Ansys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansys Bundle

Ansys operates in a dynamic market shaped by intense rivalry, the bargaining power of its customers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the competitive landscape and identifying strategic opportunities.

The complete report reveals the real forces shaping Ansys’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ansys's reliance on highly specialized engineers, mathematicians, and software developers with deep expertise in simulation and computational methods means these individuals hold considerable bargaining power. The scarcity of such niche talent, particularly in areas like AI and cloud computing, intensifies this power, directly affecting Ansys's innovation pipeline and its capacity to develop cutting-edge solutions. This trend is further exacerbated by the broader tech industry's intense competition for these same skill sets.

While Ansys develops a significant portion of its simulation technology internally, it may leverage external research institutions or specialized tech firms for highly niche algorithms or foundational research. If these partners possess proprietary rights to essential intellectual property, they could influence licensing fees or the terms of collaborative ventures, thereby impacting Ansys's operational costs and strategic flexibility.

Ansys's strategic collaborations, such as its 2024 partnership with LightSolver aimed at accelerating simulation speeds through optical computing, underscore the critical role these external relationships play. Such partnerships can provide Ansys with access to cutting-edge advancements that might be too costly or time-consuming to develop independently, but they also introduce a degree of supplier dependence.

As Ansys expands its cloud-based simulation offerings, its dependence on major cloud infrastructure providers, such as Microsoft Azure, increases. These providers, often massive tech corporations, can wield significant bargaining power through their pricing structures, service level agreements, and data location mandates. Ansys's strategic emphasis on cloud solutions and High-Performance Computing (HPC), highlighted in its 2025 R2 release, underscores this growing reliance.

Hardware Component Suppliers

Hardware component suppliers, particularly those providing specialized processors like CPUs and GPUs, hold some bargaining power over Ansys. This leverage stems from the critical role high-performance computing hardware plays in the effective operation of Ansys' simulation software. The growing reliance on GPU acceleration, as seen with Ansys Fluids 2025 R2's integration of GPU solvers, means that suppliers of cutting-edge, simulation-optimized hardware could command better terms, especially if they offer unique technological advantages or face limited competition.

- Specialized Processors: Suppliers of high-end CPUs and GPUs crucial for complex simulations can exert influence.

- Limited Competition: Scarcity of suppliers for specific, advanced hardware components increases their bargaining power.

- Technological Advancements: Suppliers with unique, performance-enhancing hardware innovations gain leverage.

- GPU Integration: The increasing use of GPUs in Ansys software, like in Fluids 2025 R2, amplifies the importance of GPU hardware suppliers.

Operating System and Development Tool Vendors

Ansys's reliance on various operating systems and development tools means vendors in this space can wield some influence. While many of these components are widely available, the market concentration among a few dominant players, particularly in areas like cloud operating systems or specialized development environments, could grant them leverage. This is especially true when it comes to ensuring seamless compatibility and navigating evolving licensing structures.

The bargaining power of operating system and development tool vendors for Ansys is moderate. Ansys's software is designed to run on multiple platforms, mitigating the risk of over-reliance on a single OS provider. However, the integration with specific development tools and libraries can create dependencies. For instance, as of early 2024, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominate the infrastructure-as-a-service market, meaning Ansys's ability to offer its solutions on these platforms is crucial, giving these providers some sway over terms and integration requirements.

- Platform Dependence: Ansys's need to support a wide range of operating systems (e.g., Windows, Linux distributions) and development tools (e.g., C++, Python libraries) exposes it to potential supplier power.

- Market Concentration: Key vendors in operating systems (like Microsoft for Windows) and cloud infrastructure (AWS, Azure, GCP) hold significant market share, increasing their bargaining position.

- Compatibility and Updates: Suppliers can exert pressure through changes in compatibility requirements or the cadence of software updates, potentially impacting Ansys's development cycles and costs.

- Licensing Frameworks: The terms and pricing structures of licenses for operating systems and critical development tools can directly affect Ansys's operational expenses and go-to-market strategies.

Ansys's reliance on specialized hardware, particularly high-performance GPUs and CPUs, grants suppliers of these components significant bargaining power. As Ansys increasingly leverages GPU acceleration, as demonstrated in its Fluids 2025 R2 release, the importance of suppliers offering advanced, simulation-optimized hardware grows. This is amplified when these suppliers have limited competition or unique technological advantages.

| Supplier Type | Bargaining Power Factor | Ansys Impact |

|---|---|---|

| GPU/CPU Manufacturers | Scarcity of advanced simulation-optimized chips | Increased hardware costs, potential supply chain constraints |

| Proprietary Algorithm Developers | Control over essential niche simulation technologies | Higher licensing fees, potential limitations on R&D integration |

| Cloud Infrastructure Providers | Dominance in cloud computing market (e.g., AWS, Azure, GCP) | Influence on pricing, service level agreements, and data management terms |

What is included in the product

This analysis dissects the competitive forces impacting Ansys, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the simulation software market.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of key strategic challenges.

Customers Bargaining Power

Customers investing in Ansys's sophisticated simulation software often face substantial expenses when transitioning to a new provider. These costs encompass training personnel on new platforms, migrating complex existing data, and re-integrating the software into established product development workflows. For instance, a company deeply reliant on Ansys for its advanced structural analysis might spend months and significant resources retraining its engineering teams and validating new simulation outputs.

The deep integration of Ansys tools into a customer's core product development lifecycle creates considerable inertia. This means that switching to a competitor, even if offering a slightly lower price, would likely disrupt ongoing projects and require extensive revalidation of processes. This inherent difficulty and expense in switching directly diminishes the bargaining power of these existing customers, as they are less likely to demand concessions due to the high cost of changing vendors.

Ansys's customer base spans diverse sectors like aerospace, automotive, electronics, and biomedical. While this breadth offers resilience, significant revenue concentration within certain large enterprise clients in critical industries can emerge.

These major customers, due to their substantial purchasing power, may wield considerable influence. They could leverage this to negotiate for better pricing, dedicated support, or even bespoke software modifications, thereby increasing the bargaining power of customers.

For instance, a major automotive manufacturer, a key Ansys client, might represent a substantial percentage of Ansys's revenue in a given year. This dependency can embolden such clients to demand more favorable terms, impacting Ansys's pricing flexibility and profit margins.

For many of Ansys's clients, simulation software is absolutely essential to speed up innovation, cut down on development expenses, and guarantee product performance and safety. This vital role in their design and testing procedures makes customers very dependent on Ansys, which in turn restricts their power to negotiate strongly on pricing or product specifications.

Availability of In-house Development or Open-Source Alternatives

The availability of in-house development or open-source alternatives presents a potential avenue for customers to reduce reliance on Ansys. While some very large corporations might explore developing simpler, in-house simulation tools for niche applications, or leverage open-source options like OpenFOAM, the significant investment in validation, ongoing maintenance, and specialized expertise required often diminishes the practical appeal of these alternatives for most users.

For instance, while OpenFOAM is a powerful open-source CFD toolbox, its implementation and validation for complex engineering problems can demand substantial resources, often exceeding the cost and effort of utilizing Ansys’s established and validated solutions. This complexity acts as a significant barrier, thereby limiting the bargaining power of customers in this regard.

- In-house Development Costs: Developing proprietary simulation software can incur millions in R&D, personnel, and infrastructure, a significant hurdle compared to Ansys's subscription models.

- Open-Source Complexity: While free, open-source tools like OpenFOAM require considerable expertise for customization, validation, and support, often making them less cost-effective for specialized, mission-critical applications.

- Ansys's Validation and Support: Ansys provides robust validation, extensive documentation, and dedicated customer support, which are crucial for industries requiring high levels of accuracy and reliability, further reducing the threat of alternative solutions.

- Market Share: Ansys holds a dominant position in many simulation markets, indicating that the perceived value and necessity of their offerings often outweigh the perceived benefits of developing or adopting alternatives.

Synopsys Acquisition Impact on Customer Power

The pending acquisition of Ansys by Synopsys, slated for completion in the first half of 2025, could significantly reshape customer bargaining power. While the merger promises a more integrated 'silicon to systems' offering, some Ansys customers may face a perceived reduction in choice, potentially prompting them to exert greater negotiation leverage or seek alternative solutions in the near term.

Customers might also anticipate shifts in product development priorities and support structures post-acquisition. This uncertainty could empower them to demand more favorable terms or pricing, especially if they believe the combined entity's roadmap doesn't fully align with their specific simulation and design needs.

- Reduced Choice: The consolidation may limit the number of independent simulation software providers, potentially increasing customer reliance on the Synopsys-Ansys combined entity.

- Potential for Price Increases: With fewer competitors, the combined company might have greater latitude to adjust pricing, incentivizing customers to bargain for better deals.

- Impact on Product Roadmaps: Customers may worry that their specific feature requests or critical updates could be deprioritized in favor of broader market strategies, leading to increased negotiation.

Ansys's customers generally exhibit low bargaining power due to high switching costs, the critical nature of simulation software in their product development, and Ansys's strong market position. The significant investment required for training, data migration, and process revalidation makes switching providers a complex and expensive undertaking. This inertia, coupled with the essential role Ansys tools play in innovation and cost reduction for its users, limits their ability to negotiate aggressively.

While some large clients possess substantial purchasing power that could allow for negotiation on pricing or bespoke solutions, the overall dependence on Ansys's validated and comprehensive offerings often tempers this influence. The limited viability of in-house or open-source alternatives for mission-critical applications further reinforces Ansys's advantage.

The impending acquisition by Synopsys in mid-2025 introduces a dynamic element. Customers might experience a perceived reduction in choice, potentially leading to increased negotiation efforts or a search for alternatives if product roadmaps and support structures change unfavorably. This uncertainty could temporarily boost customer leverage as they assess the new landscape.

| Factor | Impact on Customer Bargaining Power | Ansys's Position (as of mid-2025) |

|---|---|---|

| Switching Costs | Lowers bargaining power | High due to integration and validation |

| Product Dependency | Lowers bargaining power | High as software is critical for innovation and safety |

| Alternative Solutions | Lowers bargaining power | Strong due to complexity and validation of open-source/in-house options |

| Customer Concentration | Potentially increases bargaining power for key clients | Ansys serves diverse sectors, but large clients represent significant revenue |

| Synopsys Acquisition | Potentially increases bargaining power due to perceived reduced choice/uncertainty | Creates a larger entity with potential shifts in customer focus |

Preview Before You Purchase

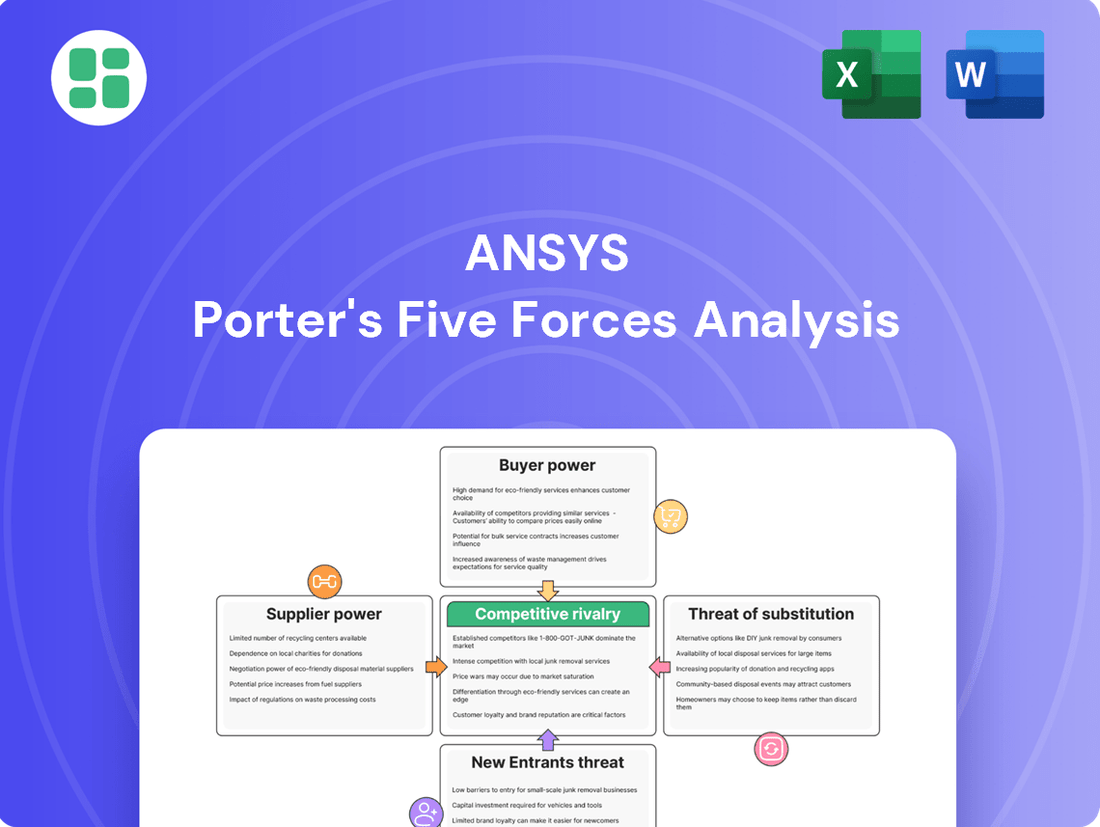

Ansys Porter's Five Forces Analysis

This preview showcases the exact Ansys Porter's Five Forces Analysis you will receive. What you see here is the complete, professionally formatted document, ready for immediate download and use after purchase. There are no placeholders or sample content; you get the full, actionable analysis.

Rivalry Among Competitors

The engineering simulation landscape is highly competitive, with major players like Dassault Systèmes, Siemens, Altair, and COMSOL Multiphysics vying for market dominance. These companies offer robust suites of specialized simulation software, creating a dynamic environment where innovation and customer acquisition are paramount. For instance, Siemens' Simcenter portfolio has seen significant investment and integration, aiming to capture a larger share of the digital twin and simulation market.

Ansys faces intense rivalry due to the substantial fixed costs associated with developing and maintaining its sophisticated simulation software. These costs, encompassing ongoing research and development, essential updates, customer support, and the recruitment of specialized talent, create a high barrier to entry and necessitate aggressive competition to justify the investment.

The need to recoup significant R&D expenditures, which for Ansys can run into hundreds of millions annually, pushes existing players to vie fiercely for market share. For instance, Ansys reported R&D expenses of approximately $677 million in 2023, highlighting the financial commitment required to stay at the forefront of simulation technology.

Competitive rivalry in the engineering simulation software market is intense, fueled by a relentless pursuit of product differentiation. Companies like Ansys are heavily invested in continuous innovation, aiming to provide more specialized physics solvers, intuitive user interfaces, and seamlessly integrated workflows. This focus on enhanced functionality and user experience is key to capturing market share.

Ansys is actively employing advanced strategies to stand out. By integrating AI-powered tools into its simulation platforms, the company is enhancing predictive capabilities and automating complex tasks. Furthermore, its expansion into cloud-based solutions aims to offer greater accessibility and scalability, differentiating its offerings and strengthening its competitive position in the evolving market.

Customer Loyalty and Switching Costs

Ansys benefits from high customer loyalty, a significant advantage in a competitive landscape. This loyalty is partly due to the substantial switching costs associated with its simulation software, which can involve significant investment in training, integration, and data migration. However, this doesn't mean Ansys is immune to competitive pressures.

Intense rivalry compels competitors to actively target Ansys's customer base. They often do this by offering compelling alternatives that feature enhanced functionalities, more aggressive pricing structures, or superior customer service and technical support. For instance, in 2024, the CAE software market continued to see aggressive marketing campaigns from key players like Dassault Systèmes and Siemens Digital Industries Software, directly aiming to capture market share from established leaders like Ansys.

- Customer Retention: Ansys's ability to maintain strong customer relationships is a key differentiator.

- Switching Costs: The investment required for customers to change simulation software providers remains a barrier to entry for new competitors.

- Competitive Disruption: Rivals actively seek to erode Ansys's customer loyalty through aggressive product development and pricing strategies.

Strategic Mergers and Acquisitions Reshaping the Landscape

The competitive rivalry within the industry is intensifying due to strategic mergers and acquisitions. A prime example is Synopsys's acquisition of Ansys, a move valued at approximately $35 billion, which closed in May 2024. This consolidation aims to create a more integrated and comprehensive suite of solutions for customers.

This trend of consolidation puts increased pressure on remaining independent companies. As larger entities emerge with broader offerings, smaller or specialized players may find it challenging to compete on scale and scope. This can lead to market share shifts and a redefinition of competitive benchmarks.

- Synopsys acquired Ansys for approximately $35 billion in May 2024.

- This acquisition aims to create a more comprehensive provider of electronic design automation (EDA) and simulation software.

- The consolidation increases competitive pressure on other independent players in the simulation and design software market.

- Such M&A activity can lead to altered market dynamics and potentially fewer, but larger, competitors.

Competitive rivalry is a significant force in the engineering simulation market, with Ansys facing strong competition from established players like Siemens and Dassault Systèmes. The industry is characterized by high R&D investments, with Ansys alone spending approximately $677 million in 2023 to maintain its technological edge. This intense competition drives innovation in areas like AI integration and cloud solutions, as companies strive to differentiate their offerings and capture market share.

The acquisition of Ansys by Synopsys in May 2024 for roughly $35 billion highlights the consolidation trend, creating a more formidable entity and intensifying pressure on remaining independent competitors. This strategic move reshapes the competitive landscape, potentially leading to fewer but larger players with broader solution portfolios.

| Competitor | 2023 Revenue (Approx.) | Key Offerings | Strategic Focus |

|---|---|---|---|

| Siemens Digital Industries Software | $10 billion+ (Digital Industries segment) | Simcenter, NX, Solid Edge | Digital twin, integrated PLM solutions |

| Dassault Systèmes | €5.7 billion (2023) | CATIA, SIMULIA, SOLIDWORKS | 3DEXPERIENCE platform, virtual twins |

| Altair Engineering | $1.1 billion (2023) | HyperWorks, Altair Inspire | High-performance computing, AI-driven design |

SSubstitutes Threaten

While simulation tools like Ansys are powerful, the threat of substitutes, particularly physical prototyping and traditional testing, remains a factor. Historically, these were the only ways to validate designs. Even with advanced simulation capabilities, some industries or specific, less complex applications might still rely on physical prototypes for validation, acting as a substitute for certain simulation-driven insights.

For straightforward analyses, or by companies with strong in-house technical skills, internally developed tools like spreadsheets or custom scripts can sometimes serve as alternatives to commercial simulation software. These homegrown solutions might handle basic calculations or specific, tailored tasks effectively.

However, these in-house alternatives often fall short when tackling intricate engineering challenges. They typically lack the rigorous accuracy, broad scope, and established validation processes inherent in professional simulation software, thus restricting their utility for complex design and analysis needs.

Open-source simulation software, like OpenFOAM for fluid dynamics, presents a free alternative to Ansys's commercial offerings. These tools, while demanding significant technical skill for setup and ongoing use, can attract users prioritizing cost savings, particularly in academic settings. This represents a moderate threat, as the barrier to entry is high, but the absence of licensing fees is compelling for some segments.

General-Purpose CAD/CAE Tools with Limited Simulation

While some general-purpose CAD/CAE software offers basic simulation features, these often fall short of the advanced capabilities found in specialized platforms. For instance, many CAD packages might include rudimentary stress analysis, but they typically lack the sophisticated multiphysics solvers and material modeling required for complex engineering challenges. This creates a scenario where these tools can act as a substitute for less demanding simulation tasks, potentially diverting users who might otherwise opt for more robust solutions.

The market for these integrated CAD/CAE tools is substantial, with many users prioritizing convenience for straightforward design validation. For example, the global CAD software market was projected to reach over $15 billion by 2023, indicating a broad user base that might leverage these tools for their simulation needs. However, for critical applications demanding high fidelity and accuracy, these general-purpose tools are often insufficient, making them a limited threat to dedicated simulation providers like Ansys.

- Limited Scope: General-purpose CAD/CAE tools often provide only basic simulation functionalities, lacking advanced physics and material models.

- Accuracy Concerns: The accuracy and depth of simulation results from these tools may not meet the rigorous standards required for specialized engineering applications.

- User Base Diversion: While they can serve as a substitute for simpler tasks, they do not fully replace the need for specialized simulation software in complex scenarios.

Emerging AI-driven Design and Optimization Tools

The emergence of AI-driven design and optimization tools presents a potential long-term threat of substitutes. These advanced systems, capable of generating optimized designs with minimal human intervention, could lessen the reliance on traditional, iterative simulation processes. For instance, generative design platforms are increasingly being integrated into product development cycles, aiming to reduce the time and resources spent on manual design exploration.

However, in the short to medium term, these AI tools often function as complements rather than direct substitutes. They frequently depend on robust simulation engines for design validation and are typically incorporated within existing simulation workflows, enhancing rather than replacing them. This integration suggests a symbiotic relationship, where AI amplifies the capabilities of simulation software.

The market for AI in engineering design is rapidly expanding. By 2024, it's projected that investments in AI for product design and simulation will see significant growth, with many companies exploring these technologies to gain a competitive edge. This trend underscores the evolving landscape where AI assists, rather than supplants, established simulation methodologies.

- AI-driven design tools aim to automate and optimize product conceptualization.

- Generative design leverages AI to explore a vast number of design possibilities based on specified constraints.

- Simulation validation remains a critical step, often requiring traditional simulation engines even with AI-generated designs.

- Integration into existing workflows positions AI as an enhancer, not a complete replacement, for simulation software in the near future.

While Ansys offers sophisticated simulation capabilities, the threat of substitutes remains. Physical prototyping and traditional testing, though less efficient, are still employed, especially for simpler validation needs or in industries with established workflows. Internally developed tools like spreadsheets or custom scripts can also serve as basic alternatives for less complex analyses, though they lack the depth and accuracy of professional software.

Open-source simulation software, such as OpenFOAM, presents a cost-free alternative, appealing to academic institutions and users with strong technical expertise, despite a high barrier to entry. Additionally, general-purpose CAD/CAE tools with integrated, albeit basic, simulation features can divert users for less demanding tasks. The global CAD software market, projected to exceed $15 billion by 2023, highlights a broad user base that might leverage these for simpler validation.

| Substitute Type | Key Characteristics | Ansys's Advantage | Market Penetration/Trend |

|---|---|---|---|

| Physical Prototyping | Direct validation, tangible results | Speed, cost-effectiveness, broad applicability | Established but being augmented by simulation |

| In-house Tools (Spreadsheets, Scripts) | Low cost, customizable for simple tasks | Advanced solvers, accuracy, scalability, comprehensive libraries | Limited to very basic analyses |

| Open-Source Software | Free licensing, community support | Dedicated support, advanced features, ease of use for complex problems | Growing in academia, niche applications |

| Integrated CAD/CAE Tools | Convenience for basic design validation | Specialized multiphysics, advanced material modeling, high fidelity | Significant for simpler tasks, limited for complex engineering |

Entrants Threaten

Developing advanced engineering simulation software demands substantial and ongoing investment in research and development. This includes acquiring deep scientific expertise, creating sophisticated algorithms, and conducting rigorous testing, creating a significant financial hurdle for newcomers.

For instance, Ansys consistently invests heavily in R&D; in 2023, their R&D expenses reached $775.8 million, highlighting the scale of resources needed to innovate and maintain a competitive edge in this specialized field.

This high capital requirement for R&D acts as a formidable barrier, making it exceedingly challenging for new companies to enter the market and effectively challenge established leaders like Ansys.

Ansys's deep well of proprietary algorithms and simulation technologies, honed over decades, acts as a formidable barrier. Developing comparable physics solvers and methodologies from scratch would require immense investment in research and development, a cost prohibitive for most newcomers.

Ansys commands significant brand recognition and customer trust, cultivated over decades of delivering accurate and reliable simulation software. This deep-seated credibility, particularly in demanding sectors like aerospace and automotive, presents a formidable barrier for newcomers aiming to establish a similar reputation. For instance, Ansys's long-standing partnerships with leading automotive manufacturers, which often involve extensive validation processes, underscore the difficulty new entrants face in displacing established trust.

Access to Distribution Channels and Ecosystems

Established players like Ansys possess deeply entrenched global sales networks and a vast array of channel partners. This existing infrastructure is incredibly difficult and costly for newcomers to replicate, posing a significant barrier to entry.

Furthermore, Ansys benefits from a robust ecosystem of academic and industry collaborations, which fosters loyalty and provides critical feedback loops. New entrants would face immense challenges in cultivating similar relationships and building a comparable support system necessary to serve a diverse, global clientele effectively.

- Ansys's extensive global sales network and channel partner relationships are a significant deterrent.

- Building a comparable distribution and support infrastructure would require substantial capital investment and time.

- The established ecosystem of academic and industry collaborations provides Ansys with a competitive advantage in market penetration and customer retention.

Talent Acquisition and Retention

The threat of new entrants in the engineering simulation software market is significantly impacted by the challenge of talent acquisition and retention. Developing sophisticated simulation software requires a highly specialized skill set, meaning new companies must compete for a limited pool of experienced engineers and developers. This intense competition for talent, particularly for those with expertise in areas like computational fluid dynamics or finite element analysis, presents a substantial barrier to entry.

Established players in the market, like Ansys, have already cultivated deep talent pools and possess strong employer branding, making it difficult for newcomers to attract and retain top-tier professionals. For instance, in 2024, the demand for AI/ML engineers with simulation experience saw an average salary increase of 15-20% year-over-year, highlighting the premium placed on such specialized skills.

- Specialized Skill Demand: Engineering simulation software development requires niche expertise not readily available in the general tech workforce.

- Talent Scarcity: Experienced simulation engineers and developers are in high demand, leading to fierce competition for qualified individuals.

- Established Competition: Existing companies have built strong teams and brand recognition, making it harder for new entrants to attract talent.

- High Recruitment Costs: The scarcity of talent drives up recruitment costs, as companies often need to offer competitive salaries and attractive benefits packages to secure skilled professionals.

The high cost of developing and maintaining sophisticated engineering simulation software, coupled with the need for specialized talent, creates substantial barriers for new entrants. Ansys's significant R&D investments, exceeding $775 million in 2023, and its established global sales networks further solidify its market position.

New companies must overcome the challenge of replicating Ansys's decades of accumulated proprietary algorithms and deep customer trust, particularly in critical sectors. The intense competition for specialized engineering talent, with salaries for AI/ML simulation engineers rising by 15-20% in 2024, also adds to the difficulty of market entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| R&D Investment | Developing advanced simulation software requires substantial, ongoing capital for research, algorithms, and testing. | Prohibitive cost for newcomers; requires deep scientific expertise. |

| Proprietary Technology | Ansys possesses decades of honed, unique simulation solvers and methodologies. | Replication is immensely costly and time-consuming, creating a significant hurdle. |

| Brand Recognition & Trust | Ansys has cultivated decades of credibility, especially in demanding industries like aerospace and automotive. | New entrants struggle to establish comparable reputation and displace existing trust. |

| Sales & Distribution Network | Ansys benefits from entrenched global sales and channel partner infrastructure. | Replicating this network is costly and time-intensive for new companies. |

| Talent Acquisition | High demand for specialized simulation engineers leads to fierce competition for limited talent. | New entrants face challenges attracting and retaining skilled professionals, increasing recruitment costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including detailed financial reports from public companies, market research from leading industry analysts, and comprehensive economic indicators from governmental and international organizations. This ensures a thorough examination of industry structure and competitive dynamics.