in 2024 continue to drive performance gains through GPU acceleration, while alliances with cloud giants like AWS and Microsoft Azure expand access to scalable simulation resources.

| Partner Type | Key Focus | Impact on Ansys | 2024 Insight |

| Hardware Vendors (e.g., NVIDIA) | GPU Acceleration, HPC | Faster simulation runtimes, enhanced complex problem-solving | Continued demand for high-performance computing, benefiting Ansys users. |

| Cloud Providers (AWS, Azure, Google Cloud) | Scalable Access, SaaS Models | Democratized access to simulation, reduced upfront costs for users | Robust growth in cloud HPC, enabling wider adoption of Ansys cloud solutions. |

| ISVs & Software Integrators | CAD/CAM/CAE/PLM Integration | Expanded ecosystem, seamless workflows, holistic digital solutions | Ongoing integration efforts to embed simulation into diverse engineering toolchains. |

| Academic & Research Institutions | Innovation, Talent Development | Cutting-edge technology advancements, skilled future workforce | Ansys continues to support thousands of universities, fostering simulation expertise. |

| VARs & Consulting Firms | Market Reach, Localized Support | Expanded customer base (especially SMBs), tailored solutions, implementation services | Partnerships remain critical for global market penetration and customer onboarding. |

What is included in the product

A detailed breakdown of Ansys's strategy, outlining its key customer segments, value propositions, and revenue streams through the lens of the classic Business Model Canvas.

The Ansys Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex strategic thinking.

It alleviates the pain of scattered ideas and lengthy documentation by providing a single, actionable page for understanding and communicating the business.

Activities

Ansys's core strength lies in its relentless pursuit of innovation through software research and development. This involves a significant and ongoing investment in creating advanced simulation algorithms and refining current solvers to maintain a competitive edge.

The company's R&D efforts are geared towards integrating cutting-edge technologies, such as artificial intelligence and machine learning, into its simulation platforms. This ensures Ansys software remains at the forefront of accuracy and capability, ready to tackle complex engineering problems.

In 2024 alone, Ansys demonstrated its commitment to R&D by investing a substantial $528 million. This financial commitment underscores the critical role R&D plays in developing software that is both state-of-the-art and capable of meeting evolving industry demands.

Ansys's sales and marketing engine is focused on promoting and selling its powerful engineering simulation software and associated services worldwide. This involves a multi-pronged approach, utilizing both dedicated direct sales teams and a network of trusted channel partners. Digital marketing strategies are also crucial for reaching a broad audience and generating interest.

Key activities include generating qualified leads, understanding and segmenting different customer groups, and customizing Ansys solutions to meet the unique challenges of various industries. Building a strong brand presence and awareness within the highly competitive computer-aided engineering (CAE) market is paramount.

In 2024, Ansys continued to invest heavily in these areas. The company reported a revenue of $2.3 billion for the fiscal year 2024, demonstrating the effectiveness of its sales and marketing efforts in driving growth. Their strategic partnerships and digital campaigns played a significant role in expanding their global footprint and customer base.

Ansys prioritizes customer success through robust support and training, which is crucial for ensuring clients can effectively utilize their advanced simulation software. This includes providing comprehensive technical support and troubleshooting to resolve any issues promptly.

To further empower users, Ansys offers extensive training programs. In 2024, Ansys continued to invest in its digital learning platforms, providing access to a vast library of courses and tutorials designed to enhance user proficiency and application of their simulation tools.

The company fosters a strong user community through online resources like user forums and dedicated communities, allowing customers to share knowledge and best practices. Ansys also offers certification programs, validating user expertise and ensuring they can maximize the value derived from Ansys solutions.

Strategic Acquisitions and Partnerships Management

Ansys's strategic acquisitions and partnerships management are vital for its growth. For example, the company's acquisition by Synopsys in 2024, valued at approximately $35 billion, significantly reshaped the electronic design automation (EDA) landscape. This move aimed to combine Ansys's simulation and testing capabilities with Synopsys's strengths in chip design.

Managing these strategic alliances, alongside existing technology and channel partnerships, is a core activity. It ensures Ansys can offer comprehensive, integrated solutions to its customers. This ecosystem approach is critical for maintaining a competitive edge in the complex simulation and engineering software market.

- Acquisition by Synopsys: Completed in 2024, this $35 billion deal significantly expanded Ansys's reach and technological integration.

- Complementary Technology Integration: Ansys actively seeks and integrates technologies that enhance its simulation and analysis offerings.

- Ecosystem Development: Managing relationships with technology providers and channel partners is key to delivering end-to-end solutions.

- Market Expansion: Partnerships and acquisitions are used to enter new markets and strengthen presence in existing ones.

Product Release and Innovation Cycles

Ansys's product release and innovation cycles are central to its business model. The company regularly launches new software versions, such as Ansys 2025 R1 and Ansys 2025 R2, packed with advanced features and performance upgrades. These updates are crucial for maintaining a competitive edge and meeting evolving customer needs in the simulation software market.

These releases often incorporate cutting-edge technologies like AI-driven tools, enhanced cloud integration, and GPU acceleration to boost simulation speeds and capabilities. For instance, Ansys 2025 R1 introduced significant advancements in areas like multiphysics simulation and system simulation, reflecting the company's commitment to innovation.

- Regular Software Updates: Ansys consistently delivers new versions, like Ansys 2025 R1 and R2, to keep its product suite current and powerful.

- Feature Enhancements: These releases focus on improving performance, adding new functionalities, and integrating emerging technologies such as AI and cloud computing.

- Market Responsiveness: Innovation cycles ensure Ansys's offerings remain relevant and competitive by addressing current market demands and technological progress.

- Customer Value: By providing advanced simulation tools, Ansys empowers its diverse customer base to accelerate product development and achieve better design outcomes.

Ansys's key activities revolve around continuous research and development to enhance its simulation software, ensuring it remains at the cutting edge. This includes integrating advanced technologies like AI and machine learning into its platforms. The company also focuses on robust sales and marketing efforts, utilizing direct sales, channel partners, and digital strategies to reach a global audience and drive revenue growth.

Customer success is paramount, achieved through comprehensive technical support, extensive training programs, and fostering a strong user community. Furthermore, Ansys actively manages strategic acquisitions and partnerships to expand its technological capabilities and market reach, as exemplified by its 2024 acquisition by Synopsys.

The company's product release cycle is a critical activity, with regular updates like Ansys 2025 R1 and R2 introducing new features and performance improvements to meet evolving industry demands.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Research & Development | Creating advanced simulation algorithms and integrating new technologies. | $528 million invested in R&D. |

| Sales & Marketing | Promoting and selling software globally through direct sales, partners, and digital channels. | $2.3 billion in revenue reported for FY 2024. |

| Customer Support & Training | Providing technical assistance and educational resources to users. | Investment in digital learning platforms and user communities. |

| Strategic Acquisitions & Partnerships | Expanding capabilities and market reach through alliances and M&A. | Acquisition by Synopsys for approximately $35 billion completed in 2024. |

| Product Release & Innovation | Launching new software versions with enhanced features and performance. | Release of Ansys 2025 R1 and R2 with AI and cloud integration. |

Full Version Awaits

Business Model Canvas

The Ansys Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive file that will be delivered to you, ready for immediate use and customization.

Resources

Ansys's key resources are its robust suite of proprietary engineering simulation software, encompassing sophisticated algorithms, solvers, and patented technologies. This intellectual property spans critical physics areas like structural analysis, fluid dynamics, electromagnetics, and semiconductor design, forming the bedrock of its competitive edge and value delivery.

In 2023, Ansys reported approximately $2.2 billion in revenue, a testament to the market's reliance on its advanced simulation capabilities. The company holds a significant number of patents, safeguarding its innovations and providing a barrier to entry for competitors in the high-stakes engineering software market.

Ansys relies heavily on its global team of expert engineers, scientists, software developers, and sales professionals. This deep domain expertise across physics, mathematics, computer science, and various industries is fundamental to creating, marketing, and supporting their sophisticated simulation software.

In 2023, Ansys reported approximately 5,000 employees, with a significant portion dedicated to R&D and engineering, underscoring the importance of this highly skilled workforce. Their technical acumen directly translates into the advanced capabilities of Ansys products, driving innovation and customer value.

Ansys commands a powerful global brand, recognized as a premier leader in engineering simulation software. This strong reputation, cultivated over decades, underpins its ability to attract and retain a vast, loyal customer base.

Its customer ecosystem spans the globe, including major corporations, small and medium-sized businesses, and academic institutions. This broad reach ensures a significant stream of recurring revenue and provides substantial market influence.

In 2023, Ansys reported approximately 60,000 customers across various industries, highlighting the breadth and depth of its market penetration and the recurring nature of its revenue streams.

Extensive Simulation Data and Benchmarks

Ansys leverages extensive simulation data and benchmarks, accumulated over years of industry application, to continuously refine and validate its software. This vast dataset is crucial for developing advanced AI and machine learning models integrated into its tools, significantly boosting accuracy and operational efficiency.

- Refinement and Validation: Ansys's software undergoes rigorous testing against real-world scenarios, ensuring its predictive capabilities are highly reliable.

- AI and ML Development: The vast historical simulation data fuels the development of intelligent algorithms, leading to more accurate and faster design iterations.

- Industry Best Practices: Benchmarks derived from successful industry implementations inform Ansys's development, embedding proven methodologies into its solutions.

- Enhanced User Experience: This data-driven approach translates into user-friendly tools that deliver superior performance and insights.

Robust IT Infrastructure and Cloud Capabilities

Ansys relies on a robust IT infrastructure, including high-performance computing (HPC) clusters, to power its internal research and development. This infrastructure is crucial for the complex simulations that drive innovation in their software. In 2024, Ansys continued to invest heavily in these capabilities to maintain its competitive edge.

Their cloud capabilities are equally vital, enabling the delivery of simulation solutions directly to customers. This model offers scalability and accessibility, allowing a broader range of users to leverage Ansys's powerful tools without significant upfront hardware investment. The company's cloud offerings are designed to support a growing subscription-based revenue model.

- HPC Investment: Ansys's commitment to HPC ensures faster simulation turnaround times, a key differentiator for their customers.

- Cloud Adoption: The expansion of cloud-based simulation services in 2024 broadened Ansys's market reach and recurring revenue streams.

- Scalability: The IT infrastructure is built to scale, accommodating both increasing internal demands and a growing external customer base on cloud platforms.

Ansys's intellectual property, including its sophisticated software algorithms and extensive patent portfolio, forms the core of its value proposition. This proprietary technology, covering diverse physics domains, is central to its market leadership and recurring revenue generation.

The company's human capital, comprising highly skilled engineers, scientists, and developers, is instrumental in creating and advancing its simulation solutions. This expertise, coupled with a strong global brand and a vast customer base of approximately 60,000 users in 2023, reinforces its competitive advantage.

Ansys's extensive simulation data and robust IT infrastructure, including significant investments in HPC and cloud capabilities in 2024, are critical enablers. These resources fuel continuous software improvement, AI development, and scalable service delivery, ensuring sustained innovation and market penetration.

| Key Resource | Description | 2023/2024 Data Point |

| Proprietary Software & Patents | Advanced engineering simulation software, algorithms, solvers, and patented technologies across multiple physics domains. | Revenue of $2.2 billion in 2023; significant patent holdings. |

| Human Capital | Global team of expert engineers, scientists, developers, and sales professionals with deep domain expertise. | Approximately 5,000 employees in 2023, with a strong R&D focus. |

| Brand & Customer Ecosystem | Recognized global brand as a leader in engineering simulation, with a broad customer base. | Approximately 60,000 customers globally in 2023. |

| Data & Infrastructure | Extensive simulation data, benchmarks, high-performance computing (HPC), and cloud capabilities. | Continued investment in HPC and cloud services in 2024. |

Value Propositions

Ansys’s simulation software dramatically speeds up product development by allowing companies to test designs virtually, slashing the need for expensive and time-consuming physical prototypes. This capability directly translates to faster innovation cycles.

For instance, in 2023, Ansys reported a 15% year-over-year increase in revenue, partly driven by the adoption of its simulation tools that enable more rapid product iteration and development, ultimately shortening time-to-market for its clients.

By facilitating numerous design iterations in a virtual environment, Ansys empowers organizations to refine their products more efficiently, leading to a quicker path from concept to market availability.

Ansys simulation software allows companies to virtually test product designs, predicting how they'll perform in real-world conditions. This proactive approach helps catch design issues early, preventing costly changes later in the manufacturing process.

By identifying potential flaws before physical prototypes are built, Ansys solutions significantly cut down on material waste and the expenses tied to rework. For instance, the automotive industry, a major Ansys user, can save millions by optimizing designs for crashworthiness and fuel efficiency through simulation, avoiding numerous expensive physical tests.

This early detection and correction of design problems directly translate into reduced risks. Companies can avoid the significant financial and reputational damage associated with product failures, recalls, or performance issues in the market, ensuring greater product reliability and customer satisfaction.

Ansys software empowers engineers to refine product designs, boosting performance, durability, and efficiency. This optimization directly translates to higher quality goods that surpass expectations, ultimately delighting customers and solidifying a company's market standing.

In 2024, industries relying on advanced simulation, like automotive and aerospace, saw significant gains. For instance, automotive manufacturers utilizing Ansys for vehicle dynamics simulation reported an average of 15% reduction in prototype testing costs, directly linked to improved design validation and fewer physical iterations, showcasing the value of enhanced product performance.

Comprehensive Multiphysics Simulation Capabilities

Ansys provides an extensive suite of simulation tools that span numerous physics domains, enabling the analysis of intricate, interconnected phenomena. This all-encompassing approach fosters a complete understanding of product performance, from how it reacts to physical forces and fluid flow to its electromagnetic properties and semiconductor behavior.

This breadth of capability is crucial for modern engineering challenges. For instance, in 2024, the demand for integrated simulations in sectors like automotive and aerospace, where structural integrity, thermal management, and aerodynamics must be considered simultaneously, continued to grow. Companies are increasingly leveraging these multiphysics capabilities to reduce physical prototyping and accelerate time-to-market.

- Holistic Product Understanding: Analyze complex interactions across structural, fluid, thermal, and electromagnetic domains.

- Reduced Prototyping Costs: Virtual testing of multiphysics scenarios minimizes the need for expensive physical prototypes.

- Accelerated Innovation: Faster design iterations and validation cycles lead to quicker product development.

- Enhanced Product Performance: Optimize designs by understanding and mitigating the interplay of various physical effects.

Democratization of Advanced Simulation

Ansys is making sophisticated engineering simulations available to more people through simpler interfaces and AI tools like Ansys Engineering Copilot. This approach allows a broader group of engineers, designers, and students to use these powerful tools, bringing simulation into the early stages of product development.

This democratization is crucial for innovation. For instance, Ansys reported a significant increase in its customer base, with a notable portion being new users accessing their cloud solutions in 2024. This expansion means simulation is no longer confined to highly specialized teams.

- Wider Accessibility: User-friendly interfaces and cloud access bring advanced simulation to engineers and designers who may not have specialized expertise.

- AI-Powered Assistance: Tools like Ansys Engineering Copilot simplify complex workflows, making simulation more intuitive.

- Early Design Integration: By lowering barriers, Ansys enables simulation to be used earlier in the design cycle, leading to faster iteration and better product outcomes.

- Expanded User Base: Ansys saw a substantial uptick in new users engaging with its simulation platforms in 2024, highlighting the success of its democratization strategy.

Ansys’s simulation software significantly reduces the need for costly physical prototypes by enabling virtual testing, thereby accelerating product development timelines. This efficiency boost was reflected in 2023, where Ansys saw a 15% year-over-year revenue increase, partly due to clients adopting these faster development tools.

By allowing for numerous design iterations in a virtual setting, Ansys helps companies refine products more efficiently, leading to a quicker path from concept to market. This capability is crucial for industries like automotive, where users reported an average 15% reduction in prototype testing costs in 2024 by leveraging Ansys for improved design validation.

Ansys’s comprehensive suite covers multiple physics domains, offering a holistic understanding of product performance by simulating complex interactions. This multiphysics capability is increasingly vital, with sectors like aerospace in 2024 demanding integrated simulations for structural integrity, thermal management, and aerodynamics.

Ansys democratizes advanced simulation through user-friendly interfaces and AI tools like Engineering Copilot, making powerful engineering capabilities accessible to a broader audience. This strategy led to a notable increase in new users engaging with Ansys cloud solutions in 2024, indicating a successful expansion of simulation accessibility.

| Value Proposition | Description | 2023/2024 Impact |

|---|---|---|

| Accelerated Product Development | Virtual testing slashes prototype needs, speeding up innovation cycles. | 15% YoY revenue growth for Ansys in 2023; 15% reduction in prototype costs for automotive users in 2024. |

| Reduced Development Costs | Early detection of design flaws prevents costly rework and material waste. | Automotive sector savings from optimized designs via simulation. |

| Enhanced Product Performance | Optimization through simulation leads to higher quality, more reliable products. | Improved vehicle dynamics simulation leading to better product performance. |

| Holistic Product Understanding | Multiphysics simulation provides a complete view of product behavior. | Growing demand for integrated simulations in aerospace and automotive. |

| Democratized Simulation Access | User-friendly interfaces and AI tools broaden simulation adoption. | Significant increase in new users on Ansys cloud platforms in 2024. |

Customer Relationships

For its large enterprise clients, Ansys deploys dedicated account managers and specialized technical experts. These teams provide highly personalized support, offering strategic guidance and crafting solutions specifically for each client's unique needs.

This hands-on approach cultivates robust, long-term partnerships, ensuring clients not only achieve but sustain their success with Ansys's offerings. In 2024, Ansys reported that over 80% of its revenue came from repeat customers, underscoring the effectiveness of this relationship strategy.

Ansys provides a robust multi-tier technical support system, including extensive online resources, active user forums, and direct access to expert assistance. This comprehensive approach ensures customers can efficiently resolve technical challenges and maximize their simulation outcomes.

Beyond basic support, Ansys offers specialized consulting services designed to help users optimize their simulation workflows and achieve specific engineering objectives. In 2023, Ansys reported that over 90% of its customers utilized its technical support channels, with a significant portion leveraging consulting for complex projects.

Ansys fosters a vibrant online community, featuring active forums and an extensive knowledge base. This platform empowers users to readily find solutions, exchange valuable best practices, and engage in collaborative discussions with fellow users and Ansys specialists. This self-service and peer-driven support system significantly elevates the user experience and facilitates efficient knowledge sharing across the Ansys user base.

Training and Certification Programs

Ansys offers a robust suite of training and certification programs designed to cultivate deep user expertise. These resources are crucial for customers seeking to fully leverage Ansys software capabilities and ensure they are up-to-date with the latest advancements.

These educational initiatives are a cornerstone of Ansys's customer relationship strategy, enabling users to not only master the tools but also to maximize their return on investment. By staying current with new features and methodologies, customers can enhance their simulation workflows and drive innovation.

- Extensive Training: Ansys provides a wide array of training courses, both online and in-person, covering fundamental to advanced topics.

- Webinars and Online Resources: Regular webinars and a comprehensive library of online content keep users informed about new releases and best practices.

- Certification Programs: Formal certification validates user proficiency, enhancing their credibility and Ansys's software adoption.

- Customer Success: In 2023, Ansys reported a significant increase in engagement with its training platforms, indicating a strong customer drive for skill development.

User Conferences and Feedback Mechanisms

Ansys actively cultivates customer relationships through various engagement channels. Their global user conferences, industry-specific events, and regular webinars serve as vital platforms for direct interaction. These gatherings not only showcase Ansys's latest technological advancements but also provide invaluable opportunities to solicit customer feedback, fostering a collaborative environment for product enhancement.

This direct feedback loop is instrumental in Ansys's customer-centric development strategy. By actively listening to user experiences and suggestions, Ansys can refine its offerings to better meet market demands and drive innovation. For instance, feedback from the 2023 Ansys Gateway, a major user conference, directly influenced the development roadmap for several key simulation software suites.

- Global User Conferences: Ansys hosts major conferences like Ansys Gateway, bringing together thousands of users worldwide to share best practices and learn about new features.

- Industry Events and Webinars: Participation in and hosting of industry-specific events and regular webinars ensures continuous engagement and knowledge sharing.

- Feedback Mechanisms: Direct feedback channels, including surveys and direct communication during events, are integrated into the product development lifecycle.

- Community Building: These interactions foster a strong sense of community among Ansys users, promoting knowledge exchange and loyalty.

Ansys cultivates deep customer loyalty through a multi-faceted approach, prioritizing personalized support and continuous engagement. Dedicated account managers and technical experts work closely with large enterprise clients, tailoring solutions to specific needs, which is reflected in Ansys’s 2024 report showing over 80% of revenue from repeat customers.

The company also offers extensive, multi-tier technical support, including a robust online knowledge base and active user forums, alongside specialized consulting services. In 2023, over 90% of Ansys customers utilized these support channels, with many leveraging consulting for complex projects, highlighting the value placed on user success and problem resolution.

Furthermore, Ansys invests heavily in user education through comprehensive training and certification programs, ensuring customers can maximize software capabilities. This commitment to skill development, evidenced by increased engagement with training platforms in 2023, solidifies customer proficiency and drives long-term value. Direct engagement via global user conferences and industry events also fosters community and incorporates user feedback directly into product development, as seen with influences from the 2023 Ansys Gateway conference.

Channels

Ansys leverages a dedicated global direct sales force to cultivate relationships with major enterprise clients and strategic accounts. This approach is crucial for selling complex, high-value simulation solutions, enabling direct negotiation and fostering deep, long-term partnerships.

In 2024, Ansys reported that its direct sales channel remained a cornerstone of its revenue generation, particularly for its high-end simulation software suites. This channel facilitated the tailored delivery of solutions addressing intricate engineering challenges for Fortune 500 companies.

Ansys leverages a robust network of Value-Added Resellers (VARs) and distributors to significantly expand its market penetration. These partners are crucial for reaching smaller and medium-sized enterprises and for establishing a strong presence in geographical areas where direct Ansys operations are less extensive. For instance, in 2023, Ansys reported that its channel partners contributed a substantial portion of its revenue, highlighting the critical role of this segment in its go-to-market strategy.

These authorized VARs and distributors offer more than just sales access; they provide essential localized support, technical consulting, and tailored solutions that resonate with specific regional customer needs. This localized expertise allows Ansys to deliver a more personalized and effective customer experience, fostering deeper relationships and driving adoption of its simulation software across diverse industries.

Ansys's official website and dedicated online portals are vital channels, offering customers convenient digital access for information, software downloads, and license management. These platforms also facilitate direct sales for select products and subscriptions, streamlining the customer journey.

Academic Programs and University Partnerships

Ansys actively cultivates the next generation of engineers and researchers through its Academic Programs, offering discounted or free software licenses to universities worldwide. This strategy is crucial for embedding Ansys's simulation tools into curricula, ensuring a pipeline of skilled professionals familiar with their platforms.

These partnerships are not just about software distribution; they are about fostering innovation. By supporting academic research, Ansys gains insights into emerging technologies and potential new applications for its software. For instance, in 2024, Ansys reported engaging with over 3,000 universities globally, providing access to its comprehensive simulation suite.

- Fostering Talent: Ansys academic programs equip students with industry-standard simulation skills, making them highly sought-after graduates.

- Early Adoption: Universities serve as early adopters, testing and validating new Ansys features, which can inform product development.

- Research Advancement: Providing access to advanced simulation tools accelerates scientific discovery and technological breakthroughs in various engineering fields.

- Global Reach: Ansys's academic outreach extends to over 3,000 universities, demonstrating a significant commitment to global education and research enablement.

Industry Events, Webinars, and Digital Marketing

Ansys leverages industry events and digital marketing as crucial channels to connect with its target audience. Participation in major trade shows, like those hosted by the IEEE or specific engineering societies, provides direct engagement opportunities. In 2024, Ansys continued its presence at key events, showcasing its simulation software's advanced capabilities, which is vital for a company in the high-tech engineering sector.

Webinars are a cornerstone of Ansys's digital strategy, offering deep dives into product functionalities and industry solutions. These online sessions allow for broad reach, enabling potential customers globally to learn about Ansys's offerings without the need for physical travel. The company consistently hosts webinars covering topics from multiphysics simulation to specific industry applications, driving engagement and lead generation.

Comprehensive digital marketing campaigns, including content marketing, search engine optimization (SEO), paid advertising, and social media engagement, are essential for maintaining brand visibility and reaching a diverse financial and technical audience. Ansys's content marketing efforts, such as white papers and case studies, highlight successful customer implementations and the ROI of their simulation tools. For instance, in the first half of 2024, Ansys saw a notable increase in website traffic attributed to targeted SEO and paid search campaigns focused on simulation software for automotive and aerospace sectors.

- Industry Events: Ansys consistently exhibits at major engineering and technology conferences, fostering direct customer interaction and product demonstrations.

- Webinars: The company hosts regular webinars covering product updates, technical tutorials, and industry best practices, attracting thousands of attendees globally.

- Digital Marketing: A robust strategy encompassing content marketing, SEO, paid advertising, and social media drives brand awareness and lead generation.

- Lead Generation: These channels are critical for identifying and nurturing potential customers, with digital efforts often contributing a significant percentage of new sales pipeline in 2024.

Ansys utilizes a multi-faceted channel strategy, combining direct sales for high-value enterprise accounts with a broad network of Value-Added Resellers (VARs) for wider market reach. Digital platforms and academic programs are also key, fostering future users and providing accessible information. Industry events and targeted digital marketing campaigns further amplify Ansys's presence and lead generation efforts.

Customer Segments

Large enterprise corporations, spanning sectors like aerospace, automotive, and energy, represent a core customer segment for advanced simulation software. These giants, often with global operations, demand sophisticated, high-fidelity solutions to tackle intricate product development and extensive research and development initiatives. For instance, in 2024, the automotive industry alone invested billions in R&D, with simulation playing a critical role in accelerating vehicle design and testing.

Small and Medium-sized Businesses (SMBs) are increasingly looking for ways to innovate and improve their product development without breaking the bank. Ansys recognizes this, offering powerful simulation software that can help these companies compete more effectively. For instance, in 2024, the global market for engineering simulation software was projected to reach over $9 billion, with SMBs being a significant growth driver in this expansion.

Ansys' strategy involves providing flexible, scalable solutions tailored to the unique challenges and budgets of SMBs. This means offering tiered access to their advanced simulation capabilities, allowing smaller businesses to leverage sophisticated design and analysis tools that were once only accessible to large corporations. This accessibility is crucial as many SMBs aim to shorten product development cycles and reduce physical prototyping costs.

Universities, colleges, and research institutions are key customers for Ansys, using its simulation software for both teaching and cutting-edge research. In 2024, Ansys continued to support academic programs, enabling students to gain hands-on experience with industry-standard tools. This segment is vital for nurturing future engineers and driving innovation.

The academic sector leverages Ansys for a wide array of applications, from undergraduate design projects to complex doctoral research in fields like aerospace, automotive, and biomedical engineering. This engagement fosters a deep understanding of simulation principles, preparing students for careers where Ansys tools are prevalent. For instance, many universities offer specialized courses built around Ansys platforms, ensuring a steady pipeline of skilled professionals.

Individual Engineers and Designers

Individual engineers and designers, whether working solo or in small, agile teams, represent a crucial segment for simulation software. These professionals often need robust, yet accessible, tools to tackle specific design challenges, personal innovation projects, or to offer specialized services as freelancers. Their demand is driven by the need for powerful simulation without the overhead of enterprise-level complexity.

The market for these individual professionals is significant and growing. For instance, in 2024, the global freelance economy was projected to reach over $4.5 trillion, with a substantial portion of these freelancers operating in engineering and design fields. This indicates a strong demand for flexible, powerful software solutions that can be adopted on a per-project or subscription basis.

- Specialized Needs: This group often requires highly specific simulation capabilities for niche applications, rather than broad, all-encompassing enterprise suites.

- User-Friendliness: Ease of use and intuitive interfaces are paramount, as many individual users may not have dedicated IT support or extensive training resources.

- Cost-Effectiveness: Flexible licensing models, such as per-user subscriptions or pay-as-you-go options, are highly attractive to independent professionals managing their own budgets.

- Accessibility: Cloud-based solutions or readily downloadable software that can be installed on personal workstations are preferred for immediate deployment and flexibility.

Government and Defense Organizations

Government and defense organizations are key customers, needing advanced simulation for national security, infrastructure, and military tech. These sectors demand high fidelity and security for complex, sensitive projects.

For instance, defense spending globally is projected to reach $2.44 trillion in 2024, highlighting the significant market for simulation technologies that enhance readiness and capability.

- National Security: Simulation aids in threat assessment, cybersecurity, and intelligence gathering.

- Defense Technologies: Development of advanced aircraft, vehicles, and weaponry relies heavily on simulation.

- Infrastructure: Government agencies use simulation for critical infrastructure resilience, like bridges and power grids.

- Compliance: Meeting stringent government and defense standards for performance and security is paramount.

Ansys serves a diverse customer base, from massive corporations to individual innovators. Each segment has distinct needs regarding complexity, cost, and accessibility of simulation tools.

Large enterprises in aerospace and automotive, for example, require high-fidelity solutions for complex R&D, reflecting billions invested in these sectors in 2024. Conversely, SMBs and individual professionals seek cost-effective, user-friendly options to enhance their product development and compete effectively.

Academic institutions are crucial for training future engineers and driving research, with Ansys actively supporting educational programs. Government and defense sectors rely on Ansys for critical national security and infrastructure projects, a market bolstered by significant global defense spending in 2024.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Large Enterprises | High-fidelity, complex R&D solutions | Automotive R&D investment in billions |

| SMBs | Cost-effective, scalable innovation tools | Growth driver in $9B+ engineering simulation market |

| Academia | Teaching and research capabilities | Nurturing future engineers with industry-standard tools |

| Individual Professionals | Accessible, flexible, per-project solutions | Part of the $4.5T+ global freelance economy |

| Government/Defense | Secure, high-fidelity for national security | Supported by $2.44T global defense spending |

Cost Structure

Ansys's cost structure is heavily influenced by its substantial commitment to Research and Development (R&D). This significant investment is crucial for maintaining its competitive edge in the simulation software market, funding the creation of new technologies and improving existing products.

In 2024, Ansys allocated $528 million to R&D, a clear indicator of its focus on innovation. This expenditure covers the essential costs of employing highly skilled engineers and scientists, acquiring sophisticated software development tools, and maintaining the necessary infrastructure to drive continuous product enhancement and technological advancement.

Ansys invests heavily in its global sales and marketing infrastructure. These expenses, encompassing everything from sales team salaries and commissions to extensive marketing campaigns and participation in key industry trade shows, are critical for driving market penetration and, ultimately, revenue growth.

In 2024, Ansys continued to focus on digital marketing and account-based strategies, alongside maintaining its presence at major engineering and simulation events. The company's commitment to these areas reflects the necessity of reaching a diverse customer base, from individual engineers to large enterprise clients, across various industries.

Ansys's cost structure is heavily influenced by its substantial investment in a highly skilled, global workforce. This includes the engineers and developers crucial for creating their advanced simulation software, alongside sales teams, technical support, and administrative staff worldwide.

In 2024, Ansys reported significant expenses related to compensation and benefits for its specialized personnel. For instance, their total operating expenses for the fiscal year ending December 31, 2024, were approximately $1.7 billion, with a substantial portion allocated to employee-related costs, reflecting the specialized nature and global reach of their talent pool.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Ansys encompass the essential corporate functions that keep a global enterprise operational. These costs cover vital areas like legal services, finance and accounting departments, human resources management, and the salaries of executive leadership. Additionally, facilities management and other overheads necessary for running the business on a worldwide scale fall under this category.

For Ansys, these G&A costs are critical for maintaining its infrastructure and supporting its strategic initiatives. In 2023, Ansys reported G&A expenses of $373.7 million. This figure reflects the significant investment required to manage a complex, international software company.

- Legal and Compliance: Ensuring adherence to global regulations and managing intellectual property.

- Finance and Accounting: Overseeing financial reporting, budgeting, and investor relations.

- Human Resources: Managing talent acquisition, employee development, and compensation.

- Executive Management: Leadership and strategic direction for the company.

Intellectual Property and Licensing Costs

Ansys incurs significant expenses in safeguarding its intellectual property, including maintaining a vast patent portfolio. These costs are crucial for protecting its core technologies and competitive advantage. Legal fees associated with patent filings, enforcement, and defense are a substantial part of this expenditure.

Furthermore, Ansys may incur licensing fees for integrating third-party technologies or data into its software solutions. These agreements are essential for enhancing product capabilities and offering comprehensive simulation tools to customers. For instance, in 2023, Ansys reported $1.2 billion in total operating expenses, a portion of which directly supports its intellectual property and licensing strategies.

- Patent Portfolio Maintenance: Ongoing costs to preserve and expand Ansys's extensive patent library.

- Legal Fees: Expenses for protecting intellectual property rights, including litigation and trademark registration.

- Third-Party Licensing: Payments for using external technologies or data essential for Ansys's product development.

Ansys's cost structure is dominated by its significant investment in Research and Development (R&D) and its global sales and marketing operations. These areas are critical for maintaining its leadership in simulation software. The company also incurs substantial costs for its skilled workforce and general administrative functions.

In 2024, Ansys's R&D expenditure reached $528 million, underscoring its commitment to innovation. Operating expenses for the fiscal year ending December 31, 2024, were approximately $1.7 billion, with a considerable portion dedicated to employee compensation and benefits, reflecting the specialized nature of its global talent. General and Administrative expenses were $373.7 million in 2023, supporting essential corporate functions.

| Cost Category | 2023 (Millions USD) | 2024 (Millions USD) |

|---|---|---|

| Research & Development | N/A* | 528 |

| Total Operating Expenses | 1,200 | 1,700 |

| General & Administrative | 373.7 | N/A* |

Revenue Streams

Ansys's core revenue generation stems from selling software licenses. This includes traditional perpetual licenses, a one-time purchase for ongoing use, and a growing segment of subscription-based licenses, which provide access for a set period through recurring fees. This dual approach caters to different customer needs and financial preferences.

The company saw a significant increase in subscription lease revenue during 2024, highlighting a strategic pivot towards recurring revenue models. This shift is crucial for predictable income and customer retention, as evidenced by the growing contribution of these subscriptions to the overall revenue mix.

Ansys secures recurring revenue through annual maintenance and support contracts. These contracts are vital for customers, providing essential access to software updates, critical bug fixes, and ongoing technical assistance, ensuring their simulation tools remain current and functional.

This revenue stream offers Ansys a foundation of stable and predictable income, which is crucial for financial planning and investment. The consistent nature of these contracts allows for better forecasting and resource allocation within the company.

Demonstrating the strength of this segment, Ansys reported that maintenance revenue experienced a growth of over 9% in the first half of 2024, highlighting its continued importance to the company's financial performance.

Ansys generates significant revenue through its training and consulting services, focusing on empowering customers to master their simulation software. These offerings include specialized courses, hands-on workshops, and expert guidance tailored to optimize simulation workflows.

In 2023, Ansys reported that its software and services revenue grew by 12% year-over-year, reaching $2.2 billion. While specific figures for training and consulting are not broken out, this segment is a crucial contributor to overall customer success and software adoption, driving long-term value.

Cloud-Based Simulation Services

Ansys is seeing a growing portion of its income come from services that allow customers to use simulation tools hosted in the cloud. This means users pay based on how much they use the service or through recurring subscription fees. This model offers a flexible and scalable way for businesses to access powerful simulation capabilities without the need for extensive on-premises hardware.

For instance, Ansys Cloud offers pay-as-you-go options, allowing engineers to spin up high-performance computing resources as needed for complex simulations. This approach directly supports the company's strategy to make advanced simulation technology more accessible and cost-effective for a wider range of users.

- Cloud-based simulation services provide scalable access to Ansys software.

- Revenue is generated through consumption-based and subscription fees.

- This model enhances accessibility and reduces upfront hardware investment for users.

- Ansys Cloud's pay-as-you-go options exemplify this revenue stream.

Strategic Partnerships and OEM Agreements

Ansys generates revenue through strategic partnerships and Original Equipment Manufacturer (OEM) agreements. These collaborations allow Ansys's simulation software to be integrated into the products and services of other companies, expanding its reach and creating new revenue streams. For example, Ansys has OEM agreements with companies like Microsoft and NVIDIA, embedding their simulation technology into broader solutions.

These partnerships often involve joint development projects, where collaborators contribute funding for the creation of new technologies or specialized applications. This model diversifies Ansys's income beyond direct software sales, leveraging its core technology through channel partners and co-development initiatives. In 2023, Ansys reported significant growth in its channel partner ecosystem, indicating the increasing importance of these strategic relationships.

- OEM Agreements: Revenue from Ansys technology embedded or resold by other companies.

- Strategic Partnerships: Collaborations for joint development and market expansion.

- Joint Development Funding: Revenue generated from projects funded by external collaborators.

- Channel Partner Growth: Increasing contributions from partners reselling Ansys solutions.

Ansys's revenue streams are diverse, encompassing software licenses, maintenance and support, professional services, and cloud-based offerings. The company also benefits from strategic partnerships and OEM agreements, extending its market reach.

In 2024, Ansys continued to see a strong shift towards subscription-based software licenses, which provide more predictable recurring revenue compared to perpetual licenses. This strategy is supported by robust annual maintenance and support contracts, ensuring customers receive ongoing updates and assistance.

The company's investment in cloud-based simulation services, such as Ansys Cloud, offers flexible, consumption-based revenue models, making advanced simulation accessible to a broader user base. Training and consulting services further enhance customer engagement and software utilization, contributing to overall revenue growth.

Ansys's strategic partnerships and OEM agreements are crucial for embedding its technology into other companies' products, creating additional revenue channels and expanding its market presence. These collaborations are vital for driving innovation and market penetration.

| Revenue Stream | Description | 2024 Trend/Data Point |

|---|---|---|

| Software Licenses | Perpetual and subscription-based access to Ansys simulation software. | Growing subscription revenue, indicating a shift to recurring models. |

| Maintenance & Support | Annual contracts for software updates, bug fixes, and technical assistance. | Maintenance revenue grew over 9% in H1 2024, showing continued importance. |

| Training & Consulting | Services to help customers master and optimize simulation workflows. | Contributes to customer success and software adoption; overall software and services grew 12% in 2023. |

| Cloud-Based Services | Consumption-based or subscription access to simulation tools hosted in the cloud. | Offers scalable access and reduces upfront hardware costs for users. |

| Partnerships & OEM | Revenue from Ansys technology integrated into or resold by other companies. | Expands market reach and creates new revenue streams through collaborations. |

Business Model Canvas Data Sources

The Ansys Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure each block of the canvas is populated with accurate, relevant, and actionable information.